USA Fast Food and Quick Service Restaurant Market Outlook to 2030

Region:North America

Author(s):Naman Rohilla

Product Code:KROD4739

December 2024

80

About the Report

USA Fast Food and Quick Service Restaurant Market Overview

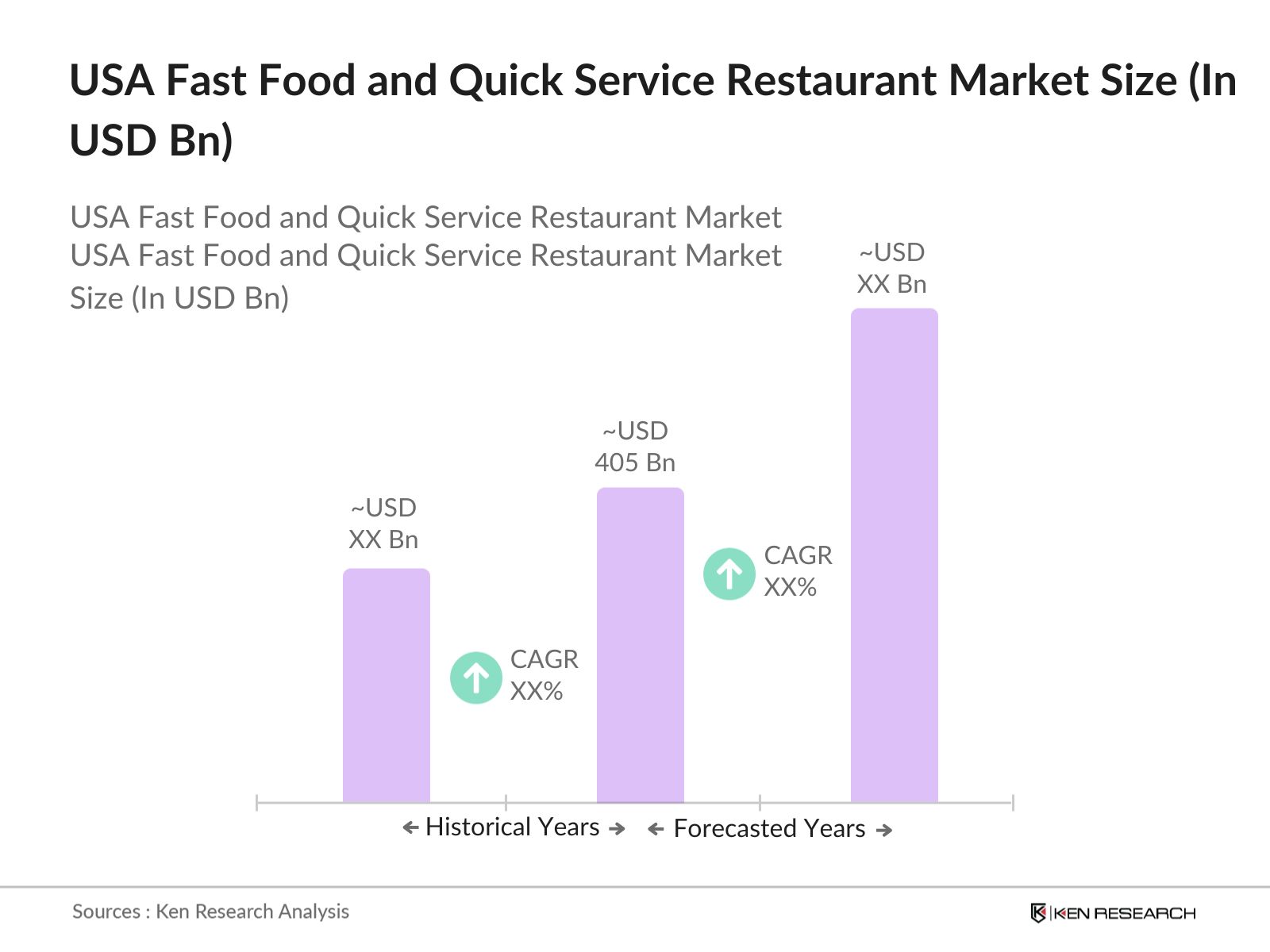

- The USA Fast Food and Quick Service Restaurant market is valued at USD 405 billion, based on a five-year historical analysis. This market size is driven by a strong demand for convenience and affordability among consumers, which is bolstered by the increasing urbanization and the fast-paced lifestyle prevalent across the United States. The market's expansion is fueled by innovations in digital technology, such as mobile ordering apps and delivery services, and the consumer shift towards on-the-go dining options, particularly among working professionals.

- Dominant regions in this market include California, Texas, and New York, which are characterized by their high population density and vibrant urban centers. These regions are home to major metropolitan areas with a large concentration of working professionals who demand quick, convenient, and affordable meal options. Moreover, these states have a strong presence of both global fast food chains and local brands, further supporting their dominance in the market.

- The U.S. Food and Drug Administration (FDA) enforces strict food safety regulations to ensure public health in the QSR industry. The FDAs Food Safety Modernization Act (FSMA) of 2011 remains the cornerstone of food safety, requiring QSRs to implement preventive controls and hazard analysis processes. In 2023, the FDA conducted over 21,000 inspections, ensuring compliance with regulations aimed at reducing foodborne illnesses. This regulatory framework mandates that QSR operators adhere to stringent guidelines on food storage, preparation, and handling, significantly impacting operational procedures and costs.

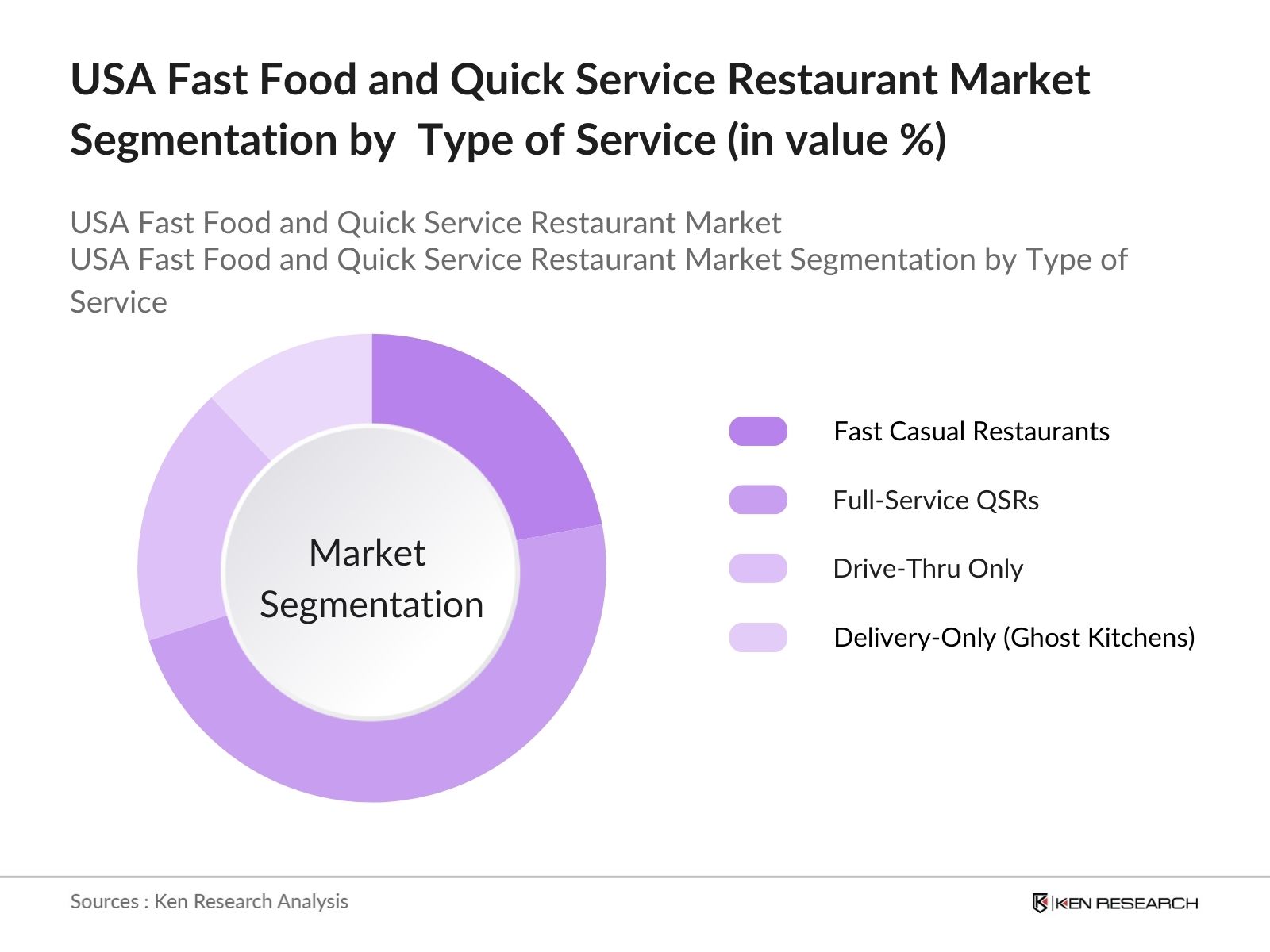

USA Fast Food and Quick Service Restaurant Market Segmentation

- By Type of Service: The USA Fast Food and Quick Service Restaurant market is segmented by type of service into fast casual restaurants, full-service QSRs, drive-thru only, and delivery-only (ghost kitchens). Full-service QSRs currently dominate the market due to their ability to offer a consistent experience with established brand loyalty, particularly among chains like McDonalds, Taco Bell, and Subway. Their streamlined operations, extensive menu options, and ability to cater to diverse consumer preferences allow these chains to thrive. The rise of digital platforms has also enhanced the consumer experience, making full-service QSRs highly competitive.

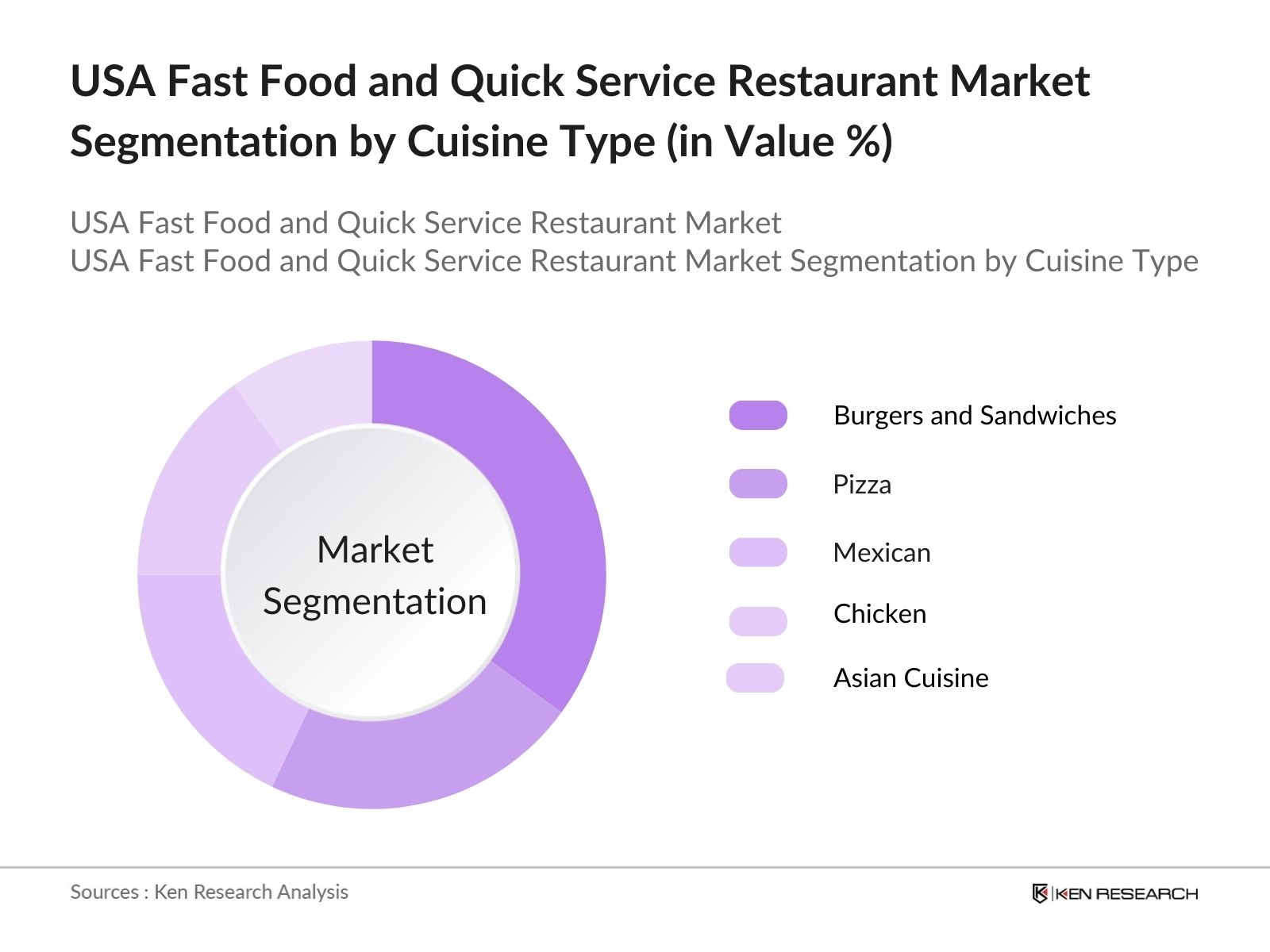

- By Cuisine Type: The market is further segmented by cuisine type into burgers and sandwiches, pizza, Mexican, chicken, and Asian cuisine. The burgers and sandwiches segment holds the largest share due to the historical prominence of American brands like McDonalds and Burger King. The ingrained habit of consuming burgers and sandwiches as staple fast-food items in the United States, along with continuous menu innovation (e.g., plant-based options), ensures this segment's continued dominance.

USA Fast Food and Quick Service Restaurant Market Competitive Landscape

The USA Fast Food and Quick Service Restaurant market is dominated by several key players, with McDonalds, Starbucks, and Subway leading the pack. The market consolidation is marked by strong global brands that have established dominance through wide-reaching franchise networks, technological adoption (e.g., digital loyalty programs), and consistent innovation in menu offerings.

|

Company Name |

Year Established |

Headquarters |

Number of Locations |

Revenue (2023) |

Franchise Ratio |

Technological Adoption |

Average Ticket Size |

Brand Loyalty Score |

Market Segment Dominance |

|

McDonalds |

1940 |

Chicago, IL |

- |

- |

- |

- |

- |

- |

- |

|

Starbucks |

1971 |

Seattle, WA |

- |

- |

- |

- |

- |

- |

- |

|

Subway |

1965 |

Milford, CT |

- |

- |

- |

- |

- |

- |

- |

|

Taco Bell |

1962 |

Irvine, CA |

- |

- |

- |

- |

- |

- |

- |

|

Chick-fil-A |

1946 |

Atlanta, GA |

- |

- |

- |

- |

- |

- |

- |

USA Fast Food and Quick Service Restaurant Market Analysis

USA Fast Food and Quick Service Restaurant Market Growth Drivers

- Consumer Demand for Convenience and Speed: In the U.S., rising workforce participation is a key driver for the fast food and quick service restaurant (QSR) market. The U.S. labour force consists of around 166 million people, according to the U.S. Bureau of Labor Statistics (BLS), with over 80% of employees working full-time. This creates significant demand for convenient, fast meals. Consumers seek quicker meal solutions due to time constraints, and with more than 124 million households, busy lifestyles foster consistent reliance on QSRs for meals. Growth in e-commerce, accounting for over $900 billion annually in the U.S., has also fueled online food delivery, which further supports demand for speed and convenience.

- Increasing Urbanization and Workforce Participation: The U.S. is over 83% urbanized, with cities like New York, Los Angeles, and Chicago leading with populations exceeding 8 million, 4 million, and 2 million, respectively, according to U.S. Census Bureau data. Increased urbanization facilitates more opportunities for QSRs to thrive, as dense populations require quick meal options. Additionally, 58% of the population aged 16 and over is actively participating in the labour force, leading to greater demand for fast meals during work hours. This urban expansion and workforce growth create an ideal environment for QSR market expansion in major cities across the country.

- Menu Customization and Healthy Offerings: In response to shifting consumer preferences, U.S. QSRs are increasingly offering customizable and health-conscious menu items. The U.S. Department of Agriculture (USDA) estimates that 70% of Americans prioritize healthier options, leading QSRs to adapt by including more plant-based, organic, and low-calorie meals. Major chains have integrated these trends, providing options that cater to gluten-free, vegan, and keto diets. Additionally, customization allows consumers to build meals based on dietary preferences, contributing to the expansion of QSRs appeal to health-conscious diners.

USA Fast Food and Quick Service Restaurant Market Challenges

- Rising Operational Costs: Operational costs in the U.S. QSR industry have surged due to increasing labor costs and food prices. The federal minimum wage remains at $7.25 per hour, but many states, such as California and New York, have minimum wages at $15 per hour. According to the BLS, labor costs now constitute 30-35% of QSRs' total expenditures. In addition, the USDA reports that food prices increased by 7% in 2023 due to inflationary pressures, with key ingredients such as meat, dairy, and grains becoming more expensive. These factors continue to squeeze profit margins for QSR operators across the country.

- Health and Wellness Concerns: The increasing prevalence of obesity and chronic diseases has heightened health concerns related to fast food consumption. According to the Centers for Disease Control and Prevention (CDC), over 40% of American adults are obese, and diet-related conditions such as diabetes affect approximately 37 million people in the U.S. These statistics underscore the negative perceptions surrounding fast food, leading to greater scrutiny of the industry. Health-conscious consumers are increasingly turning away from traditional fast food and seeking healthier alternatives, posing a challenge for QSRs relying on classic, calorie-dense menu items.

USA Fast Food and Quick Service Restaurant Market Future Outlook

Over the next five years, the USA Fast Food and Quick Service Restaurant market is expected to witness steady growth. Factors driving this expansion include continued advancements in digital ordering systems, the adoption of sustainable practices (such as eco-friendly packaging), and increased demand for healthier menu options, particularly plant-based and alternative protein offerings. Additionally, the expansion of delivery-only and ghost kitchen models is anticipated to reshape the landscape, catering to the evolving preferences of convenience-focused consumers.

USA Fast Food and Quick Service Restaurant Market Opportunities

- Expansion of Drive-Thru and Curbside Pickup Models: The expansion of drive-thru and curbside pickup models presents significant growth opportunities for QSRs in the U.S. According to the NRA, drive-thru sales account for more than 70% of total sales for major QSR chains like McDonald's and Chick-fil-A. The rise of curbside pickup, a $200 billion industry in 2024, has also seen increased adoption as consumers seek minimal-contact meal options. This trend, accelerated by the COVID-19 pandemic, continues to drive investment in mobile ordering technology and real estate development focused on efficient drive-thru designs.

- Growth of Plant-Based and Alternative Protein Options: The U.S. plant-based food market reached $8 billion in 2023, driven by a surge in consumer demand for meat alternatives. The USDA reports that over 30% of American consumers actively seek out plant-based options, with QSR chains like Burger King and KFC leading the way with products like the Impossible Whopper and Beyond Fried Chicken. As concerns over sustainability and animal welfare grow, QSRs are increasingly incorporating alternative proteins into their menus. This shift represents a major opportunity for brands to cater to a broader demographic, including vegetarians, vegans, and flexitarians.

Scope of the Report

|

By Type of Service |

Fast Casual Restaurants Full-Service QSRs Drive-Thru Only Delivery-Only (Ghost Kitchens) |

|

By Cuisine Type |

Burgers and Sandwiches Pizza Mexican Chicken Asian Cuisine |

|

By Distribution Channel |

Online Delivery Takeaway Dine-In Drive-Thru |

|

By Region |

North-East South Midwest West |

|

By Customer Demographics |

Millennials Gen Z Families Working Professionals |

Products

Key Target Audience

Fast Food Franchise Owners

Restaurant Operators

Food and Beverage Suppliers

Technology Providers (POS Systems, Delivery Platforms)

Investor and Venture Capitalist Firms

Banks and Financial Institutions

Government and Regulatory Bodies (FDA, USDA)

Sustainability and Environmental Groups

Food Packaging Manufacturers

Companies

USA Fast Food and Quick Service Restaurant Market Major Players

McDonalds

Starbucks

Subway

Taco Bell

Chick-fil-A

Burger King

KFC

Wendys

Dominos Pizza

Dunkin

Pizza Hut

Chipotle Mexican Grill

Panera Bread

Sonic Drive-In

Popeyes

Table of Contents

1. USA Fast Food and Quick Service Restaurant Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. USA Fast Food and Quick Service Restaurant Market Size (In USD Bn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. USA Fast Food and Quick Service Restaurant Market Analysis

3.1. Growth Drivers

3.1.1. Consumer Demand for Convenience and Speed

3.1.2. Increasing Urbanization and Workforce Participation

3.1.3. Technological Integration (Online Ordering, Delivery Apps)

3.1.4. Menu Customization and Healthy Offerings

3.2. Market Challenges

3.2.1. Rising Operational Costs (Labor, Ingredients)

3.2.2. Health and Wellness Concerns

3.2.3. Intense Competition and Price Wars

3.2.4. Regulatory Compliance and Labor Laws

3.3. Opportunities

3.3.1. Expansion of Drive-Thru and Curbside Pickup Models

3.3.2. Growth of Plant-Based and Alternative Protein Options

3.3.3. Global Franchise Expansion

3.3.4. Digital Loyalty Programs and Personalization

3.4. Trends

3.4.1. Rise of Ghost Kitchens and Delivery-Only Restaurants

3.4.2. Emphasis on Sustainability (Eco-Friendly Packaging)

3.4.3. Influence of social media on Menu Innovation

3.4.4. Integration of Artificial Intelligence in Customer Service

3.5. Government Regulations

3.5.1. FDA Food Safety Standards

3.5.2. Nutritional Labelling Requirements

3.5.3. Wage and Labor Regulations

3.5.4. Franchise Laws and Compliance

3.6. SWOT Analysis

3.7. Stake Ecosystem (Suppliers, Distributors, Franchisors, and Franchisees)

3.8. Porters Five Forces Analysis

3.9. Competition Ecosystem

4. USA Fast Food and Quick Service Restaurant Market Segmentation

4.1. By Type of Service (In Value %)

4.1.1. Fast Casual Restaurants

4.1.2. Full-Service QSRs

4.1.3. Drive-Thru Only

4.1.4. Delivery-Only (Ghost Kitchens)

4.2. By Cuisine Type (In Value %)

4.2.1. Burgers and Sandwiches

4.2.2. Pizza

4.2.3. Mexican

4.2.4. Chicken

4.2.5. Asian Cuisine

4.3. By Distribution Channel (In Value %)

4.3.1. Online Delivery

4.3.2. Takeaway

4.3.3. Dine-In

4.3.4. Drive-Thru

4.4. By Region (In Value %)

4.4.1. North-East

4.4.2. South

4.4.3. Midwest

4.4.4. West

4.5. By Customer Demographics (In Value %)

4.5.1. Millennials

4.5.2. Gen Z

4.5.3. Families

4.5.4. Working Professionals

5. USA Fast Food and Quick Service Restaurant Market Competitive Analysis

5.1 Detailed Profiles of Major Companies

5.1.1. McDonalds

5.1.2. Starbucks

5.1.3. Subway

5.1.4. Taco Bell

5.1.5. Chick-fil-A

5.1.6. KFC

5.1.7. Burger King

5.1.8. Wendys

5.1.9. Dominos Pizza

5.1.10. Dunkin

5.1.11. Pizza Hut

5.1.12. Chipotle Mexican Grill

5.1.13. Panera Bread

5.1.14. Sonic Drive-In

5.1.15. Popeyes

5.2 Cross Comparison Parameters (Revenue, No. of Locations, Franchise/Owned Ratio, Drive-Thru Penetration, Average Ticket Size, Brand Loyalty, Technological Adoption, Marketing Spend)

5.3 Market Share Analysis

5.4 Strategic Initiatives

5.5 Mergers And Acquisitions

5.6 Investment Analysis

5.7 Government Grants and Support Programs

5.8 Private Equity and Franchise Funding

6. USA Fast Food and Quick Service Restaurant Market Regulatory Framework

6.1. Health and Safety Regulations

6.2. Labor Laws and Employment Compliance

6.3. Franchise Operations Compliance

6.4. Food Labelling and Nutritional Disclosure Standards

7. USA Fast Food and Quick Service Restaurant Future Market Size (In USD Bn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. USA Fast Food and Quick Service Restaurant Future Market Segmentation

8.1. By Type of Service (In Value %)

8.2. By Cuisine Type (In Value %)

8.3. By Distribution Channel (In Value %)

8.4. By Region (In Value %)

8.5. By Customer Demographics (In Value %)

9. USA Fast Food and Quick Service Restaurant Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

Research Methodology

Step 1: Identification of Key Variables

The research began by identifying key factors influencing the USA Fast Food and Quick Service Restaurant market. Extensive desk research and analysis of proprietary and publicly available databases were employed to map out the competitive ecosystem and major market players. Critical variables such as consumer demand trends, technological adoption, and regulatory developments were identified as key drivers.

Step 2: Market Analysis and Construction

In this phase, historical data related to revenue generation, consumer behavior, and market penetration were analyzed to construct a reliable market model. Special attention was given to the role of digital ordering systems and their impact on the overall market dynamics. Comparative analyses were also conducted to assess the performance of various service types and cuisine segments.

Step 3: Hypothesis Validation and Expert Consultation

To validate the market hypotheses, interviews were conducted with industry experts from leading fast food and QSR chains. Their insights on operational challenges, customer preferences, and future growth opportunities were crucial in refining the market model. These consultations provided both qualitative and quantitative insights into the market.

Step 4: Research Synthesis and Final Output

The final stage involved synthesizing the data collected from primary and secondary research sources. A bottom-up approach was used to ensure the accuracy of the market size estimates, which were further cross-verified with data from financial reports of key companies. The end result is a comprehensive and validated analysis of the USA Fast Food and Quick Service Restaurant market.

Frequently Asked Questions

01. How big is the USA Fast Food and Quick Service Restaurant Market?

The USA Fast Food and Quick Service Restaurant market is valued at USD 405 billion, driven by the increasing consumer demand for convenience and affordable dining options.

02. What are the challenges in the USA Fast Food and Quick Service Restaurant Market?

Challenges in the USA Fast Food and Quick Service Restaurant market include rising operational costs, health and wellness concerns among consumers, and increasing competition from delivery-only and ghost kitchen models.

03. Who are the major players in the USA Fast Food and Quick Service Restaurant Market?

Major players in the USA Fast Food and Quick Service Restaurant market include McDonalds, Starbucks, Subway, Taco Bell, and Chick-fil-A. These companies lead the market due to their extensive networks, brand recognition, and innovation in service delivery.

04. What are the growth drivers of the USA Fast Food and Quick Service Restaurant Market?

The USA Fast Food and Quick Service Restaurant market is driven by factors such as increasing urbanization, technological advancements in mobile ordering and delivery services, and evolving consumer preferences towards fast, convenient meal options.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.