USA Golf Ball Market Outlook to 2030

Region:North America

Author(s):Shreya

Product Code:KROD6989

December 2024

81

About the Report

USA Golf Ball Market Overview

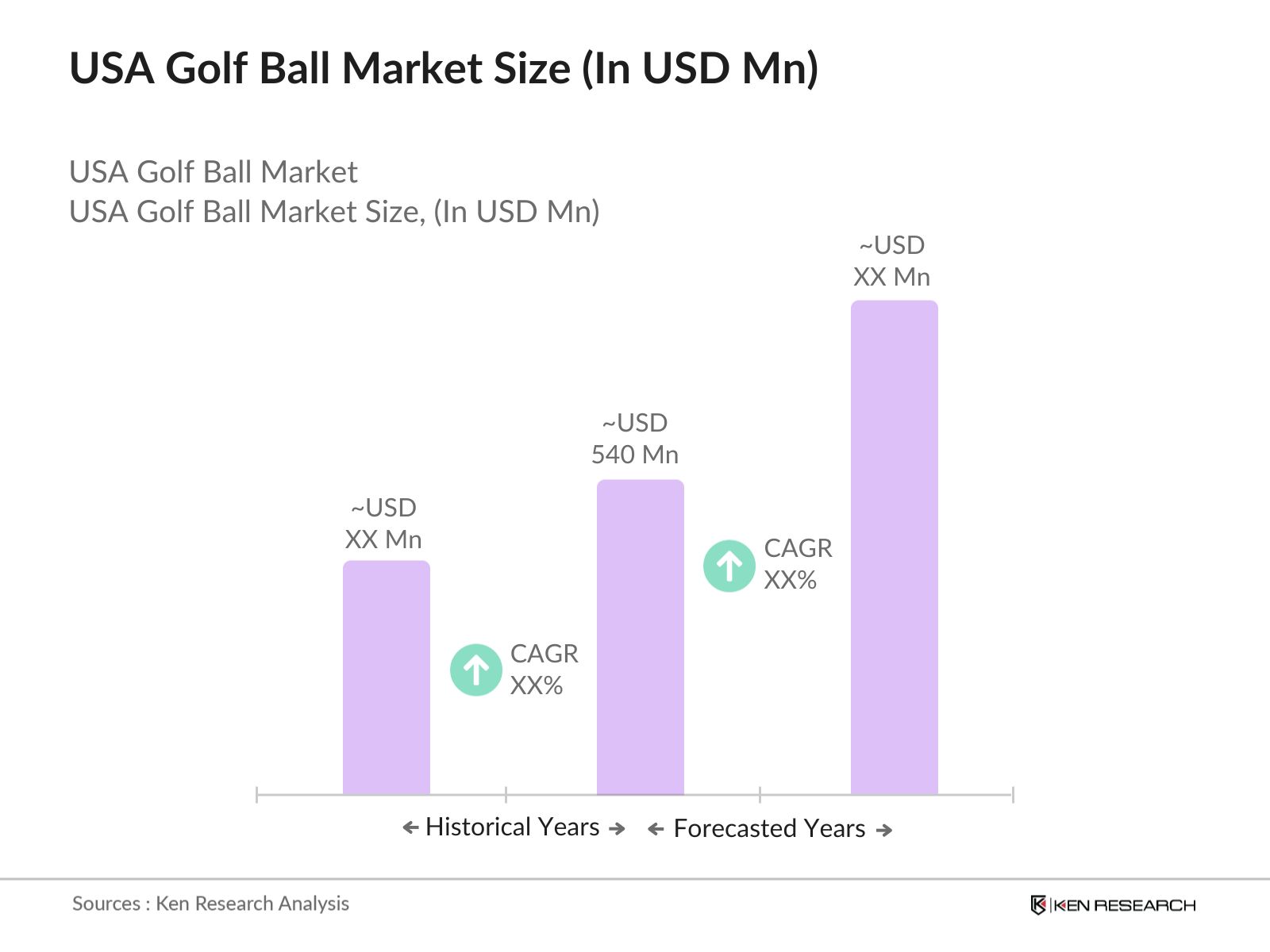

- The USA Golf Ball Market is valued at USD 540 million, driven by a consistent rise in golf participation, a well-established golf culture, and the sports popularity among both recreational and professional players. Technological advancements in golf ball manufacturing, such as improved aerodynamics and multi-layer construction, have elevated performance, which, in turn, has attracted a growing number of players and fueled the demand for high-quality golf balls.

- The USA golf ball market is dominated by regions with a high density of golf courses, namely California, Florida, and Texas. These states not only have a favorable climate that allows year-round play but also host a number of golf clubs, tournaments, and events. This concentration supports higher demand for premium golf equipment, including golf balls, due to the large base of frequent players and an affluent consumer segment that invests in high-quality golf gear.

- All golf balls in the U.S. adhere to the USGA and R&A standards, ensuring quality control in terms of size, weight, and aerodynamics. Compliance is mandatory, with testing protocols to maintain the integrity of competition.

USA Golf Ball Market Segmentation

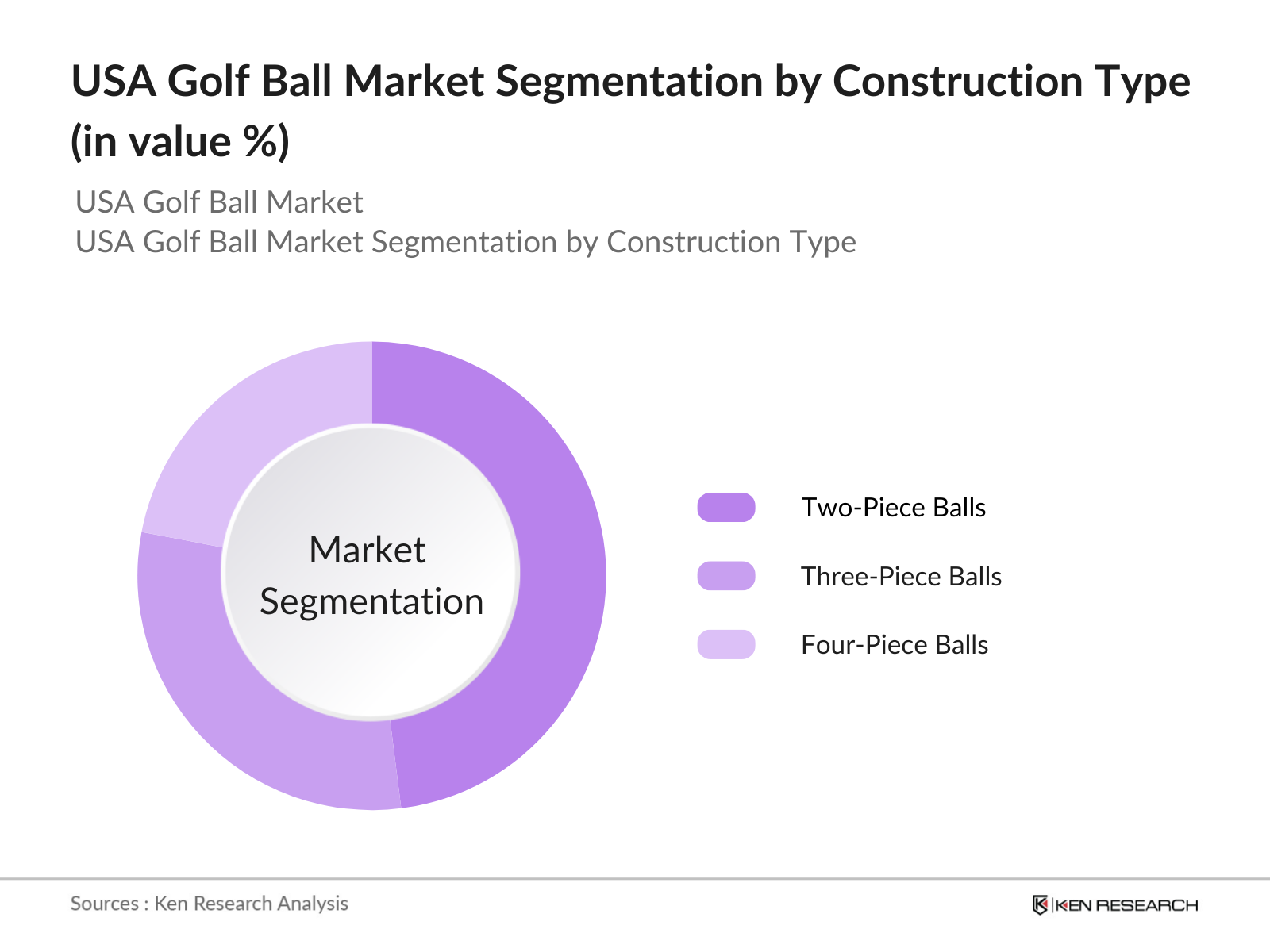

By Construction Type: The Market is segmented by construction type into two-piece, three-piece, and four-piece balls. Two-piece balls currently dominate the market due to their durability, affordability, and distance-enhancing qualities, making them popular among both recreational golfers and driving ranges. Two-piece balls, made of a single solid core and a tough outer cover, offer excellent value and are well-suited for beginners and amateurs who seek cost-effective options without compromising on quality.

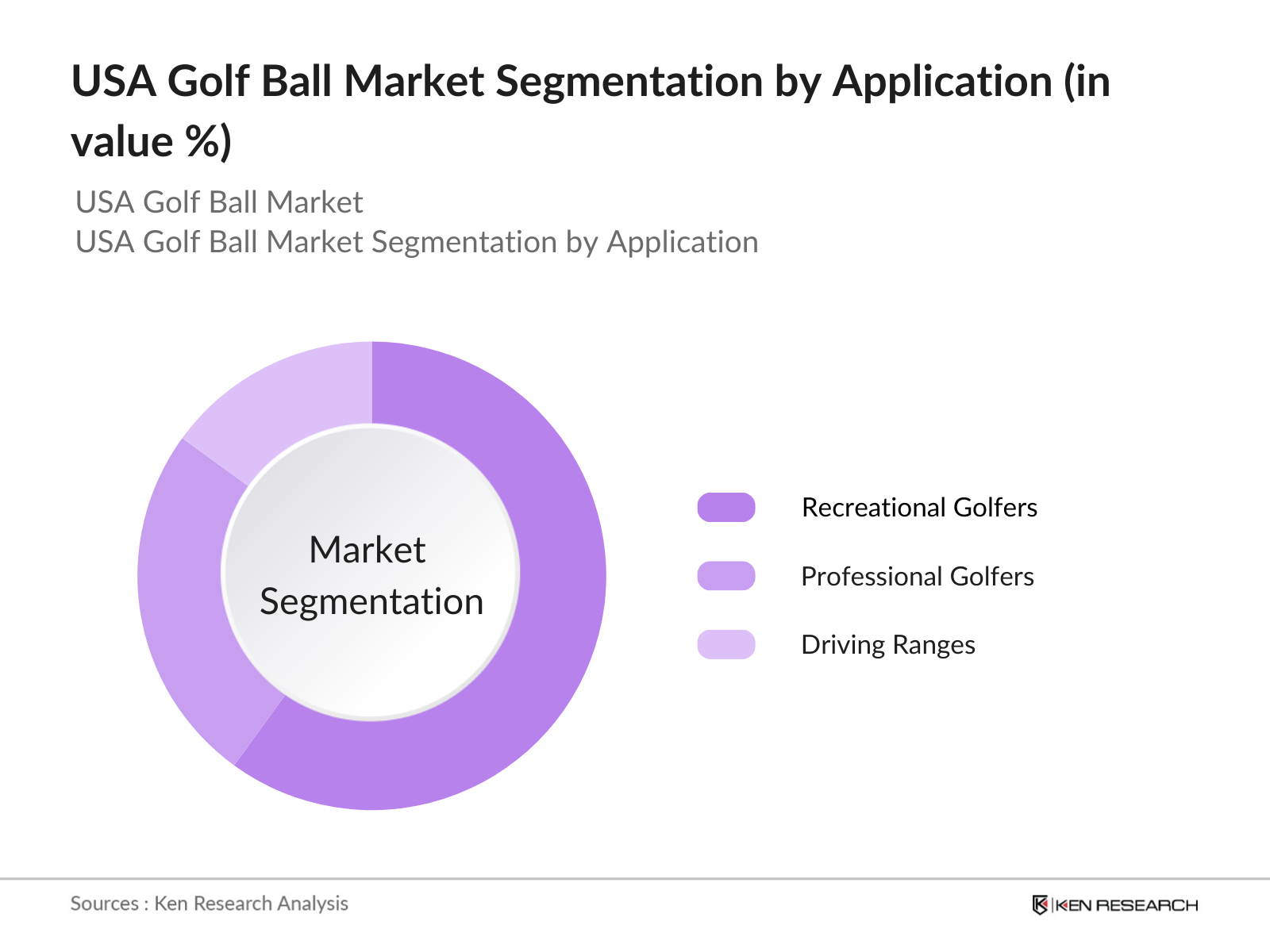

By Application: The market is segmented by application into recreational golfers, professional golfers, and driving ranges. Recreational golfers lead the segment as this group forms the largest customer base, focusing on enjoying the game rather than professional tournaments. Recreational players prioritize affordability and ease of use, making this segment a key contributor to the market. Additionally, recreational players tend to purchase golf balls more frequently, further boosting the market share of this segment.

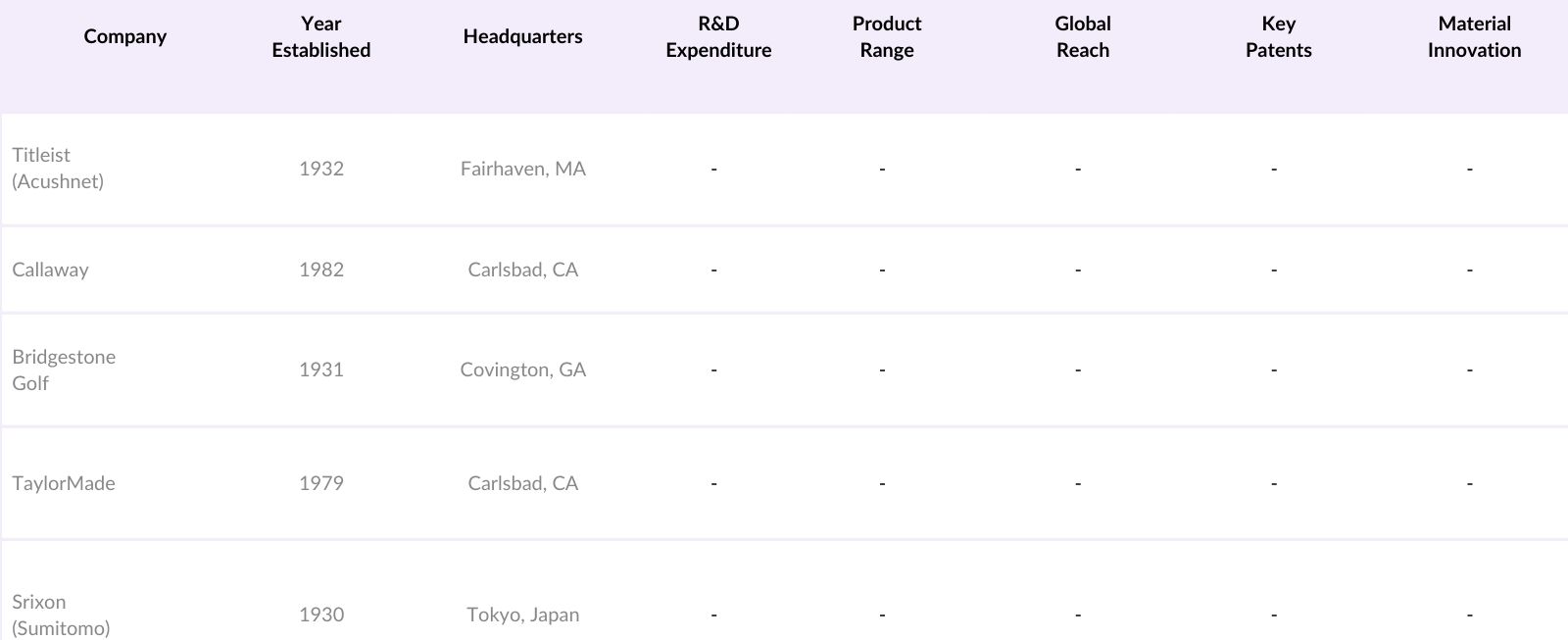

USA Golf Ball Market Competitive Landscape

The USA Golf Ball Market is marked by the presence of several established brands, each with unique strengths in R&D, branding, and innovation. The market is led by well-known companies like Titleist and Callaway, which maintain a loyal customer base through high-quality products and brand recognition. This competitive environment emphasizes the role of innovation and consumer trust in sustaining brand dominance.

USA Golf Ball Industry Analysis

Growth Drivers

- Increasing Popularity of Golf: In 2024, the USA golf participation rate reached 36 million active players, up by 1.5 million since 2022. The demographic composition shows a significant share of players aged 25-44, comprising around 40% of the total golfing population, supporting the sport's sustained interest across age groups. Key population centers, like California and Florida, account for 8 million participants collectively, highlighting regional interest. Increasing accessibility to golf courses in suburban areas is credited for this rise.

- Technological Advancements in Ball Construction: Material innovations, such as the adoption of urethane for improved durability, are driving golf ball sales. In 2024, 20% of golf balls sold were urethane-based, enhancing performance by improving spin and control for mid-level and professional players. Companies are investing in materials that improve aerodynamic precision, allowing for longer drives. The average lifespan of advanced golf balls has increased by 15% over traditional materials.

- Rise in Golf Associations and Events: Membership in U.S.-based golf associations, such as the USGA, reached 2 million members in 2024, reflecting a 7% increase from 2022. Event sponsorship revenues topped $200 million, driven by corporate interest in high-profile tournaments. Major sponsors report ROI growth, indicating the expanding business potential within golf.

Market Challenges

- High Cost of Premium Golf Balls: The price sensitivity among recreational players continues to challenge the premium golf ball segment. In 2024, sales data revealed that 60% of consumers opt for mid-range golf balls, avoiding high-end options. Consumer surveys indicate that rising living costs discourage frequent purchases of premium products, impacting sales.

- Environmental Concerns: The non-biodegradable nature of traditional golf balls poses environmental issues. In the U.S., around 300 million golf balls are discarded yearly, contributing to plastic pollution. The lack of affordable biodegradable alternatives is a significant hurdle, with industry stakeholders calling for environmentally friendly solutions.

USA Golf Ball Market Future Outlook

Over the next five years, the USA Golf Ball Market is expected to witness steady growth, driven by increased interest in recreational golf, product innovations focusing on eco-friendly materials, and sustained participation in professional golf events. The rising trend of digital platforms and e-commerce in sports equipment sales is anticipated to further contribute to the markets growth, making premium and customized products more accessible to a broad consumer base.

Future Market Opportunities

- Growth in Recreational Golfers: In 2024, the influx of 5 million new recreational golfers into the U.S. market, especially in urban areas, highlights an expanding customer base. Youth programs are witnessing increased enrollments, with participation in golf academies up by 12% year-over-year, showcasing a growing interest among young players.

- Expansion in E-Commerce Channels: Online sales of golf balls grew by 18% in 2024, with an increasing preference for digital platforms among consumers. The rise in smartphone penetration, at 90% among adults, facilitates the growth of e-commerce channels. Major retailers report that 35% of their golf ball sales now occur online.

Scope of the Report

|

By Construction Type |

- Two-Piece Balls |

|

By Application |

- Recreational Golfers |

|

By Material Type |

- Surlyn |

|

By Distribution Channel |

- Specialty Stores |

|

By Region |

- Northeast |

Products

Key Target Audience

Recreational Golfers

Professional Golfers

Sports Equipment Retailers

Golf Clubs and Pro Shops

Online Sporting Goods Retailers

Event and Tournament Organizers

Investments and Venture Capitalist Firms

Government and Regulatory Bodies (e.g., United States Golf Association - USGA)

Companies

Major Players

Titleist (Acushnet Company)

Callaway Golf Company

Bridgestone Golf, Inc.

TaylorMade Golf Company, Inc.

Srixon (Sumitomo Rubber Industries)

Wilson Sporting Goods

Mizuno Corporation

Volvik

Pinnacle (Acushnet Company)

Vice Golf

Maxfli

OnCore Golf

Snell Golf

Dixon Golf

Nike Golf (formerly)

Table of Contents

1. USA Golf Ball Market Overview

1.1 Definition and Scope

1.2 Market Taxonomy

1.3 Market Growth Rate

1.4 Market Segmentation Overview

2. USA Golf Ball Market Size (In USD Million)

2.1 Historical Market Size

2.2 Year-On-Year Growth Analysis

2.3 Key Market Developments and Milestones

3. USA Golf Ball Market Analysis

3.1 Growth Drivers

- 3.1.1 Increasing Popularity of Golf (Participation Rate, Demographics)

- 3.1.2 Growth in Golf Tourism (Tourism Spend, Course Density)

- 3.1.3 Technological Advancements in Ball Construction (Materials, Performance Metrics)

- 3.1.4 Rise in Golf Associations and Events (Association Memberships, Event Sponsorship)

3.2 Market Challenges

- 3.2.1 High Cost of Premium Golf Balls (Price Sensitivity, Consumer Preferences)

- 3.2.2 Environmental Concerns (Recyclability, Biodegradability)

- 3.2.3 Seasonal Demand Fluctuations (Seasonality, Retailer Inventory)

3.3 Opportunities

- 3.3.1 Growth in Recreational Golfers (New Entrants, Youth Engagement)

- 3.3.2 Expansion in E-Commerce Channels (Online Sales, Digital Marketing)

- 3.3.3 Customization and Personalization of Golf Balls (Customization Options, Brand Identity)

3.4 Trends

- 3.4.1 Demand for Eco-Friendly Golf Balls (Sustainable Materials, Eco-Conscious Branding)

- 3.4.2 Innovations in Golf Ball Aerodynamics (Dimple Patterns, Flight Stability)

- 3.4.3 Use of Data Analytics in Performance Monitoring (Ball Tracking, Swing Analysis)

3.5 Regulatory Landscape

- 3.5.1 USGA and R&A Standards (Conformity Rules, Testing Procedures)

- 3.5.2 Environmental Regulations (Recycling Policies, Eco-Standards)

- 3.5.3 Trade Regulations and Tariffs (Import-Export Policies, Duty Regulations)

3.6 SWOT Analysis

3.7 Stakeholder Ecosystem

3.8 Porters Five Forces Analysis

3.9 Competitive Landscape

4. USA Golf Ball Market Segmentation

4.1 By Product Type (In Value %)

- 4.1.1 One-Piece Balls

- 4.1.2 Two-Piece Balls

- 4.1.3 Three-Piece Balls

- 4.1.4 Four-Piece and Five-Piece Balls

4.2 By Application (In Value %)

- 4.2.1 Recreational Golfers

- 4.2.2 Professional Golfers

- 4.2.3 Driving Ranges

- 4.2.4 Mini-Golf Courses

4.3 By Construction Material (In Value %)

- 4.3.1 Surlyn

- 4.3.2 Urethane

- 4.3.3 Ionomer

4.4 By Distribution Channel (In Value %)

- 4.4.1 Specialty Stores

- 4.4.2 Sporting Goods Stores

- 4.4.3 Online Retail

- 4.4.4 Golf Clubs and Pro Shops

4.5 By Region (In Value %)

- 4.5.1 Northeast

- 4.5.2 Midwest

- 4.5.3 South

- 4.5.4 West

5. USA Golf Ball Market Competitive Analysis

5.1 Profiles of Key Competitors

- 5.1.1 Titleist (Acushnet Company)

- 5.1.2 Callaway Golf Company

- 5.1.3 Bridgestone Golf, Inc.

- 5.1.4 TaylorMade Golf Company, Inc.

- 5.1.5 Srixon/Cleveland Golf/XXIO (Sumitomo Rubber Industries)

- 5.1.6 Wilson Sporting Goods

- 5.1.7 Mizuno Corporation

- 5.1.8 Volvik

- 5.1.9 Pinnacle (Acushnet Company)

- 5.1.10 Nike Golf (formerly)

- 5.1.11 Maxfli

- 5.1.12 Vice Golf

- 5.1.13 OnCore Golf

- 5.1.14 Snell Golf

- 5.1.15 Dixon Golf

5.2 Cross Comparison Parameters (Market Share, Manufacturing Capabilities, R&D Investment, Product Portfolio, Quality Certifications, Average Retail Price, Environmental Policies, Innovation Index)

5.3 Market Share Analysis

5.4 Strategic Initiatives

5.5 Mergers and Acquisitions

5.6 Investment Analysis

5.7 Partnerships and Collaborations

5.8 Government Grants and Tax Incentives

5.9 Marketing and Sponsorship Strategies

6. USA Golf Ball Market Regulatory Framework

6.1 USGA Conformity Rules

6.2 Material Safety Standards

6.3 Environmental Compliance and Recycling Policies

6.4 Import Tariff and Trade Regulations

7. USA Golf Ball Future Market Size (In USD Million)

7.1 Future Market Size Projections

7.2 Key Factors Driving Future Market Growth

8. USA Golf Ball Future Market Segmentation

8.1 By Product Type (In Value %)

8.2 By Application (In Value %)

8.3 By Construction Material (In Value %)

8.4 By Distribution Channel (In Value %)

8.5 By Region (In Value %)

9. USA Golf Ball Market Analysts Recommendations

9.1 Total Addressable Market (TAM), Serviceable Available Market (SAM), and Serviceable Obtainable Market (SOM) Analysis

9.2 Customer Segmentation and Persona Development

9.3 Recommended Marketing and Sales Strategies

9.4 New Product Development and Innovation Opportunities

9.5 Expansion and White Space Analysis

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

The research begins with mapping the ecosystem, identifying stakeholders, and understanding the dynamics of the USA Golf Ball Market. This includes gathering initial insights from secondary sources and databases to set the foundational structure of the market.

Step 2: Market Analysis and Construction

A comprehensive analysis of historical data, product penetration, and revenue patterns is conducted to assess current market dynamics. This step also examines service providers, consumer preferences, and the overall revenue generation structure.

Step 3: Hypothesis Validation and Expert Consultation

Developed hypotheses are tested and validated through interviews with industry experts, ensuring accuracy and relevancy. Insights from these consultations help refine market estimates and projections.

Step 4: Research Synthesis and Final Output

The last phase involves a synthesis of data collected from direct interactions with key market players, product segment analysis, and revenue validation to finalize the market report. This approach ensures accuracy, reliability, and a holistic understanding of the USA Golf Ball Market.

Frequently Asked Questions

01. How big is the USA Golf Ball Market?

The USA Golf Ball Market is valued at USD 540 million, driven by technological advancements, a strong golfing culture, and rising interest among recreational and professional players.

02. What are the challenges in the USA Golf Ball Market?

Challenges in the USA Golf Ball Market include the high cost of premium golf balls, environmental concerns related to material disposal, and seasonal demand fluctuations that impact production and inventory management.

03. Who are the major players in the USA Golf Ball Market?

Key players in the USA Golf Ball Market include Titleist, Callaway, Bridgestone, TaylorMade, and Srixon. Their dominance is due to robust R&D, extensive product offerings, and strong brand recognition.

04. What are the growth drivers of the USA Golf Ball Market?

Growth in the USA Golf Ball Market is propelled by an increase in golf participation, advancements in ball technology, and a shift towards eco-friendly golf equipment. The market is further supported by a high number of golf courses and events.

05. What types of golf balls are popular in the USA Golf Ball Market?

Two-piece golf balls are widely popular in the USA Golf Ball Market due to their durability and affordability, making them suitable for recreational players. Premium multi-layer balls, preferred by professionals, also hold a significant share.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.