USA Fast Food Market Outlook to 2030

Region:North America

Author(s):Sanjeev

Product Code:KROD3928

December 2024

96

About the Report

USA Fast Food Market Overview

- The USA fast food market is valued at USD 212 billion, driven by consumer demand for convenience and the rise of digital ordering platforms. This growth is supported by an increasing number of dual-income households, along with the popularity of quick-service restaurants (QSRs). Over the past five years, the market has seen robust performance, reflecting the continued preference for affordable, convenient dining options in urban and suburban settings. The rise of food delivery apps such as DoorDash and UberEats has also played a pivotal role in propelling growtssh.

- The USA fast food market is dominated by major metropolitan areas, particularly cities like New York, Los Angeles, and Chicago. These cities have high population densities, significant disposable income, and strong tourist inflows, creating a substantial demand for quick, affordable dining options. Furthermore, states such as California, Texas, and Florida have become hubs for fast food chains due to their large, diverse populations and strong infrastructure for food delivery services.

- In 2023, the U.S. Food and Drug Administration (FDA) strengthened its regulations on nutritional labeling for fast food chains, mandating clearer calorie counts on menus. These regulations require all chains with more than 20 locations to display calorie information for standard menu items, aiming to promote healthier eating habits among consumers. The FDA also introduced new guidelines to limit sodium and trans-fat content in food offerings, affecting recipe formulations across the industry. This initiative is part of the FDAs broader public health strategy to combat obesity and other diet-related diseases.

USA Fast Food Market Segmentation

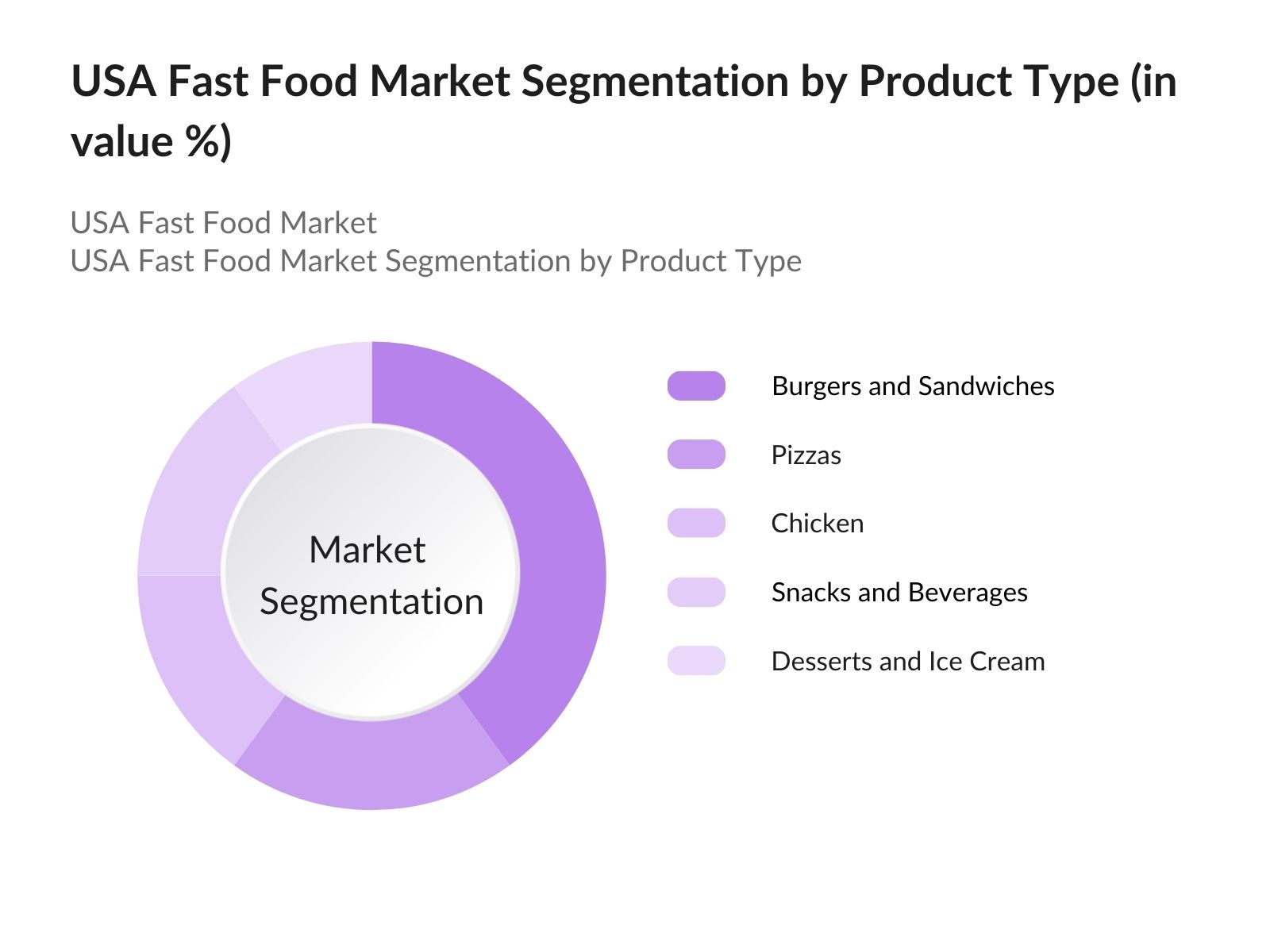

By Product Type: The market is segmented by product type into burgers and sandwiches, pizzas, chicken, snacks and beverages, and desserts and ice cream. Among these, burgers and sandwiches dominate the market due to the longstanding cultural affinity towards burger chains like McDonald's, Wendys, and Burger King. Their extensive menu options, convenience, and continuous innovation through plant-based and healthier menu choices have maintained their popularity. Additionally, the increasing trend of premium burgers from brands like Shake Shack has sustained their market position.

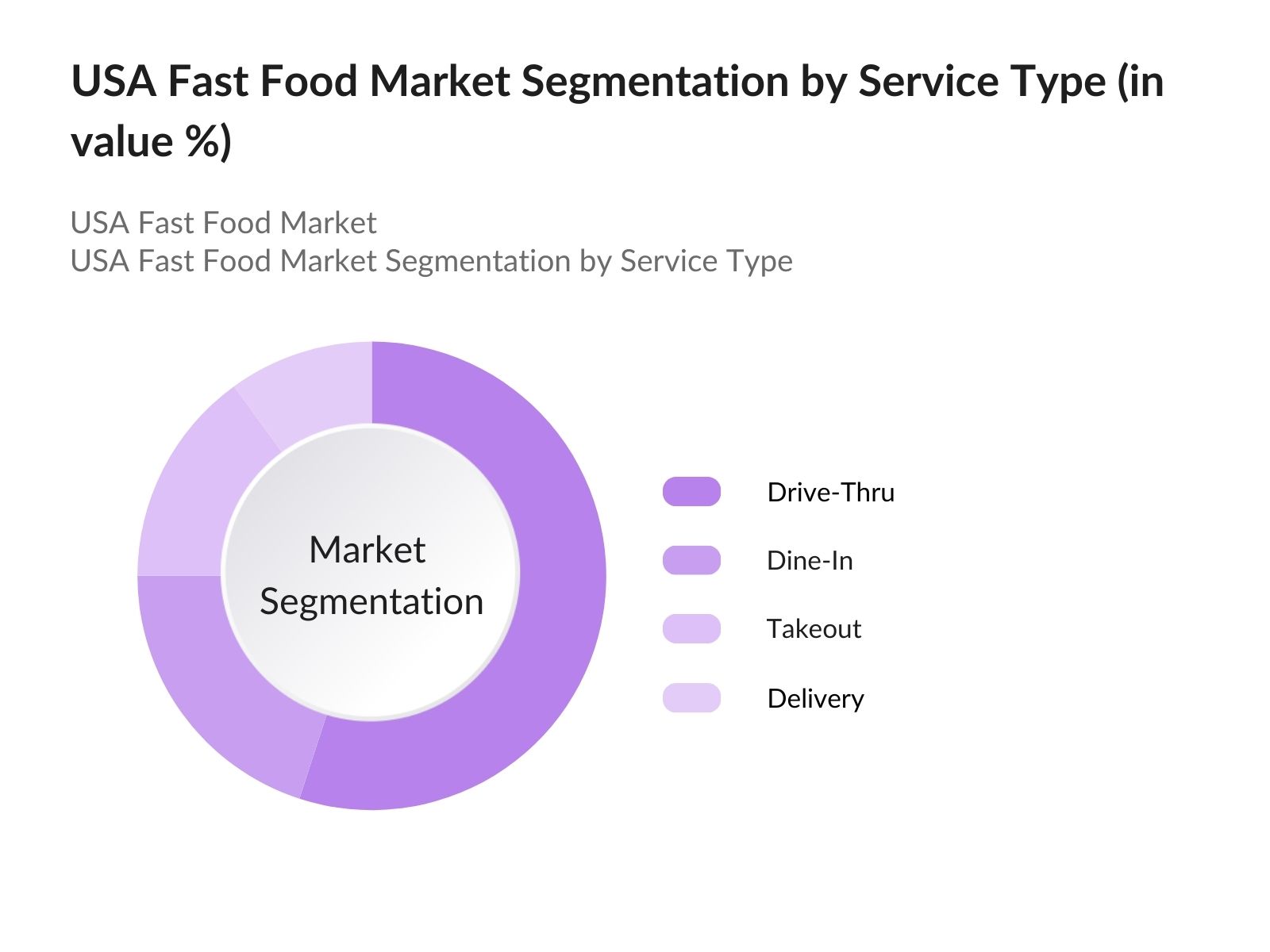

By Service Type: The market is also segmented by service type into drive-thru, dine-in, takeout, and delivery. The drive-thru service dominates the market, capturing a significant share due to its convenience and efficiency. This is particularly prevalent in suburban and rural areas where customers prefer quick meals without leaving their vehicles. The pandemic has further accelerated the drive-thru model, making it the go-to option for many consumers wary of in-store dining.

USA Fast Food Market Competitive Landscape

The USA fast food market is highly competitive and dominated by several key players, many of which are multinational corporations. These companies continue to innovate with new menu offerings and service delivery mechanisms such as mobile apps, loyalty programs, and sustainability initiatives. The market has also seen increased investment in technology, with brands focusing on AI-powered ordering systems, digital kiosks, and automated kitchens to streamline operations.

|

Company Name |

Establishment Year |

Headquarters |

No. of Employees |

Revenue |

Franchise Model |

Global Reach |

Key Innovation |

No. of Outlets |

Sustainability Initiatives |

|

McDonald's Corporation |

1940 |

Chicago, Illinois |

|||||||

|

Yum! Brands (KFC, Pizza Hut) |

1997 |

Louisville, Kentucky |

|||||||

|

Restaurant Brands International (Burger King, Popeyes) |

2014 |

Toronto, Canada |

|||||||

|

Starbucks Corporation |

1971 |

Seattle, Washington |

|||||||

|

Chipotle Mexican Grill |

1993 |

Newport Beach, California |

USA Fast Food Industry Analysis

Growth Drivers

- Changing Consumer Preferences: The increased demand for convenience food is a significant growth driver in the U.S. fast food market. In 2023, the Bureau of Labor Statistics (BLS) noted that over 70 million Americans relied on quick-service meals weekly, driven by fast-paced lifestyles and urbanization. Economic data shows that 57% of U.S. households are dual income, which pushes demand for convenient food options. Additionally, urbanization in the U.S. grew by about 0.7% annually from 2022 to 2024, leading to higher consumption of fast food in metropolitan areas. These factors, coupled with increasing time constraints, drive demand for fast food across demographics.

- Expansion of Quick-Service Restaurant Chains: Quick-service restaurant (QSR) chains continue expanding across the U.S. with major brands like McDonalds, Wendys, and Taco Bell opening over 2,200 new locations in 2023 alone. The economic strength of QSR chains stems from streamlined operations and economies of scale, which have reduced operating costs by 12% since 2022. In 2024, the industry employed over 4 million workers, supported by the demand for convenient, affordable meals. Data from the U.S. Census Bureau confirms that QSRs are increasingly penetrating suburban and rural markets, enhancing their geographic reach and driving growth.

- Increased Focus on Digital and Delivery Platforms: The fast-food market saw a significant boost in digital platforms and delivery services, growing by over 20 million users from 2022 to 2024, according to the BLS. Food delivery services generated $26 billion in 2023, driven by companies like Uber Eats and DoorDash, which capitalized on the 90% smartphone penetration rate in the U.S. As e-commerce boomed, online food ordering became a key growth pillar for QSRs. The Federal Reserve Bank reported that digital transactions for food services grew by 18% in the first half of 2024 alone, supporting rapid growth in delivery-focused fast-food operations.

Market Challenges

- Rising Health Consciousness: With over 60% of Americans seeking healthier food options, the fast-food industry faces significant pressure to adapt. The USDA reported that consumption of fruits and vegetables increased by 8% from 2022 to 2024, signaling a shift towards healthier eating. This trend has challenged fast food chains to diversify their offerings, as more consumers scrutinize the nutritional value of their meals. Chains such as McDonalds and Subway have introduced healthier menu options to keep pace with this trend, though the challenge remains in balancing taste, cost, and health.

- Regulatory Challenges: FDA regulations concerning nutritional labeling and content requirements are a growing challenge for the fast-food industry. New laws enacted in 2023 mandate stricter calorie disclosures on menus, affecting operational costs and compliance. Additionally, the FDA's regulations on sodium and trans fats have forced chains to reformulate recipes, resulting in supply chain adjustments. The cost of compliance has increased by an estimated $1.2 billion across the industry in 2023 alone, according to FDA reports. These regulatory shifts add operational complexities and cost pressures for fast food businesses.

USA Fast Food Market Future Outlook

Over the next five years, the USA fast food market is expected to see moderate growth, driven by continuous demand for convenience, enhanced digital experiences, and innovations in sustainable and plant-based food offerings. Brands are expected to focus on enhancing their sustainability efforts, with a strong emphasis on reducing carbon footprints and using eco-friendly packaging. Additionally, the adoption of automation and AI to streamline operations, particularly in high-volume outlets, will also be a significant driver of future market expansion.

Future Market Opportunities

- Expansion into Plant-Based and Health-Conscious Offerings: The plant-based food sector presents a growing opportunity for fast food brands. According to the USDA, the consumption of plant-based foods increased by 7% between 2022 and 2024. Fast food chains are increasingly incorporating vegan and vegetarian options to cater to this demand. In 2023, Burger King reported that its plant-based Whopper accounted for 10% of total sales in urban areas, reflecting the shift towards health-conscious eating. As more consumers prioritize sustainable diets, chains offering plant-based alternatives are well-positioned for growth.

- Integration of AI and Automation in Operations: The integration of AI and automation has become a major growth driver for operational efficiency in the fast-food industry. By 2023, more than 2,000 U.S. fast food outlets employed AI-powered kiosks and drive-thrus, significantly reducing customer wait times and labor costs. The BLS reported that businesses deploying automation experienced a 15% increase in throughput. Automation not only cuts labor costs but also improves service accuracy, making it an attractive investment for fast food chains looking to offset labor shortages and wage inflation.

Scope of the Report

|

By Product Type |

Burgers and Sandwiches Pizzas Chicken Snacks and Beverages Desserts and Ice Cream |

|

By Service Type |

Drive-Thru Dine-In Takeout Delivery |

|

By Distribution Channel |

Quick Service Restaurants (QSRs) Food Trucks Online Food Delivery Platforms Fast Casual |

|

By Ingredient Type |

Plant-Based Animal-Based Organic |

|

By Region |

North East West South |

Products

Key Target Audience

Quick Service Restaurant (QSR) Operators

Food & Beverage Manufacturers

Investment and Venture Capitalist Firms

Government and Regulatory Bodies (FDA, USDA)

Technology Providers for Fast Food Industry

Restaurant Supply Chain Managers

Banks and Financial Institutes

Franchise Owners and Operators

Food Delivery Platforms

Companies

USA Fast Food Market Major Players

McDonald's Corporation

Yum! Brands (Taco Bell, Pizza Hut, KFC)

Restaurant Brands International (Burger King, Popeyes)

Chipotle Mexican Grill

Dominos Pizza, Inc.

Subway

Wendys

Dunkin' Brands Group

Starbucks Corporation

Chick-fil-A

Panera Bread

Sonic Drive-In

Jack in the Box

Five Guys

Arbys

Table of Contents

1. USA Fast Food Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. USA Fast Food Market Size (In USD Bn)

2.1. Historical Market Size

2.2. Year-on-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. USA Fast Food Market Analysis

3.1. Growth Drivers

3.1.1. Changing Consumer Preferences (e.g., increased demand for convenience food)

3.1.2. Expansion of Quick-Service Restaurant Chains

3.1.3. Increased Focus on Digital and Delivery Platforms

3.1.4. Competitive Pricing Strategies

3.2. Market Challenges

3.2.1. Rising Health Consciousness (shift towards healthy eating habits)

3.2.2. Regulatory Challenges (FDA regulations on nutritional content)

3.2.3. Labor Shortages and Wage Inflation (increased labor costs)

3.2.4. Environmental Concerns (sustainability and packaging)

3.3. Opportunities

3.3.1. Expansion into Plant-Based and Health-Conscious Offerings

3.3.2. Integration of AI and Automation in Operations

3.3.3. Growth of Delivery-Only (Ghost) Kitchens

3.3.4. International Market Expansion for US Brands

3.4. Trends

3.4.1. Rise of Plant-Based Alternatives (vegan fast food)

3.4.2. Mobile App and Online Ordering Adoption

3.4.3. Sustainability Initiatives (eco-friendly packaging, sourcing)

3.4.4. Customization and Personalized Menu Options

3.5. Government Regulations

3.5.1. Nutritional Labeling Standards (FDA calorie count regulations)

3.5.2. Minimum Wage Legislation Impact

3.5.3. Health and Safety Compliance (OSHA, FDA)

3.5.4. Green and Sustainability Policies (plastic reduction mandates)

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem

3.8. Porters Five Forces

3.9. Competition Ecosystem

4. USA Fast Food Market Segmentation

4.1. By Product Type (In Value %)

4.1.1. Burgers and Sandwiches

4.1.2. Pizzas

4.1.3. Chicken

4.1.4. Snacks and Beverages

4.1.5. Desserts and Ice Cream

4.2. By Service Type (In Value %)

4.2.1. Drive-Thru

4.2.2. Dine-In

4.2.3. Takeout

4.2.4. Delivery

4.3. By Distribution Channel (In Value %)

4.3.1. Quick Service Restaurants (QSRs)

4.3.2. Food Trucks

4.3.3. Online Food Delivery Platforms

4.3.4. Fast Casual

4.4. By Ingredient Type (In Value %)

4.4.1. Plant-Based

4.4.2. Animal-Based

4.4.3. Organic

4.5. By Region (In Value %)

4.5.1. North

4.5.2. East

4.5.3. South

4.5.4. West

5. USA Fast Food Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. McDonalds Corporation

5.1.2. Yum! Brands (Taco Bell, Pizza Hut, KFC)

5.1.3. Restaurant Brands International (Burger King, Popeyes)

5.1.4. Chipotle Mexican Grill

5.1.5. Dominos Pizza, Inc.

5.1.6. Subway

5.1.7. Wendys

5.1.8. Dunkin' Brands Group

5.1.9. Starbucks Corporation

5.1.10. Chick-fil-A

5.1.11. Panera Bread

5.1.12. Sonic Drive-In

5.1.13. Jack in the Box

5.1.14. Five Guys

5.1.15. Arbys

5.2. Cross Comparison Parameters (No. of Employees, Headquarters, Inception Year, Revenue, Franchise Model, Menu Customization, Global Reach, Tech Innovation)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Venture Capital Funding

5.8. Government Grants

5.9. Private Equity Investments

6. USA Fast Food Market Regulatory Framework

6.1. Food Safety Regulations (FDA)

6.2. Labor Laws and Compliance (Fair Labor Standards Act)

6.3. Environmental Regulations

6.4. Nutritional Standards Compliance

7. USA Fast Food Future Market Size (In USD Bn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. USA Fast Food Future Market Segmentation

8.1. By Product Type (In Value %)

8.2. By Service Type (In Value %)

8.3. By Distribution Channel (In Value %)

8.4. By Ingredient Type (In Value %)

8.5. By Region (In Value %)

9. USA Fast Food Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

DisclaimerContact Us

Research Methodology

Step 1: Identification of Key Variables:

The initial step involved mapping the entire ecosystem of the USA Fast Food Market, including major stakeholders such as fast-food chains, franchise owners, and supply chain entities. Data was gathered from reputable databases and sources to identify variables influencing market growth, such as consumer preferences, technological advancements, and labor costs.

Step 2: Market Analysis and Construction

In this phase, historical market data from multiple fast-food chains was analyzed, including financial performance, market penetration, and service preferences. Revenue generation patterns were analyzed to understand consumer spending behavior and its impact on the market.

Step 3: Hypothesis Validation and Expert Consultation:

Key market assumptions were validated through direct consultations with industry experts, including fast food franchise operators and delivery platform executives. These interviews provided first-hand insights into operational challenges and opportunities, which informed the final report.

Step 4: Research Synthesis and Final Output:

Engagement with fast food brands was conducted to acquire detailed insights into product segments, service models, and customer behavior. The data gathered was validated through a bottom-up approach, ensuring the accuracy and reliability of market projections and trends.

Frequently Asked Questions

How big is the USA Fast Food Market?

The USA fast food market is valued at USD 212 billion, driven by the increasing popularity of digital ordering, delivery services, and consumer demand for quick, affordable meals.

What are the challenges in the USA Fast Food Market?

Challenges in the USA fast food market include rising health consciousness among consumers, labor shortages, regulatory pressure from FDA nutritional guidelines, and environmental concerns surrounding packaging waste.

Who are the major players in the USA Fast Food Market?

Key players in the USA fast food market include McDonald's, Yum! Brands, Restaurant Brands International (Burger King, Popeyes), Chipotle Mexican Grill, and Starbucks Corporation, dominating due to extensive distribution networks and continuous innovation in service and product offerings.

What are thae growth drivers of the USA Fast Food Market?

Growth drivers in the USA fast food market include consumer demand for convenience, the rise of digital ordering platforms, menu innovation (particularly plant-based options), and robust franchise models that ensure scalability.

Which service type is dominating the USA Fast Food Market?

The drive-thru service type dominates the USA fast food market, as it offers unmatched convenience and efficiency, especially in suburban and rural regions, supported by the acceleration of contactless services during the pandemic.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.