USA Food & Grocery Retail Market Outlook to 2030

Region:North America

Author(s):Sanjna

Product Code:KROD11279

November 2024

92

About the Report

USA Food & Grocery Retail Market Overview

- The USA Food & Grocery Retail Market is valued at USD 800 billion, based on a five-year historical analysis, largely driven by shifts in consumer habits and the increasing appeal of convenience through online grocery services. With the demand for organic and health-conscious options rising, supermarkets and online retail channels have adapted, incorporating extensive health-focused inventories. Notably, the surge in e-commerce and efficient home delivery models by major retailers has intensified market dynamics, catering to evolving consumer needs for convenience and variety.

- Major cities like New York, Los Angeles, and Chicago dominate the market due to high population densities and a well-established retail infrastructure that supports large grocery chains, local markets, and innovative distribution channels. These cities serve as primary hubs for grocery demand, driven by urban lifestyle preferences that favor accessible retail options and an increasing adoption of digital grocery shopping platforms by consumers seeking convenience.

- The FDA has tightened food safety standards to ensure product quality across the retail sector. In 2024, the FDA conducted over 20,000 inspections across grocery chains, reflecting an increased focus on consumer safety. The implementation of digital tracking systems, mandated for stores with annual sales exceeding $1 million, helps identify contamination sources within an average of 5 hours, reducing health risks and improving compliance. These regulations bolster consumer trust and emphasize quality assurance.

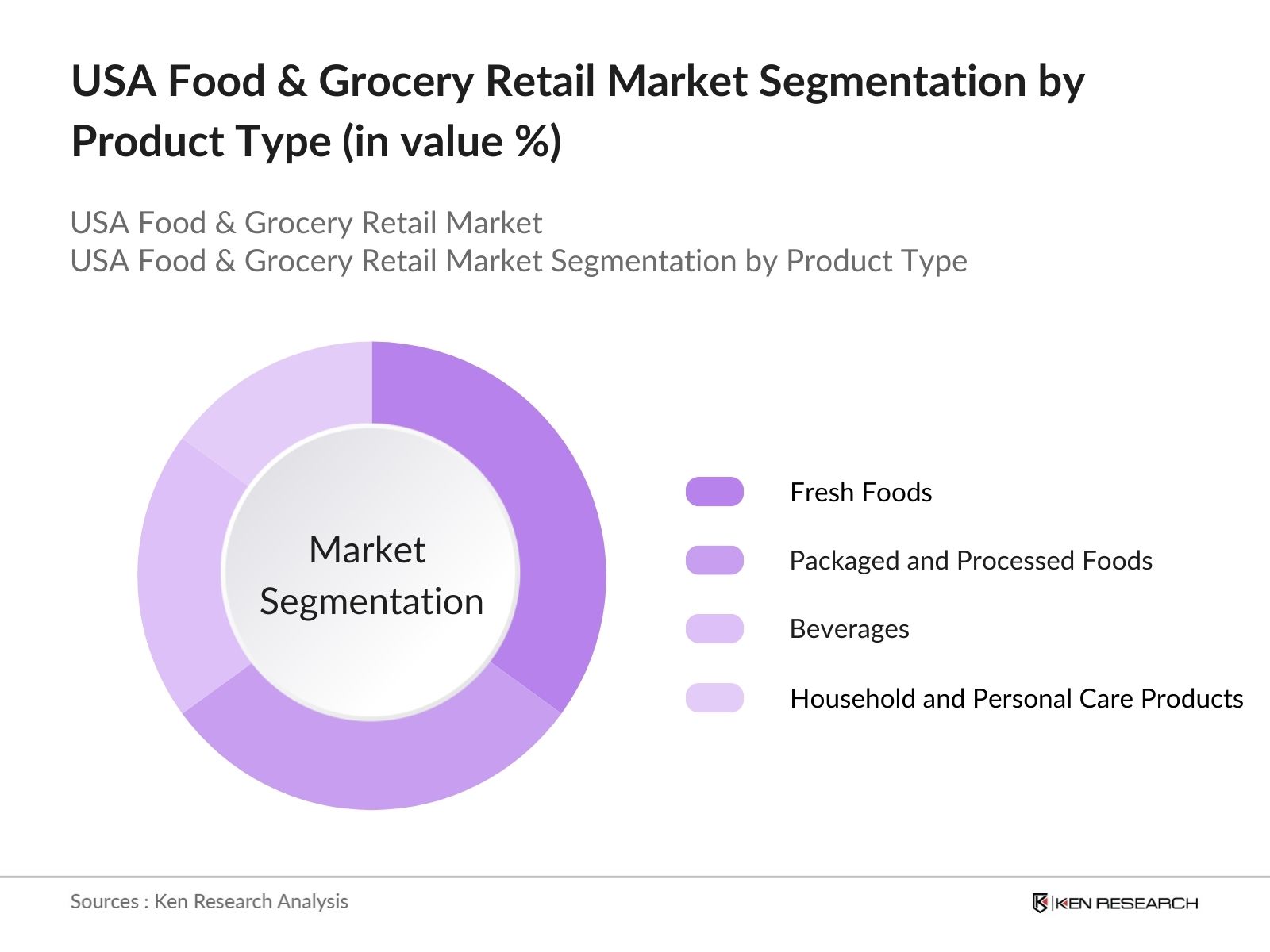

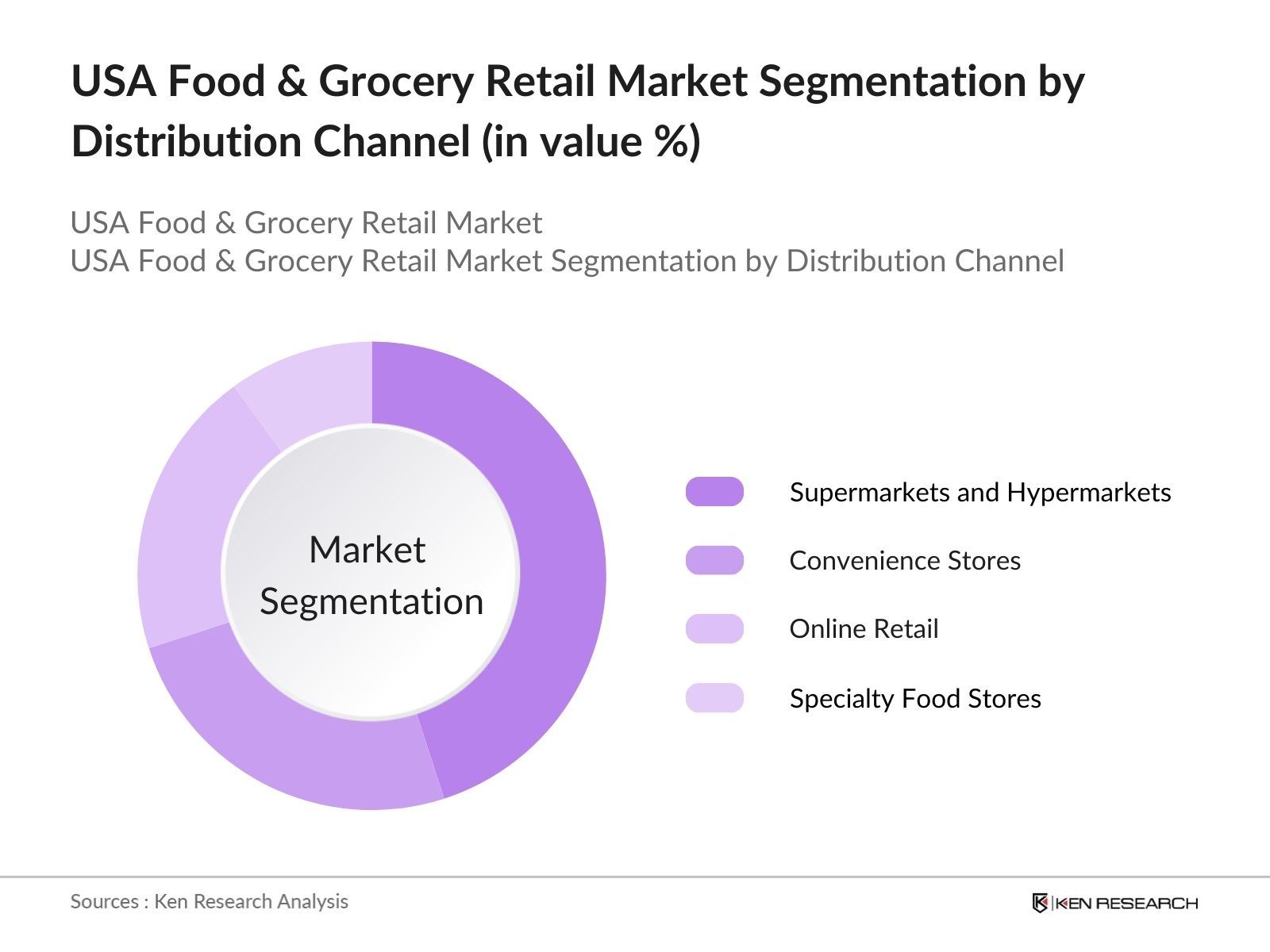

USA Food & Grocery Retail Market Segmentation

By Product Type: The USA Food & Grocery Retail Market is segmented by product type into fresh foods, packaged and processed foods, beverages, and household and personal care products. Fresh foods maintain a dominant market share in this category, primarily due to consumer preferences for organic, locally sourced, and high-quality produce. This segment benefits from the health-focused shift among consumers, along with marketing efforts by retailers to promote freshness, organic labels, and premium quality across major grocery outlets and online platforms.

By Distribution Channel: The distribution channel segmentation includes supermarkets and hypermarkets, convenience stores, online retail, and specialty food stores. Supermarkets and hypermarkets are predominant in the distribution channel, owing to their broad product range, competitive pricing, and established consumer trust. This segment has thrived due to its accessible store locations, variety of options, and recent adaptations such as self-checkout and curbside pickup, meeting consumers' demand for convenience and efficiency.

By Distribution Channel: The distribution channel segmentation includes supermarkets and hypermarkets, convenience stores, online retail, and specialty food stores. Supermarkets and hypermarkets are predominant in the distribution channel, owing to their broad product range, competitive pricing, and established consumer trust. This segment has thrived due to its accessible store locations, variety of options, and recent adaptations such as self-checkout and curbside pickup, meeting consumers' demand for convenience and efficiency.

USA Food & Grocery Retail Market Competitive Landscape

The USA Food & Grocery Retail Market is primarily led by a few large players that hold significant market shares due to their extensive distribution networks, brand reputation, and diverse product offerings. Key players such as Walmart Inc., Kroger Co., and Albertsons Companies, Inc., along with others, showcase a mix of physical and online presence, underlining the competitive nature of the industry.

USA Food & Grocery Retail Market Analysis

Growth Drivers

- Expansion of E-commerce and Omnichannel Strategies: The USA food and grocery retail sector is seeing significant growth due to the expansion of e-commerce and omnichannel strategies. In 2024, around 250 million Americans have access to high-speed internet, which fuels online shopping convenience for consumers, including groceries. This shift is supported by logistics improvements, such as same-day delivery options in major metro areas, reducing wait times to an average of 3-5 hours. Government data shows that investment in e-commerce infrastructure is up by $15 billion since 2022, emphasizing the sectors adaptation to digital demands.

- Rising Demand for Health and Organic Products: Consumers increasingly prefer health-oriented and organic food options, significantly influencing the food and grocery retail landscape. According to USDA reports, the organic food segment accounted for around $58 billion in 2024, with a steady rise since 2022. This trend is supported by the dietary shifts of over 120 million Americans who identify as health-conscious shoppers, focusing on unprocessed and nutrient-rich foods. The CDC notes a 40% decrease in sugar and trans-fat consumption from 2022 to 2024, emphasizing consumer commitment to health and wellness.

- Innovations in Private Labeling: Innovations in private labeling are increasing brand loyalty and affordability in the grocery sector. USDA reports that over 40% of grocery sales in 2024 are from private-label brands, a 30% increase from 2022, reflecting consumers preference for affordable yet quality products. Retailers like Walmart and Kroger are investing heavily, spending over $5 billion in brand development between 2023 and 2024, enabling them to offer diverse, competitively priced private-label products. This shift drives consumer retention and strengthens profit margins, supporting the continued growth of the sector.

Challenges

- Supply Chain Disruptions: The USDA and Department of Transportation data reflect ongoing supply chain disruptions impacting grocery retailers. In 2024, U.S. retailers faced an average of 3-5 day delays in stock replenishment, often due to logistics issues like truck driver shortages, currently at 80,000 vacancies. Disruptions are further exacerbated by high fuel prices, which increased by $1.2 per gallon from 2022 to 2024, pushing logistics costs upwards. This results in decreased inventory turnover and increased pressure on retailers to maintain consistent product availability.

- High Operational Costs: High operational costs, driven by inflation and rising wages, are a critical challenge for grocery retailers. The Bureau of Labor Statistics shows an average wage increase of $1.5 per hour in retail since 2022, reaching an average hourly rate of $15.8 in 2024. Additionally, energy costs have risen by $5 billion in the food retail sector, as noted by the Energy Information Administration. Such expenses strain profitability, requiring retailers to implement efficiency measures without compromising service quality.

USA Food & Grocery Retail Market Future Outlook

USA Food & Grocery Retail Market is poised for considerable growth driven by continued investment in digital infrastructure, innovations in supply chain logistics, and a strong consumer shift towards health and sustainability. Additionally, advancements in personalized shopping experiences and omnichannel retail strategies are expected to further shape the market landscape.

Market Opportunities

- Technological Advancements in Inventory Management: The integration of AI-based inventory systems is transforming inventory management in grocery retail. The U.S. Department of Commerce indicates that around 70% of grocery chains implemented automated inventory solutions in 2024, up from 40% in 2022. Such technologies improve stock accuracy and reduce waste by an average of 15%, streamlining supply management. Automated systems also allow retailers to optimize shelf placement and forecast demand accurately, aligning supply with consumer trends and reducing operational disruptions.

- Expansion in Rural and Suburban Markets: Expansion in rural and suburban areas presents a significant growth opportunity for grocery retailers. The USDA reports a 15% rise in retail openings in these areas from 2022 to 2024, providing access to an additional 10 million consumers previously underserved. As infrastructure improves, the average distance to grocery stores in rural areas has reduced from 15 to 8 miles, enhancing accessibility. Investment in rural grocery distribution centers, totaling $1.8 billion in 2024, further supports this expansion, enabling retailers to reach broader demographics.

Scope of the Report

|

Segment |

Sub-segment |

|

Product Type |

Fresh Foods (Fruits, Vegetables, Meat, Seafood) |

|

Distribution Channel |

Supermarkets and Hypermarkets |

|

Purchase Frequency |

Weekly |

|

Consumer Demographic |

Age Group |

|

Region |

Northeast |

Products

Key Target Audience

Retail Chains and Supermarket Chains

E-commerce Platforms and Online Grocers

Food and Beverage Manufacturers

Packaging and Distribution Companies

Health and Wellness Product Companies

Food Safety and Quality Assurance Agencies

Investors and Venture Capitalist Firms

Government and Regulatory Bodies (e.g., USDA, FDA)

Companies

Players Mentioned in the Report

Walmart Inc.

Kroger Co.

Albertsons Companies, Inc.

Target Corporation

Costco Wholesale Corporation

Amazon Fresh

Whole Foods Market Inc.

Publix Super Markets Inc.

Aldi Inc.

H-E-B Grocery Company

Table of Contents

1. USA Food & Grocery Retail Market Overview

1.1 Definition and Scope

1.2 Market Taxonomy

1.3 Market Segmentation Overview

2. USA Food & Grocery Retail Market Size (In USD Mn)

2.1 Historical Market Size

2.2 Year-On-Year Growth Analysis

2.3 Key Market Developments and Milestones

3. USA Food & Grocery Retail Market Analysis

3.1 Growth Drivers

3.1.1 Expansion of E-commerce and Omnichannel Strategies

3.1.2 Rising Demand for Health and Organic Products

3.1.3 Innovations in Private Labeling

3.1.4 Increasing Urbanization and Lifestyle Changes

3.2 Market Challenges

3.2.1 Supply Chain Disruptions

3.2.2 High Operational Costs

3.2.3 Competition from Discount Retailers

3.3 Opportunities

3.3.1 Technological Advancements in Inventory Management

3.3.2 Growth in Online Grocery Delivery Services

3.3.3 Expansion in Rural and Suburban Markets

3.4 Trends

3.4.1 Adoption of AI and Machine Learning in Retail

3.4.2 Popularity of Subscription-Based Grocery Services

3.4.3 Emphasis on Sustainable and Eco-friendly Products

3.5 Government Regulations

3.5.1 Food Safety Standards

3.5.2 Labeling and Nutritional Information Requirements

3.5.3 Retail Compliance Policies

3.6 Stakeholder Ecosystem

3.7 Porters Five Forces Analysis

3.8 Competition Ecosystem

4. USA Food & Grocery Retail Market Segmentation

4.1 By Product Type (In Value %)

4.1.1 Fresh Foods (Fruits, Vegetables, Meat, Seafood)

4.1.2 Packaged and Processed Foods

4.1.3 Beverages (Alcoholic and Non-Alcoholic)

4.1.4 Household and Personal Care Products

4.2 By Distribution Channel (In Value %)

4.2.1 Supermarkets and Hypermarkets

4.2.2 Convenience Stores

4.2.3 Online Retail

4.2.4 Specialty Food Stores

4.3 By Purchase Frequency (In Value %)

4.3.1 Weekly

4.3.2 Bi-Weekly

4.3.3 Monthly

4.4 By Consumer Demographic (In Value %)

4.4.1 Age Group

4.4.2 Income Level

4.4.3 Household Size

4.5 By Region (In Value %)

4.5.1 Northeast

4.5.2 Midwest

4.5.3 South

4.5.4 West

5. USA Food & Grocery Retail Market Competitive Analysis

5.1 Detailed Profiles of Major Companies

5.1.1 Walmart Inc.

5.1.2 Kroger Co.

5.1.3 Albertsons Companies, Inc.

5.1.4 Ahold Delhaize USA

5.1.5 Target Corporation

5.1.6 Costco Wholesale Corporation

5.1.7 Amazon Fresh

5.1.8 Whole Foods Market Inc.

5.1.9 Publix Super Markets Inc.

5.1.10 Aldi Inc.

5.2 Cross Comparison Parameters (Revenue, Market Share, Headquarters, Operational Footprint, Store Formats, Digital Presence, Consumer Loyalty Programs, Sustainability Initiatives)

5.3 Market Share Analysis

5.4 Strategic Initiatives

5.5 Mergers and Acquisitions

5.6 Investment Analysis

5.7 Venture Capital Funding

6. USA Food & Grocery Retail Market Regulatory Framework

6.1 Food and Drug Administration (FDA) Regulations

6.2 USDA Food Standards

6.3 Nutritional Labeling Compliance

6.4 Import and Export Policies

6.5 Retail Compliance Standards

7. USA Food & Grocery Retail Future Market Size (In USD Bn)

7.1 Projected Market Size

7.2 Key Factors Driving Future Market Growth

8. USA Food & Grocery Retail Future Market Segmentation

8.1 By Product Type (In Value %)

8.2 By Distribution Channel (In Value %)

8.3 By Purchase Frequency (In Value %)

8.4 By Consumer Demographic (In Value %)

8.5 By Region (In Value %)

9. USA Food & Grocery Retail Market Analysts Recommendations

9.1 Customer Behavior Analysis

9.2 White Space Opportunity Analysis

9.3 Strategic Positioning Recommendations

9.4 Competitive Advantage Strategies

Disclaimer

Contact Us

Research Methodology

Step 1: Identification of Key Variables

This phase involves defining primary variables affecting the USA Food & Grocery Retail Market through a detailed ecosystem map. Extensive desk research from both secondary and proprietary databases is used to capture industry insights, focusing on key drivers like consumer trends and technology advancements.

Step 2: Market Analysis and Construction

Historical data on market penetration, online and offline retail performance, and revenue dynamics is collated to understand the current landscape. This analysis ensures an accurate depiction of trends and consumer behaviors shaping market growth.

Step 3: Hypothesis Validation and Expert Consultation

Key hypotheses are refined through expert interviews and consultations. Insights gathered from industry professionals in major retail companies confirm and enhance the reliability of the market data.

Step 4: Research Synthesis and Final Output

Final validation involves consultations with top retail and grocery companies, providing data on consumer preferences, sales trends, and product segmentation. This collaborative approach ensures a comprehensive, validated report reflecting the USA Food & Grocery Retail Market accurately.

Frequently Asked Questions

01. How big is the USA Food & Grocery Retail Market?

The USA Food & Grocery Retail Market was valued at USD 800 billion, driven by the growth of e-commerce, health-conscious products, and convenience-based shopping options.

02. What are the challenges in the USA Food & Grocery Retail Market?

Challenges in USA Food & Grocery Retail Market include rising operational costs, supply chain disruptions, and increased competition among major and discount retailers. Addressing sustainability is also a key concern due to evolving consumer expectations.

03. Who are the major players in the USA Food & Grocery Retail Market?

Key players in USA Food & Grocery Retail Market include Walmart Inc., Kroger Co., and Albertsons Companies, Inc., among others, whose extensive reach and brand reputation have solidified their market positions.

04. What factors are driving growth in the USA Food & Grocery Retail Market?

Growth in USA Food & Grocery Retail Market is driven by consumer demand for fresh, organic options, the rise of online retail channels, and the increasing popularity of hybrid retail models that offer both convenience and quality.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.