USA Electronic Health Records Market Outlook to 2030

Region:North America

Author(s):Naman Rohilla

Product Code:KROD10081

December 2024

84

About the Report

USA Electronic Health Records Market Overview

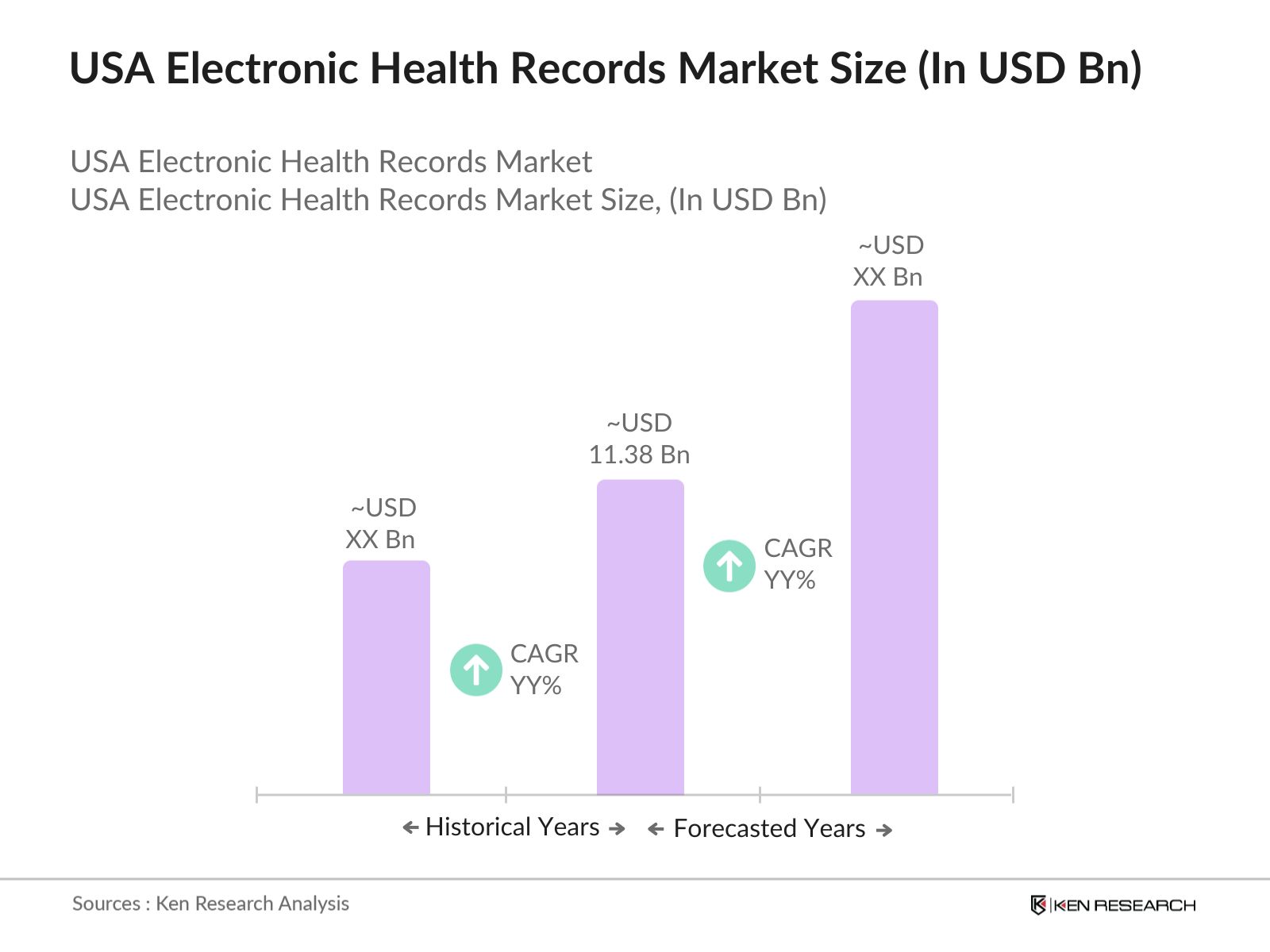

- The U.S. Electronic Health Records (EHR) market is valued at USD 11.38 billion, based on a five-year historical analysis. This valuation is driven by government initiatives promoting healthcare IT adoption, technological advancements in healthcare services, and the increasing demand for centralized and streamlined healthcare data to enhance patient outcomes and reduce costs.

- Major urban centers such as New York, Los Angeles, and Chicago dominate the EHR market due to their extensive healthcare infrastructures, high patient volumes, and early adoption of advanced healthcare technologies. These cities' large hospital networks and emphasis on improving healthcare delivery contribute significantly to their market dominance.

- The HITECH Act, which allocated over $30 billion for EHR adoption, continues to influence the U.S. EHR market by enforcing meaningful use standards. This regulation aims to improve healthcare quality, safety, and efficiency, impacting over 400,000 healthcare providers nationwide.

USA Electronic Health Records Market Segmentation

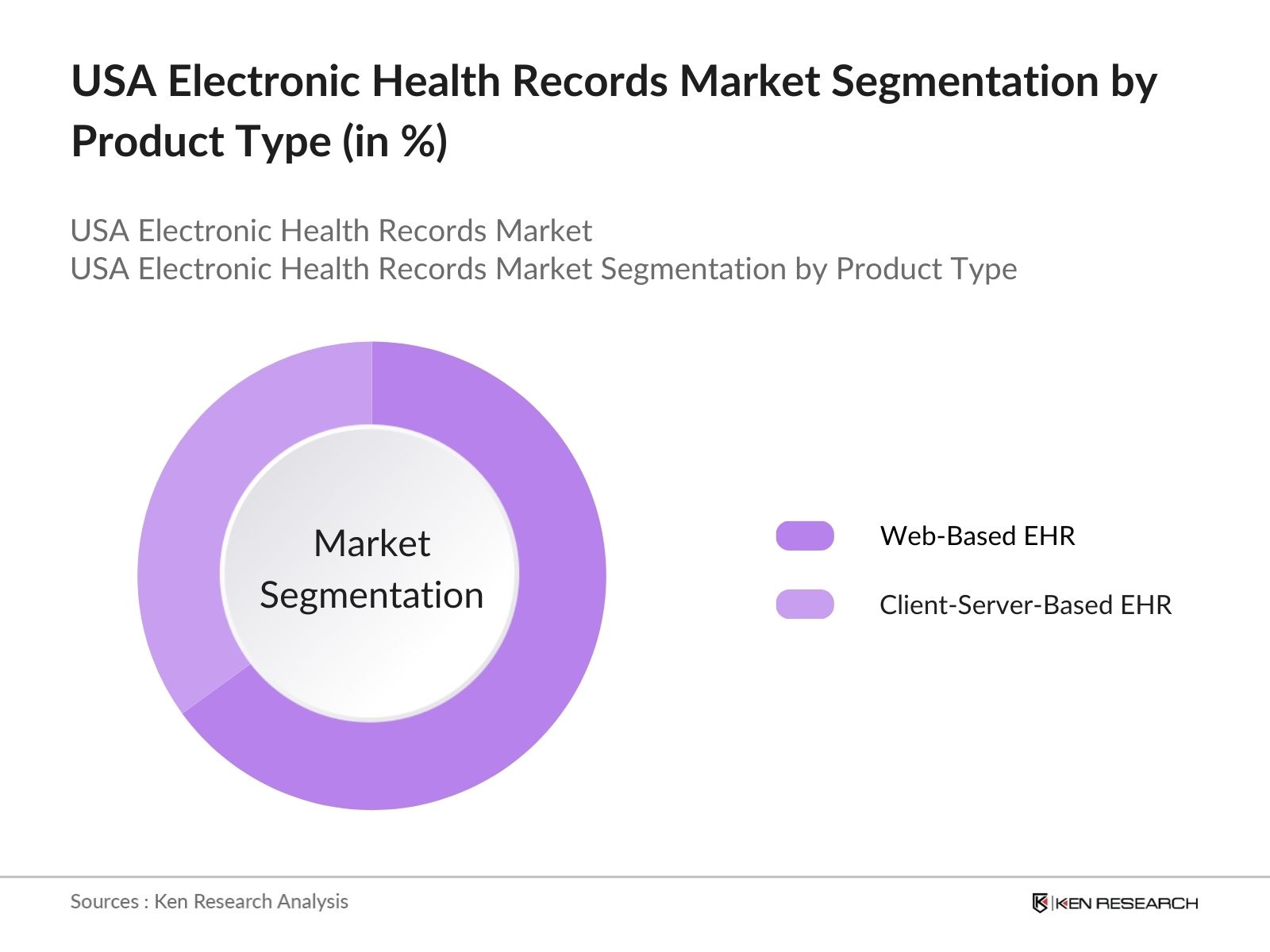

By Product Type: The market is segmented by product type into Web-Based EHR and Client-Server-Based EHR. Web-Based EHRs hold a dominant market share due to their cost-effectiveness, ease of access, and scalability, making them particularly appealing to small and medium-sized healthcare providers. The ability to access patient records remotely and the reduced need for in-house IT infrastructure further enhance their adoption.

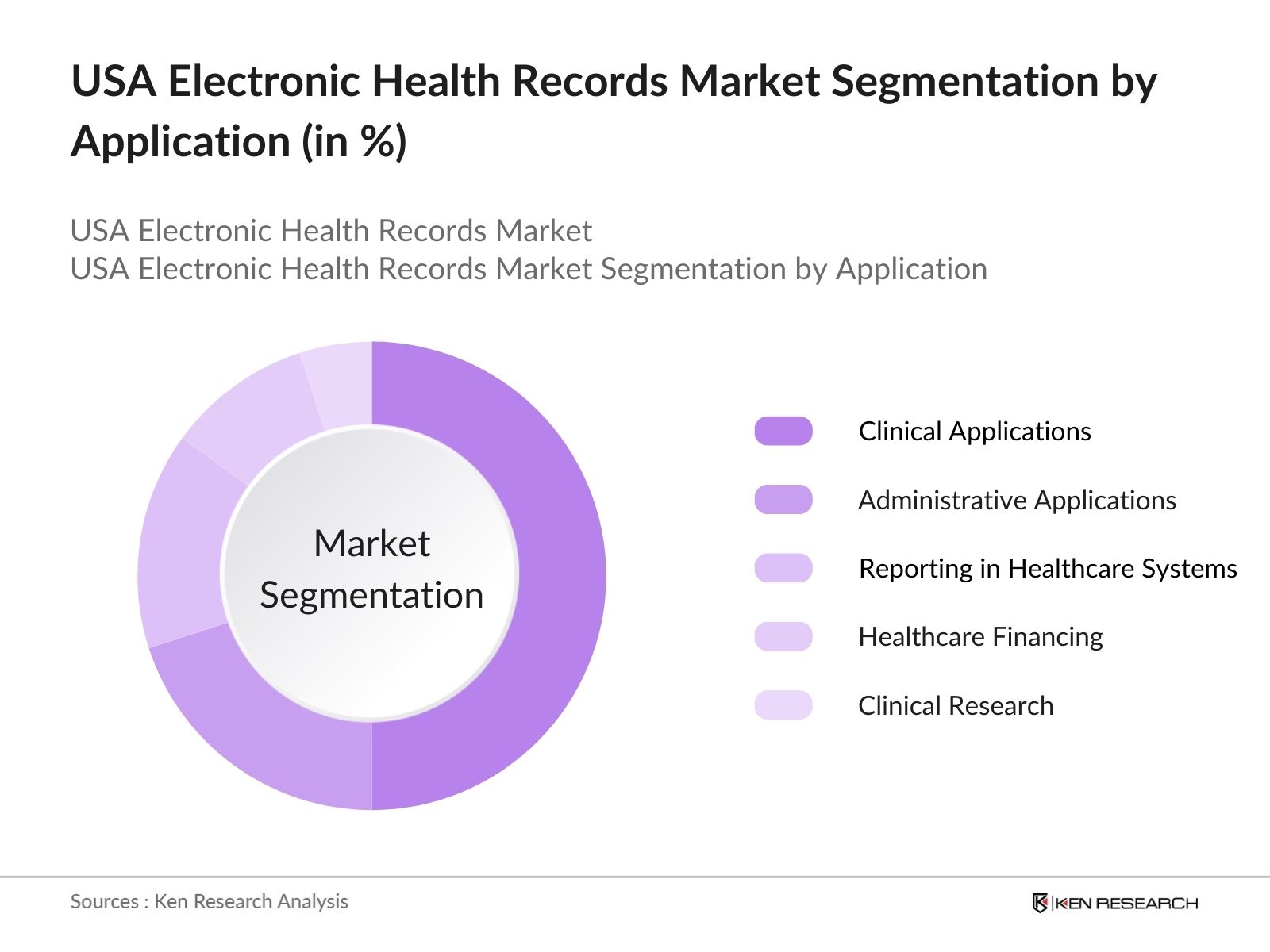

By Application: The market is also segmented by application into Clinical Applications, Administrative Applications, Reporting in Healthcare Systems, Healthcare Financing, and Clinical Research. Clinical Applications dominate the market share, as EHRs are primarily utilized to improve patient care by providing comprehensive and real-time access to patient health information, facilitating better diagnosis and treatment decisions.

USA Electronic Health Records Market Competitive Landscape

The U.S. EHR market is characterized by the presence of several key players who have established strong positions through extensive product offerings and strategic initiatives.

|

Company Name |

Establishment Year |

Headquarters |

Revenue (USD Billion) |

Number of Employees |

Market Share (%) |

Key Products/Services |

Recent Developments |

|

Epic Systems Corporation |

1979 |

Verona, Wisconsin |

|||||

|

Cerner Corporation |

1979 |

Kansas City, Missouri |

|||||

|

Allscripts Healthcare Solutions |

1986 |

Chicago, Illinois |

|||||

|

MEDITECH |

1969 |

Westwood, Massachusetts |

|||||

|

NextGen Healthcare |

1974 |

Irvine, California |

USA Electronic Health Records Market Analysis

Market Growth Drivers

- Technological Advancements: Technological advancements, including AI and machine learning, are critical to enhancing EHR functionality. Over 60% of hospitals in the U.S. now incorporate AI-driven analytics for patient record management, allowing for quicker decision-making and predictive insights. Major healthcare networks, including over 150 teaching hospitals, have embedded predictive AI tools within their EHR systems, streamlining diagnostics and personalized care approaches. Enhanced technology integration is reducing administrative tasks, allowing practitioners to allocate more time to patient care.

- Increasing Healthcare Digitization: The digital transformation of healthcare in the U.S. shows substantial traction, with approximately 95% of non-federal hospitals fully digitized by 2024. This includes patient data digitalization across over 4,000 hospitals and 15,000 ambulatory sites. Digitization enables faster access to patient records, improved care coordination, and enhanced patient outcomes, impacting over 400 million annual hospital visits. The expansion of telemedicine has further accelerated the shift towards digital health systems nationwide.

- Rising Demand for Centralized Data Management: Centralized data management is vital in the U.S. healthcare sector, impacting over 2.7 billion patient encounters annually. By 2024, 80% of healthcare facilities employ centralized EHR systems, facilitating smoother data sharing among providers and improved patient safety. Standardized and accessible patient records minimize duplicative testing and reduce medical errors. Hospitals report a 15% reduction in redundant testing attributed to centralized data sharing, saving millions in healthcare costs annually.

Market Challenges

- High Implementation and Maintenance Costs: Implementing and maintaining EHR systems is financially challenging for U.S. healthcare providers. The average initial setup cost for an EHR system in a single hospital reaches $5 million, with annual maintenance expenses ranging from $100,000 to $1 million. Smaller clinics, representing over 30% of U.S. healthcare providers, struggle with this financial burden, often leading to limited or partial EHR adoption, affecting interoperability and comprehensive patient data availability.

- Data Privacy and Security Concerns: Data breaches have raised concerns about EHR systems' security. In 2023 alone, there were over 1,300 healthcare-related breaches, compromising nearly 50 million patient records. This vulnerability impacts patient trust and could lead to potential legal challenges. The need for robust cybersecurity measures has become increasingly critical, with EHR providers and healthcare facilities investing in advanced security protocols to safeguard sensitive patient data.

USA Electronic Health Records Market Future Outlook

Over the next five years, the U.S. Electronic Health Records market is expected to show growth driven by continuous government support, advancements in EHR technology, and increasing demand for integrated healthcare solutions. The shift towards value-based care models and the integration of artificial intelligence and machine learning into EHR systems are anticipated to enhance clinical decision-making and operational efficiency. Additionally, the growing emphasis on patient engagement and interoperability among healthcare systems is likely to further propel market expansion.

Market Opportunities

- Integration with Telemedicine: Telemedicine integration offers substantial growth potential, with over 20% of U.S. healthcare providers now incorporating telehealth solutions within EHR platforms. This integration supports real-time data sharing during virtual consultations, enhancing patient care accessibility, especially for the 46 million Americans living in rural areas. Telemedicine within EHRs allows for streamlined follow-ups, reduced hospital readmissions, and improved continuity of care.

- Adoption of Cloud-Based Solutions: The shift to cloud-based EHR systems is gaining traction, with about 45% of U.S. hospitals adopting cloud storage for healthcare records. Cloud solutions reduce infrastructure costs, offer scalability, and improve disaster recovery capabilities. Cloud-based systems also support compliance with data privacy regulations while providing seamless data access, even in remote settings, improving healthcare accessibility and reducing administrative costs.

- Expansion into Ambulatory Care Centers: EHR systems in ambulatory care centers represent a growth area, with over 9,000 ambulatory centers adopting EHRs as of 2024. These systems streamline patient data management for outpatient visits, which constitute over 50% of healthcare interactions in the U.S. EHR expansion into ambulatory settings enables efficient record-keeping, rapid diagnostics, and continuity of care across multiple care facilities.

Scope of the Report

|

Segment |

Sub-Segments |

|

Product Type |

Web-Based EHR |

|

Application |

Clinical Applications |

|

End-User |

Hospitals |

|

Deployment Mode |

Cloud-Based |

|

Business Model |

Licensed Software |

Products

Key Target Audience

Healthcare Providers (Hospitals, Clinics)

Health IT Vendors

Government and Regulatory Bodies (e.g., Office of the National Coordinator for Health Information Technology)

Insurance Companies

Pharmaceutical Companies

Research Institutions

Investors and Venture Capitalist Firms

Patient Advocacy Groups

Companies

Players Mentioned in the Report

Epic Systems Corporation

Cerner Corporation

Allscripts Healthcare Solutions

MEDITECH

NextGen Healthcare

eClinicalWorks

Greenway Health

Athenahealth

GE Healthcare

McKesson Corporation

Table of Contents

1. U.S. Electronic Health Records Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. U.S. Electronic Health Records Market Size (In USD Billion)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. U.S. Electronic Health Records Market Analysis

3.1. Growth Drivers

3.1.1. Government Initiatives and Incentives

3.1.2. Technological Advancements

3.1.3. Increasing Healthcare Digitization

3.1.4. Rising Demand for Centralized Data Management

3.2. Market Challenges

3.2.1. High Implementation and Maintenance Costs

3.2.2. Data Privacy and Security Concerns

3.2.3. Interoperability Issues

3.3. Opportunities

3.3.1. Integration with Telemedicine

3.3.2. Adoption of Cloud-Based Solutions

3.3.3. Expansion into Ambulatory Care Centers

3.4. Trends

3.4.1. Incorporation of Artificial Intelligence

3.4.2. Mobile EHR Applications

3.4.3. Patient Engagement Tools

3.5. Government Regulations

3.5.1. Health Information Technology for Economic and Clinical Health (HITECH) Act

3.5.2. Medicare and Medicaid EHR Incentive Programs

3.5.3. 21st Century Cures Act

3.5.4. ONC Health IT Certification Program

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem

3.8. Porters Five Forces Analysis

3.9. Competitive Landscape

4. U.S. Electronic Health Records Market Segmentation

4.1. By Product Type (In Value %)

4.1.1. Web-Based EHR

4.1.2. Client-Server-Based EHR

4.2. By Application (In Value %)

4.2.1. Clinical Applications

4.2.2. Administrative Applications

4.2.3. Reporting in Healthcare Systems

4.2.4. Healthcare Financing

4.2.5. Clinical Research

4.3. By End-User (In Value %)

4.3.1. Hospitals

4.3.2. Ambulatory/Outpatient Settings

4.3.3. Others

4.4. By Deployment Mode (In Value %)

4.4.1. Cloud-Based

4.4.2. On-Premise

4.5. By Business Model (In Value %)

4.5.1. Licensed Software

4.5.2. Subscriptions

4.5.3. Open-Source

5. U.S. Electronic Health Records Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. Epic Systems Corporation

5.1.2. Cerner Corporation

5.1.3. Allscripts Healthcare Solutions

5.1.4. MEDITECH

5.1.5. NextGen Healthcare

5.1.6. eClinicalWorks

5.1.7. Greenway Health

5.1.8. Athenahealth

5.1.9. GE Healthcare

5.1.10. McKesson Corporation

5.1.11. Practice Fusion

5.1.12. AdvancedMD

5.1.13. Kareo

5.1.14. DrChrono

5.1.15. CureMD

5.2. Cross Comparison Parameters (Revenue, Market Share, Product Portfolio, Regional Presence, Number of Employees, Headquarters, Inception Year, Recent Developments)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Venture Capital Funding

5.8. Government Grants

5.9. Private Equity Investments

6. U.S. Electronic Health Records Market Regulatory Framework

6.1. Certification Requirements

6.2. Compliance Standards

6.3. Data Protection Regulations

7. U.S. Electronic Health Records Future Market Size (In USD Billion)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. U.S. Electronic Health Records Future Market Segmentation

8.1. By Product Type (In Value %)

8.2. By Application (In Value %)

8.3. By End-User (In Value %)

8.4. By Deployment Mode (In Value %)

8.5. By Business Model (In Value %)

9. U.S. Electronic Health Records Market Analysts Recommendations

9.1. Total Addressable Market (TAM), Serviceable Available Market (SAM), and Serviceable Obtainable Market (SOM) Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

The initial phase involves constructing an ecosystem map encompassing all major stakeholders within the U.S. Electronic Health Records Market. This step is underpinned by extensive desk research, utilizing a combination of secondary and proprietary databases to gather comprehensive industry-level information. The primary objective is to identify and define the critical variables that influence market dynamics.

Step 2: Market Analysis and Construction

In this phase, we compile and analyze historical data pertaining to the U.S. Electronic Health Records Market. This includes assessing market penetration, the ratio of marketplaces to service providers, and the resultant revenue generation. Furthermore, an evaluation of service quality statistics is conducted to ensure the reliability and accuracy of the revenue estimates.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses are developed and subsequently validated through computer-assisted telephone interviews (CATIs) with industry experts representing a diverse array of companies. These consultations provide valuable operational and financial insights directly from industry practitioners, which are instrumental in refining and corroborating the market data.

Step 4: Research Synthesis and Final Output

The final phase involves direct engagement with multiple EHR vendors to acquire detailed insights into product segments, sales performance, consumer preferences, and other pertinent factors. This interaction serves to verify and complement the statistics derived from the bottom-up approach, thereby ensuring a comprehensive, accurate, and validated analysis of the U.S. Electronic Health Records market.

Frequently Asked Questions

1. How big is the U.S. Electronic Health Records (EHR) market?

The U.S. Electronic Health Records market is valued at USD 11.38 billion, driven by government initiatives, technological advancements, and the demand for efficient healthcare data management systems.

2. What are the challenges in the U.S. Electronic Health Records market?

Challenges include high implementation and maintenance costs, interoperability issues among systems, and stringent data security and privacy regulations that impact the scalability of EHR systems.

3. Who are the major players in the U.S. Electronic Health Records market?

Key players in the market include Epic Systems Corporation, Cerner Corporation, Allscripts Healthcare Solutions, MEDITECH, and NextGen Healthcare. These companies lead due to their robust product offerings, market presence, and focus on innovation.

4. What are the growth drivers of the U.S. Electronic Health Records market?

Key growth drivers include supportive government policies, increasing adoption of digital health solutions, and a shift toward patient-centered care. Technological advancements in AI and cloud computing further support market expansion.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.