USA Fish Oil Market Outlook to 2030

Region:North America

Author(s):Paribhasha Tiwari

Product Code:KROD5504

December 2024

85

About the Report

USA Fish Oil Market Overview

- The USA fish oil market is valued at USD 725 million based on historical analysis, driven by rising consumer demand for omega-3 supplements, increased awareness of the health benefits associated with fish oil, and expanding applications across nutraceuticals, pharmaceuticals, and animal feed industries. The demand for fish oil, particularly for human consumption, has seen significant growth due to its proven effects on cardiovascular and brain health. The aquaculture sector, where fish oil is used in animal feed, also contributes significantly to the markets growth.

- The fish oil market in the USA is primarily dominated by coastal regions such as California, Alaska, and Washington, due to their proximity to rich marine resources and well-established fisheries. These regions have robust fish processing industries that support large-scale fish oil production. Additionally, Alaska leads in sustainable fishing practices, ensuring a stable supply of high-quality fish oil, which contributes to the region's dominance in the market.

- The National Oceanic and Atmospheric Administration (NOAA) plays a critical role in regulating fishing quotas to protect marine biodiversity. In 2024, NOAA continues to implement measures to ensure the sustainable harvest of fish oil-producing species, such as menhaden and herring. These initiatives are designed to balance market demand with environmental sustainability, ensuring the long-term availability of fish oil resources in the USA.

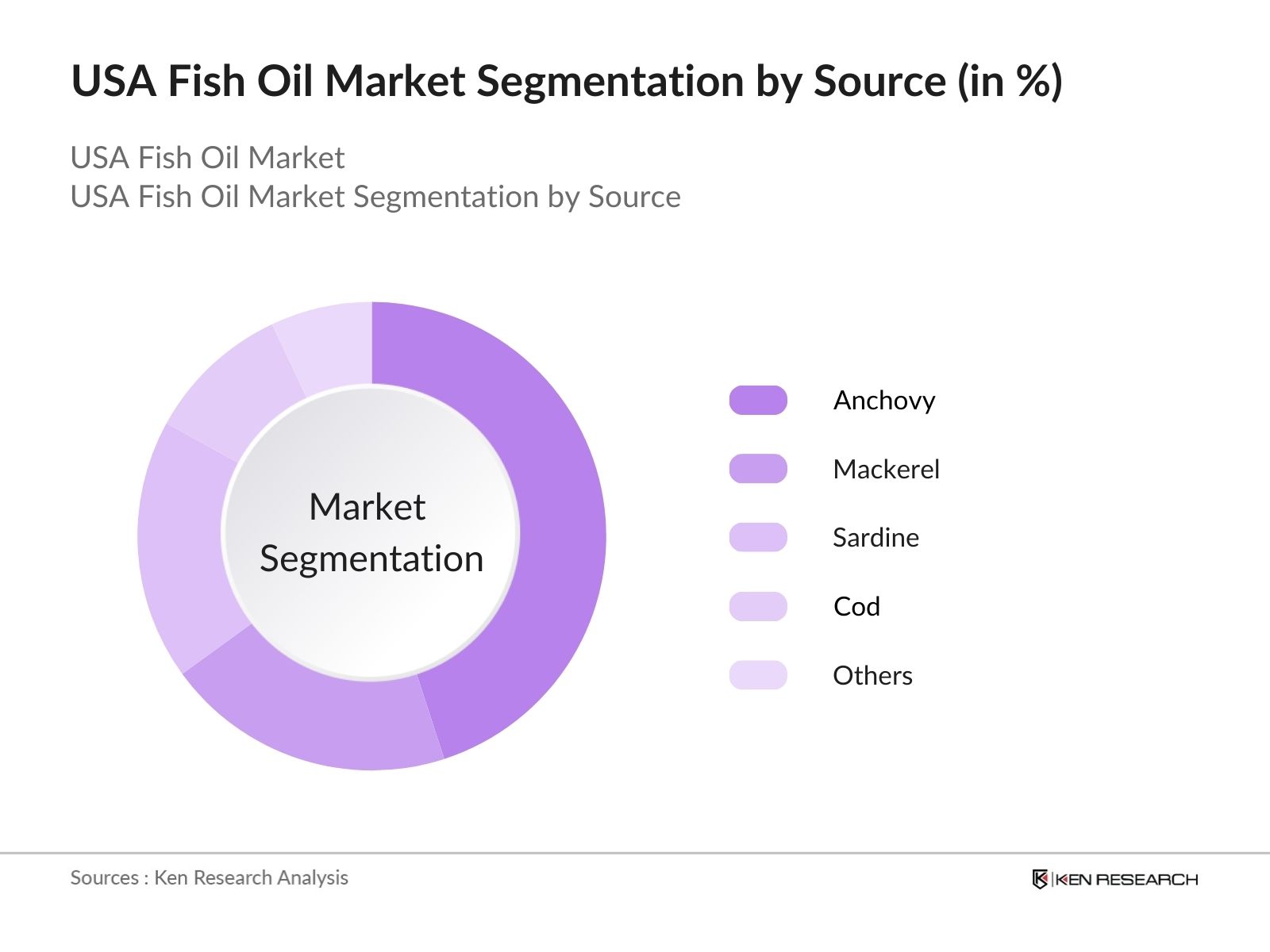

USA Fish Oil Market Segmentation

By Source: The USA fish oil market is segmented by source into anchovy, mackerel, sardine, cod, and others. Anchovy fish oil holds the dominant market share due to its high concentration of omega-3 fatty acids, particularly EPA and DHA, making it the preferred source for nutritional supplements. Anchovies are also relatively abundant and sustainable, with consistent catch volumes, further reinforcing their dominant position in the market.

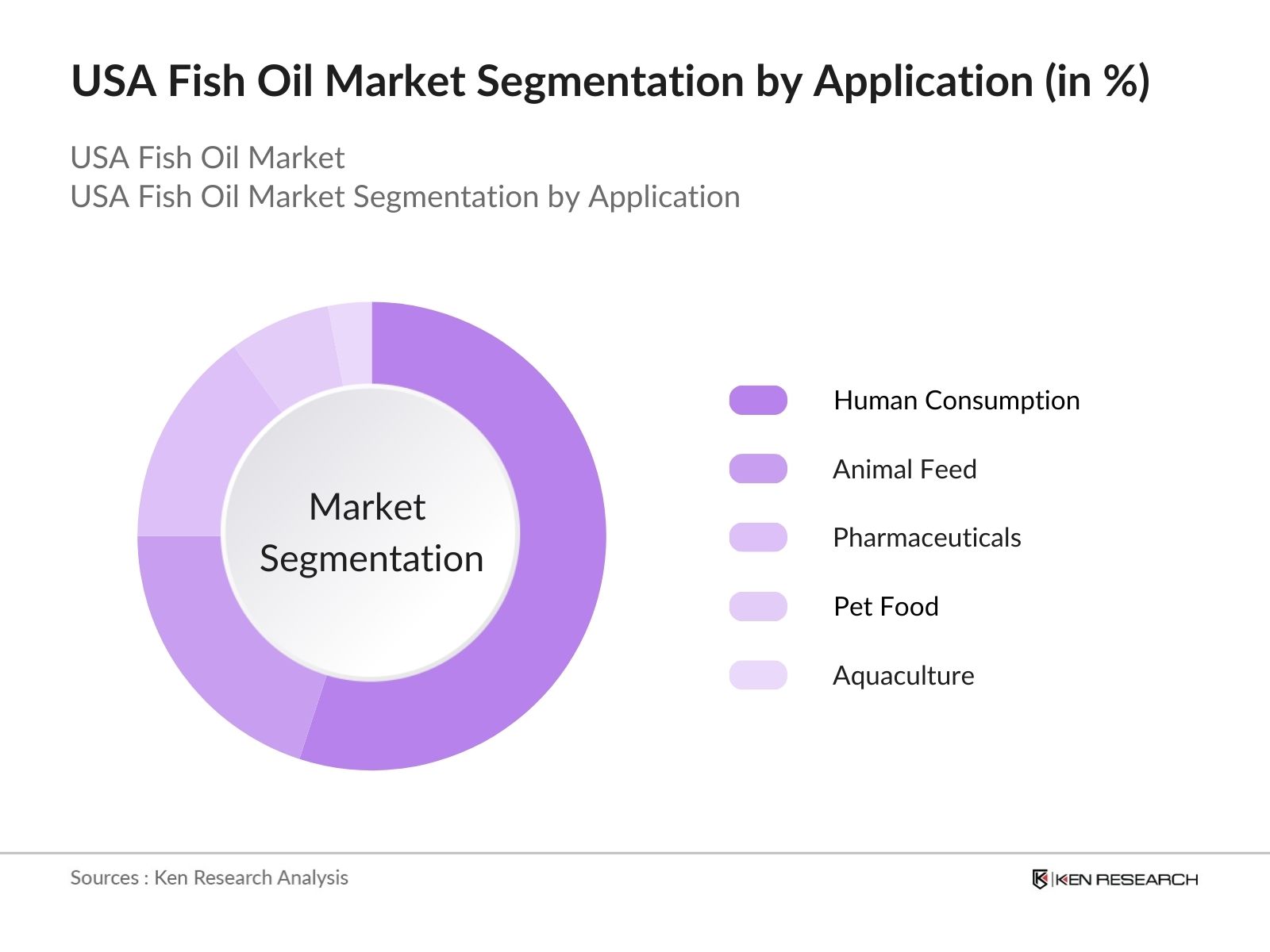

By Application: The market is segmented by application into human consumption, animal feed, pharmaceuticals, pet food, and aquaculture. The human consumption segment dominates the market, accounting for the largest share due to the increasing use of fish oil in dietary supplements, functional foods, and omega-3 fortified products. The rising prevalence of cardiovascular diseases and the growing interest in preventive healthcare are driving demand for fish oil in this segment.

USA Fish Oil Market Competitive Landscape

The USA fish oil market is moderately concentrated, with a mix of global and domestic players dominating the landscape. These companies engage in various strategies, including mergers and acquisitions, partnerships with fisheries, and investments in sustainable practices to secure their positions in the market.

|

Company |

Establishment Year |

Headquarters |

Omega-3 Concentration |

Sustainable Sourcing |

Production Capacity |

Global Reach |

R&D Investment |

Supply Chain Integration |

|

DSM Nutritional Products |

1902 |

Switzerland |

- | - | - | - | - | - |

|

Omega Protein Corporation |

1913 |

Texas, USA |

- | - | - | - | - | - |

|

BASF SE |

1865 |

Germany |

- | - | - | - | - | - |

|

Croda International Plc |

1925 |

UK |

- | - | - | - | - | - |

|

Cargill Inc. |

1865 |

Minnesota, USA |

- | - | - | - | - | - |

USA Fish Oil Market Analysis

Growth Drivers

- Rising Demand for Omega-3 Supplements: The increased consumption of omega-3 fatty acids for their health benefits is a primary driver for fish oil in the USA. In 2024, the US dietary supplement market is expected to see a significant boost in demand for fish oil due to its proven benefits in improving cardiovascular, brain, and joint health. The consumption of omega-3 supplements by adults and children alike is expected to exceed 55 million units across various product categories, driving the production of fish oil across the industry. The demand for fish oil-based omega-3 supplements is also being propelled by healthcare professionals advocating for its inclusion in daily dietary regimens.

- Growing Aquaculture Industry: The USA's aquaculture industry has seen significant growth, with over 600 million pounds of fish harvested in 2023 for fishmeal and fish oil production, supporting the increased need for quality fish oil. The rising global demand for farmed fish has led to a corresponding demand for fish oil, which is essential for feeding farmed species such as salmon. The U.S. aquaculture industry is contributing to a steady supply of fish oil, primarily from menhaden, herring, and anchovy fisheries. The industry's expansion aligns with national policies aimed at reducing overfishing while still meeting consumer demands.

- Increased Focus on Cardiovascular Health: Cardiovascular diseases are a leading cause of mortality in the USA, with over 650,000 deaths recorded in 2023. Fish oil, particularly its omega-3 components, is widely recognized for its cardiovascular benefits, including reducing cholesterol levels and preventing heart disease. With healthcare costs for cardiovascular treatment in the USA reaching $214 billion in 2023, preventative care through dietary supplements like fish oil has become increasingly prominent. The American Heart Association continues to promote omega-3-rich diets, leading to sustained growth in the fish oil market.

Market Challenges

- High Cost of Raw Materials The production of fish oil is significantly influenced by the rising costs associated with sourcing fish. In 2024, the average cost of fishing and processing fish oil-producing species such as menhaden and herring has increased due to stringent regulations and declining wild stocks. As fish oil is often harvested from wild fish species, the diminishing availability of fish and higher operational costs pose substantial challenges to manufacturers. These cost pressures have led to higher pricing for fish oil products, which could limit their accessibility in certain market segments.

- Environmental Concerns and Overfishing Regulations Environmental sustainability issues have become a prominent challenge for the fish oil market. In response to growing concerns over overfishing and the depletion of marine species, the U.S. government has imposed stricter fishing quotas. The National Oceanic and Atmospheric Administration (NOAA) reported that several species used for fish oil extraction, such as menhaden, are closely monitored to prevent overfishing. These regulations limit the quantity of fish oil that can be produced, creating supply-side challenges for the market.

USA Fish Oil Market Future Outlook

Over the next five years, the USA fish oil market is expected to grow steadily, driven by advancements in product formulations, sustainable sourcing practices, and increasing consumer awareness of omega-3 health benefits. The continuous expansion of the aquaculture industry, coupled with growing demand for dietary supplements and pharmaceuticals, will support the markets growth. Furthermore, investments in research and development to enhance the extraction and preservation of omega-3 fatty acids from fish oil will create new opportunities.

Market Opportunities

- Expansion in Functional Foods & Beverages Fish oils incorporation into functional foods and beverages presents a significant growth opportunity. The demand for fortified foods containing omega-3s is expanding rapidly, with an estimated market penetration of 60 million U.S. consumers in 2024. Several food manufacturers are incorporating fish oil into daily consumables like dairy products, snack bars, and beverages, offering health-conscious consumers more convenient ways to incorporate omega-3s into their diets. This trend is opening new distribution channels for fish oil producers.

- Investment in Sustainable Fisheries and Fish Oil Sources There is a growing investment in sustainable fishery practices, driven by consumer demand for eco-friendly products. In 2024, the USA has seen an influx of over $1 billion in investments targeting sustainable fishing practices and fish oil production, particularly in the Gulf of Mexico and the Pacific Northwest regions. These investments are focused on minimizing environmental impact and ensuring long-term viability of fish oil sources. This shift towards sustainable sourcing is expected to create stable opportunities for fish oil production while addressing environmental concerns.

Scope of the Report

|

By Source |

Anchovy Mackerel Sardine Cod Others |

|

By Application |

Human Consumption Animal Feed Pharmaceuticals Pet Food Aquaculture |

|

By Type |

EPA-DHA Fish Oil Regular Fish Oil Concentrated Fish Oil |

|

By Distribution Channel |

Online Sales Retail Stores Direct Sales |

|

By Region |

Northeast Midwest South West |

Products

Key Target Audience

Omega-3 Supplement Manufacturers

Aquaculture Industry Leaders

Nutraceutical Companies

Pharmaceutical Corporations

Animal Feed Producers

Pet Food Manufacturers

Investors and Venture Capitalist Firms

Government and Regulatory Bodies (FDA, USDA)

Companies

Players Mentioned in the Report:

DSM Nutritional Products

Omega Protein Corporation

BASF SE

Croda International Plc

Cargill Inc.

GC Rieber Oils

Archer Daniels Midland Company

Barleans Organic Oils

Marine Ingredients

Copeinca AS

Table of Contents

1. USA Fish Oil Market Overview

1.1 Definition and Scope

1.2 Market Taxonomy

1.3 Market Growth Rate (Driven by Human Nutrition, Animal Feed, Pharmaceuticals)

1.4 Market Segmentation Overview

2. USA Fish Oil Market Size (In USD Bn)

2.1 Historical Market Size

2.2 Year-On-Year Growth Analysis

2.3 Key Market Developments and Milestones (Regulatory Approvals, New Product Launches)

3. USA Fish Oil Market Analysis

3.1 Growth Drivers

3.1.1 Rising Demand for Omega-3 Supplements

3.1.2 Growing Aquaculture Industry

3.1.3 Increased Focus on Cardiovascular Health

3.1.4 Expanding Pet Food Sector (Market-specific)

3.2 Market Challenges

3.2.1 High Cost of Raw Materials (Fish Sourcing Costs)

3.2.2 Environmental Concerns and Overfishing Regulations

3.2.3 Limited Fish Oil Extraction Capacity

3.2.4 Consumer Awareness of Alternatives

3.3 Opportunities

3.3.1 Expansion in Functional Foods & Beverages

3.3.2 Investment in Sustainable Fisheries and Fish Oil Sources

3.3.3 Innovation in Encapsulation Technologies

3.3.4 Growth in Nutraceuticals (Market-specific)

3.4 Trends

3.4.1 Shift Toward Plant-Based Omega-3 Alternatives

3.4.2 Increasing Use of Fish Oil in Infant Formulas

3.4.3 Mergers and Acquisitions in the Fish Oil Industry

3.4.4 Development of Pharmaceutical-Grade Fish Oils (Market-specific)

3.5 Government Regulation

3.5.1 FDA Regulations for Fish Oil Supplements

3.5.2 Sustainable Fisheries Act and Impacts on Sourcing

3.5.3 USDA Certification Requirements for Fish Oil Products

3.5.4 US Dietary Guidelines and Omega-3 Consumption

3.6 SWOT Analysis

3.7 Stakeholder Ecosystem

3.8 Porters Five Forces (Supplier Bargaining Power, Consumer Trends, Regulatory Impact)

3.9 Competition Ecosystem

4. USA Fish Oil Market Segmentation

4.1 By Source (In Value %)

4.1.1 Anchovy

4.1.2 Mackerel

4.1.3 Sardine

4.1.4 Cod

4.1.5 Others

4.2 By Application (In Value %)

4.2.1 Human Consumption

4.2.2 Animal Feed

4.2.3 Pharmaceuticals

4.2.4 Pet Food

4.2.5 Aquaculture

4.3 By Type (In Value %)

4.3.1 EPA-DHA Fish Oil

4.3.2 Regular Fish Oil

4.3.3 Concentrated Fish Oil

4.4 By Distribution Channel (In Value %)

4.4.1 Online Sales

4.4.2 Retail Stores

4.4.3 Direct Sales

4.5 By Region (In Value %)

4.5.1 Northeast

4.5.2 Midwest

4.5.3 South

4.5.4 West

5. USA Fish Oil Market Competitive Analysis

5.1 Detailed Profiles of Major Companies

5.1.1 DSM Nutritional Products

5.1.2 Croda International Plc

5.1.3 Omega Protein Corporation

5.1.4 BASF SE

5.1.5 Cargill Inc.

5.1.6 GC Rieber Oils

5.1.7 Archer Daniels Midland Company

5.1.8 Barleans Organic Oils

5.1.9 Marine Ingredients

5.1.10 Copeinca AS

5.1.11 TASA Fish Oil

5.1.12 Pesquera Diamante S.A.

5.1.13 FMC Corporation

5.1.14 Colpex International S.A.

5.1.15 TripleNine Group

5.2 Cross Comparison Parameters (Revenue, Fish Oil Capacity, Market Share, Key Products)

5.3 Market Share Analysis

5.4 Strategic Initiatives

5.5 Mergers and Acquisitions

5.6 Investment Analysis

5.7 Venture Capital Funding

5.8 Government Grants

5.9 Private Equity Investments

6. USA Fish Oil Market Regulatory Framework

6.1 FDA Compliance for Dietary Supplements

6.2 Sustainability Standards for Fisheries

6.3 Certification Processes (MSC Certification, IFFO RS)

6.4 Trade Tariffs and Import/Export Policies

7. USA Fish Oil Future Market Size (In USD Bn)

7.1 Future Market Size Projections

7.2 Key Factors Driving Future Market Growth

8. USA Fish Oil Future Market Segmentation

8.1 By Source (In Value %)

8.2 By Application (In Value %)

8.3 By Type (In Value %)

8.4 By Distribution Channel (In Value %)

8.5 By Region (In Value %)

9. USA Fish Oil Market Analysts Recommendations

9.1 TAM/SAM/SOM Analysis

9.2 Customer Cohort Analysis

9.3 Marketing Initiatives

9.4 White Space Opportunity Analysis

Research Methodology

Step 1: Identification of Key Variables

The first step involves defining the key variables influencing the USA Fish Oil Market, including product sourcing, consumer trends, and government regulations. This stage is backed by desk research and industry reports to establish a foundational understanding of market drivers.

Step 2: Market Analysis and Construction

In this step, historical market data is analyzed to understand the trends and drivers of the fish oil market. Key factors such as production capacity, fish species used, and demand across applications are considered to build a robust market framework.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses are validated through interviews with industry experts, including fishery operators, fish oil manufacturers, and distributors. These consultations provide insights into industry challenges and future growth opportunities.

Step 4: Research Synthesis and Final Output

The final step integrates all gathered data to present a comprehensive report. This includes validation through direct engagement with stakeholders to ensure accuracy and reliability in market estimates and trends.

Frequently Asked Questions

1. How big is the USA Fish Oil Market?

The USA fish oil market is valued at USD 725 million, driven by strong demand for omega-3 supplements and the expansion of the aquaculture industry.

2. What are the challenges in the USA Fish Oil Market?

Key challenges in the USA fish oil market include high raw material costs due to environmental regulations, concerns over overfishing, and competition from plant-based alternatives like algae oil.

3. Who are the major players in the USA Fish Oil Market?

Major players in the USA fish oil market include DSM Nutritional Products, Omega Protein Corporation, BASF SE, and Croda International Plc. These companies dominate due to their strong sourcing and manufacturing capabilities.

4. What are the growth drivers of the USA Fish Oil Market?

Growth drivers in the USA fish oil market include increasing consumer awareness of the health benefits of omega-3, rising demand in the nutraceutical and pharmaceutical sectors, and advancements in sustainable fishing practices.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.