USA EV Battery Market Outlook to 2030

Region:North America

Author(s):Sanjana

Product Code:KROD1924

October 2024

87

About the Report

USA EV Battery Market Overview

- USA EV Battery Market was valued at USD 5 billion, driven by the rapid increase in EV adoption and the push toward renewable energy. The countrys expanding EV infrastructure, higher consumer demand for electric vehicles, and significant advancements in battery technology are all driving market growth.

- USA EV Battery Market is dominated by several key players, including Panasonic, Tesla, LG Energy Solution, General Motors, and Samsung SDI. Panasonic, in collaboration with Tesla, plays a vital role in the U.S. market, producing a significant portion of EV batteries through the Gigafactory in Nevada. LG Energy Solution and Samsung SDI have also established a presence with their advanced battery technology, while General Motors has entered the race with their Ultium battery platform.

- In 2024, Ford announced a realignment of its U.S. battery sourcing plan aimed at reducing costs and maximizing capacity utilization. The company is adjusting its North America vehicle roadmap to include a wider range of electrification options, such as lower-priced and longer-range electric vehicles.

- The U.S. EV battery market is predominantly centered around cities with high EV adoption rates, such as San Francisco, Los Angeles, and New York. These cities lead the market due to their robust infrastructure, supportive government policies, and higher consumer awareness of electric vehicles. Additionally, regions like Texas and Michigan are emerging as significant players, thanks to investments in EV manufacturing and battery production facilities.

USA EV Battery Market Segmentation

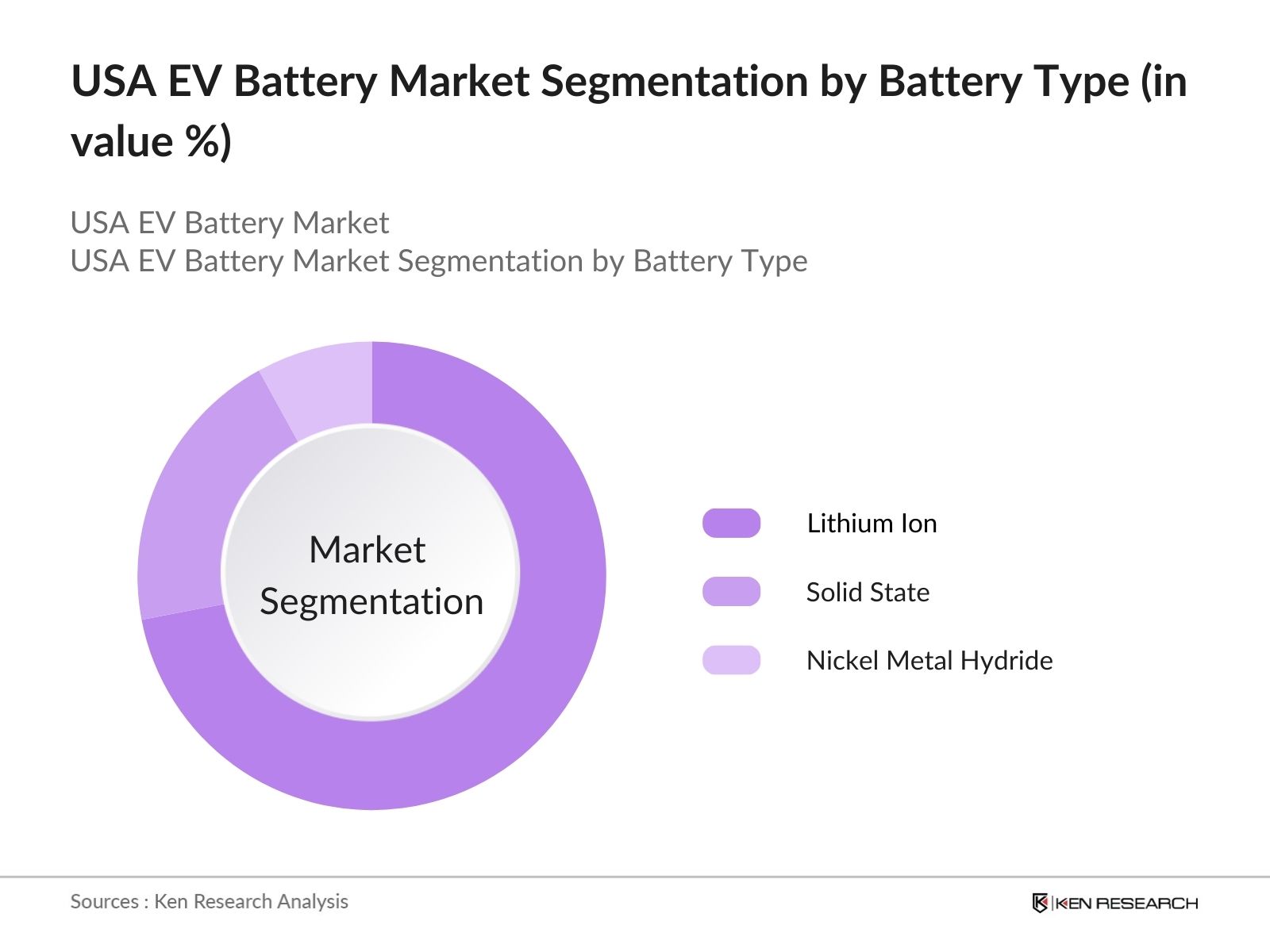

By Battery Type: The USA EV battery market is segmented by battery type into lithium-ion batteries, solid-state batteries, and nickel-metal hydride batteries. In 2023, lithium-ion batteries dominated the market due to their widespread use in electric vehicles and their high energy density. They have become the standard in EV manufacturing because of their proven performance, long lifecycle, and improved charging capabilities.

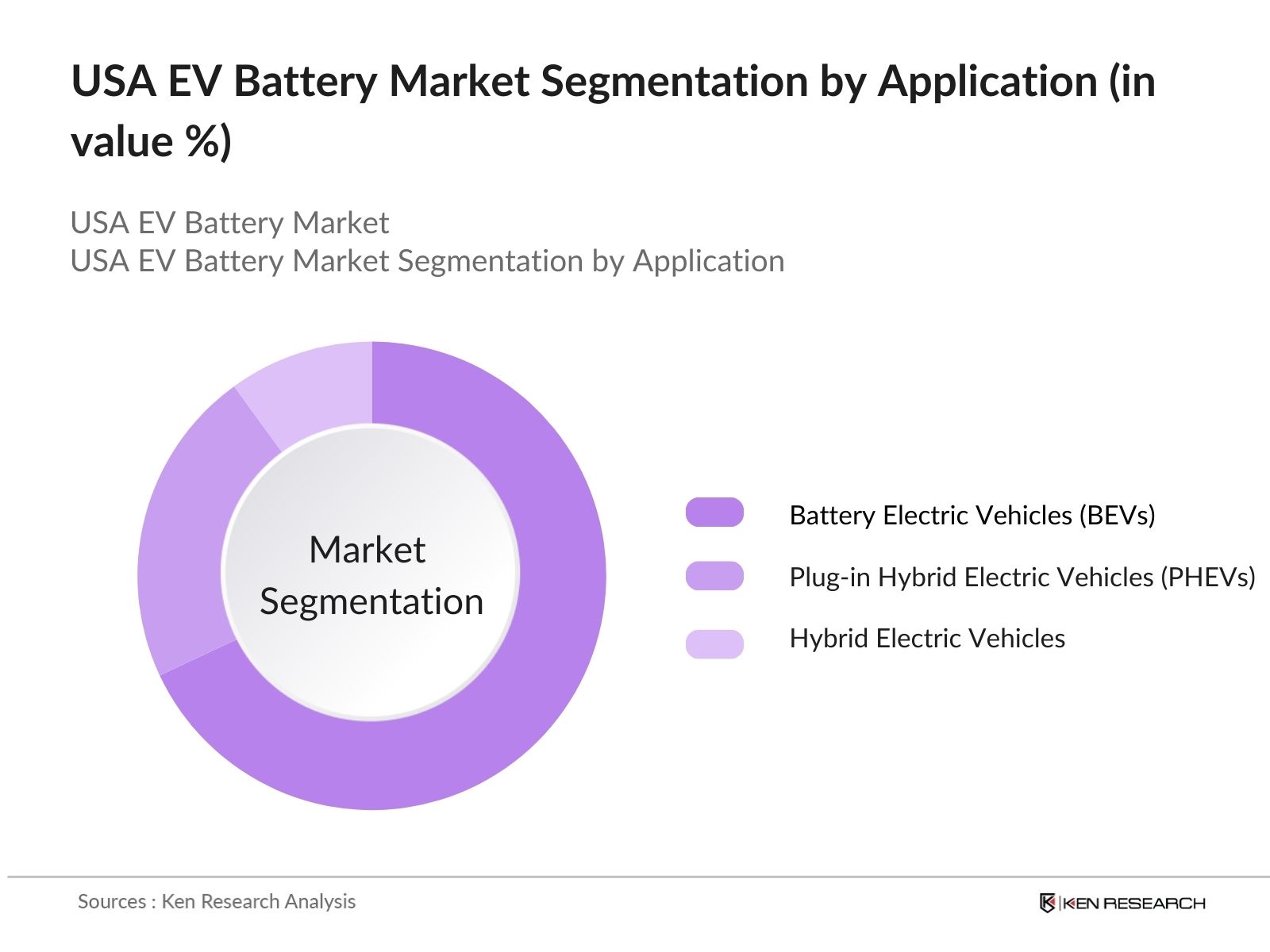

By Vehicle Type: The market is also segmented by vehicle type into battery electric vehicles (BEVs), plug-in hybrid electric vehicles (PHEVs), and hybrid electric vehicles (HEVs). In 2023, BEVs held a dominant market share due to their zero-emission profile and significant investments by automakers. Tesla's Model 3 and Ford's Mustang Mach-E have led the BEV market, with growing popularity among consumers driven by government incentives and the rapid expansion of charging infrastructure across the country.

By Region: The regional segmentation divides the USA EV battery market into North, South, Midwest, and West. The West dominated the market in 2023, primarily due to California's stringent emission regulations and the state's aggressive push towards electric vehicle adoption. The region's supportive government policies, consumer awareness, and vast charging infrastructure make it a leader in EV battery demand.

USA EV Battery Market Competitive Landscape

|

Company |

Establishment Year |

Headquarters |

|

Panasonic |

1918 |

Osaka, Japan |

|

Tesla |

2003 |

Palo Alto, USA |

|

LG Energy Solution |

2020 |

Seoul, South Korea |

|

General Motors |

1908 |

Detroit, USA |

|

Samsung SDI |

1970 |

Suwon, South Korea |

- Samsung SDI: In 2024, Samsung SDI has officially signed an agreement with General Motors (GM) to establish a joint venture for electric vehicle (EV) battery production in the United States. This partnership will see the construction of a battery cell manufacturing plant in New Carlisle, Indiana, with an initial investment of approximately $3.5 billion. The plant will focus on producing nickel-cobalt-aluminum (NCA) prismatic batteries for GM's upcoming EV models.

- Panasonic: In 2023, Subaru Corporation and Panasonic Energy Co. Ltd have strengthened their partnership by signing an agreement for the supply of cylindrical lithium-ion batteries for electric vehicles (EVs). This collaboration aims to support the growing demand for battery electric vehicles and contribute to societal challenges like carbon neutrality. Subaru plans to increase its electrification target to 50% pure BEVs by 2030.

USA EV Battery Industry Analysis

Growth Drivers:

- Increased Consumer Demand for EVs: The growing adoption of electric vehicles (EVs) is driving the demand for EV batteries. In 2023, global EV battery demand surpassed 750 GWh, marking a 40% increase from 2022, with EVs accounting for 95% of this demand. This surge in demand is supported by increased consumer awareness, tax incentives, and stricter emission norms. More automakers are launching new EV models to meet consumer demand, further increasing the need for high-capacity EV batteries.

- Advancement in Battery Technology: New developments in battery technology, particularly the shift toward solid-state batteries, are propelling the EV battery market forward. Major manufacturers are focusing on solid-state battery technology, which promises higher energy densities and improved safety. For instance, Panasonic's new Tesla-specific 4680 battery cell offers six times higher power capacity and five times more energy than previous models, indicating a significant leap in battery performance.

- Government Tax Credits and Subsidies: The U.S. government has introduced substantial incentives to encourage EV adoption and local battery manufacturing. The Inflation Reduction Act (IRA) includes provisions for $10 billion in manufacturing tax credits specifically for EV projects, as well as $6.135 billion for battery material processing and recycling grants. These incentives are directly increasing the market demand for EV batteries in the country.

Challenges:

- Supply Chain Disruptions for Raw Materials: The EV battery market is heavily dependent on key raw materials like lithium, cobalt, and nickel, and disruptions in the supply chain are a major challenge. Global cobalt production came from the Democratic Republic of Congo, where political instability and labor issues have led to supply constraints. This has resulted in delays and increased costs for EV battery manufacturers in the U.S.

- Recycling and Environmental Concerns: The growing number of electric vehicles is creating a significant challenge in terms of battery recycling. Only a few EV batteries in the U.S. were recycled, posing environmental concerns due to the hazardous materials involved in battery production and disposal. Without advancements in recycling technology or stricter regulations, the industry could face environmental backlash, especially as battery production scales up in the coming years.

Government Initiatives:

- The Bipartisan Infrastructure Law: It was enacted in 2021, after being signed into law. This legislation represents a significant investment in the United States' infrastructure, with a total allocation of approximately $1.2 trillion, which includes $550 billion in new spending aimed at modernizing and improving various infrastructure sectors. This initiative is critical in ensuring that the charging infrastructure can keep up with the growing number of electric vehicles on the road.

- The Inflation Reduction Act (IRA): The Inflation Reduction Act (IRA) is considered one of the largest investments in clean energy and climate initiatives in U.S. history, with approximately $391 billion allocated for various programs and incentives designed to stimulate economic growth and job creation while promoting green technologies. This is expected to lower battery production costs and increase local manufacturing capabilities.

USA EV Battery Future Market Outlook

The future of the USA EV battery market looks promising, driven by strong government support, technological advancements, and growing consumer demand. By 2028, the market is expected to be characterized by widespread adoption of solid-state batteries, which will offer superior performance, safety, and energy efficiency compared to traditional lithium-ion batteries.

Future Trends

- Shift to Solid-State Batteries: The EV battery market will see a significant shift toward solid-state battery technology. These batteries promise higher energy densities, faster charging times, and improved safety compared to current lithium-ion technology. Several automakers, including Toyota and Ford, have already announced plans to launch EVs with solid-state batteries, which will further drive market growth.

- Increased Domestic Battery Production: The U.S. will significantly reduce its dependence on imported EV batteries. New manufacturing facilities by companies like Tesla, Ford, and LG Energy Solution will ramp up domestic production, helping to secure the supply chain and lower costs. The U.S. Department of Energy's initiatives to increase domestic mining and processing of critical materials like lithium will also support this shift.

Scope of the Report

|

USA EV Battery Market Segmentation |

|

|

By Battery Type |

Lithium-Ion Solid-State Nickel-Metal Hydride |

|

By Vehicle Type |

Battery Electric Vehicles (BEVs) Plug-in Hybrid Electric Vehicles (PHEVs) Hybrid Electric Vehicles (HEVs) |

|

By Region |

North Midwest South West |

Products

Key Target Audience Organizations and Entities who can benefit by Subscribing This Report:

Electric vehicle manufacturers

Battery manufacturers

Automotive component suppliers

Charging infrastructure providers

Electric utility companies

Renewable energy companies

Investors and venture capitalist firms

Government and regulatory bodies (U.S. Department of Energy, Environmental Protection Agency)

Time Period Captured in the Report:

Historical Period: 2018-2023

Base Year: 2023

Forecast Period: 2023-2028

Companies

Players Mentioned in the Report:

Panasonic

Tesla

LG Energy Solution

Samsung SDI

General Motors

Ford

BYD

Rivian

Volkswagen Group

Stellantis

SK Innovation

CATL

Proterra

Nissan

QuantumScape

Table of Contents

1. USA EV Battery Market Overview

1.1 Definition and Scope (market definition, electrification scope)

1.2 Market Taxonomy (by battery type, vehicle type, region, raw materials)

1.3 Market Growth Rate (CAGR, year-on-year growth)

1.4 Market Segmentation Overview (battery type, vehicle type, region, application)

2. USA EV Battery Market Size (USD Billion)

2.1 Historical Market Size (market revenue, units sold, GWh capacity)

2.2 Year-on-Year Growth Analysis (revenue and volume analysis)

2.3 Key Market Developments and Milestones (major investments, new entrants, technology launches)

3. USA EV Battery Market Analysis

3.1 Growth Drivers

3.1.1 Rapid EV adoption and infrastructure expansion

3.1.2 Technological advancements in battery technology (solid-state, fast-charging, etc.)

3.1.3 Government policies and tax incentives (IRA, infrastructure plans)

3.1.4 Investments by key automakers and battery manufacturers

3.2 Market Restraints

3.2.1 Supply chain disruptions (raw material constraints: lithium, cobalt, nickel)

3.2.2 High manufacturing costs (cost per kWh)

3.2.3 Environmental and recycling concerns

3.3 Opportunities

3.3.1 Emerging battery technologies (solid-state, high-density cells)

3.3.2 New market entrants (startups, international players)

3.3.3 Expansion in emerging regions (Texas, Michigan, new gigafactories)

3.4 Trends

3.4.1 Shift to solid-state batteries

3.4.2 Increasing domestic battery production (localization, new factories)

3.4.3 Collaboration between automakers and battery companies (joint ventures)

3.5 Government Regulations

3.5.1 Inflation Reduction Act (tax credits, grants)

3.5.2 Bipartisan Infrastructure Law (EV infrastructure, charging stations)

3.5.3 Emission reduction targets (California ZEV mandates)

3.6 SWOT Analysis (financial and operational parameters)

3.7 Stakeholder Ecosystem (OEMs, battery manufacturers, raw material suppliers, recyclers)

3.8 Competitive Ecosystem

4. USA EV Battery Market Segmentation

4.1 By Battery Type

4.1.1 Lithium-Ion Batteries

4.1.2 Solid-State Batteries

4.1.3 Nickel-Metal Hydride Batteries

4.2 By Vehicle Type

4.2.1 Battery Electric Vehicles (BEVs)

4.2.2 Plug-in Hybrid Electric Vehicles (PHEVs)

4.2.3 Hybrid Electric Vehicles (HEVs)

4.3 By Region

4.3.1 West (California, key cities)

4.3.2 South (Texas, Florida)

4.3.3 Midwest (Michigan, Ohio)

4.3.4 North (New York, Illinois)

4.4 By Application

4.4.1 Passenger Electric Vehicles

4.4.2 Commercial Electric Vehicles (trucks, buses)

4.4.3 Industrial and Grid Storage

4.5 By Raw Materials

4.5.1 Lithium

4.5.2 Cobalt

4.5.3 Nickel

4.5.4 Graphite

5. USA EV Battery Market Competitive Landscape

5.1 Market Share Analysis (by revenue, capacity)

5.2 Strategic Initiatives (partnerships, joint ventures, technology collaborations)

5.3 Mergers and Acquisitions (recent deals, their impact)

5.4 Investment Analysis

5.4.1 Venture Capital Funding

5.4.2 Government Grants and Subsidies

5.4.3 Private Equity and Corporate Investments

6. Detailed Profiles of Major Competitors

6.1 Panasonic

6.2 Tesla

6.3 LG Energy Solution

6.4 General Motors

6.5 Samsung SDI

6.6 Ford

6.7 BYD

6.8 Rivian

6.9 Volkswagen Group

6.10 Stellantis

6.11 SK Innovation

6.12 CATL

6.13 Proterra

6.14 Nissan

6.15 QuantumScape

7. USA EV Battery Market Competitive Landscape Analysis

7.1 Market Entry Strategies (new market entrants, innovations)

7.2 Key Success Factors (technology leadership, vertical integration)

7.3 Cross-Comparison of Competitors (revenue, capacity, geographic reach)

8. USA EV Battery Market Future Outlook

8.1 Projected Market Size and Growth (USD Billion, GWh, CAGR)

8.2 Key Factors Driving Future Market Growth (technology, consumer demand, government policies)

8.3 Expected Shifts in Battery Technology (solid-state batteries, recycling technology)

8.4 Trends in Domestic Battery Manufacturing (local production, raw material sourcing)

9. Analysts' Recommendations

9.1 Total Addressable Market (TAM) and Serviceable Addressable Market (SAM) Analysis

9.2 Strategic Initiatives for Growth (vertical integration, regional expansion)

9.3 Technology Adoption Recommendations (solid-state batteries, battery recycling)

9.4 White Space Opportunities (emerging segments, high-potential regions)

10. Disclaimer

10.1 Legal and Data Disclaimers

10.2 Report Limitations and Methodology

Research Methodology

Step 1: Identifying Key Variables:

Ecosystem creation for all the major entities and referring to multiple secondary and proprietary databases to perform desk research around market to collate industry level information.

Step 2: Market Building:

Collating statistics on USA EV Battery Market over the years, penetration of marketplaces and service providers ratio to compute revenue generated for USA EV Battery Market. We will also review service quality statistics to understand revenue generated which can ensure accuracy behind the data points shared.

Step 3: Validating and Finalizing:

Building market hypothesis and conducting CATIs with industry experts belonging to different companies to validate statistics and seek operational and financial information from company representatives.

Step 4: Research output:

Our team will approach multiple EV Battery companies and understand nature of product segments and sales, consumer preference and other parameters, which will support us validate statistics derived through bottom to top approach from EV Battery companies.

Frequently Asked Questions

01 How big is USA EV Battery Market?

USA EV Battery Market was valued at USD 5 billion, driven by the rapid increase in EV adoption and the push toward renewable energy. The countrys expanding EV infrastructure, higher consumer demand for electric vehicles, and significant advancements in battery technology are all driving market growth.

02. What are the growth drivers of the USA EV Battery Market?

Growth drivers of USA EV Battery Market include increasing consumer demand for electric vehicles, advancements in battery technology such as solid-state batteries, and government tax incentives that encourage EV adoption and domestic battery production. The push toward reducing carbon emissions also supports market growth.

03 What are the challenges in USA EV Battery Market?

Challenges of USA EV Battery Market include supply chain disruptions for critical raw materials like lithium and cobalt, high production costs, and environmental concerns related to battery recycling. These issues hinder the ability of manufacturers to scale up production and meet increasing demand.

04 Who are the major players in the USA EV Battery Market?

Key players in the USA EV Battery Market include Tesla, Panasonic, LG Energy Solution, General Motors, and Samsung SDI. These companies dominate the market due to their large production capacities, technological advancements, and strategic partnerships with automakers.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.