USA Fleet Management Market Outlook to 2030

Region:North America

Author(s):Samanyu

Product Code:KROD5032

October 2024

91

About the Report

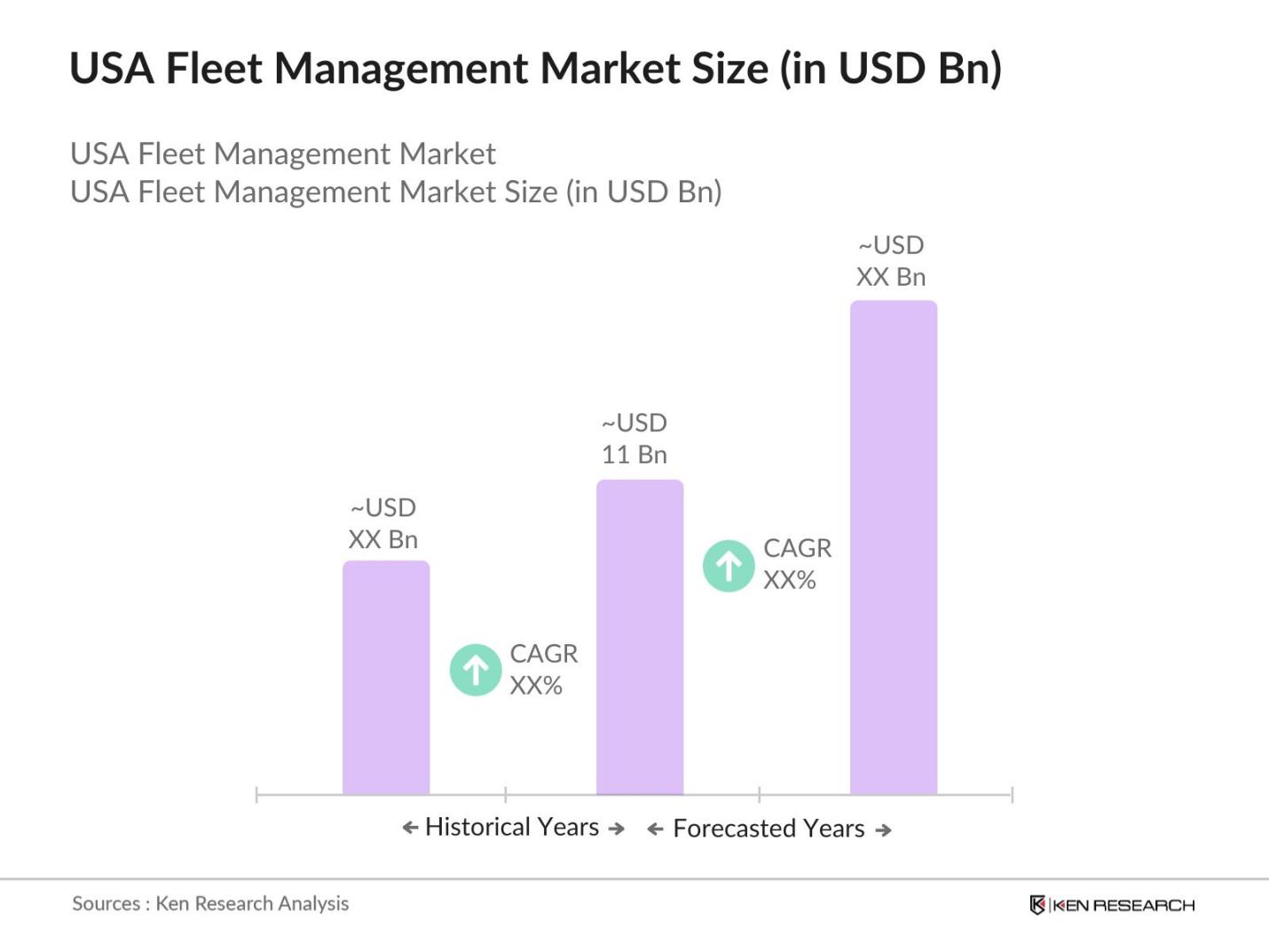

USA Fleet Management Market Overview

- The USA Fleet Management market is valued at USD 11 Bn, driven by the growing need for efficient vehicle management across various industries. Key factors fueling the market's growth include advancements in IoT and telematics, which enable real-time vehicle tracking and analytics. The increasing adoption of electric vehicles (EVs) within corporate fleets and regulatory mandates concerning vehicle safety and emissions are also contributing to the market's expansion. With the continuous rise in fuel costs, businesses are increasingly looking for technologies that optimize fuel usage, vehicle maintenance, and overall fleet productivity.

- In the USA fleet management market, regions like California and Texas dominate due to their vast transportation networks, significant commercial vehicle usage, and proactive adoption of advanced technologies. Californias leadership in environmental policies, such as mandates for zero-emission vehicles, positions it as a key market player. Meanwhile, Texas benefits from its large logistics and oil and gas industries, which rely heavily on commercial vehicle fleets for day-to-day operations.

- Corporate Average Fuel Economy (CAFE) standards are key in promoting fuel efficiency across fleets in the U.S. As of 2024, CAFE standards require a fleet-wide average of 49 miles per gallon for passenger vehicles. These regulations drive fleet operators to invest in fuel-efficient technologies and telematics systems to track and optimize fuel consumption. Non-compliance with CAFE standards can result in fines of up to $14 for each 0.1 miles per gallon below the required target. Fleet management systems are vital in helping operators meet these fuel efficiency standards.

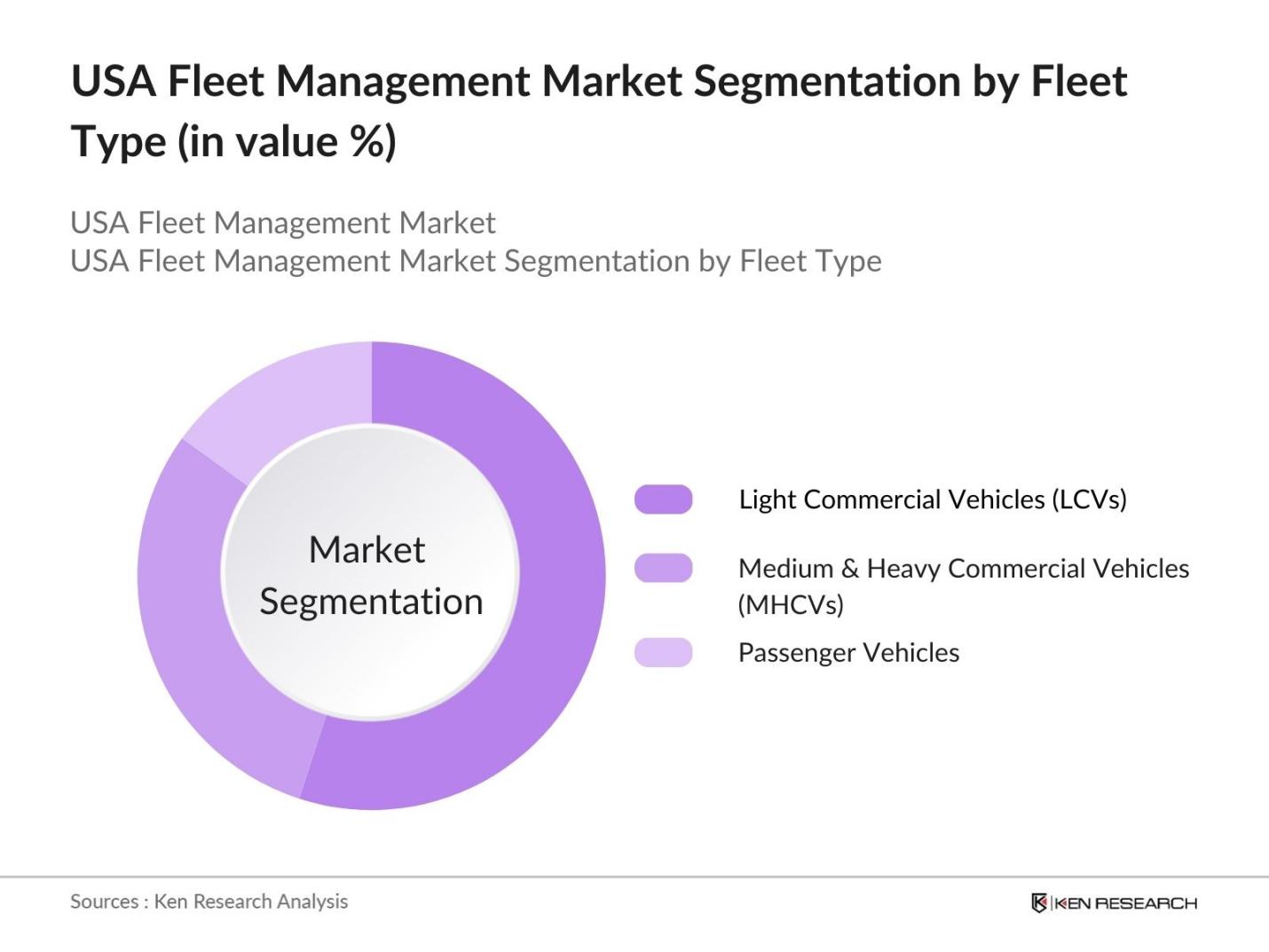

USA Fleet Management Market Segmentation

By Fleet Type: The market is segmented by fleet type into light commercial vehicles (LCVs), medium & heavy commercial vehicles (MHCVs), and passenger vehicles. Among these, light commercial vehicles dominate the fleet type segment due to their widespread use in delivery services, particularly for e-commerce companies. With the rise in online shopping, businesses like Amazon and UPS heavily rely on fleets of LCVs to ensure timely delivery of goods. Additionally, the cost-effectiveness and versatility of LCVs make them a preferred option for fleet operators in various sectors, driving their market dominance.

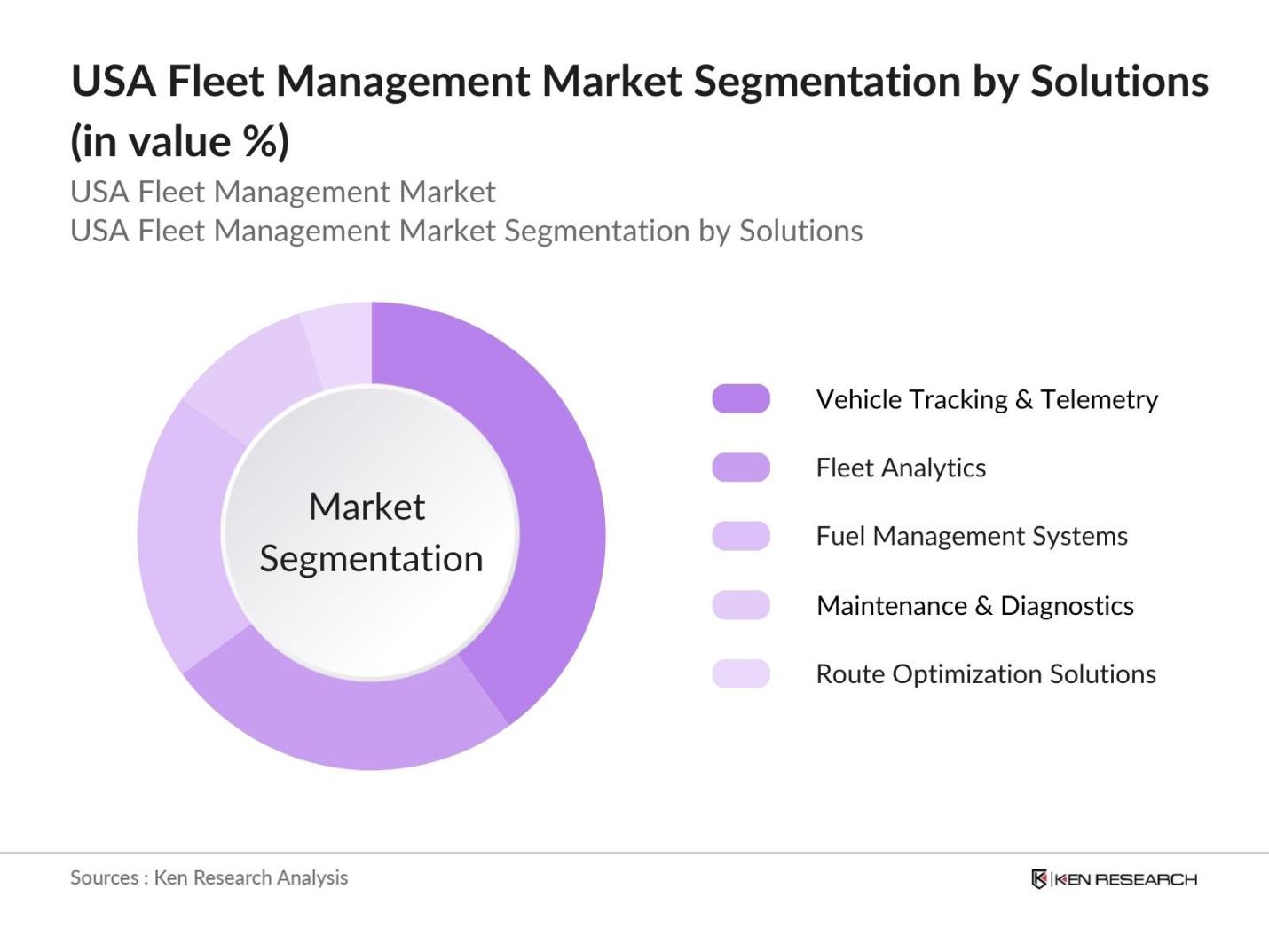

By Solutions: The market is also segmented by solutions, which include fleet analytics, vehicle tracking & telemetry, fuel management systems, maintenance & diagnostics, and route optimization solutions. Vehicle tracking and telemetry solutions hold the largest market share, driven by their critical role in improving fleet efficiency, ensuring driver safety, and reducing operational costs. These solutions allow fleet operators to track real-time vehicle location, monitor driver behavior, and optimize routes, which in turn reduces fuel consumption and enhances overall productivity. The adoption of telematics is also being pushed by regulatory compliance, such as the ELD mandate in the USA.

USA Fleet Management Market Competitive Landscape

The USA fleet management market is dominated by a mix of established global companies and emerging domestic players. The competitive landscape shows consolidation, with key players investing heavily in technology development and strategic partnerships. Companies like Verizon Connect, Trimble Inc., and Geotab Inc. lead the market, driven by their innovative solutions and established customer base. The markets competitive nature also sees frequent mergers and acquisitions as companies aim to expand their solution portfolios and gain market share.

|

Company Name |

Establishment Year |

Headquarters |

Revenue (2023) |

Employees |

Key Services |

Fleet Size |

Recent Investments |

Market Presence |

|

Verizon Connect |

2006 |

USA |

||||||

|

Geotab Inc. |

2000 |

Canada |

||||||

|

Trimble Inc. |

1978 |

USA |

||||||

|

Omnitracs LLC |

1988 |

USA |

||||||

|

Samsara Inc. |

2015 |

USA |

USA Fleet Management Industry Analysis

Growth Drivers

-

Increasing Demand for Fleet Efficiency and Fuel Management: The rising cost of fuel, according to world bank, crude oil prices fluctuating between $80 to $100 per barrel in 2024, has prompted fleet managers to prioritize fuel efficiency. Fleet management systems help optimize routes and monitor driver behavior, reducing fuel consumption by up to 15%. With transportation contributing 29% of total U.S. greenhouse gas emissions (EPA, 2023), the demand for fleet management solutions that enhance fuel efficiency is growing. The implementation of these systems can save fleet operators millions of dollars annually, making them crucial in controlling operational costs.

- Government Regulations and Safety Compliance: The Federal Motor Carrier Safety Administration (FMCSA) mandates the use of electronic logging devices (ELDs) for all commercial vehicles to monitor hours of service (HOS) compliance, affecting over 3.5 million trucks and 1.5 million bus drivers across the United States. Non-compliance can result in fines up to $10,000 per violation, pushing fleet operators to adopt fleet management systems. Additionally, the push for safer road conditions and reduced fatigue-related accidents has made fleet telematics indispensable in helping companies meet regulatory requirements while avoiding hefty penalties.

- Adoption of Electric Vehicles (EVs): According to International Energy Agency with over 2 million electric vehicles registered in the U.S. as of 2023,fleet operators are increasingly integrating EVs to reduce emissions and lower long-term fuel costs. Fleet management platforms assist in monitoring EV performance, optimizing charging schedules, and managing total cost of ownership (TCO). The Biden administration's target to electrify 50% of new vehicles sold by 2030 has further accelerated this trend, providing significant growth opportunities for EV-centric fleet management solutions in the immediate term.

Market Challenges

-

High Initial Setup Costs: The upfront investment in fleet management systems, including telematics hardware and software, can exceed $300 to $1,200 per vehicle, according to industry averages. This high setup cost, especially for small to medium enterprises managing limited fleets, has been a notable restraint. Despite potential long-term savings, the initial expenditure creates barriers to adoption, particularly for smaller fleet operators struggling with cash flow in a post-pandemic economy. Capital-intensive industries such as logistics and public transportation face challenges in justifying these expenditures without immediate ROI.

- Complexity in Integration with Existing Systems: Many fleet operators face challenges in integrating new fleet management software with legacy systems. Integration issues can lead to operational inefficiencies and costly disruptions. About 60% of fleet operators reported difficulties in achieving seamless integration between telematics systems and existing ERP or CRM platforms (FMCSA). These technical barriers can slow down adoption rates, especially for companies hesitant to overhaul established IT infrastructures. The cost of downtime due to integration failures is estimated to reach several hundred thousand dollars for large-scale fleets.

USA Fleet Management Market Future Outlook

The USA fleet management market is expected to experience substantial growth over the next five years, primarily driven by technological advancements, regulatory support, and increasing demand for operational efficiency. The continued rise in fuel costs, coupled with stringent emission regulations, will push fleet operators to adopt more advanced fleet management solutions. Moreover, the growing adoption of electric and autonomous vehicles within fleets will also present new opportunities for market players. Telematics and AI-based analytics are expected to play a critical role in reshaping fleet management practices in the near future.

Future Market Opportunities

-

Increased Penetration of Cloud-Based Fleet Management: According to U.S. Census Bureau cloud computing is revolutionizing fleet management with over 90% of businesses in the U.S. adopting cloud-based solutions in 2023. The benefits of real-time data access, enhanced scalability, and cost-effectiveness make cloud-based fleet management a highly attractive option. Companies utilizing cloud services can reduce their IT infrastructure costs by 30%, while also benefiting from enhanced data storage capabilities and cybersecurity protections. As more organizations transition from on-premise to cloud-based systems, this shift will create significant opportunities for providers offering tailored fleet solutions.

- Growing Adoption of AI and Data Analytics: In 2023, it was estimated that 55% of large-scale fleet operators in the U.S. had adopted AI-driven fleet management tools (Forrester). These tools enable fleet operators to process vast amounts of data, predict maintenance needs, and improve overall performance. Predictive analytics has reduced vehicle downtime by 20% and extended vehicle life cycles, resulting in millions of dollars in cost savings for large fleets. The increasing sophistication of AI models offers future growth opportunities for fleet management providers, particularly in optimizing operations and reducing unplanned maintenance.

Scope of the Report

|

By Fleet Type |

Light Commercial Vehicles (LCV) Medium & Heavy Commercial Vehicles (MHCV) Passenger Vehicles |

|

By Industry |

Transportation & Logistics Retail & E-commerce Construction & Manufacturing Utilities Oil & Gas |

|

By Deployment Model |

On-Premise Cloud-Based |

|

By Solutions |

Fleet Analytics Vehicle Tracking & Telemetry Fuel Management Systems Maintenance & Diagnostics Route Optimization Solutions |

|

By Region |

North East South West |

Products

Key Target Audience

Fleet Operators and Managers

Automotive OEMs

Fleet Management Solution Providers

Transportation & Logistics Companies

Banks and Financial Institutes

Government and Regulatory Bodies (FMCSA, DOT)

Fuel Management System Providers

Investments and Venture Capitalist Firms

Telematics & IoT Technology Providers

Companies

Players Mentioned in the Report:

Verizon Connect

Geotab Inc.

Trimble Inc.

Omnitracs LLC

Samsara Inc.

Wheels, Inc.

ARI Fleet Management

Element Fleet Management Corp.

Motive Technologies

AT&T Fleet Complete

FleetCor Technologies

Donlen Corporation

LeasePlan USA

Teletrac Navman

Azuga Fleet

Table of Contents

1. USA Fleet Management Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy (Fleet Solutions, Services, and Software)

1.3. Market Growth Rate (CAGR and Market Size)

1.4. Market Segmentation Overview (Based on Fleet Type, Industry, Deployment Model, Solutions, Services)

2. USA Fleet Management Market Size (In USD Bn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis (Y-o-Y Growth for Each Segment)

2.3. Key Market Developments and Milestones (New Technological Integrations, EV Adoption in Fleets, Automation)

3. USA Fleet Management Market Analysis

3.1. Growth Drivers

3.1.1. Increasing Demand for Fleet Efficiency and Fuel Management

3.1.2. Government Regulations and Safety Compliance (ELD Mandates, HOS Regulations)

3.1.3. Adoption of Electric Vehicles (EVs)

3.1.4. Advancements in IoT and Telematics

3.2. Restraints

3.2.1. High Initial Setup Costs

3.2.2. Complexity in Integration with Existing Systems

3.2.3. Cybersecurity Risks

3.3. Opportunities

3.3.1. Increased Penetration of Cloud-Based Fleet Management

3.3.2. Strategic Partnerships for Autonomous Vehicles

3.3.3. Growing Adoption of AI and Data Analytics

3.4. Trends

3.4.1. Use of Predictive Maintenance

3.4.2. Expansion of Vehicle-as-a-Service (VaaS) Models

3.4.3. Evolution of Mobility-as-a-Service (MaaS)

3.5. Government Regulation

3.5.1. FMCSA Regulations

3.5.2. ELD Mandates

3.5.3. Corporate Average Fuel Economy (CAFE) Standards

3.5.4. Tax Incentives for EV Fleets

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem (Fleet Operators, Service Providers, Solution Vendors, End Customers)

3.8. Porters Five Forces (Supplier Power, Buyer Power, Threat of New Entrants, Threat of Substitutes, Competitive Rivalry)

3.9. Competition Ecosystem (Fleet Management Software Providers, Hardware Suppliers, OEM Integrations)

4. USA Fleet Management Market Segmentation

4.1. By Fleet Type (In Value %)

4.1.1. Light Commercial Vehicles (LCV)

4.1.2. Medium & Heavy Commercial Vehicles (MHCV)

4.1.3. Passenger Vehicles

4.2. By Industry (In Value %)

4.2.1. Transportation & Logistics

4.2.2. Retail & E-commerce

4.2.3. Construction & Manufacturing

4.2.4. Utilities

4.2.5. Oil & Gas

4.3. By Deployment Model (In Value %)

4.3.1. On-Premise

4.3.2. Cloud-Based

4.4. By Solutions (In Value %)

4.4.1. Fleet Analytics

4.4.2. Vehicle Tracking & Telemetry

4.4.3. Fuel Management Systems

4.4.4. Maintenance & Diagnostics

4.4.5. Route Optimization Solutions

4.5. By Region (In Value %)

4.5.1. North

4.5.2. East

4.5.3. South

4.5.4. West

5. USA Fleet Management Market Competitive Analysis

5.1. Detailed Profiles of Major Competitors

5.1.1. Verizon Connect

5.1.2. Geotab Inc.

5.1.3. Trimble Inc.

5.1.4. Teletrac Navman

5.1.5. Samsara Inc.

5.1.6. Wheels, Inc.

5.1.7. Element Fleet Management Corp.

5.1.8. ARI Fleet Management

5.1.9. Donlen Corporation

5.1.10. OBnitracs LLC

5.1.11. LeasePlan USA

5.1.12. Motive Technologies (formerly KeepTruckin)

5.1.13. AT&T Fleet Complete

5.1.14. FleetCor Technologies

5.1.15. Azuga Fleet

5.2. Cross Comparison Parameters (Revenue, Fleet Size, Technology Stack, Headquarters, Fleet Solutions Portfolio)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis (Private Equity, Venture Capital)

5.7. Partnerships and Collaborations

5.8. New Product Launches

6. USA Fleet Management Market Regulatory Framework

6.1. Environmental Standards for Fleet Operations (Emissions Standards)

6.2. Compliance Requirements (Data Privacy, Cybersecurity)

6.3. Certification Processes (ISO Certifications, FMCSA Certifications)

7. USA Fleet Management Future Market Size (In USD Bn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth (Autonomous Vehicle Integration, Smart City Initiatives)

8. USA Fleet Management Future Market Segmentation

8.1. By Fleet Type (In Value %)

8.2. By Industry (In Value %)

8.3. By Deployment Model (In Value %)

8.4. By Solutions (In Value %)

8.5. By Region (In Value %)

9. USA Fleet Management Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Fleet Management ROI Analysis

9.3. Emerging Business Models (Vehicle Subscription Services, Fleet Sharing Models)

9.4. White Space Opportunity Analysis

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

The initial stage involved identifying key stakeholders within the USA fleet management ecosystem. This included fleet operators, technology providers, and regulatory bodies. Extensive desk research and secondary databases were utilized to collect relevant data on market dynamics and operational variables.

Step 2: Market Analysis and Construction

In this step, historical market data, including fleet penetration and industry growth trends, were analyzed. Metrics like vehicle maintenance, fuel consumption, and driver safety were examined to ensure the accuracy of market sizing and revenue projections.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses were developed based on the collected data and validated through interviews with industry professionals from fleet management companies. These consultations provided practical insights, helping to refine and corroborate the gathered information.

Step 4: Research Synthesis and Final Output

The final step involved synthesizing the research data through direct engagement with fleet solution providers. The objective was to verify key market statistics and ensure a comprehensive and accurate analysis of the USA fleet management market.

Frequently Asked Questions

01. How big is the USA Fleet Management Market?

The USA fleet management market is valued at USD 11 Bn, driven by the increasing demand for efficient vehicle tracking, fuel management, and real-time data analytics.

02. What are the challenges in the USA Fleet Management Market?

Challenges in USA fleet management market include high upfront costs for adopting advanced fleet management systems, integration complexities with existing legacy systems, and increasing concerns over data privacy and cybersecurity.

03. Who are the major players in the USA Fleet Management Market?

Key players in USA fleet management market include Verizon Connect, Geotab Inc., Trimble Inc., Omnitracs LLC, and Samsara Inc., all of which dominate due to their innovative technologies and wide customer base.

04. What are the growth drivers of the USA Fleet Management Market?

The USA fleet management market is propelled by the rising need for fuel-efficient vehicles, government regulations on vehicle safety and emissions, and the growing use of telematics and IoT technologies for fleet optimization.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.