USA Health and Wellness Market Outlook to 2030

Region:North America

Author(s):Meenakshi Bisht

Product Code:KROD11110

November 2024

99

About the Report

USA Health and Wellness Market Overview

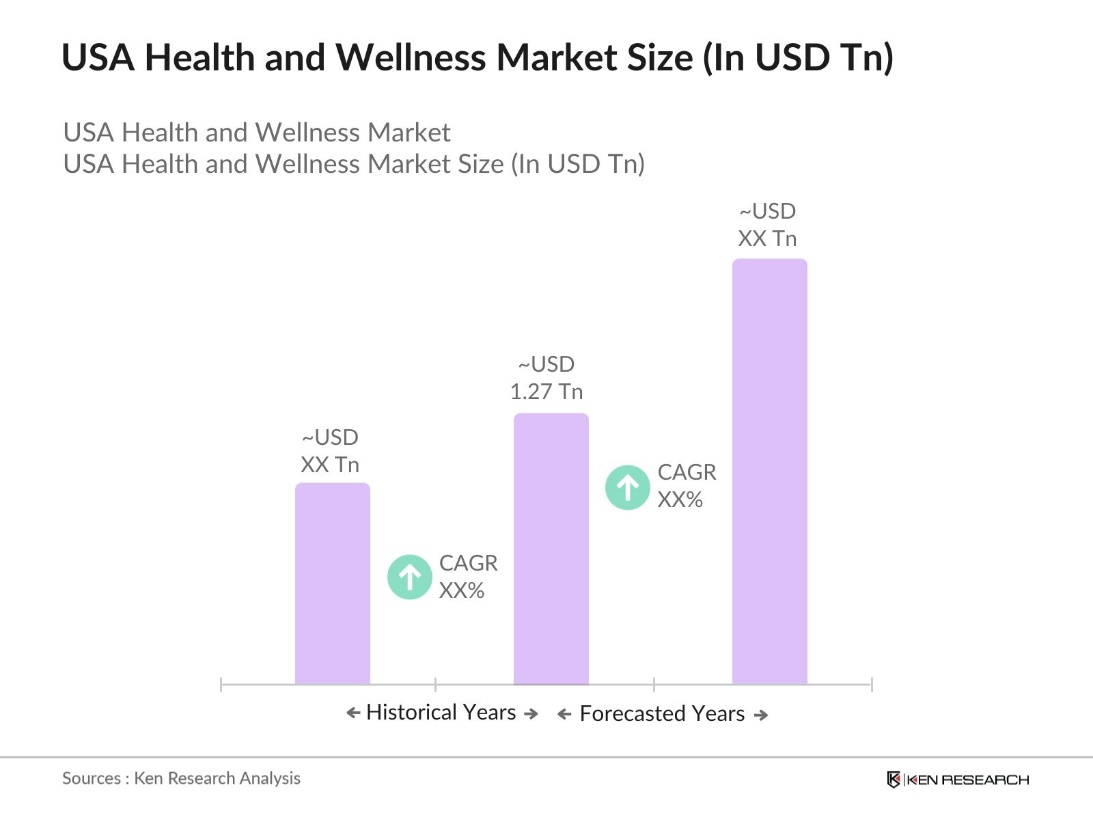

- The USA Health and Wellness market is valued at USD 1.27 trillion, reflecting a five-year historical growth pattern propelled by increasing awareness of preventive healthcare, demand for mental wellness solutions, and growth in fitness-related products. This markets robust expansion aligns with rising healthcare costs, prompting consumers to invest in wellness alternatives and health-tracking technologies.

- The market is highly concentrated in metropolitan regions such as New York, Los Angeles, and Chicago due to their population density, affluence, and higher concentration of wellness centers. These cities attract wellness-focused consumers and have numerous facilities catering to fitness, dietary supplements, and mental health, boosted by high disposable incomes and lifestyle trends emphasizing wellness and self-care.

- Senator Dick Durbin introduced the Dietary Supplement Listing Act of 2024, aimed at requiring dietary supplement manufacturers to register their products with the FDA. This legislation seeks to provide the FDA with critical information about supplements, including product names, ingredient lists, and labeling details. The goal is to improve transparency and consumer safety in a market that has expanded significantly since the enactment of the Dietary Supplement Health and Education Act.

USA Health and Wellness Market Segmentation

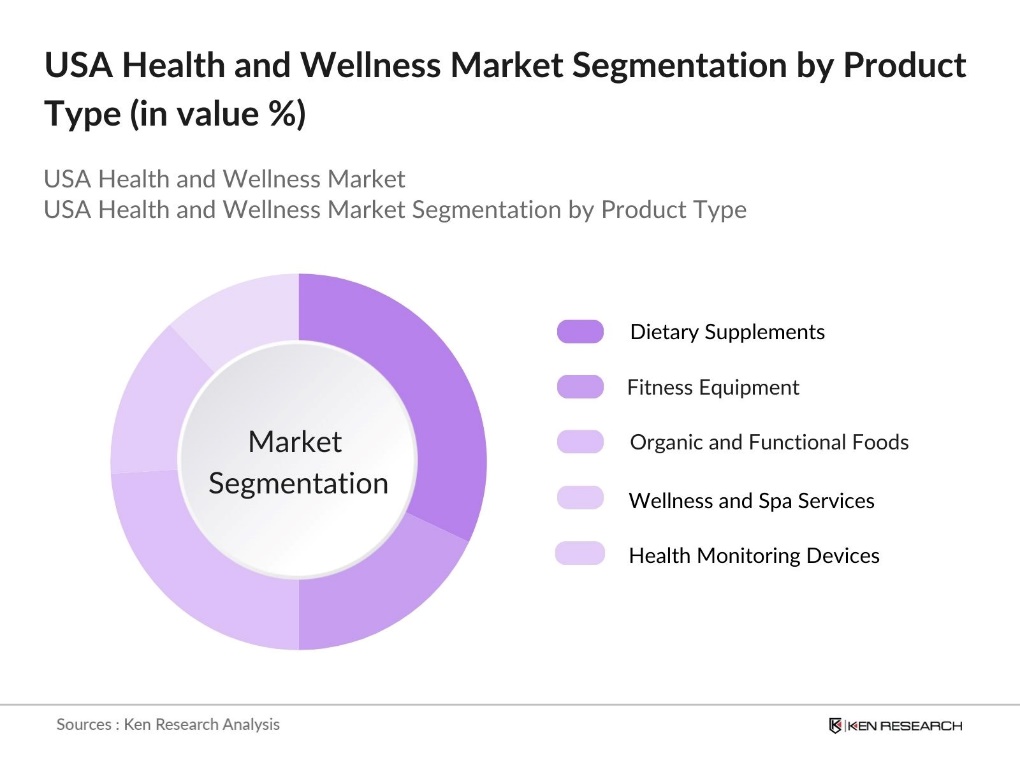

By Product Type: The market is segmented by product type into dietary supplements, fitness equipment, organic and functional foods, wellness and spa services, and health monitoring devices. Among these, dietary supplements dominate due to their convenience in addressing specific health needs such as immunity, energy, and weight management. This segment benefits from the increasing popularity of holistic health solutions and widespread consumer acceptance of preventive healthcare supplements.

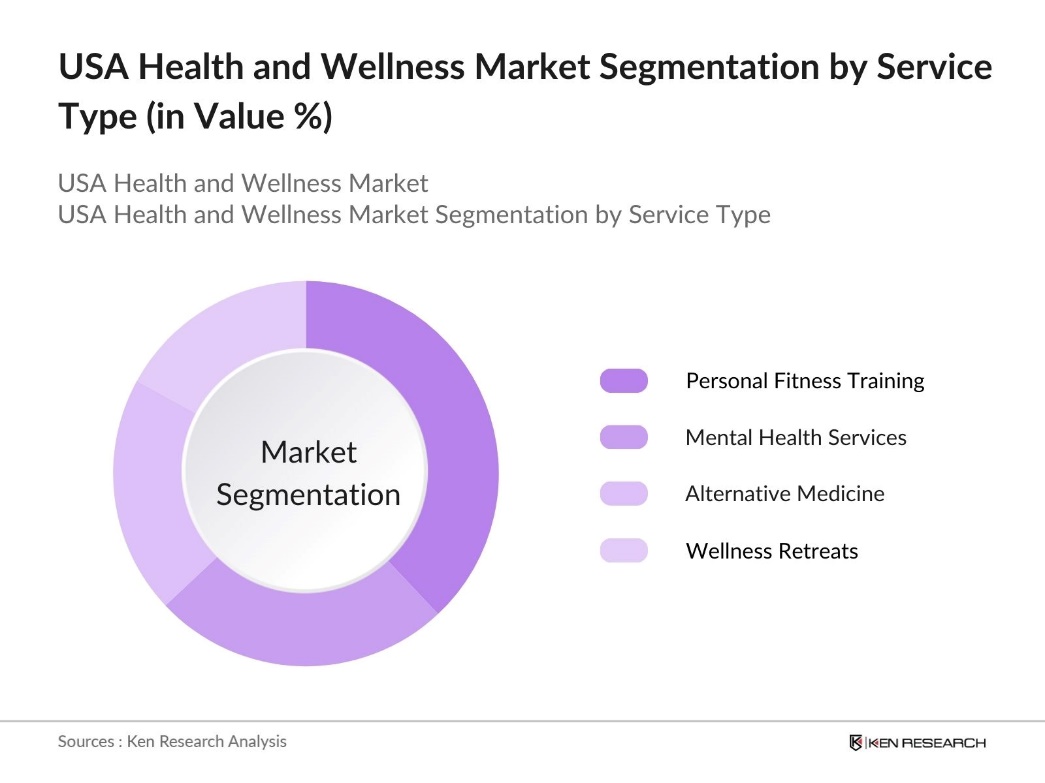

By Service Type: The market is segmented by service type into personal fitness training, mental health services, alternative medicine, and wellness retreats. Personal fitness training holds a significant share in this segment, driven by the growth of personalized fitness programs and on-demand services that offer tailored workout plans and one-on-one coaching. This is bolstered by consumer demand for customized fitness solutions that align with individual health goals and schedules.

USA Health and Wellness Market Competitive Landscape

The USA Health and Wellness market is dominated by a combination of established global brands and local providers catering to various aspects of wellness. Major players in this market include companies specializing in dietary supplements, fitness equipment, and mental health services, underscoring the markets highly segmented nature.

USA Health and Wellness Industry Analysis

Growth Drivers

- Increased Awareness of Preventive Healthcare: In 2024, preventive healthcare awareness has surged in the USA, driven by government and health advocacy efforts. The U.S. Centers for Disease Control and Prevention (CDC) reports that nearly 200 million individuals have received preventive health services in recent years, which includes vaccinations, regular screenings, and wellness check-ups aimed at reducing chronic illnesses. This awareness is supported by government programs like Healthy People 2030, which incentivizes preventive care among citizens, leading to a significant reduction in healthcare costs across state programs.

- Rising Prevalence of Chronic Diseases: According to recent data from the CDC, approximately 129 million people in the U.S. have at least one major chronic disease such as heart disease, cancer, or diabetes. Conditions like diabetes, heart disease, and respiratory diseases are increasingly common, fueling demand for health and wellness products and services aimed at managing these issues. The governments focus on curbing chronic illness through initiatives like the National Diabetes Prevention Program has further encouraged health spending in wellness markets, reflecting broader healthcare trends in 2024.

- Technological Advancements in Health Tracking: The U.S. health tech market is advancing with wearable devices like fitness trackers and smartwatches, enabling real-time monitoring of health metrics and supporting preventive care. Complementary mobile health apps provide additional tools for tracking fitness, mental wellness, and nutrition. Together, these technologies help users take a proactive approach to health management, blending digital innovation seamlessly into everyday healthcare routines.

Market Challenges

- High Product Costs and Affordability Issues: Affordability remains a significant barrier in the U.S. wellness market, as the high cost of health and wellness services limits access for many consumers. Rising expenses in medical and wellness products affect wider adoption, particularly among lower-income households, who often struggle to afford preventive healthcare. These cost challenges highlight the need for more accessible pricing to ensure broader reach within the wellness sector.

- Regulatory Compliance Challenges (FDA, USDA Standards): Compliance with FDA and USDA standards poses challenges for health and wellness product manufacturers, covering areas like dietary supplements, organic labeling, and health applications. Strict regulatory requirements necessitate considerable resources to maintain adherence, increasing operational costs for companies. As standards become more stringent, manufacturers face added complexities that require ongoing investment in regulatory compliance across their product lines.

USA Health and Wellness Market Future Outlook

The USA Health and Wellness market is positioned for substantial expansion driven by advancements in health monitoring technology, increasing emphasis on preventive care, and the rise of personalized wellness solutions. As consumers continue to prioritize health, fitness, and mental well-being, the sector is expected to experience broad-based growth across product and service segments, particularly in areas like digital wellness and organic dietary supplements.

Market Opportunities

- Expansion into Digital Wellness Solutions (Telemedicine, Virtual Consultations): Digital wellness solutions, including telemedicine and virtual consultations, are transforming the U.S. wellness market by enhancing accessibility and offering scalable, cost-effective care. These digital options are particularly valuable for reaching underserved rural populations and expanding the reach of wellness services. The demand for virtual health options creates opportunities for healthcare providers to integrate and develop diverse wellness services, supporting broader, more inclusive healthcare access.

- Collaborations with Health Insurance Providers: Collaborations between wellness providers and health insurance companies are making wellness services more accessible and affordable. As insurers increasingly cover wellness-related services like mental health counseling and fitness programs, these partnerships help reach a broader insured audience. By aligning with insurers, wellness providers can promote preventive health practices, creating a more accessible wellness landscape for covered populations.

Scope of the Report

|

Product Type |

Dietary Supplements, Fitness Equipment Organic Foods Wellness Services Health Monitoring Devices |

|

Service Type |

Personal Training Mental Health Services Alternative Medicine Wellness Retreats |

|

Distribution Channel |

E-Commerce Specialty Stores Pharmacies Direct-to-Consumer (DTC) |

|

End User |

Individual Consumers Corporate Wellness Government Programs |

|

Region |

North East South West |

Products

Key Target Audience

Nutrition and Dietary Counseling Firms

Biofeedback and Wellness Equipment Manufacturers

Wearable Technology Manufacturers

Government and Regulatory Bodies (FDA, USDA)

Investors and venture capital Firms

Banks and Financial Institutions

Companies

Players Mentioned in the Report

Johnson & Johnson

Nestle Health Science

Medtronic

Peloton Interactive

Fitbit Inc.

Wellness Living

24 Hour Fitness

Planet Fitness

WW International (formerly Weight Watchers)

GNC Holdings

Table of Contents

1. USA Health and Wellness Market Overview

1.1 Definition and Scope

1.2 Market Taxonomy

1.3 Market Growth Rate (Year-on-Year Growth, Quarterly Growth Analysis)

1.4 Market Segmentation Overview

2. USA Health and Wellness Market Size (In USD Mn)

2.1 Historical Market Size

2.2 Key Market Developments and Milestones

2.3 Major Milestones and Achievements

3. USA Health and Wellness Market Analysis

3.1 Growth Drivers

3.1.1 Increased Awareness of Preventive Healthcare

3.1.2 Rising Prevalence of Chronic Diseases

3.1.3 Technological Advancements in Health Tracking (Wearable Technology, Mobile Health Apps)

3.1.4 Supportive Government Regulations and Funding

3.2 Market Challenges

3.2.1 High Product Costs and Affordability Issues

3.2.2 Regulatory Compliance Challenges (FDA, USDA Standards)

3.2.3 Lack of Skilled Professionals in Wellness Therapies

3.3 Opportunities

3.3.1 Expansion into Digital Wellness Solutions (Telemedicine, Virtual Consultations)

3.3.2 Collaborations with Health Insurance Providers

3.3.3 Growing Interest in Mental Health and Stress Management Programs

3.4 Trends

3.4.1 Personalized Nutrition and Genetic Health Testing

3.4.2 Adoption of AI in Health Assessment and Fitness Tracking

3.4.3 Rise of Wellness Tourism and Experience-Centric Programs

3.5 Government Regulation

3.5.1 FDA Regulations on Dietary Supplements

3.5.2 Reimbursement Policies for Preventive Health

3.5.3 Standards for Health and Wellness Apps

3.6 SWOT Analysis

3.7 Stakeholder Ecosystem

3.8 Porters Five Forces Analysis

3.9 Competition Ecosystem

4. USA Health and Wellness Market Segmentation

4.1 By Product Type (In Value %)

4.1.1 Dietary Supplements

4.1.2 Fitness Equipment and Accessories

4.1.3 Organic and Functional Foods

4.1.4 Wellness and Spa Services

4.1.5 Health Monitoring Devices (Wearables, Smart Health Devices)

4.2 By Service Type (In Value %)

4.2.1 Personal Fitness Training

4.2.2 Mental Health and Counseling Services

4.2.3 Alternative Medicine (Acupuncture, Herbal Medicine)

4.2.4 Spa and Wellness Retreats

4.3 By Distribution Channel (In Value %)

4.3.1 E-Commerce

4.3.2 Specialty Health and Wellness Stores

4.3.3 Pharmacies and Drugstores

4.3.4 Direct-to-Consumer (DTC)

4.4 By End User (In Value %)

4.4.1 Individual Consumers

4.4.2 Corporate Wellness Programs

4.4.3 Government Health Programs

4.5 By Region (In Value %)

4.5.1 North

4.5.2 East

4.5.3 South

4.5.4 West

5. USA Health and Wellness Market Competitive Analysis

5.1 Detailed Profiles of Major Companies

5.1.1 Johnson & Johnson

5.1.2 Nestle Health Science

5.1.3 Medtronic

5.1.4 Peloton Interactive

5.1.5 Fitbit Inc.

5.1.6 Wellness Living

5.1.7 24 Hour Fitness

5.1.8 Planet Fitness

5.1.9 WW International (formerly Weight Watchers)

5.1.10 GNC Holdings

5.1.11 Mindbody Inc.

5.1.12 Natures Bounty

5.1.13 Garmin Ltd.

5.1.14 Life Time Fitness

5.1.15 Stryker Corporation

5.2 Cross-Comparison Parameters (Revenue, Number of Locations, Product/Service Portfolio, Market Penetration Rate, Customer Retention Rate, Technological Integration, Employee Strength, Growth Rate)

5.3 Market Share Analysis

5.4 Strategic Initiatives (New Product Launches, Partnerships, Wellness Program Development)

5.5 Mergers and Acquisitions

5.6 Investment Analysis

5.7 Private Equity and Venture Capital Funding

5.8 Government Grants and Incentives

5.9 Innovation and R&D Initiatives

6. USA Health and Wellness Market Regulatory Framework

6.1 Federal Standards (FDA, USDA)

6.2 State-Level Compliance Requirements

6.3 Reimbursement and Health Insurance Policies

6.4 Licensing and Accreditation (Wellness Centers, Alternative Medicine Providers)

6.5 Data Privacy Regulations for Health Apps

7. USA Health and Wellness Future Market Size (In USD Mn)

7.1 Future Market Size Projections

7.2 Key Factors Driving Future Market Growth

8. USA Health and Wellness Future Market Segmentation

8.1 By Product Type (In Value %)

8.2 By Service Type (In Value %)

8.3 By Distribution Channel (In Value %)

8.4 By End User (In Value %)

8.5 By Region (In Value %)

9. USA Health and Wellness Market Analysts Recommendations

9.1 Total Addressable Market (TAM) / Serviceable Available Market (SAM) / Serviceable Obtainable Market (SOM) Analysis

9.2 Customer Cohort Analysis

9.3 Marketing and Brand Positioning Strategies

9.4 Innovation and Product Diversification Opportunities

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

The research process began with the identification of key variables impacting the USA Health and Wellness Market. This involved extensive desk research and an assessment of both proprietary and secondary data sources to capture the most relevant market drivers and challenges.

Step 2: Market Analysis and Construction

Data was collected and analyzed based on historical revenue figures and market penetration rates. This stage involved reviewing product/service segmentation trends and examining consumer demand dynamics across various regions within the USA Health and Wellness Market.

Step 3: Hypothesis Validation and Expert Consultation

Market assumptions were validated through expert consultations with key stakeholders, including industry experts and leaders from prominent companies. Insights gathered from these interactions enhanced the accuracy and reliability of our market projections.

Step 4: Research Synthesis and Final Output

All collected data points were synthesized to provide a comprehensive outlook of the USA Health and Wellness market. This phase included final data verification and consolidation of insights from manufacturers, retailers, and service providers across the market.

Frequently Asked Questions

01 How big is the USA Health and Wellness Market?

The USA Health and Wellness market is valued at USD 1.27 trillion, driven by preventive healthcare, mental wellness demand, and rising fitness awareness.

02 What are the challenges in the USA Health and Wellness Market?

Key challenges in USA Health and Wellness market include high product and service costs, regulatory compliance with FDA standards, and limited accessibility in some regions.

03 Who are the major players in the USA Health and Wellness Market?

Leading players in USA Health and Wellness market include Johnson & Johnson, Peloton, Fitbit, WW International, and GNC Holdings, with their strong brand presence and extensive distribution networks.

04 What drives growth in the USA Health and Wellness Market?

The USA Health and Wellness market is driven by increased awareness of preventive healthcare, consumer demand for mental health services, and advancements in wellness technology.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.