USA Green Technology and Sustainability Market Outlook to 2030

Region:North America

Author(s):Shubham Kashyap

Product Code:KROD2165

November 2024

82

About the Report

USA Green Technology and Sustainability Market Overview

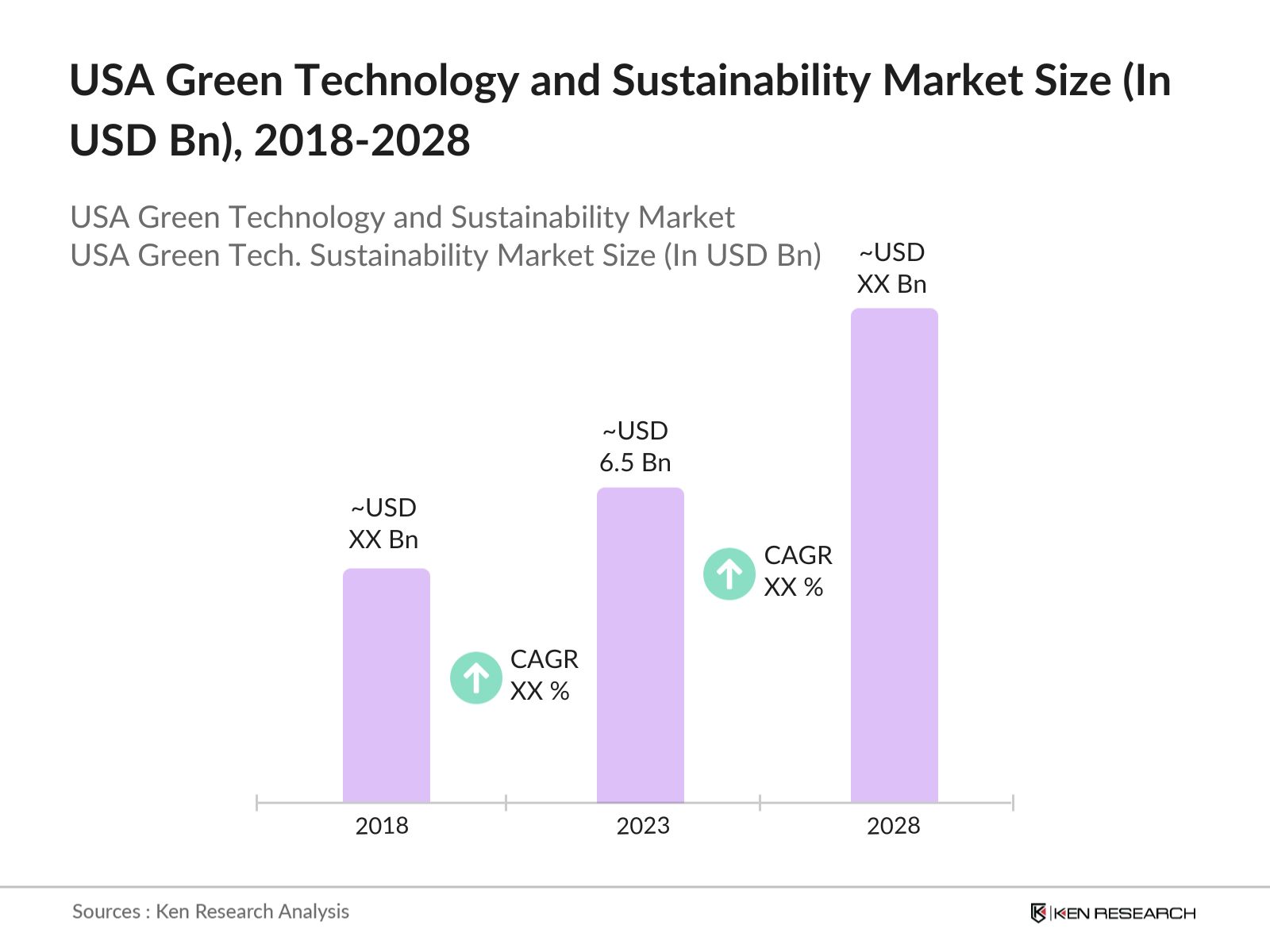

- The USA Green Technology and Sustainability Market was valued at USD 6.5 billion in 2023, driven by increasing government initiatives, corporate sustainability commitments, and rising consumer awareness about environmental conservation. The market encompasses various solutions, including renewable energy, sustainable agriculture, carbon capture, waste management, and green building technologies.

- Major players in the USA Green Technology and Sustainability Market include companies like NextEra Energy, Tesla, Johnson Controls, Siemens, and Waste Management. These players are driving the market with innovative green solutions, partnerships with government and private organizations, and large-scale investment in renewable energy projects.

- States such as California, New York, Texas, and Washington lead the market, driven by robust policy frameworks, abundant natural resources for renewable energy, and aggressive targets for carbon neutrality. These regions also experience substantial investments in energy efficiency and green building projects.

- Tesla's energy division, known as Tesla Energy, has been increasingly focusing on projects that maximize profitability, particularly those involving their Powerwall battery systems.In 2023, the company reported momentous growth in battery storage deployments, achieving a 125% increase compared to the previous year, while solar energy system deployments saw a decline.

USA Green Technology and Sustainability Market Segmentation

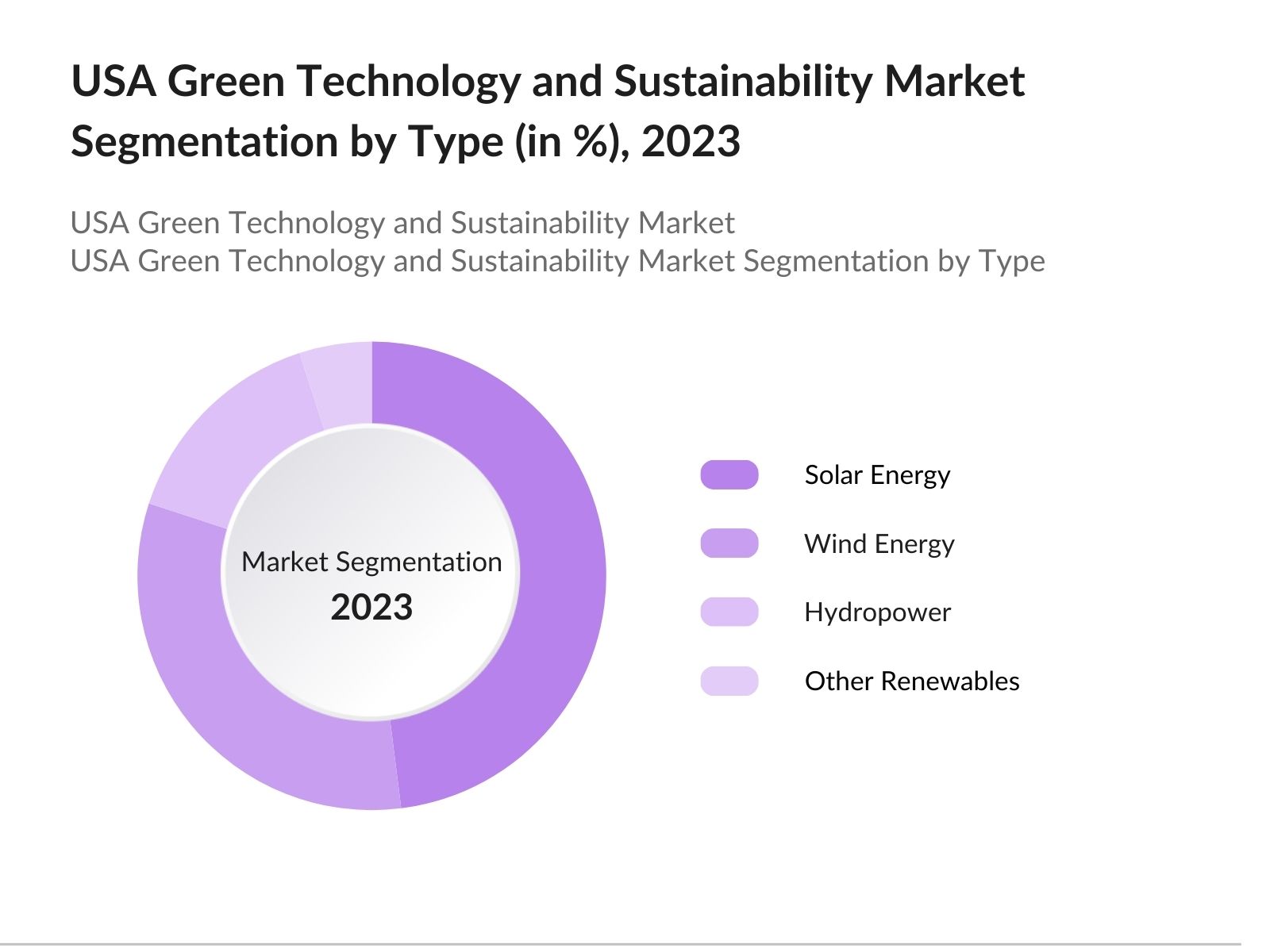

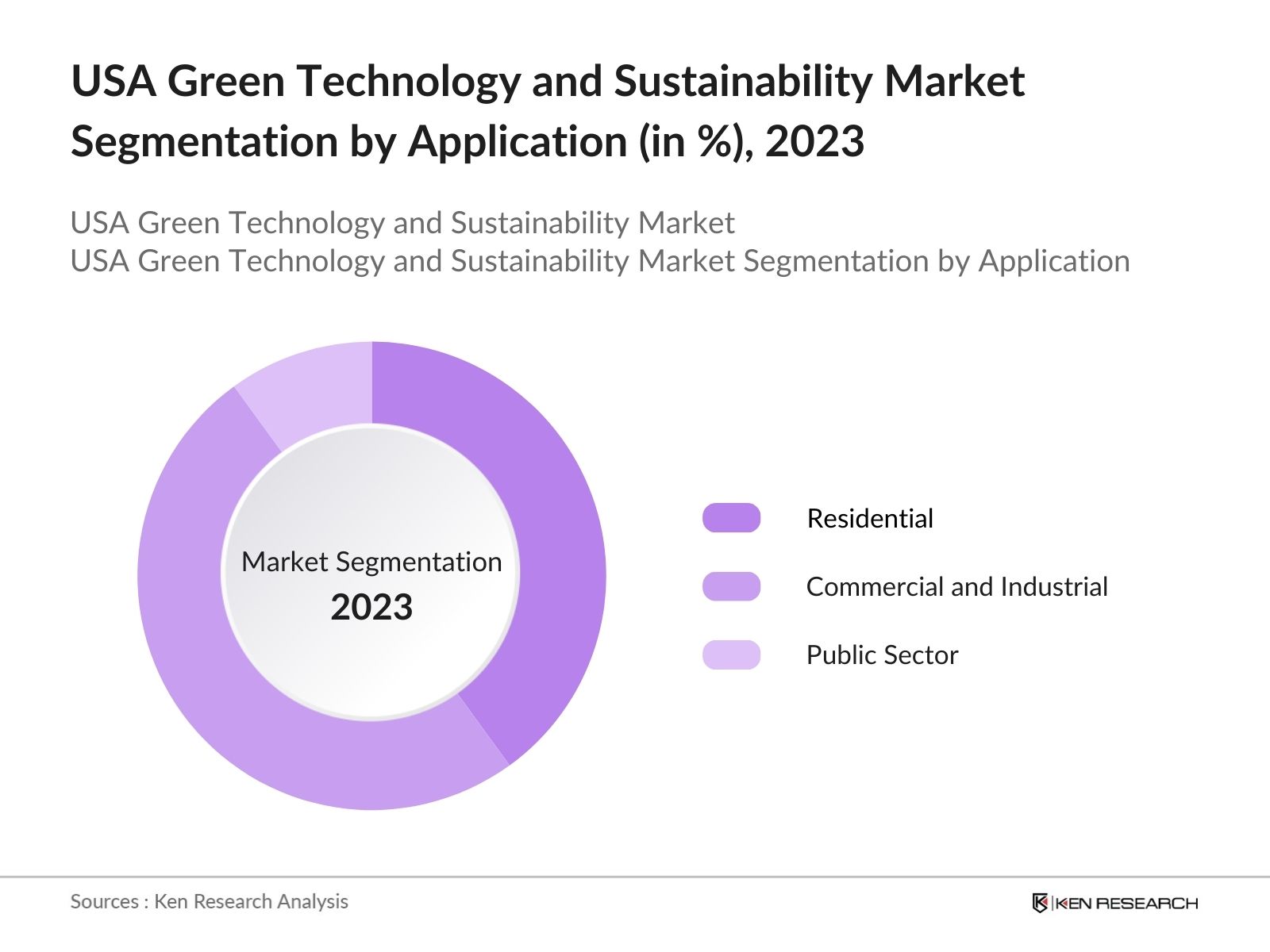

The USA Green Technology and Sustainability Market is segmented by type, application, and region.

- By Type: The Market is segmented by type into solar, wind, hydropower and others. In 2023, solar energy dominated the renewable energy segment, driven by declining installation costs and extensive tax incentives provided under federal programs. Companies like Tesla and NextEra Energy lead this market by offering innovative solar energy solutions that are integrated with battery storage systems.

- By Application: The Market is segmented by application into Residential, Commercial and Industrial, and Public Sector. In 2023, the commercial and industrial sectors held a dominant market share due to their noteworthy investments in energy-efficient building systems, renewable energy adoption, and sustainable waste management.

- By Region: The Market is segmented by region into east, west, north & south. West region leads the market in 2023, thanks to its aggressive renewable energy policies and the presence of large tech companies committed to sustainability. The states strong regulatory environment, along with tax incentives for solar and wind energy projects, has resulted in widespread adoption of green technology solutions.

USA Green Technology and Sustainability Market Competitive Landscape

|

Company |

Establishment Year |

Headquarters |

|

NextEra Energy |

1984 |

Juno Beach, Florida |

|

Tesla |

2003 |

Palo Alto, California |

|

Johnson Controls |

1885 |

Cork, Ireland |

|

Siemens |

1847 |

Munich, Germany |

|

Waste Management |

1968 |

Houston, Texas |

- NextEra Energy: In 2023, NextEra Energy announced plans to expand its solar and wind capacity, with a target of adding 33 to 42 gigawatts (GW) of new renewable energy projects by 2026. This expansion includes large-scale solar and wind projects across the United States, aligning with the company's strategy to enhance its renewable energy portfolio and support the transition to clean energy.

- Siemens: In 2024, Siemens Government Technologies being awarded a USD 24.8 million contract to deliver energy efficient infrastructure improvements for the U.S. Army in Europe and Africa. Additionally, Siemens investing around 1 billion in research and development annually.

USA Green Technology and Sustainability Market Analysis

Growth Drivers

- Increased Corporate Focus on Sustainability: In 2024, several major U.S. corporations, including Apple, Microsoft, and Amazon, committed to achieving carbon neutrality by 2030. This push has remarkably driven demand for renewable energy solutions and green technologies across the country. In 2023, a total of 46 gigawatts of renewable power were contracted through corporate power purchase agreements (PPAs) worldwide, as businesses increasingly seek sustainable alternatives to meet their environmental goals and reduce their carbon footprint.

- Government Incentives for Renewable Energy Adoption: The Inflation Reduction Act of 2022 allocated USD 369 billion towards climate and energy-related projects, including subsidies and tax credits for renewable energy installation. This legislative move has spurred large-scale solar and wind energy projects, with 12 GW of new renewable energy capacity installed in 2023. The U.S. governments plan to install 10,000 new electric vehicle (EV) charging stations by 2025 is also contributing to the growth of green technology across the nation.

- Public and Private Investments in Clean Energy: Investments in green technology have soared, with venture capital funding for clean energy projects exceeding USD 70 billion in 2022. Public sector initiatives, like the Clean Energy Fund, have further bolstered market growth. A substantial portion of this fund is provided for renewable energy projects in 2023. Private companies such as Tesla and NextEra Energy are also leading investments in battery storage and renewable energy, driving market expansion in the U.S.

Challenges

- Grid Capacity and Infrastructure Limitations: As renewable energy sources become more integrated into the energy grid, grid capacity and infrastructure remain critical issues. In 2024, grid operators reported that wind and solar energy contributed to increased transmission congestion in states like Texas and California. This resulted in higher costs and grid instability, highlighting the need for infrastructure upgrades.

- Inconsistent State-Level Regulations: State-by-state variations in regulatory frameworks for green technologies have created uncertainty for businesses and investors. While states like California and New York offer robust incentives for solar and wind projects, other states have slower regulatory processes or lack the same level of commitment. This disparity has caused delays in project approvals and hampered the nationwide adoption of green technologies.

Government Initiatives

- Inflation Reduction Act (IRA) 2023: The Inflation Reduction Act (IRA) was signed into law on August 16, 2022, and represents an important legislative effort in the United States to address climate change and promote clean energy.The IRA has already led to substantial announcements in clean energy investments, with companies committing over USD 110 billion in manufacturing investments within the first year of its enactment.

- National Electric Vehicle Infrastructure (NEVI) Program: Launched in 2022, the NEVI program aims to develop a nationwide network of EV charging stations. The NEVI program is allocated USD 5 billion over five years (2022-2026) to support the installation of EV charging infrastructure. This funding is part of the broader Bipartisan Infrastructure Law, which aims to install 500,000 charging stations by 2030.

USA Green Technology and Sustainability Market Future Outlook

The USA Green Technology and Sustainability Market is expected to witness robust growth in the forecasted period, driven by increased corporate and government commitments to sustainability, technological innovations, and the expansion of renewable energy capacity.

Future Market Trends

- Widespread Adoption of Smart Grid Solutions: By 2028, the U.S. will see the widespread adoption of smart grid technologies that enable real-time energy management and grid efficiency. Recent government investments to upgrade the national grid are a crucial step toward integrating more renewable energy. These smart grids will enhance energy distribution and allow for more seamless integration of renewable sources like wind and solar.

- Growth of Offshore Wind Farms: Offshore wind capacity is expected to grow exceptionally over the next five years, with numerous projects currently in development. States like New York and Massachusetts are leading the charge, with major projects slated to come online by 2028. Offshore wind will play a critical role in the U.S. achieving its long-term renewable energy goals.

Scope of the Report

|

By Type |

Solar Poer Wind Energy Hydropower Others |

|

By Application |

Residential Commercial and Industrial Public Sector |

|

By Region |

North East West South |

Products

Key Target Audience Organizations and Entities Who Can Benefit by Subscribing to This Report:

Renewable Energy Providers

Sustainable Agriculture Companies

Electric Vehicle Manufacturers

Energy and Utility Companies

Real Estate Developers

Fleet Management Companies

Waste Management Firms

Investments and Venture Capitalist Firms

Government and Regulatory Bodies (Environmental Protection Agency, U.S. Department of Energy)

Time Period Captured in the Report:

Historical Period: 2018-2023

Base Year: 2023

Forecast Period: 2023-2028

Companies

Key Players Mentioned in the Report:

NextEra Energy

Tesla

Johnson Controls

Siemens

Waste Management

First Solar

General Electric

Schneider Electric

Vestas Wind Systems

Enel Green Power

Orsted

Iberdrola

Duke Energy

Dominion Energy

Brookfield Renewable Partners

Table of Contents

1. USA Green Technology and Sustainability Market Overview

1.1 Definition and Scope

1.2 Market Taxonomy

1.3 Market Valuation and Historical Performance

1.4 Key Market Trends and Developments

1.5 Market Segmentation Overview

2. USA Green Technology and Sustainability Market Size (in USD Bn), 2018-2023

2.1 Historical Market Size

2.2 Year-on-Year Growth Analysis

2.3 Key Market Developments and Milestones

3. USA Green Technology and Sustainability Market Analysis

3.1 Growth Drivers

3.1.1 Increased Corporate Focus on Sustainability

3.1.2 Government Incentives for Renewable Energy Adoption

3.1.3 Public and Private Investments in Clean Energy

3.2 Challenges

3.2.1 Grid Capacity and Infrastructure Limitations

3.2.2 Inconsistent State-Level Regulations

3.3 Opportunities

3.3.1 Expansion of Clean Energy Projects

3.3.2 Innovation in Battery Storage and Carbon Capture

3.4 Trends

3.4.1 Surge in Battery Storage Deployments

3.4.2 Growth in Corporate Renewable Power Purchase Agreements (PPAs)

3.5 Government Initiatives

3.5.1 Inflation Reduction Act (IRA)

3.5.2 National Electric Vehicle Infrastructure (NEVI) Program

3.6 SWOT Analysis

3.7 Stakeholder Ecosystem

3.8 Competition Ecosystem

4. USA Green Technology and Sustainability Market Segmentation, 2023

4.1 By Type (in Value %)

4.1.1 Solar Poer

4.1.2 Wind Energy

4.1.3 Hydropower

4.2.4 Others

4.2 By Application (in Value %)

4.2.1 Residential

4.2.2 Commercial and Industrial

4.2.3 Public Sector

4.3 By Region (in Value %)

4.3.1 East

4.3.2 West

4.3.3 South

4.3.4 North

5. USA Green Technology and Sustainability Market Competitive Landscape

5.1 Detailed Profiles of Major Companies

5.1.1 NextEra Energy

5.1.2 Tesla

5.1.3 Johnson Controls

5.1.4 Siemens

5.1.5 Waste Management

5.2 Cross Comparison Parameters (No. of Employees, Headquarters, Inception Year, Revenue)

6. USA Green Technology and Sustainability Market Competitive Landscape Analysis

6.1 Market Share Analysis

6.2 Strategic Initiatives

6.3 Mergers and Acquisitions

6.4 Investment Analysis

6.4.1 Venture Capital Funding

6.4.2 Government Grants

6.4.3 Private Equity Investments

7. USA Green Technology and Sustainability Market Regulatory Framework

7.1 Inflation Reduction Act (IRA) Guidelines

7.2 Federal and State Incentives

7.3 Compliance Requirements and Certification Processes

8. USA Green Technology and Sustainability Market Future Outlook (in USD Bn), 2023-2028

8.1 Future Market Size Projections

8.2 Key Factors Driving Future Market Growth

9. USA Green Technology and Sustainability Future Market Segmentation, 2028

9.1 By Type (in Value %)

9.2 By Application (in Value %)

9.3 By Region (in Value %)

10. USA Green Technology and Sustainability Market Analysts’ Recommendations

10.1 TAM/SAM/SOM Analysis

10.2 Customer Cohort Analysis

10.3 Marketing Initiatives

10.4 White Space Opportunity Analysis

Disclaimer

Contact Us

Research Methodology

Step: 1 Identifying Key Variables

Ecosystem creation for all the major entities and referring to multiple secondary and proprietary databases to perform desk research around market to collate industry level information.

Step: 2 Market Building

Collating statistics on USA green technology and sustainability market over the years, penetration of marketplaces and service providers ratio to compute revenue generated for US green technology and sustainability market. We will also review service quality statistics to understand revenue generated which can ensure accuracy behind the data points shared.

Step: 3 Validating and Finalizing

Building market hypothesis and conducting CATIs with industry experts belonging to different companies to validate statistics and seek operational and financial information from company representatives.

Step: 4 Research Output

Our team will approach multiple essential technology companies and understand nature of product segments and sales, consumer preference and other parameters, which will support us validate statistics derived through bottom to top approach from technology companies.

Frequently Asked Questions

1. How big is the USA Green Technology and Sustainability Market?

The USA Green Technology and Sustainability Market was valued at USD 6.5 billion in 2023, driven by increasing government initiatives, corporate sustainability commitments, and rising consumer awareness about environmental conservation.

2. What are the challenges in the USA Green Technology and Sustainability Market?

Challenges include grid capacity and infrastructure limitations, which hinder the integration of renewable energy sources. Additionally, inconsistent state-level regulations across the country create uncertainty for businesses and slow the nationwide adoption of green technologies.

3. Who are the major players in the USA Green Technology and Sustainability Market?

Key players in the market include NextEra Energy, Tesla, Johnson Controls, Siemens, and Waste Management. These companies dominate due to their innovative green solutions, strong partnerships with government bodies, and significant investments in renewable energy projects.

4. What are the growth drivers of the USA Green Technology and Sustainability Market?

The market is propelled by increased corporate focus on sustainability, government incentives for renewable energy, and rising public and private investments in clean energy. The commitment to carbon neutrality by major corporations is also driving the adoption of green technologies.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.