USA Food Color Market Outlook to 2030

Region:North America

Author(s):Shreya Garg

Product Code:KROD3417

December 2024

86

About the Report

USA Food Color Market Overview

- The USA food color market, valued at USD 480 million, is driven by the increasing demand for visually appealing food products. This growth is propelled by consumer preferences for natural and synthetic colorants that enhance the aesthetic appeal of food and beverages. The expansion of the processed food industry and technological advancements in color extraction further contribute to market growth.

- Major cities such as New York, Los Angeles, and Chicago dominate the market due to their large populations and diverse food industries. These urban centers have a high concentration of food manufacturers and consumers seeking innovative and attractive food products, leading to a higher demand for food colorants.

- The U.S. Food and Drug Administration (FDA) regulates food color additives under the Federal Food, Drug, and Cosmetic Act. Manufacturers must obtain FDA approval for new color additives, demonstrating safety through scientific data. The FDA maintains a list of approved color additives, specifying permissible uses and restrictions. For example, in 2023, the FDA approved the use of spirulina extract as a color additive in certain confectioneries, reflecting the agency's role in ensuring the safety of food colors.

USA Food Color Market Segmentation

By Type: The market is segmented by type into natural colors, synthetic colors, nature-identical colors, and caramel colors. Natural colors hold a dominant market share due to the growing consumer preference for clean-label products and health consciousness. Derived from plant and animal sources, natural colors are perceived as safer and healthier alternatives to synthetic counterparts, driving their widespread adoption in the food industry.

By Application: The market is further segmented by application into beverages, bakery and confectionery, dairy products, meat products, and processed foods. The beverages segment leads the market, attributed to the extensive use of food colors in soft drinks, energy drinks, and flavored beverages. The need for vibrant and appealing colors in beverages to attract consumers contributes significantly to this segment's dominance.

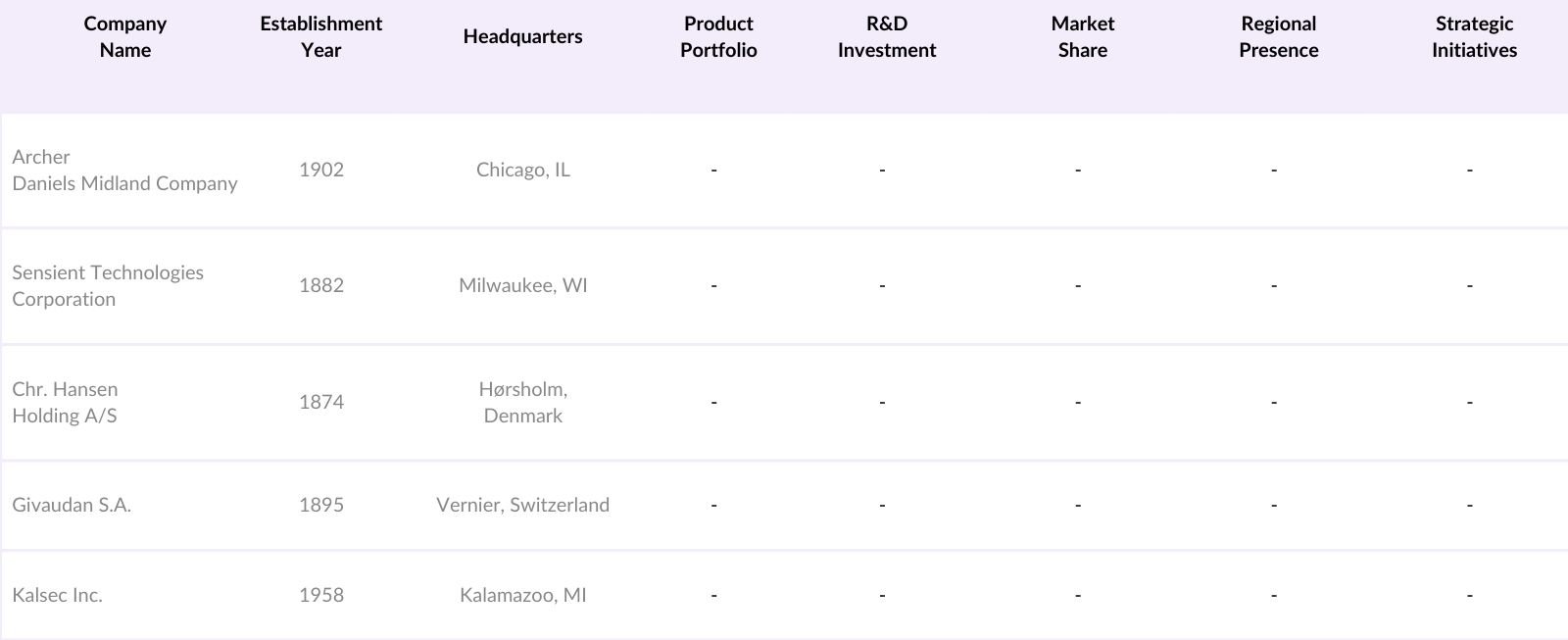

USA Food Color Market Competitive Landscape

The USA food color market is characterized by the presence of several key players, including Archer Daniels Midland Company, Sensient Technologies Corporation, Chr. Hansen Holding A/S, Givaudan S.A., and Kalsec Inc. These companies have established strong market positions through extensive product portfolios, strategic acquisitions, and continuous innovation. Their dominance is further reinforced by robust distribution networks and a focus on natural and sustainable color solutions.

USA Food Color Industry Analysis

Growth Drivers

- Increasing Demand for Natural Food Colors: In the United States, consumer preference is shifting towards natural food colors due to health concerns associated with synthetic additives. A 2023 survey by the International Food Information Council found that 63% of U.S. consumers prefer natural ingredients in their food products. This trend is driving manufacturers to replace artificial colors with natural alternatives derived from plant and animal sources. The U.S. Department of Agriculture reports that the organic food sector, which often utilizes natural colorants, reached $62 billion in sales in 2023, reflecting a growing market for naturally colored products.

- Expansion of Processed Food Industry: The U.S. processed food industry is experiencing significant growth, contributing to the increased use of food colors to enhance product appeal. According to the U.S. Census Bureau, the value of shipments for the food manufacturing sector was approximately $800 billion in 2023, up from $750 billion in 2022. This expansion necessitates the use of food colorants to maintain product consistency and attractiveness across a wide range of processed foods.

- Technological Advancements in Color Extraction: Advancements in extraction technologies have improved the efficiency and cost-effectiveness of producing natural food colors. Innovations such as supercritical fluid extraction and microencapsulation have enhanced the stability and vibrancy of natural colorants. The U.S. Food and Drug Administration (FDA) has approved several new natural color additives in recent years, reflecting the industry's commitment to adopting advanced technologies for safer and more appealing food products.

Market Challenges

- High Costs of Natural Colorants: Natural food colorants often involve higher production costs compared to synthetic alternatives. Factors such as raw material availability, extraction processes, and stability issues contribute to these costs. For example, the production of carmine, a natural red colorant derived from cochineal insects, is labor-intensive and costly, leading to higher prices for manufacturers and consumers. This cost disparity can deter some manufacturers from adopting natural colorants, despite consumer demand.

- Stability and Shelf-life Issues: Natural colorants are often less stable than synthetic ones, leading to challenges in maintaining color consistency and product shelf life. Factors such as pH, temperature, and light exposure can cause natural colors to degrade over time. For instance, anthocyanins, commonly used for red and purple hues, are sensitive to pH changes and can lose their color intensity in certain food matrices. This instability necessitates additional formulation adjustments, increasing production complexity and costs.

USA Food Color Market Future Outlook

Over the next five years, the USA food color market is expected to experience significant growth, driven by the increasing consumer demand for natural and clean-label products. Advancements in extraction technologies and the development of stable natural colorants will further propel market expansion. Additionally, the growing trend of plant-based and functional foods is anticipated to create new opportunities for food color manufacturers.

Future Market Opportunities

- Innovation in Plant-Based Colorants: The growing plant-based food sector offers opportunities for developing new natural colorants. Innovations in extracting pigments from sources like spirulina, turmeric, and beetroot are providing vibrant and stable colors suitable for various applications. The Plant Based Foods Association reported that U.S. retail sales of plant-based foods reached $7.4 billion in 2023, indicating a robust market for plant-derived colorants.

- Expansion into Organic and Clean Label Products: The demand for organic and clean label products is rising, creating opportunities for natural food colorants. The Organic Trade Association reported that U.S. organic food sales were $62 billion in 2023, reflecting consumer preference for products free from synthetic additives. Manufacturers are increasingly reformulating products to meet clean label standards, which often involve replacing artificial colors with natural alternatives.

Scope of the Report

|

Type |

Natural Colors |

|

Application |

Beverages |

|

Form |

Liquid |

|

Solubility |

Water-Soluble |

|

Source |

Plant-Based |

Products

Key Target Audience

Food and Beverage Manufacturers

Natural Colorant Suppliers

Synthetic Colorant Producers

Food Processing Companies

Regulatory Bodies (e.g., U.S. Food and Drug Administration)

Research and Development Institutes

Investor and Venture Capitalist Firms

Government and Regulatory Bodies (e.g., U.S. Department of Agriculture)

Companies

Major Players

Archer Daniels Midland Company

Sensient Technologies Corporation

Chr. Hansen Holding A/S

Givaudan S.A.

Kalsec Inc.

Dhler Group

D.D. Williamson & Co., Inc.

Koninklijke DSM N.V.

Naturex S.A.

Roha Dyechem Pvt. Ltd.

FMC Corporation

Fiorio Colori S.p.A.

GNT Group B.V.

San-Ei Gen F.F.I., Inc.

Symrise AG

Table of Contents

USA Food Color Market Overview

1.1 Definition and Scope

1.2 Market Taxonomy

1.3 Market Growth Rate

1.4 Market Segmentation Overview

USA Food Color Market Size (In USD Billion)

2.1 Historical Market Size

2.2 Year-On-Year Growth Analysis

2.3 Key Market Developments and Milestones

USA Food Color Market Analysis

3.1 Growth Drivers

3.1.1 Increasing Demand for Natural Food Colors

3.1.2 Expansion of Processed Food Industry

3.1.3 Technological Advancements in Color Extraction

3.1.4 Rising Consumer Awareness of Food Aesthetics

3.2 Market Challenges

3.2.1 Regulatory Compliance and Approvals

3.2.2 High Costs of Natural Colorants

3.2.3 Stability and Shelf-life Issues

3.3 Opportunities

3.3.1 Innovation in Plant-Based Colorants

3.3.2 Expansion into Organic and Clean Label Products

3.3.3 Growth in Functional Foods and Beverages

3.4 Trends

3.4.1 Shift Towards Natural and Organic Colors

3.4.2 Adoption of Microbial Fermentation for Color Production

3.4.3 Use of Food Colors in Plant-Based Meat Alternatives

3.5 Government Regulation

3.5.1 FDA Guidelines on Food Additives

3.5.2 Labeling Requirements for Artificial Colors

3.5.3 Impact of the Food Safety Modernization Act (FSMA)

3.6 SWOT Analysis

3.7 Stakeholder Ecosystem

3.8 Porters Five Forces Analysis

3.9 Competitive Landscape

USA Food Color Market Segmentation

4.1 By Type (In Value %)

4.1.1 Natural Colors

4.1.2 Synthetic Colors

4.1.3 Nature-Identical Colors

4.1.4 Caramel Colors

4.2 By Application (In Value %)

4.2.1 Beverages

4.2.2 Bakery and Confectionery

4.2.3 Dairy Products

4.2.4 Meat Products

4.2.5 Processed Foods

4.3 By Form (In Value %)

4.3.1 Liquid

4.3.2 Powder

4.3.3 Gel

4.3.4 Emulsion

4.4 By Solubility (In Value %)

4.4.1 Water-Soluble

4.4.2 Oil-Soluble

4.5 By Source (In Value %)

4.5.1 Plant-Based

4.5.2 Animal-Based

4.5.3 Mineral-Based

4.5.4 Microbial-Based

USA Food Color Market Competitive Analysis

5.1 Detailed Profiles of Major Companies

5.1.1 Archer Daniels Midland Company

5.1.2 Sensient Technologies Corporation

5.1.3 Chr. Hansen Holding A/S

5.1.4 Givaudan S.A.

5.1.5 Kalsec Inc.

5.1.6 Dhler Group

5.1.7 D.D. Williamson & Co., Inc.

5.1.8 Koninklijke DSM N.V.

5.1.9 Naturex S.A.

5.1.10 Roha Dyechem Pvt. Ltd.

5.1.11 FMC Corporation

5.1.12 Fiorio Colori S.p.A.

5.1.13 GNT Group B.V.

5.1.14 San-Ei Gen F.F.I., Inc.

5.1.15 Symrise AG

5.2 Cross Comparison Parameters (Revenue, Market Share, Product Portfolio, R&D Investment, Regional Presence, Strategic Initiatives, Production Capacity, Sustainability Practices)

5.3 Market Share Analysis

5.4 Strategic Initiatives

5.5 Mergers and Acquisitions

5.6 Investment Analysis

5.7 Venture Capital Funding

5.8 Government Grants

5.9 Private Equity Investments

USA Food Color Market Regulatory Framework

6.1 FDA Approval Processes

6.2 Compliance Requirements

6.3 Certification Processes

USA Food Color Future Market Size (In USD Billion)

7.1 Future Market Size Projections

7.2 Key Factors Driving Future Market Growth

USA Food Color Future Market Segmentation

8.1 By Type (In Value %)

8.2 By Application (In Value %)

8.3 By Form (In Value %)

8.4 By Solubility (In Value %)

8.5 By Source (In Value %)

USA Food Color Market Analysts Recommendations

9.1 Total Addressable Market (TAM), Serviceable Available Market (SAM), Serviceable Obtainable Market (SOM) Analysis

9.2 Customer Cohort Analysis

9.3 Marketing Initiatives

9.4 White Space Opportunity Analysis

Disclaimer

Contact Us

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves constructing an ecosystem map encompassing all major stakeholders within the USA Food Color Market. This step is underpinned by extensive desk research, utilizing a combination of secondary and proprietary databases to gather comprehensive industry-level information. The primary objective is to identify and define the critical variables that influence market dynamics.

Step 2: Market Analysis and Construction

In this phase, we compile and analyze historical data pertaining to the USA Food Color Market. This includes assessing market penetration, the ratio of marketplaces to service providers, and the resultant revenue generation. Furthermore, an evaluation of service quality statistics is conducted to ensure the reliability and accuracy of the revenue estimates.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses are developed and subsequently validated through computer-assisted telephone interviews (CATIs) with industry experts representing a diverse array of companies. These consultations provide valuable operational and financial insights directly from industry practitioners, which are instrumental in refining and corroborating the market data.

Step 4: Research Synthesis and Final Output

The final phase involves direct engagement with multiple food color manufacturers to acquire detailed insights into product segments, sales performance, consumer preferences, and other pertinent factors. This interaction serves to verify and complement the statistics derived from the bottom-up approach, thereby ensuring a comprehensive, accurate, and validated analysis of the USA Food Color Market.

Frequently Asked Questions

01 How big is the USA Food Color Market?

The USA food color market, valued at USD 480 million, is driven by a surge in demand for natural and synthetic food colors that enhance food and beverage appeal. This valuation is based on a robust five-year historical analysis, indicating sustained growth in the industry.

02 What are the challenges in the USA Food Color Market?

Challenges in the market include regulatory compliance requirements, high costs associated with natural color production, and stability issues of certain colorants. Additionally, maintaining quality across synthetic and natural colorants remains complex due to varying regulatory standards.

03 Who are the major players in the USA Food Color Market?

Key players in this market include Archer Daniels Midland Company, Sensient Technologies Corporation, Chr. Hansen Holding A/S, Givaudan S.A., and Kalsec Inc. These companies are known for their strong product portfolios, extensive distribution networks, and commitment to sustainability.

04 What drives the USA Food Color Market?

The market is propelled by growing consumer awareness of natural ingredients, the expansion of the processed food sector, and advancements in extraction technologies. The increasing preference for clean-label products further fuels demand for natural colorants.

05 Which applications dominate the USA Food Color Market?

The beverages segment holds a significant share of the market, driven by the need for vibrant colors in sodas, juices, and flavored drinks. This dominance is due to the high consumer demand for visually appealing and flavorful beverages.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.