USA Electric Kettle Market

Region:North America

Author(s):Paribhasha Tiwari

Product Code:KROD10085

December 2024

84

About the Report

Market Overview

- Market Size and Drivers

The USA electric kettle market is valued at USD 4 billion, propelled by a consistent demand for time-efficient and energy-saving appliances in American households and hospitality sectors. This market growth is further supported by technological advancements such as temperature control and Wi-Fi connectivity, catering to the evolving preferences of consumers who prioritize convenience and quality. Additionally, rising awareness about energy efficiency and environmental impacts enhances the demand for electric kettles, especially among eco-conscious consumers in urban areas. - Dominant Regions and Key Factors

The East Coast, including cities like New York and Boston, along with California, dominate the electric kettle market in the USA. This regional dominance is attributed to high household incomes, a preference for premium appliances, and the popularity of tea and coffee consumption. The West Coast, especially in tech-savvy regions, further drives demand due to early adoption of smart appliances, reinforcing California as a central market player in the sector.

Market Segmentation

By Product Type

The USA electric kettle market is segmented by product type into standard electric kettles, temperature control kettles, wireless electric kettles, and travel-friendly kettles. Temperature control kettles hold a dominant market share, driven by the demand for precise temperature settings, especially for specialty tea and coffee brewing. Their popularity is reinforced by the growing market for quality hot beverages, and brands like Breville and Cuisinart have optimized offerings in this segment to cater to consumer preferences.

By Material

The electric kettle market is also segmented by material into stainless steel, glass, plastic, and ceramic. Stainless steel dominates due to its durability, heat retention, and high preference in premium kettles. This material choice aligns well with consumer concerns about chemical leaching in plastic kettles and provides a more aesthetically pleasing and durable option. Glass kettles are also popular due to their sleek appearance and chemical-free benefits, but stainless steel retains the largest share.

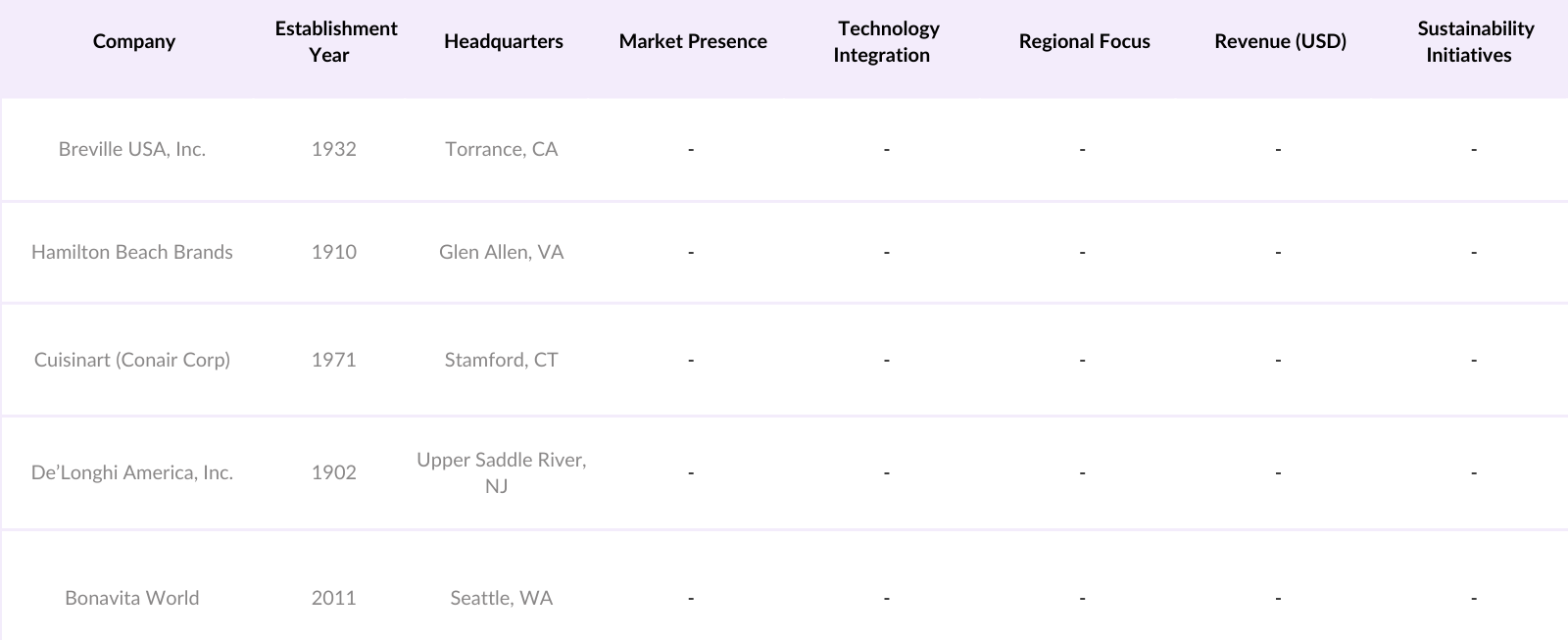

Competitive Landscape

The USA electric kettle market is shaped by prominent players that capitalize on technological advancements, design improvements, and diverse product offerings. Major players include both established global brands and niche manufacturers, catering to a variety of preferences and price points.

Competitive Landscape Table

USA Electric Kettle Market Analysis

3.1 Growth Drivers

- Technological Advancements in Heating Efficiency

- Advanced heating technology, such as rapid boil systems, is reducing boiling time for electric kettles by up to 30 seconds, catering to demand for quick-service appliances in busy households. With nearly 125 million American homes actively using quick-service kitchen devices, this trend fuels growth in the market as it aligns with consumer expectations for speed and convenience.

- Rising Demand for Energy-Efficient Appliances

- The U.S. Department of Energy (DOE) recently reported a rise in energy-efficient kitchen appliance usage across 98 million households, aligning with consumers concerns over energy usage in everyday devices. Electric kettles with energy-efficient features, such as automatic shut-off, are becoming popular in urban and suburban households.

- Increased Consumer Preference for Smart Kitchen Appliances

- Smart kettles, integrated with Bluetooth and mobile app compatibility, have experienced a notable demand boost in 2024, with shipments of connected kitchen appliances increasing by 5 million units year-to-date. This demand is driven by tech-savvy consumers seeking convenience and control over their appliances through smartphone applications.

Market Challenges

- High Energy Consumption Concerns

- Despite advancements in energy-efficient models, electric kettles still consume high wattage when in use, with some models requiring up to 3,000 watts. This consumption is becoming a concern as the average American household sees electricity usage rise to over 10,000 kWh annually, leading to cost-conscious consumers reconsidering frequent kettle usage.

- Strict Regulations on Plastic Use

- With ongoing federal restrictions on single-use plastics, approximately 50 million consumers now actively seek BPA-free products. The electric kettle market faces pressure to shift entirely to alternative materials, driving up production costs for manufacturers committed to plastic-free and environmentally conscious solutions.

Future Outlook

The USA electric kettle market is projected to continue on a growth trajectory, spurred by the adoption of smart appliances, advancements in energy efficiency, and increasing preference for premium materials. Consumer demand is expected to shift towards kettles with advanced features such as app control, faster heating mechanisms, and sustainable materials as awareness around environmental impacts grows.

Opportunities

- Growth in IoT-Enabled Electric Kettles

- The IoT-enabled appliance sector has witnessed a marked increase in demand, with smart kettles contributing approximately 12% of the total sales of connected kitchen appliances. U.S. households increasingly value remote access, which enhances convenience for busy lifestyles, thereby creating growth opportunities in this niche sector.

- Expansion in Specialty and Retail Channels

- Specialty retail channels report a surge in electric kettle sales, contributing $280 million to the category. This growth is fueled by an increased consumer preference for retail channels that offer curated, high-quality kitchen appliances, providing electric kettle manufacturers with an opportunity to target a discerning customer base.

|

Segment |

Sub-Segments |

|---|---|

|

Product Type |

Standard Electric Kettles, Temperature Control Kettles, Wireless Electric Kettles, Travel-Friendly Kettles |

|

Material |

Stainless Steel, Glass, Plastic, Ceramic |

|

Application |

Residential, Commercial (Hotels, Restaurants), Specialty Retail, E-commerce |

|

Power Rating |

Below 1000W, 1000W - 1500W, 1500W - 2000W, Above 2000W |

|

Region |

Northeast, Midwest, South, West |

10 Major Players in the Market

- Breville USA, Inc.

- Hamilton Beach Brands, Inc.

- Cuisinart (Conair Corporation)

- DeLonghi America, Inc.

- Bonavita World

- Fellow Industries, Inc.

- Midea Group

- KitchenAid (Whirlpool Corporation)

- BLACK+DECKER (Stanley Black & Decker)

- Zojirushi America Corporation

Products

Key Target Audience

Electric Kettle Manufacturers

Retail and E-commerce Vendors

Hospitality and Catering Businesses

Investors and Venture Capitalist Firms

Government and Regulatory Bodies (U.S. Environmental Protection Agency, Energy Star)

Smart Home Technology Providers

Distribution and Supply Chain Partners

Kitchen Appliance Resellers

Table of Contents

- USA Electric Kettle Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview - USA Electric Kettle Market Size (In USD Mn)

2.1. Historical Market Size

2.2. Year-on-Year Growth Analysis

2.3. Key Market Milestones and Developments - USA Electric Kettle Market Analysis

3.1. Growth Drivers

3.1.1. Technological Advancements in Heating Efficiency

3.1.2. Rising Demand for Energy-Efficient Appliances

3.1.3. Increased Consumer Preference for Smart Kitchen Appliances

3.1.4. Growing Trend of Quick-Service Household Appliances

3.2. Market Challenges

3.2.1. High Energy Consumption Concerns

3.2.2. Strict Regulations on Plastic Use

3.2.3. Market Saturation in Key Regions

3.2.4. Limited Adoption in Low-Penetration Regions

3.3. Opportunities

3.3.1. Growth in IoT-Enabled Electric Kettles

3.3.2. Expansion in Specialty and Retail Channels

3.3.3. Increased Preference for Premium Quality Materials (BPA-free, Stainless Steel)

3.3.4. Upsurge in Demand from Hospitality Industry

3.4. Market Trends

3.4.1. Rise of Temperature-Control Electric Kettles

3.4.2. Eco-Friendly and Energy-Saving Models

3.4.3. Wireless and Portable Electric Kettles

3.4.4. Demand for Sleek and Minimalistic Designs

3.5. Government Regulation

3.5.1. Environmental Compliance Standards

3.5.2. Energy Efficiency Requirements

3.5.3. Materials and Manufacturing Standards

3.5.4. Import/Export Regulations

3.6. SWOT Analysis

3.7. Value Chain and Stakeholder Ecosystem

3.8. Porters Five Forces Analysis

3.9. Competition Ecosystem - USA Electric Kettle Market Segmentation

4.1. By Product Type (In Value %)

4.1.1. Standard Electric Kettles

4.1.2. Temperature Control Kettles

4.1.3. Wireless Electric Kettles

4.1.4. Portable and Travel Kettles

4.2. By Material (In Value %)

4.2.1. Stainless Steel

4.2.2. Glass

4.2.3. Plastic

4.2.4. Ceramic

4.3. By Application (In Value %)

4.3.1. Residential

4.3.2. Commercial (e.g., Hotels, Restaurants, Offices)

4.3.3. Specialty Retail

4.3.4. E-commerce

4.4. By Power Rating (In Value %)

4.4.1. Below 1000W

4.4.2. 1000W - 1500W

4.4.3. 1500W - 2000W

4.4.4. Above 2000W

4.5. By Region (In Value %)

4.5.1. Northeast

4.5.2. Midwest

4.5.3. South

4.5.4. West - USA Electric Kettle Market Competitive Analysis

5.1 Detailed Profiles of Major Companies

5.1.1. Breville USA, Inc.

5.1.2. Hamilton Beach Brands, Inc.

5.1.3. Cuisinart (Conair Corporation)

5.1.4. De'Longhi America, Inc.

5.1.5. Bonavita World

5.1.6. Fellow Industries, Inc.

5.1.7. Midea Group

5.1.8. KitchenAid (Whirlpool Corporation)

5.1.9. Zojirushi America Corporation

5.1.10. BLACK+DECKER (Stanley Black & Decker)

5.1.11. Chefman

5.1.12. Sunbeam Products, Inc.

5.1.13. Secura

5.1.14. Ovente

5.1.15. Proctor Silex

5.2 Cross Comparison Parameters (Revenue, Product Range, Innovation in Smart Features, Distribution Network, Regional Presence, Market Share, Customer Base, Sustainability Initiatives)

5.3. Market Share Analysis

5.4. Strategic Initiatives and Competitive Landscape

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Private Equity and Venture Capital Funding - USA Electric Kettle Market Regulatory Framework

6.1. Safety Standards Compliance

6.2. Energy Consumption Standards

6.3. Certification and Approval Processes - USA Electric Kettle Future Market Size (In USD Mn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth - USA Electric Kettle Future Market Segmentation

8.1. By Product Type (In Value %)

8.2. By Material (In Value %)

8.3. By Application (In Value %)

8.4. By Power Rating (In Value %)

8.5. By Region (In Value %) - USA Electric Kettle Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

Research Methodology

Step 1: Identification of Key Variables

The research begins with mapping key stakeholders in the USA electric kettle market. Through secondary data and industry databases, critical market variables are identified, such as product segmentation, technological advancements, and consumer preferences.

Step 2: Market Analysis and Construction

The second phase involves the collection and analysis of historical data, encompassing market penetration rates, regional sales breakdown, and brand performance metrics. This data aids in establishing the revenue structure and understanding market patterns.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses on growth drivers and trends are validated through expert interviews and consultations with key players. These discussions are instrumental in refining the understanding of emerging technologies and consumer behavior in the electric kettle market.

Step 4: Research Synthesis and Final Output

The final stage synthesizes data from manufacturers and distributors, verifying key market statistics and product insights. The result is a validated, data-backed report offering a precise and actionable overview of the USA electric kettle market.

Frequently Asked Questions

01. How big is the USA Electric Kettle Market?

The USA electric kettle market is valued at USD 1.2 billion, driven by the demand for quick and efficient heating appliances, supported by an expanding base of eco-conscious consumers and technological innovations.

02. What are the main challenges in the USA Electric Kettle Market?

Challenges in the USA electric kettle market include energy consumption concerns, competition with traditional stovetop kettles, and regulatory compliance on materials and energy efficiency.

03. Who are the leading players in the USA Electric Kettle Market?

Key players in the USA electric kettle market include Breville, Hamilton Beach, and Cuisinart, each renowned for product innovation, quality, and customer trust.

04. What factors are driving growth in the USA Electric Kettle Market?

Growth in the USA electric kettle market is driven by consumer demand for convenience, rising interest in specialty tea and coffee, and the trend toward eco-friendly and energy-efficient appliances.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.