USA Fitness & Exercise Equipment Market Outlook to 2030

Region:North America

Author(s):Sanjna

Product Code:KROD11249

November 2024

85

About the Report

USA Fitness & Exercise Equipment Market Overview

- The USA fitness and exercise equipment market, valued at USD 3.5 billion, reflects substantial growth due to increased consumer awareness about health and fitness, coupled with a growing preference for home-based workout solutions. This growth trajectory is further fueled by the expansion of digital fitness platforms and the integration of technology in equipment, such as smart connected devices, which enhance the user experience and encourage sustained engagement in fitness activities.

- Major metropolitan areas, including Los Angeles, New York City, and Chicago, drive the USA fitness and exercise equipment market due to high urban populations, a strong emphasis on wellness, and advanced gym facilities. These cities are known for their high concentration of fitness centers, strong consumer spending power, and a culture that prioritizes health and fitness. This combination supports robust demand for advanced equipment and innovative fitness solutions in both commercial and residential sectors.

- Trade policies and import tariffs impact U.S. fitness equipment costs, particularly for equipment sourced from Asia, which makes up about 50% of U.S. imports. Recent tariff increases add approximately 15% to equipment costs, affecting pricing for retailers and consumers alike. This cost pressure emphasizes the need for local manufacturing solutions or alternative sourcing strategies to mitigate tariff impacts, shaping future industry responses to global trade policies.

USA Fitness & Exercise Equipment Market Segmentation

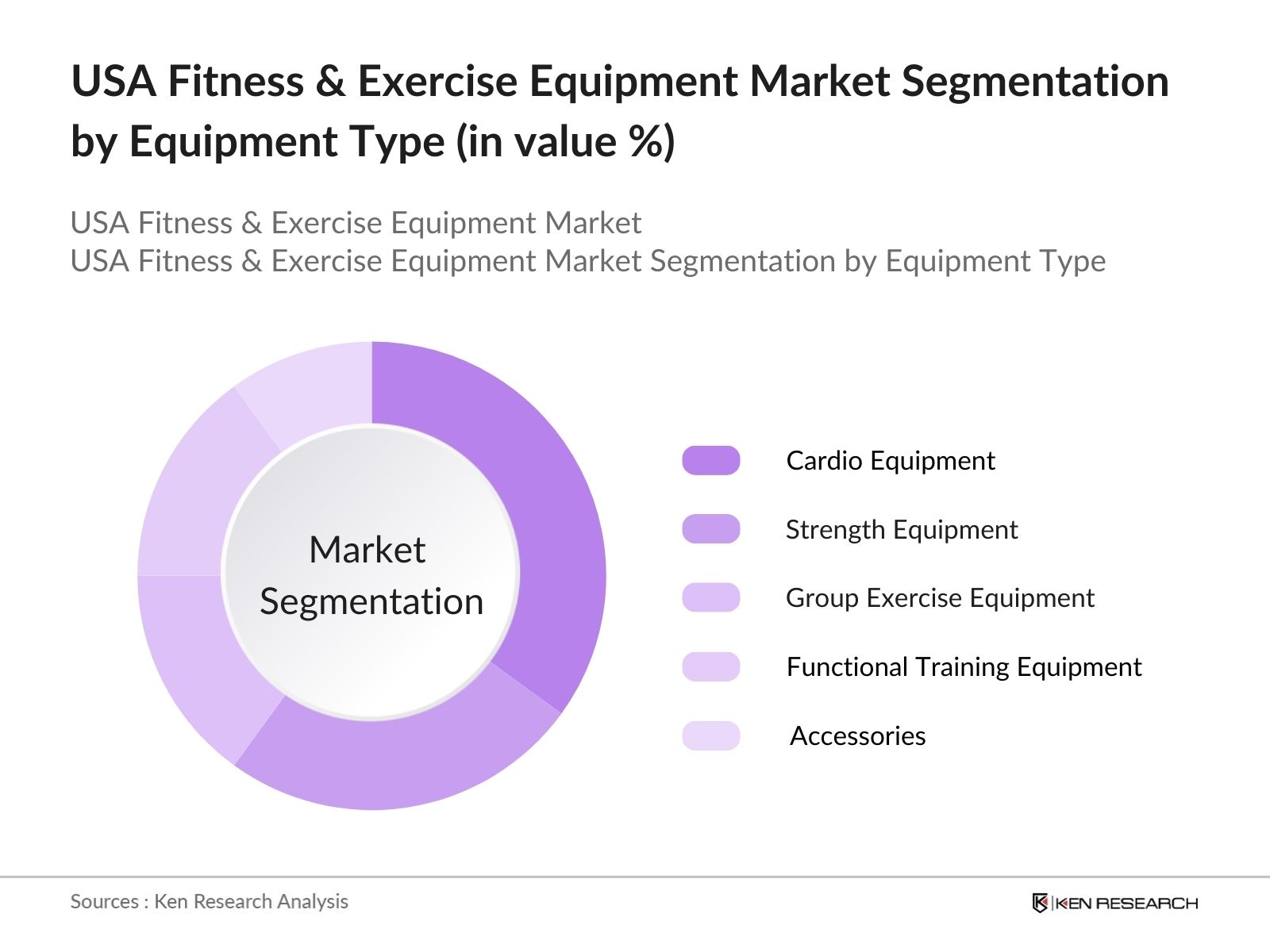

By Equipment Type: The USA fitness equipment market is segmented by equipment type into cardio equipment, strength equipment, group exercise equipment, functional training equipment, and accessories. Cardio equipment, such as treadmills and stationary bikes, holds the dominant market share within this segmentation due to the broad range of applications across home gyms, commercial facilities, and rehabilitation centers. Consumers favor cardio equipment for its diverse features, including connectivity options that sync with health apps, and advancements that support cardiovascular health, weight management, and overall fitness.

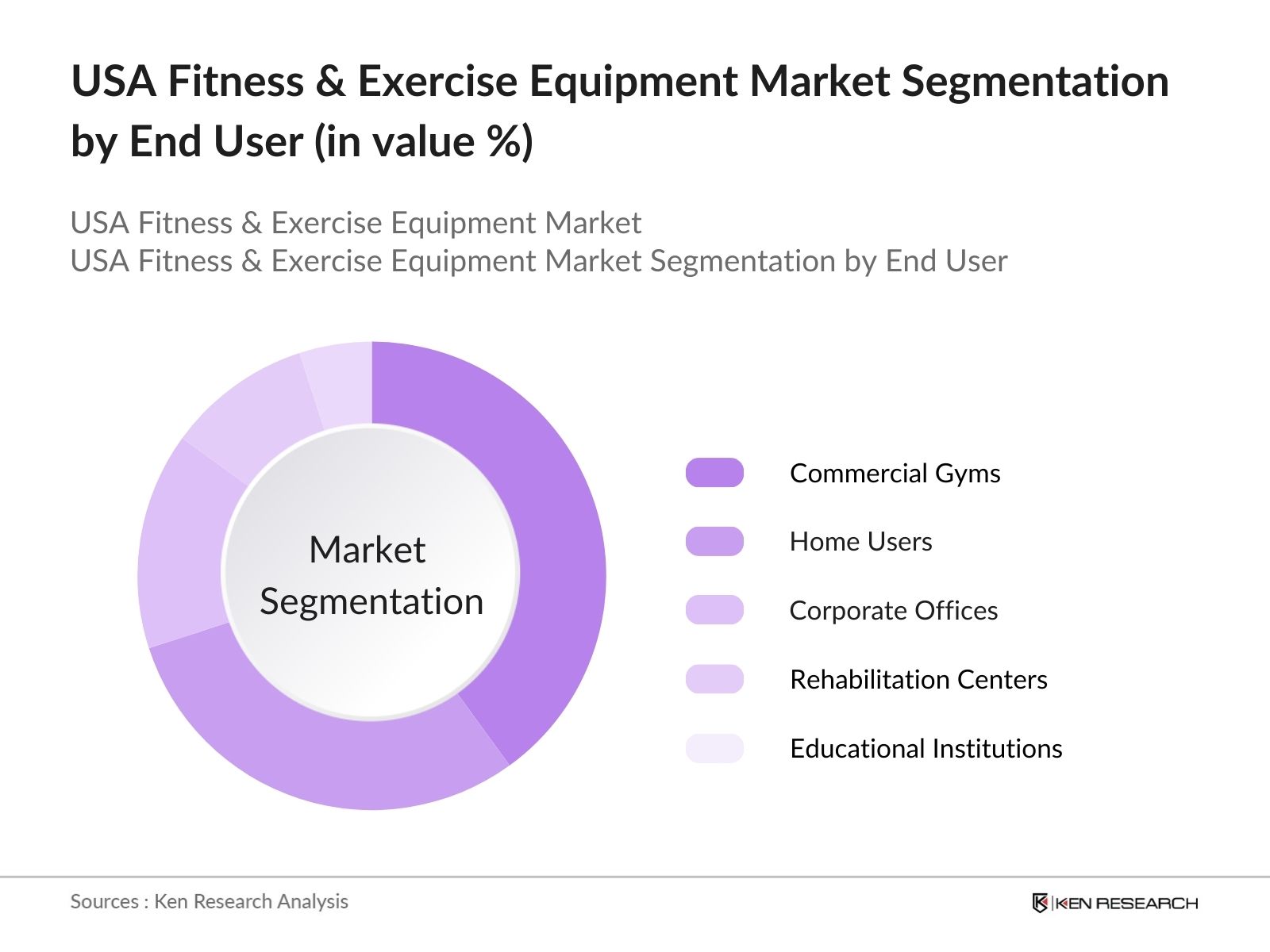

By End User: The USA fitness and exercise equipment market is categorized by end users into commercial gyms and fitness centers, home users, corporate offices, rehabilitation centers, and educational institutions. Commercial gyms and fitness centers dominate this segment due to their large customer bases and high demand for a variety of equipment types, particularly as they aim to differentiate through premium offerings, like smart-connected and digital fitness solutions. The demand is further driven by gym chains expanding their presence and corporate wellness programs gaining traction.

By End User: The USA fitness and exercise equipment market is categorized by end users into commercial gyms and fitness centers, home users, corporate offices, rehabilitation centers, and educational institutions. Commercial gyms and fitness centers dominate this segment due to their large customer bases and high demand for a variety of equipment types, particularly as they aim to differentiate through premium offerings, like smart-connected and digital fitness solutions. The demand is further driven by gym chains expanding their presence and corporate wellness programs gaining traction.

USA Fitness & Exercise Equipment Market Competitive Landscape

The USA fitness and exercise equipment market is shaped by leading players, including both domestic and international brands that emphasize technological advancements, customer engagement, and brand positioning. The competition is intense, with established companies like Nautilus, Inc. and ICON Health & Fitness, Inc. playing crucial roles in shaping market trends.

|

Company |

Establishment Year |

Headquarters |

Market Presence |

Technology Integration |

Revenue (USD) |

Employees |

Sustainability Initiatives |

|---|---|---|---|---|---|---|---|

|

Nautilus, Inc. |

1986 |

Vancouver, WA, USA |

- |

- |

- |

- |

- |

|

ICON Health & Fitness, Inc. |

1977 |

Logan, UT, USA |

- |

- |

- |

- |

- |

|

Life Fitness |

1968 |

Rosemont, IL, USA |

- |

- |

- |

- |

- |

|

Technogym |

1983 |

Cesena, Italy |

- |

- |

- |

- |

- |

|

Precor (Peloton Interactive) |

1980 |

Woodinville, WA, USA |

- |

- |

- |

- |

- |

USA Fitness & Exercise Equipment Market Analysis

Growth Drivers

- Increasing Health Awareness: Heightened awareness around preventive health in the U.S. has shifted consumer focus to regular exercise and well-being management. Lifestyle diseases like heart issues and obesity remain significant health challenges, prompting an estimated 21 million U.S. adults to incorporate fitness into their routines, often supported by wearables and personalized health-tracking tools. Health agencies report a growing trend in health-conscious behavior as individuals increasingly prioritize long-term well-being over appearance, impacting demand for fitness equipment.

- Rising Gym Membership Rates: The U.S. gym and fitness center industry has been experiencing steady growth, with membership levels reaching around 64 million in 2023. This trend has remained robust due to increasing demand for fitness services and group training, as people return to in-person workouts. Gyms that offer specialized classes and personalized training options are particularly popular. Rising median incomes and a renewed focus on health post-pandemic further support gym participation, making memberships a staple of urban health-conscious living.

- Home Fitness Equipment Demand: Demand for home fitness equipment surged with lifestyle shifts, and it remains a key market component as consumers prioritize at-home exercise options. Over 15 million U.S. households now include at least one piece of home fitness equipment, including cardio and strength training machines. Home fitness setups allow users flexibility and privacy, especially among the 2544 age group, who are most likely to invest in home gym products. Rising household expenditure on health and wellness products reflects a broader macroeconomic trend favoring home-based fitness solutions, supporting consistent demand for fitness equipment.

Challenges

- High Initial Setup Costs: Setting up commercial and home fitness facilities involves substantial initial investments, with commercial-grade equipment often exceeding $5,000 per unit. High setup costs are especially challenging for smaller fitness businesses and emerging players. Financial data indicates that fitness facilities allocate a significant portion of initial capital towards equipment purchases, a factor that has limited growth in lower-income communities and rural regions.

- Space Constraints in Urban Areas: Urban areas, where 82% of Americans live, present spatial challenges for fitness setups. High real estate costs and limited square footage in densely populated areas restrict gym expansions and affect residential buyers looking for compact home gym solutions. The average living space per person in metropolitan regions has reduced, making compact, foldable fitness equipment a critical area of demand. This constraint emphasizes the need for flexible equipment options tailored to smaller living spaces, particularly for urban consumers interested in home-based fitness solutions.

USA Fitness & Exercise Equipment Market Future Outlook

USA fitness and exercise equipment market is anticipated to experience sustained growth driven by increasing consumer demand for personalized fitness solutions, the integration of AI and IoT in fitness equipment, and a rising inclination toward home fitness. Growth is further propelled by partnerships between tech companies and fitness brands aiming to deliver interactive and gamified workout experiences.

Market Opportunities

- Growing Online Fitness Market: Online fitness platforms offer a significant growth opportunity, with over 25 million Americans regularly utilizing digital fitness services. The trend toward on-demand workouts, remote classes, and virtual training provides a convenient and flexible alternative to traditional gyms, particularly appealing to younger demographics and remote workers. Improved digital infrastructure supports this shift, as more households invest in virtual fitness subscriptions.

- Integration with Smart Home Ecosystems: Smart home ecosystem integration presents a promising avenue for growth. Approximately 54% of U.S. homes now incorporate smart devices, creating demand for fitness equipment compatible with these systems. Smart equipment allows users to track and customize workouts, blending convenience with personalization, making home-based exercise more interactive and effective. This opportunity aligns with the increasing adoption of IoT-enabled devices in American households, facilitating a connected fitness experience that complements other smart home features.

Scope of the Report

|

Segment |

Sub-Segments |

|

Equipment Type |

Cardio Equipment Strength Equipment Group Exercise Equipment Functional Training Equipment Accessories and Miscellaneous |

|

End User |

Commercial Gyms and Fitness Centers Home Users Corporate Offices and Hotels Rehabilitation Centers Schools and Universities |

|

Sales Channel |

Direct Sales E-commerce Specialty Retailers Large Retail Chains |

|

Technology Integration |

Smart/Connected Equipment Non-Smart Equipment |

|

Region |

Northeast Midwest South West |

Products

Key Target Audience

Commercial Gym Chains

Corporate Wellness Program Providers

Home Fitness Equipment Retailers

Digital Fitness and Health App Developers

Healthcare and Rehabilitation Centers

Educational Institutions with Gym Facilities

Investors and Venture Capitalist Firms

Government and Regulatory Bodies (e.g., U.S. Consumer Product Safety Commission)

Companies

Players Mentioned in the Report

Nautilus, Inc.

ICON Health & Fitness, Inc.

Life Fitness (Brunswick Corporation)

Technogym

Precor (Peloton Interactive)

Johnson Health Tech Co., Ltd.

Rogue Fitness

Bowflex

Matrix Fitness

Tonal Systems, Inc.

Table of Contents

1. USA Fitness & Exercise Equipment Market Overview

1.1 Definition and Scope

1.2 Market Taxonomy

1.3 Market Growth Rate

1.4 Market Segmentation Overview

2. USA Fitness & Exercise Equipment Market Size (In USD Million)

2.1 Historical Market Size

2.2 Year-on-Year Growth Analysis

2.3 Key Market Developments and Milestones

3. USA Fitness & Exercise Equipment Market Analysis

3.1 Growth Drivers

3.1.1 Increasing Health Awareness

3.1.2 Rising Gym Membership Rates

3.1.3 Home Fitness Equipment Demand

3.1.4 Technological Innovations

3.2 Market Challenges

3.2.1 High Initial Setup Costs

3.2.2 Space Constraints in Urban Areas

3.2.3 Equipment Maintenance Costs

3.3 Opportunities

3.3.1 Growing Online Fitness Market

3.3.2 Integration with Smart Home Ecosystems

3.3.3 Expansion into Small Gyms and Corporate Wellness Programs

3.4 Trends

3.4.1 Demand for Connected Fitness Equipment

3.4.2 Rise of Compact and Space-Saving Designs

3.4.3 Subscription-based Fitness Models

3.5 Government Regulations

3.5.1 Import Tariffs and Trade Policies

3.5.2 Safety Standards for Fitness Equipment

3.6 SWOT Analysis

3.7 Stakeholder Ecosystem

3.8 Porters Five Forces

3.9 Competitive Landscape

4. USA Fitness & Exercise Equipment Market Segmentation

4.1 By Equipment Type (In Value %)

4.1.1 Cardio Equipment

4.1.2 Strength Equipment

4.1.3 Group Exercise Equipment

4.1.4 Functional Training Equipment

4.1.5 Accessories and Miscellaneous

4.2 By End User (In Value %)

4.2.1 Commercial Gyms and Fitness Centers

4.2.2 Home Users

4.2.3 Corporate Offices and Hotels

4.2.4 Rehabilitation Centers

4.2.5 Schools and Universities

4.3 By Sales Channel (In Value %)

4.3.1 Direct Sales

4.3.2 E-commerce

4.3.3 Specialty Retailers

4.3.4 Large Retail Chains

4.4 By Technology Integration (In Value %)

4.4.1 Smart/Connected Equipment

4.4.2 Non-Smart Equipment

4.5 By Region (In Value %)

4.5.1 Northeast

4.5.2 Midwest

4.5.3 South

4.5.4 West

5. USA Fitness & Exercise Equipment Market Competitive Analysis

5.1 Detailed Profiles of Major Companies

5.1.1 Nautilus, Inc.

5.1.2 ICON Health & Fitness, Inc.

5.1.3 Life Fitness (Brunswick Corporation)

5.1.4 Precor (Peloton Interactive)

5.1.5 Technogym

5.1.6 Johnson Health Tech Co., Ltd.

5.1.7 Rogue Fitness

5.1.8 Bowflex

5.1.9 Matrix Fitness

5.1.10 Tonal Systems, Inc.

5.2 Cross Comparison Parameters (Product Range, Market Position, Revenue, Technological Integration, Distribution Network, Customer Base, Brand Value, Sustainability Initiatives)

5.3 Market Share Analysis

5.4 Strategic Initiatives

5.5 Mergers and Acquisitions

5.6 Investment Analysis

5.7 Venture Capital Funding

5.8 Government Grants

5.9 Private Equity Investments

6. USA Fitness & Exercise Equipment Market Regulatory Framework

6.1 Equipment Safety and Testing Standards

6.2 Import and Trade Regulations

6.3 Certification Requirements

6.4 Tax Incentives for Health and Wellness

7. USA Fitness & Exercise Equipment Future Market Size (In USD Million)

7.1 Future Market Size Projections

7.2 Key Factors Driving Future Market Growth

8. USA Fitness & Exercise Equipment Future Market Segmentation

8.1 By Equipment Type (In Value %)

8.2 By End User (In Value %)

8.3 By Sales Channel (In Value %)

8.4 By Technology Integration (In Value %)

8.5 By Region (In Value %)

9. USA Fitness & Exercise Equipment Market Analysts Recommendations

9.1 TAM/SAM/SOM Analysis

9.2 Customer Cohort Analysis

9.3 Marketing Initiatives

9.4 White Space Opportunity Analysis

Research Methodology

Step 1: Identification of Key Variables

The research process begins with a detailed mapping of the USA fitness equipment ecosystem, analyzing key stakeholders, including manufacturers, distributors, and end-users. Primary data sources such as government databases and secondary sources provide foundational insights into the industry.

Step 2: Market Analysis and Construction

Historical data on fitness equipment adoption, gym memberships, and home fitness preferences are collected and analyzed to form revenue estimates. This includes examining market penetration trends and average equipment lifespans across end-user segments.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses are developed and validated through expert consultations with executives and practitioners in the fitness equipment industry. This is done through structured interviews to gain insights into operational, financial, and strategic aspects that influence the market.

Step 4: Research Synthesis and Final Output

In the final phase, we engage directly with major equipment manufacturers to refine data on segment-specific growth and consumer preferences. This approach verifies the insights gathered and ensures the output is comprehensive and accurate.

Frequently Asked Questions

01. How big is the USA Fitness & Exercise Equipment Market?

The USA fitness and exercise equipment market is valued at USD 3.5 billion, driven by factors like increasing consumer health awareness and a preference for home-based fitness solutions.

02. What are the challenges in the USA Fitness & Exercise Equipment Market?

USA fitness and exercise equipment market faces challenges such as high initial setup costs for commercial fitness centers, space constraints in urban homes, and regular maintenance requirements that add to overall costs.

03. Who are the major players in the USA Fitness & Exercise Equipment Market?

Key players in USA fitness and exercise equipment include Nautilus, Inc., ICON Health & Fitness, Inc., Life Fitness, Technogym, and Precor, all of which have a strong market presence and are known for integrating advanced technology in their product lines.

04. What are the growth drivers in the USA Fitness & Exercise Equipment Market?

Growth drivers in USA fitness and exercise equipment include the increasing popularity of digital fitness solutions, rising health consciousness, and the expansion of wellness programs in the corporate sector, contributing to the demand for quality fitness equipment.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.