USA Food Safety Testing Market Outlook to 2030

Region:North America

Author(s):Sanjana

Product Code:KROD2808

October 2024

86

About the Report

USA Food Safety Testing Market Overview

- The USA Food Safety Testing Market is valued at USD 4.2 billion, driven by stringent government regulations like the Food Safety Modernization Act (FSMA) and increasing consumer awareness regarding food safety. The rise in demand for processed food and the expanding food and beverage sector further fuel the growth of the market. Companies and regulatory bodies are investing in advanced testing technologies to ensure compliance with these regulations and to reduce the risks associated with foodborne illnesses.

- The market dominance in the USA is observed primarily in states like California, Texas, and New York, which are key hubs for food production and distribution. These regions have a large concentration of food processing plants and advanced food testing infrastructure. Furthermore, their proximity to agricultural production zones and high population density makes them strategic locations for food safety testing services.

- USDA Organic Regulations impose strict guidelines for testing organic food products to ensure they are free from prohibited substances, including synthetic pesticides and fertilizers. In 2023, the USDA expanded its oversight, conducting more than 6,500 inspections of organic farms and food processors. Organic products also face rigorous testing for contaminants such as heavy metals and pesticides, which are not allowed under organic certification. This drives the need for specialized food safety testing services for the organic food segment.

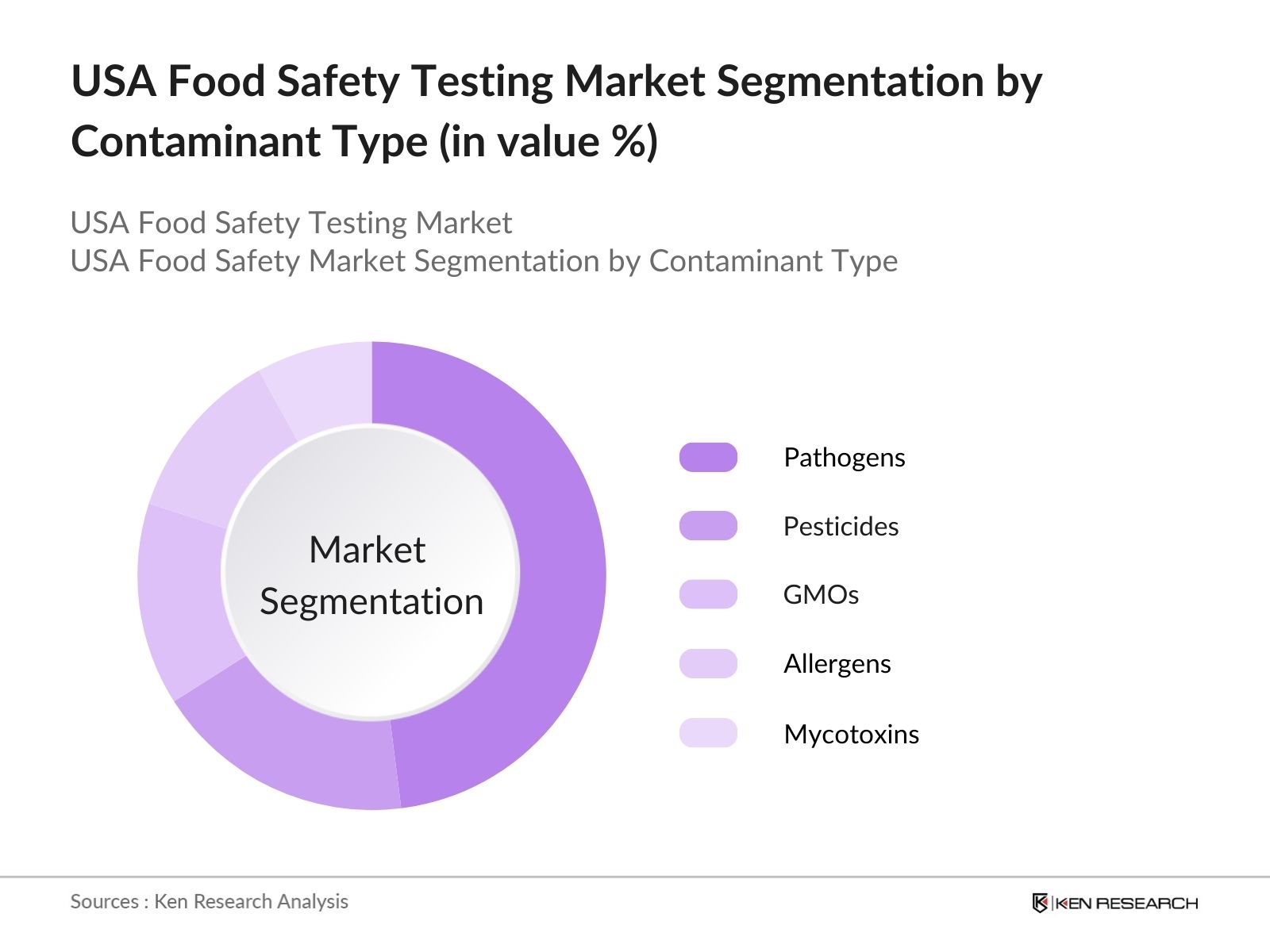

USA Food Safety Testing Market Segmentation

By Contaminant Type: The USA food safety testing market is segmented by contaminant type into pathogens, pesticides, GMOs, allergens, and mycotoxins. Pathogens such as E. coli, Salmonella, and Listeria hold a dominant market share due to their high prevalence in foodborne illness outbreaks. The need for stringent testing to detect these pathogens in products like meat, poultry, and seafood drives this segment's growth. Additionally, ongoing public health campaigns and regulatory demands for pathogen testing contribute to this segment's importance in ensuring food safety.

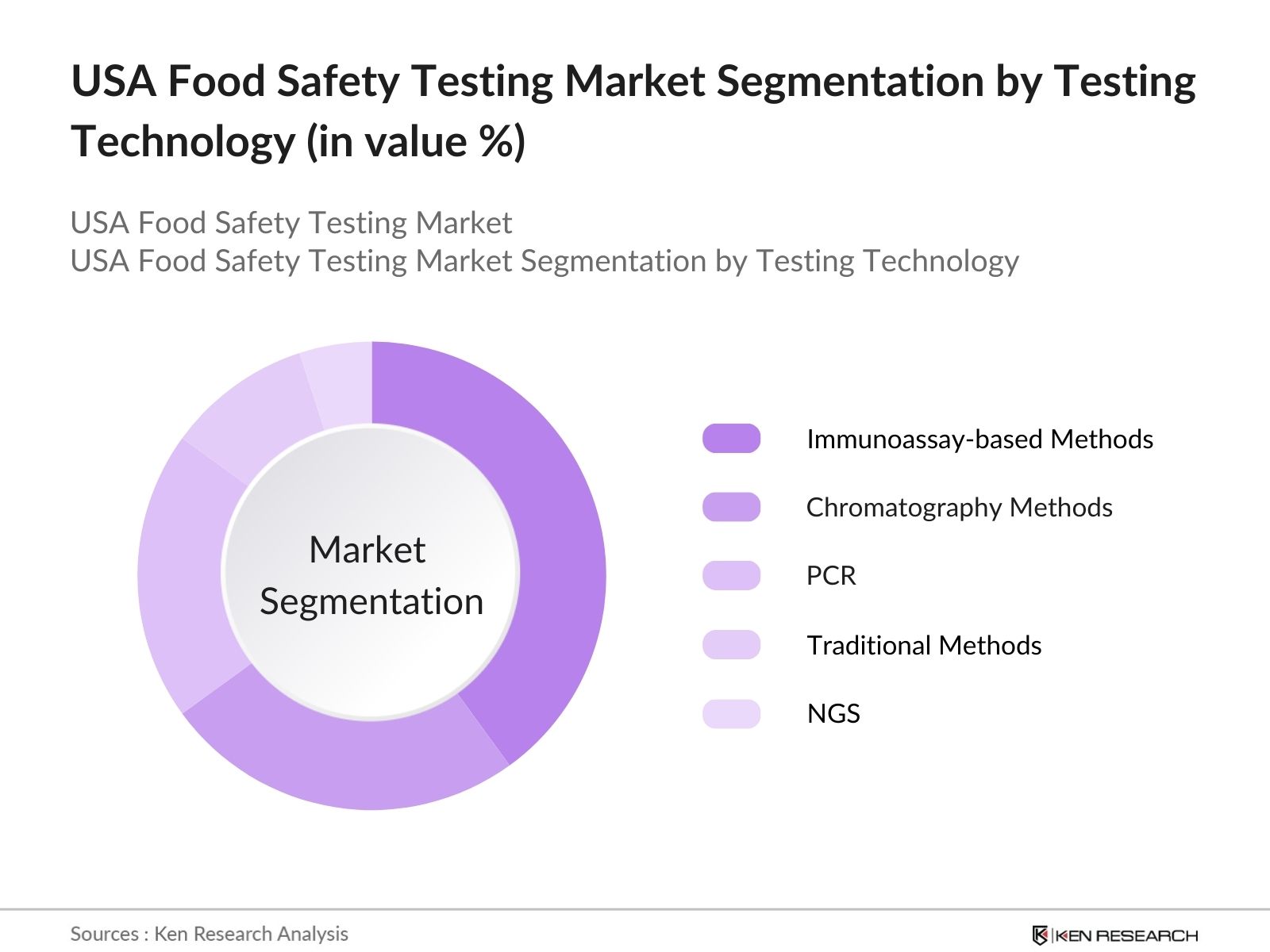

By Testing Technology: The market is also segmented by testing technology into traditional methods, immunoassay-based methods, chromatography-based methods, polymerase chain reaction (PCR), and next-generation sequencing (NGS). Among these, immunoassay-based methods dominate the market due to their high specificity, rapid results, and cost-effectiveness. This technology is widely adopted for detecting allergens, pesticides, and bacterial contaminants. Furthermore, advancements in immunoassay kits have made it easier for food testing labs to perform accurate and high-throughput testing.

USA Food Safety Testing Market Competitive Landscape

The USA food safety testing market is consolidated, with a few key players dominating the landscape. These companies are known for their extensive testing capabilities, global presence, and wide product portfolios, which allow them to capture a significant portion of the market. Moreover, they maintain strong relationships with regulatory bodies, giving them an edge in adapting to changes in food safety regulations. The competitive landscape highlights the dominance of global players who have invested heavily in technology, regulatory compliance, and quality assurance. These companies maintain their positions through consistent partnerships, innovation, and acquisitions.

|

Company Name |

Year of Establishment |

Headquarters |

Number of Employees |

Revenue (USD Bn) |

Testing Capabilities |

Certifications |

Partnerships |

R&D Investment |

Market Presence |

|

SGS SA |

1878 |

Geneva, Switzerland |

- |

- |

- |

- |

- |

- |

- |

|

Eurofins Scientific |

1987 |

Luxembourg |

- |

- |

- |

- |

- |

- |

- |

|

Intertek Group PLC |

1885 |

London, UK |

- |

- |

- |

- |

- |

- |

- |

|

Mrieux NutriSciences |

1967 |

Chicago, USA |

- |

- |

- |

- |

- |

- |

- |

|

Bureau Veritas SA |

1828 |

Paris, France |

- |

- |

- |

- |

- |

- |

- |

USA Food Safety Testing Market Analysis

Growth Drivers

- Increasing Demand for Processed Food: The rising demand for processed food products in the USA is driven by urbanization, busy lifestyles, and higher disposable incomes. In 2022, the U.S. processed food industry contributed over $1.08 trillion to the countrys economy. This trend correlates with increased testing demand to ensure food safety, as processed foods are more susceptible to contamination during packaging and transport. According to the USDA Foreign Agricultural Service, in 2023, the U.S. processed food products exports totaled approximately10.51 million metric tons. This ongoing shift is pushing the food safety testing market towards significant growth.

- Stringent Food Safety Regulations (FDA, USDA): The U.S. government has been tightening food safety regulations to prevent contamination and foodborne diseases, guided by FDA and USDA standards. In 2024, the FDA increased its inspections by 25%, and more than 15,000 warning letters were issued to businesses violating food safety norms. Similarly, the USDAs stringent measures, particularly for meat, poultry, and egg products, have led to an increase in the demand for thorough testing procedures across the food supply chain.

- Rising Consumer Awareness: Consumer awareness about food safety has significantly increased in recent years, with reports from the CDC indicating that foodborne illnesses affect approximately 48 million Americans annually. In response, more consumers are scrutinizing the safety of the food they purchase, leading to a rise in demand for food testing services. This heightened concern has been catalyzed by media coverage of food recalls and contamination incidents, further boosting the market for safety testing services.

Market Challenges

- High Cost of Testing Procedures: Food safety testing in the U.S. can be cost-prohibitive for smaller businesses due to the high cost of advanced testing methods. On average, testing costs per sample range from $100 to $500, depending on the complexity and type of contaminants being screened. In 2023, small and medium enterprises (SMEs) in the U.S. accounted for 98% of food manufacturers, many of whom face challenges in affording these tests. The cost burden is compounded by compliance with stringent regulatory requirements, leading to financial strain on smaller producers.

- Complexity in Regulatory Compliance: Navigating the complex regulatory landscape in the U.S. food industry presents challenges for manufacturers. FDA, USDA, and local state regulations each require different safety protocols and documentation, increasing the compliance burden. In 2023, food businesses faced compliance challenges due to the diversity of regulatory frameworks. This complexity often results in delays and additional costs related to ensuring products meet the varying safety standards, particularly for companies exporting food products.

USA Food Safety Testing Future Market Outlook

The USA food safety testing market is expected to witness significant growth due to the increasing complexity of food supply chains, rising demand for processed and convenience foods, and stricter regulatory frameworks. Innovations in testing methods, such as real-time testing and blockchain integration for traceability, will further accelerate the market. Moreover, the emergence of new foodborne pathogens and allergens will increase the demand for advanced testing methods, providing new opportunities for market players.

Market Opportunities

- Growth of Contract Testing Laboratories: The rise of contract testing laboratories presents a substantial growth opportunity in the U.S. food safety testing market. As of 2023, approximately 35% of food manufacturers outsource their testing needs due to cost efficiency and access to specialized testing capabilities. The number of third-party contract labs has increased by 15% annually, offering advanced testing methods to meet regulatory demands. This trend helps smaller food producers ensure compliance without having to invest in expensive in-house testing infrastructure.

- Development of Rapid Testing Methods: Rapid testing methods have become a game-changer for food safety, with PCR and immunoassays reducing testing time from several days to just hours. As of 2023, over 50% of pathogen samples analyzed in the U.S. were conducted using rapid microbiological methods (RMM) such as PCR and ELISA, highlighting a shift from traditional testing methods that could take several days to produce results. The market for these methods is projected to grow as they enable businesses to quickly detect and address contaminants, minimizing the risk of large-scale recalls.

Scope of the Report

|

Segments |

Sub-Segments |

|

By Contaminant |

Pathogens Pesticides GMOs Allergens Mycotoxins |

|

By Technology |

Traditional Immunoassay Chromatography PCR NGS |

|

By Food Type |

Meat Poultry Seafood Dairy Products Processed Foods Fruits & Vegetables Grains & Cereals |

|

By End-User |

Food Manufacturers Retailers Food Service Providers Government Bodies Independent Labs |

|

By Region |

North-East Midwest South West |

Products

Key Target Audience

Food manufacturers

Food and Beverage Companies

Agricultural Companies

Food service providers

Food Packaging Companies

Logistics and Supply Chain Management Companies

Investors and venture capitalists

Government and regulatory bodies (FDA, USDA)

Companies

Major Players in the USA Food Safety Testing Market

SGS SA

Eurofins Scientific

Intertek Group PLC

Bureau Veritas SA

Mrieux NutriSciences

ALS Limited

Bio-Rad Laboratories, Inc.

Neogen Corporation

NSF International

Agilent Technologies Inc.

Thermo Fisher Scientific

PerkinElmer Inc.

Romer Labs

Charm Sciences Inc.

3M Company

Table of Contents

1. USA Food Safety Testing Market Overview

1.1 Definition and Scope

1.2 Market Taxonomy

1.3 Market Growth Rate

1.4 Market Segmentation Overview

2. USA Food Safety Testing Market Size (In USD Bn)

2.1 Historical Market Size

2.2 Year-on-Year Growth Analysis

2.3 Key Market Developments and Milestones

3. USA Food Safety Testing Market Analysis

3.1 Growth Drivers

3.1.1 Increasing Demand for Processed Food

3.1.2 Stringent Food Safety Regulations (FDA, USDA)

3.1.3 Rising Consumer Awareness

3.1.4 Technological Advancements in Food Testing

3.2 Market Challenges

3.2.1 High Cost of Testing Procedures

3.2.2 Limited Skilled Workforce

3.2.3 Complexity in Regulatory Compliance

3.3 Opportunities

3.3.1 Growth of Contract Testing Laboratories

3.3.2 Development of Rapid Testing Methods

3.3.3 Expansion into Emerging Food Categories (Plant-based, Organic)

3.4 Trends

3.4.1 Rise in Testing for GMO and Allergens

3.4.2 Increasing Use of Blockchain for Traceability

3.4.3 Demand for Real-time Testing Technologies

3.5 Government Regulations

3.5.1 FDA Food Safety Modernization Act (FSMA)

3.5.2 Hazard Analysis Critical Control Point (HACCP) Programs

3.5.3 USDA Organic Regulations

3.5.4 Import and Export Compliance Requirements

3.6 SWOT Analysis

3.7 Stakeholder Ecosystem

3.8 Porters Five Forces

3.9 Competitive Ecosystem

4. USA Food Safety Testing Market Segmentation

4.1 By Contaminant Type (In Value %)

4.1.1 Pathogens (E. coli, Salmonella, Listeria)

4.1.2 Pesticides

4.1.3 Genetically Modified Organisms (GMOs)

4.1.4 Allergens

4.1.5 Mycotoxins

4.2 By Testing Technology (In Value %)

4.2.1 Traditional Methods

4.2.2 Immunoassay-based Methods

4.2.3 Chromatography-based Methods

4.2.4 Polymerase Chain Reaction (PCR)

4.2.5 Next-Generation Sequencing (NGS)

4.3 By Food Type (In Value %)

4.3.1 Meat, Poultry, and Seafood

4.3.2 Dairy Products

4.3.3 Processed Foods

4.3.4 Fruits and Vegetables

4.3.5 Grains and Cereals

4.4 By End-User (In Value %)

4.4.1 Food Manufacturers

4.4.2 Retailers

4.4.3 Food Service Providers

4.4.4 Government and Regulatory Bodies

4.4.5 Independent Laboratories

4.5 By Region (In Value %)

4.5.1 North-East

4.5.2 Midwest

4.5.3 South

4.5.4 West

5. USA Food Safety Testing Market Competitive Analysis

5.1 Detailed Profiles of Major Competitors

5.1.1 SGS SA

5.1.2 Eurofins Scientific

5.1.3 Intertek Group PLC

5.1.4 Bureau Veritas SA

5.1.5 ALS Limited

5.1.6 Mrieux NutriSciences Corporation

5.1.7 NSF International

5.1.8 Neogen Corporation

5.1.9 Bio-Rad Laboratories, Inc.

5.1.10 Thermo Fisher Scientific

5.1.11 Agilent Technologies Inc.

5.1.12 PerkinElmer Inc.

5.1.13 3M Company

5.1.14 Romer Labs

5.1.15 Charm Sciences Inc.

5.2 Cross Comparison Parameters (Number of Employees, Headquarters, Revenue, Testing Capabilities, Product Portfolio, Certifications, Partnerships, Mergers)

5.3 Market Share Analysis

5.4 Strategic Initiatives

5.5 Mergers and Acquisitions

5.6 Investment Analysis

5.7 Government Contracts and Tenders

5.8 Private Equity Investments

6. USA Food Safety Testing Market Regulatory Framework

6.1 Food Safety Standards

6.2 Certification Processes

6.3 Import/Export Regulations

6.4 Industry-Specific Safety Regulations

6.5 Compliance with International Food Safety Norms

7. USA Food Safety Testing Future Market Size (In USD Bn)

7.1 Future Market Size Projections

7.2 Key Factors Driving Future Market Growth

8. USA Food Safety Testing Future Market Segmentation

8.1 By Contaminant Type (In Value %)

8.2 By Testing Technology (In Value %)

8.3 By Food Type (In Value %)

8.4 By End-User (In Value %)

8.5 By Region (In Value %)

9. USA Food Safety Testing Market Analysts Recommendations

9.1 Total Addressable Market (TAM) Analysis

9.2 Serviceable Available Market (SAM) Analysis

9.3 Serviceable Obtainable Market (SOM) Analysis

9.4 White Space Opportunities

9.5 Market Entry Strategy Recommendations

Disclaimer

Contact Us

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves constructing an ecosystem map encompassing all major stakeholders within the USA Food Safety Testing Market. This step is underpinned by extensive desk research, utilizing a combination of secondary and proprietary databases to gather comprehensive industry-level information. The primary objective is to identify and define the critical variables that influence market dynamics.

Step 2: Market Analysis and Construction

In this phase, we compile and analyze historical data pertaining to the USA Food Safety Testing Market. This includes assessing market penetration, the ratio of marketplaces to service providers, and the resultant revenue generation. Furthermore, an evaluation of service quality statistics will be conducted to ensure the reliability and accuracy of the revenue estimates.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses are developed and subsequently validated through computer-assisted telephone interviews (CATIS) with industry experts representing a diverse array of companies. These consultations provide valuable operational and financial insights directly from industry practitioners, which are instrumental in refining and corroborating the market data.

Step 4: Research Synthesis and Final Output

The final phase involves direct engagement with multiple food safety testing laboratories and manufacturers to acquire detailed insights into product segments, sales performance, consumer preferences, and other pertinent factors. This interaction serves to verify and complement the statistics derived from the bottom-up approach, ensuring a comprehensive, accurate, and validated analysis of the USA Food Safety Testing Market.

Frequently Asked Questions

1. How big is the USA Food Safety Testing Market?

The USA food safety testing market is valued at USD 4.2 billion, driven by increasing regulatory requirements, consumer awareness, and technological advancements in food testing methodologies.

2. What are the challenges in the USA Food Safety Testing Market?

Challenges include high testing costs, the complexity of navigating regulatory compliance, and the need for continuous technological upgrades to stay in line with emerging contaminants and pathogens.

3. Who are the major players in the USA Food Safety Testing Market?

Key players in the market include SGS SA, Eurofins Scientific, Intertek Group PLC, Bureau Veritas SA, and Mrieux NutriSciences. These companies dominate due to their extensive lab networks, technological innovations, and strong regulatory relationships.

4. What are the growth drivers of the USA Food Safety Testing Market?

The market is propelled by factors such as stringent government regulations (e.g., FSMA), increased consumer awareness of foodborne illnesses, and the rise in demand for processed and ready-to-eat foods.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.