USA Electric Trucks Market Outlook to 2030

Region:North America

Author(s):Meenakshi Bisht

Product Code:KROD4667

December 2024

89

About the Report

USA Electric Trucks Market Overview

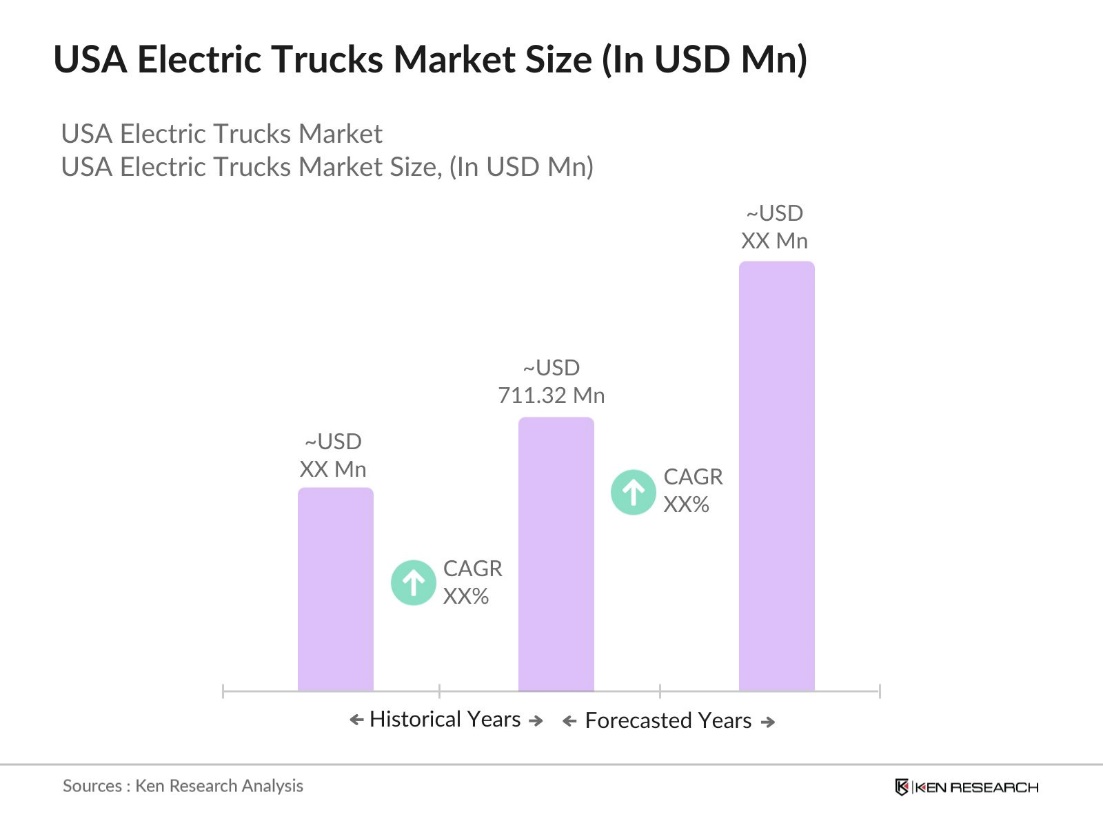

- The USA Electric Trucks Market is valued at USD 711.32 million, based on a five-year historical analysis. The growth is primarily driven by advancements in battery technology and the increasing availability of fast-charging infrastructure. The push towards sustainable transportation, coupled with governmental incentives for electric vehicles (EVs) such as tax credits and grants, has further spurred the adoption of electric trucks. Rising fuel costs and heightened environmental concerns are driving fleet operators to transition to electric trucks for cost savings and emission reductions.

- Cities like Los Angeles, New York, and San Francisco are dominant players in the market due to their extensive infrastructure and high adoption rates. These cities have aggressive climate action plans aimed at reducing emissions and promoting zero-emission transportation. In addition, California's stringent emission regulations and significant investment in EV charging stations place it at the forefront of the electric truck market in the USA.

- In 2023, California saw a significant rise in the adoption of zero-emission vehicles (ZEVs), with one in six new trucks, buses, and vans sold being zero-emission. The state exceeded its Advanced Clean Trucks (ACT) goal two years ahead of schedule, with 18,473 medium- and heavy-duty ZEVs sold, a fivefold increase over the target. California's regulatory framework, including future mandates requiring 100% ZEV sales by 2045, continues to drive this shift towards cleaner transportation solutions.

USA Electric Trucks Market Segmentation

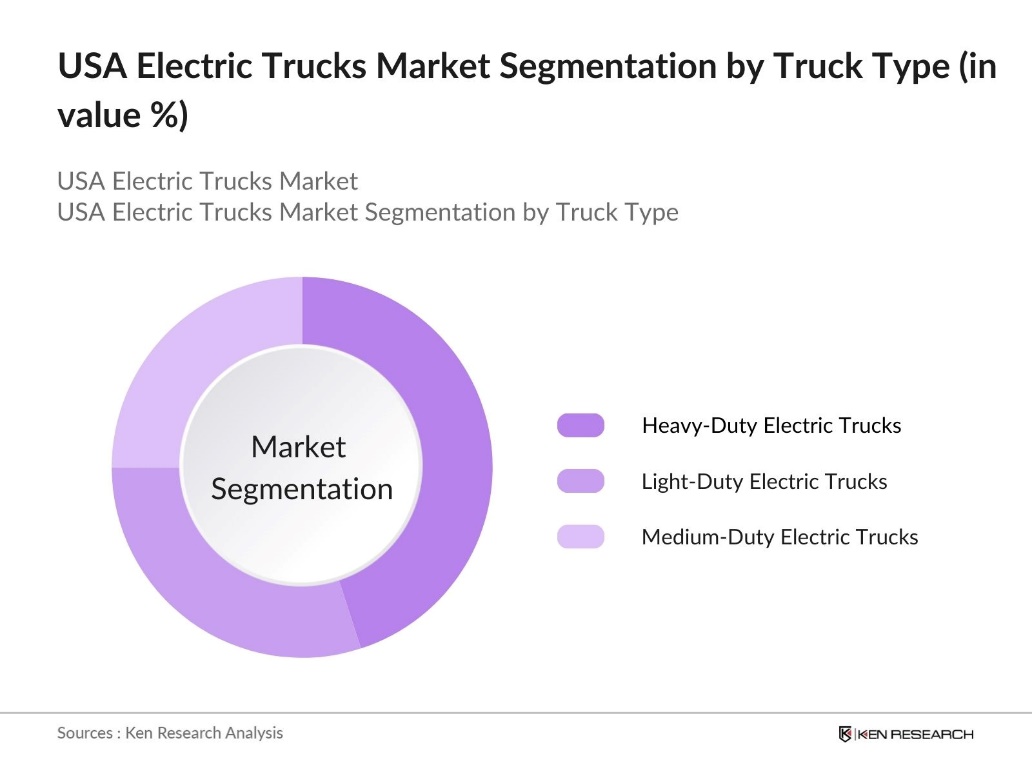

By Truck Type: The USA electric trucks market is segmented by truck type into light-duty electric trucks, medium-duty electric trucks, and heavy-duty electric trucks. Heavy-duty electric trucks currently dominate the market share due to the growing demand from logistics companies and the construction sector. These trucks are designed to cover long distances and haul large loads, making them ideal for interstate transport and industrial usage. Key companies like Tesla and Freightliner have introduced advanced heavy-duty models that offer improved range and performance, driving their popularity.

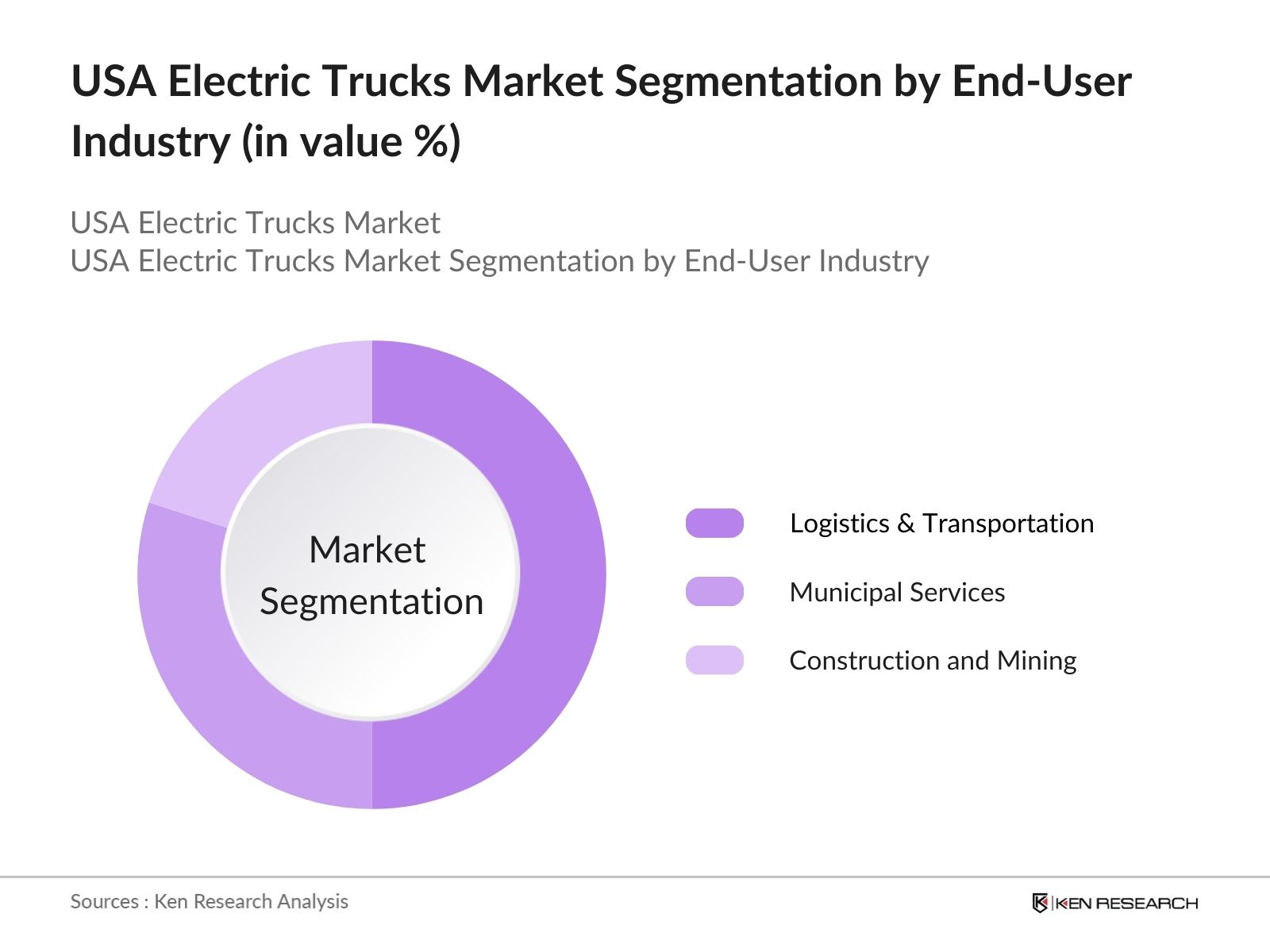

By End-User Industry: The electric trucks market in the USA is also segmented by end-user industries, including logistics & transportation, municipal services, and construction and mining. The logistics & transportation segment leads the market due to the rise in e-commerce and the need for sustainable last-mile delivery solutions. Companies like Amazon and UPS are heavily investing in electric delivery trucks to reduce their carbon footprint. Furthermore, urban delivery solutions require trucks with zero emissions to comply with city-level regulations, driving demand in this segment.

USA Electric Trucks Market Competitive Landscape

The market is dominated by a mix of established automotive giants and new entrants, both local and international. The market's competitive landscape is marked by innovation in battery technology, strategic partnerships, and collaborations with charging infrastructure companies. Leading companies are constantly improving their electric truck models in terms of range, payload capacity, and fast-charging capabilities to cater to the evolving needs of businesses.

|

Company |

Establishment Year |

Headquarters |

No. of Employees |

Battery Range |

Charging Time |

Revenue (USD Bn) |

Truck Models |

Production Capacity |

|

Tesla, Inc. |

2003 |

Palo Alto, CA |

||||||

|

Rivian Automotive |

2009 |

Irvine, CA |

||||||

|

Daimler Trucks |

1896 |

Portland, OR |

||||||

|

Volvo Group |

1927 |

Gothenburg, Sweden |

||||||

|

Ford Motor Company |

1903 |

Dearborn, MI |

USA Electric Trucks Industry Analysis

Growth Drivers

- Electrification of Fleet Services: The transition of fleet services towards electric trucks has been driven by increased demand from logistics and delivery sectors. According to an analysis by the Environmental Defense Fund (EDF), approximately 10,265 electric trucks were deployed in 2023. The logistics sectors shift to electrification is further incentivized by government mandates on reducing emissions in transport. This growth was largely driven by major logistics companies such as Amazon and FedEx, which are integrating electric vehicles into their fleets to align with sustainability goals.

- Advances in Battery Technology: Advancements in battery technology have greatly improved the range of electric trucks. The Tesla Semi, for instance, can cover 500 miles (804 kilometers) on a full charge, enhancing its viability for long-haul routes. This increased range boosts operational efficiency for logistics companies, allowing them to reduce reliance on fossil fuels while expanding the potential use of electric trucks in longer-distance transportation.

- Expansion of EV Charging Infrastructure: The U.S. has seen significant growth in EV charging infrastructure, with a focus on stations designed for heavy-duty electric trucks. This expansion is driven by both public funding and private investments aimed at supporting the increasing adoption of electric vehicles in the commercial sector. Public initiatives, such as infrastructure bills, alongside private contributions from major companies, are helping to improve the accessibility and efficiency of charging networks. These efforts are particularly focused on key transportation corridors, ensuring that electric trucks can operate effectively over long distances and in various regions.

Market Challenges

- High Initial Investment Cost (Battery Cost, EV Manufacturing Cost): The cost of electric trucks remains higher than traditional diesel trucks, mainly due to expensive battery technology and manufacturing costs. While the prices of batteries have been gradually decreasing, electric trucks still require a significant upfront investment. This higher initial cost poses a challenge for fleet operators, especially smaller businesses, who may struggle with the financial burden.

- Range Anxiety (Long-Haul Distance Feasibility): Electric trucks face limitations in long-haul applications due to concerns about their driving range, often referred to as "range anxiety." Drivers worry about running out of power before reaching a charging station, which can be particularly challenging on long-distance routes. While advancements in electric truck technology are improving range capabilities, they still fall short compared to traditional diesel trucks. The availability and distribution of charging infrastructure, especially along long-haul routes, remain critical factors in addressing this challenge and supporting broader adoption of electric trucks for long-distance transport.

USA Electric Trucks Market Future Outlook

The USA electric trucks market is poised for rapid growth in the coming years, driven by a combination of regulatory support and technological advancements. With state and federal governments offering various incentives and stringent emission regulations, the market is expected to continue its upward trajectory. Companies are investing heavily in research and development to produce trucks with extended ranges and quicker charging times, making them more practical for long-haul transport.

Market Opportunities

- Growth in E-commerce Sector: The rapid expansion of e-commerce is driving a shift towards electrifying delivery fleets. Major logistics companies are increasingly adopting electric trucks to meet sustainability goals and reduce operational costs. As demand for last-mile delivery continues to grow, electric trucks are becoming an essential part of the logistics network. Stricter emission regulations are also encouraging companies to transition to electric vehicles, further increasing opportunities in the e-commerce sector.

- Technological Advancements in Autonomous Electric Trucks: Autonomous electric trucks are a growing opportunity in the U.S. market, with ongoing testing of self-driving technology by key industry players. The integration of AI and machine learning helps optimize route efficiency and reduces the need for drivers, enhancing overall fleet management. These technological advancements have the potential to significantly lower operational costs, making electric trucks even more attractive to logistics companies.

Scope of the Report

|

By Truck Type |

Light-Duty Electric Trucks Medium-Duty Electric Trucks Heavy-Duty Electric Trucks |

|

By End-User Industry |

Logistics & Transportation Municipal Services Construction and Mining |

|

By Propulsion Technology |

Battery Electric Vehicles (BEV) Plug-in Hybrid Electric Vehicles (PHEV) Hydrogen Fuel Cell Electric Vehicles |

|

By Range |

Less than 100 Miles 100-200 Miles Above 200 Miles |

|

By Region |

North-East West Coast Midwest Southern |

Products

Key Target Audience

Electric Truck Manufacturers

Logistics & Transportation Companies

Energy and Utility Companies

Truck Leasing and Rental Companies

Banks and Financial Institutions

Investment and Venture Capitalist Firms

Government and Regulatory Bodies (Department of Energy, Federal Highway Administration)

Companies

Players Mentioned in the Report

Tesla, Inc.

Rivian Automotive

Daimler Trucks North America LLC

Volvo Group

BYD Motors Inc.

Ford Motor Company

Nikola Corporation

Freightliner Trucks

Workhorse Group Inc.

Peterbilt Motors Company

Kenworth Truck Company

Lordstown Motors Corp.

Lion Electric Company

Mack Trucks

Xos Trucks Inc.

Table of Contents

1. USA Electric Trucks Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. USA Electric Trucks Market Size (In USD Mn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. USA Electric Trucks Market Analysis

3.1. Growth Drivers

3.1.1. Electrification of Fleet Services (Electric Truck Fleet Growth, Logistics Demand)

3.1.2. Government Incentives and Emission Regulations (EV Tax Credits, Zero Emission Targets)

3.1.3. Advances in Battery Technology (Range Efficiency, Fast Charging Development)

3.1.4. Expansion of EV Charging Infrastructure (Public Charging Networks, Private Investments)

3.2. Market Challenges

3.2.1. High Initial Investment Cost (Battery Cost, EV Manufacturing Cost)

3.2.2. Range Anxiety (Long-Haul Distance Feasibility)

3.2.3. Limited Charging Infrastructure in Rural Areas

3.2.4. Competition from Traditional Fuel Trucks (Price Competition, Transition Period)

3.3. Opportunities

3.3.1. Growth in E-commerce Sector (Delivery Fleet Electrification)

3.3.2. Technological Advancements in Autonomous Electric Trucks (Self-Driving Technology)

3.3.3. Increasing Demand for Sustainable Transport Solutions (Carbon-Neutral Logistics)

3.3.4. Expansion into Heavy-Duty Trucks Segment (Development of Heavy Electric Trucks)

3.4. Trends

3.4.1. Integration of AI and IoT for Fleet Management (Telematics, Predictive Maintenance)

3.4.2. Collaboration between Automakers and Technology Companies (Strategic Partnerships)

3.4.3. Rising Adoption of Hydrogen-Electric Trucks (Hydrogen Fuel Cells, Hybrid Electric Solutions)

3.4.4. Urban Delivery Solutions Focus (Last-Mile Electric Trucks)

3.5. Government Regulations

3.5.1. Federal EV Tax Incentives and Subsidies (Electric Vehicle Incentive Programs)

3.5.2. State-Level Emission Standards (California Zero-Emission Truck Mandates)

3.5.3. Infrastructure Investments (Funding for Charging Stations)

3.5.4. Green Logistics and Sustainability Policies (Government Initiatives for Emission Reduction)

3.6. SWOT Analysis (Electric Truck Market)

3.7. Stakeholder Ecosystem (Automakers, Logistics Providers, Charging Infrastructure Developers)

3.8. Porters Five Forces (Competition Dynamics, Supplier Influence, Buyer Power, Threat of Substitutes, Entry Barriers)

3.9. Competitive Landscape

4. USA Electric Trucks Market Segmentation

4.1. By Truck Type (In Value %)

4.1.1. Light-Duty Electric Trucks

4.1.2. Medium-Duty Electric Trucks

4.1.3. Heavy-Duty Electric Trucks

4.2. By End-User Industry (In Value %)

4.2.1. Logistics & Transportation

4.2.2. Municipal Services (Waste Management, Public Transportation)

4.2.3. Construction and Mining

4.3. By Propulsion Technology (In Value %)

4.3.1. Battery Electric Vehicles (BEV)

4.3.2. Plug-in Hybrid Electric Vehicles (PHEV)

4.3.3. Hydrogen Fuel Cell Electric Vehicles

4.4. By Range (In Value %)

4.4.1. Less than 100 Miles

4.4.2. 100-200 Miles

4.4.3. Above 200 Miles

4.5. By Region (In Value %)

4.5.1. North-East USA

4.5.2. West Coast USA

4.5.3. Midwest USA

4.5.4. Southern USA

5. USA Electric Trucks Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. Tesla, Inc.

5.1.2. Rivian Automotive, LLC

5.1.3. Nikola Corporation

5.1.4. Daimler Trucks North America LLC

5.1.5. Volvo Group

5.1.6. BYD Motors Inc.

5.1.7. Freightliner Trucks

5.1.8. Ford Motor Company

5.1.9. Workhorse Group Inc.

5.1.10. Peterbilt Motors Company

5.1.11. Kenworth Truck Company

5.1.12. Lordstown Motors Corp.

5.1.13. Lion Electric Company

5.1.14. Mack Trucks

5.1.15. Xos Trucks Inc.

5.2. Cross Comparison Parameters

(Revenue, Truck Units Sold, Range Capability, Battery Capacity, Charging Speed, Electric Powertrain Type, Production Capacity, Headquarters)

5.3. Market Share Analysis

5.4. Strategic Initiatives (Partnerships, Mergers, New Product Launches)

5.5. Mergers and Acquisitions (Recent Activities)

5.6. Investment Analysis (Private Funding, Government Grants, Public Offerings)

5.7. Government Grants and Incentives for EV Development

5.8. Private Equity and Venture Capital Funding

6. USA Electric Trucks Market Regulatory Framework

6.1. Federal Emission Standards and Regulations (EPA, CAFE Standards)

6.2. State-Specific EV Laws (CARB Zero-Emission Regulations)

6.3. Certification Processes (Vehicle Safety and Emission Compliance)

7. USA Electric Trucks Future Market Size (In USD Mn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. USA Electric Trucks Future Market Segmentation

8.1. By Truck Type (In Value %)

8.2. By End-User Industry (In Value %)

8.3. By Propulsion Technology (In Value %)

8.4. By Range (In Value %)

8.5. By Region (In Value %)

9. USA Electric Trucks Market Analysts Recommendations

9.1. Total Addressable Market (TAM) Analysis

9.2. Serviceable Addressable Market (SAM) Analysis

9.3. Market Penetration Strategies

9.4. New Market Entry Opportunities

Research Methodology

Step 1: Identification of Key Variables

The research process begins with constructing a comprehensive map of all major stakeholders within the USA Electric Trucks Market. Extensive desk research was conducted using secondary data from proprietary and public databases, ensuring that all critical factors influencing the market are identified and defined.

Step 2: Market Analysis and Construction

In this phase, we compile historical data on electric truck adoption and production volumes. Analyzing key metrics like truck range, battery capacity, and adoption rates, we assess market penetration and revenue generation. These insights form the foundation for projecting market trends.

Step 3: Hypothesis Validation and Expert Consultation

We engage with industry experts through computer-assisted telephone interviews (CATIs), gathering insights directly from electric truck manufacturers, logistics providers, and battery technology companies. These consultations validate the hypotheses generated during the desk research phase, refining our market projections.

Step 4: Research Synthesis and Final Output

The final phase involves synthesizing the insights gained from primary and secondary research into a cohesive market analysis. This includes cross-verification of data through bottom-up approaches, ensuring the accuracy of market estimates and forecasts. Direct engagement with truck manufacturers provides further clarity on product innovations, market challenges, and growth opportunities.

Frequently Asked Questions

01. How big is the USA Electric Trucks Market?

The USA Electric Trucks Market is valued at USD 711.32 million, driven by advancements in battery technology and increasing adoption among fleet operators.

02. What are the key challenges in the USA Electric Trucks Market?

Key challenges in USA Electric Trucks Market include the high initial cost of electric trucks, limited charging infrastructure in rural areas, and range limitations for long-haul transport.

03. Who are the major players in the USA Electric Trucks Market?

Major players in USA Electric Trucks Market include Tesla, Inc., Rivian Automotive, Daimler Trucks North America, Volvo Group, and Ford Motor Company, all driving innovation in electric truck technology.

04. What factors are driving growth in the USA Electric Trucks Market?

The USA Electric Trucks Market is driven by increasing demand for sustainable transportation, government incentives, and advancements in battery technology that extend truck range and reduce charging time.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.