USA Essential Oils Market Outlook to 2030

Region:North America

Author(s):Sanjeev

Product Code:KROD3684

September 2024

99

About the Report

USA Essential Oils Market Overview

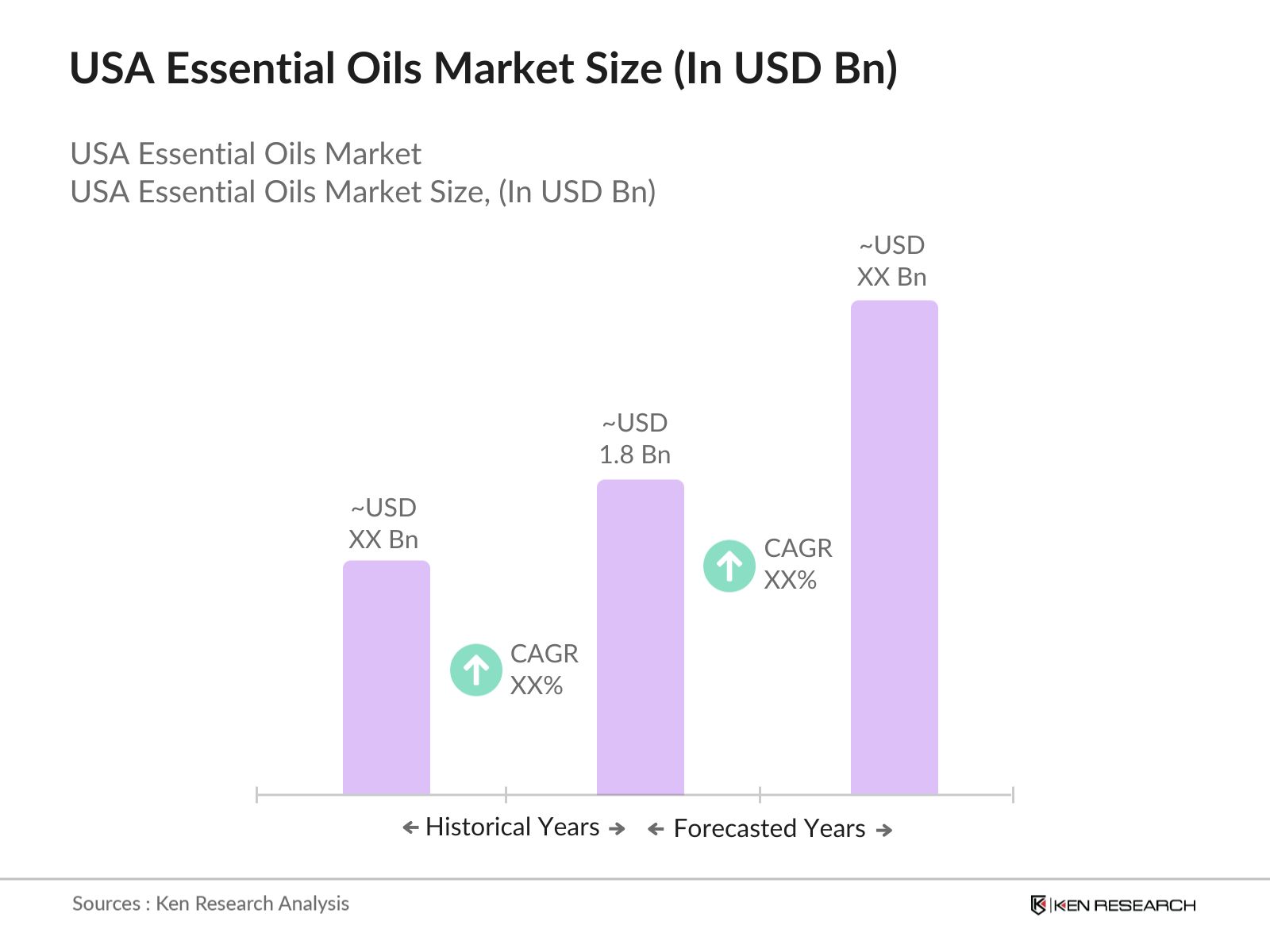

- The USA essential oils market is valued at USD 1.8 billion, driven by rising consumer demand for natural and organic products across multiple sectors such as personal care, cosmetics, and aromatherapy. Consumers are increasingly opting for chemical-free products, and essential oils, due to their natural origin, have become key ingredients in many beauty, wellness, and healthcare products. This market has also benefited from increased awareness about the therapeutic benefits of essential oils, further driving growth across various sectors such as the food and beverage industry, where these oils are used for flavoring and preservation.

- The USA is a dominant player in the essential oils market, with key cities such as Los Angeles, New York, and Miami serving as distribution hubs. The country's dominance is attributed to the strong presence of well-established companies, high consumer awareness, and significant investments in research and development. Additionally, the USA's stringent regulatory framework ensures that essential oils meet high-quality standards, making the products appealing both domestically and in international markets.

- The FDA classifies essential oils based on their intended use, whether for food, cosmetics, or therapeutic purposes, each with specific regulatory requirements. As of 2024, any essential oil marketed as a treatment for specific conditions must comply with FDA's drug guidelines, requiring clinical testing to prove safety and efficacy. The FDA has increased its enforcement efforts, with nearly 100 cease-and-desist orders issued in 2023 against companies making unauthorized health claims about essential oils. These strict guidelines ensure consumer protection while maintaining industry standards.

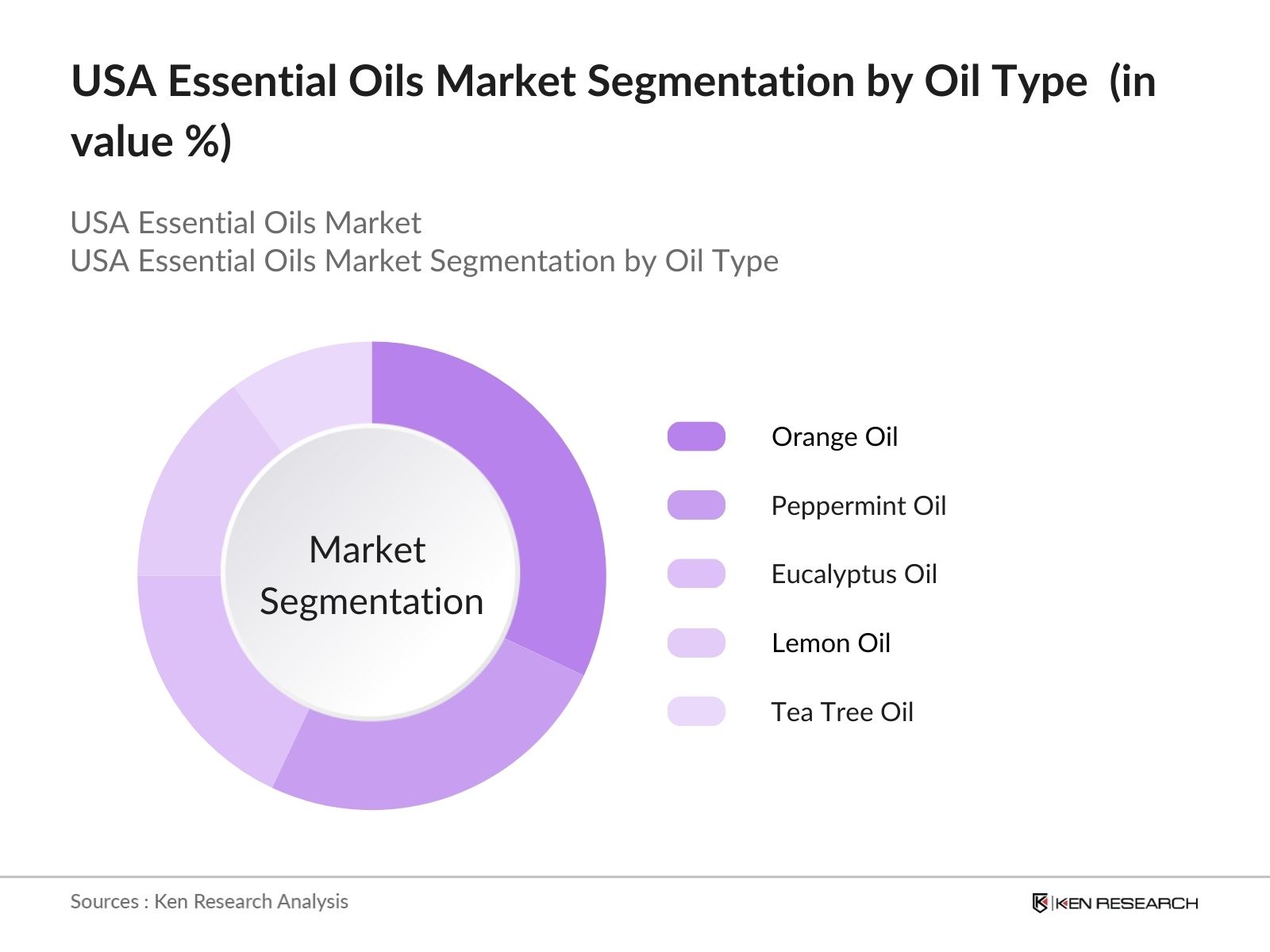

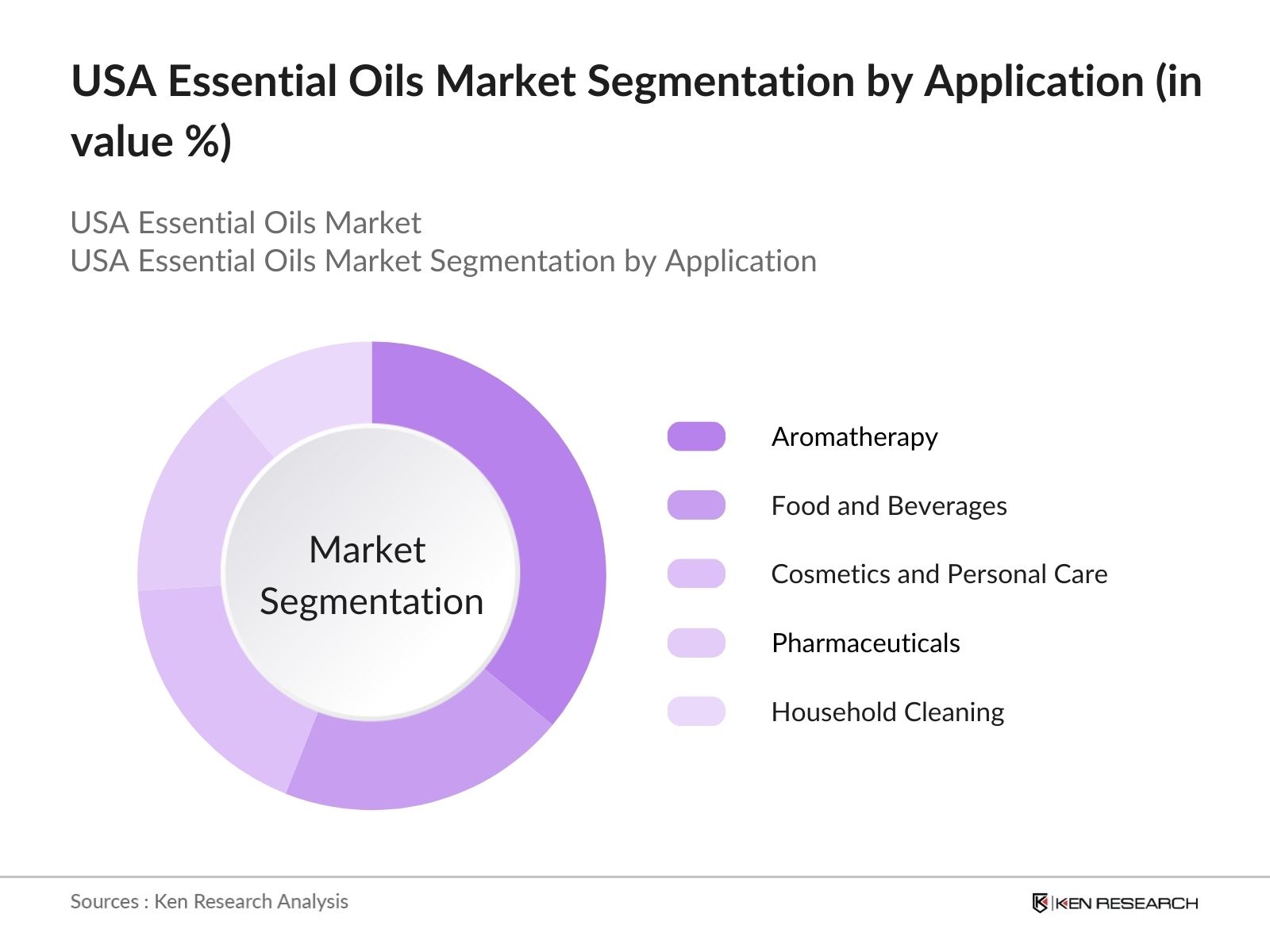

USA Essential Oils Market Segmentation

- By Oil Type: The market is segmented by oil type into orange oil, peppermint oil, eucalyptus oil, lemon oil, and tea tree oil. Orange oil is the dominant sub-segment under this segmentation due to its widespread use in the food and beverage industry as a flavoring agent. Its popularity stems from its refreshing aroma and the natural sweetness it imparts, making it a favorite among consumers. Additionally, orange oil's anti-inflammatory and antioxidant properties make it highly sought after in the cosmetic and pharmaceutical industries.

- By Application: The market is also segmented by application into aromatherapy, food and beverages, cosmetics and personal care, pharmaceuticals, and household cleaning. Aromatherapy leads the application segment due to increasing consumer inclination towards wellness and relaxation products. The growth in wellness centers, spas, and home usage of diffusers has propelled the demand for essential oils, particularly lavender, eucalyptus, and peppermint oils, which are commonly used in aromatherapy for their stress-relieving and therapeutic properties.

USA Essential Oils Competitive Landscape

The USA essential oils market is dominated by both domestic and international players, including companies such as doTERRA International and Young Living Essential Oils, which hold a significant market share due to their extensive product portfolios and robust distribution networks. Many of these companies focus on sustainability and innovation in extraction methods to meet consumer demand for high-quality, natural products. Additionally, new entrants and niche players are increasing their presence by offering specialized or organic-certified oils, driving further market growth.

|

Company |

Establishment Year |

Headquarters |

Number of Employees |

Product Portfolio |

Certifications |

Global Presence |

R&D Investments |

Raw Material Sourcing |

Sustainability Initiatives |

|

doTERRA International LLC |

2008 |

Pleasant Grove, UT |

|

|

|

|

|

|

|

|

Young Living Essential Oils |

1993 |

Lehi, UT |

|

|

|

|

|

|

|

|

Givaudan SA |

1895 |

Geneva, Switzerland |

|

|

|

|

|

|

|

|

International Flavors & Fragrances Inc. (IFF) |

1889 |

New York, NY |

|

|

|

|

|

|

|

|

Rocky Mountain Oils, LLC |

2004 |

Orem, UT |

|

|

|

|

|

|

|

USA Essential Oils Industry Analysis

Market Growth Drivers

- Rising Consumer Awareness for Natural and Organic Products: The demand for natural and organic products in the USA has been steadily increasing, driven by rising consumer awareness regarding health and environmental sustainability. According to the USDA, the number of organic farms in the U.S. has grown to over 17,000 in 2023, reflecting the broader consumer preference for natural goods. This shift is significant in the essential oils market, where consumers increasingly seek organic oils free from synthetic chemicals. In 2024, the overall organic product sales in the U.S. reached approximately 63 billion USD, further emphasizing the growing market. USDA Organic Statistics

- Increasing Demand from Cosmetics and Personal Care Industry

The U.S. cosmetics and personal care industry is one of the largest globally, generating about 92 billion USD in 2024. Essential oils are widely used in skin and hair care products due to their therapeutic properties. Ingredients like lavender and tea tree oils are now standard in premium cosmetics. The growing trend towards clean beauty, where consumers favor natural over synthetic ingredients, is driving this demand. The National Institute of Health reported a 30% rise in consumer spending on personal care products containing natural ingredients in the last two years. - Expanding Aromatherapy Sector: The aromatherapy sector in the U.S. has seen strong growth, particularly in wellness centers and spas, where essential oils are increasingly integrated into treatments. In 2024, over 36,000 registered spas in the U.S. collectively generated nearly 22 billion USD in revenue, with a portion coming from aromatherapy services. Essential oils like eucalyptus and peppermint are in high demand due to their stress-relief and therapeutic benefits. The International Spa Association recorded a notable increase in consumer interest in natural therapies, contributing to the essential oil industry's expansion.

Market Challenges

- High Cost of Production and Raw Material Volatility: The production of essential oils is capital-intensive, with fluctuations in raw material costs posing a challenge. For instance, the cost of lavender oil production is heavily dependent on climate conditions in key growing regions like France and Bulgaria. In 2023, the USDA reported volatile prices in essential oil crops, with a 15% increase in lavender plant costs due to extreme weather conditions. These raw material price fluctuations directly impact the overall cost of essential oils, making them less accessible to cost-conscious consumers.

- Limited Availability of Quality Resources:

The cultivation of plants for essential oils requires specific climatic conditions, and their limited geographical availability restricts the supply. According to the World Bank, regions where essential oil crops such as sandalwood and vetiver are grown have seen environmental degradation due to overharvesting. In 2023, over 50,000 hectares of sandalwood-producing regions were affected by deforestation and unsustainable farming practices. This limited availability of quality resources is creating supply shortages and raising the prices of rare oils.

USA Essential Oils Future Outlook

Over the next five years, the USA essential oils market is expected to witness substantial growth driven by the increasing consumer focus on natural and sustainable products, the rise in wellness and aromatherapy trends, and innovations in extraction technologies. Additionally, the growing demand for essential oils in food and beverages, pharmaceuticals, and personal care products will continue to drive market expansion. The rising popularity of organic and therapeutic oils for personal and home use is expected to further fuel market growth.

Future Market Opportunities

- Expansion into Emerging Markets: U.S. essential oil producers are exploring expansion into emerging markets, particularly in Asia and Latin America, where demand for natural and wellness products is growing. According to the U.S. Census Bureau, essential oil exports to these regions grew by 12,000 metric tons in 2023, with countries like China and Brazil leading in demand for U.S.-sourced oils. This expansion presents a significant opportunity for U.S. companies to tap into new markets while diversifying revenue streams.

- Development of Synthetic Essential Oils: With the rising costs and environmental concerns surrounding natural oils, there is growing interest in synthetic alternatives. Synthetic oils offer similar aromatic properties without depleting natural resources. In 2024, U.S. labs have successfully synthesized over 45 different essential oil components, reducing the reliance on hard-to-cultivate plants like sandalwood. These synthetic oils are gaining traction, especially in the fragrance and personal care industries, due to their cost-effectiveness and ethical sourcing appeal.

Scope of the Report

|

By Oil Type |

Orange Oil |

|

By Source |

Flowers |

|

By Application |

Aromatherapy |

|

By Distribution Channel |

E-Commerce |

|

By Region |

North |

Companies

- doTERRA International LLC

- Young Living Essential Oils

- Givaudan SA

- International Flavors & Fragrances Inc. (IFF)

- Symrise AG

- Firmenich SA

- Rocky Mountain Oils, LLC

- Plant Therapy Essential Oils

- Eden Botanicals

- Now Foods

- Lebermuth Company

- Biolandes SAS

- Essential Oils of New Zealand Ltd

- Florihana Distillerie

- Mountain Rose Herbs

Key Target Audience

- Essential Oil Manufacturers

-

Aromatherapy Practitioners and Wellness Centers

- Food & Beverage Manufacturers

- Banks and Financial Institutes

- Cosmetics & Personal Care Companies

- Pharmaceuticals and Nutraceuticals Companies

- Investments and Venture Capitalist Firms

- Government and Regulatory Bodies (FDA, USDA)

Table of Contents

1. USA Essential Oils Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. USA Essential Oils Market Size (In USD Bn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. USA Essential Oils Market Analysis

3.1. Growth Drivers

3.1.1. Rising Consumer Awareness for Natural and Organic Products

3.1.2. Increasing Demand from Cosmetics and Personal Care Industry

3.1.3. Expanding Aromatherapy Sector

3.1.4. Growing Application in Food & Beverage Industry

3.1.5. Health and Wellness Trends Driving Consumption

3.2. Market Challenges

3.2.1. High Cost of Production and Raw Material Volatility

3.2.2. Limited Availability of Quality Resources

3.2.3. Regulatory and Compliance Barriers

3.2.4. Environmental Concerns Over Resource Depletion

3.3. Opportunities

3.3.1. Expansion into Emerging Markets

3.3.2. Development of Synthetic Essential Oils

3.3.3. Innovation in Extraction Techniques (Supercritical CO2 extraction)

3.3.4. Increasing Application in Pharmaceuticals and Nutraceuticals

3.4. Trends

3.4.1. Organic Certification Trend

3.4.2. Increased Popularity of Diffusion Products

3.4.3. Growing E-commerce Distribution Channels

3.4.4. Sustainable Sourcing and Eco-friendly Packaging

3.5. Government Regulations (USA FDA, USDA Organic, ISO Standards)

3.5.1. Essential Oil Labeling Requirements

3.5.2. Compliance with Food and Drug Administration (FDA) Guidelines

3.5.3. Certification of Organic Essential Oils by USDA

3.5.4. ISO Standards for Oil Quality and Purity

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem (Suppliers, Manufacturers, Distributors, Retailers, End Users)

3.8. Porter’s Five Forces Analysis

3.9. Competitive Landscape

4. USA Essential Oils Market Segmentation

4.1. By Type (In Value %)

4.1.1. Orange Oil

4.1.2. Peppermint Oil

4.1.3. Eucalyptus Oil

4.1.4. Lemon Oil

4.1.5. Tea Tree Oil

4.2. By Application (In Value %)

4.2.1. Aromatherapy

4.2.2. Food and Beverages

4.2.3. Cosmetics and Personal Care

4.2.4. Pharmaceuticals

4.2.5. Household Cleaning

4.3. By Source (In Value %)

4.3.1. Flowers

4.3.2. Leaves

4.3.3. Fruits

4.3.4. Roots

4.3.5. Wood

4.4. By Distribution Channel (In Value %)

4.4.1. E-Commerce

4.4.2. Supermarkets & Hypermarkets

4.4.3. Specialty Stores

4.4.4. Direct Sale

4.5. By Region (In Value %)

4.5.1. North

4.5.2. West

4.5.3. South

4.5.4. East

5. USA Essential Oils Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. doTERRA International LLC

5.1.2. Young Living Essential Oils

5.1.3. Givaudan SA

5.1.4. International Flavors & Fragrances Inc. (IFF)

5.1.5. Symrise AG

5.1.6. Firmenich SA

5.1.7. Rocky Mountain Oils, LLC

5.1.8. Plant Therapy Essential Oils

5.1.9. Eden Botanicals

5.1.10. Now Foods

5.1.11. Lebermuth Company

5.1.12. Biolandes SAS

5.1.13. Essential Oils of New Zealand Ltd

5.1.14. Florihana Distillerie

5.1.15. Mountain Rose Herbs

5.2. Cross Comparison Parameters (Market share, Number of employees, Global Presence, Revenue, Product Portfolio,

Certification Standards, Raw Material Sourcing, Sustainability Practices)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Government Grants

5.8. Venture Capital Funding

5.9. Private Equity Investments

6. USA Essential Oils Market Regulatory Framework

6.1. Certification Standards

6.2. Import/Export Regulations

6.3. Environmental Impact Assessments

7. USA Essential Oils Future Market Size (In USD Bn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. USA Essential Oils Future Market Segmentation

8.1. By Type (In Value %)

8.2. By Application (In Value %)

8.3. By Source (In Value %)

8.4. By Distribution Channel (In Value %)

8.5. By Region (In Value %)

9. USA Essential Oils Market Analyst’s Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Segmentation Analysis

9.3. White Space Opportunity Analysis

9.4. Product Positioning Strategy

Disclaimer

Contact Us

Research Methodology

Step 1: Identification of Key Variables

The first step involves developing a comprehensive map of the USA essential oils market, identifying key stakeholders, such as manufacturers, suppliers, and distributors. This process is supported by extensive desk research and the use of secondary databases, allowing us to identify the key variables driving the market, such as consumer preferences and regulatory frameworks.

Step 2: Market Analysis and Construction

This step focuses on compiling historical market data and trends, assessing the essential oil penetration in different segments such as food and beverage, cosmetics, and wellness. This analysis also includes evaluating supply chain dynamics and the overall market structure, which helps us derive the most accurate revenue and market share estimates.

Step 3: Hypothesis Validation and Expert Consultation

After developing hypotheses on market trends and growth drivers, we conduct interviews with industry experts from leading essential oil manufacturers and distributors. These consultations help validate the hypotheses, refine the data, and provide deeper insights into operational challenges and market opportunities.

Step 4: Research Synthesis and Final Output

In the final phase, we integrate findings from all research phases, synthesizing data from both top-down and bottom-up approaches. This ensures a holistic and validated view of the market dynamics, enabling us to provide actionable insights for stakeholders in the essential oils industry.

Frequently Asked Questions

01. How big is the USA Essential Oils Market?

The USA essential oils market is valued at USD 1.8 billion, driven by the rising demand for natural and organic products across various industries including personal care, cosmetics, and aromatherapy.

02. What are the challenges in the USA Essential Oils Market?

Challenges in the USA essential oils market include the high cost of production due to raw material volatility, stringent regulatory frameworks, and the limited availability of high-quality raw materials, which can hinder market growth.

03. Who are the major players in the USA Essential Oils Market?

Key players in the USA essential oils market include doTERRA International LLC, Young Living Essential Oils, Givaudan SA, International Flavors & Fragrances Inc. (IFF), and Rocky Mountain Oils, LLC, known for their wide product offerings and strong distribution networks.

04. What are the growth drivers of the USA Essential Oils Market?

The growth of the USA essential oils market is driven by increasing consumer demand for natural and chemical-free products, the rise in wellness and aromatherapy trends, and the expanding application of essential oils in food, beverages, and personal care products.

05. Which applications dominate the USA Essential Oils Market?

Aromatherapy dominates the USA essential oils market, due to increasing consumer focus on relaxation, stress relief, and wellness. The growth of wellness centers and home aromatherapy use contributes to the segment’s dominance.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.