USA Fetal Bovine Serum (FBS) Market Outlook to 2030

Region:North America

Author(s):Shreya Garg

Product Code:KROD8682

December 2024

97

About the Report

USA Fetal Bovine Serum (FBS) Market Overview

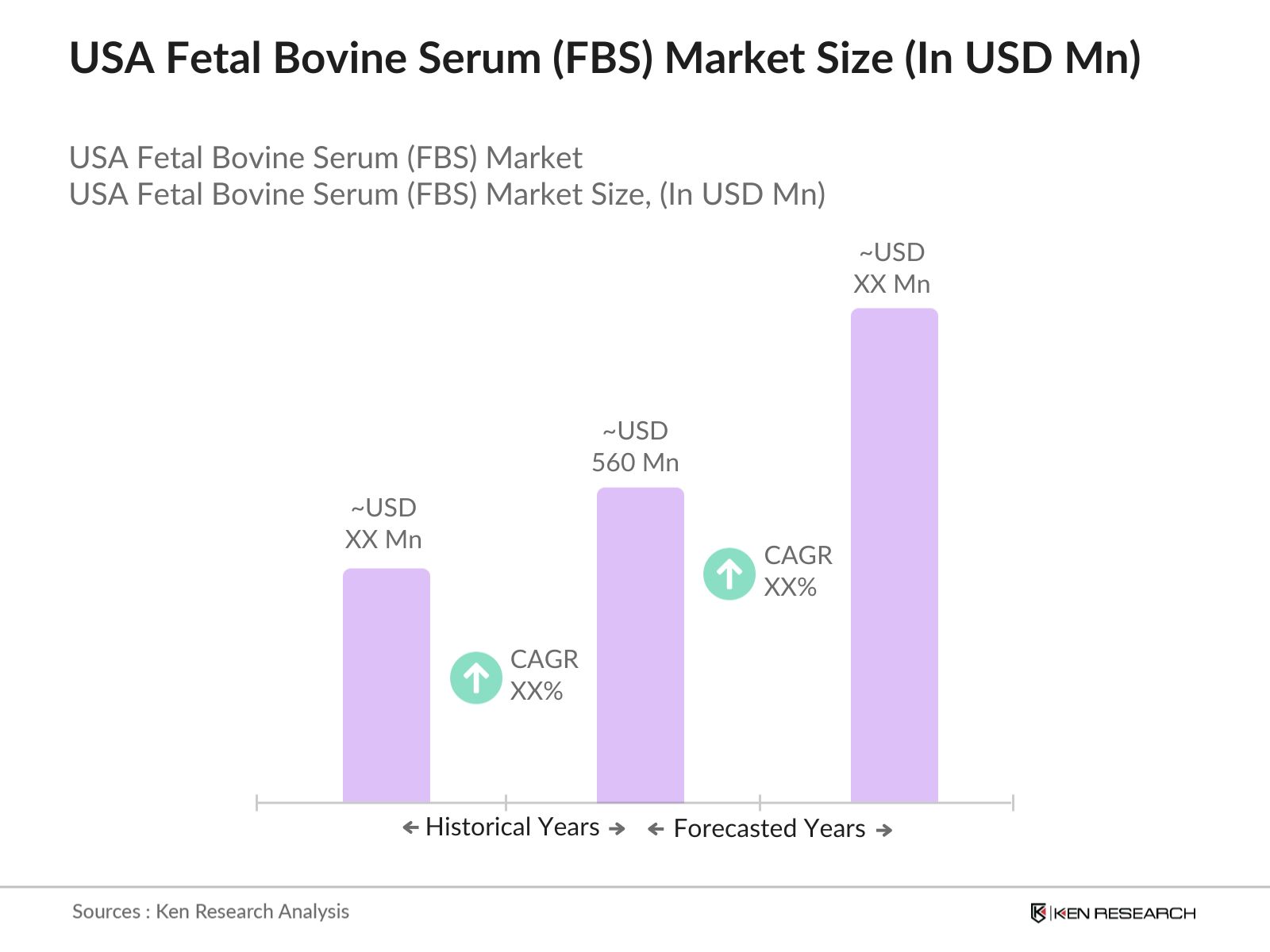

- The USA Fetal Bovine Serum (FBS) market is valued at USD 560 million, based on a comprehensive historical analysis. It is driven primarily by the increasing demand for biopharmaceutical applications, including vaccine development, drug discovery, and tissue engineering. The growth in the biotechnology and cell culture industries, fueled by advancements in research and medical treatments, plays a pivotal role in expanding the market. The rise of cell-based assays in diagnostics and research institutions also propels the demand for high-quality FBS, ensuring continuous market expansion.

- The USA dominates the FBS market due to its large-scale biopharmaceutical manufacturing capacity, advanced research infrastructure, and high demand from leading biotechnology firms. States like California and Massachusetts lead in FBS consumption because of their concentration of research institutes and biopharma companies. The South American region also plays a significant role in supplying raw FBS, especially countries like Argentina and Brazil, which have vast cattle farming practices that align with the demand for high-quality serum.

- The U.S. Food and Drug Administration (FDA) plays a critical role in regulating FBS imports and ensuring compliance with quality standards. As of 2023, the FDA has mandated stringent testing for contaminants in imported FBS, ensuring that products meet the safety and efficacy standards required for use in the biopharmaceutical industry. These regulations have had a profound impact on FBS suppliers, requiring adherence to strict safety protocols.

USA Fetal Bovine Serum (FBS) Market Segmentation

By Product Type: The market is segmented by product type into Charcoal Stripped FBS, Iron-Supplemented FBS, Heat-Inactivated FBS, Dialyzed FBS, and others. Recently, Heat-Inactivated FBS has captured the dominant market share under this segmentation. The demand for Heat-Inactivated FBS is high because of its utility in reducing complement activity in cell culture, making it highly suitable for sensitive cell lines. Biopharmaceutical companies heavily rely on this product type for its consistent performance in both research and clinical trials.

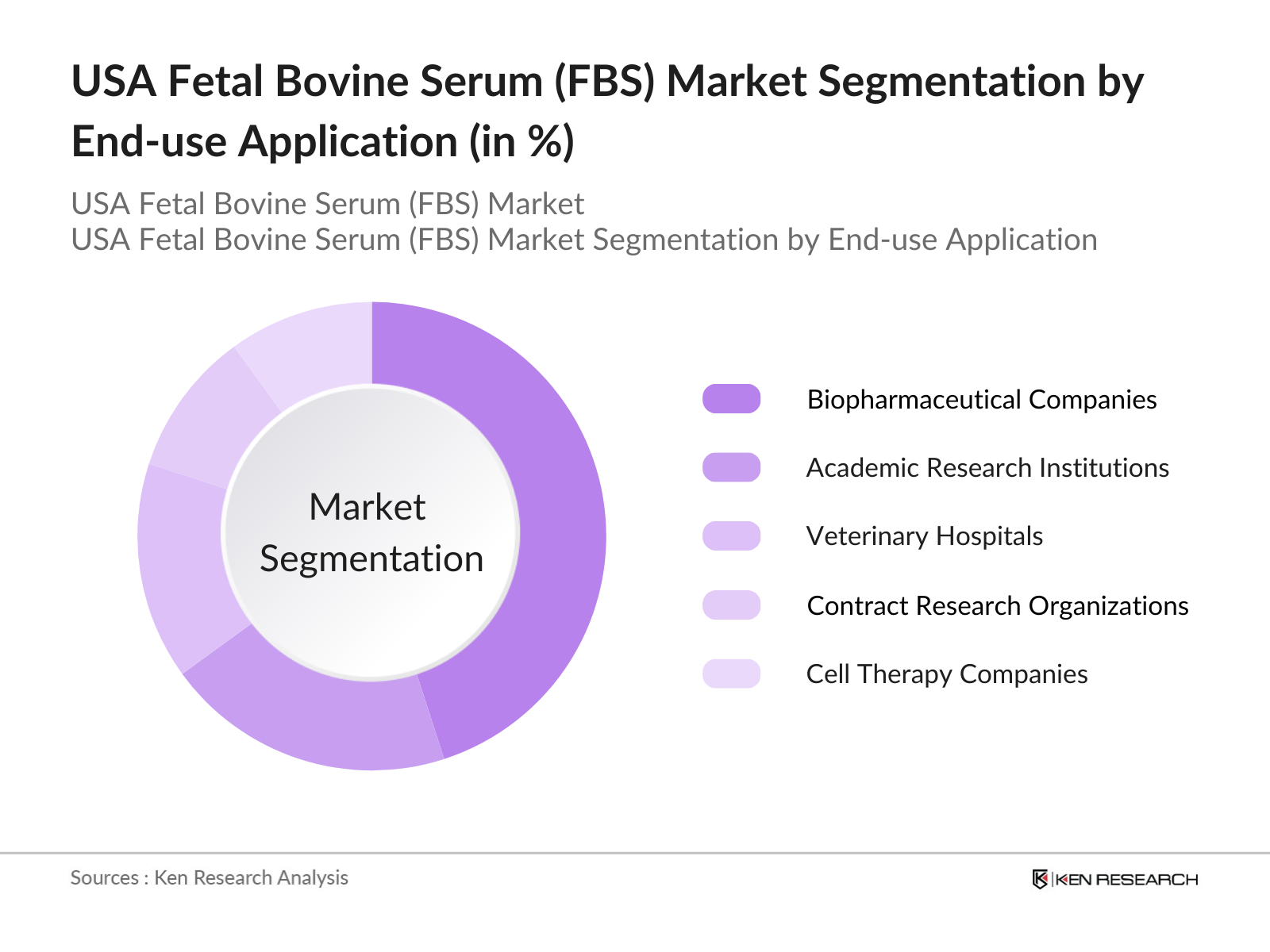

By End-use Application: The market is also segmented by end-use application into Biopharmaceutical Companies, Academic Research Institutions, Veterinary Hospitals, Contract Research Organizations (CROs), and Cell Therapy Companies. Biopharmaceutical companies hold the highest market share under this segmentation. Their demand for FBS is driven by the rising need for consistent cell culture performance, essential for drug development and clinical testing. As these companies continue to push the boundaries of biologic and gene therapy research, the demand for high-purity FBS remains robust.

USA Fetal Bovine Serum (FBS) Market Competitive Landscape

The USA Fetal Bovine Serum market is dominated by several major players who control a significant portion of the market. These companies have established strong supplier networks, ensuring a stable supply of high-quality FBS for biopharmaceutical and research purposes. Their dominance is further strengthened by strategic acquisitions, partnerships with cattle farms for serum sourcing, and investment in R&D for alternative products like serum-free media.

|

Company Name |

Establishment Year |

Headquarters |

Revenue |

R&D Investment |

Geographic Reach |

Serum Product Line |

Partnerships |

Sourcing Country |

Certifications |

|

Thermo Fisher Scientific |

1956 |

Waltham, Massachusetts |

|||||||

|

Merck KGaA |

1668 |

Darmstadt, Germany |

|||||||

|

Bio-Techne Corporation |

1976 |

Minneapolis, Minnesota |

|||||||

|

Lonza Group |

1897 |

Basel, Switzerland |

|||||||

|

Sigma-Aldrich (Merck) |

1935 |

St. Louis, Missouri |

USA Fetal Bovine Serum (FBS) Industry Analysis

Growth Drivers

- Increasing R&D in Biopharma: The U.S. biopharmaceutical sector has been a major consumer of fetal bovine serum (FBS), driven by the increasing investment in R&D. In 2023, the National Institutes of Health (NIH) allocated over $45 billion for biomedical research, a significant portion of which supports cell culture and vaccine development using FBS. The use of FBS in biotechnology research has been pivotal in enhancing pharmaceutical production. As demand for advanced treatments grows, this increase in R&D spending directly correlates with rising FBS consumption in the U.S. biopharma market.

- Expansion in Cell Culture Applications: Cell culture has seen rapid growth due to the expansion of biotech and pharmaceutical applications. The U.S. accounts for approximately 30% of global cell culture activities. The growing use of cell culture in drug development and toxicity testing, supported by regulatory frameworks, continues to boost FBS demand. In 2024, government-backed initiatives like the Biomedical Advanced Research and Development Authority (BARDA) allocated significant funding toward cell culture-based therapeutics, highlighting the importance of FBS as a key resource. Source.

- Demand for Biotechnology and Vaccine Production: The U.S. biotechnology sector has significantly increased FBS consumption for vaccine production, particularly after the COVID-19 pandemic. As of 2023, over 200 million vaccine doses were produced annually using cell culture techniques, which often rely on FBS as a critical growth supplement. The increased focus on both human and veterinary vaccine production has resulted in heightened demand for high-quality FBS.

Market Challenges

- Supply Chain Disruptions: Supply chain disruptions for fetal bovine serum have intensified due to global trade restrictions and geopolitical tensions. The U.S. imports a significant portion of its FBS, with sourcing challenges exacerbated by regulatory hurdles. For instance, in 2023, FBS shipments from South America faced delays due to stricter USDA import regulations, causing fluctuations in availability. These disruptions directly impact biopharma production timelines, requiring companies to seek alternative sourcing strategies.

- Rising Ethical and Regulatory Scrutiny: There has been increasing scrutiny over the ethical sourcing of FBS, particularly regarding animal welfare. Regulatory bodies such as the FDA and USDA have introduced stricter guidelines for FBS sourcing to ensure animal health and welfare during serum collection. In 2023, the U.S. FDA tightened regulations surrounding the ethical treatment of livestock, placing additional compliance requirements on serum producers. This increased scrutiny has posed challenges for suppliers and manufacturers, potentially increasing operational costs and limiting supply options.

USA Fetal Bovine Serum (FBS) Market Future Outlook

Over the next five years, the USA Fetal Bovine Serum market is expected to continue benefiting from advances in biotechnology and increased demand for cell-based therapies. As the biopharmaceutical industry grows, driven by innovation in gene and cell therapy, the demand for high-purity FBS is likely to remain strong. There will also be a shift toward ethically sourced and serum-free alternatives as more companies aim to meet stringent regulatory standards while addressing ethical concerns in serum extraction. Additionally, increased investment in R&D for more efficient production processes will shape the future of this market.

Future Market Opportunities

- Technological Advancements in Serum-Free Media: Technological innovations are creating opportunities to reduce reliance on FBS through the development of serum-free media. By 2023, several U.S.-based biotech companies had adopted advanced media formulations that minimize or eliminate FBS in their cell culture processes. This trend is supported by the FDAs regulatory incentives for innovative technologies that can improve production efficiency while adhering to ethical standards. As these technologies mature, they offer promising cost-effective and sustainable alternatives to traditional FBS usage.

- Collaborations with Academic Institutions: Collaborations between biopharma companies and academic research institutions are on the rise. In 2023, U.S. universities received over $16 billion in federal funding for biomedical research, much of which is directed toward developing new cell culture techniques and enhancing FBS alternatives. These collaborations enable innovation in cell culture systems and expand the market for FBS by opening new avenues for application in cutting-edge research.

Scope of the Report

|

Product Type |

Charcoal Stripped FBS |

|

End-use |

Biopharmaceutical Companies |

|

Source |

North America Sourced FBS |

|

Application |

Vaccine Production |

|

Purity |

Standard Grade FBS |

Products

Key Target Audience

Biopharmaceutical Companies

Veterinary Hospitals and Clinics

Cell Therapy Companies

Contract Research Organizations (CROs)

Academic Research Institutions

Government and Regulatory Bodies (FDA, USDA)

Investor and Venture Capitalist Firms

Biotechnology Start-ups

Companies

Major Players

Thermo Fisher Scientific

Merck KGaA

Bio-Techne Corporation

Lonza Group

Sigma-Aldrich (Merck)

Bovogen Biologicals

Moregate Biotech

Atlas Biologicals

Zen-Bio Inc.

VWR International

HiMedia Laboratories

Tissue Culture Biologicals

PAN-Biotech GmbH

GE Healthcare

CellEss

Table of Contents

1. USA Fetal Bovine Serum Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. USA Fetal Bovine Serum Market Size (In USD Mn)

2.1. Historical Market Size

2.2. Year-on-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. USA Fetal Bovine Serum Market Analysis

3.1. Growth Drivers (Regulatory Approvals, Agricultural Development, Biotechnology Demand, Livestock Population Growth)

3.1.1. Increasing R&D in Biopharma

3.1.2. Expansion in Cell Culture Applications

3.1.3. Demand for Biotechnology and Vaccine Production

3.1.4. Rising Use in Veterinary Medicine

3.2. Market Challenges (Ethical Concerns, Product Quality Variability, Supply Chain Issues, Cost Fluctuations)

3.2.1. Supply Chain Disruptions

3.2.2. Rising Ethical and Regulatory Scrutiny

3.2.3. High Costs Due to FBS Variability

3.3. Opportunities (Technological Innovations, Emerging Cell Culture Techniques, Expansion into Non-traditional Sectors)

3.3.1. Technological Advancements in Serum-Free Media

3.3.2. Collaborations with Academic Institutions

3.3.3. Increased Demand from Emerging Economies

3.4. Trends (Sustainability, Serum-Free Media, Innovation in Alternative Sourcing)

3.4.1. Shift Towards Synthetic Serum Alternatives

3.4.2. Emphasis on Ethical Sourcing

3.4.3. Integration of AI in Quality Control

3.5. Regulatory Framework (FDA Compliance, USDA Regulations, Import/Export Protocols)

3.5.1. FDA Regulations on Serum Import and Quality Standards

3.5.2. USDA Animal Health Protocols

3.5.3. Global Trade Regulations for Fetal Bovine Serum

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem (Biopharmaceutical Companies, Veterinary Research Centers, Academic Institutions)

3.8. Porters Five Forces (Supplier Bargaining Power, Buyer Bargaining Power, Competitive Rivalry, Substitution Threat, New Entrants)

3.9. Competition Ecosystem

4. USA Fetal Bovine Serum Market Segmentation

4.1. By Product Type (In Value %)

4.1.1. Charcoal Stripped FBS

4.1.2. Iron-Supplemented FBS

4.1.3. Heat-Inactivated FBS

4.1.4. Dialyzed FBS

4.1.5. Others

4.2. By End-use (In Value %)

4.2.1. Biopharmaceutical Companies

4.2.2. Academic Research Institutions

4.2.3. Veterinary Hospitals and Clinics

4.2.4. Contract Research Organizations (CROs)

4.2.5. Cell Therapy Companies

4.3. By Source (In Value %)

4.3.1. North America Sourced FBS

4.3.2. South America Sourced FBS

4.3.3. New Zealand Sourced FBS

4.3.4. Australia Sourced FBS

4.4. By Application (In Value %)

4.4.1. Vaccine Production

4.4.2. Tissue Engineering

4.4.3. Drug Screening

4.4.4. Cell Culture and Development

4.4.5. Gene Therapy

4.5. By Purity (In Value %)

4.5.1. Standard Grade FBS

4.5.2. Premium Grade FBS

4.5.3. Exosome-depleted FBS

5. USA Fetal Bovine Serum Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. Thermo Fisher Scientific

5.1.2. Merck KGaA

5.1.3. GE Healthcare

5.1.4. Bio-Techne Corporation

5.1.5. PAN-Biotech GmbH

5.1.6. Bovogen Biologicals

5.1.7. Moregate Biotech

5.1.8. Lonza Group

5.1.9. Tissue Culture Biologicals

5.1.10. HiMedia Laboratories

5.1.11. Sigma-Aldrich (Merck)

5.1.12. Atlas Biologicals

5.1.13. CellEss

5.1.14. Zen-Bio Inc.

5.1.15. VWR International

5.2. Cross Comparison Parameters (Product Offerings, No. of Employees, Revenue, Regional Presence, Sourcing Regions, Investment in R&D, Sustainability Efforts, Certification Standards)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Venture Capital Funding

5.8. Government Grants

5.9. Private Equity Investments

6. USA Fetal Bovine Serum Market Regulatory Framework

6.1. FDA Standards for Serum Quality

6.2. USDA Guidelines for Livestock and Serum Sourcing

6.3. Animal Welfare Compliance

6.4. Import and Export Certification

7. USA Fetal Bovine Serum Future Market Size (In USD Mn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. USA Fetal Bovine Serum Future Market Segmentation

8.1. By Product Type (In Value %) 8.2. By End-use (In Value %) 8.3. By Source (In Value %) 8.4. By Application (In Value %) 8.5. By Purity (In Value %)

9. USA Fetal Bovine Serum Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

The first phase in the research involved identifying the key variables influencing the USA Fetal Bovine Serum market. This included desk research on product types, supply chains, regulatory guidelines, and end-user applications, using both secondary databases and proprietary sources.

Step 2: Market Analysis and Construction

In this phase, historical data on market performance, product adoption, and revenue growth were analyzed. The aim was to understand market penetration by product type and the role of FBS in the growing biopharmaceutical industry.

Step 3: Hypothesis Validation and Expert Consultation

Interviews with industry experts were conducted to validate market assumptions, including demand drivers in research institutions and biopharmaceutical companies. These experts offered insights into supply chain dynamics and market fluctuations.

Step 4: Research Synthesis and Final Output

Finally, the research data was synthesized into comprehensive insights, ensuring the reliability of the market estimates and trends derived from both top-down and bottom-up approaches. Multiple companies were engaged to verify these insights.

Frequently Asked Questions

01 How big is the USA Fetal Bovine Serum Market?

The USA Fetal Bovine Serum market is valued at USD 560 million, driven by biopharmaceutical R&D, advancements in cell culture, and increased demand for vaccine production.

02 What are the challenges in the USA Fetal Bovine Serum Market?

Challenges in the USA Fetal Bovine Serum market include ethical concerns regarding serum extraction, fluctuations in supply due to cattle diseases, and the high cost of production.

03 Who are the major players in the USA Fetal Bovine Serum Market?

Major players in the USA Fetal Bovine Serum market include Thermo Fisher Scientific, Merck KGaA, Bio-Techne Corporation, Lonza Group, and Sigma-Aldrich, which dominate due to their global distribution networks and strong research capabilities.

04 What drives the demand for Fetal Bovine Serum in the USA?

The demand in the USA Fetal Bovine Serum market is driven by the growing biotechnology and biopharmaceutical industries, where FBS is extensively used in cell culture, drug development, and vaccine production.

05 What is the future outlook for the USA Fetal Bovine Serum Market?

The future outlook is positive, with continued demand from biopharmaceutical firms, advances in gene therapy, and a focus on developing ethically sourced serum alternatives in the USA Fetal Bovine Serum market.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.