USA Hair Care Market Outlook to 2030

Region:North America

Author(s):Shubham Kashyap

Product Code:KROD4201

December 2024

80

About the Report

USA Hair Care Market Overview

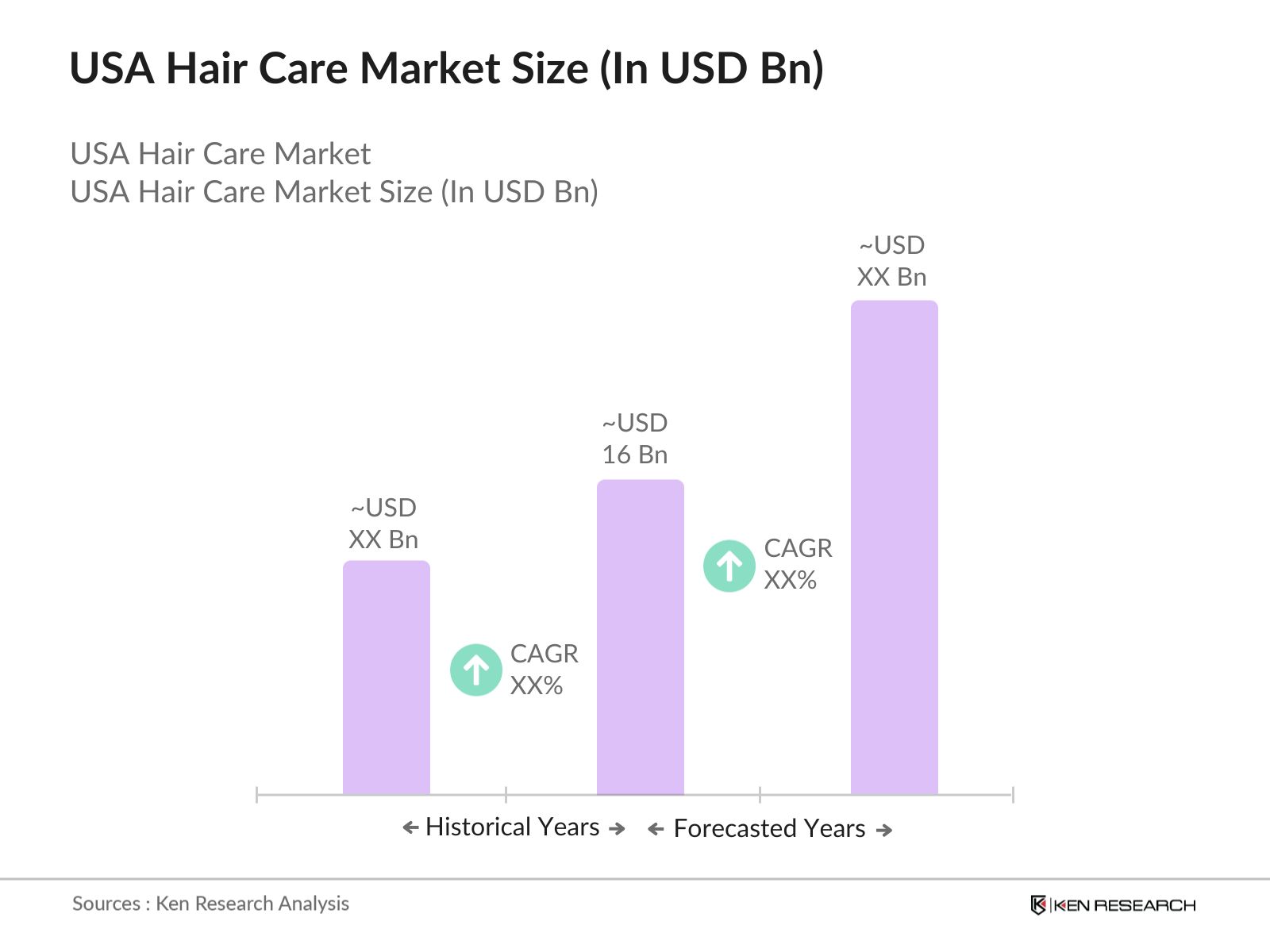

- The USA hair care market, valued at USD 16 billion, is primarily driven by increasing consumer awareness about personal grooming, rising demand for premium products, and the growing trend of natural and organic hair care solutions. The hair care industry benefits from an expanding consumer base that includes not only women but also a significant portion of male consumers, as well as younger demographics looking for specialized treatments like anti-hair fall, dandruff control, and hair strengthening solutions.

- Major cities such as New York, Los Angeles, and Chicago dominate the market due to their high population density, fashion-forward trends, and strong retail infrastructure. In these metropolitan areas, salons and spas contribute significantly to hair care product sales, with premium and professional-grade products seeing increased demand. Online platforms such as Amazon, Ulta Beauty, and Sephora are making hair care products more accessible nationwide, catering to consumers preferences for convenience and variety.

- The U.S. Food and Drug Administration (FDA) regulates the safety and labeling of hair care products to ensure consumer protection. In 2023, the FDA introduced new guidelines to address the growing demand for clean and sustainable beauty products. These regulations include stricter standards for ingredient transparency, labeling, and marketing claims, particularly for organic and chemical-free products. Compliance with these guidelines is critical for manufacturers to avoid penalties and maintain consumer trust.

USA Hair Care Market Segmentation

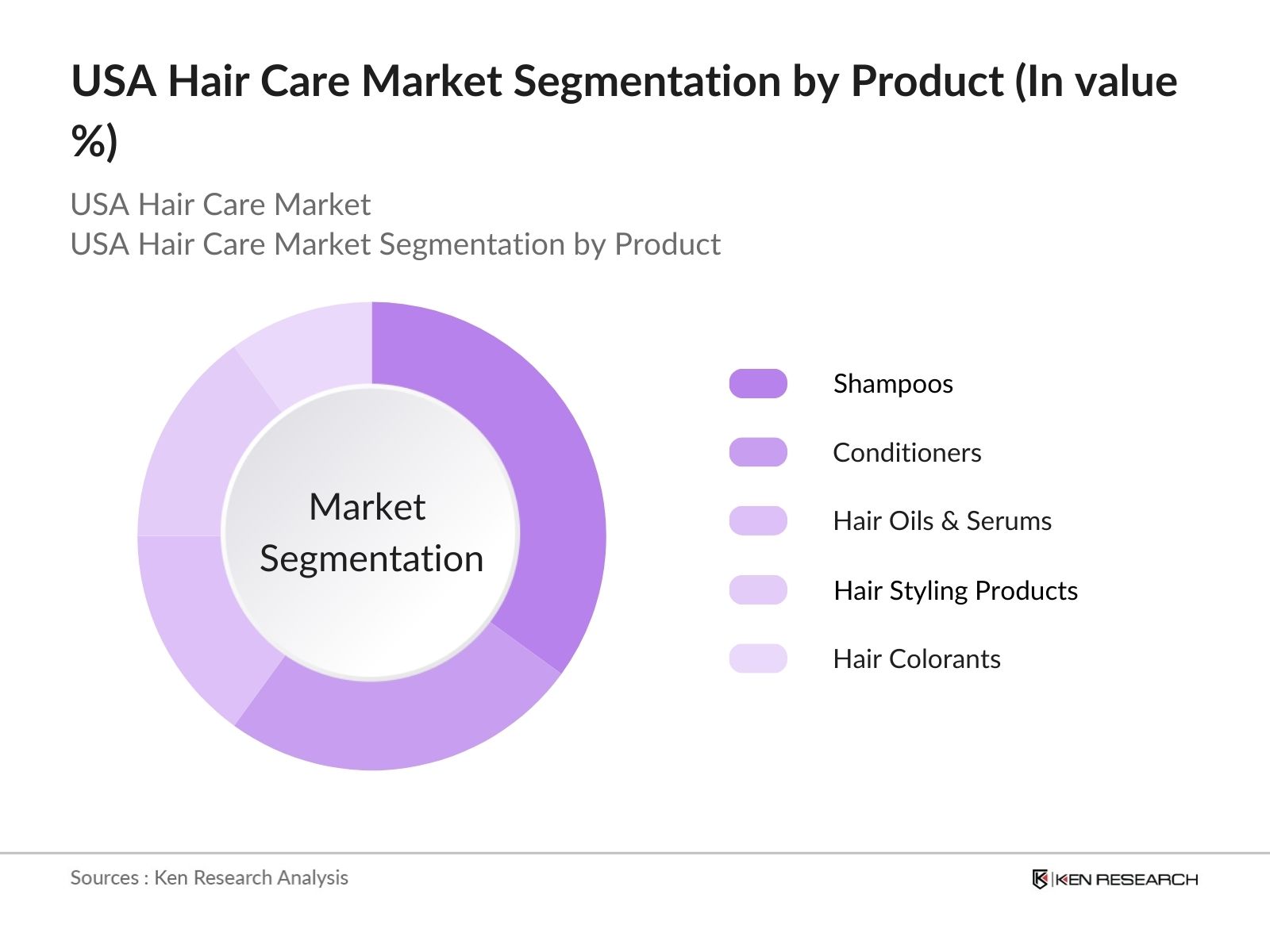

- By Product Type: The market is segmented by product type into shampoos, conditioners, hair oils, hair styling products, and hair colorants. Shampoos account for the largest share of this segment, driven by consumer demand for specific treatments, such as anti-dandruff and moisturizing shampoos. Hair styling products, such as gels, sprays, and creams, are also gaining traction as consumers experiment with diverse hair looks, particularly in the professional and social media influencer space. Leading brands like L'Oral, Pantene, and OGX dominate the shampoo and conditioner segment, offering a variety of options catering to different hair types and concerns.

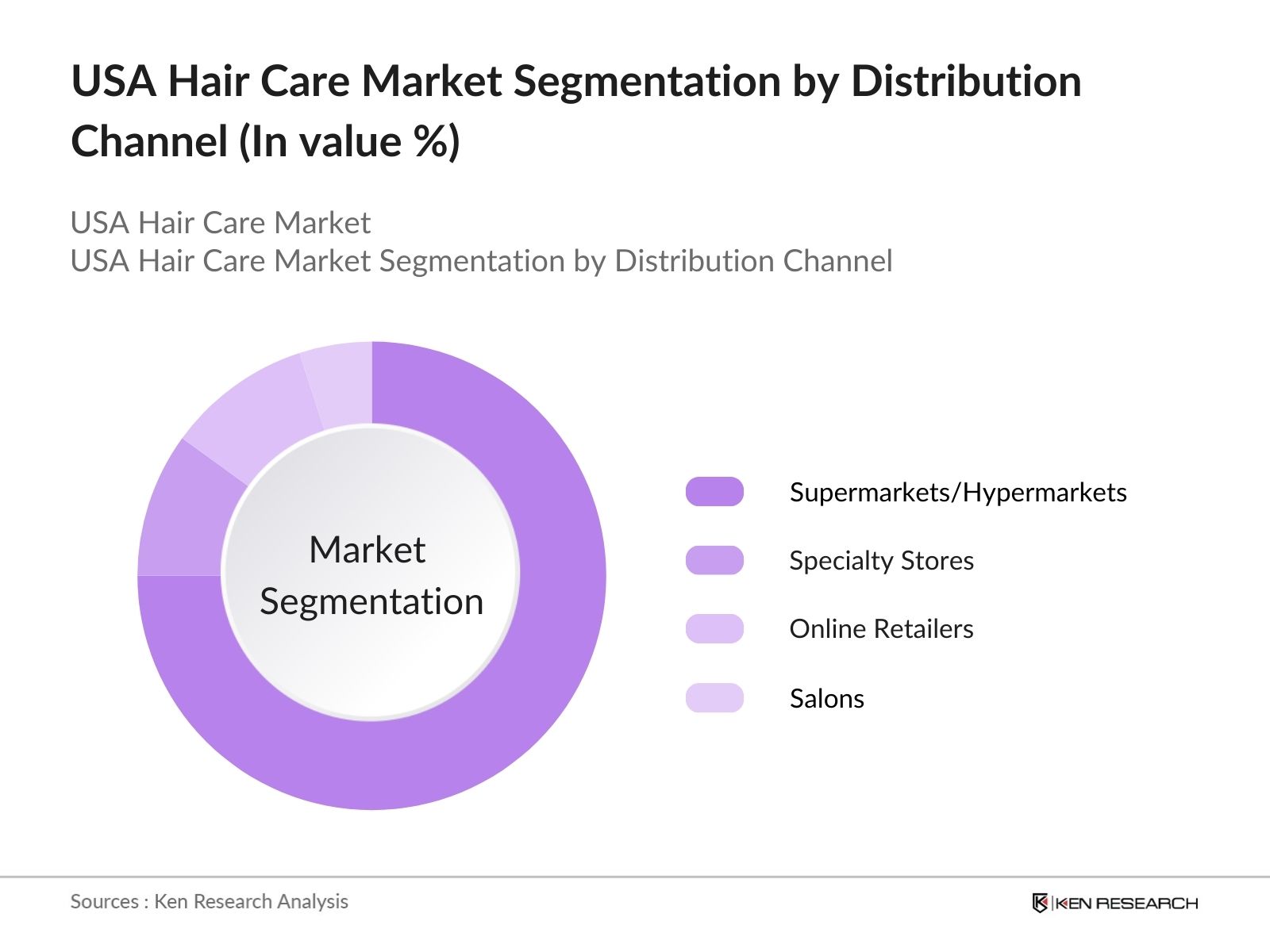

- By Distribution Channel: The market is segmented by distribution channels into online retailers, supermarkets/hypermarkets, specialty stores, and salons. Supermarkets/hypermarkets hold the largest market share due to the convenience they offer, but online retailers are rapidly gaining popularity as consumers shift toward e-commerce platforms for their hair care purchases. Companies like Ulta Beauty and Sephora offer a wide range of high-end and niche products, while platforms such as Amazon provide competitive pricing and fast delivery, making them popular choices for a broad range of consumers.

USA Hair Care Market Competitive Landscape

The USA hair care market is highly competitive, with both global and domestic players striving to capture market share through innovation, marketing strategies, and sustainability initiatives. Leading companies such as Procter & Gamble, L'Oral, and Unilever dominate the market with their extensive product portfolios and strong distribution networks. These companies are focusing on introducing products with natural ingredients, eco-friendly packaging, and advanced formulations to meet the evolving preferences of environmentally conscious consumers.

|

Company Name |

Establishment Year |

Headquarters |

Revenue (2023) |

Employees |

Key Product |

R&D Investment |

Key Clients |

Partnerships |

|

Procter & Gamble |

1837 |

USA |

||||||

|

L'Oral |

1909 |

France |

||||||

|

Unilever |

1929 |

UK/Netherlands |

||||||

|

Johnson & Johnson |

1886 |

USA |

||||||

|

Estee Lauder Companies |

1946 |

USA |

USA Hair Care Industry Analysis

Growth Drivers

- Rising Demand for Natural and Organic Products: The shift towards natural and organic products is a major growth driver in the USA hair care market. Consumers are increasingly concerned about the harmful effects of synthetic ingredients in conventional hair care products. According to a 2024 report by the Organic Trade Association, sales of organic personal care products, including hair care, grew by 12% year-over-year, reflecting growing consumer demand for chemical-free formulations. Major brands are responding to this trend by launching new product lines featuring natural ingredients like argan oil, coconut oil, and aloe vera.

- Influence of social media and Celebrity Endorsements: Social media has become a dominant force in shaping consumer preferences in the U.S. hair care market. Platforms like Instagram and TikTok saw a combined 25 million U.S.-based beauty content views daily in 2024, influencing purchasing decisions and brand awareness. The Federal Communications Commission reported that influencer marketing in beauty sectors, including hair care, accounted for a substantial amount in 2023. Consumers are heavily influenced by reviews and tutorials, driving demand for trending products and brands.

- Expansion of E-commerce Platforms: E-commerce has revolutionized the hair care market, with online sales accounting for a large portion of consumer purchases. In 2024, over majority of U.S. consumers purchased hair care products through e-commerce platforms like Amazon and Sephora, registering noteworthy compare from 2022 (U.S. Census Bureau). The convenience and wide range of options available online have driven this growth. E-commerce also facilitates the easy dissemination of customer reviews, which heavily influence buying behavior in this sector.

Market Challenges

- Supply Chain Disruptions: Similar to other industries, the USA hair care market has been impacted by global supply chain disruptions. The pandemic-induced logistics bottlenecks have led to shortages of key raw materials, such as packaging components and active ingredients. This has affected production schedules and resulted in delayed product launches and reduced inventory levels. Manufacturers are now looking at diversifying their supply chains to mitigate the risks of future disruptions, which has led to increased operational costs and challenges in maintaining profitability.

- Regulatory Compliance and Ingredient Transparency: The growing consumer demand for clean beauty and sustainable products has increased regulatory pressure on hair care brands. The U.S. FDA has introduced stricter guidelines around ingredient transparency and marketing claims, particularly for products labeled as "organic" or "natural." Companies are required to comply with these regulations to avoid legal penalties and maintain consumer trust, which has increased the cost of research and development for compliant formulations.

USA Hair Care Market Future Outlook

The USA hair care market is expected to witness steady growth over the next five years, driven by the rising demand for premium, organic, and sustainable products. The expansion of the e-commerce segment and the increasing influence of social media on consumer behavior will continue to shape the market. The emergence of smart hair care devices, such as scalp analyzers and personalized hair care solutions, will also contribute to the future growth of the market.

Future Market Opportunities

- Innovation in Personalized Hair Care Solutions: The demand for personalized hair care products is expected to rise as consumers look for solutions tailored to their specific hair type and concerns. Advanced technologies such as AI and machine learning are enabling brands to offer customized product recommendations based on individual hair profiles. In 2023, L'Oral launched its AI-powered diagnostic tool, which analyzes scalp health and hair needs, offering consumers personalized product suggestions, thus driving the trend towards individualized care.

- Sustainability Initiatives in Packaging: As environmental concerns gain prominence, hair care brands are exploring sustainable packaging solutions to reduce their ecological footprint. In 2024, Unilever announced a major initiative to eliminate single-use plastic packaging for its TRESemm and Dove hair care lines, opting for biodegradable and recyclable alternatives. This focus on sustainability is expected to create opportunities for brands that prioritize eco-friendly practices in their production processes.

Scope of the Report

|

By Product Type |

Shampoos Conditioners Hair Oils & Serums Hair Styling Products Hair Colorants |

|

By Distribution Channel |

Supermarkets/Hypermarkets Specialty Stores Online Retailers Salons & Professional Channels |

|

By Consumer Group |

Women Men Children |

|

By Ingredient Type |

Organic/Natural Ingredients Synthetic Ingredients Vegan/Animal-Free Products |

|

By Region |

Northeast Midwest South West |

Products

Key Target Audience

Investors and Venture Capitalist Firms

Government and Regulatory Bodies (FDA, U.S. Department of Commerce)

Hair Care Product Manufacturers

Raw Material Suppliers (cosmetic ingredients, packaging)

E-commerce Platforms

Salons and Professional Hair Care Services

Retailers (supermarkets, specialty stores)

Consumer Goods Distributors

Banks and Financial Institutions

Companies

Major Players Mentioned in the Report

Procter & Gamble

LOral USA

Unilever

Johnson & Johnson

Estee Lauder Companies

Henkel Corporation

Shiseido Company

Coty Inc.

Kao Corporation

Revlon

AmorePacific Corporation

Church & Dwight Co., Inc.

Aveda Corporation

Oribe Hair Care

Bumble and Bumble

Table of Contents

1. USA Hair Care Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. USA Hair Care Market Size (In USD Bn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. USA Hair Care Market Analysis

3.1. Growth Drivers (Market specific: consumer demand for natural ingredients, male grooming rise, premiumization of products)

3.1.1. Increasing Preference for Organic and Clean Label Products

3.1.2. Growing Influence of Social Media and Beauty Influencers

3.1.3. Expansion of E-commerce Platforms

3.1.4. Rising Demand for Male Grooming Products

3.2. Market Challenges (Market specific: high competition, supply chain disruptions, regulatory hurdles)

3.2.1. High Competition Among Brands

3.2.2. Supply Chain and Raw Material Shortages

3.2.3. Regulatory Compliance for Clean Beauty Products

3.2.4. Shifting Consumer Preferences

3.3. Opportunities (Market specific: expansion of product categories, sustainable practices, personalized hair care)

3.3.1. Personalized Hair Care Solutions

3.3.2. Eco-Friendly Packaging Innovations

3.3.3. Expansion into Untapped Consumer Segments (e.g., curly hair care)

3.3.4. Digital and AI-Driven Hair Care Solutions

3.4. Trends (Market specific: clean beauty, scalp care, and technology integrations)

3.4.1. Rising Popularity of Scalp Health Products

3.4.2. Increasing Focus on Sustainable and Ethical Sourcing

3.4.3. Integration of Technology into Hair Care (smart devices, AI-based solutions)

3.4.4. The Shift Towards Gender-Neutral Hair Care Products

3.5. Government Regulation (Market specific: FDA regulations, labeling requirements)

3.5.1. FDA Regulations on Hair Care Product Ingredients

3.5.2. Clean Beauty Standards and Certifications

3.5.3. Safety and Labeling Guidelines for Hair Colorants and Treatments

3.5.4. Compliance with Environmental and Sustainability Regulations

3.6. SWOT Analysis

3.7. Stake Ecosystem (Market specific: raw material suppliers, manufacturing units, distributors, retailers)

3.8. Porters Five Forces

3.9. Competition Ecosystem

4. USA Hair Care Market Segmentation

4.1. By Product Type (In Value %)

4.1.1. Shampoos

4.1.2. Conditioners

4.1.3. Hair Oils & Serums

4.1.4. Hair Styling Products

4.1.5. Hair Colorants

4.2. By Distribution Channel (In Value %)

4.2.1. Supermarkets/Hypermarkets

4.2.2. Specialty Stores

4.2.3. Online Retailers

4.2.4. Salons & Professional Channels

4.3. By Consumer Group (In Value %)

4.3.1. Women

4.3.2. Men

4.3.3. Children

4.4. By Ingredient Type (In Value %)

4.4.1. Organic/Natural Ingredients

4.4.2. Synthetic Ingredients

4.4.3. Vegan/Animal-Free Products

4.5. By Region (In Value %)

4.5.1. Northeast

4.5.2. Midwest

4.5.3. South

4.5.4. West

5. USA Hair Care Market Competitive Analysis

5.1. Detailed Profiles of Major Companies (15 competitors as specified)

5.1.1. Procter & Gamble

5.1.2. LOral USA

5.1.3. Unilever

5.1.4. Johnson & Johnson

5.1.5. Estee Lauder Companies

5.1.6. Henkel Corporation

5.1.7. Shiseido Company

5.1.8. Coty Inc.

5.1.9. Kao Corporation

5.1.10. Revlon

5.1.11. AmorePacific Corporation

5.1.12. Church & Dwight Co., Inc.

5.1.13. Aveda Corporation

5.1.14. Oribe Hair Care

5.1.15. Bumble and Bumble

5.2. Cross Comparison Parameters (Market specific: No. of Employees, Headquarters, Inception Year, Revenue, Key Product Lines, Distribution Channels, Sustainability Practices, R&D Investment)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers And Acquisitions

5.6. Investment Analysis

5.7. Venture Capital Funding

5.8. Government Grants

5.9. Private Equity Investments

6. USA Hair Care Market Regulatory Framework

6.1. FDA Guidelines for Hair Care Products

6.2. Ingredient Compliance and Bans (e.g., paraben bans, sulfate regulations)

6.3. Certification Processes for Organic and Clean Beauty Products

6.4. Environmental Regulations for Sustainable Sourcing and Packaging

7. USA Hair Care Future Market Size (In USD Bn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. USA Hair Care Future Market Segmentation

8.1. By Product Type (In Value %)

8.2. By Distribution Channel (In Value %)

8.3. By Consumer Group (In Value %)

8.4. By Ingredient Type (In Value %)

8.5. By Region Type (In Value %)

9. USA Hair Care Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

Research Methodology

Step 1: Identification of Key Variables

The first phase involved mapping out the ecosystem of the USA Hair Care Market. This included analyzing primary stakeholders, such as product manufacturers, distributors, retailers, and regulatory bodies. Data was sourced from secondary databases and proprietary reports to identify key market variables such as product trends, consumer preferences, and regulatory requirements.

Step 2: Market Analysis and Construction

In this step, historical data on the USA Hair Care Market was compiled and analyzed to understand market penetration, sales performance by product type, and revenue generation. Key metrics such as product performance and distribution channel growth were evaluated to form accurate market forecasts.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses were developed and validated through consultations with industry experts. These interviews provided insights into operational challenges, financial performance, and consumer behavior patterns, which helped refine the data. The feedback from professionals in the hair care sector ensured the credibility and accuracy of market estimates.

Step 4: Research Synthesis and Final Output

The final stage involved engaging with hair care product manufacturers to gather detailed insights into product segments, sales growth, and consumer preferences. This validated the findings derived from secondary research and allowed for a comprehensive and accurate analysis of the USA Hair Care Market.

Frequently Asked Questions

01. How big is the USA Hair Care Market?

The USA hair care market was valued at USD 16 billion, driven by increased demand for organic products, scalp treatments, and the expansion of e-commerce platforms.

02. What are the challenges in the USA Hair Care Market?

Challenges in the USA hair care market include high competition among global brands, supply chain disruptions, and regulatory hurdles related to clean beauty product standards.

03. Who are the major players in the USA Hair Care Market?

Key players in the USA hair care market include Procter & Gamble, L'Oral USA, Unilever, Johnson & Johnson, and Estee Lauder Companies, all of which have a strong global presence and wide product offerings.

04. What are the growth drivers of the USA Hair Care Market?

Growth drivers in the USA hair care market include the rising demand for natural and organic hair care products, increased consumer awareness of scalp health, and the growth of e-commerce platforms that provide easy access to diverse product ranges.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.