USA Hair Wigs And Extensions Market Outlook to 2030

Region:North America

Author(s):Yogita Sahu

Product Code:KROD4832

November 2024

91

About the Report

USA Hair Wigs and Extensions Market Overview

- The USA Hair Wigs and Extensions market was valued at USD 2.97 billion andis primarily driven by the rising demand for aesthetic and functional uses of hair products. This includes applications for personal fashion, hair loss treatments, and increasing consumer preference for customization. The markets growth is influenced by the social media culture, where influencers and celebrities set trends that boost demand for wigs and extensions.

- Cities such as Los Angeles, New York, and Atlanta dominate the market due to their strong connections to the fashion, entertainment, and beauty industries. Los Angeles and New York, as global hubs for fashion and entertainment, contribute significantly to the demand for high-end wigs and extensions. Atlanta plays a crucial role due to the large African-American demographic, which has a cultural inclination towards hair extensions and wigs for styling and protective purposes.

- In 2024, the U.S. Food and Drug Administration (FDA) is revising regulations on medical wigs (cranial prostheses), ensuring higher safety standards and providing insurance coverage for chemotherapy patients. This initiative is expected to increase the annual demand for FDA-certified medical wigs by around 80,000 units, benefiting patients with hair loss due to medical treatments.

USA Hair Wigs and Extension Market Segmentation

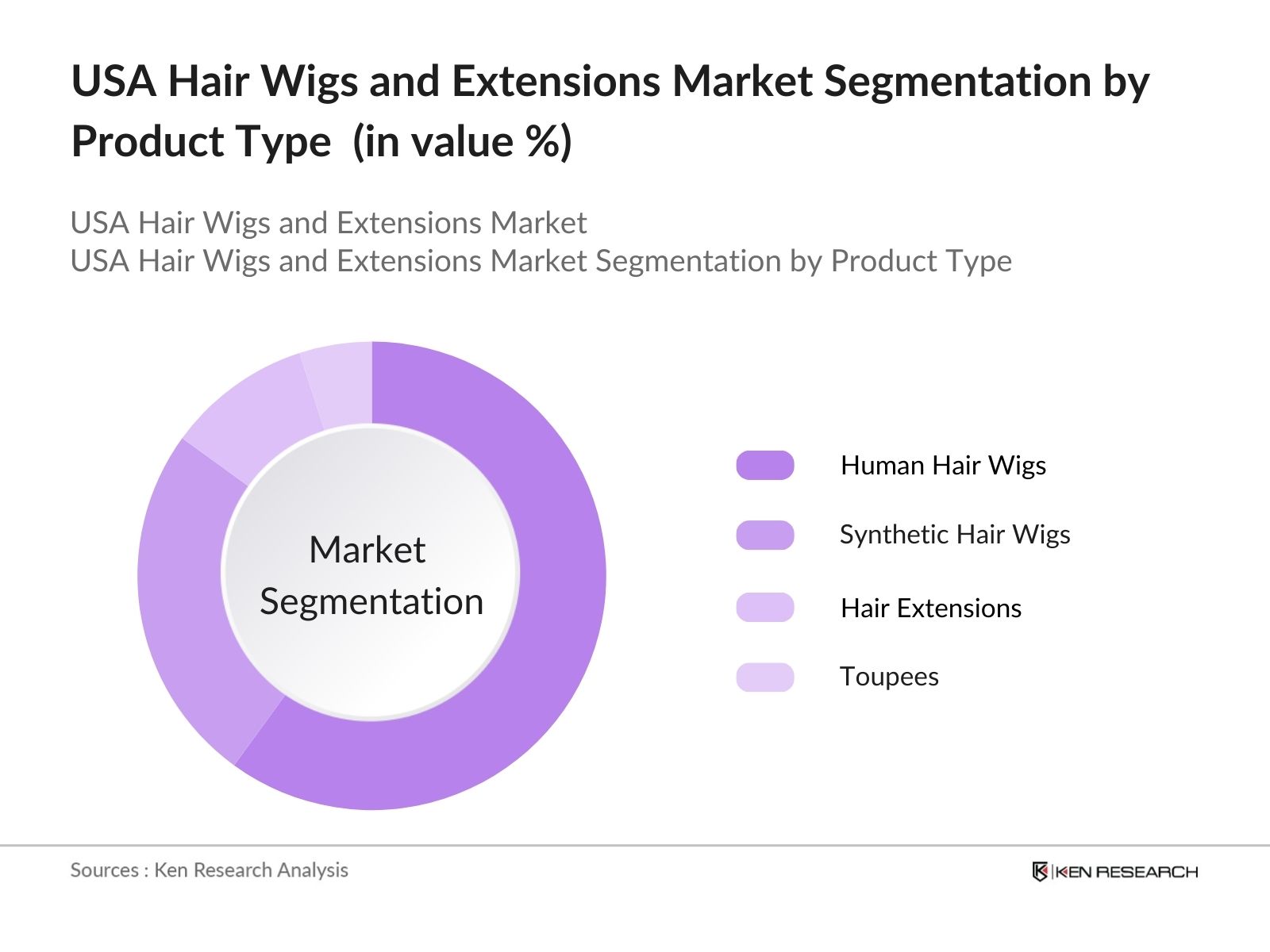

By Product Type: The market is segmented by product type into human hair wigs, synthetic hair wigs, hair extensions (weaves, clip-ins, tapes, pre-bonded), and toupees. Human hair wigs hold the dominant market share due to their natural look and feel, making them preferable for long-term wearers, especially among individuals facing hair loss issues and professionals in the fashion and entertainment industry. Human hair wigs are more durable and can be styled like natural hair, driving demand.

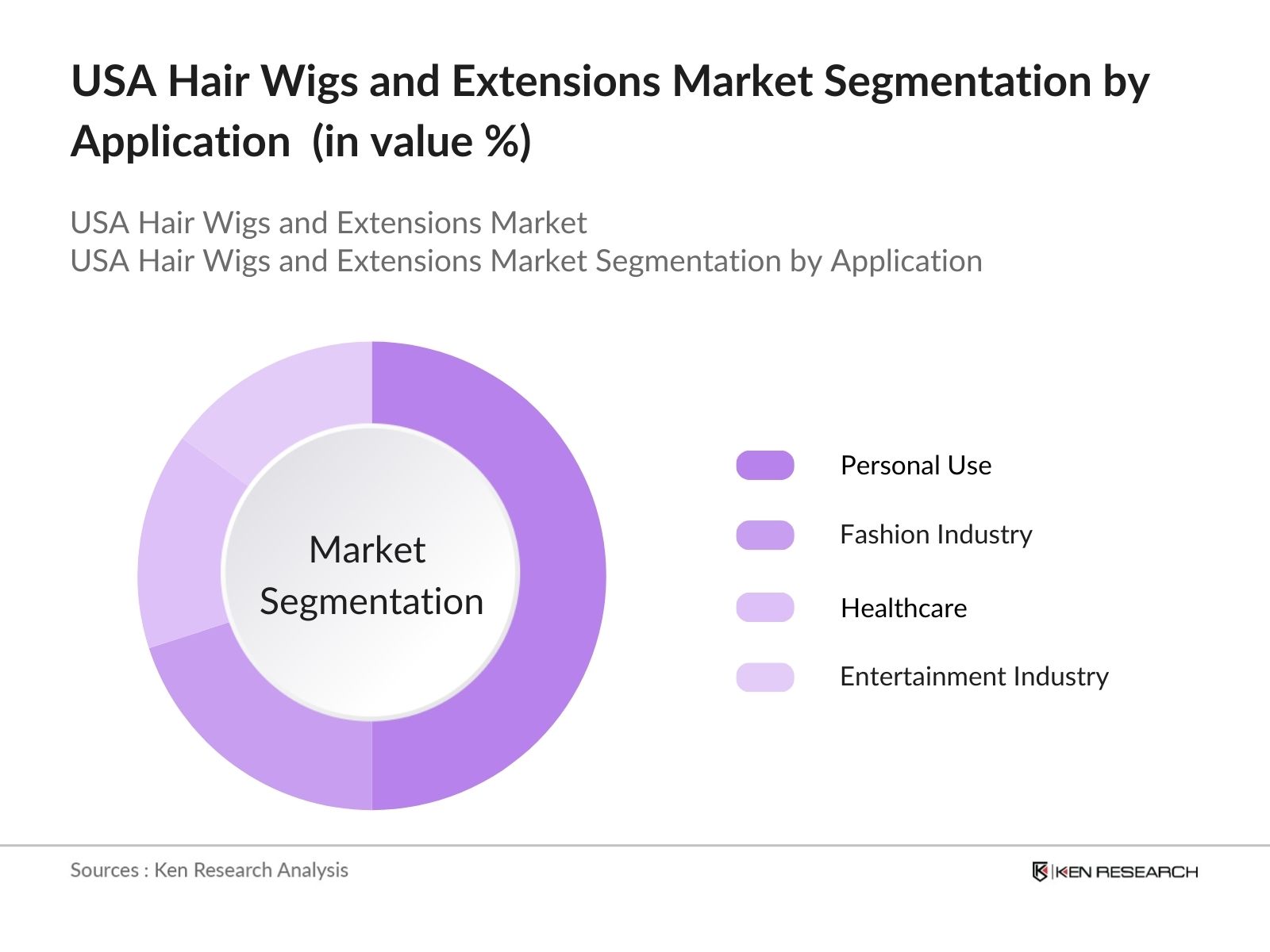

By Application: The market is segmented by application into personal use, fashion industry, healthcare (for individuals experiencing alopecia or undergoing chemotherapy), and the entertainment industry. Personal use dominates the market, with consumers increasingly adopting wigs and extensions for everyday wear. Rising awareness about hair protection techniques and non-invasive styling has spurred the demand for wigs and extensions in personal grooming.

USA Hair Wigs and Extensions Market Competitive Landscape

The market is characterized by intense competition with key global and domestic players. This market is dominated by established brands that have built reputations for quality, variety, and innovation in product offerings. Companies such as HairUWear and Jon Renau have been at the forefront due to their extensive distribution networks and high-quality human hair products.

|

Company |

Establishment Year |

Headquarters |

Product Portfolio |

E-commerce Presence |

Celebrity Collaborations |

Ethical Sourcing Practices |

Sustainability Initiatives |

Distribution Network |

R&D Investment |

|

HairUWear |

1968 |

Kansas, USA |

|||||||

|

Jon Renau |

1984 |

California, USA |

|||||||

|

Bellami Hair |

2012 |

California, USA |

|||||||

|

Luxy Hair |

2010 |

Toronto, Canada |

|||||||

|

Great Lengths |

1992 |

Rome, Italy |

USA Hair Wigs and Extensions Market Analysis

Market Growth Drivers

- Rising Demand for Customized Hair Solutions: The increasing demand for wigs and hair extensions designed to cater to personalized aesthetics and specific hair textures is a significant driver. In 2024, over 3 million individuals in the USA are seeking hair replacement solutions for aesthetic and medical reasons, including alopecia and chemotherapy patients, which directly impacts the market for custom-designed wigs and extensions.

- Growth in Ethnic Consumer Base: The USA is home to a large African American population, estimated at over 45 million people in 2024. A notable percentage of this demographic actively uses wigs and hair extensions as part of daily grooming and fashion routines. This ethnic group is expected to drive consistent demand, with over 1.5 million units of hair wigs and extensions sold annually in this segment alone.

- Increasing Medical Needs for Hair Wigs: In 2024, nearly 650,000 women in the USA are diagnosed with cancer, with many undergoing chemotherapy treatments that lead to hair loss. This has led to a surge in demand for medical-grade wigs. Furthermore, alopecia, affecting around 6.8 million Americans, contributes to growing market demand for high-quality, comfortable wigs designed for long-term use.

Market Challenges

- Counterfeit and Substandard Products: The USA market is facing an influx of counterfeit and low-quality hair wigs and extensions, with an estimated 300,000 fake products seized by U.S. Customs in 2024. These products damage the reputation of legitimate manufacturers and reduce consumer trust in the market. The rising presence of substandard products, particularly on e-commerce platforms, continues to be a key challenge for authentic brands.

- Environmental Concerns Related to Synthetic Hair: In 2024, around 100 million synthetic wigs and extensions are produced annually. However, the environmental impact of these products, which are non-biodegradable and contribute to plastic pollution, is causing consumer backlash. Growing awareness of sustainability is likely to present challenges for synthetic hair manufacturers as consumers shift toward eco-friendly alternatives.

USA Hair Wigs and Extensions Market Future Outlook

Over the next five years, the USA Hair Wigs and Extensions industry is expected to experience continued growth driven by several key factors. The increasing consumer demand for customization and premium hair solutions, advancements in synthetic hair technologies, and the expansion of online retail channels will support market expansion.

Future Market Opportunities

- Increasing Use of AI in Wig Customization: By 2029, the integration of AI in the wig customization process will allow for more precise and personalized wig fittings. It is anticipated that over 300,000 customers annually will use AI-powered tools to select wigs based on their unique facial structure and scalp measurements.

- Shift Toward Organic and Ethically Sourced Human Hair: The demand for organic and ethically sourced human hair is expected to increase by 2029. It is estimated that at least 50% of human hair wigs sold in the USA will be certified as ethically sourced, as consumers become more conscious of the environmental and ethical implications of hair sourcing.

Scope of the Report

|

By Product Type |

Human Hair Wigs Synthetic Hair Wigs Hair Extensions Toupees |

|

By Application |

Personal Use Fashion Industry Healthcare Entertainment |

|

By Distribution |

Online Retail Brick-and-Mortar Stores Specialty Salons Direct Sales |

|

By Hair Type |

Brazilian Hair Indian Hair European Hair Synthetic Hair |

|

By Region |

North West South |

Products

Key Target Audience Organizations and Entities Who Can Benefit by Subscribing This Report:

Hair Product Manufacturers

Banks and Financia Institution

Private Equity Firms

Government and Regulatory Bodies (FDA, U.S. Trade Commission)

Investment and Venture Capitalist Firms

Entertainment Industry (film production houses, theater companies)

Companies

Players Mentioned in the Report:

HairUWear

Jon Renau

Bellami Hair

Luxy Hair

Great Lengths International

Ellen Wille

The Wig Company

Indique Hair

Shake-N-Go Fashion Inc.

Lordhair

Beautyforever Hair

Mayvenn Inc.

Diva Divine Hair Extensions

Hairdreams Haarhandels GmbH

Godrej Consumer Products Ltd.

Table of Contents

1. USA Hair Wigs and Extensions Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. USA Hair Wigs and Extensions Market Size (In USD Bn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. USA Hair Wigs and Extensions Market Analysis

3.1. Growth Drivers

3.1.1. Rising Adoption of Hair Wigs and Extensions (consumer preference for customization, beauty standards, medical purposes)

3.1.2. Increasing Influence of Social Media and Fashion (celebrity endorsements, beauty influencers, hairstyle trends)

3.1.3. Growth in the African-American Demographic Market (cultural influence, hair care trends)

3.1.4. Surge in Demand from the Entertainment Industry (TV shows, movies, theater productions)

3.2. Market Challenges

3.2.1. High Costs of Premium Human Hair Products

3.2.2. Counterfeit and Low-Quality Products in the Market

3.2.3. Fluctuating Raw Material Prices (human hair sourcing, synthetic fiber costs)

3.2.4. Ethical and Environmental Concerns (sustainable sourcing of hair, environmental impact of synthetic materials)

3.3. Opportunities

3.3.1. Expansion of E-commerce Channels (online shopping, direct-to-consumer)

3.3.2. Technological Advancements in Synthetic Hair (improved texture, durability, low maintenance)

3.3.3. New Markets for Customizable Solutions (personalization, custom wigs for medical purposes)

3.3.4. Rising Demand for Mens Hair Wigs and Extensions (male grooming trends, non-surgical hair replacement)

3.4. Trends

3.4.1. Increasing Popularity of Lace Front Wigs and Clip-in Extensions

3.4.2. Growing Preference for Natural-Looking Wigs (undetectable lace, seamless application techniques)

3.4.3. Demand for Low-Maintenance Hair Solutions (durable, easy-to-wear wigs and extensions)

3.4.4. Adoption of 3D Printing for Wig Caps and Custom Hairpieces

3.5. Regulatory Landscape

3.5.1. U.S. Trade Regulations on Human Hair Imports (import duties, sourcing country regulations)

3.5.2. FDA Guidelines on Hair Extensions (safety standards, certification requirements)

3.5.3. Fair Trade and Ethical Sourcing Standards

3.5.4. Environmental Policies and Sustainability Initiatives

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem

3.8. Porters Five Forces

3.9. Competition Ecosystem

4. USA Hair Wigs and Extensions Market Segmentation

4.1. By Product Type (In Value %)

4.1.1. Human Hair Wigs

4.1.2. Synthetic Hair Wigs

4.1.3. Hair Extensions (weaves, clip-ins, tapes, pre-bonded)

4.1.4. Toupees and Hairpieces

4.2. By Application (In Value %)

4.2.1. Personal Use

4.2.2. Fashion Industry

4.2.3. Healthcare (alopecia, cancer treatment)

4.2.4. Entertainment Industry

4.3. By Distribution Channel (In Value %)

4.3.1. Online Retail

4.3.2. Brick-and-Mortar Stores

4.3.3. Specialty Salons

4.3.4. Direct Sales

4.4. By Hair Type (In Value %)

4.4.1. Brazilian Hair

4.4.2. Indian Hair

4.4.3. European Hair

4.4.4. Synthetic Hair

4.5. By Region (In Value %)

4.5.1. North

4.5.2. East

4.5.3. South

4.5.4. West

5. USA Hair Wigs and Extensions Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. Great Lengths International

5.1.2. HairUWear

5.1.3. Diva Divine Hair Extensions

5.1.4. Luxy Hair

5.1.5. Bellami Hair

5.1.6. The Wig Company

5.1.7. Lordhair

5.1.8. Shake-N-Go Fashion Inc.

5.1.9. Beautyforever Hair

5.1.10. Mayvenn Inc.

5.1.11. Hairdreams Haarhandels GmbH

5.1.12. Godrej Consumer Products Ltd.

5.1.13. Ellen Wille

5.1.14. Jon Renau

5.1.15. Indique Hair

5.2. Cross Comparison Parameters (No. of Employees, Headquarters, Inception Year, Revenue, Product Portfolio, Sustainability Initiatives, Distribution Channels, Brand Collaborations)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers And Acquisitions

5.6. Investment Analysis

5.7. Venture Capital Funding

5.8. Government Grants

5.9. Private Equity Investments

6. USA Hair Wigs and Extensions Market Regulatory Framework

6.1. Import-Export Regulations

6.2. Ethical Sourcing Guidelines

6.3. Product Certification Requirements

7. USA Hair Wigs and Extensions Future Market Size (In USD Bn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. USA Hair Wigs and Extensions Future Market Segmentation

8.1. By Product Type (In Value %)

8.2. By Application (In Value %)

8.3. By Distribution Channel (In Value %)

8.4. By Hair Type (In Value %)

8.5. By Region (In Value %)

9. USA Hair Wigs and Extensions Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

Research Methodology

Step 1: Identification of Key Variables

This phase involved mapping out the ecosystem of the USA Hair Wigs and Extensions Market. Desk research was used to identify key stakeholders, including manufacturers, suppliers, distributors, and consumers. Key variables such as consumer demographics, product trends, and distribution channels were identified to form the basis of the research.

Step 2: Market Analysis and Construction

This step focused on compiling historical data to analyze market trends and revenue generation. Data sources included government reports, trade databases, and company financials. The analysis focused on determining market penetration and segment revenue.

Step 3: Hypothesis Validation and Expert Consultation

We conducted expert consultations with hair product manufacturers and industry experts to validate market trends. Interviews were carried out using Computer-Assisted Telephone Interviews (CATIs) to refine hypotheses based on industry feedback.

Step 4: Research Synthesis and Final Output

In this final step, data collected from desk research and expert consultations were synthesized into a coherent market analysis. A bottom-up approach was used to ensure accuracy, providing a comprehensive view of market dynamics and future trends.

Frequently Asked Questions

01. How big is the USA Hair Wigs and Extensions Market?

The USA Hair Wigs and Extensions market is valued at USD 2.97 billion, driven by increasing consumer demand for high-quality, customizable wigs and extensions.

02. What are the challenges in the USA Hair Wigs and Extensions Market?

Challenges in the USA Hair Wigs and Extensions market include high prices for premium human hair products and the prevalence of counterfeit or low-quality alternatives, which pose risks to both consumers and businesses.

03. Who are the major players in the USA Hair Wigs and Extensions Market?

Major players in the USA Hair Wigs and Extensions market include HairUWear, Jon Renau, Bellami Hair, Luxy Hair, and Great Lengths. These companies lead the market due to their extensive product portfolios, e-commerce presence, and celebrity collaborations.

04. What are the growth drivers of the USA Hair Wigs and Extensions Market?

Growth in the USA Hair Wigs and Extensions market is driven by increasing consumer preference for premium wigs and extensions, the influence of social media and fashion trends, and growing demand from the healthcare sector for medical wigs.

05. What trends are shaping the future of the USA Hair Wigs and Extensions Market?

Key trends in the USA Hair Wigs and Extensions market include the increasing adoption of lace front wigs, advancements in synthetic hair technologies, and rising demand for eco-friendly, sustainable hair solutions.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.