USA Energy Drink Market Outlook to 2030

Region:North America

Author(s):Shreya Garg

Product Code:KROD4508

November 2024

86

About the Report

USA Energy Drink Market Overview

- The USA Energy Drink Market is valued at USD 19 billion, based on a five-year historical analysis. The market is primarily driven by increasing consumer demand for functional beverages that provide quick energy boosts, particularly among younger demographics like millennials and Gen Z. Rising health consciousness has also led to a shift toward sugar-free and organic options within this segment, contributing to market growth. Furthermore, widespread adoption of energy drinks among athletes and fitness enthusiasts further fuels the sectors expansion.

- The market is dominated by cities such as Los Angeles, New York, and Miami, where fitness culture, fast-paced lifestyles, and brand availability drive consumption. These cities also host a large concentration of sporting events and fitness expos, which reinforce the presence of energy drink brands. Moreover, high population density and disposable income in these urban centers have made them crucial hubs for industry.

- In certain U.S. states, additional regulations target energy drink sales and marketing practices. For example, New York imposes a sugar tax on beverages containing more than 7.5 grams of sugar per 100 ml, directly impacting energy drinks with high sugar content. Some states also have marketing restrictions, particularly for products aimed at minors. In 2023, California introduced regulations that prevent energy drinks from being marketed to children under the age of 16. These state-level regulations vary but collectively increase the compliance burden for manufacturers.

USA Energy Drink Market Segmentation

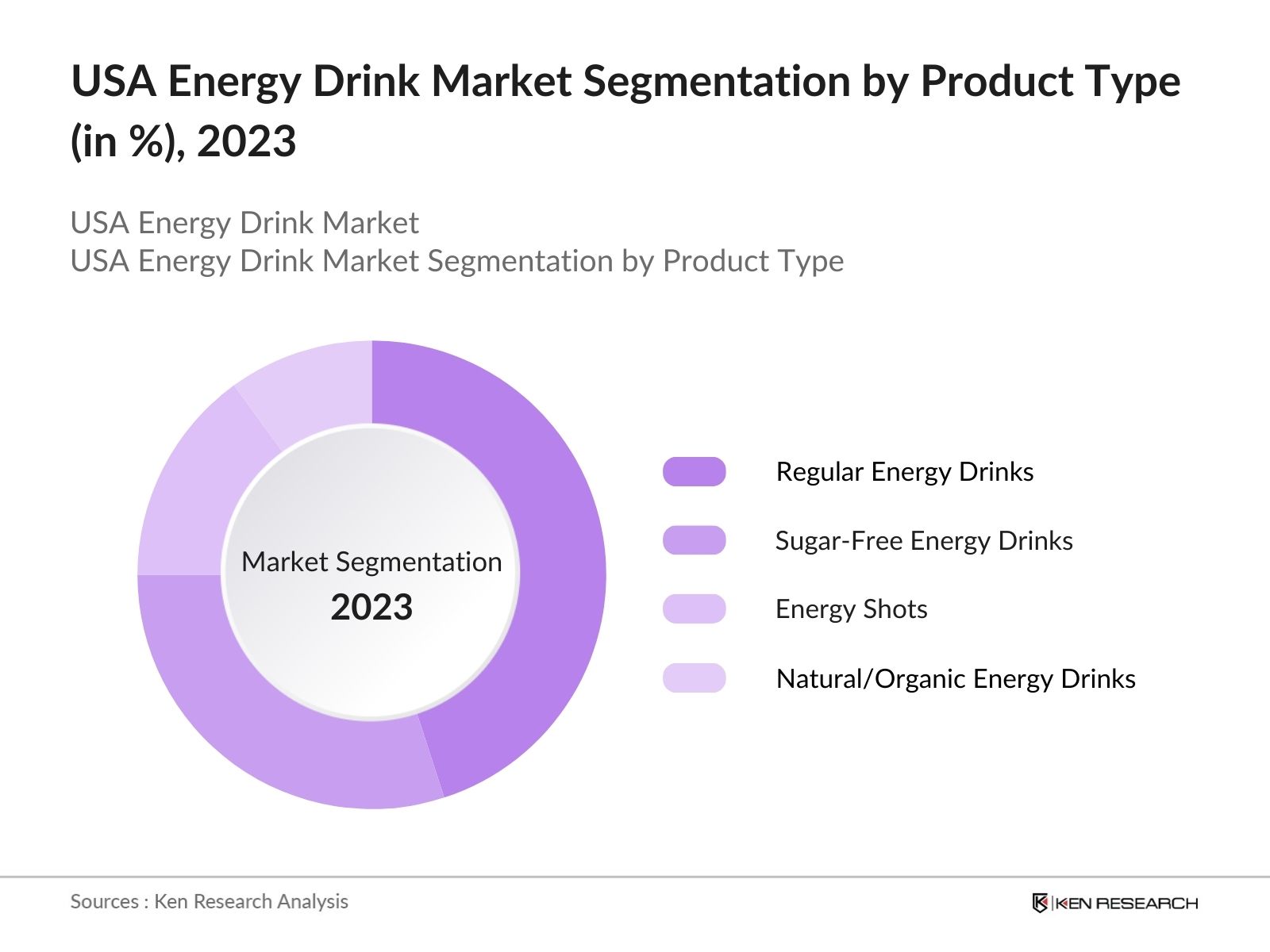

By Product Type: The Market is segmented by product type into Regular Energy Drinks, Sugar-Free Energy Drinks, Energy Shots, and Natural/Organic Energy Drinks. Recently, Sugar-Free Energy Drinks have taken a dominant market share due to a growing preference for healthier, low-calorie options among health-conscious consumers. The shift toward sugar alternatives and the rising prevalence of diabetes and obesity concerns in the country have contributed to the increased adoption of sugar-free beverages.

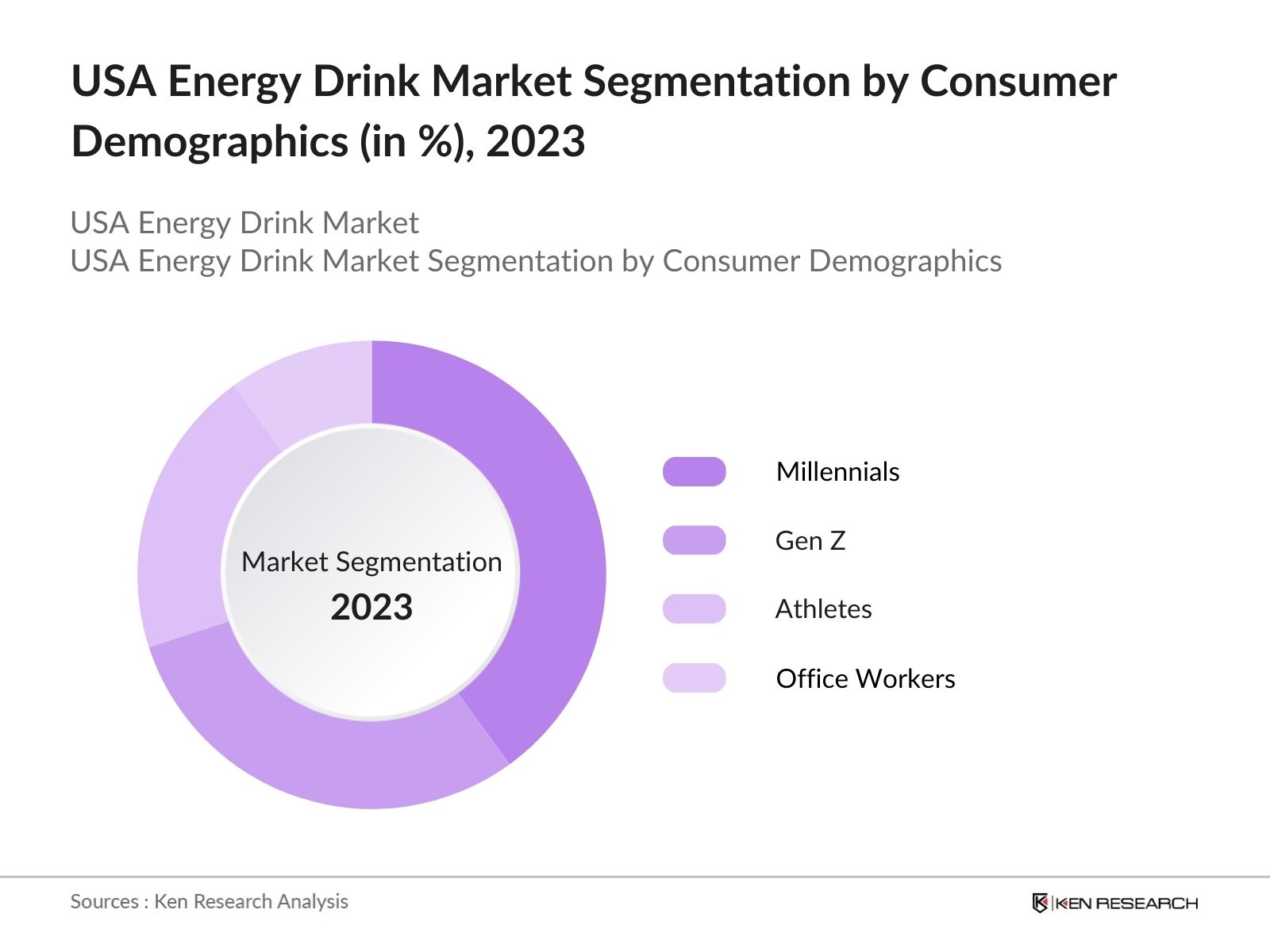

By Consumer Demographics: In terms of consumer demographics, the market is divided into Millennials, Gen Z, Athletes, and Office Workers. Millennials currently hold the largest market share within the consumer demographic segmentation. This is due to their active lifestyle, preference for on-the-go energy solutions, and increased participation in sports and fitness activities. Moreover, the growing influence of social media and the focus on wellness trends among this age group has further driven energy drink consumption.

By Consumer Demographics: In terms of consumer demographics, the market is divided into Millennials, Gen Z, Athletes, and Office Workers. Millennials currently hold the largest market share within the consumer demographic segmentation. This is due to their active lifestyle, preference for on-the-go energy solutions, and increased participation in sports and fitness activities. Moreover, the growing influence of social media and the focus on wellness trends among this age group has further driven energy drink consumption.

USA Energy Drink Market Competitive Landscape

USA Energy Drink Market Competitive Landscape

The USA Energy Drink Market is dominated by key players such as Red Bull, Monster Beverage Corporation, PepsiCo (Rockstar), and Coca-Cola (NOS, Full Throttle). These companies have cemented their position through aggressive marketing, sponsorship of sports events, and continual innovation in their product offerings. The competitive landscape reflects consolidation among major brands, with a few firms holding a portion of the market, highlighting their dominance.

|

Company |

Establishment Year |

Headquarters |

Market Reach |

Product Range |

Revenue (USD Mn) |

Distribution Channels |

Innovation Strategies |

Mergers & Acquisitions |

Marketing Campaigns |

|

Red Bull |

1987 |

Austria |

|||||||

|

Monster Beverage Corp |

1935 |

USA |

|||||||

|

PepsiCo (Rockstar) |

1965 |

USA |

|||||||

|

Coca-Cola (NOS, Full Throttle) |

1886 |

USA |

|||||||

|

Bang Energy (Vital Pharmaceuticals) |

1993 |

USA |

USA Energy Drink Industry Analysis

Growth Drivers

- Increase in Fitness and Athletic Activities: With a global surge in fitness activities, the demand for energy-boosting drinks is rising. In 2023, 220 million people worldwide participated in gym-based fitness activities, marking a rise from previous years. This correlates with the increased consumption of energy drinks targeted at athletes and gym-goers, who seek hydration and performance-enhancing beverages. In the U.S., about 60 million adults now have gym memberships, contributing to energy drink uptake. This trend supports the robust demand for specialized beverages tailored to fitness enthusiasts.

- Product Innovation: Product innovation has been instrumental in keeping the energy drink market dynamic. Flavored energy drinks, particularly those using exotic fruits and herbs, are now a major trend. According to the European Food Safety Authority, 75% of new energy drink products launched in 2023 had flavor variations, appealing to broader consumer preferences. Organic energy drinks are also gaining traction, especially in Europe and North America, where organic product sales reached nearly 110 billion euros in 2023, reinforcing consumer interest in clean-label beverages.

- E-commerce Expansion: The rapid growth of e-commerce platforms has impacted on the distribution of energy drinks. Sales on Amazon to reach $9 billion in 2024, with a growth rate of 27.3%, with energy drinks being a contributor. Walmart's e-commerce platform also noted a substantial rise in beverage sales, driven by demand for energy-boosting products. Online shopping channels provide convenience and access to a wider range of flavors and formulations, catering to consumer demand. The proliferation of e-commerce has expanded the reach of energy drink manufacturers, enhancing market penetration.

Market Challenges

- High Competition and Saturation: The energy drink market faces intense competition and saturation, with over 500 distinct brands in the U.S. alone as of 2023, leading to aggressive price wars. The large number of players in the market has resulted in product fatigue among consumers, particularly with flavored energy drinks. A study by the USDA indicated that 40% of consumers believe there are too many similar energies drink flavors on the market, causing brand loyalty to wane. This saturation presents a challenge for companies trying to differentiate their products in an overcrowded space.

- Public Health Concerns: Public health concerns related to caffeine and sugar intake have posed challenges to the energy drink industry. The World Health Organization reported that excessive caffeine consumption contributes to health risks such as hypertension and anxiety, affecting over 700 million people globally in 2022. In the U.S., the average sugar intake remains high, with the CDC reporting that adult Americans consume 77 grams of sugar daily, well above the recommended limits. These concerns lead to increased scrutiny of energy drinks, which often contain both caffeine and sugar, impacting their market perception.

USA Energy Drink Market Future Outlook

The USA Energy Drink Market is expected to continue growing steadily, driven by consumer demand for functional, convenient energy sources. As more consumers prioritize health and wellness, the market will likely see increased interest in sugar-free and organic energy drinks. In addition, innovation in packaging, such as eco-friendly options, is expected to play a crucial role in shaping future market trends. Expanding distribution channels, especially online platforms, will further bolster growth, providing easier access to a broader range of products.

Future Market Opportunities

- Functional Beverage Growth: The rise of functional beverages presents opportunities for growth in the energy drink sector. Wellness-focused energy drinks, which contain additional vitamins, minerals, and adaptogens, are increasingly in demand. According to the U.S. Department of Agriculture, functional beverages are experiencing uptake, with a 12% growth in consumer interest in beverages that offer health benefits beyond energy. This trend aligns with the growing wellness movement, where consumers seek beverages that provide cognitive and physical benefits, positioning energy drinks as part of a broader functional beverage category.

- Rise of Organic and Natural Products: Organic and natural energy drinks are becoming mainstream, as consumers increasingly demand products with clean labels. A 2023 report by the U.S. Department of Agriculture highlighted that organic food and beverage sales reached $61 billion in the U.S., with organic energy drinks being a growing segment. These beverages, free from synthetic additives and artificial ingredients, cater to health-conscious consumers who prioritize sustainability and transparency in their food and drink choices. The rise of clean-label energy drinks creates a strong opportunity for growth in this niche market

Scope of the Report

|

By Product Type |

Regular Energy Drinks Sugar-Free Energy Drinks Energy Shots Natural/Organic Energy Drinks |

|

By Consumer Demographics |

Millennials Gen Z Athletes Office Workers |

|

By Distribution Channel |

Supermarkets/Hypermarkets Convenience Stores Online Retail Specialist Stores |

|

By Region |

Northeast Southeast Midwest West |

|

By Packaging Type |

Cans Bottles Pouches |

Products

Key Target Audience

Energy Drink Manufacturers

Beverage Distributors

Health and Fitness Retailers

Online Beverage Retailers

Supermarkets and Hypermarkets

Investors and Venture Capitalist Firms

Government and Regulatory Bodies (FDA, USDA)

Packaging and Labeling Suppliers

Companies

Major Players

Red Bull GmbH

Monster Beverage Corporation

PepsiCo (Rockstar)

Coca-Cola (NOS, Full Throttle)

Bang Energy (Vital Pharmaceuticals)

Celsius Holdings Inc.

5-hour Energy (Living Essentials)

Alani Nu

Reign (Monster)

Xyience Energy

Runa Energy

Guru Organic Energy

EBOOST

Zevia Energy

OCA Energy Drink

Table of Contents

USA Energy Drink Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Evolution and Growth Rate

1.4. Market Segmentation Overview

1.5. Market Dynamics Summary (growth drivers, challenges, opportunities)

USA Energy Drink Market Size (In USD Mn)

2.1. Historical Market Size (past 5 years)

2.2. Key Market Developments and Milestones

2.3. Consumer Spending Trends

USA Energy Drink Market Analysis

3.1. Growth Drivers (Health consciousness, Sports nutrition demand, Lifestyle trends)

3.2. Market Challenges (Regulatory scrutiny, Competition from alternative beverages, Ingredient sourcing)

3.3. Opportunities (Innovation in flavors, Energy drinks with natural ingredients, Expansion in new markets)

3.4. Trends (Functional beverages, Sugar-free energy drinks, Caffeine alternatives)

3.5. Regulatory Overview (FDA regulations, Ingredient approvals, Labeling requirements)

3.6. SWOT Analysis

3.7. Porters Five Forces Analysis (Buyer power, Supplier power, Threat of substitutes, Industry rivalry, Threat of new entrants)

3.8. Competitor Ecosystem (Market shares, Competitive intensity)

USA Energy Drink Market Segmentation

4.1. By Product Type (In Value %)

4.1.1. Regular Energy Drinks

4.1.2. Sugar-Free Energy Drinks

4.1.3. Energy Shots

4.1.4. Natural/Organic Energy Drinks

4.2. By Consumer Demographics (In Value %)

4.2.1. Millennials

4.2.2. Gen Z

4.2.3. Athletes

4.2.4. Office Workers

4.3. By Distribution Channel (In Value %)

4.3.1. Supermarkets/Hypermarkets

4.3.2. Convenience Stores

4.3.3. Online Retail

4.3.4. Specialist Stores

4.4. By Region (In Value %)

4.4.1. Northeast

4.4.2. Southeast

4.4.3. Midwest

4.4.4. West

4.5. By Packaging Type (In Value %)

4.5.1. Cans

4.5.2. Bottles

4.5.3. Pouches

USA Energy Drink Brands Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. Red Bull GmbH

5.1.2. Monster Beverage Corporation

5.1.3. PepsiCo (Rockstar)

5.1.4. Coca-Cola (NOS, Full Throttle)

5.1.5. Bang Energy (Vital Pharmaceuticals)

5.1.6. Celsius Holdings Inc.

5.1.7. 5-hour Energy (Living Essentials)

5.1.8. Alani Nu

5.1.9. Reign (Monster)

5.1.10. Xyience Energy

5.1.11. Runa Energy

5.1.12. Guru Organic Energy

5.1.13. EBOOST

5.1.14. Zevia Energy

5.1.15. OCA Energy Drink

5.2. Cross Comparison Parameters (Headquarters, Market Reach, Product Range, Revenue)

5.3. Market Share Analysis (by Brand)

5.4. Strategic Initiatives (New product launches, Collaborations, Marketing campaigns)

5.5. Mergers & Acquisitions in the Energy Drink Space

5.6. Investment Analysis (Venture Capital & Private Equity)

5.7. Product Pricing Strategies

USA Energy Drink Market Regulatory Framework

6.1. Federal Regulatory Compliance (FDA guidelines, Caffeine limits)

6.2. State-specific Regulations (e.g., age restrictions)

6.3. Environmental Regulations (Sustainability in packaging)

6.4. Certifications (Organic, Non-GMO, etc.)

USA Energy Drink Brands Future Market Size (In USD Mn)

7.1. Key Factors Driving Future Market Growth (Product innovation, Consumer awareness, Expansion into rural markets)

7.2. Consumer Behavior Shifts (Preference for healthier options, Impact of digital marketing)

USA Energy Drink Brands Future Market Segmentation

8.1. By Product Type (Regular vs. Sugar-Free)

8.2. By Consumer Demographics (Age groups)

8.3. By Region (Urban vs. Rural split)

8.4. By Distribution Channel (In-store vs. Online)

8.5. By Packaging Innovations (Eco-friendly packaging trends)

USA Energy Drink Market Analysts' Recommendations

9.1. TAM/SAM/SOM Analysis (Total, Addressable, and Serviceable Market)

9.2. Consumer Behavior Insights (Engagement patterns, Purchase drivers)

9.3. Market Entry Strategies (Partnerships, Distribution alliances)

9.4. White Space Opportunity Analysis

Disclaimer

Contact Us

Research Methodology

Step 1: Identification of Key Variables

The first phase involves mapping the ecosystem of the USA Energy Drink Market, including stakeholders such as manufacturers, retailers, and consumers. Extensive desk research is conducted using secondary sources like proprietary databases and government reports. Key variables like market size, consumption patterns, and pricing structures are identified for further analysis.

Step 2: Market Analysis and Construction

In this phase, historical data on the USA Energy Drink Market is compiled to assess growth rates, revenue trends, and market penetration. The analysis includes evaluating consumer preferences for specific sub-segments, such as sugar-free or organic drinks, and correlating them with revenue generation statistics.

Step 3: Hypothesis Validation and Expert Consultation

Industry experts from leading beverage companies are consulted through structured interviews. These experts validate market hypotheses, provide insights on consumer preferences, and confirm data on production and sales. These consultations help refine the research findings and ensure accuracy.

Step 4: Research Synthesis and Final Output

The final stage of the research involves synthesizing data from manufacturers and retailers to gain a comprehensive view of product performance, distribution, and consumer trends. The results are cross-referenced with historical data to provide a validated analysis of the USA Energy Drink Market.

Frequently Asked Questions

01. How big is the USA Energy Drink Market?

The USA Energy Drink Market is valued at USD 19 billion. This market growth is driven by increasing consumer demand for functional beverages that provide energy boosts, especially among younger demographics.

02. What are the challenges in the USA Energy Drink Market?

Key challenges in the USA Energy Drink Market include regulatory scrutiny, especially concerning caffeine and sugar content, and intense competition from alternative beverages like coffee and sports drinks. The rising cost of raw materials for organic and natural energy drinks also poses challenges.

03. Who are the major players in the USA Energy Drink Market?

Major players in the USA Energy Drink Market include Red Bull GmbH, Monster Beverage Corporation, PepsiCo (Rockstar), Coca-Cola (NOS, Full Throttle), and Bang Energy (Vital Pharmaceuticals). These companies dominate through innovation, aggressive marketing, and extensive distribution networks.

04. What are the growth drivers of the USA Energy Drink Market?

The USA Energy Drink Market is propelled by factors such as increasing health consciousness, a growing preference for sugar-free options, and high demand from fitness enthusiasts. The influence of social media marketing and fitness culture also contributes to market growth.

05. What are the trends in the USA Energy Drink Market?

Key trends in the USA Energy Drink Market include a shift toward organic and sugar-free energy drinks, as well as innovations in packaging, such as recyclable and eco-friendly materials. Additionally, energy drink brands are increasingly focusing on health-centric formulations to cater to fitness enthusiasts.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.