USA Electric Vehicle Market Outlook to 2030

Region:North America

Author(s):Mukul Soni

Product Code:KROD2421

December 2024

84

About the Report

USA Electric Vehicle Market Overview

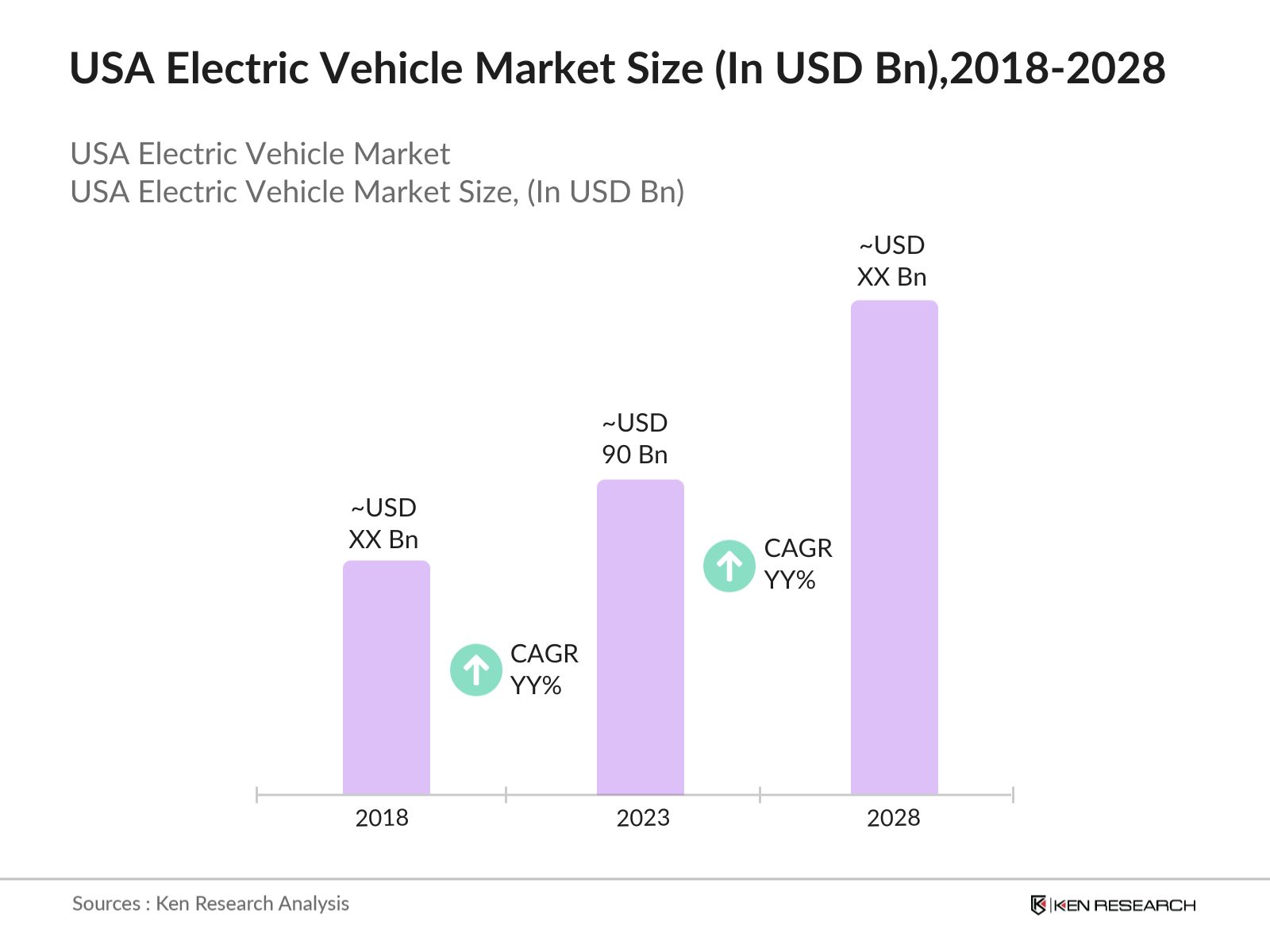

- The USA Electric Vehicle market was valued at USD 90 billion in 2023, driven by rising environmental concerns, strong governmental support, and the shift towards sustainable transportation. Increasing awareness of climate change and consumer demand for zero-emission vehicles are key factors propelling the growth of the EV market. The availability of tax incentives and advancements in battery technology are also encouraging widespread adoption of EVs across the country.

- Key players in the USA EV market include Tesla, General Motors, Ford, Rivian, and Lucid Motors. These companies dominate the market due to their advanced technologies, strong brand presence, and large-scale production capabilities. Tesla leads with its vast network of Superchargers and market-defining EV models, while GM and Ford are investing heavily in electric trucks and SUVs to capture a larger share of the market.

- The USA EV market is led by cities such as Los Angeles, San Francisco, and New York, driven by high consumer demand, favorable state regulations, and extensive charging infrastructure. New York City and San Francisco have also implemented aggressive goals to electrify their city fleets by 2030.

- In 2023, Tesla continued its dominance in the USA EV market by expanding its Gigafactory in Texas, further increasing production of the Model Y and Cybertruck. Tesla's Supercharger network also expanded, reaching 12,000 charging stations nationwide, significantly boosting its accessibility and appeal. The companys innovative approach to battery technology, including new 4680 cells, has set the stage for long-term growth.

USA Electric Vehicle Market Segmentation

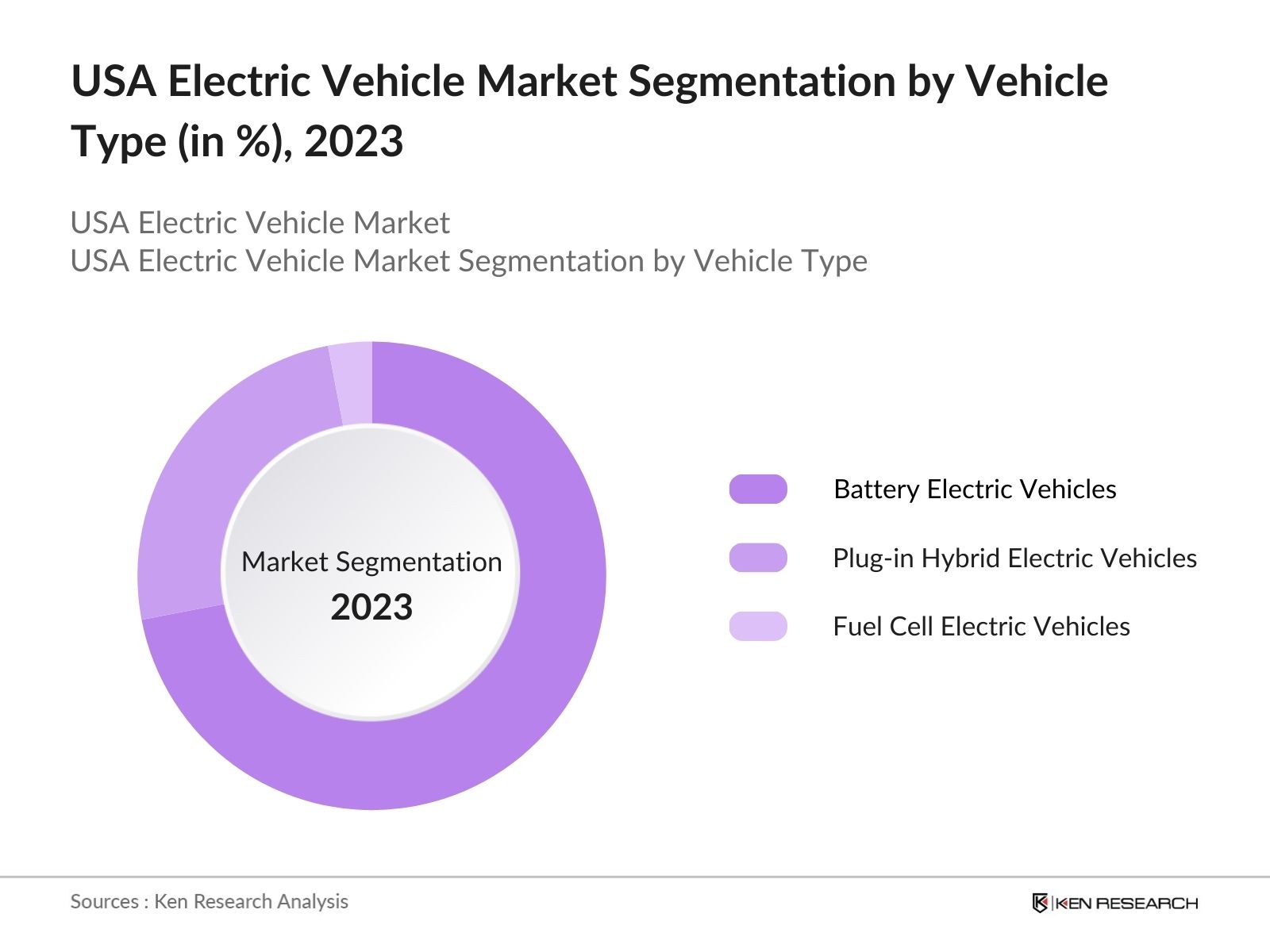

- By Vehicle Type: The USA Electric Vehicle market is segmented by vehicle type into Battery Electric Vehicles (BEVs), Plug-in Hybrid Electric Vehicles (PHEVs), and Fuel Cell Electric Vehicles (FCEVs). In 2023, BEVs dominated the market, driven by their lower maintenance costs, zero emissions, and strong consumer preference for long-range electric cars like Teslas Model 3. Government incentives for BEVs also contribute to their dominance in the market.

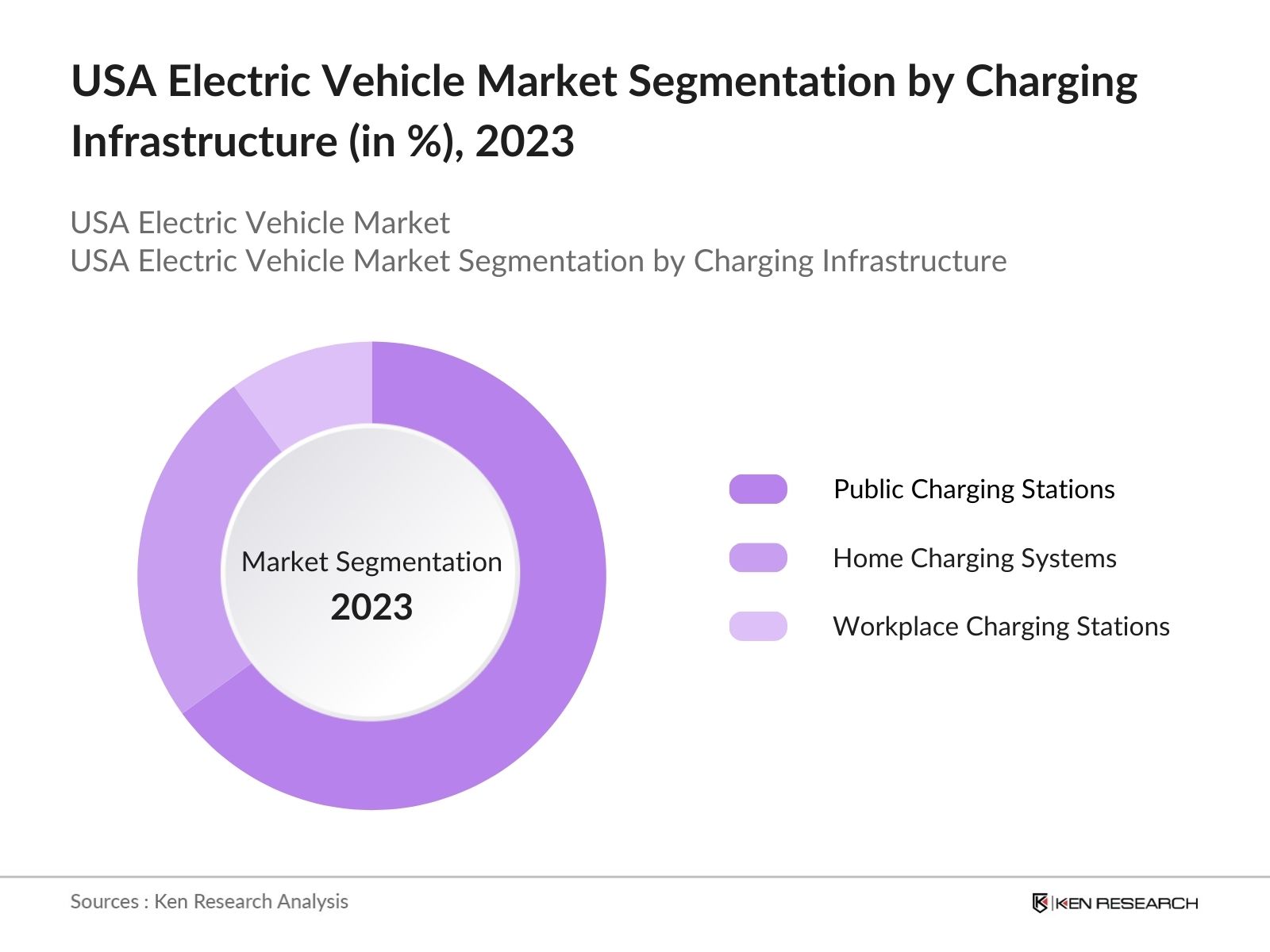

- By Charging Infrastructure: The USA Electric Vehicle market is further segmented by charging infrastructure into public charging stations, home charging systems, and workplace charging stations. In 2023, public charging stations dominated the market, driven by the expansion of the Tesla Supercharger network and the launch of the NEVI Program. As more charging stations are built along major highways and in urban areas, EV adoption is expected to grow rapidly.

- By Region: The USA Electric Vehicle market is divided into North, South, East, and West regions. In 2023, the West region dominated the market due to Californias progressive policies on EV adoption and the extensive charging infrastructure in place. The states ZEV (Zero Emission Vehicle) mandates and financial incentives have made it the largest EV market in the country.

USA Electric Vehicle Market Competitive Landscape

|

Company |

Establishment Year |

Headquarters |

|

Tesla |

2003 |

Palo Alto, CA |

|

General Motors |

1908 |

Detroit, MI |

|

Ford Motor Company |

1903 |

Dearborn, MI |

|

Rivian |

2009 |

Irvine, CA |

|

Lucid Motors |

2007 |

Newark, CA |

- Ford: Fords commitment to electric vehicles is reflected in the success of the F-150 Lightning, which became one of the best-selling electric trucks in the USA in 2023. The company invested USD 5.6 billion in the BlueOval City, a mega-campus dedicated to manufacturing next-generation electric vehicles and batteries, scheduled to begin production by 2025. Fords strategy focuses on the electrification of its most iconic models.

- Rivian: In 2023, Rivian produced57,232 electric vehiclesand delivered50,122, marking a substantial increase of135%in production and147%in deliveries compared to 2022. This growth reflects Rivian's successful ramp-up of manufacturing at its facility in Normal, Illinois, where it produced17,541 vehiclesin Q4 alone, a75%increase year-over-year.

USA Electric Vehicle Industry Analysis

USA Electric Vehicle Market Growth Drivers

- Investment in EV Charging Infrastructure: The expansion of charging infrastructure remains a critical growth driver for the USA Electric Vehicle market. With USD 7.5 billion allocated under the Bipartisan Infrastructure Law (2023) for building 500,000 EV charging stations by 2030, the accessibility of EVs is increasing, particularly in underserved rural areas.

- Increased Domestic Production of EV Batteries: The growing emphasis on building domestic battery production capacity is fueling market growth. In 2024, General Motors and Samsung SDI invested USD 3.5 billion in a new battery plant in Indiana to reduce reliance on foreign suppliers and secure a steady supply of batteries for EV production. This move will help lower costs and increase the affordability of electric vehicles, further driving adoption.

- Government Support and Incentives: The Inflation Reduction Act (2022) continues to provide significant tax credits for consumers purchasing electric vehicles, with up to USD 7,500 available for new EV purchases. These incentives, coupled with additional state-level subsidies, are making electric vehicles more affordable for consumers. In addition, government initiatives like the Federal Transit Administrations USD 1.5 billion grant program for electric buses are helping to electrify public transportation, reducing emissions in urban areas.

USA Electric Vehicle Market Challenges

- Supply Chain Disruptions: The global semiconductor shortage continues to affect EV production. In 2023, Ford and General Motors faced delays in their EV production lines due to the unavailability of critical electronic components. These disruptions have led to slower delivery times and reduced output, affecting the ability of automakers to meet the growing demand for electric vehicles.

- Limited Charging Infrastructure in Rural Areas: While urban centers are well-equipped with EV charging stations, rural areas in the USA still face significant infrastructure gaps. As of 2023, less than 15% of public charging stations were located in rural regions, making it difficult for EV owners in these areas to charge their vehicles conveniently. This infrastructure deficit remains a barrier to wider EV adoption across the country.

USA Electric Vehicle Market Future Outlook

The USA Electric Vehicle market is expected to experience significant growth through 2028, driven by technological advancements, expanding infrastructure, and favorable government policies. The shift towards electrification of public and private transport fleets, coupled with declining battery costs, will further accelerate market growth.

Future Market Trends

- Growth in Electric Commercial Vehicles: The demand for electric commercial vehicles, such as delivery trucks and buses, is projected to grow significantly by 2028. Companies like Rivian and Ford are already working on expanding their electric truck and van offerings for commercial use, with large-scale orders from businesses like Amazon and UPS. Government mandates to reduce emissions in the logistics and transportation sectors will further drive this trend.

- Development of Solid-State Batteries: By 2028, solid-state batteries are expected to become a key technological advancement in the EV market. These batteries offer higher energy density, faster charging times, and improved safety compared to current lithium-ion batteries. Automakers are heavily investing in research and development of solid-state technology, which will enhance the range and performance of electric vehicles in the future.

Scope of the Report

|

By Vehicle Type |

Battery Electric Vehicles (BEVs) Plug-in Hybrid Electric Vehicles (PHEVs) Fuel Cell Electric Vehicles (FCEVs) |

|

By Charging Infrastructure |

Public Charging Stations Home Charging Systems Workplace Charging Stations |

|

By Region |

West North East South |

Products

Key Target Audience Organizations and Entities Who Can Benefit by Subscribing This Report:

EV Manufacturers

Automotive Component Suppliers

Battery Manufacturers

Government and Regulatory Bodies (e.g., U.S. Department of Energy, Environmental Protection Agency)

Charging Infrastructure Providers

Technology Solution Providers

Investments and Venture Capitalist Firms

EV Fleet Operators

Automotive Associations (e.g., American Automotive Policy Council)

Companies

Players Mentioned in the Report

Tesla

General Motors

Ford Motor Company

Rivian

Lucid Motors

Nissan

BMW

Mercedes-Benz

Hyundai

Volkswagen

Polestar

Volvo

Audi

Kia

Stellantis

Table of Contents

1. USA Electric Vehicle Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. USA Electric Vehicle Market Size (in USD Bn), 2018-2023

2.1. Historical Market Size

2.2. Year-on-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. USA Electric Vehicle Market Analysis

3.1. Growth Drivers

3.1.1. Investment in EV Charging Infrastructure

3.1.2. Increased Domestic Production of EV Batteries

3.1.3. Government Support and Incentives

3.2. Restraints

3.2.1. High Initial Purchase Costs

3.2.2. Supply Chain Disruptions

3.2.3. Limited Charging Infrastructure in Rural Areas

3.3. Opportunities

3.3.1. Development of Solid-State Batteries

3.3.2. Growth in Electric Commercial Vehicles

3.3.3. Expansion of EV Charging Infrastructure

3.4. Trends

3.4.1. Integration of Vehicle-to-Grid (V2G) Technology

3.4.2. Rise of Electric Commercial Vehicles

3.4.3. Technological Advancements in Battery Manufacturing

3.5. Government Regulation

3.5.1. Inflation Reduction Act (2022)

3.5.2. Bipartisan Infrastructure Law (2023)

3.5.3. NEVI Program (2023)

3.6. SWOT Analysis

3.7. Stake Ecosystem

3.8. Competition Ecosystem

4. USA Electric Vehicle Market Segmentation, 2023

4.1. By Vehicle Type (in Value %)

4.1.1. Battery Electric Vehicles (BEVs)

4.1.2. Plug-in Hybrid Electric Vehicles (PHEVs)

4.1.3. Fuel Cell Electric Vehicles (FCEVs)

4.2. By Charging Infrastructure (in Value %)

4.2.1. Public Charging Stations

4.2.2. Home Charging Systems

4.2.3. Workplace Charging Stations

4.3. By Region (in Value %)

4.3.1. West

4.3.2. North

4.3.3. East

4.3.4. South

5. USA Electric Vehicle Market Cross Comparison

5.1 Detailed Profiles of Major Companies

5.1.1. Tesla

5.1.2. General Motors

5.1.3. Ford Motor Company

5.1.4. Rivian

5.1.5. Lucid Motors

5.2 Cross Comparison Parameters (No. of Employees, Headquarters, Inception Year, Revenue)

6. USA Electric Vehicle Market Competitive Landscape

6.1. Market Share Analysis

6.2. Strategic Initiatives

6.3. Mergers and Acquisitions

6.4. Investment Analysis

6.4.1. Venture Capital Funding

6.4.2. Government Grants

6.4.3. Private Equity Investments

7. USA Electric Vehicle Market Regulatory Framework

7.1. Environmental Standards

7.2. Compliance Requirements

7.3. Certification Processes

8. USA Electric Vehicle Future Market Size (in USD Bn), 2023-2028

8.1. Future Market Size Projections

8.2. Key Factors Driving Future Market Growth

9. USA Electric Vehicle Future Market Segmentation, 2028

9.1. By Vehicle Type (in Value %)

9.2. By Charging Infrastructure (in Value %)

9.3. By Region (in Value %)

10. USA Electric Vehicle Market Analysts Recommendations

10.1. TAM/SAM/SOM Analysis

10.2. Customer Cohort Analysis

10.3. Marketing Initiatives

10.4. White Space Opportunity Analysis

Disclaimer Contact UsResearch Methodology

Step 1: Identifying Key Variables

Ecosystem creation for all major entities involved in the USA Electric Vehicle market, including electric vehicle manufacturers, battery suppliers, and infrastructure developers. We referred to multiple secondary and proprietary databases to perform desk research and gather industry-level information, such as electric vehicle production volumes, charging infrastructure expansion, and consumer adoption trends.

Step 2: Market Building

Collating statistics on the USA Electric Vehicle market over the years, including production and sales data from key players like Tesla, General Motors, and Ford. This step involved analyzing electric vehicle adoption rates across different regions (North, South, East, and West) and vehicle types (BEVs, PHEVs, FCEVs) to compute revenue generation for the market.

Step 3: Validating and Finalizing

Building market hypotheses based on initial research and conducting Computer-Assisted Telephone Interviews (CATIs) with industry experts, such as executives from EV manufacturers, charging infrastructure providers, and battery technology companies. These interviews helped validate statistics and gather detailed insights on the operational strategies and financial performances of key market players.

Step 4: Research Output

Our team engaged with electric vehicle manufacturers, industry associations, and government bodies to understand the evolving trends in consumer preferences, regulatory shifts, and technological advancements. Feedback from these entities allowed us to refine our research findings and validate data derived through a bottom-up approach.

Frequently Asked Questions

01. How big is the USA Electric Vehicle market?

In 2023, the USA Electric Vehicle market reached a valuation of USD 90 billion, fueled by growing environmental concerns, robust government backing, and the transition toward sustainable transportation. The rising awareness of climate change and increasing consumer demand for zero-emission vehicles are significant drivers of the EV market's expansion.

02. What are the challenges in the USA Electric Vehicle market?

The major challenges include high upfront costs of EVs, supply chain disruptions, particularly in semiconductor availability, and the limited availability of EV charging infrastructure in rural areas. These issues create barriers to broader adoption of electric vehicles across the country.

03. Who are the major players in the USA Electric Vehicle market?

Key players in the market include Tesla, General Motors, Ford Motor Company, Rivian, and Lucid Motors. These companies lead due to their innovative technologies, extensive product lines, and substantial investments in manufacturing and infrastructure.

04. What are the growth drivers of the USA Electric Vehicle market?

The market is primarily driven by government support through tax incentives, increased investments in EV charging infrastructure, and rising consumer demand for lower operating costs. Additionally, advancements in battery technology are further propelling market growth.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.