USA Facility Management Market Outlook to 2030

Region:North America

Author(s):Shreya Garg

Product Code:KROD2803

November 2024

87

About the Report

USA Facility Management Market Overview

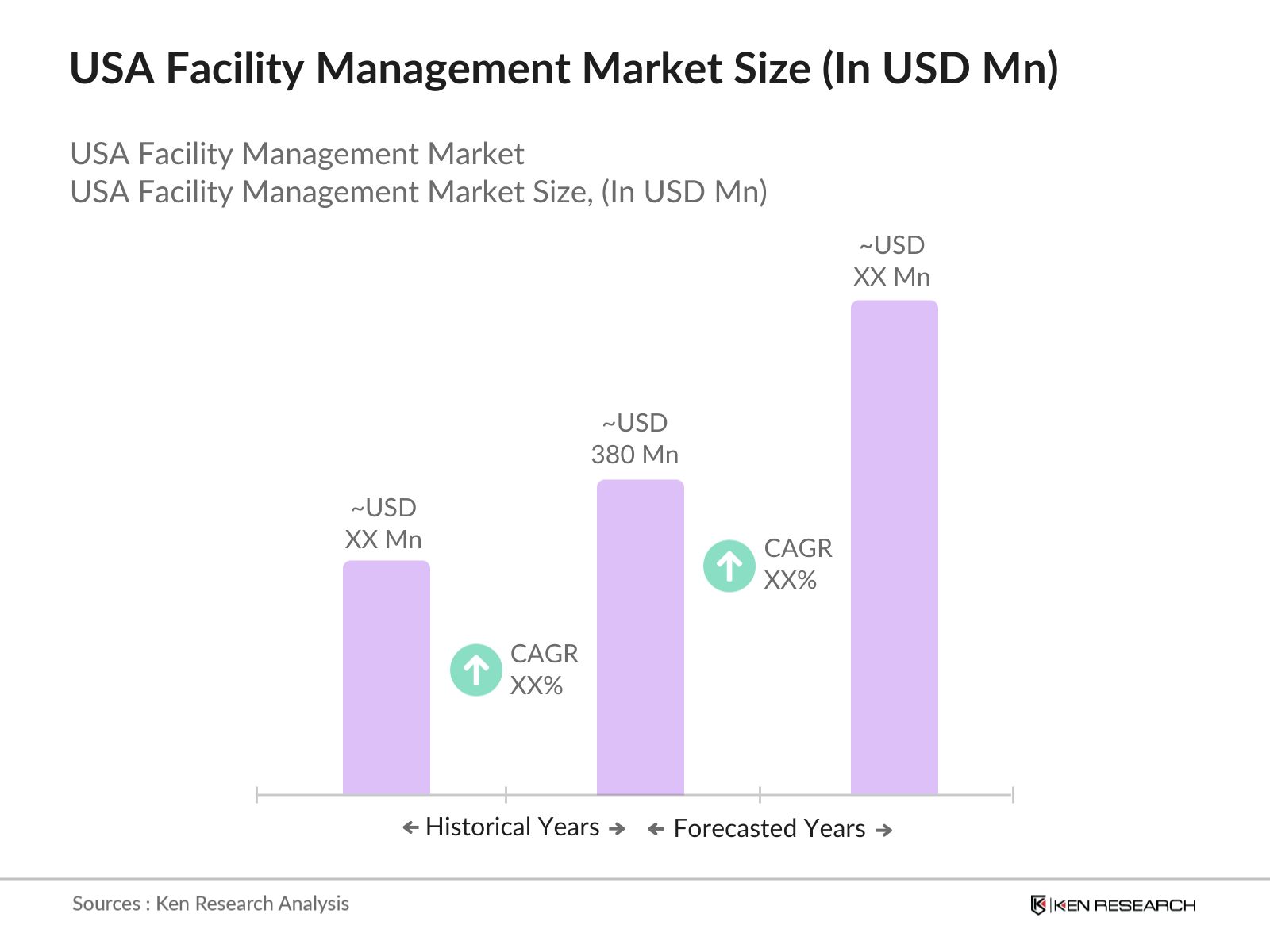

The USA Facility Management Market was valued at USD 380 Million based on the historic data of past five years. The market size has been expanding due to the increasing focus on maintaining efficient and sustainable facilities across commercial, industrial, and residential sectors. Growth is largely driven by the increased adoption of integrated facility management (IFM) solutions, which allow organizations to streamline operations, reduce costs, and improve efficiency.

Several key players dominate the USA Facility Management Market including CBRE Group, Inc., JLL (Jones Lang LaSalle Incorporated), Sodexo, Inc., Compass Group USA, Inc., and Aramark Corporation. These companies are leveraging digital solutions, sustainability practices, and outsourcing to maintain their market leadership.

In 2023, CBRE Group made an announcement regarding the expansion of its digital facility management solutions through partnerships with technology providers. The companys adoption of AI-powered building analytics has led to substantial improvements in energy efficiency, reducing costs for clients by over 12% in some cases. This partnership has been a game-changer, enhancing CBREs ability to serve large-scale commercial facilities.

California leads the USA Facility Management Industry. This dominance is due to the states large concentration of commercial properties, tech companies, and energy efficiency mandates. The demand for facility management services is particularly high in Silicon Valley, where technology-driven solutions are vital for managing complex commercial infrastructure.

USA Facility Management Market Segmentation

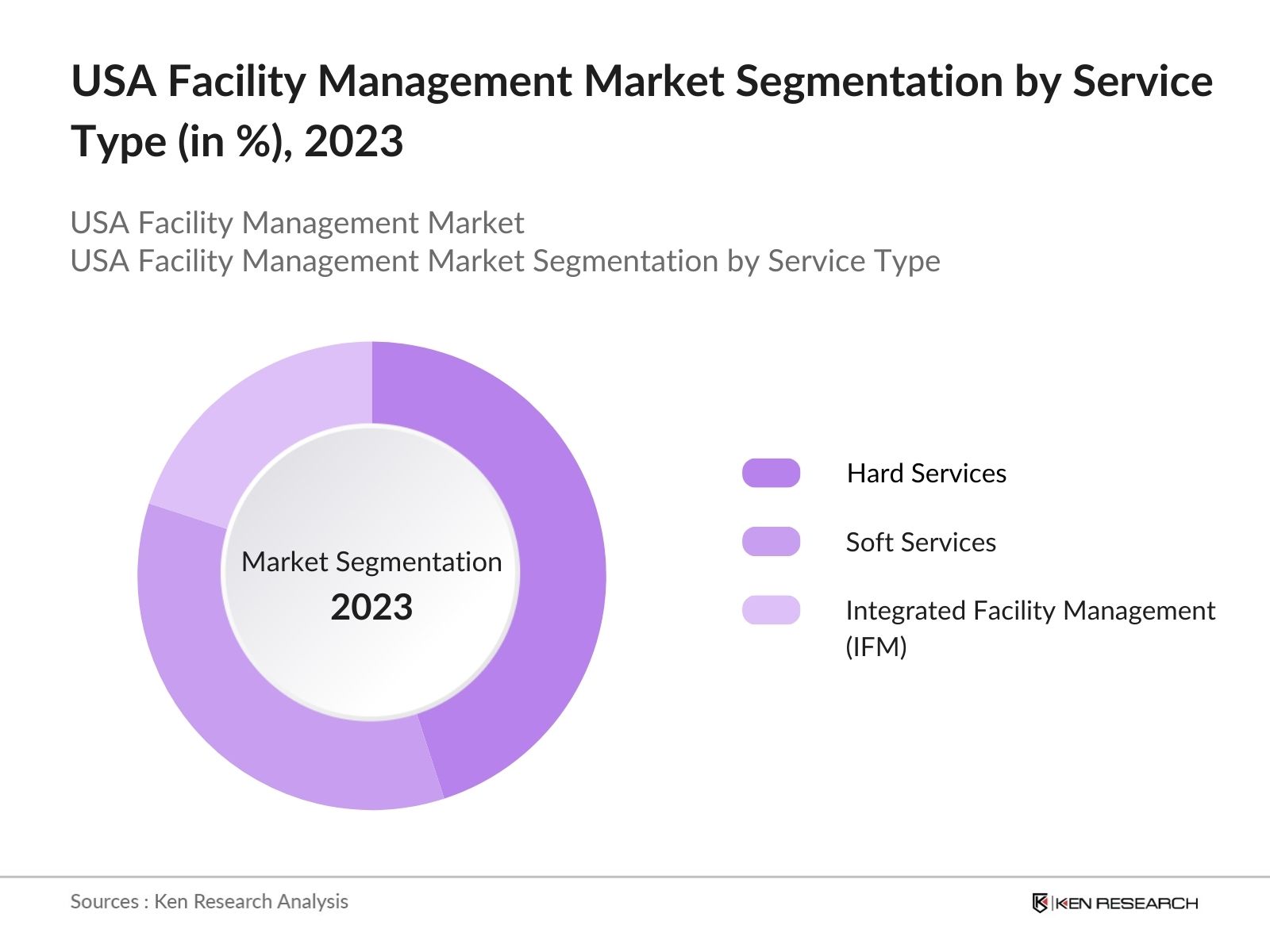

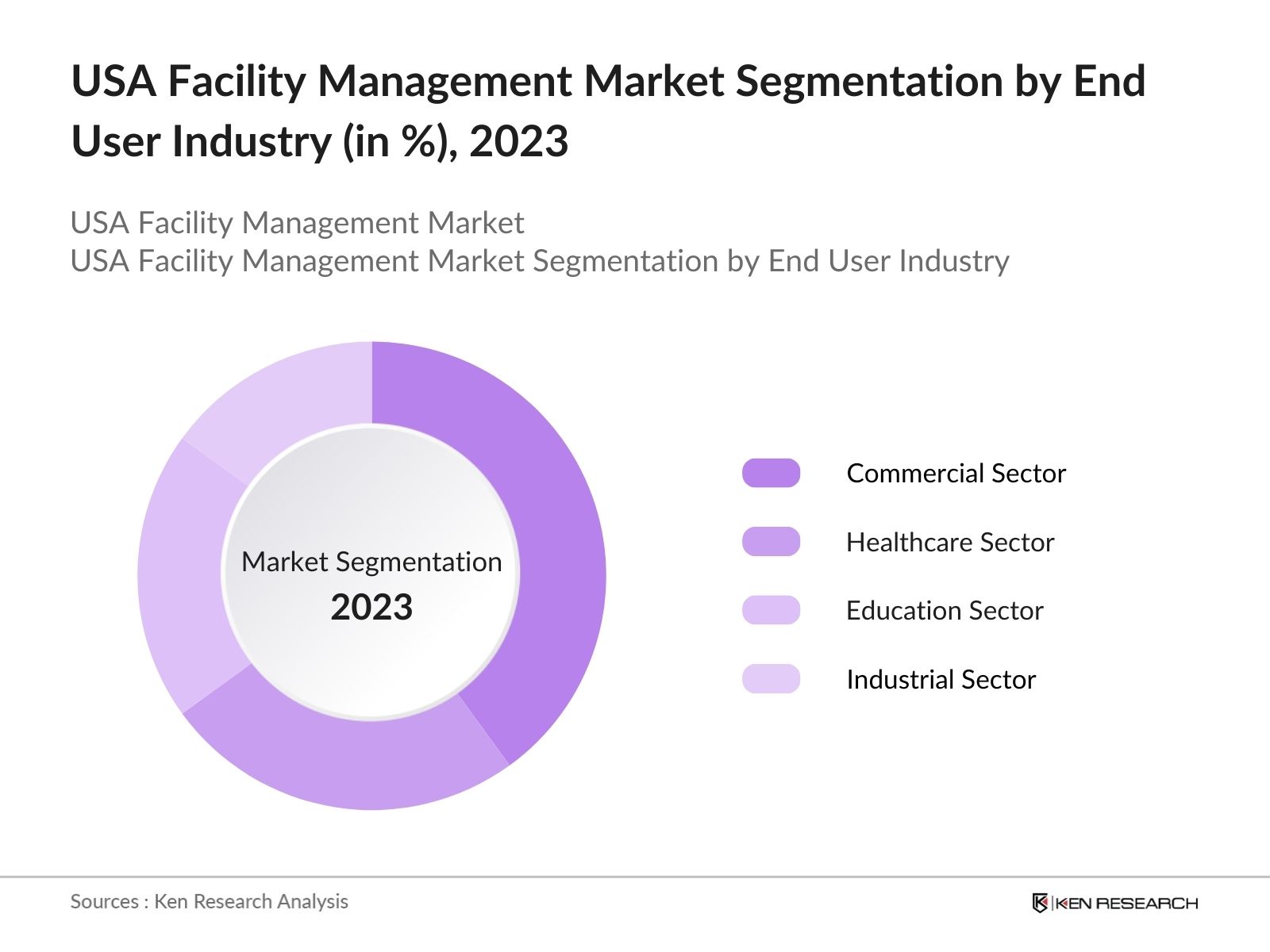

The USA Facility Management Market can be segmented into various sectors such as service type, end-user industry, and region.

By Service Type: The market is segmented by service type into Hard Services, Soft Services, and Integrated Facility Management (IFM). Hard services dominate the market because they are essential for the operational integrity of buildings, particularly in commercial and industrial sectors. With stricter regulations and the rising need for energy-efficient systems, the demand for technical maintenance has surged, solidifying this segment's leadership.

By End-User Industry: The market is segmented into Commercial, Healthcare, Education, and Industrial sectors. The commercial sector remains dominant due to the expansion of office complexes, particularly in urban centers. As companies continue to outsource their non-core activities, including building maintenance and operational efficiency, the demand for facility management services within this segment grows exponentially.

By Region: The market is segmented into North, South, East, and West. The West region, particularly California, leads the market due to its concentration of technology-driven facilities and strict environmental regulations. Companies in the West are early adopters of integrated facility management services, giving this region a substantial edge over others.

USA Facility Management Market Competitive Landscape

|

Company |

Year Established |

Headquarters |

|---|---|---|

|

CBRE Group, Inc. |

1906 |

Los Angeles, CA |

|

JLL (Jones Lang LaSalle Inc.) |

1999 |

Chicago, IL |

|

Sodexo, Inc. |

1966 |

Gaithersburg, MD |

|

Compass Group USA, Inc. |

1941 |

Charlotte, NC |

|

Aramark Corporation |

1936 |

Philadelphia, PA |

- Aramark Invests in Workforce Development and Automation: In response to labor shortages, Aramark invested USD 70 million in 2024 to develop a workforce training program and integrate automation into its facility management services. The training program will certify over 10,000 new workers in technical roles, while the companys new automation tools are expected to reduce operational costs by USD 30 million annually.

- JLL Serve Integration: On June 5, 2024, JLL announced the enhancement of its digital facilities management application, JLL Serve, through the integration of AI-powered technology from Sclera. This integration aims to streamline facilities management by providing a comprehensive view of asset performance and maintenance needs, thereby improving decision-making and operational compliance.

USA Facility Management Industry Analysis

Growth Drivers

- Increased Outsourcing of Facility Management Services by Large Corporations: Corporations in the USA increasingly outsourced facility management to specialized providers to enhance operational efficiency and cut costs. This shift resulted in a notable demand for outsourced services across sectors such as healthcare, retail, and commercial real estate. Large enterprises collectively outsourced facility management services worth USD 10 billion in 2023, creating opportunities for service providers to handle a wider array of non-core operations.

- Expansion of Commercial Real Estate and New Infrastructure Projects: With a steady rise in new commercial construction in 2024, the facility management sector witnessed an uptick in demand for operational maintenance and property management services. Economic growth and new infrastructure projects in major urban areas support the increase in demand, particularly for operational services.

- Increased Adoption of Smart Facility Management Systems: IoT-enabled smart facility management systems have gained widespread acceptance in 2024, offering real-time data collection, remote monitoring, and predictive maintenance services. Over 25,000 commercial buildings in the USA now rely on IoT-based management systems to enhance operational efficiency, reduce energy waste, and improve asset utilization.

Challenges

- Labor Shortages in Facility Management Industry: In 2024, the facility management industry continues to face a significant labor shortage, particularly in technical roles such as HVAC, electrical, and maintenance engineering. The industry has a gap of skilled workers, resulting in project delays and increased labor costs. This labor shortfall has driven up operational costs across the board, adding to the industry's annual labor expenses.

- Increased Cybersecurity Risks for Smart Buildings: As the facility management industry becomes increasingly reliant on digital systems, cybersecurity risks have escalated. Cyberattacks targeting building management systems have raised concerns about data security, particularly in sectors like healthcare and financial services, where sensitive data is critical. This risk has led to increased investments in cybersecurity measures by facility management firms, further adding to operational costs.

Government Initiatives

- Federal Energy Management Program (FEMP) Funding for Green Building Retrofits: FEMP announced a historic funding amount ofUSD 250 millionfor energy-efficient projects through the Assisting Federal Facilities with Energy Conservation Technologies (AFFECT) program. This initiative will see over 250 government buildings undergo energy upgrades, with facility management providers tasked with ensuring compliance with energy-saving goals. The retrofitting projects are expected to generate an additional USD 120 million in contracts for facility management firms specializing in energy efficiency.

- Infrastructure Investment and Jobs Act (IIJA) Allocating Funds for Public Facility Management: The 2024 federal budget continues to support the IIJA, a crucial amount of budget is allocated for the maintenance and operational management of public infrastructure, including roads, schools, and government offices. Facility management firms have secured over USD 2 billion in contracts to manage public facilities under this initiative, ensuring that these buildings remain functional and comply with safety and operational standards.

USA Facility Management Market Future Outlook

The USA Facility Management Market is expected to grow exponentially. The future growth will be supported by the increasing need for sustainable facilities and smart building solutions. Additionally, the rise in outsourcing non-core activities to facility management firms will drive further demand.

Future Trends

- Artificial Intelligence Integration in Predictive Maintenance: AI-powered predictive maintenance tools are expected to be widely adopted in the facility management sector, commercial buildings leveraging AI for real-time monitoring and equipment maintenance. These tools will reduce the need for manual inspections and increase the operational lifespan of building systems.

- Rise of Integrated Facility Management Solutions: The trend toward integrated facility management (IFM) solutions is set to accelerate over the next five years, with more enterprises expected to adopt IFM models by 2028. These solutions will consolidate multiple facility management services under a single provider, allowing for streamlined operations and reduced costs. The IFM model is projected to generate an additional service contract as companies seek to optimize their building management strategies.

Scope of the Report

|

By Service Type |

Hard Services Soft Services Integrated Facility Management (IFM) |

|

By End User Industry |

Commercial Healthcare Education Industrial sectors |

|

By Region |

North South East West |

Products

Key Target Audience Organizations and Entities Who Can Benefit by Subscribing This Report:

Government Institutions (Ministry of Skill Development & Entrepreneurship)

E-commerce Firms

Startups and SMEs

Large Enterprises

Telecommunication Firms

Educational Institutions (for workforce training partnerships)

Investors and VC Firms

Banks and Financial Institutions

Time Period Captured in the Report:

Historical Period: 2018-2023

Base Year: 2023

Forecast Period: 2023-2028

Companies

Players Mentioned in the Report:

TeamLease Services

Randstad India

Quess Corp

Adecco India

ABC Consultants

ManpowerGroup India

Monster India

HirePro Consulting

Kelly Services India

Michael Page India

Mercer India

CIEL HR Services

Ikya Human Capital Solutions

Naukri.com

PeopleStrong

Table of Contents

1. USA Facility Management Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. USA Facility Management Market Size (in USD)

2.1. Historical Market Size

2.2. Year-on-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. USA Facility Management Market Analysis

3.1. Growth Drivers

3.1.1. Increased Outsourcing of Facility Management

3.1.2. Expansion of Commercial Real Estate

3.1.3. Sustainability and Energy Efficiency Compliance

3.1.4. Adoption of Smart Building Systems

3.2. Restraints

3.2.1. Labor Shortages in Technical Roles

3.2.2. Rising Operational Costs

3.2.3. Complex Regulatory Environment

3.2.4. Cybersecurity Risks

3.3. Opportunities

3.3.1. Integration of IoT Solutions

3.3.2. Increasing Demand for Energy Management Services

3.3.3. Expanding Role of IFM Services

3.3.4. Growth of Smart City Projects

3.4. Trends

3.4.1. AI-Powered Predictive Maintenance

3.4.2. Focus on Sustainability in Facility Management

3.4.3. Real-Time Data Analytics in Facility Operations

3.4.4. Outsourcing Non-Core Facility Management Functions

3.5. Government Initiatives

3.5.1. Federal Energy Management Program (FEMP)

3.5.2. Infrastructure Investment and Jobs Act (IIJA)

3.5.3. Workforce Development Initiatives

3.5.4. Clean Energy Standards for Public Buildings

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem

3.8. Competition Ecosystem

4. USA Facility Management Market Segmentation

4.1. By Service Type (in Value)

4.1.1. Hard Services

4.1.2. Soft Services

4.1.3. Integrated Facility Management (IFM)

4.2. By End-User Industry (in Value)

4.2.1. Commercial Sector

4.2.2. Healthcare Sector

4.2.3. Industrial Sector

4.2.4. Education Sector

4.3. By Region (in Value)

4.3.1. North

4.3.2. South

4.3.3. East

4.3.4. West

5. USA Facility Management Market Cross Comparison

5.1. Detailed Profiles of Major Companies

5.1.1. CBRE Group, Inc.

5.1.2. JLL (Jones Lang LaSalle Incorporated)

5.1.3. Sodexo, Inc.

5.1.4. Compass Group USA, Inc.

5.1.5. Aramark Corporation

5.2. Cross Comparison Parameters (No. of Employees, Headquarters, Inception Year, Revenue)

6. USA Facility Management Market Competitive Landscape

6.1. Market Share Analysis

6.2. Strategic Initiatives

6.3. Mergers and Acquisitions

6.4. Investment Analysis

6.4.1. Venture Capital Funding

6.4.2. Government Grants

6.4.3. Private Equity Investments

7. USA Facility Management Market Regulatory Framework

7.1. Environmental Standards

7.2. Compliance Requirements

7.3. Certification Processes

8. USA Facility Management Future Market Size (in USD)

8.1. Future Market Size Projections

8.2. Key Factors Driving Future Market Growth

9. USA Facility Management Future Market Segmentation

9.1. By Service Type (in Value)

9.2. By End-User Industry (in Value)

9.3. By Region (in Value)

10. USA Facility Management Market Analysts Recommendations

10.1. TAM/SAM/SOM Analysis

10.2. Customer Cohort Analysis

10.3. Marketing Initiatives

10.4. White Space Opportunity Analysis

Disclaimer

Contact Us

Research Methodology

Step 1: Identifying Key Variables

Ecosystem creation for all the major entities and referring to multiple secondary and proprietary databases to perform desk research around market to collate industry level information.

Step 2: Market Building

Collating statistics on USA Facility Management Market over the years, penetration of marketplaces and service providers ratio to compute revenue generated for Facility Management Market. We will also review service quality statistics to understand revenue generated which can ensure accuracy behind the data points shared.

Step 3: Validating and Finalizing

Building market hypothesis and conducting CATIs with industry experts belonging to different companies to validate statistics and seek operational and financial information from company representatives.

Step 4: Research Output

Our team will approach multiple Facility Management companies and understand nature of product segments and sales, consumer preference and other parameters, which will support us validate statistics derived through bottom to top approach from USA Facility Management industry.

Frequently Asked Questions

01 How big is the USA Facility Management Market?

The USA Facility Management Market was valued at USD 380 Million in 2023, driven by the expansion of commercial real estate, increased outsourcing of services, and a growing focus on energy efficiency and sustainability.

02 What are the challenges in the USA Facility Management Market?

Challenges in the USA Facility Management Market include labor shortages, rising operational costs due to energy price increases, complex regulatory compliance, and cybersecurity risks associated with smart building systems. These challenges create significant hurdles for facility management providers operating across various sectors.

03 Who are the major players in the USA Facility Management Market?

Key players in the USA Facility Management Market include CBRE Group, JLL, Sodexo, Compass Group, and Aramark. These companies maintain their dominance through large-scale operations, technological integration, and comprehensive service portfolios across various industries.

04 What are the growth drivers of the USA Facility Management Market?

The USA Facility Management market is driven by factors such as the outsourcing of facility management services by large enterprises, the expansion of commercial real estate, increased demand for sustainability and energy efficiency compliance, and the adoption of IoT-enabled smart facility management systems.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.