USA Fertilizer Market Outlook to 2030

Region:North America

Author(s):Meenakshi Bisht

Product Code:KROD2804

December 2024

92

About the Report

USA Fertilizer Market Overview

- The USA fertilizer market is valued at USD 28 billion. The market is largely driven by the countrys robust agricultural sector, which accounts for significant domestic consumption. The high demand for fertilizers is fueled by the need to enhance soil fertility and improve crop yields, especially in areas where soil nutrients are increasingly depleted. The consistent use of synthetic fertilizers to maintain the productivity of key crops like corn, wheat, and soybeans contributes significantly to the market's size. This demand is supported by technological advancements in precision agriculture and sustainable farming practices, which are also pushing the adoption of innovative fertilizer products.

- In the USA, the Midwest region, known as the "Corn Belt," dominates the fertilizer market due to its large-scale production of corn, soybeans, and other grains. States such as Iowa, Illinois, and Nebraska are major fertilizer consumers, driven by their agricultural output and the need to sustain high-yield crops. These states have rich agricultural economies that demand substantial fertilizer input to maintain productivity levels. The dominance of these regions can be attributed to favorable climatic conditions, large farm sizes, and intensive farming techniques that require continuous soil enrichment.

- The USDAs agricultural policy framework provides the foundation for the regulation and promotion of sustainable fertilizer use. In 2023, the USDAs Agricultural Policy Advisory Committee (APAC) introduced new guidelines aimed at reducing the environmental impact of fertilizers while maintaining crop productivity. These guidelines, along with the Conservation Reserve Program (CRP) and the Environmental Quality Incentives Program (EQIP), offer financial and technical support to farmers, helping them adopt more efficient fertilizer application methods.

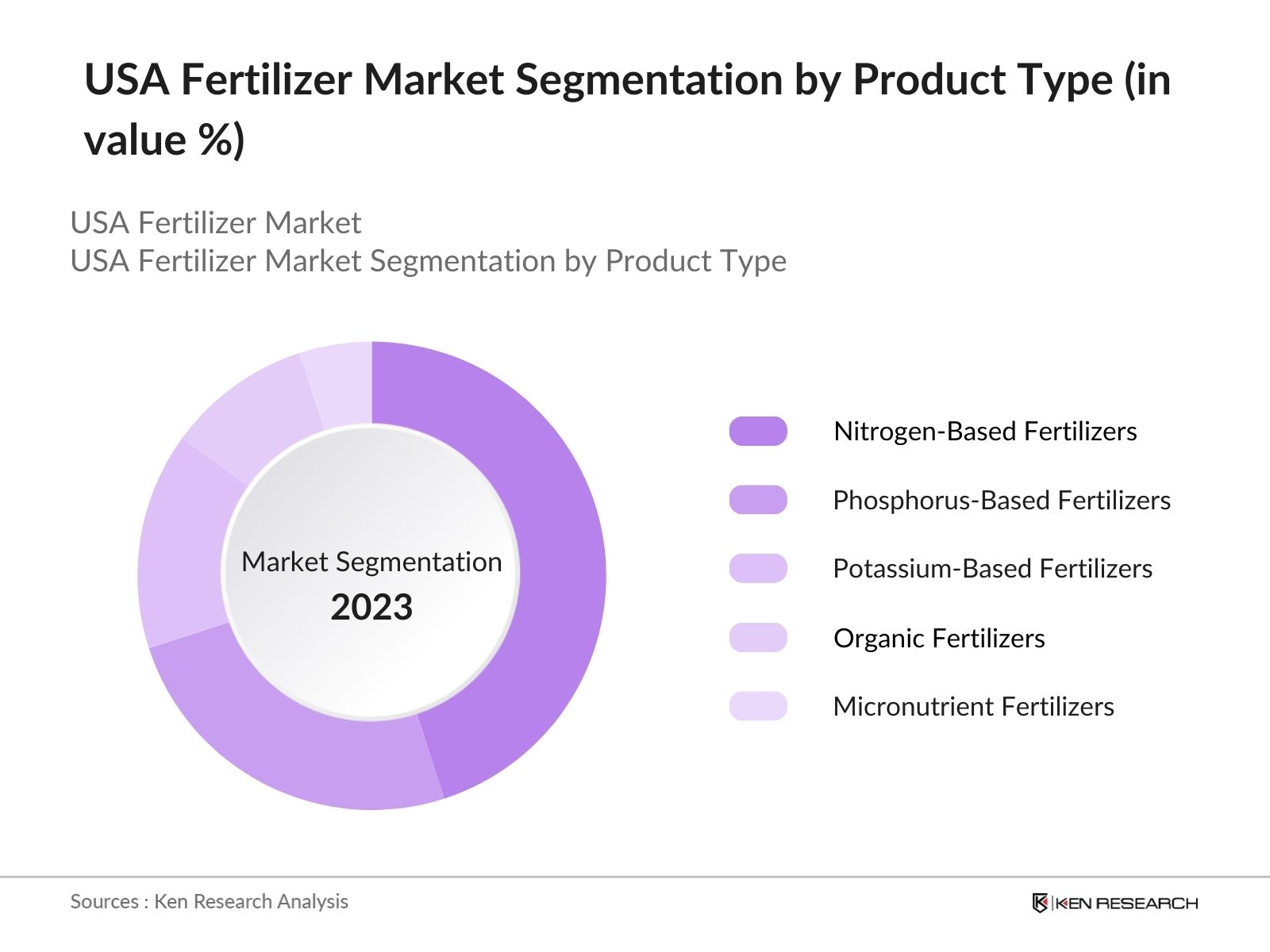

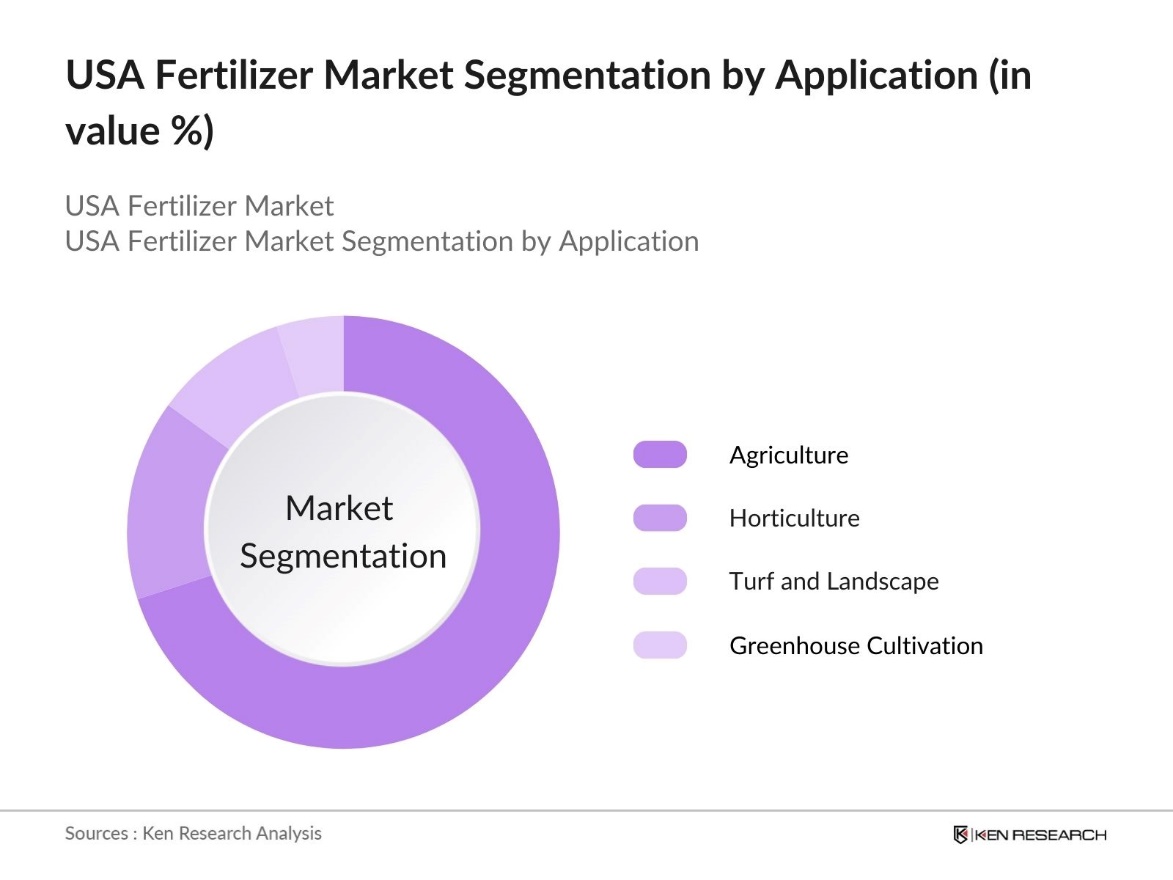

USA Fertilizer Market Segmentation

By Product Type: The USA fertilizer market is segmented by product type into nitrogen-based fertilizers, phosphorus-based fertilizers, potassium-based fertilizers, organic fertilizers, and micronutrient fertilizers. Among these, nitrogen-based fertilizers, including ammonia and urea, have the dominant market share due to their high usage in the cultivation of key crops like corn. The need to promote fast plant growth and the increasing yield of nitrogen-demanding crops drive the segment's popularity. Corn, in particular, is heavily reliant on nitrogen, making this product segment crucial for maintaining high agricultural outputs in regions like the Midwest.

By Application: The market is also segmented by application into agriculture, horticulture, turf and landscape, and greenhouse cultivation. Agriculture accounts for the largest market share, particularly field crops like corn, soybeans, and wheat, which demand high amounts of fertilizer for productivity. Corn production alone accounts for a significant portion of fertilizer consumption due to its large-scale cultivation and the nutrient requirements for maintaining yield levels. The prevalence of large-scale farming and the emphasis on increasing crop yields have made agriculture the dominant application segment in the USA fertilizer market.

USA Fertilizer Market Competitive Landscape

The USA fertilizer market is characterized by a few major players who dominate production and distribution across the country. Companies like Nutrien Ltd. and CF Industries Holdings, Inc. lead the market due to their extensive product portfolios and widespread distribution networks. These firms are highly integrated, allowing them to control both the production of raw materials and the manufacturing of finished products, giving them a competitive edge. The market's consolidation ensures that these players have a significant influence on pricing, product innovation, and market trends.

|

Company |

Establishment Year |

Headquarters |

Production Capacity (Million Tons) |

Revenue (USD Bn) |

R&D Spending |

Distribution Network |

Sustainability Initiatives |

Product Portfolio |

Geographical Presence |

|

Nutrien Ltd. |

2018 |

Canada |

|||||||

|

CF Industries Holdings, Inc. |

1946 |

USA |

|||||||

|

The Mosaic Company |

2004 |

USA |

|||||||

|

Yara International ASA |

1905 |

Norway |

|||||||

|

Koch Fertilizer, LLC |

1946 |

USA |

USA Fertilizer Industry Analysis

Growth Drivers

- Agricultural Modernization: In 2024, the modernization of the U.S. agricultural sector is driven by innovations such as precision farming and automated irrigation systems. Precision farming techniques, which involve satellite imagery, drones, and GPS-guided machinery, have enhanced fertilizer efficiency by optimizing application methods. A 2021 study published by the Association of Equipment Manufacturers (AEM) concluded that precision farming technologies have reduced fertilizer use by 7%, decreased herbicide applications by 9%, lowered fossil fuel use by 6% and gained a 4% savings in water use. This modernization effort is supported by government-backed programs such as the USDAs Environmental Quality Incentives Program (EQIP), which incentivizes farmers to adopt such advanced technologies.

- Increase in Food Demand: The USDA highlights growth in the U.S. fertilizer market through the Fertilizer Production Expansion Program (FPEP), which supports innovative domestic fertilizer production. In 2023, USDA increased funding to $900 million, aiding in the development of 17 new projects that promote alternatives like organic fertilizers. These efforts aim to enhance fertilizer availability and reduce costs for U.S. farmers. Additionally, double cropping practices have expanded, improving food production efficiency, with nearly 1 million additional acres insured in 2024.

- Soil Fertility Depletion: Soil fertility in the U.S. has been strained due to intensive farming practices, leading to widespread nutrient depletion. To address this, farmers have turned to crop rotation techniques and nutrient replenishment strategies to restore soil health. Crop rotation, such as using soybeans, helps naturally replenish essential nutrients like nitrogen. Government programs, such as the USDAs Conservation Reserve Program (CRP), actively support these practices, offering financial incentives to farmers for implementing soil conservation methods that promote long-term agricultural productivity.

Market Restraints

- Volatility in Raw Material Prices: The market heavily relies on raw materials such as natural gas and phosphate rock, both of which have experienced price fluctuations in recent years. These raw material price changes can directly impact the cost of fertilizer production, leading to challenges for producers. The volatility in these essential inputs has resulted in uncertainty for the market, making it harder for companies to maintain stable profit margins and effectively plan for future growth. This dependency on fluctuating global supply chains continues to constrain market expansion.

- Environmental Regulations: Stringent environmental regulations are affecting the U.S. fertilizer market. The Environmental Protection Agency (EPA) has introduced rules aimed at reducing nutrient runoff into water bodies, particularly in agricultural states. These regulations require farmers to adopt precision application methods and reduce the use of traditional fertilizers. Additionally, the EPA's emission regulations for fertilizer plants have increased operational costs for producers, pushing the industry to focus on sustainable and eco-friendly practices while maintaining compliance with the new environmental standards.

USA Fertilizer Market Future Outlook

Over the next five years, the USA fertilizer market is expected to experience moderate growth, driven by several key factors. The increasing adoption of precision agriculture technologies and sustainable farming practices will be pivotal in shaping the market landscape. Additionally, rising concerns over soil degradation and the need for replenishment of essential nutrients will sustain the demand for fertilizers across the agricultural sector. The growth of organic farming and the introduction of smart fertilizers will further provide opportunities for market expansion.

Market Opportunities

- Technological Advancements: Technological innovations are driving growth in the U.S. fertilizer market, with smart fertilizers and controlled-release products gaining traction. These technologies enable nutrients to be released based on soil conditions, improving efficiency and reducing waste. Controlled-release fertilizers help minimize nutrient loss and promote sustainability, aligning with the industry's environmental goals. Government incentives and research funding are encouraging the adoption of these advanced solutions, offering farmers more effective and sustainable fertilizer options.

- Expansion into New Markets: Urban agriculture and hydroponics are emerging markets for fertilizer producers, offering significant growth opportunities. As urban farming gains popularity for its sustainability and land-use efficiency, fertilizer companies are developing specialized products to support these systems. Hydroponics, which relies on nutrient-rich fertilizers, is expanding, and urban agriculture is creating demand for products that cater to limited-space farming. These trends are driving the development of innovative fertilizers tailored to meet the specific needs of urban growers and hydroponic systems.

Scope of the Report

|

By Product Type |

Nitrogen-Based Phosphorus-Based Potassium-Based Organic Micronutrient |

|

By Application |

Agriculture Horticulture Turf and Landscape Greenhouse Cultivation |

|

By Region |

Midwest Northeast South West |

|

By Distribution Channel |

Online Retailers Wholesale Distributors Direct Sales Co-operatives |

|

By Nutrient Type |

Single-Nutrient Multi-Nutrient Micronutrient-Enhanced |

Products

Key Target Audience

Agricultural Input Manufacturers

Fertilizer Companies

Agrochemical Companies

Farming Cooperatives

Investment and Venture Capitalist Firms

Large-Scale Farmers and Agribusinesses

Government and Regulatory Bodies (USDA, EPA)

Companies

Players Mentioned in the Report

Nutrien Ltd.

CF Industries Holdings, Inc.

The Mosaic Company

Yara International ASA

Koch Fertilizer, LLC

Agrium U.S. Inc.

Helena Agri-Enterprises, LLC

J.R. Simplot Company

ICL Group Ltd.

EuroChem Group

Compass Minerals

Wilbur-Ellis Company

BASF SE

OCI N.V.

Corteva Agriscience

Table of Contents

1. USA Fertilizer Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. USA Fertilizer Market Size (In USD Bn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. USA Fertilizer Market Analysis

3.1. Growth Drivers

3.1.1. Agricultural Modernization (Precision Farming, Automated Irrigation)

3.1.2. Population Growth and Food Demand

3.1.3. Soil Fertility Depletion (Crop Rotation, Nutrient Replenishment)

3.1.4. Government Subsidies and Initiatives (Farm Bill, USDA Programs)

3.2. Market Restraints

3.2.1. Volatility in Raw Material Prices (Natural Gas, Phosphate Rock)

3.2.2. Environmental Regulations (Nutrient Runoff, Emissions)

3.2.3. Increasing Use of Organic Alternatives (Bio-fertilizers, Organic Farming)

3.2.4. Supply Chain Disruptions (Logistics, Labor Shortages)

3.3. Opportunities

3.3.1. Technological Advancements (Smart Fertilizers, Controlled Release)

3.3.2. Expansion into New Markets (Urban Agriculture, Hydroponics)

3.3.3. Integration with Precision Agriculture

3.3.4. International Trade Opportunities (Export of Potash, Nitrogen)

3.4. Trends

3.4.1. Growing Demand for Organic Fertilizers

3.4.2. Use of Nano-fertilizers

3.4.3. Adoption of Digital Platforms (Farm Management Systems)

3.4.4. Development of Customized Fertilizers (Region-Specific Solutions)

3.5. Government Regulation

3.5.1. EPA Regulations on Fertilizer Usage

3.5.2. Nutrient Management Plans (NMPs)

3.5.3. Restrictions on Phosphorus Use

3.5.4. USDA Agricultural Policy Framework

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem

3.8. Porters Five Forces

3.9. Competition Ecosystem

4. USA Fertilizer Market Segmentation

4.1. By Product Type (In Value %)

4.1.1. Nitrogen-Based Fertilizers

4.1.2. Phosphorus-Based Fertilizers

4.1.3. Potassium-Based Fertilizers

4.1.4. Organic Fertilizers

4.1.5. Micronutrient Fertilizers

4.2. By Application (In Value %)

4.2.1. Agriculture (Field Crops, Cash Crops)

4.2.2. Horticulture

4.2.3. Turf and Landscape

4.2.4. Greenhouse Cultivation

4.3. By Region (In Value %)

4.3.1. Midwest

4.3.2. Northeast

4.3.3. South

4.3.4. West

4.4. By Distribution Channel (In Value %)

4.4.1. Online Retailers

4.4.2. Wholesale Distributors

4.4.3. Direct Sales

4.4.4. Co-operatives

4.5. By Nutrient Type (In Value %)

4.5.1. Single-Nutrient Fertilizers

4.5.2. Multi-Nutrient Fertilizers

4.5.3. Micronutrient-Enhanced Fertilizers

5. USA Fertilizer Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. Nutrien Ltd.

5.1.2. CF Industries Holdings, Inc.

5.1.3. The Mosaic Company

5.1.4. Yara International ASA

5.1.5. ICL Group Ltd.

5.1.6. Koch Fertilizer, LLC

5.1.7. OCI N.V.

5.1.8. Helena Agri-Enterprises, LLC

5.1.9. Agrium U.S. Inc.

5.1.10. J.R. Simplot Company

5.1.11. Compass Minerals

5.1.12. Wilbur-Ellis Company

5.1.13. EuroChem Group

5.1.14. BASF SE

5.1.15. Corteva Agriscience

5.2. Cross Comparison Parameters (Production Capacity, Market Share, Distribution Network, Technology Adoption, R&D Spending, Sustainability Initiatives, Product Portfolio, Regional Presence)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers And Acquisitions

5.6. Investment Analysis

5.7. Venture Capital Funding

5.8. Government Grants

5.9. Private Equity Investments

6. USA Fertilizer Market Regulatory Framework

6.1. Fertilizer Registration and Licensing

6.2. Compliance Requirements (EPA, USDA)

6.3. Fertilizer Labeling and Safety Regulations

6.4. Certification Processes

7. USA Fertilizer Future Market Size (In USD Bn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. USA Fertilizer Future Market Segmentation

8.1. By Product Type (In Value %)

8.2. By Application (In Value %)

8.3. By Distribution Channel (In Value %)

8.4. By Nutrient Type (In Value %)

8.5. By Region (In Value %)

9. USA Fertilizer Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

Research Methodology

Step 1: Identification of Key Variables

The first step involves mapping out the key stakeholders within the USA fertilizer market ecosystem. This process includes conducting desk research to compile data from secondary sources such as industry reports, government databases, and proprietary databases. The goal is to define the core variables that influence market dynamics, including product demand, pricing trends, and regulatory impacts.

Step 2: Market Analysis and Construction

Historical data from the USA fertilizer market is gathered and analyzed to construct a market structure. This involves evaluating production data, market penetration, and revenue generation across various fertilizer types. Additional factors such as distribution channel analysis and the ratio of small-scale to large-scale farming enterprises are considered to ensure accurate revenue estimates.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses are formulated based on initial data and validated through consultations with industry experts. These consultations provide firsthand insights into production processes, supply chain dynamics, and customer behavior, ensuring the accuracy and relevance of the market analysis.

Step 4: Research Synthesis and Final Output

The final phase involves synthesizing research findings and consulting with fertilizer manufacturers to gain insights into product segments, pricing strategies, and customer preferences. This bottom-up approach helps to create a comprehensive and validated analysis of the USA fertilizer market.

Frequently Asked Questions

01 How big is the USA Fertilizer Market?

The USA Fertilizer Market is valued at approximately USD 28 billion, driven by its large agricultural sector and the need for crop enhancement solutions.

02 What are the challenges in the USA Fertilizer Market?

The USA Fertilizer Market faces challenges such as rising raw material costs, stringent environmental regulations, and the increasing use of organic alternatives which affect the demand for synthetic fertilizers.

03 Who are the major players in the USA Fertilizer Market?

Key players in USA Fertilizer Market include Nutrien Ltd., CF Industries Holdings, Inc., The Mosaic Company, Yara International ASA, and Koch Fertilizer, LLC. These companies dominate due to their wide product portfolios and extensive distribution networks.

04 What are the growth drivers of the USA Fertilizer Market?

The USA Fertilizer Market is propelled by advancements in precision agriculture, increasing demand for food due to population growth, and government subsidies aimed at improving crop yields.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.