USA Fast Food Restaurants Market Outlook to 2030

Region:North America

Author(s):Sanjna

Product Code:KROD6992

December 2024

85

About the Report

USA Fast Food Restaurants Market Overview

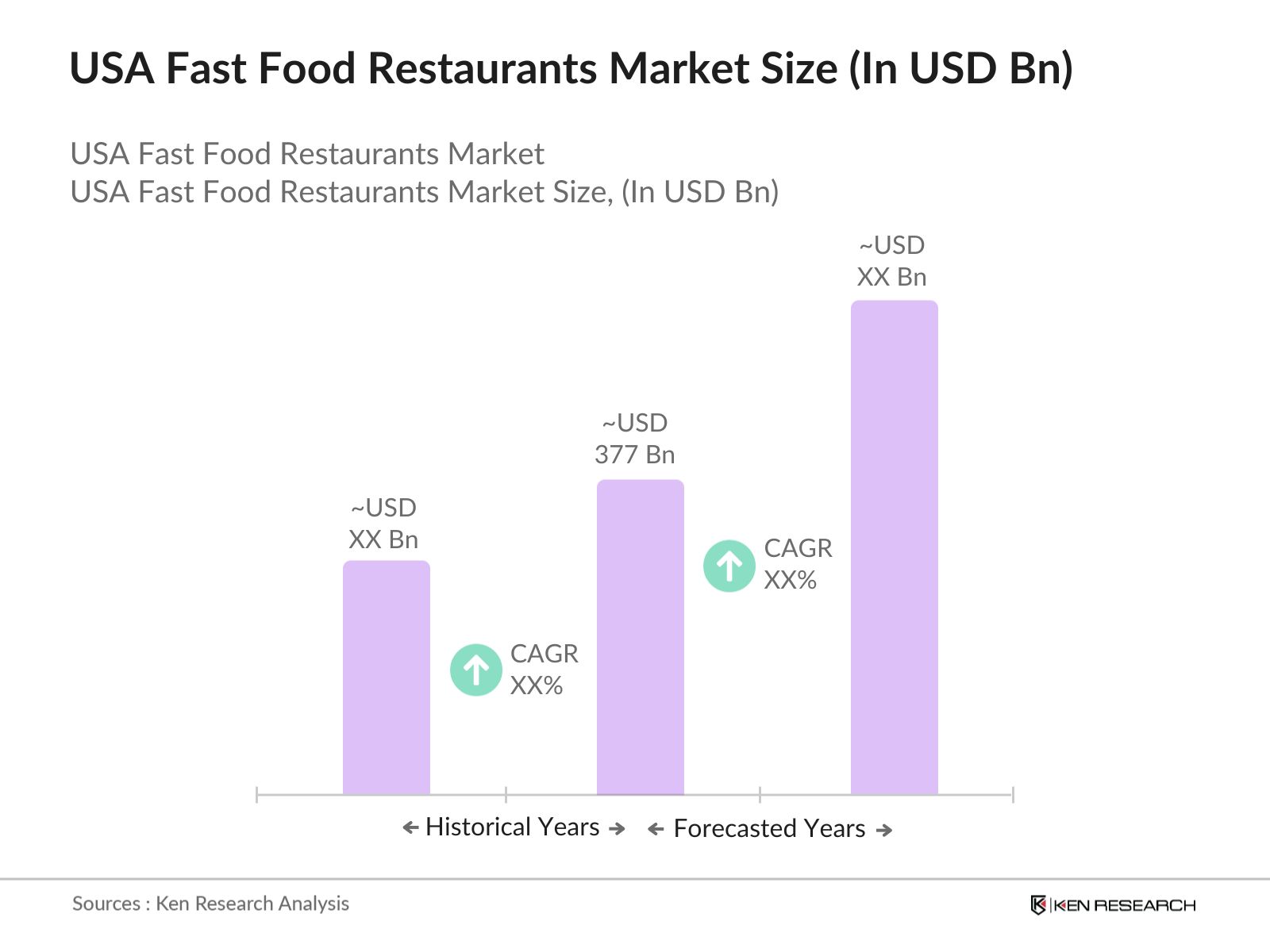

- The USA Fast Food Restaurants market is valued at USD 377 billion based on a five-year historical analysis. This industry is primarily driven by increasing urbanization, the growing demand for convenience foods, and the expansion of delivery services. As consumers continue to seek quick, affordable meal options, major fast-food chains have capitalized on this trend by introducing digital ordering platforms and integrating advanced technologies for streamlined operations, ultimately enhancing market growth.

- Major cities such as New York, Los Angeles, and Chicago dominate the USA Fast Food Restaurants market. These cities are home to large urban populations with a fast-paced lifestyle, which increases the demand for convenient and quick dining options. Furthermore, the dense concentration of fast-food chains, combined with advanced infrastructure and a tech-savvy consumer base, has contributed to the dominance of these cities within the market.

- The FDA's mandate for nutritional labeling on fast-food menus has become a critical aspect of transparency initiatives. As of 2022, fast-food restaurants with 20 or more locations are required to disclose calorie counts on their menus. This requirement, aimed at curbing obesity rates, has pushed fast-food operators to reformulate recipes and offer lower-calorie options. Compliance with these labeling regulations is crucial, as failure to meet FDA standards can lead to fines and damage to the brand's reputation.

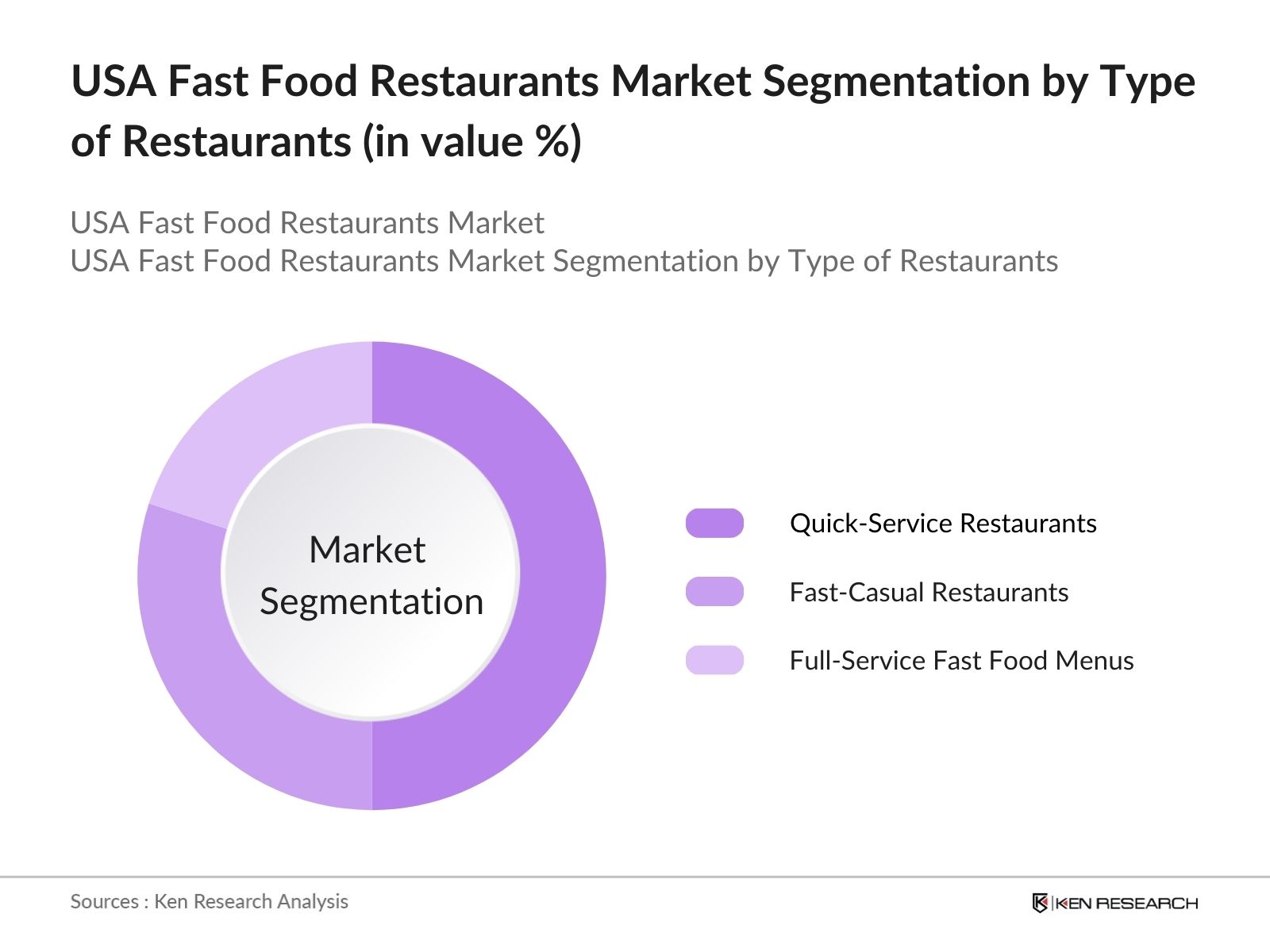

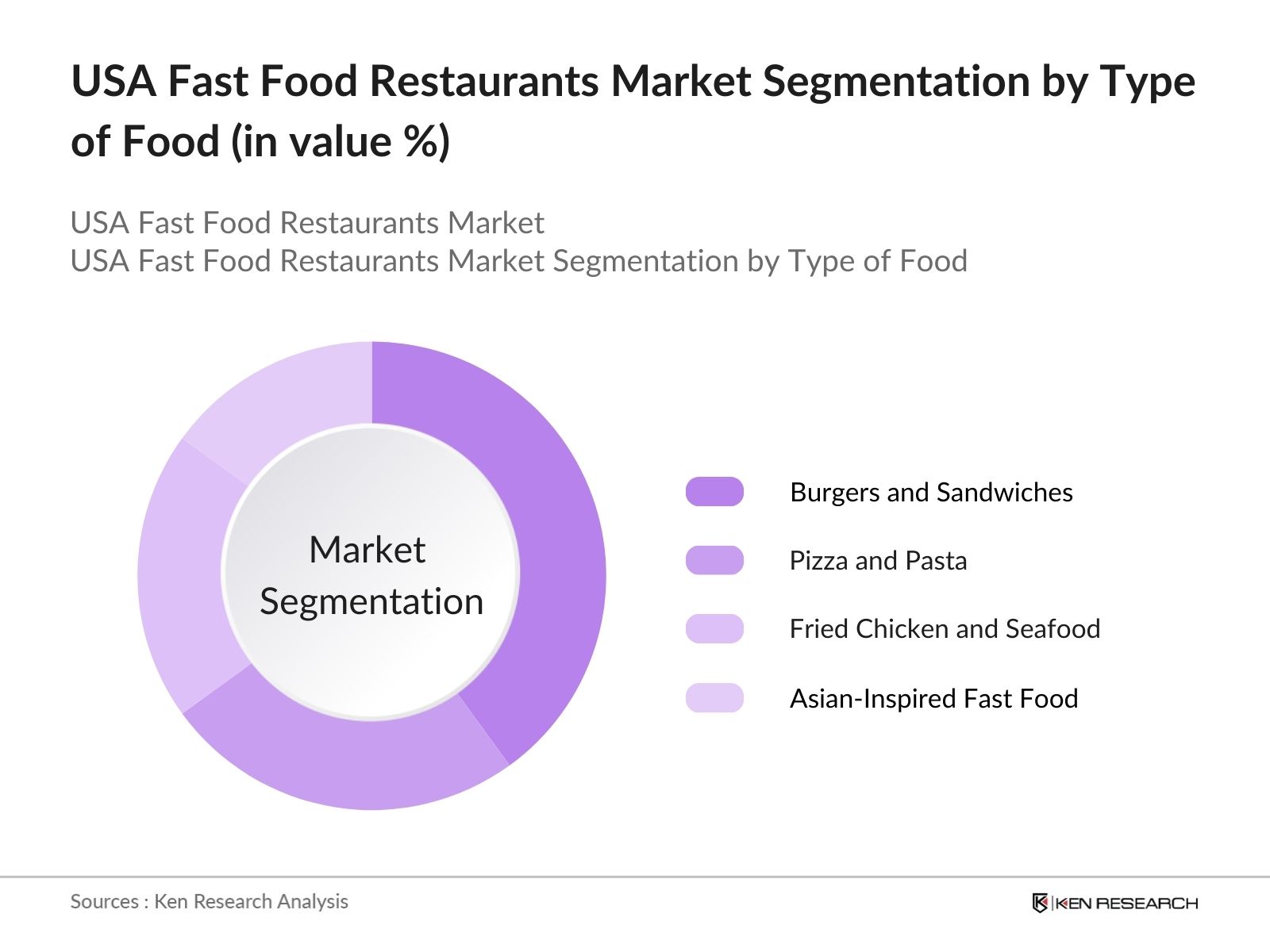

USA Fast Food Restaurants Market Segmentation

- By Type of Restaurant: The USA Fast Food Restaurants market is segmented by type of restaurant into quick-service restaurants (QSRs), fast-casual restaurants, and full-service restaurants with fast food menus. Recently, quick-service restaurants (QSRs) hold a dominant market share in this category. This dominance is attributed to the long-standing presence of global brands like McDonald's, Burger King, and Wendys, which have successfully built brand loyalty over the years through aggressive marketing and a wide range of affordable meal options.

- By Type of Food: The USA Fast Food Restaurants market is segmented by type of food into burgers and sandwiches, pizza and pasta, fried chicken and seafood, and Asian-inspired fast food. Burgers and sandwiches dominate the market share under this segmentation. Their widespread popularity among consumers stems from the long-standing American food culture centered around burgers, as well as the availability of a variety of options catering to different price points and taste preferences, driving strong demand for this sub-segment.

USA Fast Food Restaurants Market Competitive Landscape

The USA Fast Food Restaurants market is dominated by several global and domestic players. The market is highly consolidated, with a few major players holding significant market shares. These companies have built their dominance through widespread outlet presence, strong brand recognition, and the adoption of technology to streamline operations and improve customer experience. This competition drives innovation, as companies continuously invest in marketing campaigns, menu diversification, and enhanced delivery systems.

|

Company Name |

Establishment Year |

Headquarters |

Revenue |

Outlets Worldwide |

Digital Presence |

Delivery Partnerships |

Menu Innovation |

Sustainability Initiatives |

Brand Loyalty |

|

McDonalds Corporation |

1940 |

Chicago, IL |

- |

- |

- |

- |

- |

- |

- |

|

Yum! Brands, Inc. |

1997 |

Louisville, KY |

- |

- |

- |

- |

- |

- |

- |

|

The Wendys Company |

1969 |

Dublin, OH |

- |

- |

- |

- |

- |

- |

- |

|

Chipotle Mexican Grill |

1993 |

Newport Beach, CA |

- |

- |

- |

- |

- |

- |

- |

|

Restaurant Brands International |

2014 |

Toronto, Canada |

- |

- |

- |

- |

- |

- |

- |

USA Fast Food Restaurants Market Analysis

Growth Drivers

- Increasing Urbanization: The urban population in the USA grew to approximately 276 million in 2023, according to the U.S. Census Bureau, which constitutes around 83% of the total population. The rise in urbanization correlates with an increase in demand for fast food, as city dwellers prefer quick and convenient meal options. According to the World Bank, urbanization also leads to infrastructural growth, supporting the expansion of fast-food chains in metropolitan areas, where restaurants can cater to the large, fast-paced working population.

- Expansion of Delivery Services: The fast-food industry has seen significant expansion in delivery services, with the on-demand food delivery market surpassing $26 billion in the USA by 2023, based on data from the U.S. Department of Commerce. As online ordering systems and apps like UberEats and DoorDash flourish, fast food chains capitalize on the convenience offered by these platforms. Fast food restaurants are integrating more heavily into these digital delivery ecosystems, driving revenue from non-traditional in-store dining.

- Digitalization in Ordering Systems: The penetration of digital technology in the fast-food industry has transformed the customer experience, with over 60% of fast-food orders being placed through digital channels by 2023, as reported by the National Restaurant Association. Self-service kiosks, mobile apps, and digital menus have streamlined the ordering process, reducing wait times and boosting operational efficiency. This rise in technology adoption enhances customer satisfaction and drives repeat business for fast-food operators.

Challenges

- Rising Health Consciousness: The shift towards healthier eating is posing challenges for the fast-food industry, with a notable rise in consumer awareness of diet-related health issues. According to the U.S. Department of Health and Human Services, 42% of adults in the U.S. are now actively trying to reduce their calorie intake, with many seeking alternatives to high-calorie fast food. This has pressured fast-food chains to adapt by offering healthier menu options. However, the trend continues to challenge traditional fast-food offerings, where calorie-dense items are core to the menu.

- Increasing Raw Material Prices: Fast-food operators in the USA face mounting pressure from rising raw material costs. The U.S. Department of Agriculture (USDA) reports that beef prices, a staple for many fast-food items, rose by 8% in 2023, while the price of bread increased by 5% during the same period due to inflation. These cost hikes are eating into profit margins and forcing some operators to adjust prices or alter their menus.

USA Fast Food Restaurants Market Future Outlook

USA Fast Food Restaurants market is expected to see considerable growth driven by changing consumer preferences, technological advancements in food ordering systems, and the expansion of healthier and plant-based menu options. The market will also witness the rise of new restaurant models such as ghost kitchens, which operate exclusively for delivery services, enabling faster service at lower costs. Increasing consumer demand for convenience and affordability will continue to fuel the sector's expansion, with further innovations in food delivery and automation anticipated to enhance customer experience.

Market Opportunities

- Growth in Plant-Based Food Demand: The demand for plant-based fast food is growing, with the plant-based food market in the U.S. valued at over $7 billion by 2022, according to the U.S. Department of Agriculture. This rise is attributed to increasing health consciousness among consumers, with 39% of Americans now seeking to reduce their meat consumption. Fast-food chains like McDonalds and Burger King have responded by introducing plant-based alternatives, tapping into this lucrative market segment.

- Expansion into Untapped Markets: Fast-food chains are increasingly exploring untapped regional markets within the U.S. for growth. States such as Montana and Wyoming, which have lower concentrations of fast-food outlets compared to urban centers, represent significant opportunities for geographic expansion. The U.S. Census Bureau notes that these areas have experienced population growth of around 3.5% from 2020 to 2023, creating new demand for dining options. Fast-food operators can capitalize on this demographic shift by expanding their presence in these under-served regions.

Scope of the Report

|

Market Segmentation |

Sub-Segments |

|

By Type of Restaurant |

Quick-Service Restaurants (QSRs) Fast-Casual Restaurants Full-Service Restaurants with Fast Food Menus |

|

By Type of Food |

Burgers and Sandwiches Pizza and Pasta Fried Chicken and Seafood Asian-Inspired Fast Food |

|

By Service Type |

Drive-Thru Dine-In Takeaway Delivery Services |

|

By Consumer Type |

Millennials Gen Z Families Business Travelers |

|

By Region |

Northeast Midwest South West |

Products

Key Target Audience

Quick-Service Restaurants (QSRs)

Food Delivery Service Providers

Investors and Venture Capitalist Firms

Government and Regulatory Bodies (FDA, USDA)

Sustainability and Environmental Organizations

Food and Beverage Equipment Manufacturers

Franchise Owners and Operators

Companies

Players Mentioned in the Report

McDonalds Corporation

Yum! Brands, Inc.

The Wendys Company

Chipotle Mexican Grill

Restaurant Brands International

Dunkin Brands

Dominos Pizza, Inc.

Wingstop, Inc.

Subway

Chick-fil-A

Table of Contents

1. USA Fast Food Restaurants Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. USA Fast Food Restaurants Market Size (In USD Bn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. USA Fast Food Restaurants Market Analysis

3.1. Growth Drivers

3.1.1. Increasing Urbanization (Urban Population Growth)

3.1.2. Expansion of Delivery Services (On-Demand Services)

3.1.3. High Demand for Convenience Foods (Changing Lifestyles)

3.1.4. Digitalization in Ordering Systems (Technology Penetration)

3.2. Market Challenges

3.2.1. Rising Health Consciousness (Consumer Preferences Shift)

3.2.2. Increasing Raw Material Prices (Inflation and Costs)

3.2.3. Regulatory and Compliance Issues (Government Regulations)

3.3. Opportunities

3.3.1. Growth in Plant-Based Food Demand (Health-Conscious Consumers)

3.3.2. Expansion into Untapped Markets (Geographic Expansion)

3.3.3. Technological Innovations in Food Delivery (Automation & AI)

3.4. Trends

3.4.1. Rise of Ghost Kitchens (Cost-Effective Business Models)

3.4.2. Sustainable Packaging Adoption (Environmental Regulations)

3.4.3. Healthier Menu Options (Nutritional Innovation)

3.5. Government Regulation

3.5.1. Food Safety Standards (FDA Regulations)

3.5.2. Labor and Employment Laws (Minimum Wage Impact)

3.5.3. Nutritional Labeling Requirements (Transparency Initiatives)

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem

3.8. Porters Five Forces

3.9. Competition Ecosystem

4. USA Fast Food Restaurants Market Segmentation

4.1. By Type of Restaurant (In Value %)

4.1.1. Quick-Service Restaurants (QSRs)

4.1.2. Fast-Casual Restaurants

4.1.3. Full-Service Restaurants with Fast Food Menus

4.2. By Type of Food (In Value %)

4.2.1. Burgers and Sandwiches

4.2.2. Pizza and Pasta

4.2.3. Fried Chicken and Seafood

4.2.4. Asian-Inspired Fast Food

4.3. By Service Type (In Value %)

4.3.1. Drive-Thru

4.3.2. Dine-In

4.3.3. Takeaway

4.3.4. Delivery Services

4.4. By Consumer Type (In Value %)

4.4.1. Millennials

4.4.2. Gen Z

4.4.3. Families

4.4.4. Business Travelers

4.5. By Region (In Value %)

4.5.1. Northeast

4.5.2. Midwest

4.5.3. South

4.5.4. West

5. USA Fast Food Restaurants Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. McDonalds Corporation

5.1.2. Yum! Brands, Inc.

5.1.3. Restaurant Brands International

5.1.4. Chipotle Mexican Grill

5.1.5. The Wendys Company

5.1.6. Subway

5.1.7. Dunkin Brands

5.1.8. Dominos Pizza, Inc.

5.1.9. Wingstop, Inc.

5.1.10. Chick-fil-A

5.2. Cross Comparison Parameters (Market Share, Revenue, Outlets, Delivery Services Availability, Menu Innovation, Customer Satisfaction, Employee Count, Sustainability Initiatives)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Venture Capital Funding

5.8. Private Equity Investments

6. USA Fast Food Restaurants Market Regulatory Framework

6.1. Food Quality and Safety Regulations

6.2. Labor and Employment Laws

6.3. Zoning and Licensing Requirements

7. USA Fast Food Restaurants Future Market Size (In USD Bn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. USA Fast Food Restaurants Future Market Segmentation

8.1. By Type of Restaurant (In Value %)

8.2. By Type of Food (In Value %)

8.3. By Service Type (In Value %)

8.4. By Consumer Type (In Value %)

8.5. By Region (In Value %)

9. USA Fast Food Restaurants Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves constructing an ecosystem map encompassing all major stakeholders within the USA Fast Food Restaurants market. This step includes extensive desk research utilizing secondary and proprietary databases to gather comprehensive industry-level information. The primary objective is to identify the critical variables that influence market dynamics.

Step 2: Market Analysis and Construction

In this phase, historical data is compiled and analyzed, focusing on the penetration of quick-service and fast-casual restaurants, delivery services adoption, and revenue generation. Evaluating restaurant density and consumer spending patterns helps ensure the reliability and accuracy of the revenue estimates.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses are developed and subsequently validated through computer-assisted telephone interviews (CATIs) with industry experts. These consultations provide valuable operational and financial insights from key industry practitioners, refining the market data.

Step 4: Research Synthesis and Final Output

The final phase involves engaging with multiple fast food operators and delivery service providers to acquire insights into product segments, menu innovations, consumer preferences, and other pertinent factors. This interaction ensures a comprehensive, validated analysis of the USA Fast Food Restaurants market.

Frequently Asked Questions

01. How big is the USA Fast Food Restaurants Market?

The USA Fast Food Restaurants market is valued at USD 377 billion, driven by the increasing demand for quick, affordable meals and the growth of online food delivery services.

02. What are the challenges in the USA Fast Food Restaurants Market?

Challenges in USA Fast Food Restaurants market include rising raw material prices, regulatory hurdles regarding food safety, and growing competition from health-conscious brands offering healthier alternatives to traditional fast food.

03. Who are the major players in the USA Fast Food Restaurants Market?

Key players in USA Fast Food Restaurants market include McDonalds Corporation, Yum! Brands, The Wendys Company, Chipotle Mexican Grill, and Restaurant Brands International, which dominate due to their strong brand presence and vast delivery networks.

04. What are the growth drivers of the USA Fast Food Restaurants Market?

USA Fast Food Restaurants market is propelled by the expansion of delivery services, increasing urbanization, and the growing consumer demand for convenience and affordable meal options. Digital advancements in ordering systems also contribute to market growth.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.