USA Geospatial Analytics Market Outlook to 2030

Region:North America

Author(s):Shreya Garg

Product Code:KROD71422

December 2024

90

About the Report

USA Geospatial Analytics Market Overview

- The USA Geospatial Analytics Market is valued at USD 10.1 billion, driven by increased demand for spatial data and location-based services across various industries. The rise of smart city projects and the growing reliance on satellite data for critical decision-making have significantly contributed to the market's expansion. Key drivers include advancements in geospatial technologies like Geographic Information Systems (GIS), remote sensing, and real-time analytics, which help businesses and governments optimize infrastructure and resource management.

- Dominant cities leading the geospatial analytics market include New York, San Francisco, and Washington, D.C. These regions dominate due to their robust infrastructure, advanced technology adoption, and the concentration of industries like defense, logistics, and urban planning, which rely heavily on geospatial data. Additionally, the presence of key government agencies and a thriving tech sector have further propelled the growth of the market in these cities.

- The Geospatial Data Act of 2018 continues to provide a regulatory framework for managing geospatial data in the U.S. It mandates federal agencies to share geospatial data, ensuring more efficient use of resources and improving access to geospatial technologies. By 2024, over 30 federal agencies are expected to comply with these data-sharing regulations, promoting transparency and interoperability in geospatial systems.

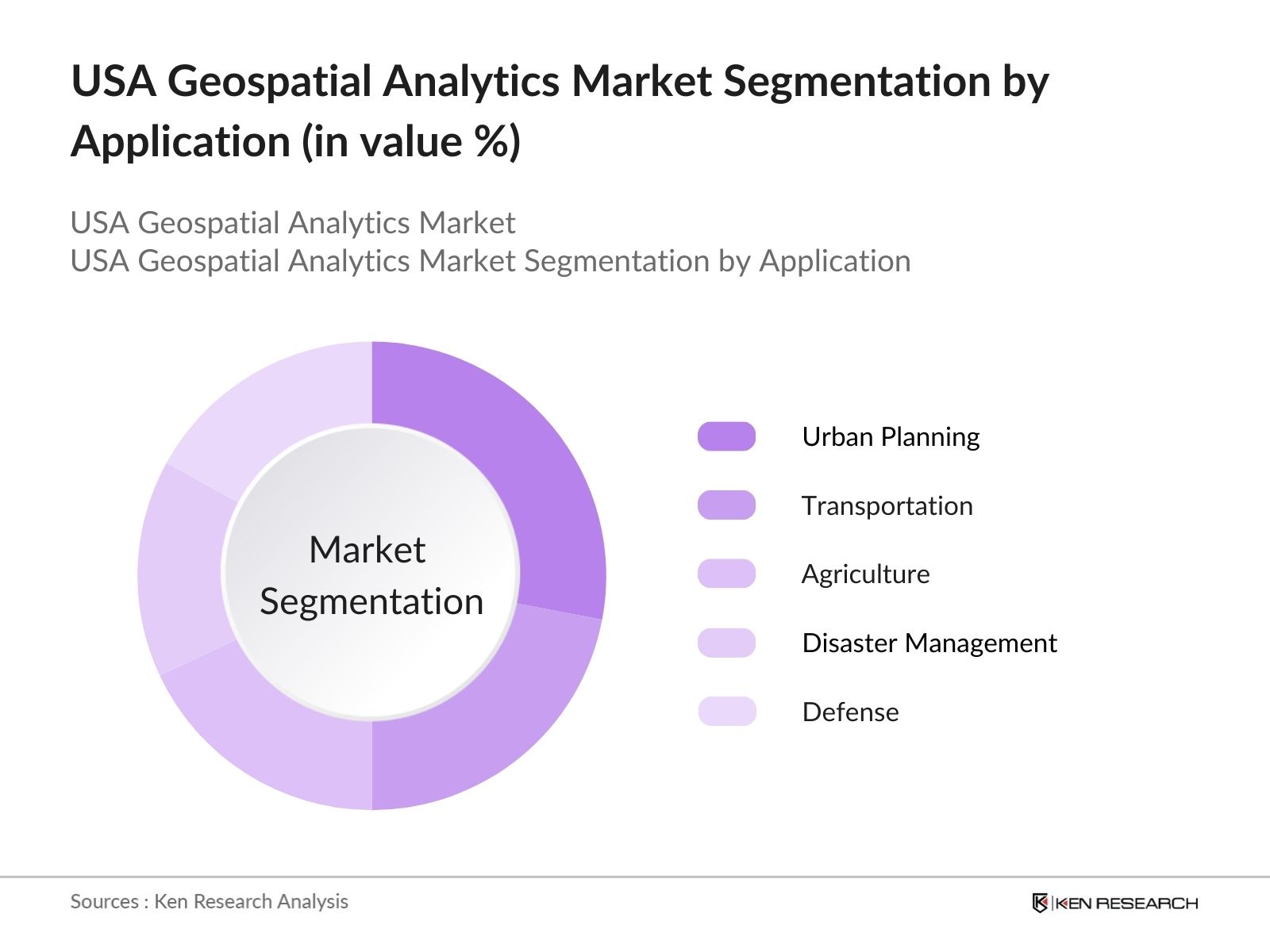

USA Geospatial Analytics Market Segmentation

By Application: The Market is segmented by application into urban planning, transportation, agriculture, disaster management, and defense. Among these, urban planning holds a dominant share due to its critical role in developing smart cities and optimizing urban infrastructure. Urban planners rely heavily on GIS and remote sensing data to design more sustainable cities, improve traffic management, and ensure efficient resource distribution, making it a leading sub-segment in this market.

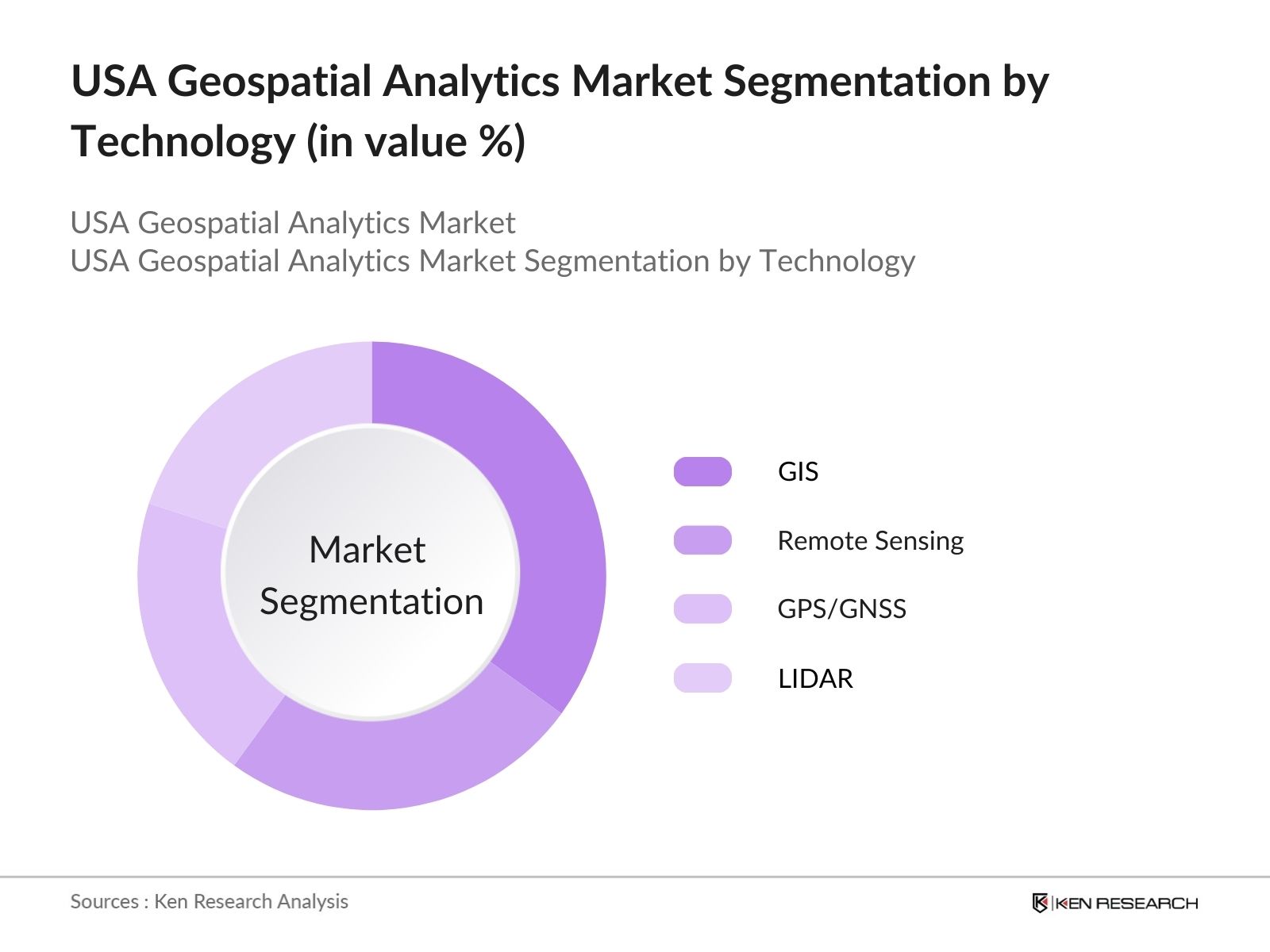

By Technology: The market is also segmented by technology into Geographic Information Systems (GIS), Remote Sensing, GPS/GNSS, and LIDAR. GIS leads the market due to its versatility and wide application in various sectors such as defense, agriculture, and public infrastructure. Its ability to capture, store, and analyze spatial data makes it indispensable for decision-making processes. The dominance of GIS is driven by increased demand for spatial data solutions across both the public and private sectors.

USA Geospatial Analytics Market Competitive Landscape

The USA Geospatial Analytics market is dominated by major global and domestic players. Companies are leveraging advanced technology, robust R&D investments, and strategic collaborations to maintain their competitive edge. The market features established players like Esri and Hexagon AB, who lead the industry with comprehensive product offerings, while companies like Maxar Technologies specialize in satellite imagery and earth observation services.

|

Company |

Establishment Year |

Headquarters |

No. of Patents |

Revenue |

Global Presence |

R&D Investment |

Acquisitions |

Product Portfolio |

|

Esri |

1969 |

Redlands, California |

||||||

|

Hexagon AB |

1992 |

Stockholm, Sweden |

||||||

|

Maxar Technologies |

1957 |

Westminster, Colorado |

||||||

|

Trimble Inc. |

1978 |

Sunnyvale, California |

||||||

|

HERE Technologies |

1985 |

Eindhoven, Netherlands |

USA Geospatial Analytics Market Analysis

Growth Drivers

- Expansion of Smart Cities: The expansion of smart cities across the USA is a key growth driver for geospatial analytics, with more than 100 U.S. cities implementing smart technologies to improve urban infrastructure by 2024. For instance, New York Citys smart city initiative includes sensor networks and data-driven solutions that require geospatial data to manage traffic and utilities. Additionally, the U.S. government has allocated $165 billion for urban infrastructure development under the Bipartisan Infrastructure Law, a huge portion of which will be used for implementing geospatial analytics for monitoring urban infrastructure.

- Increasing Use of Geospatial Data in Defense and Homeland Security: Geospatial data is becoming critical in U.S. defense and homeland security operations, aiding strategic planning and surveillance. The U.S. Department of Defense invested over $2 billion in 2023 for geospatial intelligence (GEOINT) to enhance national security. The National Geospatial-Intelligence Agency (NGA) plays a crucial role in this, utilizing advanced GIS platforms for terrain analysis and monitoring geopolitical threats. Defense expenditure in the U.S. continues to prioritize geospatial solutions, with $842 billion earmarked for the Department of Defense in 2024.

- Adoption of AI and Big Data Analytics: AI and Big Data analytics are increasingly integrated into geospatial systems, transforming data into actionable insights. In 2023, the U.S. AI market generated over 24 exabytes of data, much of which comes from geospatial analytics used in sectors like agriculture, transportation, and energy. The integration of AI allows for the rapid processing of large geospatial datasets, helping organizations in the U.S. make quicker, more informed decisions regarding land use, infrastructure, and natural resource management.

Market Challenges

- Data Privacy Concerns: The collection and use of sensitive geospatial data have led to rising concerns about privacy. With over 50% of U.S. states having enacted privacy regulations that affect geospatial data usage, such as the California Consumer Privacy Act (CCPA), businesses and governments must ensure that personal location data is protected. In 2023, federal investigations related to misuse of geospatial data increased by 17%, highlighting the growing concern over unauthorized data access.

- High Initial Investment: One of the most significant barriers for companies adopting geospatial analytics is the high upfront investment in infrastructure and software. In 2022, the average cost for implementing geospatial technologies in medium to large enterprises was $750,000, covering data acquisition, software, and hardware. These high initial costs pose a challenge for small and medium-sized enterprises, limiting widespread adoption across all sectors.

USA Geospatial Analytics Market Future Outlook

Over the next five years, the USA Geospatial Analytics Market is poised to experience significant growth, driven by technological advancements in data collection and analysis, growing adoption of AI in geospatial services, and increased demand for location-based solutions across industries such as transportation and logistics, defense, and urban planning. Continued investment in infrastructure and public-private partnerships is expected to further accelerate the market's expansion, making geospatial analytics a critical component of data-driven decision-making in the country.

Future Market Opportunities

- Growth in Location-based Services (LBS) for Retail and Marketing: Location-based services (LBS) present significant opportunities for geospatial analytics in retail and marketing. By 2023, there were over 294 million smartphone users in the U.S., enabling businesses to provide personalized location services to consumers. LBS usage increased by 35% in the retail sector in 2022, as companies employed geospatial data to enhance customer experience through targeted advertising and proximity-based services.

- Expansion in Disaster Management and Risk Assessment Applications: Geospatial analytics has become a critical tool in disaster management and risk assessment. In 2023, the Federal Emergency Management Agency (FEMA) allocated $6.2 billion for disaster preparedness, with a significant portion of the budget dedicated to geospatial monitoring for real-time analysis of flood zones, wildfire areas, and earthquake-prone regions. This investment highlights the growing role of geospatial technologies in mitigating natural disasters in the USA.

Scope of the Report

| Technology |

Remote Sensing GIS GNSS LiDAR |

| Application |

Urban Planning Agriculture Disaster Management Transportation & Logistics Defense & Security |

| Deployment Type |

On-Premise Cloud-Based |

| End-User |

Government Commercial Defense Healthcare |

| Region |

Northeast Midwest South West |

Products

Key Target Audience

Defense and Homeland Security Agencies (Department of Defense, National Geospatial-Intelligence Agency)

Urban Planning Departments (U.S. Department of Housing and Urban Development)

Transportation and Logistics Companies

Agricultural Cooperatives and Enterprises

Energy and Utilities Providers (Electric Power Research Institute)

Oil and Gas Companies

Investors and Venture Capitalist Firms

Government and Regulatory Bodies (U.S. Geological Survey, Environmental Protection Agency)

Companies

Major Players

Esri

Hexagon AB

Maxar Technologies

Trimble Inc.

HERE Technologies

Google

General Electric

Fugro

TIBCO Software

Oracle

SAP SE

TomTom

Harris Corporation

CARTO

DigitalGlobe

Table of Contents

USA Geospatial Analytics Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate (Geospatial Technology Adoption, Data Sources Expansion)

1.4. Market Segmentation Overview

USA Geospatial Analytics Market Size (In USD Bn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

USA Geospatial Analytics Market Analysis

3.1. Growth Drivers

3.1.1. Expansion of Smart Cities (Urban Infrastructure Monitoring)

3.1.2. Increasing Use of Geospatial Data in Defense and Homeland Security (GIS for Strategic Planning)

3.1.3. Adoption of AI and Big Data Analytics (AI-driven Geospatial Analytics)

3.1.4. Advancements in Remote Sensing and Satellite Imagery (LIDAR, UAV Technologies)

3.2. Market Challenges

3.2.1. Data Privacy Concerns (Sensitive Geospatial Data)

3.2.2. High Initial Investment (Costs for Infrastructure and Software)

3.2.3. Lack of Skilled Workforce (GIS and Geospatial Technology Specialists)

3.2.4. Integration with Existing Systems (Legacy Systems Compatibility)

3.3. Opportunities

3.3.1. Growth in Location-based Services (LBS) for Retail and Marketing (Personalized Location Services)

3.3.2. Expansion in Disaster Management and Risk Assessment Applications (Real-time Geospatial Monitoring)

3.3.3. Increased Use in Transportation and Logistics (Route Optimization, Fleet Management)

3.4. Trends

3.4.1. Use of 3D Mapping and Modelling (Immersive Visualization)

3.4.2. Integration with Internet of Things (IoT) (Real-time Data Analysis)

3.4.3. Use of Blockchain for Geospatial Data Security (Enhanced Data Integrity)

3.4.4. Open-Source Platforms and Cloud-based Analytics (Cost-effective Solutions)

3.5. Government Regulations

3.5.1. Geospatial Data Act

3.5.2. U.S. National Spatial Data Infrastructure (NSDI)

3.5.3. Open Data Initiatives

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem (Public Sector, Private Companies, Academic Institutions)

3.8. Porters Five Forces

3.9. Competition Ecosystem

USA Geospatial Analytics Market Segmentation

4.1. By Component (In Value %)

4.1.1. Software

4.1.2. Hardware

4.1.3. Services

4.2. By Application (In Value %)

4.2.1. Urban Planning

4.2.2. Transportation and Logistics

4.2.3. Agriculture

4.2.4. Disaster Management

4.2.5. Defense and Security

4.3. By Deployment Model (In Value %)

4.3.1. Cloud-based

4.3.2. On-premises

4.4. By Technology (In Value %)

4.4.1. Remote Sensing

4.4.2. Geographic Information Systems (GIS)

4.4.3. GPS and GNSS

4.4.4. LIDAR

4.5. By End-User Industry (In Value %)

4.5.1. Government and Public Sector

4.5.2. Agriculture

4.5.3. Oil and Gas

4.5.4. Utilities

4.5.5. Retail and E-commerce

USA Geospatial Analytics Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. Esri

5.1.2. Hexagon AB

5.1.3. Trimble Inc.

5.1.4. General Electric

5.1.5. Google

5.1.6. HERE Technologies

5.1.7. Maxar Technologies

5.1.8. TIBCO Software

5.1.9. Fugro

5.1.10. SAP SE

5.1.11. TomTom

5.1.12. Oracle

5.1.13. Harris Corporation

5.1.14. DigitalGlobe

5.1.15. CARTO

5.2. Cross Comparison Parameters (Revenue, No. of Patents, Market Share, R&D Investments, Acquisition Strategies, Global Presence, Product Portfolio, Innovation Index)

5.3. Market Share Analysis

5.4. Strategic Initiatives (Collaborations, New Product Launches)

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Venture Capital Funding

5.8. Government Grants

5.9. Private Equity Investments

USA Geospatial Analytics Market Regulatory Framework

6.1. Data Privacy Regulations (GDPR, CCPA)

6.2. Licensing Requirements

6.3. Certification Processes (ISO Standards)

USA Geospatial Analytics Future Market Size (In USD Bn)

7.1 Future Market Size Projections

7.2 Key Factors Driving Future Market Growth

USA Geospatial Analytics Future Market Segmentation

8.1 By Component (In Value %)

8.2 By Deployment Type (In Value %)

8.3 By End-User (In Value %)

8.4 By Technology (In Value %)

8.5 By Application (In Value %)

USA Geospatial Analytics Market Analysts’ Recommendations

9.1 TAM/SAM/SOM Analysis (Total Addressable Market, Serviceable Available Market, Serviceable Obtainable Market)

9.2 Customer Cohort Analysis

9.3 Marketing Initiatives (Customer Retention, Targeted Campaigns)

9.4 White Space Opportunity Analysis

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves constructing a comprehensive ecosystem map encompassing all major stakeholders within the USA Geospatial Analytics Market. This step is backed by extensive desk research, utilizing both secondary and proprietary databases to gather detailed industry-level information. The objective is to identify and define critical variables influencing the market's dynamics.

Step 2: Market Analysis and Construction

Historical data relevant to the USA Geospatial Analytics Market is compiled and analyzed in this step. This includes assessing market penetration across various applications such as urban planning and defense, as well as analyzing the ratio of GIS technology providers to end users. The aim is to derive accurate revenue estimates and evaluate key market trends.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses are developed based on initial data analysis and then validated through computer-assisted telephone interviews (CATIs) with industry experts from companies operating in the geospatial sector. These consultations provide valuable insights into the operational and financial trends driving the market.

Step 4: Research Synthesis and Final Output

The final phase involves direct engagement with geospatial technology companies to gather insights into product segments, sales performance, and customer preferences. This interaction helps to verify the bottom-up approach and ensures the final analysis is accurate and validated.

Frequently Asked Questions

01. How big is the USA Geospatial Analytics Market?

The USA Geospatial Analytics Market is valued at USD 10.3 billion, driven by the increasing demand for location-based services and the adoption of advanced geospatial technologies like GIS, remote sensing, and satellite imagery.

02. What are the challenges in the USA Geospatial Analytics Market?

Challenges include the high initial investment in geospatial technology infrastructure, concerns over data privacy, and the need for skilled professionals proficient in handling and analyzing geospatial data.

03. Who are the major players in the USA Geospatial Analytics Market?

Major players include Esri, Hexagon AB, Maxar Technologies, Trimble Inc., and HERE Technologies, with a significant presence across various application areas such as urban planning, defense, and logistics.

04. What are the growth drivers of the USA Geospatial Analytics Market?

The market is driven by the increasing use of geospatial data in smart city projects, defense applications, and transportation systems. Additionally, advancements in GIS software and remote sensing technologies are contributing to the market's growth.

05. What are the dominant technologies in the USA Geospatial Analytics Market?

GIS technology dominates the market, owing to its wide-ranging applications in urban planning, defense, and environmental monitoring. Other key technologies include remote sensing, GPS/GNSS, and LIDAR, each playing a significant role in enhancing data accuracy and analysis.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.