USA Hardware Stores Market Outlook to 2030

Region:North America

Author(s):Vijay Kumar

Product Code:KROD5319

October 2024

95

About the Report

USA Hardware Stores Market Overview

- The USA Hardware Stores market is valued at USD 56 billion, based on a five-year historical analysis. This market is primarily driven by the rising demand for home improvement products and the growing DIY culture among consumers. The consistent growth of e-commerce platforms has also expanded access to hardware tools and materials, while brick-and-mortar stores continue to thrive due to the convenience of immediate product availability. With ongoing trends in residential renovation and urban construction, the hardware stores sector remains a vital part of the retail landscape.

- Cities such as New York, Los Angeles, and Houston dominate the USA hardware stores market, thanks to their large populations and high concentration of construction and renovation projects. These cities see frequent home improvement and real estate activities, contributing to robust sales of hardware products. Additionally, rural areas also play a key role in market dynamics as they rely on local hardware stores for essential supplies, leading to consistent demand across urban and rural markets.

- Environmental regulations are increasingly affecting the types of products sold by hardware stores. In 2022, the U.S. Environmental Protection Agency implemented new regulations on the sale of certain materials, such as lead-based paints and ozone-depleting refrigerants. Hardware stores must comply with these standards by offering alternative products that meet environmental protection guidelines. Non-compliance can result in fines or product recalls, directly impacting store revenues and market position.

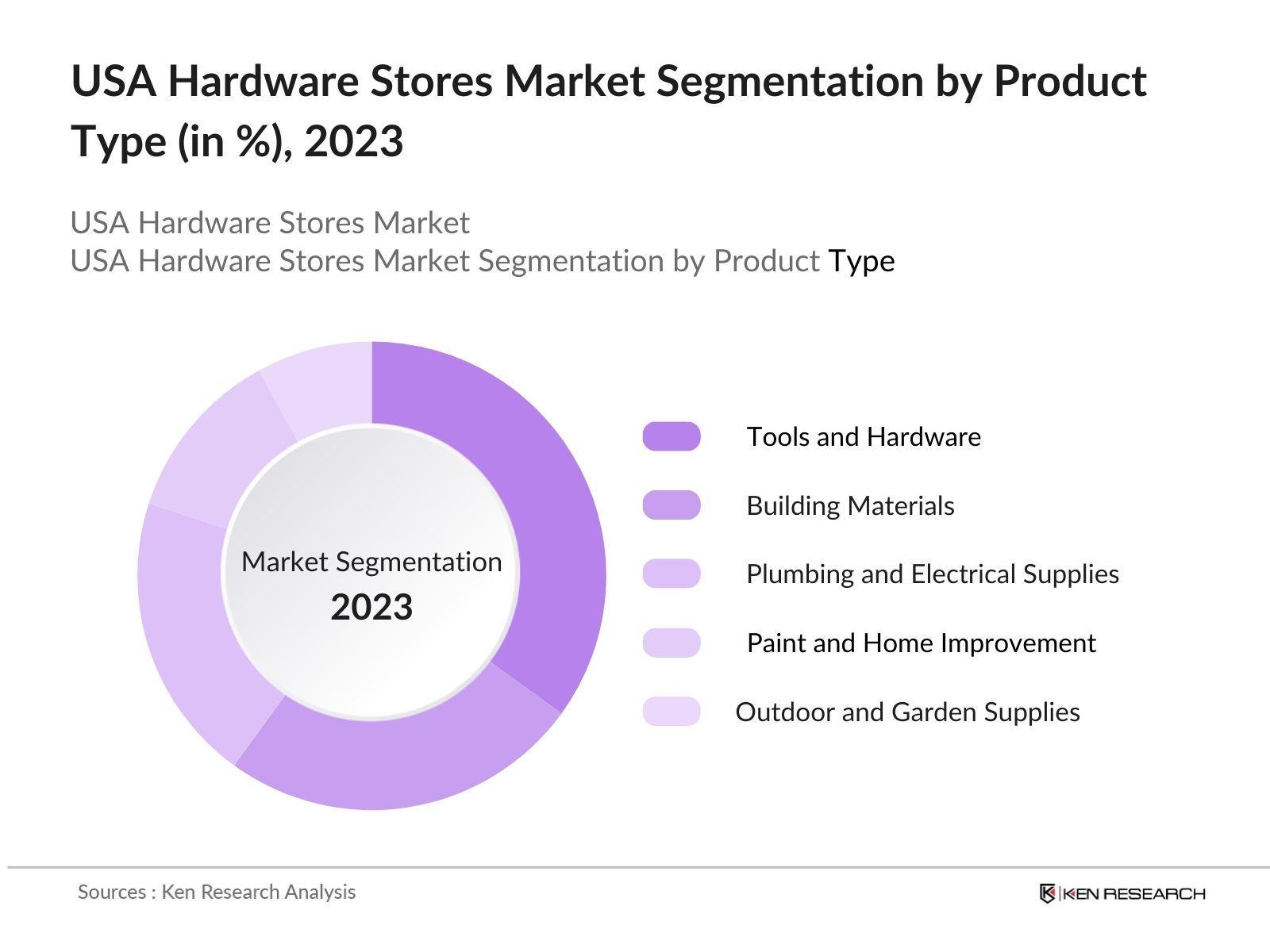

USA Hardware Stores Market Segmentation

By Product Type: The market is segmented by product type into tools and hardware, building materials, plumbing and electrical supplies, paint and home improvement, and outdoor and garden supplies. Tools and hardware have a dominant market share due to their broad application in DIY projects, professional construction, and repair services. The ease of accessibility and continued innovation in tool technology has made this segment a staple for both casual and professional users.

By Customer Type: The market is segmented by customer type into DIY consumers, professional contractors, institutional buyers, and industrial customers. The professional contractors segment dominates the market, mainly because of its high-volume purchases and long-term demand for hardware products across multiple large-scale construction and renovation projects. Contractors often depend on both local and chain hardware stores for timely supplies, driving higher revenue compared to other customer types.

USA Hardware Stores Competitive Landscape

The USA hardware stores market is dominated by a few key players, with large retail chains like The Home Depot and Lowes leading the market. These companies have substantial market shares due to their extensive product ranges, strong e-commerce platforms, and wide distribution networks. Independent and regional players also play a significant role by serving niche markets and providing specialized products that larger chains may not focus on.

USA Hardware Stores Industry Analysis

Growth Drivers

- Rising DIY Culture (Consumer Behavior): The rise of DIY culture is fueling growth in hardware stores, driven by an increasing number of consumers engaging in home improvement projects. In 2023, consumer spending on home improvement in the U.S. reached $507 billion, influenced by lifestyle changes and higher homeownership rates among younger demographics, particularly Millennials. This trend has bolstered the sales of hardware stores, which supply essential tools and materials for DIY projects. According to the U.S. Census Bureau, in 2022, over 70% of households reported engaging in at least one home improvement project.

- Urbanization and Home Improvement (Demographics): As urbanization continues in the U.S., hardware stores are benefiting from increased demand for home improvement products in densely populated areas. In 2022, 83% of the U.S. population lived in urban areas, creating a higher demand for renovation and maintenance products. These stores are often conveniently located within city limits, catering to homeowners and renters engaged in frequent repair and upkeep activities.

- Growth in E-commerce Platforms (Technological Advancements): Technological advancements have made it easier for consumers to access hardware products through e-commerce platforms, driving growth in the hardware stores market. In 2022, U.S. e-commerce sales amounted to $1.03 trillion, with the hardware and home improvement sectors contributing a significant portion of that figure.

Market Challenges

- Competition from Large Retail Chains (Competitive Pressure): The hardware stores market faces increasing competition from large retail chains like Walmart and Home Depot, which continue to dominate the U.S. retail landscape. In 2023, Walmart's total revenue exceeded $600 billion, while Home Depot recorded revenue of $157 billion. These chains leverage economies of scale to offer a broader selection of products at lower prices, making it difficult for independent hardware stores to compete.

- Supply Chain Disruptions (Logistics): Supply chain disruptions have been a persistent challenge for U.S. hardware stores, particularly due to delays in the import of materials like lumber and hardware tools. In 2022, the U.S. experienced a 12% increase in shipping delays due to ongoing global supply chain bottlenecks, according to the U.S. Department of Transportation. These disruptions have led to higher costs and inventory shortages, affecting store profitability and consumer satisfaction.

USA Hardware Stores Future Outlook

Over the next five years, the USA hardware stores market is expected to continue growing, driven by increasing consumer interest in DIY home improvement projects, the ongoing expansion of e-commerce, and the rising demand for environmentally sustainable products. The market is also likely to witness further consolidation, with large retail chains investing in omnichannel retail strategies, combining the strengths of physical stores and online platforms to enhance customer experiences.

Market Opportunities

- Green Building Products Demand (Sustainability Trends): The increasing demand for eco-friendly building materials presents a growth opportunity for U.S. hardware stores. In 2022, the U.S. green building materials market generated over $150 billion in revenue, driven by rising environmental consciousness and government incentives for sustainable construction. Hardware stores that offer eco-friendly options like energy-efficient insulation, water-saving fixtures, and low-VOC paints are well-positioned to tap into this trend.

- Expansion into Rural Markets (Geographic Expansion): Rural markets in the U.S. present an untapped opportunity for hardware stores. In 2023, 19% of the U.S. population resided in rural areas, according to the U.S. Census Bureau. Hardware stores in these regions can cater to agricultural needs, home maintenance, and local construction, addressing the unique requirements of rural communities. Additionally, federal infrastructure spending allocated $110 billion toward rural development, increasing demand for hardware supplies in these areas.

Scope of the Report

|

Product Type |

Tools and Hardware |

|

Customer Type |

DIY Consumers |

|

Distribution Channel |

In-Store Sales |

|

Store Type |

Independent Hardware Stores |

|

Region |

Northeast |

Products

Key Target Audience

Investments and Venture Capitalist Firms

Government and Regulatory Bodies (e.g., U.S. Department of Commerce, Occupational Safety and Health Administration - OSHA)

Retail and E-commerce Companies

Construction Companies

DIY and Home Improvement Brands

Manufacturing Companies

Local and Regional Hardware Store Chains

Tool and Equipment Manufacturers

Companies

Players Mentioned in the Report

The Home Depot

Lowes Companies

Ace Hardware Corporation

True Value Company

Menards

Harbor Freight Tools

Tractor Supply Company

Do it Best Corp.

Fastenal Company

Orgill, Inc.

Table of Contents

1. USA Hardware Stores Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. USA Hardware Stores Market Size (In USD Bn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. USA Hardware Stores Market Analysis

3.1. Growth Drivers

3.1.1. Rising DIY Culture (Consumer Behavior)

3.1.2. Urbanization and Home Improvement (Demographics)

3.1.3. Growth in E-commerce Platforms (Technological Advancements)

3.1.4. Renovation and Remodeling Trends (Construction Sector Trends)

3.2. Market Challenges

3.2.1. Competition from Large Retail Chains (Competitive Pressure)

3.2.2. Supply Chain Disruptions (Logistics)

3.2.3. Skilled Labor Shortage (Workforce Challenges)

3.3. Opportunities

3.3.1. Green Building Products Demand (Sustainability Trends)

3.3.2. Expansion into Rural Markets (Geographic Expansion)

3.3.3. Growth in Smart Home Products (Technological Innovations)

3.4. Trends

3.4.1. Rise of Mobile Commerce (Digital Transformation)

3.4.2. Sustainable Product Sourcing (Eco-Friendly Practices)

3.4.3. Integration of Smart Tools and Products (IoT Adoption)

3.5. Government Regulations

3.5.1. Local Building Codes and Compliance

3.5.2. Environmental Protection Standards

3.5.3. Trade Tariffs on Imported Materials

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem

3.8. Porters Five Forces Analysis (Market Structure)

3.9. Competition Ecosystem (Competitive Dynamics)

4. USA Hardware Stores Market Segmentation

4.1. By Product Type (In Value %)

4.1.1. Tools and Hardware

4.1.2. Building Materials

4.1.3. Plumbing and Electrical Supplies

4.1.4. Paint and Home Improvement

4.1.5. Outdoor and Garden Supplies

4.2. By Customer Type (In Value %)

4.2.1. DIY Consumers

4.2.2. Professional Contractors

4.2.3. Institutional Buyers

4.2.4. Industrial Customers

4.3. By Distribution Channel (In Value %)

4.3.1. In-Store Sales

4.3.2. Online/E-commerce Sales

4.3.3. Direct Sales to Contractors

4.4. By Store Type (In Value %)

4.4.1. Independent Hardware Stores

4.4.2. Chain Hardware Stores

4.4.3. Home Improvement Centers

4.4.4. Specialty Hardware Stores

4.5. By Region (In Value %)

4.5.1. Northeast

4.5.2. Midwest

4.5.3. South

4.5.4. West

5. USA Hardware Stores Market Competitive Analysis

5.1 Detailed Profiles of Major Companies

5.1.1. The Home Depot

5.1.2. Lowes Companies

5.1.3. Ace Hardware Corporation

5.1.4. True Value Company

5.1.5. Menards

5.1.6. Harbor Freight Tools

5.1.7. Tractor Supply Company

5.1.8. Do it Best Corp.

5.1.9. Fastenal Company

5.1.10. Orgill, Inc.

5.1.11. Northern Tool + Equipment

5.1.12. Build.com

5.1.13. Rockler Woodworking and Hardware

5.1.14. McMaster-Carr

5.1.15. Grizzly Industrial

5.2 Cross Comparison Parameters (Market Leadership, Product Variety, Customer Base, Pricing Strategy, Geographic Reach, Distribution Network, Innovation Capabilities, After-Sales Support)

5.3. Market Share Analysis

5.4. Strategic Initiatives (Expansion Plans, Product Innovation, Market Penetration)

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Venture Capital Funding

5.8. Government Grants and Support

5.9. Private Equity Investments

6. USA Hardware Stores Market Regulatory Framework

6.1. Health and Safety Regulations

6.2. Environmental Protection Compliance

6.3. Trade and Tariff Regulations

6.4. Certification Requirements

7. USA Hardware Stores Future Market Size (In USD Bn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. USA Hardware Stores Future Market Segmentation

8.1. By Product Type (In Value %)

8.2. By Customer Type (In Value %)

8.3. By Distribution Channel (In Value %)

8.4. By Store Type (In Value %)

8.5. By Region (In Value %)

9. USA Hardware Stores Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves constructing an ecosystem map encompassing all major stakeholders within the USA hardware stores market. This step is underpinned by extensive desk research, utilizing a combination of secondary and proprietary databases to gather comprehensive industry-level information. The primary objective is to identify and define the critical variables that influence market dynamics.

Step 2: Market Analysis and Construction

In this phase, we compile and analyze historical data pertaining to the USA hardware stores market. This includes assessing market penetration, the ratio of marketplaces to service providers, and the resultant revenue generation. Furthermore, an evaluation of sales and product demand statistics will be conducted to ensure the reliability and accuracy of the revenue estimates.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses will be developed and subsequently validated through computer-assisted telephone interviews (CATI) with industry experts representing a diverse array of companies. These consultations will provide valuable operational and financial insights directly from industry practitioners, which will be instrumental in refining and corroborating the market data.

Step 4: Research Synthesis and Final Output

The final phase involves direct engagement with multiple hardware store owners, manufacturers, and distributors to acquire detailed insights into product segments, sales performance, consumer preferences, and other pertinent factors. This interaction will serve to verify and complement the statistics derived from the bottom-up approach, thereby ensuring a comprehensive, accurate, and validated analysis of the USA hardware stores market.

Frequently Asked Questions

01 How big is the USA Hardware Stores Market?

The USA Hardware Stores market is valued at USD 56 billion, based on a five-year historical analysis. This market is primarily driven by the rising demand for home improvement products and the growing DIY culture among consumers.

2. What are the challenges in the USA Hardware Stores Market?

Challenges include high competition from e-commerce platforms, the need for adapting to digital transformation, and supply chain disruptions that can affect product availability in physical stores.

3. Who are the major players in the USA Hardware Stores Market?

Key players include The Home Depot, Lowes Companies, Ace Hardware Corporation, True Value Company, and Menards. These companies dominate due to their extensive product offerings, widespread store locations, and strong online presence.

4. What are the growth drivers of the USA Hardware Stores Market?

The growth of this market is propelled by increasing consumer interest in home improvement, the rise of the DIY culture, and the growth of online retail platforms offering hardware products.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.