USA Fruit Snacks Market Outlook to 2030

Region:North America

Author(s):Meenakshi Bisht

Product Code:KROD8908

December 2024

84

About the Report

USA Fruit Snacks Market Overview

- The USA Fruit Snacks Market is thriving, with a robust market size of USD 4.5 billion, driven by the increasing demand for healthy, convenient snack options. This market's growth has been influenced by evolving consumer preferences toward natural, minimally processed foods that are rich in vitamins and dietary fiber. The rising health consciousness, combined with innovations in product formulationsuch as sugar-free, organic, and clean-label offeringshas further fueled this expansion.

- In terms of regional dominance, North America, particularly the United States, holds the largest share of the global fruit snacks market. This dominance is attributed to the strong health-conscious consumer base, high disposable income levels, and the well-established presence of large supermarket chains and hypermarkets. The U.S. market also benefits from a thriving food innovation ecosystem, where manufacturers frequently launch new products to meet diverse consumer tastes.

- The FDA has set January 1, 2026, as the uniform compliance date for new food labeling regulations issued in 2023 and 2024. This initiative aims to give the food industry sufficient time to adjust to new labeling requirements and minimize economic impact. Companies are encouraged to comply as soon as possible, but must meet the regulations by the set date. Special circumstances may lead to different compliance dates for specific regulations.

USA Fruit Snacks Market Segmentation

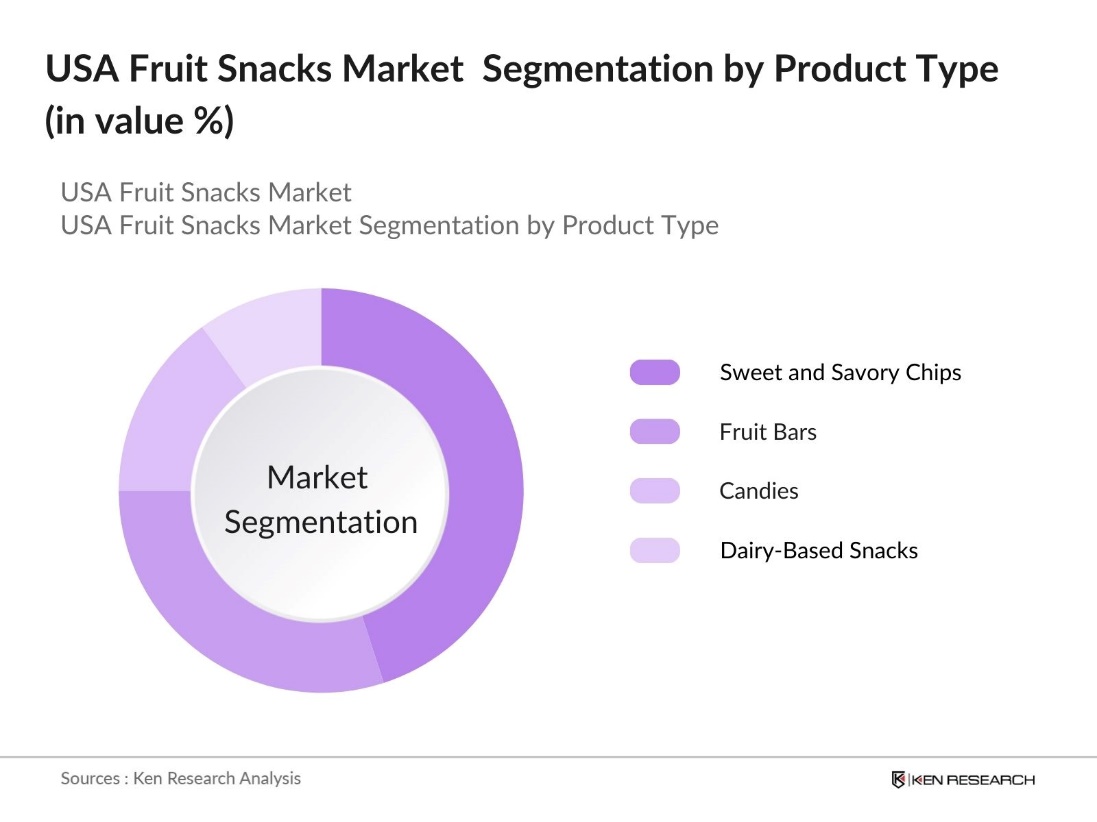

By Product Type: The fruit snacks market in the U.S. can be segmented by product type into sweet and savory chips, fruit bars, candies, and dairy-based snacks. Sweet and savory chips hold the dominant market share in this category, primarily due to their appeal to a broad range of consumers who prefer both sweet and salty flavors. These products include dried fruit crisps and fruit-coated chips, offering a versatile snacking option that caters to both health-conscious consumers and those seeking indulgence.

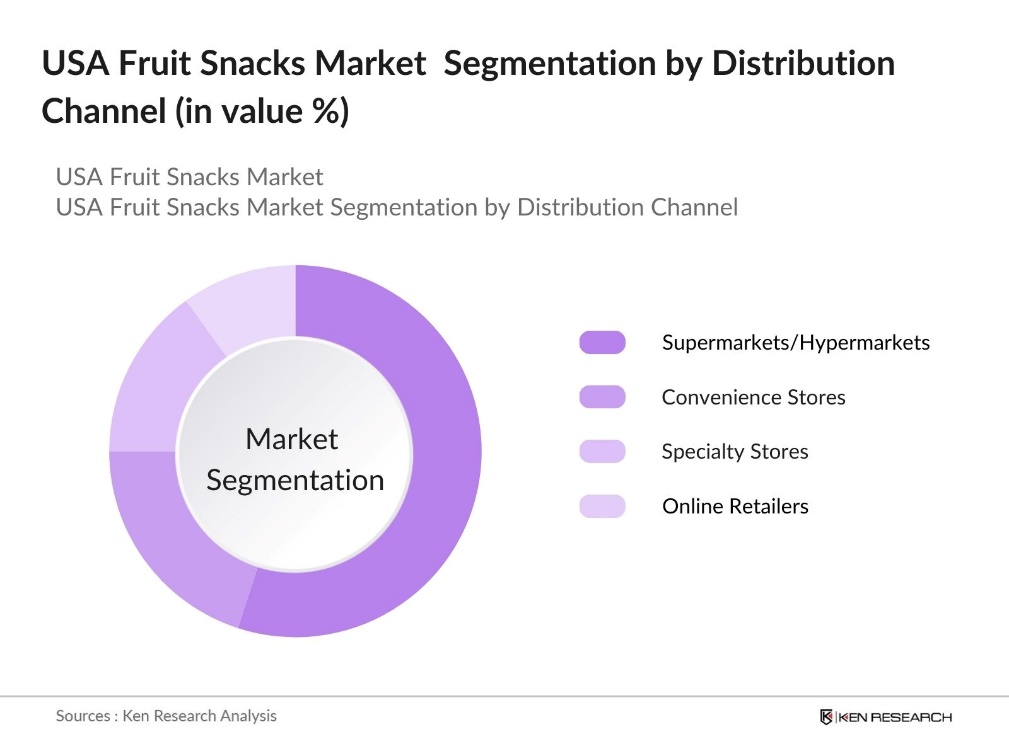

By Distribution Channel: The distribution of fruit snacks is segmented into supermarkets/hypermarkets, convenience stores, specialty stores, and online retailers. Supermarkets and hypermarkets dominate the distribution channels, contributing significantly to overall sales. This is due to their wide physical presence, allowing consumers to easily access a variety of fruit snack options. Furthermore, these large retailers often offer promotions and discounts, making them the preferred choice for bulk purchases.

USA Fruit Snacks Market Competitive Landscape

The U.S. fruit snacks market is highly competitive, with several key players dominating the market. Leading companies focus on product innovations, sustainability initiatives, and strategic partnerships to maintain their market positions. The competitive landscape is characterized by both large multinational brands and emerging startups, with a growing emphasis on organic and clean-label products.

| Company | Year Established | Headquarters | Product Portfolio | Key Focus Areas | Revenue (2023) | Geographic Reach | Distribution Channels |

|---|---|---|---|---|---|---|---|

| General Mills Inc. | 1928 | Minneapolis, MN, USA | |||||

| Welch Foods Inc. | 1869 | Concord, MA, USA | |||||

| Kellogg Company | 1906 | Battle Creek, MI, USA | |||||

| SunOpta Inc. | 1973 | Toronto, Canada | |||||

| Sunkist Growers, Inc. | 1893 | Valencia, CA, USA |

USA Fruit Snacks Industry Analysis

Growth Drivers

- Consumer Preferences for Health-Conscious Snacking: Consumer demand for health-conscious food options has surged, with more individuals choosing snacks that are low in sugar and free from artificial ingredients. According to the USDA, in 2024, the Healthy Food Financing Initiative (HFFI) is launched a program to increase access to healthy foods in underserved communities, providing $60 million in loans and grants over five years to support food retail projects. This trend is further supported by U.S. retail sales data, where fruit snacks sales experienced significant growth due to this health trend.

- Rising Demand for On-the-Go and Convenient Foods: The U.S. Bureau of Labor Statistics (BLS) reports a steady increase in consumer expenditure on convenient, portable snacks, especially among working professionals and students. In 2024, the working adults rely on convenient snacks like fruit bars for sustenance during work hours. Additionally, 70% of these consumers value portability and easy-to-eat options. The rise in urban living and busy lifestyles has contributed to this growth, with fruit snacks fitting into the category of convenient, healthy on-the-go meals.

- Impact of Online Retail Growth: The growth of e-commerce has significantly influenced fruit snack sales in the U.S. Consumers increasingly purchase snacks through platforms like Amazon and Walmart, driven by convenience and ease of access. Direct-to-consumer models are enabling fruit snack brands to reach broader audiences, bypassing traditional retail channels. This shift has expanded product variety and availability, particularly in urban areas, contributing to the overall growth of the fruit snacks market.

Market Challenges

- High Production Costs for Organic and Clean Label Products: Organic and clean label products come with higher production costs due to the more expensive raw materials and certifications required. This makes it challenging for companies to balance profitability with consumer demand for clean and organic ingredients. Fluctuating costs of agricultural commodities further strain manufacturers, who face the need to produce high-quality, clean label products while managing the financial pressures of adhering to organic and natural standards.

- Competition from Traditional Snacks and Low-Cost Alternatives: Fruit snacks face strong competition from traditional snacks like chips, cookies, and candy, which are often more affordable. This price difference makes it harder for fruit snack producers to attract price-sensitive consumers. The market for low-cost snacks has also been growing, intensifying the competitive landscape and posing a challenge for fruit snack manufacturers to maintain and grow their market share amidst more budget-friendly alternatives.

USA Fruit Snacks Market Future Outlook

Over the next five years, the U.S. fruit snacks market is expected to continue its growth trajectory. Key drivers include the increasing shift toward health-conscious eating habits, greater availability of organic products, and the rise of e-commerce platforms for food purchases. Additionally, ongoing product innovations, such as the inclusion of functional ingredients (e.g., probiotics, fiber), are likely to play a crucial role in attracting a broader consumer base.

Market Opportunities

- Expansion in E-commerce Sales: The growth of e-commerce platforms offers a significant opportunity for fruit snack manufacturers to reach consumers directly. As more shoppers turn to online grocery shopping, companies can leverage digital channels to minimize intermediary costs and offer a wider variety of products. This shift also enables manufacturers to engage consumers through subscription-based services, offering convenient, recurring purchases of fruit snacks and fostering brand loyalty.

- Rising Demand for Sustainable Packaging Solutions: Consumers are increasingly focused on sustainability, driving demand for eco-friendly packaging. Fruit snack companies are responding by adopting biodegradable or recyclable packaging to meet these expectations. This shift not only reduces environmental impact but also allows brands to differentiate themselves by aligning with consumers' growing preference for environmentally conscious products, enhancing their market appeal and competitiveness.

Scope of the Report

|

Product Type |

Sweet and Savory Chips Fruit Gummies Dried Fruit Bars |

|

Distribution Channel |

Supermarkets Convenience Stores Online Specialist Retailers |

|

Application |

Kids Health-Conscious Adults General Consumers |

|

Fruit Type |

Berries Apples Tropical Mixed Fruits |

|

Region |

Northeast Midwest South West |

Products

Key Target Audience

Fruit Snack Manufacturers

Dietary Supplement Companies

Sports Nutrition Companies

Travel and Airline Catering Companies

Nutraceutical Companies

Government and Regulatory Bodies (e.g., USDA, FDA)

Investors and venture capital Firms

Banks and Financial Institutions

Companies

Players Mentioned in the Report

General Mills Inc.

Welch Foods Inc.

SunOpta Inc.

Kellogg Company

Sunkist Growers, Inc.

Crispy Green Inc.

Rind Snacks

Sensible Foods

Mount Franklin Foods LLC

Nutty Goodness LLC

Table of Contents

1. USA Fruit Snacks Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. USA Fruit Snacks Market Size (in USD Mn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments & Milestones

3. USA Fruit Snacks Market Analysis

3.1. Growth Drivers

3.1.1. Consumer Preferences for Health-Conscious Snacking

3.1.2. Innovations in Fruit Snack Formats (natural ingredients, sugar-free options)

3.1.3. Rising Demand for On-the-Go and Convenient Foods

3.1.4. Impact of Online Retail Growth

3.2. Market Challenges

3.2.1. High Production Costs for Organic and Clean Label Products

3.2.2. Competition from Traditional Snacks and Low-Cost Alternatives

3.2.3. Product Shelf Life and Perishability

3.3. Opportunities

3.3.1. Expansion in E-commerce Sales

3.3.2. Rising Demand for Sustainable Packaging Solutions

3.3.3. Increasing Popularity of Exotic and Novel Flavors

3.4. Trends

3.4.1. Adoption of Fruit-Based Superfoods (e.g., Acai, Goji Berries)

3.4.2. Clean Label and Transparency Trends

3.4.3. Functional Fruit Snacks (added vitamins, probiotics)

3.5. Regulatory Landscape

3.5.1. FDA Guidelines on Nutritional Labelling

3.5.2. USDA Organic Certification and Standards

3.6. SWOT Analysis

3.7. Porters Five Forces Analysis

3.8. Competitive Ecosystem and Value Chain

4. USA Fruit Snacks Market Segmentation

4.1. By Product Type (in Value %)

4.1.1. Sweet and Savory Chips

4.1.2. Fruit-Based Gels and Gummies

4.1.3. Dried Fruit Snacks

4.1.4. Fruit Snack Bars

4.1.5. Other Fruit Snacks

4.2. By Distribution Channel (in Value %)

4.2.1. Supermarkets & Hypermarkets

4.2.2. Convenience Stores

4.2.3. Online Retailing

4.2.4. Specialist Retailers

4.3. By Application (in Value %)

4.3.1. Kids and Family Consumption

4.3.2. Adults (Health-Conscious Consumers)

4.4. By Fruit Type (in Value %)

4.4.1. Berries (Strawberry, Blueberry, Mixed Berries)

4.4.2. Apples (Dried Apple Chips, Apple Gels)

4.4.3. Tropical Fruits (Mango, Pineapple)

4.4.4. Other (Peach, Pear, Banana)

4.5. By Region (in Value %)

4.5.1. Northeast

4.5.2. Midwest

4.5.3. South

4.5.4. West

5. USA Fruit Snacks Competitive Analysis

5.1. Detailed Profiles of Major Competitors

5.1.1. General Mills Inc.

5.1.2. Welch Foods Inc.

5.1.3. SunOpta Inc.

5.1.4. Sunkist Growers, Inc.

5.1.5. Kellogg Company

5.1.6. Crunchies Natural Food

5.1.7. Sensible Foods

5.1.8. Rind Snacks

5.1.9. Crispy Green Inc.

5.1.10. Mount Franklin Foods LLC

5.1.11. Danone S.A. (Silk)

5.1.12. Paradise, Inc.

5.1.13. Materne North America Corp.

5.1.14. Nutty Goodness LLC

5.1.15. Ferrero Group

5.2. Cross Comparison Parameters (Revenue, Market Share, Product Portfolio, Geographic Presence, Innovation Capabilities, Sustainability Initiatives, M&A Activities, Strategic Partnerships)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Investment and Funding Overview

5.6. Venture Capital and Private Equity Investments

6. USA Fruit Snacks Market Regulatory Framework

6.1. FDA Nutrition Facts Labeling Regulations

6.2. Organic Certification Standards

6.3. USDA National Organic Program (NOP) Compliance

6.4. State-Level Labeling Regulations

7. USA Fruit Snacks Future Market Size (in USD Mn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Growth

8. USA Fruit Snacks Future Market Segmentation

8.1. By Product Type (in Value %)

8.2. By Distribution Channel (in Value %)

8.3. By Application (in Value %)

8.4. By Fruit Type (in Value %)

8.5. By Region (in Value %)

9. USA Fruit Snacks Market Analyst Recommendations

9.1. Total Addressable Market (TAM), Serviceable Available Market (SAM), Serviceable Obtainable Market (SOM) Analysis

9.2. Innovation Roadmap for New Product Development

9.3. Marketing and Customer Acquisition Strategies

9.4. Emerging White Spaces and Expansion Opportunities

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

This phase involves mapping key stakeholders in the U.S. fruit snacks market, focusing on consumer preferences and market trends. Extensive desk research is conducted, utilizing secondary data from proprietary databases to identify the variables that influence market dynamics.

Step 2: Market Analysis and Construction

We compile historical data related to market penetration, segment-specific revenue, and sales trends. This analysis ensures accuracy in revenue estimates and provides insights into the quality of products and their impact on market share.

Step 3: Hypothesis Validation and Expert Consultation

Through expert interviews with key players in the market, hypotheses about the market's growth drivers are validated. These consultations provide practical insights, complementing our data-driven analysis.

Step 4: Research Synthesis and Final Output

Final insights are developed by engaging with manufacturers to verify consumer preferences and sales performance. This results in a comprehensive report that accurately reflects the market's structure and future growth prospects.

Frequently Asked Questions

01. How big is the USA fruit snacks market?

The U.S. Fruit Snacks Market was valued at USD 4.5 billion, driven by the rising demand for healthy and convenient snacking options.

02. What are the challenges in the USA fruit snacks market?

Challenges in U.S. Fruit Snacks Market include high competition from traditional snacks, the perishable nature of fruit-based products, and concerns over added sugar content.

03. Who are the major players in the USA fruit snacks market?

Key players in U.S. Fruit Snacks Market include General Mills, Welch Foods, SunOpta, Kellogg Company, and Sunkist Growers.

04. What are the growth drivers of the USA fruit snacks market?

The U.S. Fruit Snacks Market growth drivers include increasing health awareness, product innovations, and the growing demand for organic and clean-label snacks.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.