USA Educational Toy Market Outlook to 2030

Region:North America

Author(s):Samanyu

Product Code:KROD6169

November 2024

95

About the Report

USA Educational Toy Market Overview

- The USA Educational Toy market is valued at USD 12 Bn, driven by a growing emphasis on early childhood education and the integration of learning tools in both formal and informal learning environments. This market is characterized by the rising popularity of STEM (Science, Technology, Engineering, and Math) toys, which appeal to parents seeking educational value and skill development for their children. Moreover, technological advancements in interactive toys and an increase in consumer spending on child development are further driving market growth.

- The dominant regions in the educational toy market include New York, California, and Texas. These states have the highest concentration of educational institutions, affluent consumers, and well-established retail distribution networks. California leads due to its strong presence of tech companies and educational hubs, fostering innovation in smart toys, while New York and Texas show high consumer demand for toys that align with modern educational curriculums. These regions benefit from higher disposable incomes and strong school and parental engagement with educational tools.

- Personalized learning toys, which adapt to a child's individual learning pace, are becoming increasingly popular. According to the National Association for the Education of Young Children (NAEYC), sales of customizable educational toys increased by 25% in 2023, as parents and educators seek tailored solutions for diverse learning needs. Products that can adjust to different cognitive development stages, language learning abilities, and problem-solving skills are particularly in demand. This trend is further supported by advancements in AI-powered toys that offer real-time feedback, enhancing learning outcomes through personalized interactions.

USA Educational Toy Market Segmentation

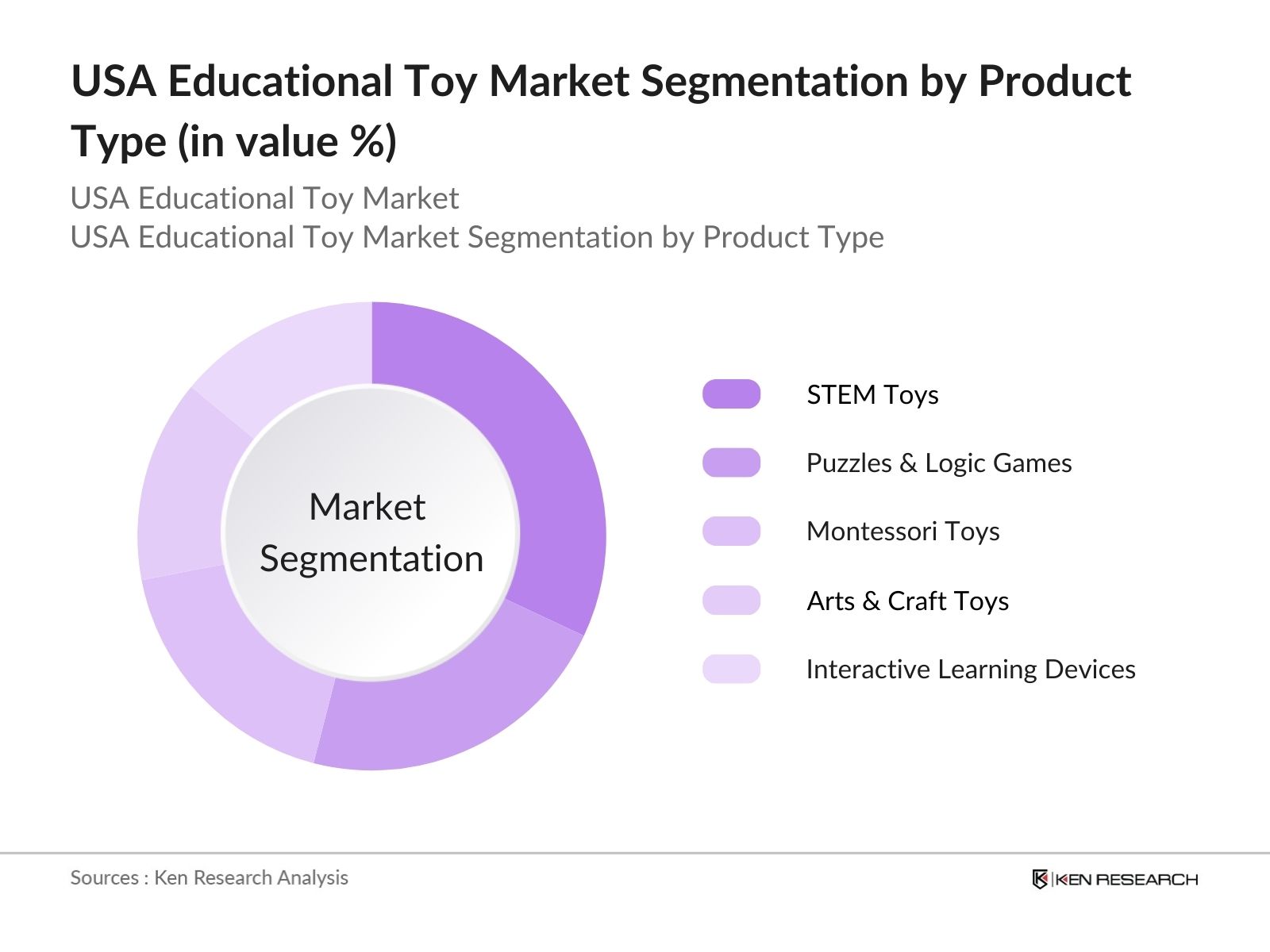

By Product Type: The market is segmented by product type into STEM toys, puzzles & logic games, Montessori toys, arts & craft toys, and interactive learning devices. In 2023, STEM toys dominated the market, primarily driven by the increasing interest in science and technology education. The appeal of building and coding toys, along with their strong alignment with educational curricula, is attracting parents and schools alike. Products such as Legos robotics kits and tech-based learning toys from VTech cater to a wide range of age groups, enhancing childrens cognitive and problem-solving skills.

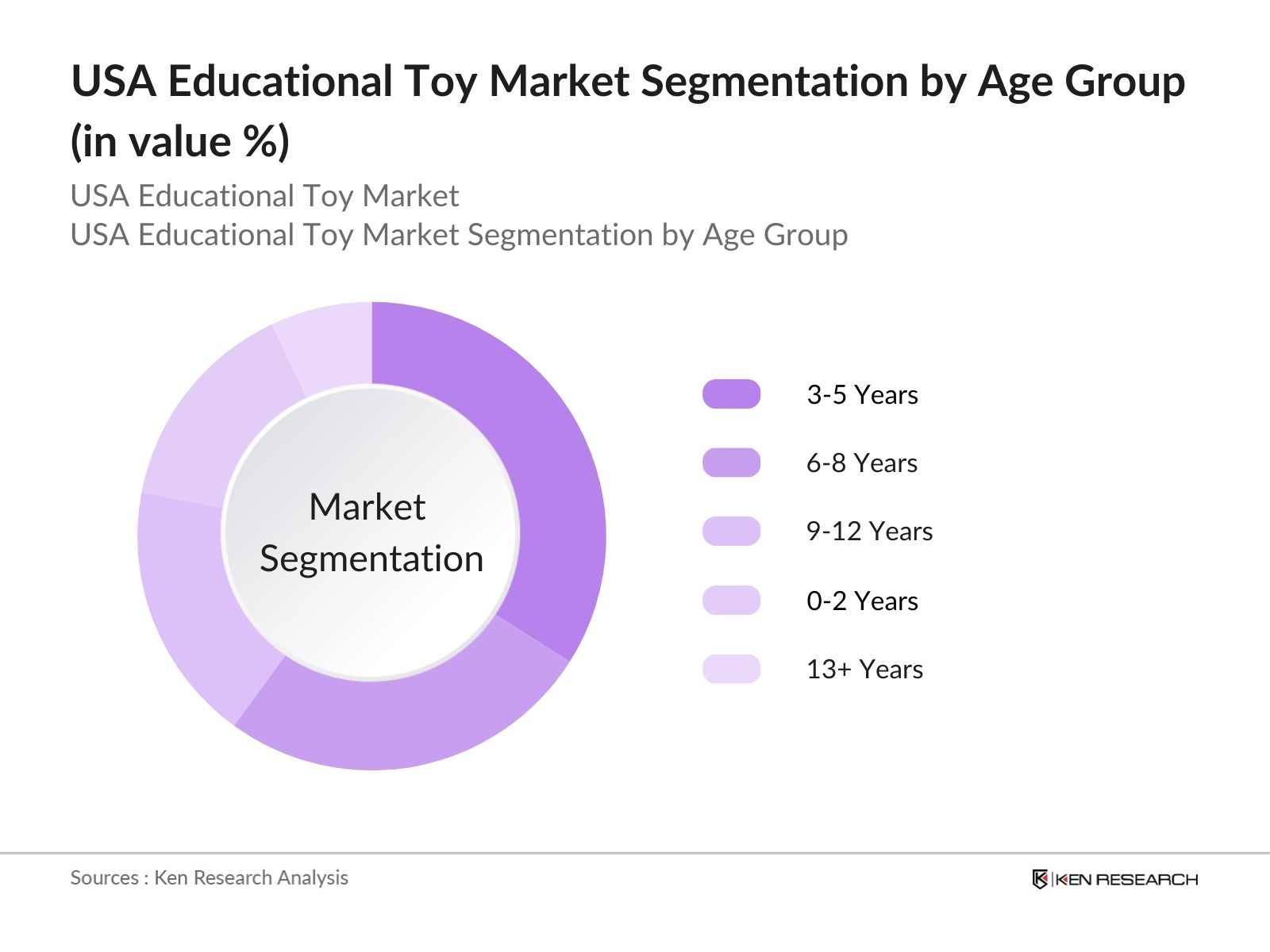

By Age Group: The market is also segmented by age group into 0-2 years, 3-5 years, 6-8 years, 9-12 years, and 13+ years. The 3-5 years age group accounted for the largest market share in 2023, due to the high demand for educational toys that focus on basic literacy, numeracy, and motor skills development. The developmental stage of this age group makes it crucial for parents and educators to provide toys that foster learning, which leads to high demand for educational tools like puzzles, blocks, and interactive learning devices.

USA Educational Toy Market Competitive Landscape

The USA educational toy market is dominated by a combination of global and domestic players, showcasing intense competition. The market features established brands such as LEGO and Mattel, which have a legacy of product innovation and a strong brand presence, along with rising educational-tech companies that specialize in interactive and STEM learning devices. These companies leverage strategic partnerships with educational institutions and have a broad distribution network, giving them a competitive edge in the market.

|

Company Name |

Establishment Year |

Headquarters |

Revenue (2023) |

Employees |

Key Product |

R&D Investment |

Sustainability Initiatives |

Partnerships |

|

LEGO Group |

1932 |

Billund, Denmark |

||||||

|

Mattel, Inc. |

1945 |

El Segundo, CA, USA |

||||||

|

VTech Holdings Ltd. |

1976 |

Hong Kong |

||||||

|

Melissa & Doug |

1988 |

Wilton, CT, USA |

||||||

|

Spin Master Corp. |

1994 |

Toronto, Canada |

USA Educational Toy Industry Analysis

Growth Drivers

- Rising Parental Awareness on Child Development: As of 2024, a notable increase in parental awareness about the role of educational toys in cognitive development and problem-solving is observed. Reports from the U.S. Bureau of Economic Analysis (BEA) highlight that households with children under 12 years allocate over $2.5 billion annually toward child developmental products, including educational toys. Educational research supports this spending, linking the use of such toys with improved cognitive and problem-solving abilities in children. Parental investment in early childhood learning resources continues to grow, especially with increased access to information on the benefits of developmental play.

- Increasing Government Initiatives for Early Childhood Education: The U.S. federal government allocated $39 billion in 2023 to early childhood education programs, including funding for educational tools in schools and preschools. This funding supports the integration of educational toys into early learning curricula, particularly in STEM fields. State-level initiatives, such as the Preschool Development Grants, help provide low-income families access to developmental toys that aid in cognitive and motor skill development. The National Center for Education Statistics (NCES) reports that over 60% of preschools now incorporate educational toys into daily activities, reflecting the governments emphasis on interactive learning.

- Expansion of e-Commerce: E-commerce has been a significant growth driver for the educational toy market, with digital platforms contributing to over $30 billion in U.S. retail sales in 2023. U.S. Census Bureau data highlights that online platforms have seen a 12% annual increase in sales of educational toys, driven by the rise in digital learning tools and toys that align with online educational content. This shift is supported by the growing integration of online learning platforms and interactive digital toys, which provide engaging ways to complement childrens formal education at home.

Market Challenges

- High Production Costs: The rising demand for eco-friendly educational toys has driven up production costs in the U.S. toy industry. A report from the U.S. Environmental Protection Agency (EPA) reveals that manufacturers using sustainable materials like recycled plastics or FSC-certified wood face increased raw material costs by 20%. Additionally, stringent certification requirements such as ASTM F963 (for toy safety) further elevate production costs by an estimated $15,000 per product line. Despite consumer demand for sustainable products, these costs act as a deterrent for smaller companies trying to compete in the educational toy sector.

- Stringent Safety Regulations: Stringent safety regulations imposed by the Consumer Product Safety Improvement Act (CPSIA) have created barriers to entry for many educational toy manufacturers. The U.S. Consumer Product Safety Commission (CPSC) reports that in 2023, nearly 500,000 toys were recalled due to non-compliance with safety standards regarding lead content and choking hazards. The cost of compliance testing, including toxic material screening and mechanical safety testing, adds approximately $1,000 to $5,000 per product. These regulatory challenges affect small and medium enterprises more significantly, hindering new market entrants in the U.S.

USA Educational Toy Market Future Outlook

Over the next five years, the USA educational toy market is expected to witness substantial growth, driven by continued advancements in technology, such as the integration of augmented reality (AR) and virtual reality (VR) into learning tools. Moreover, increased investment in early childhood education and a growing emphasis on STEM skills will provide significant opportunities for manufacturers to innovate. The trend toward sustainable and eco-friendly toys is also likely to expand, as consumers and regulators push for more environmentally conscious products in the toy industry.

Future Market Opportunities

- Growth of Montessori and Waldorf Education Systems: Montessori and Waldorf education systems, which emphasize child-centered, hands-on learning, are expanding across the U.S., with over 5,000 Montessori schools in operation as of 2024. These educational philosophies prioritize toys that promote creativity, problem-solving, and fine motor skills, creating opportunities for companies specializing in wooden, eco-friendly, and tactile learning toys. Data from the Montessori Foundation suggests that the market for these specialized educational toys grew by 10% annually between 2022 and 2024, reflecting strong demand from private and charter schools following these curricula.

- International Market Expansion: The U.S. educational toy market is increasingly eyeing international expansion, driven by demand in emerging markets like China, India, and Brazil. According to the International Trade Administration (ITA), U.S. exports of educational toys reached $2 billion in 2023, with major growth in Asia-Pacific regions. Cross-border e-commerce and trade agreements, such as the U.S.-Mexico-Canada Agreement (USMCA), have facilitated easier market access, offering lucrative opportunities for American companies to scale their international presence. The ongoing digitization of sales channels further enhances export potential, particularly in regions with rising middle-class populations.

Scope of the Report

|

By Product Type |

STEM Toys Montessori Toys Puzzle & Logic Toys Interactive Learning Devices Arts & Craft Toys |

|

By Age Group |

0-2 Years 3-5 Years 6-8 Years 9-12 Years 13+ Years |

|

By Material |

Plastic Wood Fabric/Textile Electronic Components Others (Recycled, Organic Materials) |

|

By Distribution Channel |

Online Channels Specialty Stores Mass Merchandisers Hypermarkets/Supermarkets Educational Institutions |

|

By Region |

North-East Mid-West South West |

Products

Key Target Audience

Toy Manufacturers

Educational Institutions (Primary and Secondary Schools, Kindergartens)

Government and Regulatory Bodies (CPSC, ASTM)

Investors and Venture Capitalist Firms

Retailers and Distributors (Specialty Toy Stores, Online Retailers)

EdTech Companies

Product Developers and Designers

Banks and Financial Institutes

Parent Advocacy Groups

Companies

Players Mentioned in the Report

LEGO Group

Mattel, Inc.

Hasbro, Inc.

VTech Holdings Ltd.

Fisher-Price

LeapFrog Enterprises, Inc.

Melissa & Doug

Spin Master

Ravensburger AG

Learning Resources

Table of Contents

1. USA Educational Toy Market Overview

1.1. Definition and Scope (Age Groups, Learning Objectives, Educational Institutions)

1.2. Market Taxonomy (By Product Type, By Age Group, By Material, By Distribution Channel, By Geography)

1.3. Market Growth Rate (CAGR, Market Dynamics)

1.4. Market Segmentation Overview (Product-Based, Demographic-Based)

2. USA Educational Toy Market Size (In USD Bn)

2.1. Historical Market Size (Value and Volume Analysis)

2.2. Year-On-Year Growth Analysis (Market Demand Trends, Growth Rates)

2.3. Key Market Developments and Milestones (Technological Innovations, Key Milestone Products)

3. USA Educational Toy Market Analysis

3.1. Growth Drivers

3.1.1. Rising Parental Awareness on Child Development (Cognitive Skills, Problem-Solving Abilities)

3.1.2. Increasing Government Initiatives for Early Childhood Education (Funding Programs, Curriculum Integration)

3.1.3. Technological Advancements in Toy Manufacturing (AR/VR Educational Toys)

3.1.4. Expansion of e-Commerce (Online Learning Platforms, Digital Educational Toys)

3.2. Restraints

3.2.1. High Production Costs (Sustainable Materials, Product Certifications)

3.2.2. Stringent Safety Regulations (CPSIA Compliance, Toxic Material Restrictions)

3.2.3. Competition from Digital Entertainment (Screen Time vs Physical Playtime)

3.3. Opportunities

3.3.1. Integration of STEM/STEAM Learning in Curriculum (School Collaborations, STEM Kits)

3.3.2. Growth of Montessori and Waldorf Education Systems (Specialized Toy Categories)

3.3.3. International Market Expansion (Cross-Border Sales, Export Opportunities)

3.4. Trends

3.4.1. Rise in Eco-Friendly and Sustainable Toys (Material Innovation, Parental Preferences)

3.4.2. Gamification of Education (Interactive Learning Toys, Game-Based Learning)

3.4.3. Customizable and Personalized Learning Toys (Adaptable Learning Experiences)

3.4.4. Collaboration with EdTech (Learning Apps and Connected Toys)

3.5. Government Regulations

3.5.1. Federal Toy Safety Standards (CPSC Regulations, Toy Testing)

3.5.2. Import Tariffs and Trade Policies (Trade Regulations, Import Duties on Toy Materials)

3.5.3. Educational Grants for Early Learning Centers (Subsidies for Educational Toys)

3.6. SWOT Analysis (Strengths, Weaknesses, Opportunities, Threats)

3.7. Stakeholder Ecosystem (Toy Manufacturers, Educational Institutions, Retailers)

3.8. Porters Five Forces Analysis (Market Entry Barriers, Bargaining Power)

3.9. Competitive Ecosystem (Key Competitor Analysis)

4. USA Educational Toy Market Segmentation

4.1. By Product Type (In Value %)

4.1.1. STEM Toys

4.1.2. Montessori Toys

4.1.3. Puzzle & Logic Toys

4.1.4. Interactive Learning Devices

4.1.5. Arts & Craft Toys

4.2. By Age Group (In Value %)

4.2.1. 0-2 Years

4.2.2. 3-5 Years

4.2.3. 6-8 Years

4.2.4. 9-12 Years

4.2.5. 13+ Years

4.3. By Material (In Value %)

4.3.1. Plastic

4.3.2. Wood

4.3.3. Fabric/Textile

4.3.4. Electronic Components

4.3.5. Others (Recycled, Organic Materials)

4.4. By Distribution Channel (In Value %)

4.4.1. Online Channels

4.4.2. Specialty Stores

4.4.3. Mass Merchandisers

4.4.4. Hypermarkets/Supermarkets

4.4.5. Educational Institutions

4.5. By Geography (In Value %)

4.5.1. North-East

4.5.2. Mid-West

4.5.3. South

4.5.4. West

5. USA Educational Toy Market Competitive Analysis

5.1 Detailed Profiles of Major Companies

5.1.1. LEGO Group

5.1.2. Mattel, Inc.

5.1.3. Hasbro, Inc.

5.1.4. VTech Holdings Ltd.

5.1.5. Fisher-Price

5.1.6. LeapFrog Enterprises, Inc.

5.1.7. Melissa & Doug

5.1.8. Spin Master

5.1.9. Ravensburger AG

5.1.10. Learning Resources

5.1.11. Magformers

5.1.12. Fat Brain Toys

5.1.13. Hape International

5.1.14. Janod

5.1.15. MindWare

5.2 Cross Comparison Parameters (No. of Employees, Headquarters, Revenue, Market Share, Product Innovation)

5.3 Market Share Analysis (Top Competitors, Market Share by Revenue, Growth Rate)

5.4 Strategic Initiatives (Product Launches, Partnerships, Innovations)

5.5 Mergers and Acquisitions (Recent Deals, Market Impact)

5.6 Investment Analysis (Private Equity, Venture Capital Funding)

5.7. Government Grants and Incentives (Tax Benefits, Research and Development Subsidies)

5.8. Key Collaborations with Educational Institutions (School Partnerships, Educational Sponsorships)

6. USA Educational Toy Market Regulatory Framework

6.1. Federal Safety Standards (ASTM F963, CPSIA Compliance)

6.2. Certification Processes (ISO Certification, Toy Testing Standards)

6.3. Import/Export Regulations (Trade Barriers, Licensing)

7. USA Educational Toy Future Market Size (In USD Bn)

7.1. Future Market Size Projections (Increased Demand Forecast, Supply Chain Developments)

7.2. Key Factors Driving Future Market Growth (Technological Innovations, Shifting Consumer Preferences)

8. USA Educational Toy Future Market Segmentation

8.1. By Product Type (In Value %)

8.2. By Age Group (In Value %)

8.3. By Material (In Value %)

8.4. By Distribution Channel (In Value %)

8.5. By Geography (In Value %)

9. USA Educational Toy Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis (Total Addressable Market, Serviceable Market)

9.2. Customer Cohort Analysis (Demographic Preferences, Consumer Behavior)

9.3. Marketing Initiatives (Digital Campaigns, Trade Show Participation)

9.4. White Space Opportunity Analysis (Untapped Markets, Product Gaps)

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

The initial stage involved constructing a comprehensive map of the stakeholders within the USA Educational Toy Market. Desk research was conducted using multiple proprietary and secondary data sources to define critical market variables, including consumer demand, technological advancements, and educational system integration.

Step 2: Market Analysis and Construction

In this phase, historical data was compiled and analyzed to assess market penetration, product innovation, and growth patterns. This involved tracking the performance of various market segments, including online and retail sales channels.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses were developed based on the data collected and were validated through interviews with industry experts. These consultations provided insights into emerging trends, product performance, and the competitive landscape.

Step 4: Research Synthesis and Final Output

The final phase focused on synthesizing data from multiple sources, including interviews with toy manufacturers and retailers. This provided a detailed understanding of product categories, consumer preferences, and sales trends, ensuring a comprehensive and validated report.

Frequently Asked Questions

01. How big is the USA Educational Toy Market?

The USA educational toy market is valued at USD 12 billion, driven by the increasing demand for early childhood education tools and interactive learning toys.

02. What are the key challenges in the USA Educational Toy Market?

The USA educational toy market faces challenges such as high production costs, strict safety regulations, and competition from digital entertainment platforms like video games, which divert consumer attention.

03. Who are the major players in the USA Educational Toy Market?

Key players in the USA educational toy market include LEGO Group, Mattel, Inc., VTech Holdings Ltd., and Spin Master. These companies dominate due to their innovative product lines, strong brand loyalty, and extensive retail networks.

04. What are the growth drivers of the USA Educational Toy Market?

Growth drivers in the USA educational toy market include rising parental awareness of child development, the integration of STEM education into school curricula, and technological advancements in toys such as robotics and smart devices.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.