USA Erectile Dysfunction Drugs Market Outlook to 2030

Region:North America

Author(s):Meenakshi

Product Code:KROD10610

November 2024

86

About the Report

USA Erectile Dysfunction Drugs Market Overview

- The USA Erectile Dysfunction (ED) Drugs Market is currently valued at USD 1 billion, based on a five-year historical analysis. The market is primarily driven by the increasing prevalence of erectile dysfunction, largely due to lifestyle-related conditions such as obesity, diabetes, and cardiovascular diseases. Additionally, increased awareness and acceptance of ED treatments, aided by advertising campaigns and social stigma reduction, contribute to the market's consistent growth. Drug innovations and advancements in oral and injectable therapies have further propelled the demand for these treatments.

- In the USA, major urban regions such as New York, Los Angeles, and Chicago dominate the erectile dysfunction drugs market. These cities have higher populations, more disposable income, and greater access to advanced healthcare systems. In addition, states like Florida and California have a large aging population, which significantly drives demand for ED treatments, given that erectile dysfunction prevalence increases with age.

- Reimbursement policies for ED drugs in the U.S. have been a point of contention. As of 2024, Medicare does not cover ED drugs, while private insurers offer partial coverage based on specific plans. This has led to reduced affordability for many patients, contributing to the high out-of-pocket expenses associated with branded ED medications. The Affordable Care Act (ACA) mandates that insurers must cover certain mens health conditions, but ED drugs are often excluded from this list.

USA Erectile Dysfunction Drugs Market Segmentation

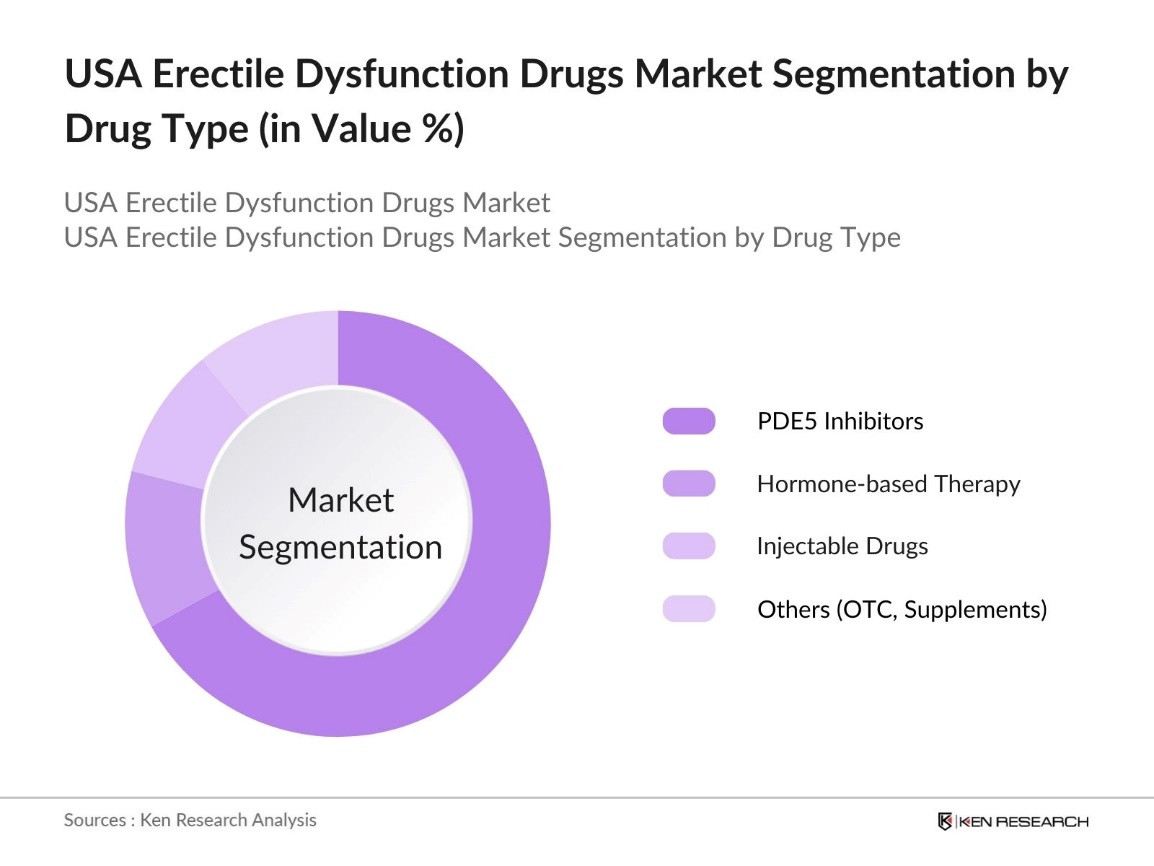

By Drug Type: The USA Erectile Dysfunction Drugs market is segmented by drug type into phosphodiesterase type 5 (PDE5) inhibitors, hormone-based therapies, injectables, and others (OTC, supplements). Recently, PDE5 inhibitors such as Sildenafil and Tadalafil hold a dominant market share within this segmentation. The reasons behind this dominance are their efficacy, ease of use (oral administration), and widespread prescription. These inhibitors are well-established and backed by extensive clinical data, making them the most trusted option by both physicians and patients.

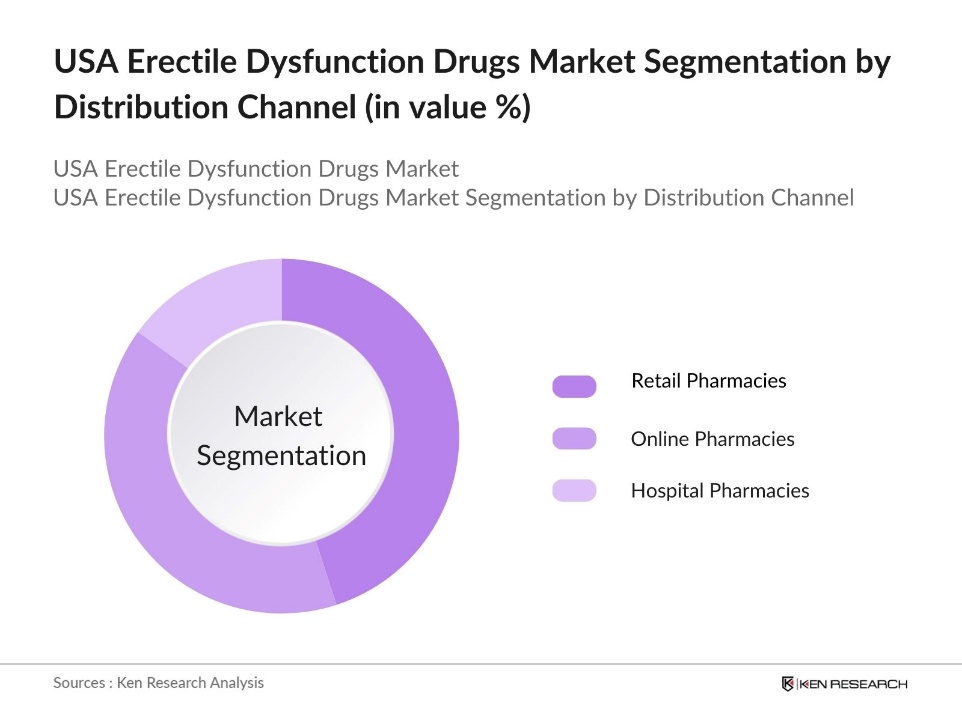

By Distribution Channel: The USA Erectile Dysfunction Drugs market is segmented by distribution channel into retail pharmacies, online pharmacies, and hospital pharmacies. Online pharmacies have been gaining a significant market share, driven by increasing consumer preference for discreet purchasing and the rise of telemedicine platforms. The convenience of having prescriptions delivered directly to the patient, along with access to licensed physicians online, has spurred the growth of this segment.

USA Erectile Dysfunction Drugs Market Competitive Landscape

The market is dominated by major players such as Pfizer and Eli Lilly, which produce industry-leading drugs like Viagra and Cialis, respectively. These companies maintain their dominance due to strong brand recognition, aggressive marketing strategies, and extensive distribution channels. The presence of generics manufacturers such as Teva Pharmaceuticals also creates competition, particularly in the pricing landscape.

|

Company |

Establishment Year |

Headquarters |

R&D Investment |

Drug Portfolio |

Revenue (USD) |

Global Presence |

Strategic Alliances |

Manufacturing Capacity |

Pricing Strategy |

|

Pfizer Inc. |

1849 |

New York, USA |

|||||||

|

Eli Lilly and Co. |

1876 |

Indianapolis, USA |

|||||||

|

Bayer AG |

1863 |

Leverkusen, Germany |

|||||||

|

Teva Pharmaceuticals |

1901 |

Petah Tikva, Israel |

|||||||

|

Viatris |

2020 |

Canonsburg, USA |

USA Erectile Dysfunction Drugs Industry Analysis

Growth Drivers

- Increase in Geriatric Population: The USA is witnessing a steady rise in its geriatric population, a key driver for erectile dysfunction (ED) drugs. In 2024, the number of individuals aged 65 and older is contributing to an increased prevalence of ED, a condition more common in older men. Research indicates that about 52% of men aged 60-69 experience some form of ED, with this figure increasing to 69% among men aged 70-79 and 76% for those aged 80 and older. This demographic shift strongly influences the market for ED drugs.

- Rise in Lifestyle-related Disorders (Obesity, Diabetes): As of 2024, it is estimated that over 40% of U.S. adults are classified as obese, which aligns with recent trends showing a significant rise in obesity rates in the country. The men with diabetes experience some degree of ED. As these lifestyle-related conditions continue to rise, the demand for effective ED drugs follows suit, further driving the market.

- Technological Advancements in Drug Delivery Systems (Oral, Injectable, Topical): Innovations in ED drug delivery systems have introduced more effective options beyond oral medications, which remain dominant. Alternatives such as injectables and topical treatments offer faster absorption and potentially fewer side effects. These options cater to patients seeking personalized treatments, especially those unresponsive to traditional oral drugs, making the overall management of erectile dysfunction more flexible and patient-friendly.

Market Challenges

- Social Stigma and Patient Reluctance: Despite growing awareness, significant social stigma still surrounds ED treatments, causing many men to hesitate in seeking help. Concerns about privacy, embarrassment, and cultural taboos often deter patients from addressing the issue, especially in regions with limited healthcare access. This reluctance poses a major challenge for the market, as many who need treatment avoid pursuing available solutions due to societal pressures.

- High Cost of Branded Drugs: The high cost of branded ED drugs, such as Viagra, remains a significant barrier for many patients. These medications are often expensive, limiting access for individuals without comprehensive insurance. Even with insurance coverage, out-of-pocket costs can still be prohibitive for many, further complicating access to effective treatments.

USA Erectile Dysfunction Drugs Market Future Outlook

Over the next five years, the USA erectile dysfunction drugs market is expected to experience substantial growth, fueled by several key factors. The aging population, increasing lifestyle diseases, and the growing popularity of telemedicine platforms are predicted to contribute to sustained demand for ED treatments. In addition, the development of novel drug formulations and the rising acceptance of non-prescription alternatives will open up new avenues for market expansion. As pharmaceutical companies continue to focus on R&D and expand their drug portfolios, the market's landscape will likely witness further consolidation and innovation.

Market Opportunities

- Growth in Online Pharmacies:The increasing popularity of online pharmacies presents a significant growth opportunity for the ED drugs market. These platforms offer convenience and privacy, encouraging more patients to seek ED treatments online. The ability to discreetly obtain medications without in-person visits has made online pharmacies an attractive option. Supportive regulatory frameworks have further facilitated easier access to medications, making this a growing sector in the market.

- New Formulations and Combination Therapies: New formulations and combination therapies are becoming more prevalent in the ED drugs market. Drug manufacturers are developing treatments that not only address ED but also related conditions like premature ejaculation or cardiovascular issues. These combination therapies, along with faster-acting formulations such as dissolvable tablets, provide more convenient and effective treatment options, particularly for aging patients with multiple health concerns.

Scope of the Report

|

By Drug Type |

PDE5 Inhibitors Hormone Therapy Injectable Others |

|

By Distribution Channel |

Retail Pharmacies Online Pharmacies Hospital Pharmacies |

|

By Dosage Form |

Oral Tablets Injectable Topical |

|

By Mode of Prescription |

Prescription Drugs OTC Treatments |

|

By Region |

North-East South-East Mid-West South-West West |

Products

Key Target Audience

Pharmaceutical Manufacturers

Retail and Online Pharmacies

Telemedicine Platforms

Government and Regulatory Bodies (FDA, CMS)

Investors and venture capital Firms

Banks and Financial Institutions

Companies

Players Mentioned in the Report

Pfizer Inc.

Eli Lilly and Company

Bayer AG

Teva Pharmaceuticals

Viatris Inc.

Sanofi S.A.

GlaxoSmithKline Plc

Ferring Pharmaceuticals

Lupin Limited

Cipla Ltd.

Table of Contents

1. USA Erectile Dysfunction Drugs Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate (Erectile Dysfunction Prevalence, Prescription Volume, Growth in Awareness)

1.4. Market Segmentation Overview

2. USA Erectile Dysfunction Drugs Market Size (In USD Mn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis (Prescription Rate, Drug Adoption Rate, New Formulations)

2.3. Key Market Developments and Milestones (Drug Approvals, Patent Expirations, New Entrants)

3. USA Erectile Dysfunction Drugs Market Analysis

3.1. Growth Drivers

3.1.1. Increase in Geriatric Population

3.1.2. Growing Awareness and Acceptance of ED Treatments

3.1.3. Rise in Lifestyle-related Disorders (Obesity, Diabetes)

3.1.4. Technological Advancements in Drug Delivery Systems (Oral, Injectable, Topical)

3.2. Market Challenges

3.2.1. Social Stigma and Patient Reluctance

3.2.2. High Cost of Branded Drugs

3.2.3. Competition from Generics and Alternative Therapies

3.3. Opportunities

3.3.1. Growth in Online Pharmacies

3.3.2. New Formulations and Combination Therapies

3.3.3. Market Expansion into Non-prescription Treatments (OTC, Supplements)

3.4. Trends

3.4.1. Increasing Use of Telemedicine for ED Consultations

3.4.2. Development of Personalized Medicine Approaches

3.4.3. Rising Popularity of Herbal and Natural ED Supplements

3.5. Government Regulation

3.5.1. FDA Approval Processes

3.5.2. Prescription Guidelines and Controlled Substance Regulations

3.5.3. Reimbursement and Insurance Policies for ED Drugs

3.6. SWOT Analysis

3.7. Stake Ecosystem (Pharmaceutical Manufacturers, Healthcare Providers, Pharmacies, Insurers)

3.8. Porters Five Forces (Market Rivalry, Entry Barriers, Supplier Power, Buyer Power, Substitutes)

3.9. Competition Ecosystem

4. USA Erectile Dysfunction Drugs Market Segmentation

4.1. By Drug Type (In Value %)

4.1.1. Phosphodiesterase Type 5 (PDE5) Inhibitors (Sildenafil, Tadalafil, Vardenafil)

4.1.2. Hormone-based Therapy (Testosterone Replacement Therapy)

4.1.3. Injectable ED Drugs (Alprostadil)

4.1.4. Others (OTC, Topical Gels, Herbal Supplements)

4.2. By Distribution Channel (In Value %)

4.2.1. Retail Pharmacies

4.2.2. Online Pharmacies

4.2.3. Hospital Pharmacies

4.3. By Dosage Form (In Value %)

4.3.1. Oral Tablets

4.3.2. Injectable

4.3.3. Topical

4.4. By Mode of Prescription (In Value %)

4.4.1. Prescription Drugs

4.4.2. Over-The-Counter (OTC) Treatments

4.5. By Region (In Value %

4.5.1. North-East

4.5.2. South-East

4.5.3. Mid-West

4.5.4. South-West

4.5.5. West

5. USA Erectile Dysfunction Drugs Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. Pfizer Inc.

5.1.2. Eli Lilly and Company

5.1.3. Bayer AG

5.1.4. Teva Pharmaceuticals

5.1.5. Viatris Inc.

5.1.6. Sanofi S.A.

5.1.7. GlaxoSmithKline Plc

5.1.8. Cipla Ltd.

5.1.9. Ferring Pharmaceuticals

5.1.10. Menarini Group

5.1.11. Lupin Limited

5.1.12. Aurobindo Pharma

5.1.13. Alembic Pharmaceuticals

5.1.14. Endo Pharmaceuticals

5.1.15. Hims & Hers Health, Inc.

5.2. Cross Comparison Parameters (Drug Portfolio Size, Global Presence, Market Share, Annual Revenue, Research Pipeline, Manufacturing Capabilities, Strategic Alliances, Pricing Strategy)

5.3. Market Share Analysis

5.4. Strategic Initiative

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Venture Capital Funding

5.8. Government Grants

5.9. Private Equity Investments

6. USA Erectile Dysfunction Drugs Market Regulatory Framework

6.1. FDA Approval and Regulatory Guidelines

6.2. Intellectual Property and Patents

6.3. Generic Drug Entry Policies

6.4. Reimbursement and Insurance Policies

7. USA Erectile Dysfunction Drugs Future Market Size (In USD Mn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. USA Erectile Dysfunction Drugs Future Market Segmentation

8.1. By Drug Type (In Value %)

8.2. By Distribution Channel (In Value %)

8.3. By Dosage Form (In Value %)

8.4. By Mode of Prescription (In Value %)

8.5. By Region (In Value %)

9. USA Erectile Dysfunction Drugs Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

The initial phase involves developing a comprehensive ecosystem map of all major stakeholders in the USA Erectile Dysfunction Drugs Market. This is achieved through extensive desk research, utilizing secondary and proprietary databases. The goal is to identify the critical variables that impact market growth and performance.

Step 2: Market Analysis and Construction

This phase involves gathering and analyzing historical data for the USA Erectile Dysfunction Drugs Market, including key indicators such as drug penetration, prescription rates, and revenue generation. An evaluation of these statistics provides a solid foundation for market sizing and analysis.

Step 3: Hypothesis Validation and Expert Consultation

During this phase, hypotheses regarding market trends and dynamics are developed and validated through consultations with industry experts. These insights, gathered through interviews and surveys, are critical to refining the data and validating the market estimates.

Step 4: Research Synthesis and Final Output

The final step consolidates all collected data, synthesizing it into actionable insights. This involves direct engagement with pharmaceutical manufacturers and other stakeholders to validate the market statistics and provide a final, accurate analysis of the USA Erectile Dysfunction Drugs Market.

Frequently Asked Questions

01. How big is the USA Erectile Dysfunction Drugs Market?

The USA Erectile Dysfunction Drugs Market is valued at USD 1 billion, driven by increasing awareness and acceptance of ED treatments, as well as lifestyle-related disorders.

02. What are the challenges in the USA Erectile Dysfunction Drugs Market?

Challenges in USA Erectile Dysfunction Drugs Market include high costs of branded drugs, competition from generic manufacturers, and patient reluctance due to social stigma. Additionally, healthcare regulations regarding prescription drugs pose obstacles for market penetration.

03. Who are the major players in the USA Erectile Dysfunction Drugs Market?

Major players in the USA Erectile Dysfunction Drugs Market include Pfizer Inc., Eli Lilly and Company, Bayer AG, Teva Pharmaceuticals, and Viatris. These companies dominate due to their strong product portfolios and strategic market initiatives.

04. What drives the growth of the USA Erectile Dysfunction Drugs Market?

The USA Erectile Dysfunction Drugs Market is driven by the increasing prevalence of erectile dysfunction, an aging population, growing consumer acceptance, and technological advancements in drug formulations and delivery systems.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.