USA Forklift Market Outlook to 2030

Region:North America

Author(s):Abhinav kumar

Product Code:KROD6668

December 2024

88

About the Report

USA Forklift Market Overview

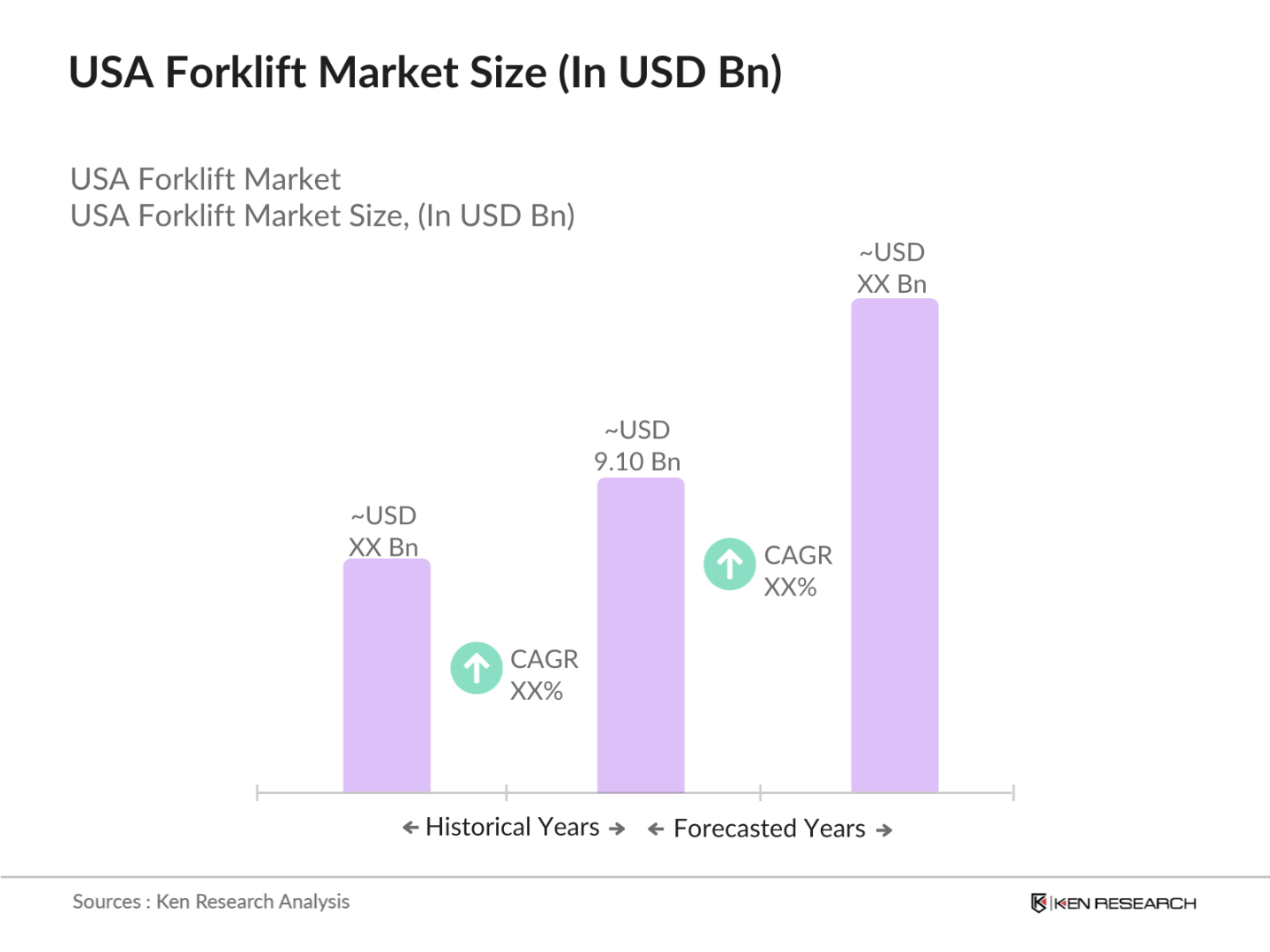

- The USA forklift market is valued at USD 9.10 billion, based on a comprehensive five-year historical analysis. This market growth is primarily driven by the rising demand from the logistics, e-commerce, and construction industries. The adoption of advanced technologies like automation in warehouses, coupled with the rising need for efficient material handling systems, has contributed significantly to the market's expansion. Additionally, a shift toward electric forklifts due to increasing environmental regulations and sustainability goals has further boosted the demand.

- In terms of geographic dominance, key cities such as New York, Chicago, and Los Angeles dominate the forklift market in the USA. These cities are home to some of the largest logistics hubs and distribution centers, driving the demand for material handling equipment. Their dominance is also attributed to the concentration of industrial and e-commerce activities in these areas, requiring efficient logistics solutions. The west coast's strong focus on sustainable practices has also seen a higher adoption of electric forklifts.

- The trend towards electric forklifts is becoming increasingly prominent, driven by environmental considerations and operational efficiency. In 2023, the sales of electric forklifts grew by 15% compared to the previous year, reflecting their rising acceptance among businesses. The total number of electric forklifts in operation is estimated to surpass 200,000 units by 2024. This shift is influenced by the federal tax credits available for electric vehicle purchases, encouraging companies to invest in cleaner technologies. As businesses continue to prioritize sustainability, electric forklifts are poised to dominate the market.

USA Forklift Market Segmentation

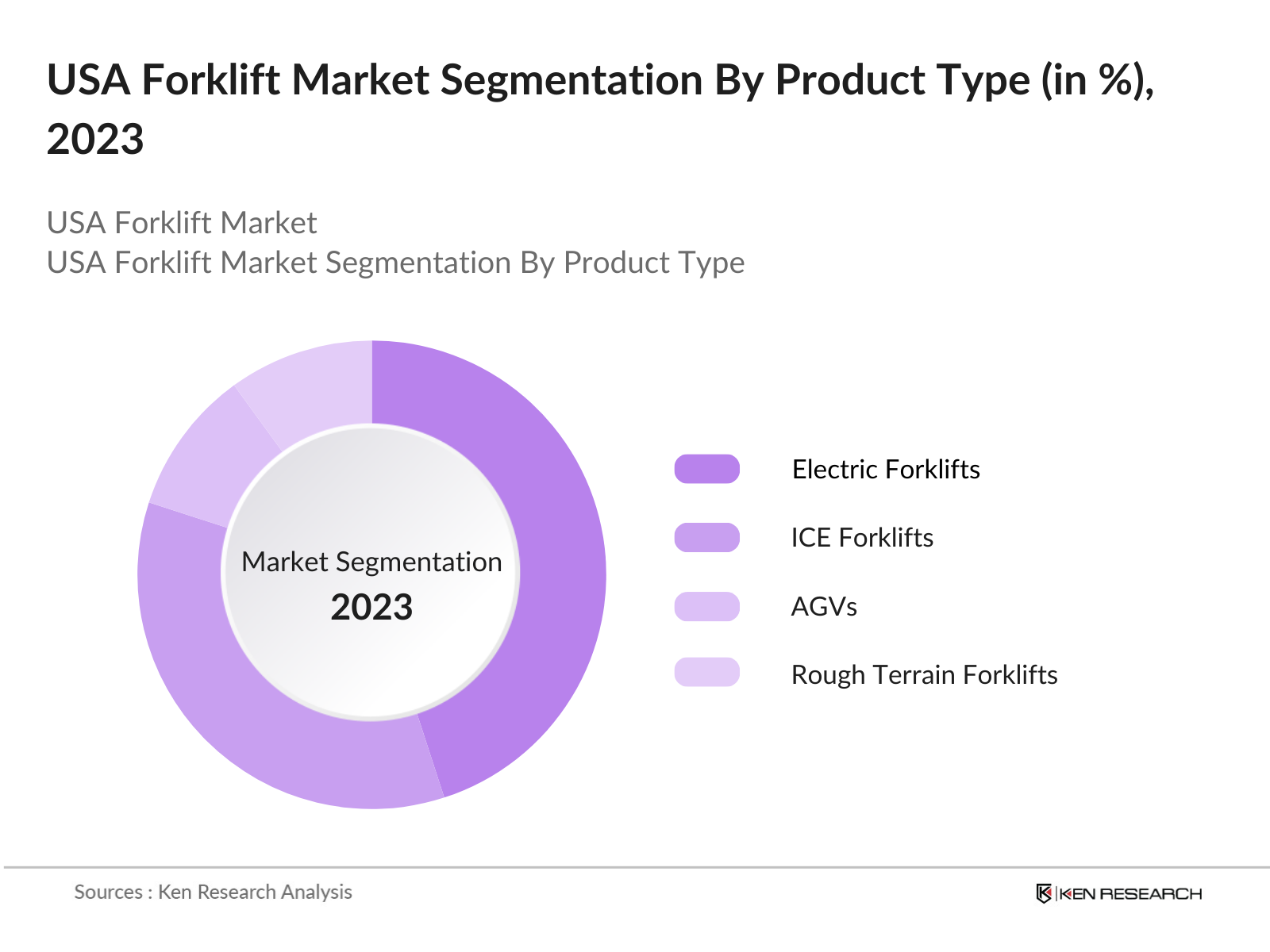

By Product Type: The USA forklift market is segmented by product type into electric forklifts, internal combustion engine (ICE) forklifts, automated guided vehicles (AGVs), and rough terrain forklifts. Recently, electric forklifts have been dominating the product type segment due to their growing demand in industries that prioritize environmental sustainability. The push for lower carbon emissions and government regulations regarding workplace safety and emissions have prompted businesses to adopt electric forklifts over traditional ICE forklifts. Moreover, advancements in battery technology have further enhanced their efficiency, making them a preferred choice for many industries.

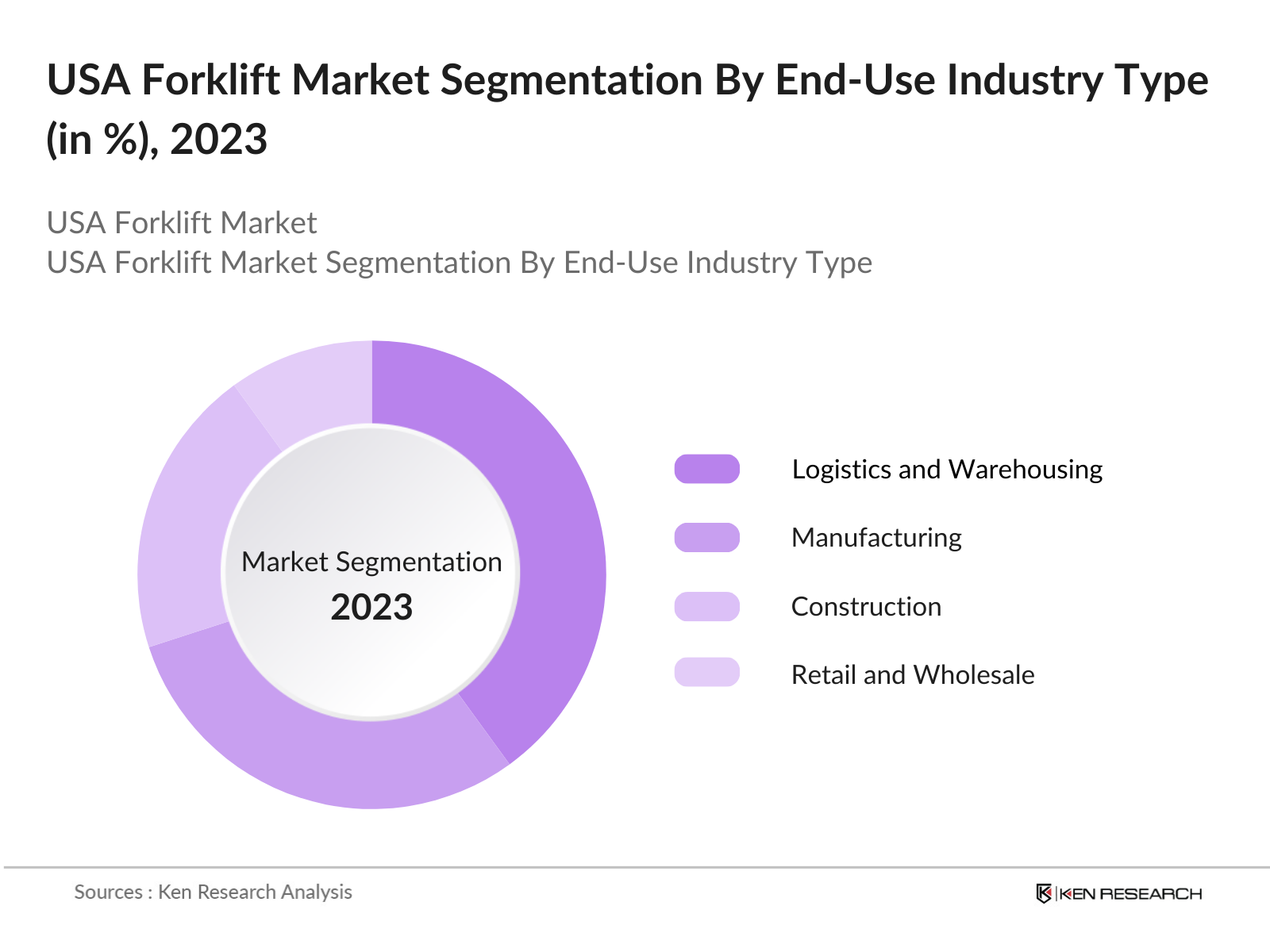

By End-Use Industry: The market is segmented by end-use industry into manufacturing, construction, retail and wholesale, and logistics and warehousing. Logistics and warehousing dominate this segmentation due to the significant expansion of e-commerce and the increasing need for efficient material handling systems. Companies like Amazon, Walmart, and other major logistics players have expanded their warehousing capabilities, necessitating a robust material handling infrastructure. The adoption of advanced forklift technologies in logistics hubs and distribution centers is further driving this segment’s growth.

USA Forklift Market Competitive Landscape

The USA forklift market is dominated by a mix of global and local players, with key companies leveraging their expertise and technological innovations to maintain a strong presence. The competitive landscape is characterized by technological advancements, investments in electric forklift production, and increasing partnerships with logistics companies to enhance distribution capabilities. The introduction of autonomous forklifts by major companies is creating a shift in the competitive dynamics, making automation a key differentiator for many players.

|

Company Name |

Establishment Year |

Headquarters |

Product Range |

Technological Advancements |

Electric Forklift Portfolio |

Global Reach |

Revenue (USD Bn) |

Market Innovations |

Strategic Partnerships |

|

Toyota Industries Corporation |

1926 |

Kariya, Japan |

_ |

_ |

_ |

_ |

_ |

_ |

_ |

|

Crown Equipment Corporation |

1945 |

Ohio, USA |

_ |

_ |

_ |

_ |

_ |

_ |

_ |

|

Hyster-Yale Materials Handling |

1985 |

Ohio, USA |

_ |

_ |

_ |

_ |

_ |

_ |

_ |

|

Mitsubishi Logisnext Co., Ltd. |

1937 |

Tokyo, Japan |

_ |

_ |

_ |

_ |

_ |

_ |

_ |

|

Jungheinrich AG |

1953 |

Hamburg, Germany |

_ |

_ |

_ |

_ |

_ |

_ |

_ |

USA Forklift Industry Analysis

Growth Drivers

- Expansion of E-Commerce and Logistics Sector: The rapid growth of the e-commerce sector is significantly driving the demand for forklifts in the United States. As of 2023, the e-commerce sales reached approximately $1.06 trillion, highlighting a surge in logistics requirements. With e-commerce sales projected to represent 24% of total retail sales in 2025, the need for efficient warehouse operations and material handling solutions has never been higher. This increase is stimulating investments in warehouse infrastructure, which directly correlates with forklift demand. According to the U.S. Bureau of Labor Statistics, the warehousing and storage industry is expected to grow by 15% from 2022 to 2032, necessitating the acquisition of advanced forklifts.

- Industrial Automation and Warehouse Modernization: The trend toward industrial automation is fundamentally transforming warehouses across the U.S. Businesses are increasingly adopting automated systems to enhance operational efficiency. The Industrial Automation market is expected to grow significantly, with investments projected to exceed $200 billion by 2025. This shift is prompting warehouses to modernize their material handling processes, thereby increasing the adoption of forklifts equipped with automation technologies. The need for real-time data and operational insights is driving the integration of IoT in forklifts, further enhancing their utility in modernized warehouses.

- Government Infrastructure Initiatives: Government infrastructure initiatives, particularly those focusing on transportation and logistics, are creating a conducive environment for forklift market growth. The Infrastructure Investment and Jobs Act, passed in 2021, allocates $1.2 trillion towards improving transportation infrastructure, which includes enhancements in logistics capabilities. This funding is aimed at modernizing ports, highways, and rail systems, which will increase the efficiency of freight movement. As infrastructure improves, the need for advanced material handling equipment, including forklifts, will rise to support enhanced operational demands.

Market Challenges

- High Initial Capital Investment: The high initial capital investment required for purchasing forklifts presents a significant barrier to entry for many businesses. As of 2023, the average cost of a new forklift ranges from $15,000 to $60,000, depending on the type and features. This financial commitment can deter small and medium-sized enterprises (SMEs) from acquiring the necessary equipment for efficient operations. According to the U.S. Small Business Administration, about 30% of small businesses report cash flow issues, which can hinder their ability to invest in new machinery. Consequently, the high upfront costs can limit market growth potential.

- Safety Regulations and Compliance Issues: The forklift industry in the U.S. is heavily regulated, and compliance with safety standards can pose challenges for operators. The Occupational Safety and Health Administration (OSHA) mandates strict adherence to safety protocols, including operator training and equipment maintenance. Non-compliance can result in penalties, impacting operational costs. In 2023, OSHA reported over 3,300 workplace accidents related to forklifts, highlighting the critical need for safety measures. The complexities of navigating these regulations can deter companies from expanding their forklift fleets, posing a challenge to market growth.

USA Forklift Market Future Outlook

The USA forklift market is poised to grow significantly over the coming years, driven by increasing demand for automation in warehousing and material handling processes. As industries continue to prioritize efficiency and sustainability, the adoption of electric and autonomous forklifts is expected to rise. Additionally, government regulations favoring the use of eco-friendly machinery will further stimulate the market. Companies that continue to invest in research and development to enhance battery technologies and automation capabilities will likely lead the market in the future.

Opportunities

- Technological Advancements: The integration of advanced technologies, such as the Internet of Things (IoT) and automation, presents significant opportunities for the forklift market. As of 2023, approximately 45% of forklifts sold in the U.S. are equipped with IoT capabilities, enabling real-time monitoring and data collection. This technological evolution enhances fleet management, improving operational efficiency and reducing downtime. Companies investing in fleet management software report up to a 20% reduction in operational costs. The ongoing advancements in technology are likely to shape the future of the forklift industry significantly.

- Demand for Electric Forklifts and Renewable Fuel Options: The growing demand for electric forklifts is reshaping the market landscape. As of 2023, sales of electric forklifts accounted for 30% of total forklift sales, with expectations for continued growth driven by environmental concerns and government incentives. The U.S. Department of Energy reports that electric forklifts can reduce operational costs by up to 25% compared to traditional fuel options. This shift towards electric and renewable fuel options presents manufacturers with opportunities to innovate and capture a larger share of the market.

Scope of the Report

|

By Product Type |

Electric Forklifts ICE Forklifts AGVs Rough Terrain Forklifts |

|

By End-Use Industry |

Manufacturing, Construction Retail and Wholesale Logistics and Warehousing |

|

By Technology |

Manual Semi-Automated Fully Automated |

|

By Fuel Type |

Electric Diesel Gasoline/LP Gas |

|

By Region |

North East Midwest South West |

Products

Key Target Audience Organizations and Entities Who Can Benefit by Subscribing to This Report:

Forklift Companies

Logistics and Warehousing Companies

E-Commerce Companies

Construction Firms

Government and Regulatory Bodies (OSHA, EPA)

Investments and Venture Capitalist Firms

Forklift Distributors Industries

Material Handling Equipment Companies

Companies

Players Mentioned in the Report:

Toyota Industries Corporation

Crown Equipment Corporation

Jungheinrich AG

Kion Group AG

Hyster-Yale Materials Handling

Mitsubishi Logisnext Co., Ltd.

Komatsu Ltd.

Doosan Industrial Vehicle Co., Ltd.

CLARK Material Handling Company

Hangcha Group Co., Ltd.

Table of Contents

1. USA Forklift Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. USA Forklift Market Size (In USD Bn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. USA Forklift Market Analysis

3.1. Growth Drivers

3.1.1. E-commerce Boom

3.1.2. Manufacturing Sector Growth

3.1.3. Adoption of Automation in Warehousing

3.1.4. Infrastructure Developments

3.2. Market Challenges

3.2.1. High Equipment Costs

3.2.2. Lack of Skilled Operators

3.2.3. Stringent Emission Norms

3.3. Opportunities

3.3.1. Electrification of Forklifts

3.3.2. Government Subsidies for Clean Energy Equipment

3.3.3. Growth in Retail Distribution Networks

3.4. Trends

3.4.1. Increasing Demand for Autonomous Forklifts

3.4.2. Shift Toward Lithium-Ion Batteries

3.4.3. Focus on Compact and High-Capacity Forklifts

3.5. Government Regulations

3.5.1. OSHA Safety Standards

3.5.2. EPA Emission Guidelines for Diesel Forklifts

3.5.3. Federal Tax Incentives for Green Energy Forklifts

3.5.4. U.S. Infrastructure Modernization Act

3.6. SWOT Analysis

3.7. Stake Ecosystem (Suppliers, Distributors, OEMs)

3.8. Porter’s Five Forces

3.9. Competition Ecosystem

4. USA Forklift Market Segmentation

4.1. By Power Source (In Value %)

4.1.1. Electric Forklifts

4.1.2. Internal Combustion Forklifts

4.2. By Class Type (In Value %)

4.2.1. Class I - Electric Motor Rider Trucks

4.2.2. Class II - Electric Motor Narrow Aisle Trucks

4.2.3. Class III - Electric Hand Trucks

4.2.4. Class IV - Internal Combustion Engine Trucks (Cushion Tires)

4.2.5. Class V - Internal Combustion Engine Trucks (Pneumatic Tires)

4.3. By End-Use Industry (In Value %)

4.3.1. Warehousing & Logistics

4.3.2. Manufacturing

4.3.3. Retail & Wholesale Distribution

4.3.4. Construction

4.3.5. Food & Beverage

4.4. By Load Capacity (In Value %)

4.4.1. Below 5 Tons

4.4.2. 5 to 10 Tons

4.4.3. Above 10 Tons

4.5. By Region (In Value %)

4.5.1. North East

4.5.2. South

4.5.3. Mid-West

4.5.4. West

5. USA Forklift Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. Toyota Industries Corporation

5.1.2. KION Group AG

5.1.3. Mitsubishi Logisnext Co., Ltd.

5.1.4. Crown Equipment Corporation

5.1.5. Hyster-Yale Materials Handling, Inc.

5.1.6. Jungheinrich AG

5.1.7. Doosan Industrial Vehicle Co., Ltd.

5.1.8. CLARK Material Handling Company

5.1.9. Komatsu Ltd.

5.1.10. Hyundai Heavy Industries Co., Ltd.

5.1.11. Lonking Holdings Limited

5.1.12. Manitou BF

5.1.13. Hangcha Group Co., Ltd.

5.1.14. UniCarriers Americas Corporation

5.1.15. EP Equipment Co., Ltd.

5.2. Cross Comparison Parameters (No. of Employees, Headquarters, Inception Year, Revenue, Sales Volume, Forklift Production Capacity, Distribution Network Size, R&D Expenditure)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers And Acquisitions

5.6. Investment Analysis

5.6.1. Venture Capital Funding

5.6.2. Government Grants

5.6.3. Private Equity Investments

6. USA Forklift Market Regulatory Framework

6.1. Safety and Emission Standards

6.2. Certification Processes

6.3. Environmental Regulations

7. USA Forklift Future Market Size (In USD Bn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. USA Forklift Future Market Segmentation

8.1. By Power Source (In Value %)

8.2. By Class Type (In Value %)

8.3. By End-Use Industry (In Value %)

8.4. By Load Capacity (In Value %)

8.5. By Region (In Value %)

9. USA Forklift Market Analysts’ Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

Disclaimer

Contact Us

Research Methodology

Step 1: Identification of Key Variables

In the initial phase, we conducted a comprehensive mapping of the key stakeholders in the USA Forklift Market. Our research was based on secondary data sources like industry reports, government publications, and proprietary databases. This step enabled us to identify the major factors influencing market growth, including technological advancements and regulatory changes.

Step 2: Market Analysis and Construction

This phase involved collecting historical market data on forklift adoption, market penetration, and revenue generation in various segments. We analyzed the impact of logistics expansion and e-commerce growth on the market's development. The historical data were validated using reliable secondary sources to ensure accurate market insights.

Step 3: Hypothesis Validation and Expert Consultation

We formulated hypotheses regarding market growth and dynamics, which were subsequently validated through interviews with industry experts. These consultations provided us with real-time operational insights and helped refine our understanding of market trends and challenges.

Step 4: Research Synthesis and Final Output

Finally, we synthesized all data collected from industry players, market analysts, and secondary sources. This synthesis was conducted using a bottom-up approach, with a focus on validating market size and segmentation. Our research output provides a detailed and accurate assessment of the USA forklift market.

Frequently Asked Questions

01. How big is the USA Forklift Market?

The USA forklift market is valued at USD 9.10 billion, driven by the expansion of logistics, e-commerce, and manufacturing sectors.

02. What are the challenges in the USA Forklift Market?

Challenges include high initial capital investments, safety regulations, and the shortage of skilled operators. Additionally, evolving environmental standards require companies to shift to electric forklifts.

03. Who are the major players in the USA Forklift Market?

Key players include Toyota Industries Corporation, Crown Equipment Corporation, Jungheinrich AG, Hyster-Yale Materials Handling, and Mitsubishi Logisnext Co., Ltd.

04. What are the growth drivers of the USA Forklift Market?

The market is propelled by the increasing need for automation in warehouses, the rise of e-commerce, and the adoption of eco-friendly electric forklifts.

05. What trends are shaping the USA Forklift Market?

Key trends include the growing adoption of electric forklifts, the development of autonomous forklifts, and the integration of IoT and fleet management systems.

TABLES

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.