USA Handbags Market Outlook to 2030

Region:North America

Author(s):Yogita Sahu

Product Code:KROD2572

October 2024

88

About the Report

USA Handbags Market Overview

- The USA Handbags Market is valued at USD 13 billion, based on a five-year historical analysis. This market growth is primarily driven by the increasing disposable income of consumers, especially among millennials and Gen Z, who are highly influenced by fashion trends and social media. The rising popularity of e-commerce platforms and the demand for premium and luxury handbags are also key factors fueling market growth.

- Cities like New York, Los Angeles, and Miami dominate the USA handbags market. These cities are home to luxury retail outlets and affluent consumers, driving demand for high-end designer handbags. New York, in particular, is a global fashion hub, with consumers displaying a penchant for premium and luxury products. Furthermore, the fashion-forward nature of these cities, coupled with higher consumer spending on fashion accessories, ensures they maintain a significant presence in the market.

- Handbag retailers are increasingly using mobile monitoring units to track inventory and consumer behavior in real time. These units, which use a combination of GPS and RFID technology, help stores optimize inventory levels and offer personalized shopping experiences. According to U.S. Census Bureau, more than 30% of U.S. retailers are using mobile monitoring units to enhance supply chain management, reducing stockouts and improving customer satisfaction.

USA Handbags Market Segmentation

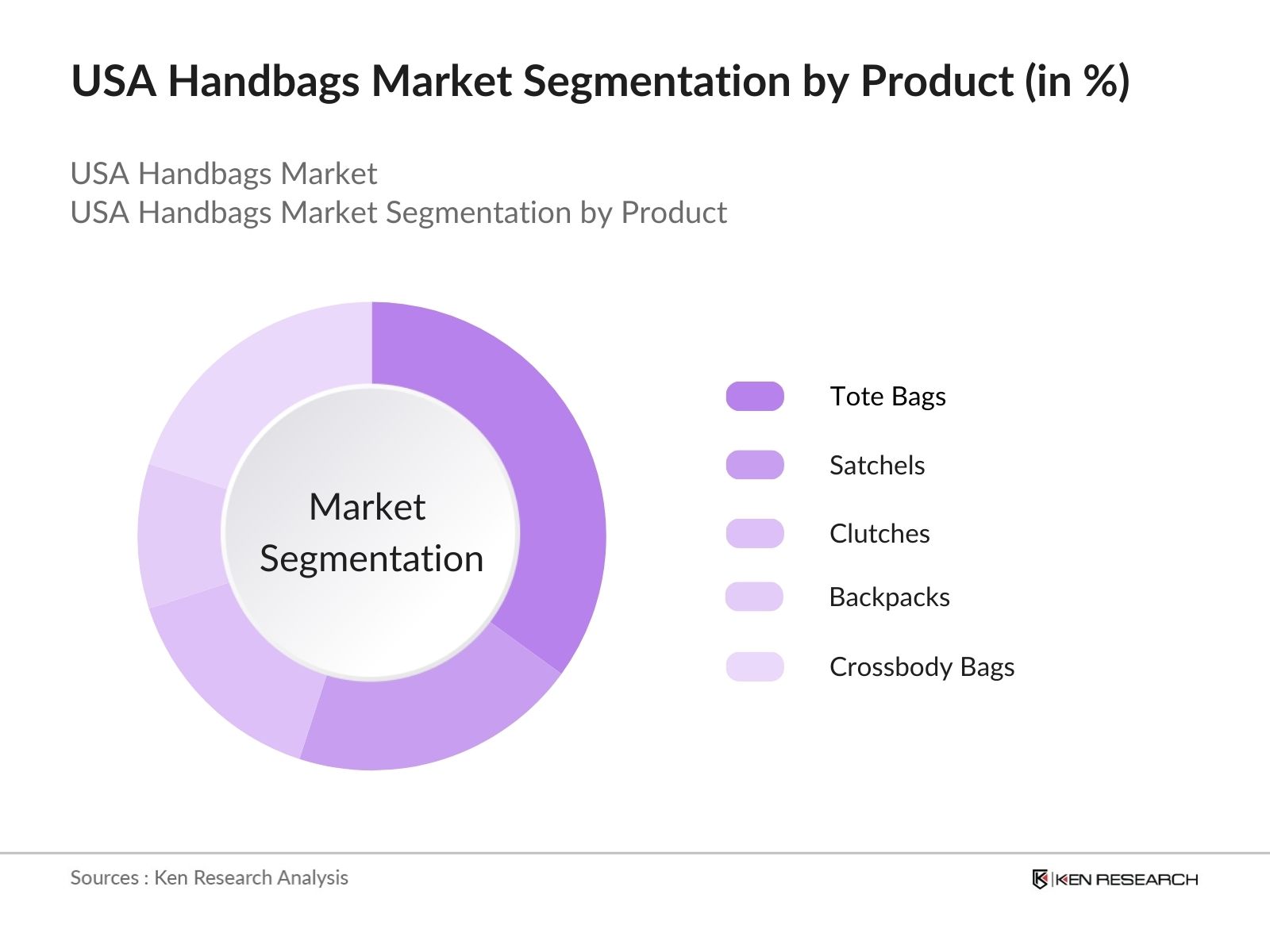

By Product Type: The market is segmented by product type into tote bags, satchels, clutches, backpacks, and crossbody bags. Tote bags hold the dominant market share due to their versatility and large storage capacity, making them a favorite among working professionals and casual shoppers.

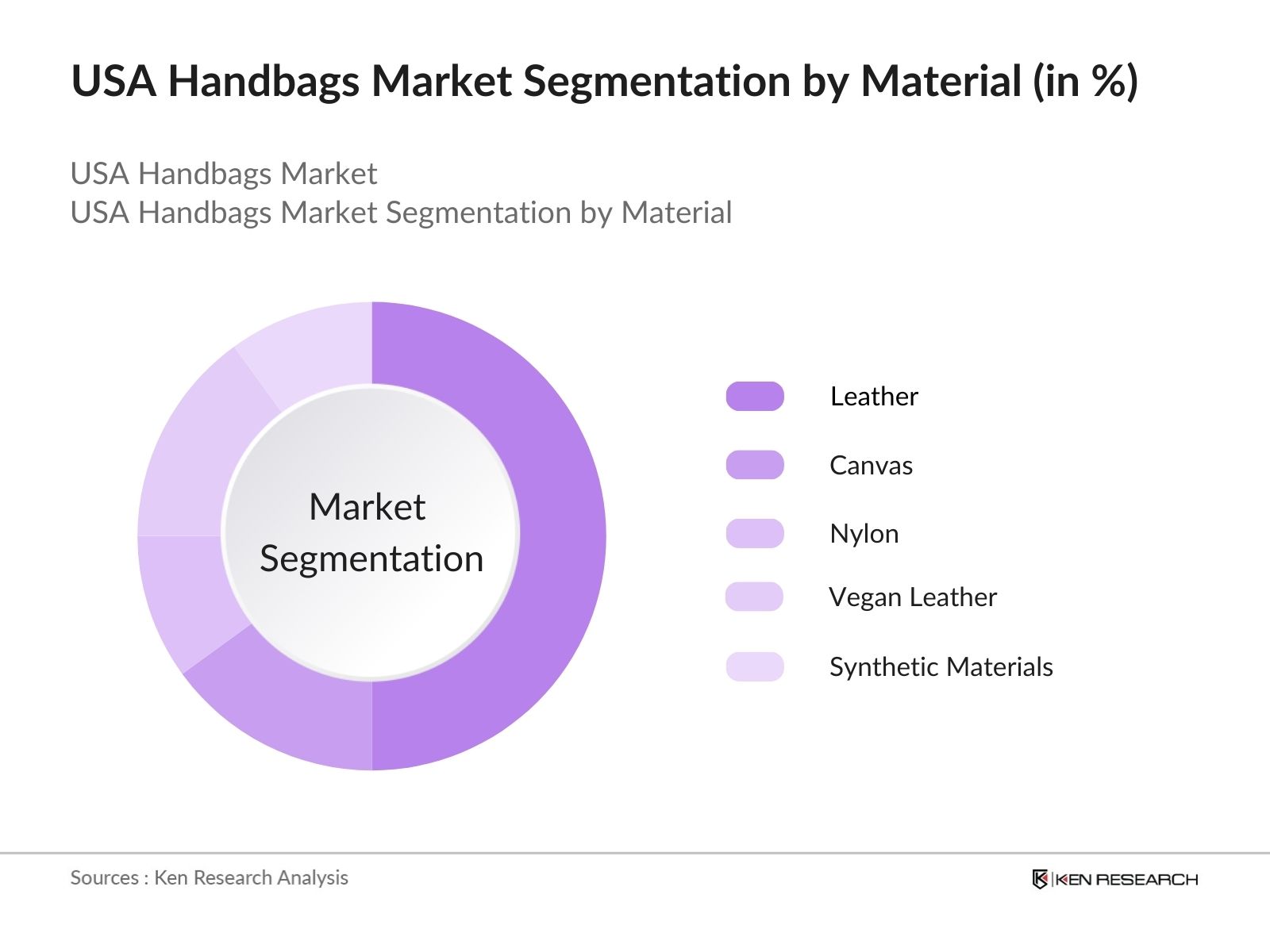

By Material: The market is also segmented by material into leather, canvas, nylon, vegan leather, and synthetic materials. Leather handbags have a dominant market share due to their durability, premium appeal, and widespread consumer perception as a status symbol.

USA Handbags Market Competitive Landscape

The market is characterized by intense competition among both domestic and international brands. Leading players focus on expanding their product lines, maintaining strong brand identities, and enhancing customer experiences. Major companies in the market, such as Coach, Michael Kors, and Louis Vuitton, dominate due to their long-standing brand reputations and extensive retail networks.

|

Company |

Establishment Year |

Headquarters |

Revenue |

Product Lines |

Sustainability Initiatives |

Distribution Channels |

Collaborations |

Market Share |

|

Coach |

1941 |

New York, USA |

||||||

|

Michael Kors |

1981 |

New York, USA |

||||||

|

Louis Vuitton |

1854 |

Paris, France |

||||||

|

Tory Burch |

2004 |

New York, USA |

||||||

|

Kate Spade |

1993 |

New York, USA |

USA Handbags Market Analysis

Market Growth Drivers

- Urbanization: Urbanization continues to be a driving force in the market, with over 83% of the U.S. population residing in urban areas as of 2023. As more people migrate to cities, the demand for fashion accessories, including handbags, is rising, particularly in metropolitan areas such as New York, Los Angeles, and Chicago. This shift is increasing the concentration of fashion-conscious consumers who are more likely to purchase premium and designer handbags. Urban dwellers also have higher disposable incomes and greater access to retail outlets, both online and offline, further fueling market growth.

- Industrialization: The U.S. continues to be a global leader in industrial production, ranking second in the world with an industrial output of $2.6 trillion in 2023, according to the International Monetary Fund (IMF). This industrial growth supports the handbag market by improving the supply chain and fostering innovation in manufacturing processes, particularly for materials like leather and synthetic alternatives. Technological advancements in U.S. manufacturing have led to better-quality products at competitive prices, further stimulating demand in the handbags market.

- Public Awareness: Growing consumer awareness about environmental sustainability and ethical fashion practices has led to increased demand for eco-friendly handbags in the USA. A survey conducted by the U.S. Environmental Protection Agency found that 67% of American consumers are more likely to purchase products from companies that follow sustainable practices, including the use of vegan leather and recyclable materials.

Market Restraints

- High Initial Costs: The high initial costs of setting up manufacturing operations for luxury handbags are a restraint in the Market. The average cost to start a manufacturing facility in the United States is high, according to the U.S. Small Business Administration. These expenses include procuring raw materials, purchasing machinery, and paying for labor, which is often more expensive in the U.S. than in other regions.

- Lack of Skilled Workforce: The decline in vocational training programs in the U.S. has led to a shortage of skilled artisans needed for the handbag manufacturing industry. In 2023, the U.S. Bureau of Labor Statistics reported that the number of skilled leatherworkers and fashion craftsmen decreased by 12% over the past decade. This shortage has forced many handbag manufacturers to either outsource labor or invest heavily in training programs, both of which can reduce profit margins and slow down production timelines.

USA Handbags Market Future Outlook

Over the next five years, the USA handbag industry is expected to experience growth driven by the increasing demand for luxury and premium handbags, the rise in eco-conscious consumer preferences, and technological advancements in smart handbags. As consumers seek more personalized and sustainable products, brands are expected to innovate by incorporating eco-friendly materials and offering customization options. E-commerce will continue to be a dominant sales channel as online shopping remains popular, with digital platforms enabling brands to reach a broader customer base.

Future Market Opportunities

- Technological Advancements: Technological advancements in material science and manufacturing are providing new growth opportunities in the market. Innovations in 3D printing are allowing designers to create custom handbag prototypes at a fraction of the traditional cost. Additionally, the rise of wearable technology is paving the way for "smart" handbags equipped with features like phone charging capabilities and RFID blocking, appealing to tech-savvy consumers.

- Expansion into Rural Areas: As urban markets become saturated, handbag brands are exploring untapped opportunities in rural areas of the United States. According to the U.S. Census Bureau, rural areas account for 20% of the U.S. population, or around 60 million people. Many of these consumers are underserved by luxury and premium brands due to limited retail access.

Scope of the Report

|

Segment |

Sub-Segments |

|

By Product Type |

Tote Bags Satchels Clutches Backpacks Crossbody Bags |

|

By Material |

Leather Canvas Nylon Vegan Leather Synthetic Materials |

|

By Distribution Channel |

Online Retail Offline Retail |

|

By Price Range |

Economy Mid-Range Premium Luxury |

|

By End-User |

Women Men Unisex |

Products

Key Target Audience Organizations and Entities Who Can Benefit by Subscribing This Report:

Handbag Manufacturers

Investments and Venture Capitalist Firms

Government and Regulatory Bodies (U.S. Federal Trade Commission, U.S. Consumer Product Safety Commission)

Luxury Fashion Brands

Private Equity Firms

Startups

Companies

Players Mentioned in the Report:

Michael Kors

Coach

Kate Spade

Tory Burch

Ralph Lauren

Gucci

Prada

Louis Vuitton

Chanel

Herms

Longchamp

Burberry

Fossil Group

Dooney & Bourke

Rebecca Minkoff

Table of Contents

1. USA Handbags Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. USA Handbags Market Size (In USD Bn)

2.1. Historical Market Size

2.2. Year-on-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. USA Handbags Market Analysis

3.1. Growth Drivers

3.1.1. Rise in Disposable Income

3.1.2. Growing Fashion Consciousness

3.1.3. Expansion of Online Retail Channels

3.1.4. Increasing Luxury Handbag Demand (Luxury Penetration Rates)

3.2. Market Challenges

3.2.1. Counterfeit Goods (Impact of Counterfeit Market)

3.2.2. Fluctuations in Raw Material Prices (Leather & Sustainable Material Costs)

3.2.3. High Competition from Local Manufacturers (Competitive Landscape Dynamics)

3.3. Opportunities

3.3.1. Rising Demand for Customization (Customization Trends)

3.3.2. Penetration into Tier-2 & Tier-3 Cities

3.3.3. Increasing Demand for Sustainable and Eco-friendly Products (Eco-conscious Consumer Behavior)

3.4. Trends

3.4.1. Rise in Demand for Premium and Personalized Handbags

3.4.2. Shift Toward Vegan Leather and Sustainable Materials (Sustainability Metrics)

3.4.3. Growing Popularity of Smart Handbags (Technology Integration in Handbags)

3.5. Government Regulations

3.5.1. Tariffs on Imported Goods (Trade and Tariff Policies)

3.5.2. Regulations on Animal Leather Production

3.5.3. Environmental Regulations on Raw Material Sourcing

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem

3.7.1. Raw Material Suppliers

3.7.2. Manufacturers

3.7.3. Distributors

3.7.4. Retailers

3.8. Porter’s Five Forces Analysis

3.9. Competition Ecosystem

4. USA Handbags Market Segmentation

4.1. By Product Type (In Value %)

4.1.1. Tote Bags

4.1.2. Satchels

4.1.3. Clutches

4.1.4. Backpacks

4.1.5. Crossbody Bags

4.2. By Material (In Value %)

4.2.1. Leather

4.2.2. Canvas

4.2.3. Nylon

4.2.4. Vegan Leather

4.2.5. Synthetic Materials

4.3. By Distribution Channel (In Value %)

4.3.1. Online Retail

4.3.2. Offline Retail (Department Stores, Boutiques, Specialty Stores)

4.4. By Price Range (In Value %)

4.4.1. Economy

4.4.2. Mid-Range

4.4.3. Premium

4.4.4. Luxury

4.5. By End-User (In Value %)

4.5.1. Women

4.5.2. Men

4.5.3. Unisex

5. USA Handbags Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. Michael Kors

5.1.2. Coach

5.1.3. Kate Spade

5.1.4. Tory Burch

5.1.5. Ralph Lauren

5.1.6. Gucci

5.1.7. Prada

5.1.8. Louis Vuitton

5.1.9. Chanel

5.1.10. Hermès

5.1.11. Longchamp

5.1.12. Burberry

5.1.13. Fossil Group

5.1.14. Dooney & Bourke

5.1.15. Rebecca Minkoff

5.2. Cross Comparison Parameters (No. of Employees, Headquarters, Inception Year, Revenue, Product Lines, Sustainability Initiatives, Distribution Channels, Market Share)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Venture Capital Funding

5.8. Government Grants

5.9. Private Equity Investments

6. USA Handbags Market Regulatory Framework

6.1. Tariffs and Import Restrictions

6.2. Compliance with Labor Laws

6.3. Environmental Standards for Raw Material Sourcing

6.4. Sustainability Certifications

7. USA Handbags Future Market Size (In USD Bn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. USA Handbags Future Market Segmentation

8.1. By Product Type (In Value %)

8.2. By Material (In Value %)

8.3. By Distribution Channel (In Value %)

8.4. By Price Range (In Value %)

8.5. By End-User (In Value %)

9. USA Handbags Market Analysts’ Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

Disclaimer

Contact Us

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves constructing an ecosystem map encompassing all major stakeholders within the USA Handbags Market. This step is underpinned by extensive desk research, utilizing a combination of secondary and proprietary databases to gather comprehensive industry-level information. The primary objective is to identify and define the critical variables that influence market dynamics.

Step 2: Market Analysis and Construction

In this phase, we compile and analyze historical data pertaining to the USA Handbags Market. This includes assessing market penetration, the ratio of marketplaces to service providers, and the resultant revenue generation. Additionally, an evaluation of service quality statistics will be conducted to ensure the reliability and accuracy of the revenue estimates.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses are developed and validated through computer-assisted telephone interviews (CATI) with industry experts representing a diverse array of companies. These consultations provide valuable operational and financial insights directly from industry practitioners, which are instrumental in refining and corroborating the market data.

Step 4: Research Synthesis and Final Output

The final phase involves direct engagement with multiple handbag manufacturers to acquire detailed insights into product segments, sales performance, consumer preferences, and other pertinent factors. This interaction serves to verify and complement the statistics derived from the bottom-up approach, ensuring a comprehensive, accurate, and validated analysis of the USA Handbags market.

Frequently Asked Questions

01. How big is the USA Handbags Market?

The USA Handbags Market is valued at USD 13 billion, based on a five-year historical analysis. This market growth is primarily driven by the increasing disposable income of consumers, especially among millennials and Gen Z, who are highly influenced by fashion trends and social media.

02. What are the challenges in the USA Handbags Market?

Challenges in the USA Handbags Market include high competition from counterfeit goods, fluctuations in raw material prices, and the rising cost of premium materials such as leather.

03. Who are the major players in the USA Handbags Market?

Key players in the market include Coach, Michael Kors, Louis Vuitton, Kate Spade, and Tory Burch. These companies dominate due to their strong brand presence, extensive retail networks, and ability to innovate with fashion trends.

04. What are the growth drivers of the USA Handbags Market?

Growth drivers include rising disposable incomes, increased consumer demand for premium products, and the growing influence of social media in driving fashion trends. Additionally, the expansion of e-commerce is contributing to market growth.

05. How is sustainability impacting the USA Handbags Market?

Sustainability is playing a critical role as consumers increasingly prefer eco-friendly and vegan leather options. Brands are adopting more sustainable practices, such as using recycled materials and reducing their carbon footprints, to meet consumer expectations.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.