USA Genetic Testing Market Outlook to 2030

Region:North America

Author(s):Samanyu

Product Code:KROD5018

October 2024

96

About the Report

USA Genetic Testing Market Overview

- The USA Genetic Testing market is valued at USD 4.5 Bn, driven by several factors, including the increasing prevalence of genetic diseases and the growing awareness of personalized medicine. The demand for genetic testing in oncology, prenatal care, and pharmacogenomics has surged in recent years due to advancements in genetic sequencing technologies like Next-Generation Sequencing (NGS) and CRISPR. Healthcare providers and patients alike are leveraging these tests for early detection and treatment planning, propelling the market's growth further.

- The genetic testing market in the USA is dominated by cities such as New York, San Francisco, and Boston, as well as major regions like California. These areas are home to leading research institutions, healthcare facilities, and biotechnology companies, making them hubs for innovation in genetic testing. The presence of a highly skilled workforce, significant investments in biotech, and favorable regulatory environments contribute to their dominance.

- The integration of genetic data into Electronic Health Records (EHRs) is revolutionizing healthcare delivery in the U.S. In 2024, the U.S. Department of Health and Human Services mandated that healthcare providers use standardized formats for incorporating genetic information into EHRs. This facilitates better coordination of care and more personalized treatment planning. With more than 70% of U.S. hospitals adopting EHR systems, genetic data integration is expected to enhance clinical decision-making and improve patient outcomes across various medical disciplines.

USA Genetic Testing Market Segmentation

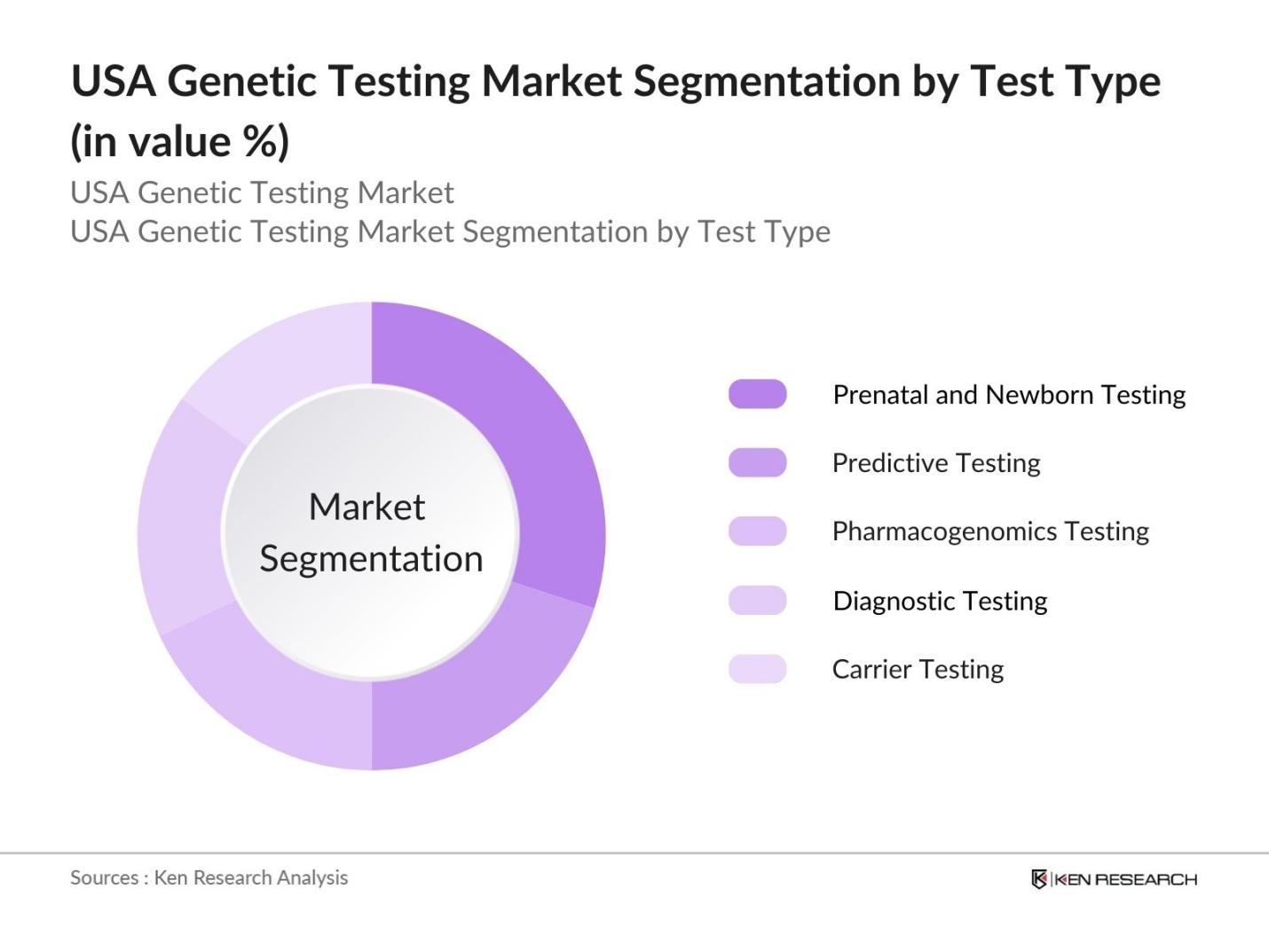

By Test Type: The market is segmented by test type into Predictive Testing, Carrier Testing, Prenatal and Newborn Testing, Pharmacogenomics Testing, and Diagnostic Testing. Prenatal and Newborn Testing currently dominates the test type segmentation due to increasing awareness among expectant parents about potential genetic disorders. The availability of non-invasive prenatal testing (NIPT), which offers safe and accurate genetic information, has further accelerated its adoption. Hospitals and healthcare providers increasingly recommend these tests as part of routine prenatal care, contributing to its high market share.

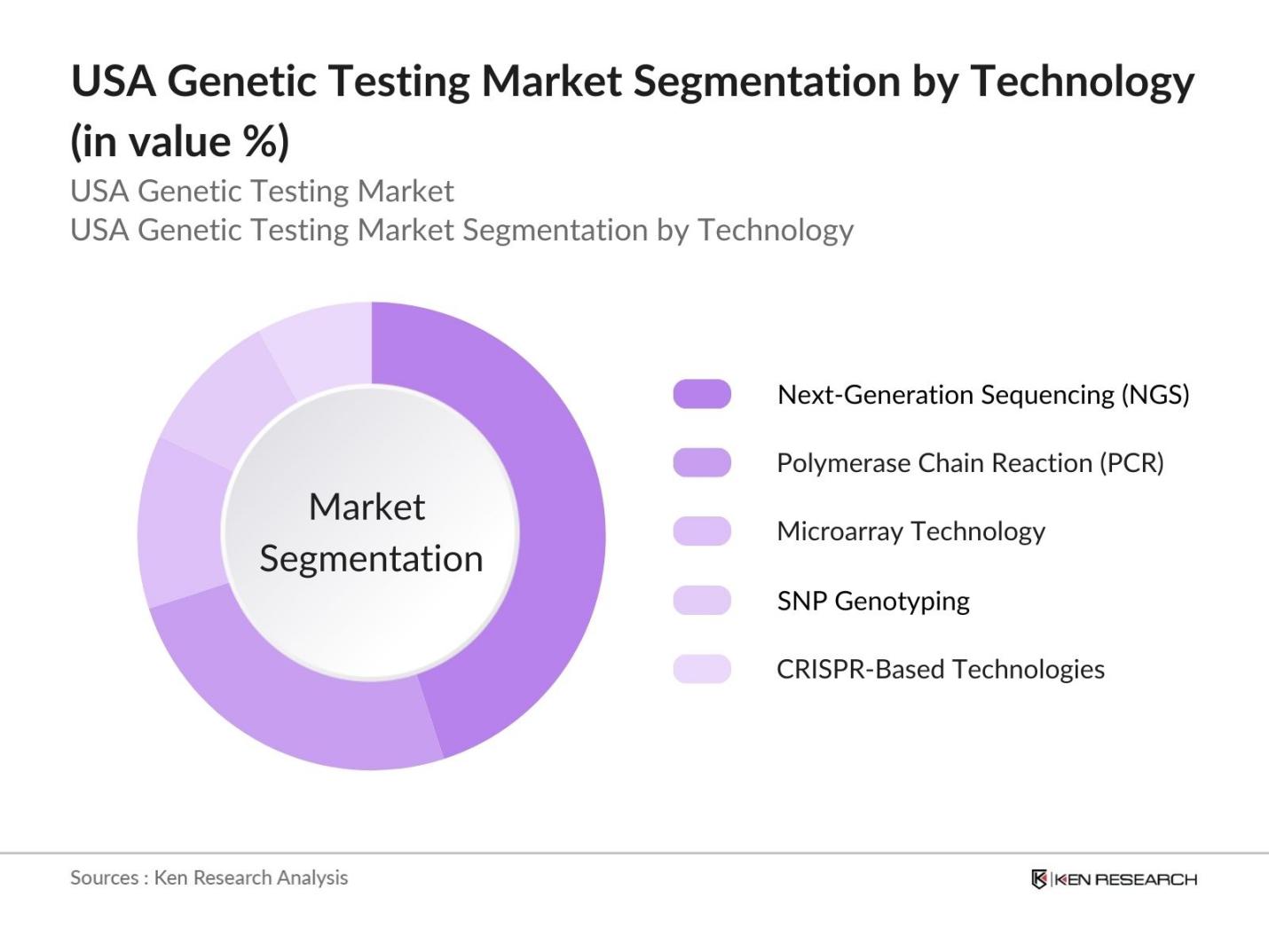

By Technology: The market is segmented by technology into Next-Generation Sequencing (NGS), Polymerase Chain Reaction (PCR), Microarray Technology, Single Nucleotide Polymorphism (SNP) Genotyping, and CRISPR-Based Technologies. Next-Generation Sequencing (NGS) dominates the technology segmentation due to its ability to process large amounts of genetic data quickly and at lower costs. NGS is widely used for oncology diagnostics, pharmacogenomics, and personalized medicine applications. Its growing use in research and clinical diagnostics is driving its large market share, particularly in hospitals and diagnostic laboratories.

USA Genetic Testing Market Competitive Landscape

The market sees a strong presence of companies like Illumina, Myriad Genetics, and Invitae. These companies dominate due to their technological advancements, broad test portfolios, and established relationships with healthcare providers. The industry is also characterized by numerous acquisitions and partnerships, as larger firms absorb smaller startups to expand their testing capabilities and market reach.

|

Company Name |

Establishment Year |

Headquarters |

Revenue (2023) |

Employees |

Key Product |

R&D Investment |

Market Reach |

Technological Focus |

|

Illumina, Inc. |

1998 |

San Diego, CA |

||||||

|

Myriad Genetics, Inc. |

1991 |

Salt Lake City, UT |

||||||

|

Invitae Corporation |

2010 |

San Francisco, CA |

||||||

|

Natera, Inc. |

2004 |

San Carlos, CA |

||||||

|

Quest Diagnostics |

1967 |

Secaucus, NJ |

USA Genetic Testing Industry Analysis

Growth Drivers

-

Increased Focus on Preventive Healthcare: Preventive healthcare in the USA has seen a significant shift with the rising burden of chronic diseases. The CDC reports that chronic conditions like heart disease and cancer account for over $3.8 trillion in healthcare costs annually. Genetic testing, which can help identify predispositions to such diseases, is gaining prominence as part of this preventive approach. With the U.S. government allocating $42 billion for chronic disease prevention initiatives, the focus is on improving early detection and personalized care, fueling demand for genetic testing services in 2024.

- Expansion in Precision Medicine: Precision medicine is revolutionizing healthcare by tailoring treatments to individual genetic profiles. The National Institutes of Health (NIH) allocated $500 million to the All of Us Research Program, aimed at gathering genetic data from one million participants to develop personalized treatment plans. This expanding approach relies heavily on genetic testing to map diseases and treatment responses. In 2024, the U.S. healthcare systems strategic focus on personalized treatment for cancer and rare diseases is further driving demand for genetic testing technologies, particularly in oncology and cardiovascular care.

- Rising Consumer Awareness: The increased awareness of genetic diseases, spurred by initiatives such as National DNA Day and widespread media coverage, has led to heightened interest in genetic testing. In 2024, more than 20 million Americans have already undergone direct-to-consumer (DTC) genetic testing. Campaigns funded by the National Human Genome Research Institute (NHGRI) have bolstered consumer education, ensuring more individuals seek genetic insights to assess hereditary risks. This consumer-driven demand is set to grow further, driven by public education efforts and easy access to testing kits.

Market Challenges

-

High Costs of Genetic Testing: Genetic testing in the U.S. remains cost-prohibitive for many. While prices have decreased over the past decade, a single test can still cost between $1,000 and $2,000. Despite its potential, access to genetic testing services is hindered by these high upfront costs, particularly for those without comprehensive health insurance. For instance, over 8.6% of Americans were uninsured in 2022, limiting their ability to afford these services. Additionally, the availability of lower-cost tests has not significantly increased adoption among lower-income households, stalling market penetration.

- Ethical and Privacy Concerns: Ethical dilemmas surrounding genetic testing continue to be a concern in the U.S. market. The Genetic Information Nondiscrimination Act (GINA) was enacted to prevent misuse of genetic data, yet privacy concerns persist. In 2023, over 50% of Americans expressed apprehension regarding data misuse, especially from direct-to-consumer genetic testing companies. Despite regulatory protections, there is a gap in consumer trust, and the handling of sensitive genetic data remains a critical barrier to the widespread adoption of genetic testing.

USA Genetic Testing Market Future Outlook

Over the next five years, the USA genetic testing market is expected to experience significant growth, fueled by continuous advancements in genetic technologies and increasing consumer demand for personalized healthcare solutions. The integration of artificial intelligence in genetic data interpretation, combined with decreasing costs of sequencing, will play a crucial role in expanding the market. Additionally, government initiatives promoting preventive healthcare and collaborations between biotech firms and research institutions will further accelerate market expansion.

Future Market Opportunities

-

Adoption in Emerging Markets: Emerging markets are increasingly adopting genetic testing due to declining costs and technological advancements. While the U.S. leads in genetic testing adoption, markets in Asia and Latin America are rapidly catching up. In 2024, U.S. genetic testing companies are looking to expand into these regions through joint ventures and partnerships. This global expansion is bolstered by U.S. government export initiatives that encourage the international trade of medical technologies. With growing healthcare infrastructure in these emerging markets, U.S.-based companies stand to gain significant revenue from genetic testing exports.

- Expansion of Genetic Data Analytics: The growing convergence of genetic testing and data analytics offers vast opportunities for healthcare. In 2024, the integration of advanced AI algorithms into genetic research is enabling more detailed interpretation of genetic data, improving diagnostic accuracy. The NIH invested over $1 billion into genomic data analysis initiatives, which are accelerating research in rare genetic disorders. These innovations create opportunities for genetic testing companies to collaborate with healthcare institutions and research centers, improving treatment outcomes and driving the growth of genetic testing applications in areas like pharmacogenomics and personalized medicine.

Scope of the Report

|

By Test Type |

Predictive Testing Carrier Testing Prenatal and Newborn Testing Pharmacogenomics Testing Diagnostic Testing |

|

By Application |

Oncology Cardiovascular Diseases Neurological Disorders Rare Genetic Disorders Reproductive Health |

|

By Technology |

Next-Generation Sequencing (NGS) Polymerase Chain Reaction (PCR) Microarray Technology SNP Genotyping CRISPR-Based Technologies |

|

By End-User |

Hospitals and Clinics Diagnostic Laboratories Academic & Research Institutions Direct-to-Consumer (DTC) |

|

By Region |

North-East Mid-West South West |

Products

Key Target Audience

Hospitals and Healthcare Providers

Diagnostic Laboratories

Biotechnology Companies

Pharmaceutical Companies

Direct-to-Consumer Genetic Testing Providers

Banks and Financial Institutes

Government and Regulatory Bodies (FDA, CMS, NIH)

Insurance Providers and Payers

Investment and Venture Capitalist Firms

Companies

Players Mentioned in the Report:

Illumina, Inc.

Myriad Genetics, Inc.

Invitae Corporation

Natera, Inc.

Quest Diagnostics

Thermo Fisher Scientific

23andMe, Inc.

Guardant Health

Fulgent Genetics

Ambry Genetics

GeneDx

PerkinElmer

Color Genomics

Helix

LabCorp

Table of Contents

1. USA Genetic Testing Market Overview

1.1. Definition and Scope (Market Overview, Testing Types, Use Cases)

1.2. Market Taxonomy (Types of Tests, Applications, End-Users)

1.3. Market Dynamics

1.3.1. Market Growth Drivers (Demand for Personalized Medicine, Population Genetics)

1.3.2. Restraints (Regulatory Challenges, Data Privacy Concerns)

1.3.3. Opportunities (Technological Advancements in Genetic Sequencing)

1.3.4. Key Trends (Direct-to-Consumer Testing, Integration with AI for Predictive Analytics)

2. USA Genetic Testing Market Size (In USD Bn)

2.1. Historical Market Size (Revenue, Test Volumes)

2.2. Year-On-Year Growth Analysis (Market Expansion)

2.3. Key Market Developments and Milestones (New Product Launches, Collaborations)

3. USA Genetic Testing Market Analysis

3.1. Growth Drivers

3.1.1. Increased Focus on Preventive Healthcare

3.1.2. Expansion in Precision Medicine

3.1.3. Rising Consumer Awareness

3.1.4. Expanding Applications in Oncology and Prenatal Testing

3.2. Market Restraints

3.2.1. High Costs of Genetic Testing

3.2.2. Ethical and Privacy Concerns

3.2.3. Reimbursement Challenges

3.3. Opportunities

3.3.1. Expansion of Genetic Data Analytics

3.3.2. Rise in Collaborative Research Initiatives

3.3.3. Adoption in Emerging Markets

3.4. Trends

3.4.1. Rise of Multi-Gene Panel Testing

3.4.2. Increasing Adoption of CRISPR Technology

3.4.3. Direct-to-Consumer (DTC) Genetic Testing Expansions

3.4.4. Genetic Data Integration into Electronic Health Records (EHRs)

3.5. Regulatory Environment

3.5.1. FDA Guidelines for Genetic Testing Products

3.5.2. HIPAA and Genetic Information Non-discrimination Act (GINA)

3.5.3. Evolving Data Privacy Laws

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem

3.8. Porters Five Forces Analysis

3.9. Competitive Landscape (Market Positioning of Key Players)

4. USA Genetic Testing Market Segmentation

4.1. By Test Type (In Value %)

4.1.1. Predictive Testing

4.1.2. Carrier Testing

4.1.3. Prenatal and Newborn Testing

4.1.4. Pharmacogenomics Testing

4.1.5. Diagnostic Testing

4.2. By Application (In Value %)

4.2.1. Oncology

4.2.2. Cardiovascular Diseases

4.2.3. Neurological Disorders

4.2.4. Rare Genetic Disorders

4.2.5. Reproductive Health

4.3. By Technology (In Value %)

4.3.1. Next-Generation Sequencing (NGS)

4.3.2. Polymerase Chain Reaction (PCR)

4.3.3. Microarray Technology

4.3.4. Single Nucleotide Polymorphism (SNP) Genotyping

4.3.5. CRISPR-Based Technologies

4.4. By End-User (In Value %)

4.4.1. Hospitals and Clinics

4.4.2. Diagnostic Laboratories

4.4.3. Academic & Research Institutions

4.4.4. Direct-to-Consumer (DTC)

4.5. By Region (In Value %)

4.5.1. North-East

4.5.2. Mid-West

4.5.3. South

4.5.4. West

5. USA Genetic Testing Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. Illumina, Inc.

5.1.2. Myriad Genetics, Inc.

5.1.3. Invitae Corporation

5.1.4. 23andMe, Inc.

5.1.5. Natera, Inc.

5.1.6. Thermo Fisher Scientific

5.1.7. Quest Diagnostics

5.1.8. Fulgent Genetics

5.1.9. GeneDx

5.1.10. Guardant Health

5.1.11. Ambry Genetics

5.1.12. PerkinElmer

5.1.13. Helix

5.1.14. Color Genomics

5.1.15. LabCorp

5.2. Cross Comparison Parameters (No. of Employees, Headquarters, Revenue, Product Portfolios, Global Reach, Strategic Collaborations)

5.3. Market Share Analysis

5.4. Strategic Initiatives (New Product Launches, Partnerships)

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Venture Capital Funding

5.8. Private Equity Investments

5.9. R&D Investments

6. USA Genetic Testing Market Regulatory Framework

6.1. Government Regulations (FDA Approvals, CMS Guidelines)

6.2. Certification Standards (CLIA, CAP Accreditation)

6.3. Reimbursement Policies (Private Insurance, Medicare/Medicaid)

7. USA Genetic Testing Future Market Size (In USD Bn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Growth (Advancements in Genomic Data Analysis, Expansion in Preventive Care)

8. USA Genetic Testing Future Market Segmentation

8.1. By Test Type (In Value %)

8.2. By Application (In Value %)

8.3. By Technology (In Value %)

8.4. By End-User (In Value %)

8.5. By Region (In Value %)

9. USA Genetic Testing Market Analysts' Recommendations

9.1. Total Addressable Market (TAM) / Serviceable Available Market (SAM) / Serviceable Obtainable Market (SOM) Analysis

9.2. Strategic Marketing Initiatives (Targeting New Consumer Segments, Expansion into Untapped Markets)

9.3. White Space Opportunity Analysis

9.4. Customer Segmentation and Targeting Strategies

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

The first phase involves developing an ecosystem map of the USA genetic testing market, identifying major stakeholders like genetic testing companies, healthcare providers, and regulatory bodies. A combination of secondary research from industry reports and databases is employed to gather crucial market data.

Step 2: Market Analysis and Construction

In this step, we analyze historical data from the USA genetic testing market, focusing on key metrics such as test adoption rates, revenue generation by segment, and the number of service providers. These insights help to determine market structure and trends.

Step 3: Hypothesis Validation and Expert Consultation

We conduct interviews with market experts, including geneticists, industry leaders, and healthcare professionals, to validate market hypotheses. This process ensures the accuracy and relevance of the market data gathered.

Step 4: Research Synthesis and Final Output

The final stage involves synthesizing all collected data to produce a comprehensive market analysis. This involves validating the bottom-up data with industry players, ensuring the report reflects the most accurate market trends.

Frequently Asked Questions

01. How big is the USA Genetic Testing Market?

The USA genetic testing market is valued at USD 4.5 Bn, driven by advancements in genetic sequencing technologies and an increasing focus on personalized medicine.

02. What are the challenges in the USA Genetic Testing Market?

The USA genetic testing market faces challenges like high costs of tests, ethical concerns regarding genetic privacy, and reimbursement hurdles, which limit widespread adoption.

03. Who are the major players in the USA Genetic Testing Market?

Key players in USA genetic testing market include Illumina, Myriad Genetics, Invitae, Natera, and Quest Diagnostics. These companies dominate due to their strong R&D investments and comprehensive test offerings.

04. What are the growth drivers of the USA Genetic Testing Market?

The USA genetic testing market is driven by the rising incidence of genetic diseases, growing consumer awareness, and technological advancements in genetic sequencing.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.