USA Generator Market Outlook to 2030

Region:North America

Author(s):Shambhavi

Product Code:KROD2813

November 2024

98

About the Report

USA Generator Market Overview

- The USA generator market is valued at USD 20.3 billion, driven by increasing demand for reliable backup power across residential, commercial, and industrial sectors. The market has seen consistent growth due to frequent natural disasters and the expansion of critical infrastructure, such as data centers and healthcare facilities. The rising energy consumption and the need for uninterrupted power in remote and off-grid locations further contribute to market demand, fostering technological innovation in generator efficiency.

- Key regions such as Texas, California, and Florida dominate the U.S. generator market due to high population density, extensive industrial infrastructure, and vulnerability to natural disasters like hurricanes and wildfires. These states have seen significant demand for backup power solutions, driven by frequent power outages, regulatory pressures, and increasing reliance on digital infrastructure in both urban and rural areas.

- The U.S. government has implemented several incentives and regulations to promote the use of cleaner energy sources, directly influencing the generator market. The federal government, through the Inflation Reduction Act of 2022, has allocated $369 billion for energy security and climate change, encouraging the adoption of low-emission and renewable-based generators. Moreover, the Federal Investment Tax Credit (ITC) encourages businesses to switch to cleaner generator technologies, with up to 30% tax credit available for qualifying investments.

USA Generator Market Segmentation

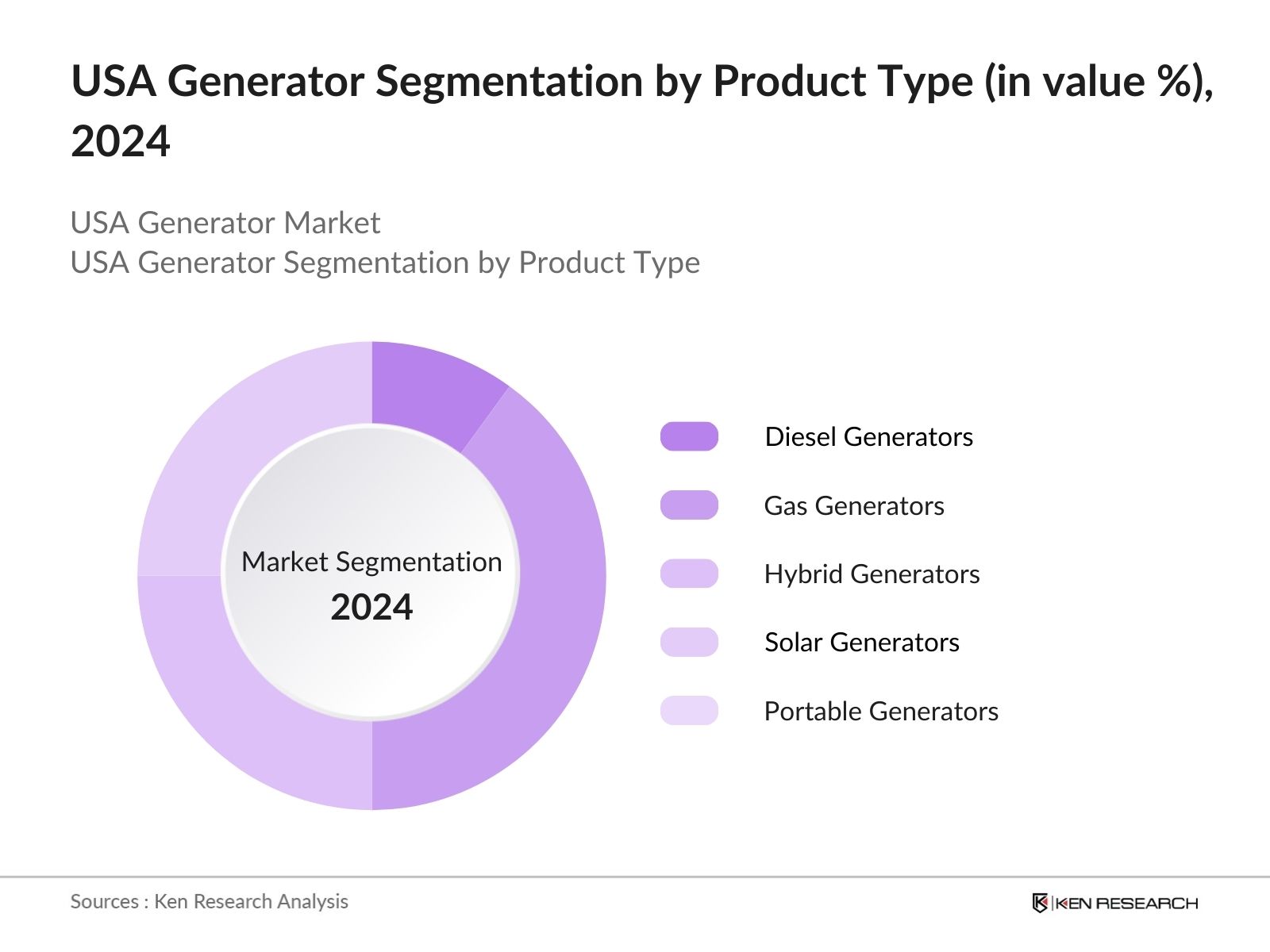

By Product Type

The USA generator market is segmented by product type into diesel generators, gas generators, hybrid generators, solar generators, and portable generators. Diesel generators maintain a dominant share due to their widespread application in industries such as oil and gas, construction, and manufacturing. The preference for diesel arises from its reliability, fuel efficiency, and ability to generate higher power output compared to alternative options. The robust supply chain for diesel fuel also contributes to its leadership within the market.

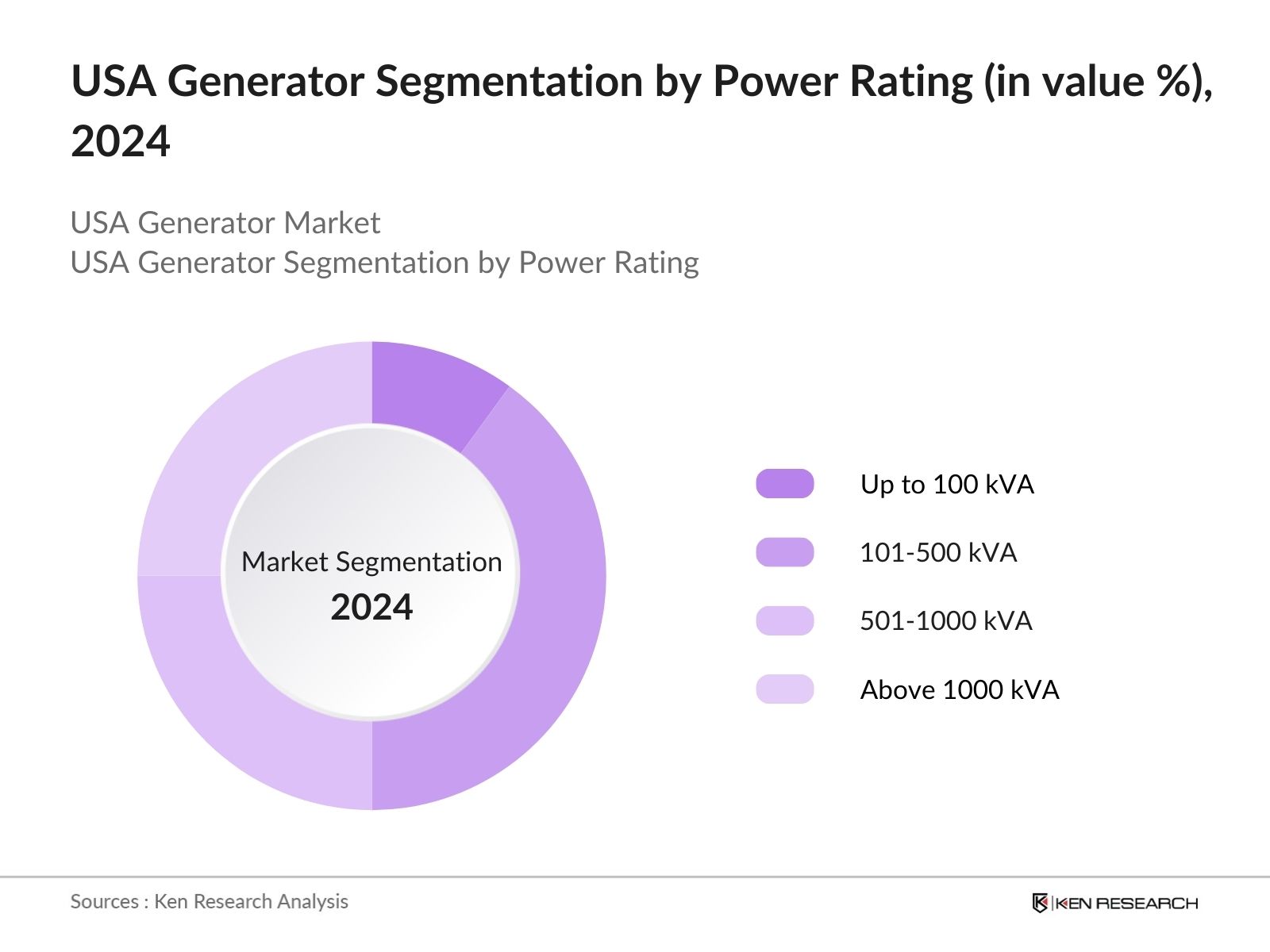

By Power Rating

The generator market is further segmented by power rating, including generators with ratings of up to 100 kVA, 101-500 kVA, 501-1000 kVA, and above 1000 kVA. Generators in the 101-500 kVA segment hold the largest share in the U.S. market, driven by their versatile use in both commercial and small industrial applications. Their adaptability in powering mid-sized facilities and meeting the energy needs of essential services makes them a popular choice across various sectors.

USA Generator Market Competitive Landscape

The USA generator market is dominated by key global and domestic players, with the competitive landscape shaped by product innovation, technological advancement, and strategic collaborations. Major players such as Cummins, Caterpillar, and Generac have established their dominance through strong distribution networks and a diverse portfolio of products catering to different sectors.

|

Company Name |

Establishment Year |

Headquarters |

Product Range |

Revenue (USD) |

R&D Investments |

No. of Employees |

Strategic Alliances |

Global Reach |

Fuel Type Specialization |

|

Cummins Inc. |

1919 |

Columbus, Indiana |

|||||||

|

Caterpillar Inc. |

1925 |

Deerfield, Illinois |

|||||||

|

Generac Power Systems |

1959 |

Waukesha, Wisconsin |

|||||||

|

Kohler Co. |

1873 |

Kohler, Wisconsin |

|||||||

|

Briggs & Stratton Corporation |

1908 |

Milwaukee, Wisconsin |

The U.S. generator market remains highly competitive, with companies continuously enhancing their technological capabilities, focusing on hybrid generators, and exploring renewable energy solutions. The market is also shaped by mergers and acquisitions, with major players leveraging their financial and operational strengths to gain a competitive edge.

Growth Drivers

- Increasing Energy Demand (Energy Consumption Trends): The rising energy consumption in the U.S. is a key driver for the generator market. The U.S. consumed around 4,130 billion kWh of electricity in 2022, and energy demand continues to grow due to factors such as industrial activity and urbanization. By 2024, the U.S. Energy Information Administration (EIA) expects total energy consumption to exceed 4,200 billion kWh. With this increased demand, reliance on backup power from generators has become crucial, particularly during peak loads or disruptions in energy supply. This upward trend in energy demand drives the generator market for both residential and industrial sector.

- Technological Advancements in Generator Design: Technological advancements are reshaping the generator industry, with new innovations focusing on fuel efficiency and lower emissions. Hybrid generators that integrate renewable energy are becoming increasingly popular. The U.S. saw a 12% increase in hybrid generator installations in 2023, with projections of continuous growth due to their efficiency and compliance with EPAs Tier 4 emissions standards. By 2025, industry experts estimate that the demand for low-emission generators will increase by 15%, driven by stringent regulatory frameworks and industrial preference for efficient power solutions.

- Increasing Frequency of Power Outages: The USA generator market is driven by the rising frequency of power outages caused by extreme weather events like hurricanes and wildfires. These outages are becoming more frequent due to climate change, increasing the need for backup power systems. Additionally, the growing construction sector, expanding data centers, and critical power demands in healthcare and industrial sectors further fuel generator adoption across residential and commercial applications.

Market Challenges

- High Initial Costs (Capital Investment): The upfront cost of purchasing and installing generators remains a significant barrier, particularly for smaller businesses and residential consumers. The U.S. Department of Energy (DOE) reported that the average installation cost for a 25kW generator can range between $7,000 to $12,000, depending on the type and location. These high initial investments, combined with the cost of ongoing maintenance, are a deterrent for potential buyers, especially for smaller enterprises or households that experience power outages less frequently.

- Stringent Environmental Regulations: The EPA's stringent emissions regulations, particularly the Tier 4 standards, which impose limits on nitrogen oxides (NOx) and particulate matter, create challenges for manufacturers and users of traditional diesel generators. The Tier 4 standards require expensive modifications to older generator models or a shift towards newer, cleaner technologies.

USA Generator Market Future Outlook

Over the next five years, the USA generator market is expected to witness substantial growth driven by increasing reliance on digital infrastructure, the need for resilient backup power, and rising energy demand across various sectors. Technological advancements in smart generators, the integration of renewable energy sources, and government initiatives supporting clean energy are key factors propelling market expansion. Additionally, growing awareness regarding energy efficiency and sustainability will likely lead to increased adoption of hybrid and solar-powered generators.

Opportunities

- Expansion into Rural and Off-Grid Areas: The U.S. governments Rural Electrification Program and increased infrastructure funding present significant growth opportunities for generator manufacturers targeting off-grid and remote locations. Rural areas, especially in states like Alaska and Montana, where grid connectivity is inconsistent, depend heavily on generators for primary and backup power.

- Increasing Adoption of Hybrid Generators: Hybrid generators, which combine traditional fuel-based power with renewable energy sources, are experiencing rapid adoption due to their efficiency and environmental benefits. The hybrid generator market is poised for further expansion as businesses seek sustainable power solutions to meet emissions regulations and rising fuel costs. This growing trend opens up significant market opportunities for hybrid technology providers.

Scope of the Report

|

Segment |

Sub-Segments |

|

Product Type |

Diesel Generators, Gas Generators, Hybrid Generators, Solar Generators, Portable Generators |

|

Power Rating |

Up to 100 kVA, 101-500 kVA, 501-1000 kVA, Above 1000 kVA |

|

Application |

Residential, Commercial, Industrial, Data Centers, Healthcare Facilities |

|

End User |

Utility Providers, Oil & Gas, Manufacturing, Telecom, Construction |

|

Region |

North-East, Midwest, South, West |

Products

Key Target Audience

Generator Manufacturers

Utility Providers

Industrial Infrastructure Companies

Energy Management Solutions Providers

Telecom and Data Center Operators

Investors and Venture Capitalist Firms

Government and Regulatory Bodies (U.S. Department of Energy, Environmental Protection Agency)

Construction Companies

Companies

Major Players in the USA Generator Market

Cummins Inc.

Caterpillar Inc.

Generac Power Systems

Kohler Co.

Briggs & Stratton Corporation

Rolls-Royce Power Systems

Atlas Copco AB

Honda Motor Co.

MTU Onsite Energy

John Deere

Wacker Neuson SE

Doosan Portable Power

Yanmar Holdings Co.

Mitsubishi Heavy Industries

Aksa Power Generation

Table of Contents

1. USA Generator Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. USA Generator Market Size (In USD Bn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. USA Generator Market Analysis

3.1. Growth Drivers

3.1.1. Increasing Energy Demand (Energy Consumption Trends)

3.1.2. Rising Demand for Backup Power (Residential, Commercial, and Industrial Sectors)

3.1.3. Government Support for Clean Energy (Federal Energy Policies, Incentives for Renewable Energy Adoption)

3.1.4. Technological Advancements in Generator Design (Product Efficiency, Low Emission Generators)

3.2. Market Challenges

3.2.1. High Initial Costs (Capital Investment)

3.2.2. Stringent Environmental Regulations (EPA Standards, Emission Regulations)

3.2.3. Fluctuating Fuel Prices (Diesel, Natural Gas)

3.2.4. Competition from Renewable Energy Sources (Solar, Wind Energy Alternatives)

3.3. Opportunities

3.3.1. Expansion into Rural and Off-Grid Areas (Infrastructure Development)

3.3.2. Increasing Adoption of Hybrid Generators (Energy Efficiency, Sustainable Solutions)

3.3.3. Growth of Data Centers and Telecom Industries (Critical Backup Power Demand)

3.3.4. International Export Opportunities (Emerging Markets, Global Expansion)

3.4. Trends

3.4.1. Integration with Smart Grid Systems (Energy Management, Monitoring)

3.4.2. Adoption of Digital and Remote Monitoring (IoT Integration, Predictive Maintenance)

3.4.3. Growing Preference for Renewable Hybrid Solutions (Solar-Diesel Hybrids, Battery Integration)

3.4.4. Urbanization and Industrialization in the U.S. (Construction, Commercial Developments)

3.5. Government Regulations

3.5.1. EPA Standards for Emissions (Tier 4 Regulations, Air Quality Standards)

3.5.2. Federal Incentives for Renewable Energy (Tax Credits, Rebates for Low-Emission Generators)

3.5.3. Energy Efficiency Standards (DOE Policies, Efficiency Rating Systems)

3.5.4. Infrastructure Investment and Jobs Act (Funding for Energy Infrastructure Projects)

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem

3.8. Porters Five Forces Analysis

3.9. Competition Ecosystem

4. USA Generator Market Segmentation

4.1. By Product Type (In Value %)

4.1.1. Diesel Generators

4.1.2. Gas Generators

4.1.3. Hybrid Generators

4.1.4. Solar Generators

4.1.5. Portable Generators

4.2. By Power Rating (In Value %)

4.2.1. Up to 100 kVA

4.2.2. 101-500 kVA

4.2.3. 501-1000 kVA

4.2.4. Above 1000 kVA

4.3. By Application (In Value %)

4.3.1. Residential

4.3.2. Commercial

4.3.3. Industrial

4.3.4. Data Centers

4.3.5. Healthcare Facilities

4.4. By End User (In Value %)

4.4.1. Utility Providers

4.4.2. Oil & Gas

4.4.3. Manufacturing

4.4.4. Telecom

4.4.5. Construction

4.5. By Region (In Value %)

4.5.1. North-East

4.5.2. Midwest

4.5.3. South

4.5.4. West

5. USA Generator Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. Caterpillar Inc.

5.1.2. Cummins Inc.

5.1.3. Generac Power Systems

5.1.4. Kohler Co.

5.1.5. Briggs & Stratton Corporation

5.1.6. Rolls-Royce Power Systems

5.1.7. Atlas Copco AB

5.1.8. Honda Motor Co.

5.1.9. MTU Onsite Energy

5.1.10. John Deere

5.1.11. Wacker Neuson SE

5.1.12. Doosan Portable Power

5.1.13. Yanmar Holdings Co.

5.1.14. Mitsubishi Heavy Industries

5.1.15. Aksa Power Generation

5.2. Cross Comparison Parameters (Headquarters, Product Portfolio, Revenue, Market Share, R&D Investments, Fuel Type Specialization, Geographical Reach, Strategic Initiatives)

5.3. Market Share Analysis

5.4. Strategic Initiatives (New Product Launches, Collaborations, Joint Ventures)

5.5. Mergers and Acquisitions

5.6. Investment Analysis (Venture Capital Funding, Private Equity)

5.7. Government Grants and Subsidies

6. USA Generator Market Regulatory Framework

6.1. Emission Standards (EPA Tier Standards)

6.2. Compliance Requirements (Safety Standards, Environmental Audits)

6.3. Certification Processes (ISO Certifications, Industry Certifications)

7. USA Generator Future Market Size (In USD Bn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. USA Generator Future Market Segmentation

8.1. By Product Type (In Value %)

8.2. By Power Rating (In Value %)

8.3. By Application (In Value %)

8.4. By End User (In Value %)

8.5. By Region (In Value %)

9. USA Generator Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

Research Methodology

Step 1: Identification of Key Variables

The initial step involved developing a detailed understanding of the USA generator market by mapping out key stakeholders, including manufacturers, suppliers, and end-users. This process was based on extensive secondary research and data collection from industry reports, government sources, and proprietary databases. The aim was to identify critical factors influencing the market.

Step 2: Market Analysis and Construction

Historical market data was collected to assess growth trends and developments within the U.S. generator market. Analysis of production and consumption patterns, as well as market penetration rates, was conducted to establish a detailed understanding of the competitive landscape. Revenue and service quality indicators were evaluated to validate market size estimates.

Step 3: Hypothesis Validation and Expert Consultation

Our market projections were refined through consultation with industry experts, utilizing computer-assisted telephone interviews (CATI) and face-to-face discussions. These interviews provided valuable insights from market participants, validating key trends and strategic initiatives undertaken by leading companies in the generator market.

Step 4: Research Synthesis and Final Output

The final phase of research involved synthesizing data from multiple sources, including feedback from key market players, to produce a comprehensive and validated analysis of the U.S. generator market. This phase ensured that the research output accurately reflected market dynamics, incorporating both bottom-up and top-down methodologies for robust insights.

Frequently Asked Questions

1. How big is the USA Generator Market?

The USA generator market was valued at USD 20.3 billion, driven by increasing demand for backup power across various industries, including healthcare, telecommunications, and manufacturing.

2. What are the challenges in the USA Generator Market?

Challenges include stringent environmental regulations, fluctuating fuel prices, and competition from renewable energy sources. The rising focus on sustainability is pushing companies to innovate, adding pressure to stay compliant while maintaining profitability.

3. Who are the major players in the USA Generator Market?

Key players include Cummins Inc., Caterpillar Inc., Generac Power Systems, Kohler Co., and Briggs & Stratton Corporation. These companies dominate due to their extensive product portfolios, strong R&D investments, and global distribution networks.

4. What are the growth drivers of the USA Generator Market?

The market is driven by increasing energy demand, the need for reliable backup power solutions, and advancements in smart generator technology. Additionally, government support for clean energy initiatives is fostering the growth of hybrid and renewable-powered generators.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.