USA Fuel Transfer Pumps Market Outlook to 2030

Region:North America

Author(s):Yogita Sahu

Product Code:KROD8212

December 2024

88

About the Report

USA Fuel Transfer Pumps Market Overview

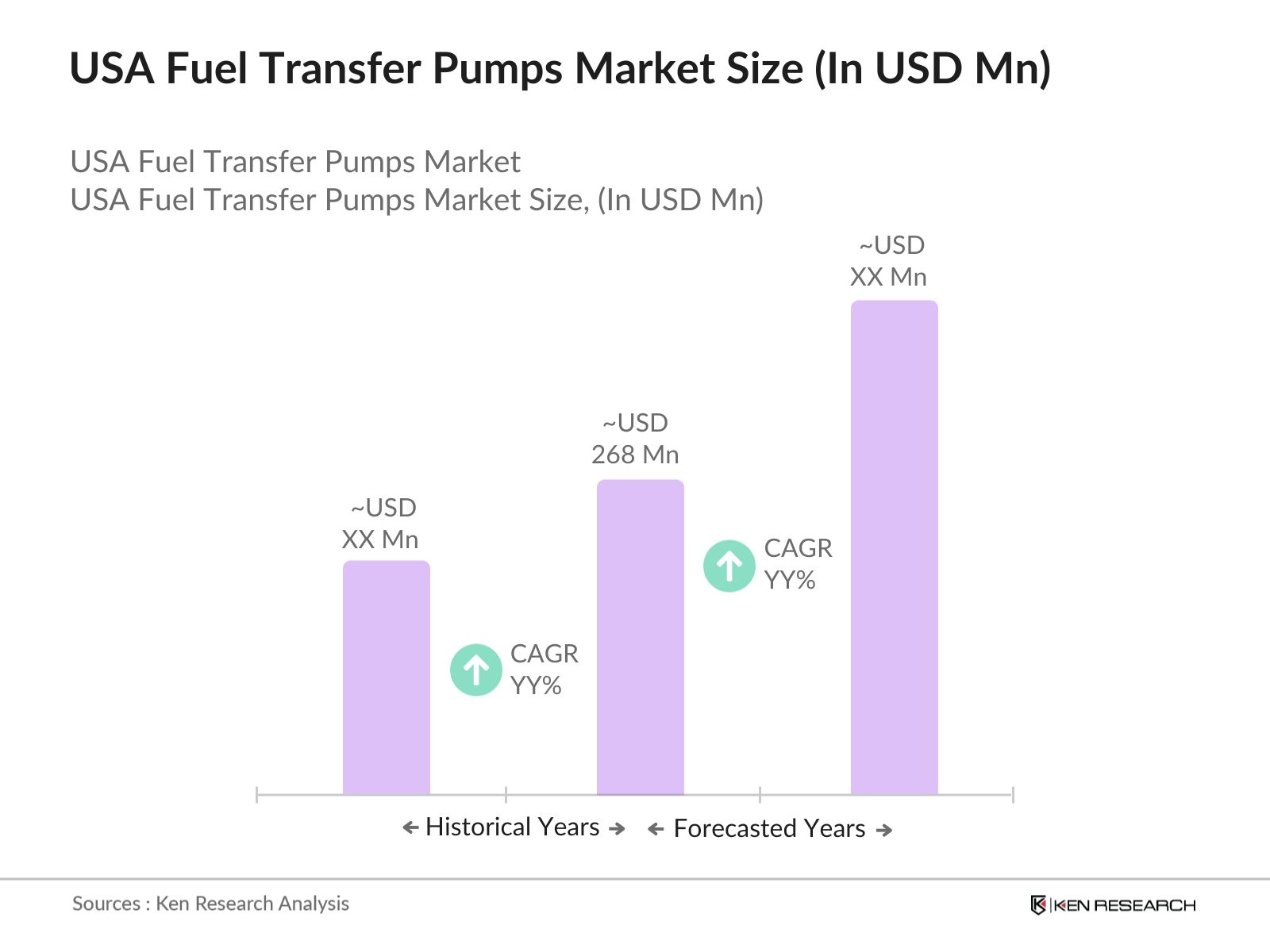

- The USA fuel transfer pumps market, valued at USD 268 million, has shown consistent growth driven by several factors. Industrial sectors like oil and gas, construction, automotive, and agriculture have been crucial in fueling the demand for these pumps. As industries continue to expand, the need for efficient fuel management systems rises. The adoption of electric and portable fuel transfer pumps is another driver, especially in applications requiring flexibility and remote fuel transfer solutions.

- In terms of dominant regions, the states of Texas, California, and Pennsylvania, as well as the Gulf Coast, are key contributors. This dominance is primarily due to their strong presence in oil and gas extraction, construction, and agricultural activities. These regions account for a significant number of operational refineries, fueling stations, and construction projects, which require efficient fuel transfer systems to maintain productivity.

- The U.S. government continues to push for alternative fuels, investing $400 million in 2024 for the expansion of biofuel infrastructure, including fuel transfer systems. This investment focuses on improving the efficiency of biofuel transfer pumps, encouraging innovations that support the blending and transfer of renewable fuels such as biodiesel and ethanol.

USA Fuel Transfer Pumps Market Segmentation

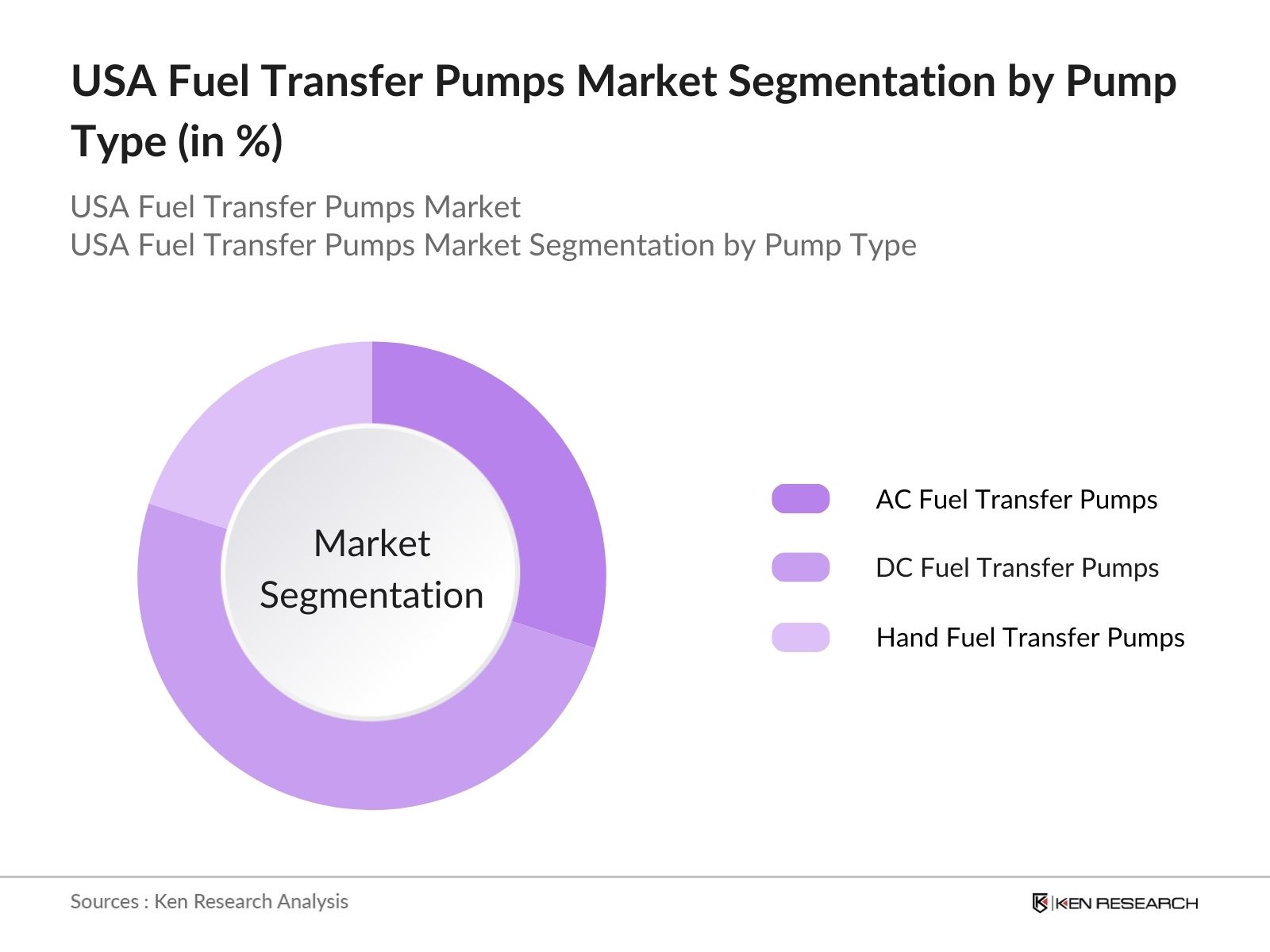

By Pump Type: The market is segmented by pump type into AC fuel transfer pumps, DC fuel transfer pumps, and hand fuel transfer pumps. Among these, DC fuel transfer pumps hold a dominant market share in the segment due to their flexibility, portability, and energy efficiency. They are particularly favored in remote and off-grid locations where power supply limitations make AC pumps impractical. These pumps are highly reliable, compact, and easy to operate, making them ideal for on-site fueling needs in industries like agriculture and mining.

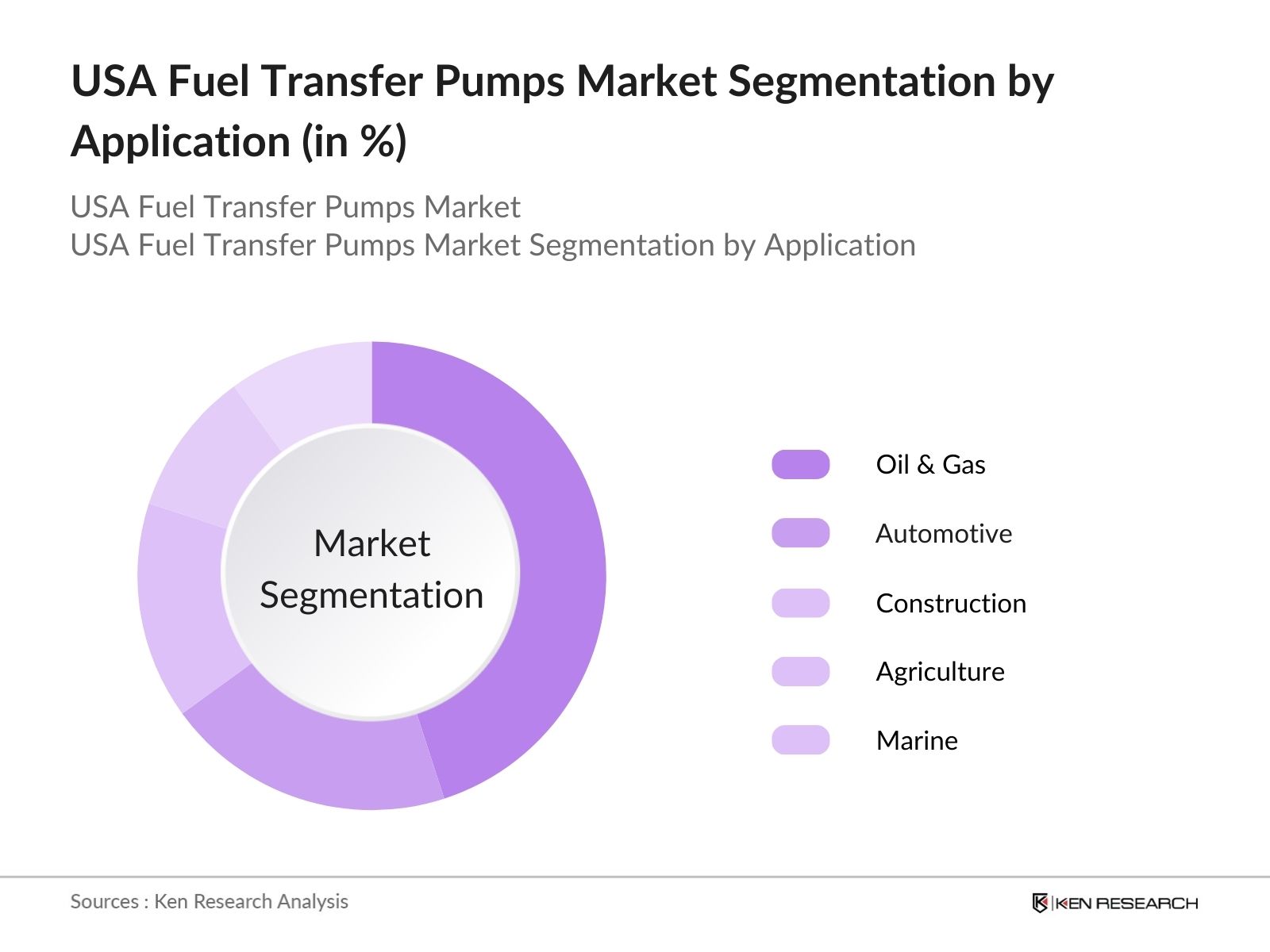

By Application: The market is also segmented by application into oil and gas, automotive, construction, agriculture, and marine sectors. The oil and gas sector dominates due to the extensive use of fuel transfer pumps for on-site fueling, refinery operations, and distribution networks. The heavy demand for reliable, high-flow pumps in the transportation and distribution of fuel within this sector ensures the continued dominance of fuel transfer pumps in this industry.

USA Fuel Transfer Pumps Market Competitive Landscape

The market is highly competitive, with both local manufacturers and global brands vying for market share. Key players include Graco Inc., Tuthill Transfer Systems, Great Plains Industries, and Piusi S.p.A.

|

Company |

Establishment Year |

Headquarters |

Pump Type Range |

Revenue (USD) |

Employees |

R&D Investments |

Product Innovations |

Recent Mergers/Acquisitions |

|

Graco Inc. |

1926 |

Minneapolis, USA |

||||||

|

Tuthill Transfer Systems |

1927 |

Fort Wayne, USA |

||||||

|

Great Plains Industries (GPI) |

1968 |

Kansas, USA |

||||||

|

Piusi S.p.A. |

1953 |

Suzzara, Italy |

||||||

|

Fill-Rite Company |

1951 |

Fort Wayne, USA |

USA Fuel Transfer Pumps Market Analysis

Market Growth Drivers

- Expansion of Fuel-Dependent Industries in the USA: The market is driven by growth in fuel-dependent sectors such as construction, agriculture, and transportation. In 2024, the construction industry in the United States is projected to employ over 11 million workers, requiring fuel transfer systems for heavy machinery and vehicles. This demand for fuel transfer pumps is fueled by increasing infrastructure projects.

- Rising Energy Production: The USA remains one of the largest producers of oil and natural gas, producing over 18.6 million barrels of crude oil per day in 2024, according to the U.S. Energy Information Administration (EIA). The continuous need to transfer large quantities of fuel across various regions will sustain the demand for fuel transfer pumps.

- Increasing Demand for Portable and Efficient Pumps in the Retail Sector: Retail fuel stations across the U.S. are experiencing increased pressure to provide faster, more efficient fuel services. With over 145,000 gas stations in the U.S. as of 2024 (Source: U.S. Census Bureau), the demand for reliable fuel transfer pump systems is on the rise. These stations require portable and efficient pumps to meet consumer demand for fast fueling, which helps drive market growth for both fixed and portable fuel transfer pump systems.

Market Challenges

- Stringent Environmental Regulations: The U.S. Environmental Protection Agency (EPA) imposes strict regulations on fuel handling and emissions, which directly affect the design and operation of fuel transfer pumps. In 2024, the EPA introduced new guidelines for reducing fuel vapor emissions during transfer processes, affecting over 100,000 fuel distribution systems nationwide.

- Volatility in Fuel Prices: The fuel market in the U.S. remains subject to price fluctuations, influenced by global geopolitical events and supply chain disruptions. In 2024, crude oil prices fluctuated between $70 to $95 per barrel, which has a direct impact on demand for fuel transfer equipment. Businesses may delay upgrading or purchasing new fuel transfer pumps during periods of high fuel costs, affecting market growth.

USA Fuel Transfer Pumps Market Future Outlook

Over the next five years, the USA fuel transfer pumps industry is projected to experience substantial growth, driven by rising industrial activities, increased demand for high-pressure fueling systems, and technological advancements such as IoT-enabled smart pumps.

Future Market Opportunities

- Rising Demand for Portable and Lightweight Pumps: The market for portable and lightweight fuel transfer pumps will experience growth as industries like construction and agriculture increasingly rely on mobile fuel solutions. By 2029, it is estimated that over 50,000 portable fuel pumps will be in use across various industries in the U.S., catering to remote fueling needs.

- Expansion of Fuel Transfer Pumps for Hydrogen Fuel Cells: As hydrogen fuel cell technology advances, the demand for specialized fuel transfer pumps capable of handling hydrogen will increase. By 2029, the market for hydrogen fuel transfer systems is projected to grow substantially, with over 2,500 hydrogen refueling stations in the U.S. requiring advanced transfer pump solutions.

Scope of the Report

|

By Pump Type |

AC Fuel Transfer Pumps |

|

DC Fuel Transfer Pumps |

|

|

Hand Fuel Transfer Pumps |

|

|

By Mounting |

Fixed |

|

Portable |

|

|

By Motor Type |

12V DC |

|

24V DC |

|

|

115V AC |

|

|

230V AC |

|

|

By Application |

Oil & Gas |

|

Automotive |

|

|

Construction |

|

|

Agriculture |

|

|

Marine |

|

|

By Region |

North |

|

East |

|

|

West |

|

|

South |

Products

Key Target Audience Organizations and Entities Who Can Benefit by Subscribing This Report:

Fuel transfer pump manufacturers

Oil & gas companies

Construction and infrastructure companies

Agricultural machinery manufacturers

Automotive industry stakeholders

Investors and venture capitalist firms

Government and regulatory bodies (e.g., U.S. Environmental Protection Agency)

Marine transport and logistics companies

Companies

Players Mentioned in the Report:

Graco Inc.

Tuthill Transfer Systems

Great Plains Industries (GPI)

Piusi S.p.A.

Fill-Rite Company

GoatThroat Pumps

Gorman-Rupp Company

Lincoln Industrial

Cim-Tek Filtration

Gilbarco Inc.

Table of Contents

1. USA Fuel Transfer Pumps Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Dynamics (Drivers, Restraints, Opportunities)

1.4. Key Market Developments

2. USA Fuel Transfer Pumps Market Size (In USD Million)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Revenue Contributions by Industry Segments (Oil & Gas, Automotive, Construction, Agriculture)

2.4. Key Milestones

3. USA Fuel Transfer Pumps Market Analysis

3.1. Growth Drivers (Fuel Efficiency Demand, High Pressure Fueling System Adoption, Infrastructure Expansion)

3.2. Market Challenges (High Initial Costs, Regulatory Pressures, Environmental Concerns)

3.3. Opportunities (Adoption of IoT-Integrated Pumps, Demand for Portable Systems in Remote Locations)

3.4. Trends (Shift to Electric and Smart Pumps, Emphasis on Fuel Efficiency and Sustainability)

3.5. Government Regulations (Environmental Standards, Fuel Safety Regulations, Compliance for Transfer Systems)

3.6. SWOT Analysis (Strengths, Weaknesses, Opportunities, Threats)

3.7. Porters Five Forces Analysis

3.8. Competition Ecosystem

4. USA Fuel Transfer Pumps Market Segmentation

4.1. By Pump Type (In Value %)

4.1.1. AC Fuel Transfer Pumps

4.1.2. DC Fuel Transfer Pumps

4.1.3. Hand Fuel Transfer Pumps

4.2. By Mounting (In Value %)

4.2.1. Fixed Pumps

4.2.2. Portable Pumps

4.3. By Motor Type (In Value %)

4.3.1. 12V DC

4.3.2. 24V DC

4.3.3. 115V AC

4.3.4. 230V AC

4.4. By Application (In Value %)

4.4.1. Oil & Gas

4.4.2. Automotive

4.4.3. Construction

4.4.4. Agriculture

4.4.5. Marine

4.5. By Region (In Value %)

4.5.1. North

4.5.2. East

4.5.3. West

4.5.4. South

5. USA Fuel Transfer Pumps Competitive Analysis

5.1. Detailed Profiles of Major Competitors (Graco Inc., Piusi S.p.A., Tuthill Transfer Systems, Great Plains Industries, Fill-Rite Company, GoatThroat Pumps, Gorman-Rupp Company, Lincoln Industrial, Cim-Tek Filtration, Gilbarco Inc., SPATCO, Liquidynamics, Meclube S.R.L., Yamada Corporation, DENSO Corporation)

5.2. Cross Comparison Parameters (Revenue, Headquarters, Market Share, Number of Employees, Product Portfolios)

5.3. Strategic Initiatives (Product Launches, Collaborations, Joint Ventures)

5.4. Mergers & Acquisitions

5.5. Investment Analysis

5.6. Government Grants & Support Programs

6. USA Fuel Transfer Pumps Market Regulatory Framework

6.1. Environmental Standards for Fuel Transfer Systems

6.2. Compliance Requirements for Safety and Efficiency

6.3. Certification Processes for Fuel Handling Equipment

7. USA Fuel Transfer Pumps Future Market Size (In USD Million)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Growth (Industry Adoption, Government Incentives, Technological Advancements)

8. USA Fuel Transfer Pumps Future Market Segmentation

8.1. By Pump Type (In Value %)

8.2. By Mounting Type (In Value %)

8.3. By Motor Type (In Value %)

8.4. By Application (In Value %)

8.5. By Region (In Value %)

9. USA Fuel Transfer Pumps Market Analysts' Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Segmentation Strategy

9.3. Marketing & Distribution Strategy

9.4. Competitive Differentiation and White Space Opportunities

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

The first step involved mapping key variables that influence the USA fuel transfer pumps market. This included extensive desk research, leveraging secondary databases to collect industry-level information and data. The goal was to identify critical variables such as industry demand drivers, technological trends, and competitive dynamics.

Step 2: Market Analysis and Construction

In this phase, historical data was compiled for market growth rates, key industry developments, and the adoption of fuel transfer systems across industries like oil & gas and construction. The analysis also included a detailed assessment of market penetration for different pump types (AC, DC, and hand-operated pumps).

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses were tested through interviews with industry experts from leading fuel pump manufacturers and end-users. These consultations provided valuable insights into operational trends, product innovations, and challenges faced by key market players.

Step 4: Research Synthesis and Final Output

The final stage involved synthesizing data from primary and secondary sources to generate a comprehensive, validated market report. The output included a detailed analysis of market segments, competitive landscape, and projections for the future of the USA fuel transfer pumps market.

Frequently Asked Questions

01. How big is the USA Fuel Transfer Pumps Market?

The USA fuel transfer pumps market was valued at USD 268 million, driven by the rising demand across key industries like oil & gas, construction, and agriculture.

02. What are the key challenges in the USA Fuel Transfer Pumps Market?

Challenges in the USA fuel transfer pumps market include high initial costs for advanced fuel transfer systems, stringent regulatory requirements, and growing environmental concerns regarding fuel spillage and emissions.

03. Who are the major players in the USA Fuel Transfer Pumps Market?

Major players in the USA fuel transfer pumps market include Graco Inc., Tuthill Transfer Systems, Great Plains Industries, Piusi S.p.A., and Fill-Rite Company, all of whom dominate due to their extensive product portfolios and innovations.

04. What are the growth drivers of the USA Fuel Transfer Pumps Market?

The USA fuel transfer pumps market is driven by increased demand for portable fuel transfer solutions, the need for fuel-efficient systems, and advancements in IoT-integrated smart pumps.

05. What is the future outlook for the USA Fuel Transfer Pumps Market?

The USA fuel transfer pumps market is expected to see growth over the next five years, bolstered by rising industrialization, infrastructure development, and the shift towards sustainable fuel management solutions.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.