USA Fintech Market Outlook to 2030

Region:North America

Author(s):Samanyu

Product Code:KROD5214

October 2024

81

About the Report

USA Fintech Market Overview

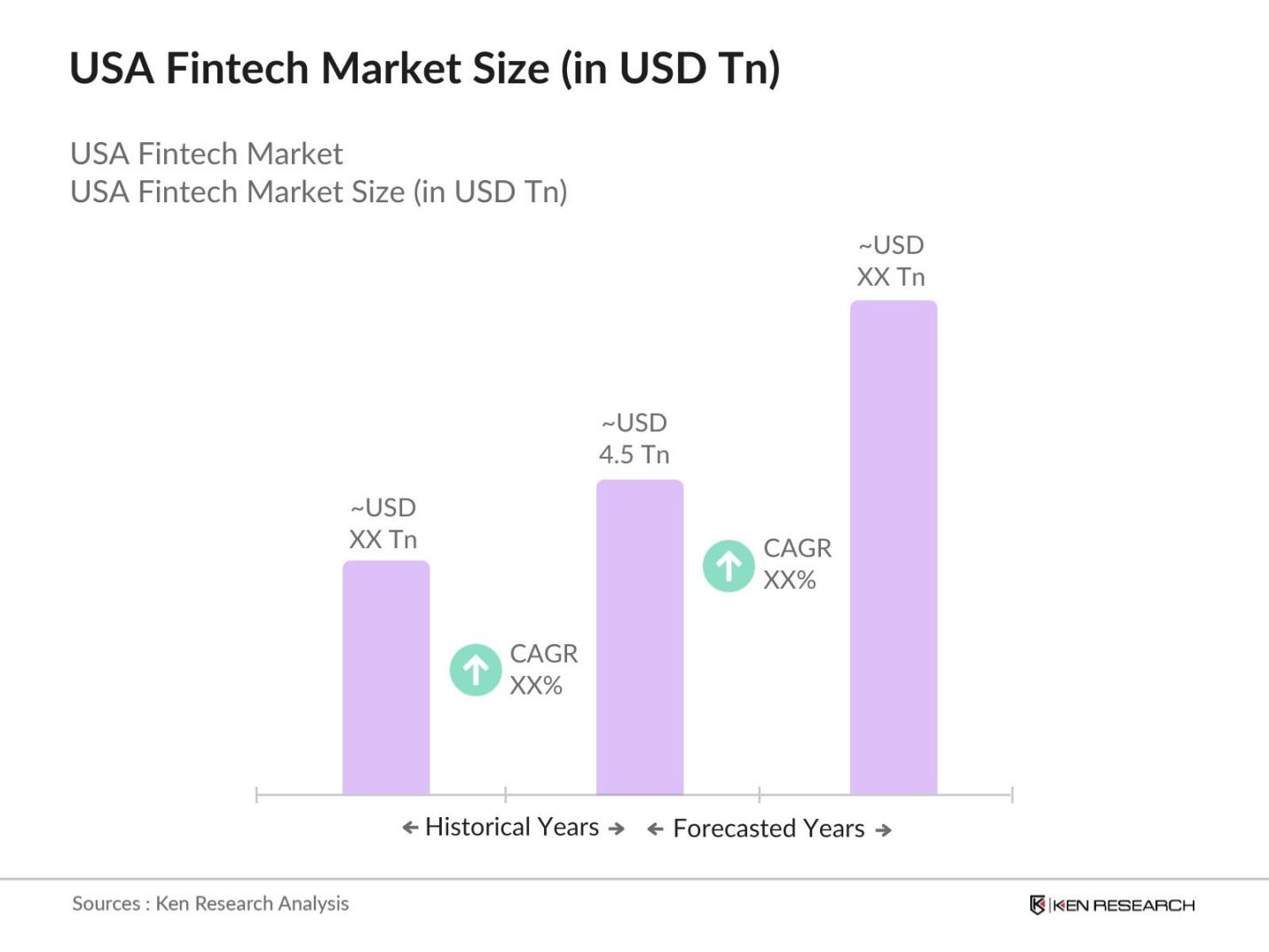

- The USA Fintech market is valued at USD 4.5 Tn, based on a five-year historical analysis. The markets rapid growth is primarily driven by the increasing adoption of digital payment solutions and innovative technologies such as blockchain and artificial intelligence (AI). Financial institutions, both traditional and fintech startups, have been rapidly digitizing their offerings to meet consumer demand for seamless online transactions, mobile banking, and digital financial services. Regulatory support from the U.S. government further accelerates the sector's expansion, fostering innovation through fintech sandboxes and progressive regulatory measures.

- Dominant fintech hubs in the USA include New York City, San Francisco, and Boston. These cities are home to a number of fintech startups and financial institutions due to their proximity to key financial markets, access to venture capital, and a strong pool of technology talent. The presence of Wall Street in New York and Silicon Valley in San Francisco drives innovation and collaboration between finance and technology, giving these cities a competitive edge in the fintech ecosystem.

- State-level regulations also shape the fintech ecosystem in the U.S. In 2023, over 35 states, including California and New York, enacted fintech-specific laws addressing digital currencies, lending platforms, and consumer protections. States with progressive fintech laws saw significant growth, with over 1,200 fintech startups emerging in these regions. In 2024, states like Wyoming and Arizona are expected to lead the way in regulatory innovation, offering fintech sandboxes that encourage experimentation with new technologies while maintaining regulatory oversight.

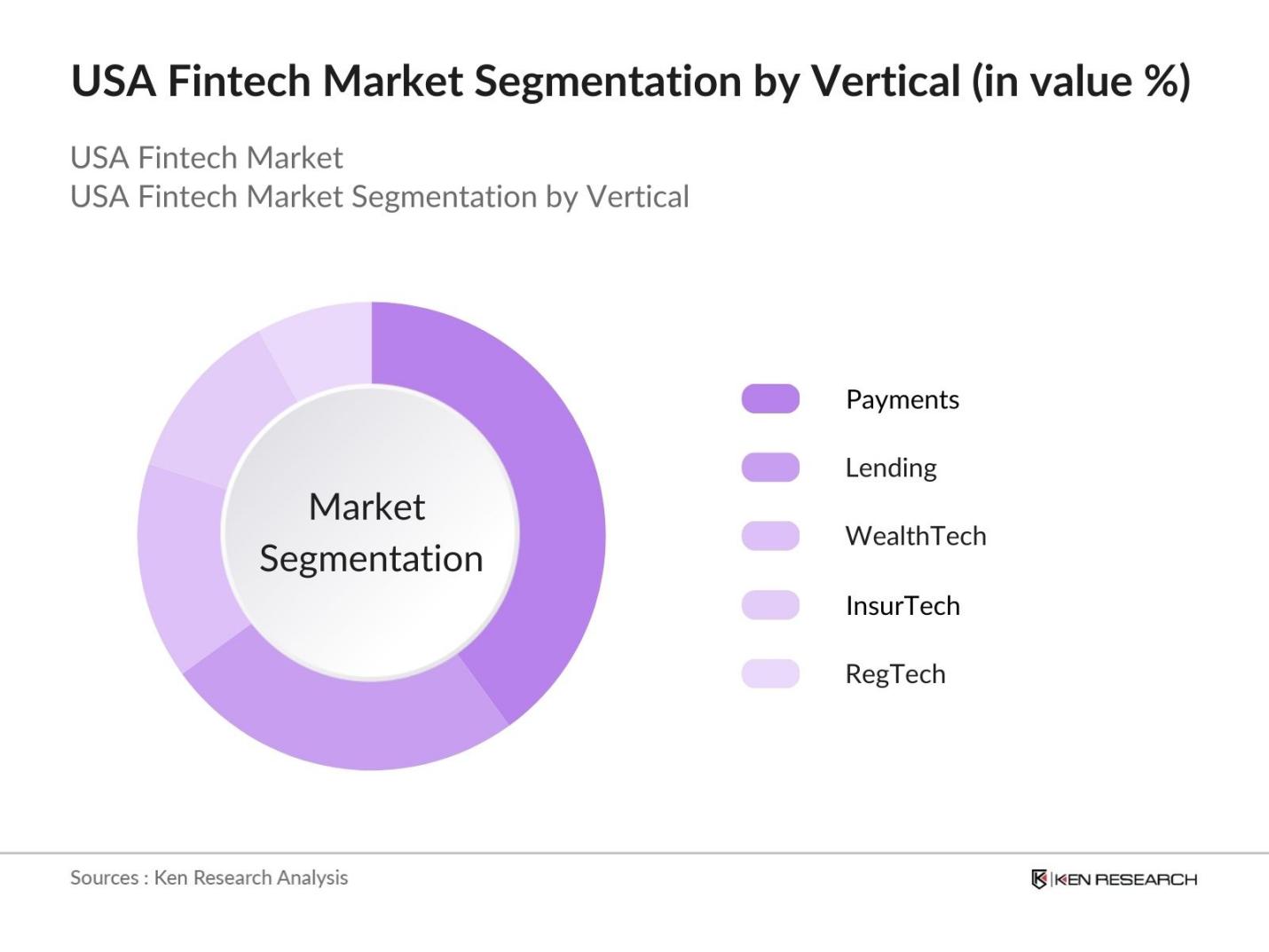

USA Fintech Market Segmentation

By Vertical: The market is segmented by vertical into payments, lending, wealthtech, insurtech, and regtech. Among these, the payments vertical has a dominant market share due to the rising adoption of digital wallets, contactless payments, and e-commerce platforms. Services like Apple Pay, PayPal, and Square have become deeply ingrained in the consumer market, fueled by the increasing use of smartphones and mobile apps for financial transactions. The COVID-19 pandemic further accelerated the shift towards contactless payments, cementing the payments verticals lead.

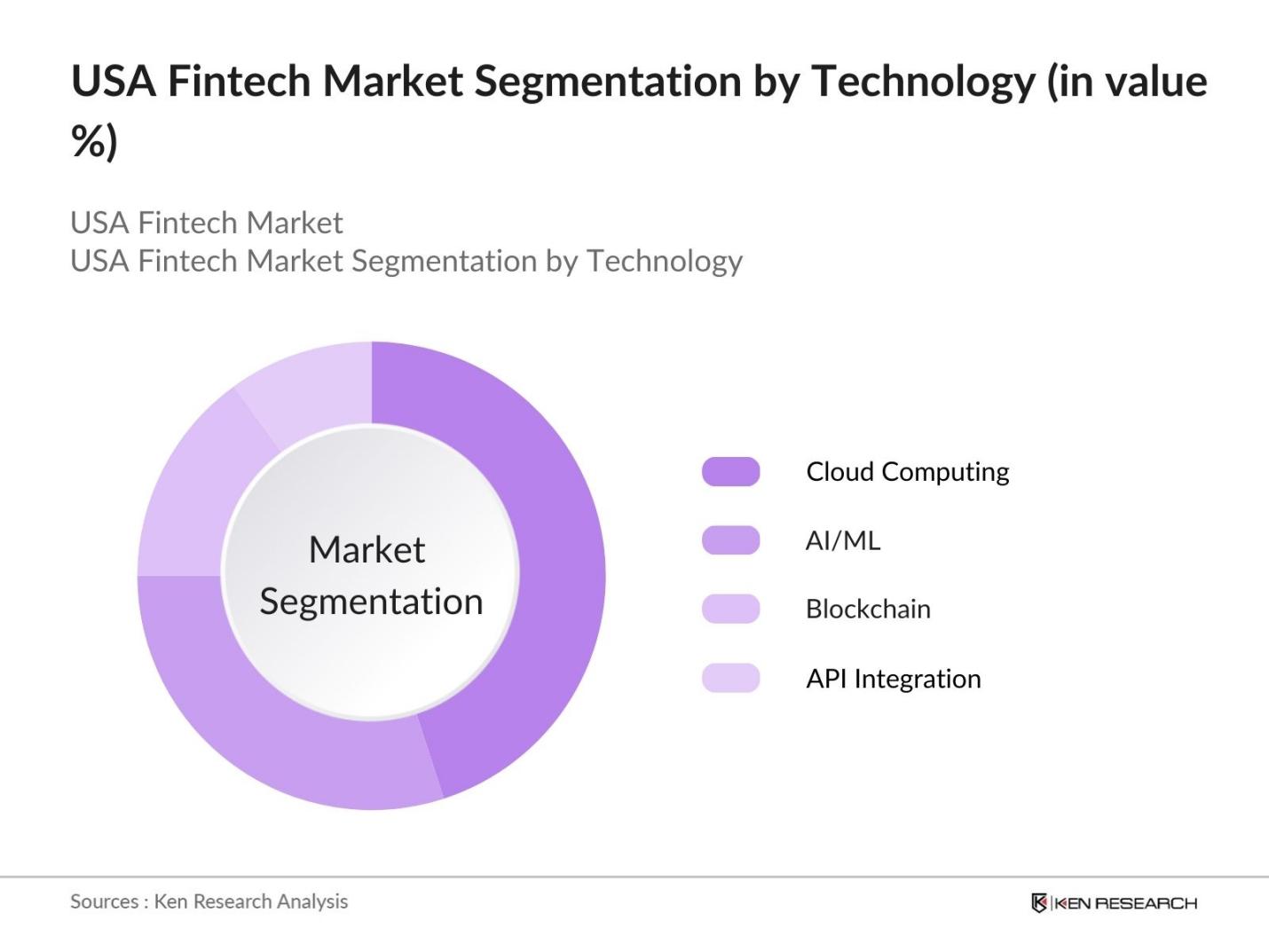

By Technology: The market is also segmented by technology into blockchain, AI/ML, cloud computing, and API integration. Cloud computing currently leads this segment, accounting for the largest market share, as fintech companies increasingly migrate their services to the cloud to enhance scalability, reduce costs, and improve accessibility. With the growing demand for real-time data processing and seamless integration of financial services, cloud-based infrastructure is becoming the backbone of fintech innovation.

USA Fintech Market Competitive Landscape

The USA fintech market is dominated by key players who have consolidated their positions through continuous innovation, strategic acquisitions, and partnerships with traditional financial institutions. Notable players such as PayPal, Square, and Robinhood have reshaped the financial services landscape, offering consumers a more streamlined and accessible way to manage their finances. The competitive landscape is also influenced by the entrance of tech giants like Google and Amazon, further intensifying competition.

|

Company Name |

Establishment Year |

Headquarters |

Revenue (2023) |

Employees |

Key Product |

R&D Investment |

Key Clients |

Recent Acquisitions |

|

yPal Holdings, Inc. |

1998 |

San Jose, CA |

||||||

|

Square, Inc. (Block, Inc.) |

2009 |

San Francisco, CA |

||||||

|

Robinhood Markets, Inc. |

2013 |

Menlo Park, CA |

||||||

|

Stripe, Inc. |

2010 |

San Francisco, CA |

||||||

|

Coinbase Global, Inc. |

2012 |

San Francisco, CA |

USA Fintech Industry Analysis

Growth Drivers

-

Increasing Adoption of Digital Payment Solutions: The United States is witnessing a surge in digital payment solutions, with more than $2.2 trillion in total transaction volumes recorded in 2023, according to the U.S. Federal Reserve. This growth is driven by the shift from cash to contactless payments and mobile wallets, particularly following the pandemic. Macroeconomic data from 2024 shows that over 75 million households now use digital payments regularly. The Federal Reserve's ongoing support for faster payment networks like FedNow also strengthens this transition, increasing the velocity of money circulation and enhancing economic activity in the broader fintech ecosystem.

- Rise of AI and Machine Learning in Financial Services: AI and machine learning are revolutionizing financial services in the U.S., with around 35% of fintech companies already employing these technologies in customer service automation and fraud detection. A report from the U.S. Department of Commerce highlighted that AI applications in fraud detection saved the financial sector an estimated $22 billion in potential losses in 2023. Additionally, as AI tools like predictive analytics improve operational efficiency and enhance customer experience, they are gaining more traction, with fintech firms investing over $9 billion in AI-related R&D during 2024, per government records.

- Regulatory Support for Fintech Ecosystem: The U.S. government, through its Financial Stability Oversight Council (FSOC), is actively promoting the fintech ecosystem by streamlining regulatory guidelines for innovation in payment systems, wealth management, and lending. Recent federal legislation has simplified compliance requirements, enabling smaller fintech firms to innovate without overwhelming regulatory burdens. In 2023, fintech-friendly regulations helped drive the number of licensed fintech entities to over 2,800. Moreover, fintech sandboxes approved by state and federal regulators support the testing of new technologies under real-world conditions, boosting the industrys innovation potential in 2024.

Market Challenges

-

Regulatory Uncertainty in Certain Fintech Verticals: While some fintech subsectors benefit from clear regulations, others face uncertainty. Peer-to-peer lending and cryptocurrency platforms, for instance, operate in a fragmented regulatory environment, with state and federal rules often conflicting. In 2023, over 40 U.S. states had varying fintech-related regulations, particularly in blockchain and digital assets, causing compliance challenges for startups and incumbents alike. The Office of the Comptroller of the Currency (OCC) highlights that these discrepancies could impede innovation, leading to increased operational costs for fintech firms trying to navigate regulatory complexity.

- Data Privacy and Security Concerns: Data privacy remains a major concern in the U.S. fintech sector, especially as digital financial transactions grow. The Federal Trade Commission (FTC) noted that in 2023 alone, over 5 million cases of identity theft and financial fraud were reported, amounting to over $17 billion in losses. With more than 85% of fintech platforms storing sensitive consumer data, securing these systems against breaches and cyberattacks is critical. The risk of breaches, exacerbated by increased digital transactions, presents operational and reputational risks for the fintech sector as it continues to grow.

USA Fintech Market Future Outlook

Over the next five years, the USA fintech market is expected to experience significant growth, driven by technological advancements, a maturing regulatory framework, and rising consumer demand for digital financial services. Innovations in AI and blockchain are expected to disrupt traditional financial services further, leading to new opportunities in areas like wealth management, peer-to-peer lending, and decentralized finance (DeFi). As the fintech ecosystem continues to expand, partnerships between fintech startups and traditional financial institutions will be key in driving sustained market growth.

Future Market Opportunities

-

Growth in Peer-to-Peer Lending Platforms: Peer-to-peer (P2P) lending platforms in the U.S. have expanded significantly, with over USD 26 Bn in loan origination in 2023, according to the U.S. Department of Treasury. These platforms are gaining traction due to their ability to offer quicker, more flexible lending solutions compared to traditional banks. With increasing demand from small and medium-sized businesses and consumers looking for alternative credit options, P2P platforms are poised for growth, backed by regulatory support and a strong appetite for credit alternatives among the U.S. population.

- Expansion of Blockchain Applications in Fintech: Blockchain technology offers tremendous opportunities for fintech, particularly in secure cross-border payments and decentralized finance (DeFi). By 2023, the U.S. Department of Treasury acknowledged that blockchain-based solutions were instrumental in enabling over $450 billion in international remittances. Government-backed initiatives, including blockchain forensics and compliance tools, are positioning the U.S. as a global leader in blockchain innovation. Blockchain is also enabling more efficient financial tracking and settlement systems, driving the adoption of tokenized assets in 2024, which could enhance transparency and reduce operational costs.

Scope of the Report

|

By Vertical |

Payments Lending Wealth Tech Insur Tech Reg Tech |

|

By Technology |

Blockchain AI/ML Cloud Computing API Integration |

|

By Application |

Retail Banking Investment Banking Insurance Payments Lending |

|

By Deployment Mode |

On-Premise Cloud-Based Hybrid |

|

By End-User |

Individual Consumers SMEs Large Enterprises Government Entities |

Products

Key Target Audience

Venture Capital and Investment Firms

Government and Regulatory Bodies (Consumer Financial Protection Bureau (CFPB), U.S. Securities and Exchange Commission)

Traditional Financial Institutions (Banks, Credit Unions)

Fintech Startups and Entrepreneurs

Banks and Financial Institutes

E-commerce Companies

Technology Providers (Cloud Service Providers, API Developers)

Insurance Companies

Payment Processing Firms

Companies

Players Mentioned in the Report:

PayPal Holdings, Inc.

Square, Inc. (Block, Inc.)

Robinhood Markets, Inc.

Stripe, Inc.

Coinbase Global, Inc.

Chime Financial, Inc.

Plaid Inc.

SoFi Technologies, Inc.

Affirm Holdings, Inc.

LendingClub Corporation

Green Dot Corporation

Lemonade, Inc.

Root Insurance Company

Ripple Labs, Inc.

Brex Inc.

Table of Contents

1. USA Fintech Market Overview

1.1 Definition and Scope (Market Drivers: Regulatory Changes, Digital Transformation)

1.2 Market Taxonomy (Key Fintech Verticals: Payments, Lending, WealthTech, InsurTech, RegTech)

1.3 Market Growth Rate (CAGR, Market Growth Velocity)

1.4 Market Segmentation Overview (Key Metrics: Adoption Rate, Revenue Contribution, Customer Segmentation)

2. USA Fintech Market Size (In USD Tn)

2.1 Historical Market Size (In USD Tn, Historical Data: Market Growth, Demand Trends)

2.2 Year-On-Year Growth Analysis (Growth Drivers: Economic Factors, Consumer Behavior, Tech Advancements)

2.3 Key Market Developments and Milestones (Major Product Launches, Regulatory Approvals, Key Market Events)

3. USA Fintech Market Analysis

3.1 Growth Drivers

3.1.1 Increasing Adoption of Digital Payment Solutions

3.1.2 Rise of AI and Machine Learning in Financial Services

3.1.3 Regulatory Support for Fintech Ecosystem

3.1.4 Growing Consumer Preference for Online Financial Services

3.2 Restraints

3.2.1 Data Privacy and Security Concerns

3.2.2 Regulatory Uncertainty in Certain Fintech Verticals

3.2.3 High Competition from Traditional Financial Institutions

3.3 Opportunities

3.3.1 Expansion of Blockchain Applications in Fintech

3.3.2 Collaboration with Traditional Banks

3.3.3 Growth in Peer-to-Peer Lending Platforms

3.4 Trends

3.4.1 Increased Use of Artificial Intelligence (AI) in Wealth Management

3.4.2 Rise of Embedded Finance in E-commerce Platforms

3.4.3 Open Banking Initiatives Driving Financial Transparency

3.5 Government Regulation

3.5.1 Consumer Financial Protection Bureau (CFPB) Guidelines

3.5.2 State-Level Regulatory Frameworks for Fintech

3.5.3 Payment Services Regulation

3.5.4 Fintech Sandboxes for Innovation

3.6 SWOT Analysis (Market-specific strengths, weaknesses, opportunities, threats)

3.7 Stakeholder Ecosystem (Key Stakeholders: Fintech Startups, Traditional Banks, Payment Processors)

3.8 Porters Five Forces (Competitive Intensity, Threat of Substitution, Bargaining Power)

3.9 Competition Ecosystem (Market Players: Fintech Companies, Banks, Tech Giants)

4. USA Fintech Market Segmentation

4.1 By Vertical (In Value %)

4.1.1 Payments

4.1.2 Lending

4.1.3 WealthTech

4.1.4 InsurTech

4.1.5 RegTech

4.2 By Technology (In Value %)

4.2.1 Blockchain

4.2.2 AI/ML

4.2.3 Cloud Computing

4.2.4 API Integration

4.3 By Application (In Value %)

4.3.1 Retail Banking

4.3.2 Investment Banking

4.3.3 Insurance

4.3.4 Payments

4.3.5 Lending

4.4 By Deployment Mode (In Value %)

4.4.1 On-Premise

4.4.2 Cloud-Based

4.4.3 Hybrid

4.5 By End-User (In Value %)

4.5.1 Individual Consumers

4.5.2 SMEs

4.5.3 Large Enterprises

4.5.4 Government Entities

5. USA Fintech Market Competitive Analysis

5.1 Detailed Profiles of Major Companies

5.1.1 PayPal Holdings, Inc.

5.1.2 Stripe, Inc.

5.1.3 Square, Inc. (Block, Inc.)

5.1.4 Robinhood Markets, Inc.

5.1.5 Chime Financial, Inc.

5.1.6 Coinbase Global, Inc.

5.1.7 SoFi Technologies, Inc.

5.1.8 Plaid Inc.

5.1.9 Ripple Labs, Inc.

5.1.10 Affirm Holdings, Inc.

5.1.11 LendingClub Corporation

5.1.12 Green Dot Corporation

5.1.13 Lemonade, Inc.

5.1.14 Root Insurance Company

5.1.15 Brex Inc.

5.2 Cross Comparison Parameters (Revenue, Number of Employees, Headquarters, Market Share, Technology Stack)

5.3 Market Share Analysis (Competitor Positioning by Revenue, Market Penetration)

5.4 Strategic Initiatives (Expansion Strategies, Partnerships, Product Launches)

5.5 Mergers and Acquisitions (Recent Deals and Strategic Implications)

5.6 Investment Analysis (Venture Capital, Private Equity)

5.7 Government Funding and Grants (Government Support and Regulatory Incentives)

5.8 Private Equity and Venture Capital Funding Analysis

6. USA Fintech Market Regulatory Framework

6.1 Federal Regulations (SEC, FINRA, CFPB)

6.2 State-Level Regulations (Fintech Licensing, Compliance)

6.3 Compliance Requirements (Data Security, AML/KYC)

6.4 Certification Processes (ISO Certifications, PCI-DSS Compliance)

7. USA Fintech Future Market Size (In USD Tn)

7.1 Future Market Size Projections (Market Forecasting Metrics: CAGR, Revenue Growth)

7.2 Key Factors Driving Future Market Growth (Technological Innovations, Regulatory Changes)

8. USA Fintech Future Market Segmentation

8.1 By Vertical (In Value %)

8.2 By Technology (In Value %)

8.3 By Application (In Value %)

8.4 By Deployment Mode (In Value %)

8.5 By End-User (In Value %)

9. USA Fintech Market Analysts Recommendations

9.1 TAM/SAM/SOM Analysis (Total Available Market, Serviceable Available Market, Serviceable Obtainable Market)

9.2 Customer Cohort Analysis (Consumer Behavior, Demographics, Fintech Adoption Rate)

9.3 Marketing Initiatives (B2B and B2C Strategies, Influencer Marketing)

9.4 White Space Opportunity Analysis (Untapped Markets, Product Development Opportunities)

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

The initial phase involves creating an in-depth ecosystem map of all major stakeholders within the USA fintech market. This process includes extensive desk research and the analysis of proprietary databases to gather comprehensive industry information. The main objective is to pinpoint the variables that drive market dynamics, such as customer behavior, technological advancements, and regulatory influences.

Step 2: Market Analysis and Construction

During this phase, historical data on market size, customer acquisition, and financial technology adoption rates are collected and analyzed. The research team evaluates the proportion of market participants in each segment and their corresponding revenue streams. This stage also includes a comprehensive assessment of service quality, ensuring that projections are reliable and accurate.

Step 3: Hypothesis Validation and Expert Consultation

Industry hypotheses are formulated based on historical trends and market drivers. These hypotheses are validated through in-depth consultations with industry professionals via computer-assisted telephone interviews (CATI). This expert feedback provides real-world insights into the operational and financial aspects of the fintech industry.

Step 4: Research Synthesis and Final Output

The final step involves combining the quantitative and qualitative data to develop a comprehensive market report. This phase includes validating insights obtained from fintech companies and cross-verifying the data with secondary research findings. The final output provides a holistic view of the fintech market, offering actionable insights for stakeholders.

Frequently Asked Questions

01. How big is the USA fintech market?

The USA fintech market was valued at USD 4.5 Tn, driven by increasing consumer adoption of digital payment solutions, regulatory support, and advancements in financial technologies like AI and blockchain.

02. What are the challenges in the USA fintech market?

Challenges in USA fintech market include stringent regulatory frameworks, data privacy concerns, and increasing competition from both fintech startups and traditional financial institutions. The market also faces high customer acquisition costs.

03. Who are the major players in the USA fintech market?

Key players in the USA fintech market include PayPal, Stripe, Square, Robinhood, and Coinbase. These companies dominate due to their strong technological infrastructure, brand presence, and wide customer bases.

04. What are the growth drivers of the USA fintech market?

Growth drivers in USA fintech market include the rising adoption of mobile banking, the proliferation of AI-based financial services, and increasing consumer demand for seamless digital payment solutions. Additionally, innovations in blockchain technology are expanding use cases in the sector.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.