USA Ethnic Food Market Outlook to 2030

Region:North America

Author(s):Meenakshi Bisht

Product Code:KROD10120

December 2024

85

About the Report

USA Ethnic Food Market Overview

- The USA Ethnic Food Market is valued at USD 24.5 billion, based on a five-year historical analysis. This significant market size is primarily driven by increasing consumer interest in global cuisines and the growing multicultural population within the United States. With the rise of health-conscious eating and a preference for authentic, regional ingredients, the demand for ethnic food continues to rise.

- The dominant regions in the USA Ethnic Food Market include major metropolitan areas such as New York, Los Angeles, and Miami. These cities have diverse populations and are known for their strong cultural influences, which contribute to the high demand for ethnic foods. In addition, the influx of immigrants in these cities has led to a thriving market for authentic ethnic foods, with a focus on cuisine from Latin America, Asia, and the Mediterranean.

- Tariff policies significantly affect the cost and availability of imported ethnic food products. For example, in 2023, the U.S. imposed tariffs on several food products from China, raising import costs by an average of 7%. These trade policies directly impact the pricing of ethnic food products such as noodles, sauces, and spices, affecting their competitiveness in the U.S. market.

USA Ethnic Food Market Segmentation

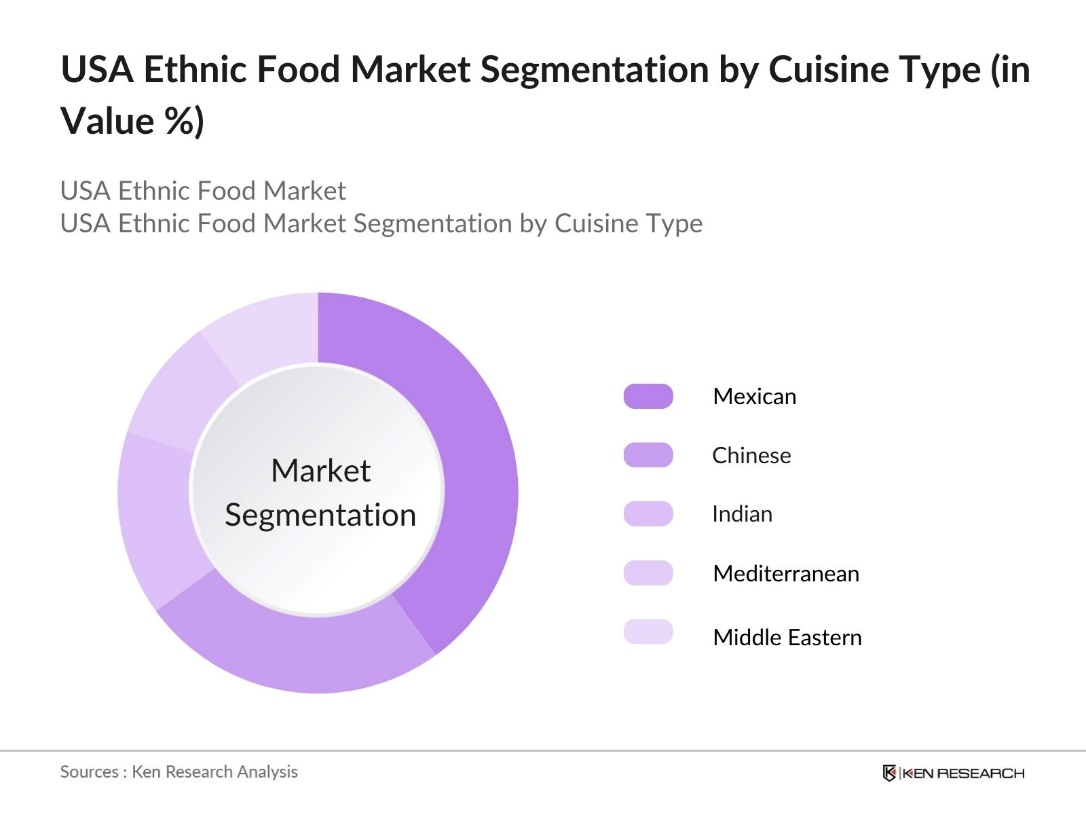

By Cuisine Type: The USA Ethnic Food Market is segmented by cuisine type into Mexican, Chinese, Indian, Mediterranean, and Middle Eastern. Mexican cuisine holds a dominant market share in this segmentation. This is due to the widespread popularity of Mexican dishes such as tacos, burritos, and nachos, which have become staples in American households. The presence of large Latin American communities in the U.S. also drives demand for Mexican food products, with supermarkets stocking a variety of Mexican brands and ingredients.

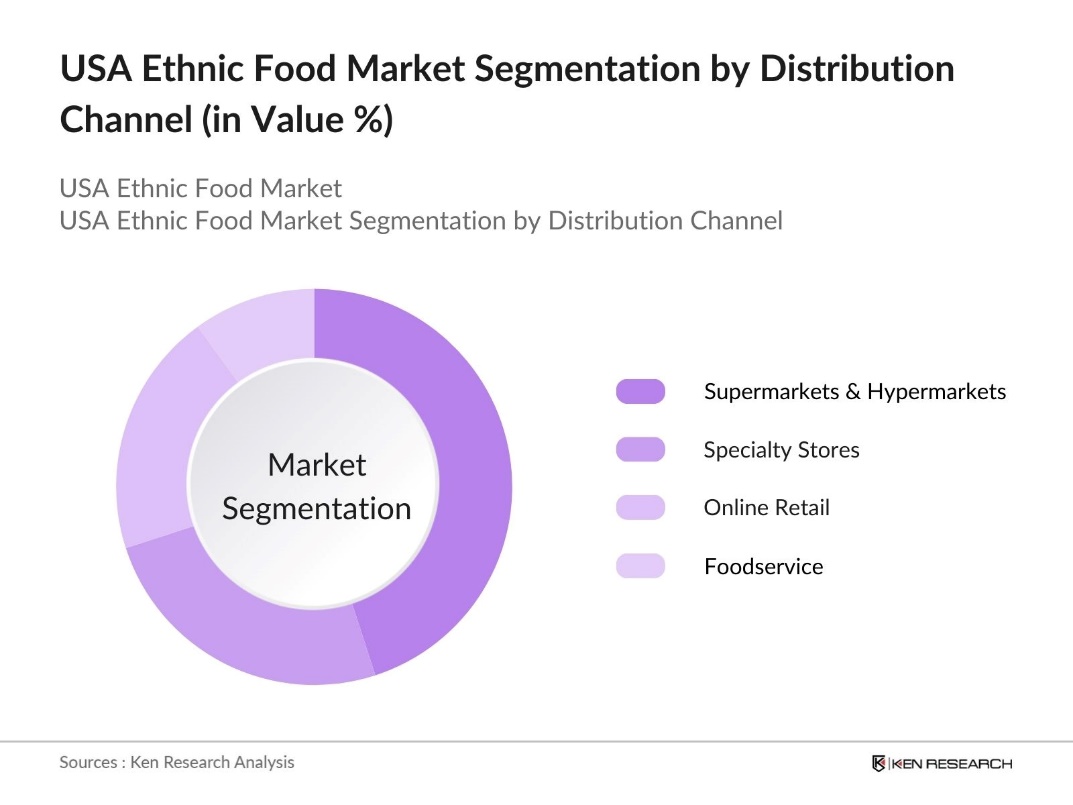

By Distribution Channel: USA Ethnic Food Market is segmented by distribution channel into Supermarkets & Hypermarkets, Specialty Stores, Online Retail, and Foodservice. Supermarkets and Hypermarkets dominate the market in this category. Their extensive distribution networks and ability to stock a variety of ethnic food products make them the preferred choice for consumers. Furthermore, many supermarkets offer a dedicated section for international foods, providing easier access to ethnic food brands.

USA Ethnic Food Market Competitive Landscape

The market is highly competitive, with both domestic and international players vying for market share. Major players in the market include Goya Foods, Ajinomoto Foods North America, and McCormick & Company, which dominate due to their extensive distribution networks, strong brand loyalty, and ability to offer a wide range of ethnic food products. These companies have established themselves as leaders by leveraging their longstanding reputation and introducing innovative ethnic food options.

|

Company |

Established |

Headquarters |

No. of Employees |

Revenue |

Market Share |

Distribution Network |

Product Range |

Innovation Index |

|

Goya Foods, Inc. |

1936 |

Jersey City, New Jersey |

||||||

|

Ajinomoto Foods N.A. |

1909 |

Torrance, California |

||||||

|

McCormick & Company |

1889 |

Hunt Valley, Maryland |

||||||

|

Hain Celestial Group |

1993 |

Lake Success, New York |

||||||

|

Amy's Kitchen |

1987 |

Petaluma, California |

USA Ethnic Food Industry Analysis

Growth Drivers

- Cultural Diversity and Migration: The United States has seen a substantial increase in immigrant populations, with over 47.9 million foreign-born residents recorded in 2022, as per the U.S. Census Bureau. This growing cultural diversity has been a major driver of the ethnic food market, as immigrants bring their culinary traditions to local communities. Additionally, the U.S. Department of State that the immigrants received lawful permanent resident status in 2023, further contributing to the spread and demand for authentic ethnic foods nationwide.

- Expansion of Restaurant Chains Offering Ethnic Foods: Restaurant chains focusing on ethnic cuisine have expanded significantly in recent years. As of 2024, there are over 78,000 ethnic restaurants in the U.S., with Mexican, Chinese, and Italian food being among the most popular. Major brands like Chipotle, Panda Express, and Olive Garden have contributed to this growth by offering both traditional and fusion ethnic food, increasing consumer exposure and consumption.

- Health Consciousness and Preference for Authentic Ingredients: Health-conscious consumers are increasingly drawn to natural, minimally processed foods, boosting the appeal of ethnic cuisines like Mediterranean and Japanese. These diets emphasize fresh, whole ingredients such as lean proteins, whole grains, and vegetables, aligning with the growing preference for authentic flavors that also promote a healthier lifestyle. This trend has made ethnic foods more popular among those seeking both taste and wellness.

Market Challenges

- Supply Chain Constraints: Ethnic food imports frequently encounter logistical challenges, including port delays and transportation bottlenecks. These issues affect the availability of fresh ethnic ingredients like tropical fruits and spices, which depend on timely shipments from countries such as Mexico, India, and Thailand. As a result, supply shortages have become more common, making it harder for consumers and businesses to access essential ingredients for ethnic cuisines.

- Regulatory Hurdles on Imports: Regulatory hurdles present significant challenges for the importation of ethnic foods into the U.S. The Food and Drug Administration (FDA) enforces strict safety and labeling standards on imported food products. Many shipments face rejection due to non-compliance with these regulations, especially from countries with different food safety protocols. These challenges complicate the import process, impacting the availability and market growth of ethnic foods in the U.S.

USA Ethnic Food Market Future Outlook

Over the next five years, the USA Ethnic Food Market is expected to witness substantial growth, driven by increasing consumer awareness of diverse cultures, a rising interest in global cuisines, and the expansion of e-commerce. As consumers seek more authentic ethnic food experiences, brands will need to innovate and focus on high-quality ingredients to capture a larger share of this evolving market.

Market Opportunities

- Growing Demand for Fusion and Gourmet Ethnic Foods: The growing popularity of fusion cuisine, which blends traditional ethnic flavors with modern culinary techniques, is creating exciting opportunities in the food industry. Millennials and Gen Z consumers are driving this trend, eager to explore innovative combinations like Korean-Mexican tacos or Italian-Japanese sushi rolls. The demand for gourmet ethnic foods reflects a broader desire for unique, diverse dining experiences that push culinary boundaries.

- E-commerce and Online Retail Expansion: The market is thriving due to the expansion of e-commerce platforms. Online retailers like Amazon and Walmart have broadened their ethnic food selections, making specialty ingredients more accessible to consumers. This increased availability online allows people to explore diverse cuisines and purchase items that may be difficult to find locally, driving further growth in the ethnic food market.

Scope of the Report

|

Cuisine Type |

Mexican Chinese Indian Mediterranean Middle Eastern |

|

Distribution Channel |

Supermarkets & Hypermarkets Specialty Stores Online Retail Foodservice |

|

Consumer Demographics |

Millennials Gen Z Baby Boomers |

|

Product Type |

Ready-to-Eat Meals Cooking Ingredients & Sauces Snacks & Confectionery |

|

Region |

Northeast Midwest South West |

Products

Key Target Audience

Ethnic Food Manufacturers

Importers and Exporters of Ethnic Food Products

Foodservice Companies

Government and Regulatory Bodies (FDA, USDA)

Investors and venture capital Firms

Banks and Financial Institutions

Companies

Players Mentioned in the Report

Goya Foods, Inc.

Ajinomoto Foods North America, Inc.

McCormick & Company

Hain Celestial Group

Amy's Kitchen

Mars, Inc. (Tasty Bite)

Nestl (Stouffer's)

Tasty Brands, LLC

Conagra Brands (Frontera)

Schwan's Company

Table of Contents

1. USA Ethnic Food Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. USA Ethnic Food Market Size (In USD Bn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. USA Ethnic Food Market Analysis

3.1. Growth Drivers

3.1.1. Cultural Diversity and Migration

3.1.2. Increasing Consumer Interest in International Cuisines

3.1.3. Expansion of Restaurant Chains Offering Ethnic Foods

3.1.4. Health Consciousness and Preference for Authentic Ingredients

3.2. Market Challenges

3.2.1. Supply Chain Constraints

3.2.2. Regulatory Hurdles on Imports

3.2.3. Price Sensitivity in Certain Segments

3.3. Opportunities

3.3.1. Growing Demand for Fusion and Gourmet Ethnic Foods

3.3.2. E-commerce and Online Retail Expansion

3.3.3. Collaborations with Local Farmers for Ingredient Sourcing

3.4. Trends

3.4.1. Introduction of Plant-Based Ethnic Foods

3.4.2. Rise of Regional Specialties within Ethnic Categories

3.4.3. Increasing Use of Sustainable and Organic Ingredients

3.5. Government Regulation

3.5.1. Food Safety Regulations for Imported Goods

3.5.2. Tariff and Trade Policies Impacting Food Imports

3.5.3. Certifications for Organic and Fair Trade Products

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem

3.8. Porters Five Forces

3.9. Competition Ecosystem

4. USA Ethnic Food Market Segmentation

4.1. By Cuisine Type (In Value %)

4.1.1. Mexican

4.1.2. Chinese

4.1.3. Indian

4.1.4. Mediterranean

4.1.5. Middle Eastern

4.2. By Distribution Channel (In Value %)

4.2.1. Supermarkets & Hypermarkets

4.2.2. Specialty Stores

4.2.3. Online Retail

4.2.4. Foodservice (Restaurants, QSRs)

4.3. By Consumer Demographics (In Value %)

4.3.1. Millennials

4.3.2. Gen Z

4.3.3. Baby Boomers

4.4. By Product Type (In Value %)

4.4.1. Ready-to-Eat Meals

4.4.2. Cooking Ingredients & Sauces

4.4.3. Snacks & Confectionery

4.5. By Region (In Value %)

4.5.1. Northeast

4.5.2. Midwest

4.5.3. South

4.5.4. West

5. USA Ethnic Food Market Competitive Analysis

5.1 Detailed Profiles of Major Companies

5.1.1. Goya Foods, Inc.

5.1.2. Ajinomoto Foods North America, Inc.

5.1.3. Hain Celestial Group

5.1.4. McCormick & Company

5.1.5. Amy's Kitchen

5.1.6. Mars, Inc. (Tasty Bite)

5.1.7. Nestl (Stouffer's)

5.1.8. Tasty Brands, LLC

5.1.9. Conagra Brands (Frontera)

5.1.10. Schwan's Company

5.1.11. Yucatan Foods

5.1.12. Lee Kum Kee

5.1.13. Patak's Foods

5.1.14. Sabra Dipping Co.

5.1.15. Saffron Road

5.2 Cross Comparison Parameters (No. of Employees, Headquarters, Inception Year, Revenue, Market Share, Product Range, Innovation Index, Distribution Network)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Venture Capital Funding

5.8. Government Grants

5.9. Private Equity Investments

6. USA Ethnic Food Market Regulatory Framework

6.1. Import Regulations for Ingredients

6.2. Labeling Requirements

6.3. Compliance with FDA Regulations

6.4. Certification for Halal, Kosher, Organic, etc.

7. USA Ethnic Food Future Market Size (In USD Bn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. USA Ethnic Food Future Market Segmentation

8.1. By Cuisine Type (In Value %)

8.2. By Distribution Channel (In Value %)

8.3. By Consumer Demographics (In Value %)

8.4. By Product Type (In Value %)

8.5. By Region (In Value %)

9. USA Ethnic Food Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Consumer Segmentation Strategy

9.3. Product Innovation and New Market Entry

9.4. White Space Opportunity Analysis

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

The initial phase involves mapping all key stakeholders within the USA Ethnic Food Market. Secondary databases, along with proprietary resources, are employed to gather detailed industry information. This helps in defining key market variables, including demand drivers, supply chain complexities, and product innovation trends.

Step 2: Market Analysis and Construction

Historical data of the USA Ethnic Food Market is analyzed to assess key growth trends and market penetration levels. This phase evaluates both retail and foodservice channels, with an emphasis on revenue generation and product adoption across different demographics.

Step 3: Hypothesis Validation and Expert Consultation

Industry experts from various ethnic food brands and distribution companies are consulted through telephonic interviews to validate key market assumptions. Their insights provide essential data to support both quantitative and qualitative analysis of the market dynamics.

Step 4: Research Synthesis and Final Output

Comprehensive insights into consumer preferences, product innovations, and distribution channels are gathered from leading ethnic food manufacturers. This information ensures the accuracy and reliability of the final market projections and segmentation analysis.

Frequently Asked Questions

01. How big is the USA Ethnic Food Market?

The USA Ethnic Food Market is valued at USD 24.5 billion, driven by the growing demand for authentic global cuisines and the increasing multicultural population in the country.

02. What are the challenges in the USA Ethnic Food Market?

Challenges in the USA Ethnic Food Market include supply chain disruptions for imported ingredients, price sensitivity among consumers, and regulatory hurdles related to food safety and labeling requirements.

03. Who are the major players in the USA Ethnic Food Market?

Key players in USA Ethnic Food Market include Goya Foods, Ajinomoto Foods North America, McCormick & Company, and Amy's Kitchen, each with extensive distribution networks and strong brand loyalty in ethnic food categories.

04. What are the growth drivers of the USA Ethnic Food Market?

The USA Ethnic Food Market growth drivers include the increasing interest in global cuisines, the expansion of ethnic food sections in supermarkets, and the rising demand for plant-based and organic ethnic food options.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.