USA Healthcare Environmental Services Market Outlook to 2030

Region:North America

Author(s):Sanjeev kumar

Product Code:KROD11064

December 2024

85

About the Report

USA Healthcare Environmental Services Market Overview

- The USA Healthcare Environmental Services market is valued at USD 7 billion, primarily driven by the increasing emphasis on infection control and patient safety within healthcare facilities. The rising number of healthcare facilities, combined with stringent government regulations on hygiene standards, has created a stable demand for environmental services. This market also benefits from technological innovations in sanitation, such as electrostatic and UV disinfection solutions, which have been widely adopted for enhancing operational efficiency and effectiveness.

- Major urban centers such as New York, California, and Texas lead the USA Healthcare Environmental Services market due to their high concentration of hospitals and healthcare facilities. These states have a substantial demand for environmental services, stemming from both population density and the advanced healthcare infrastructure. Additionally, state-specific regulations promoting patient safety and infection control contribute to their stronghold in this market.

- Environmental impact regulations, such as the Clean Air Act, mandate healthcare facilities to reduce their carbon footprint and chemical usage. In 2024, the EPA introduced updated guidelines on volatile organic compounds (VOCs) for cleaning products used in healthcare. Compliance with these regulations supports the adoption of sustainable environmental services, aligning with broader public health and environmental objectives.

USA Healthcare Environmental Services Market Segmentation

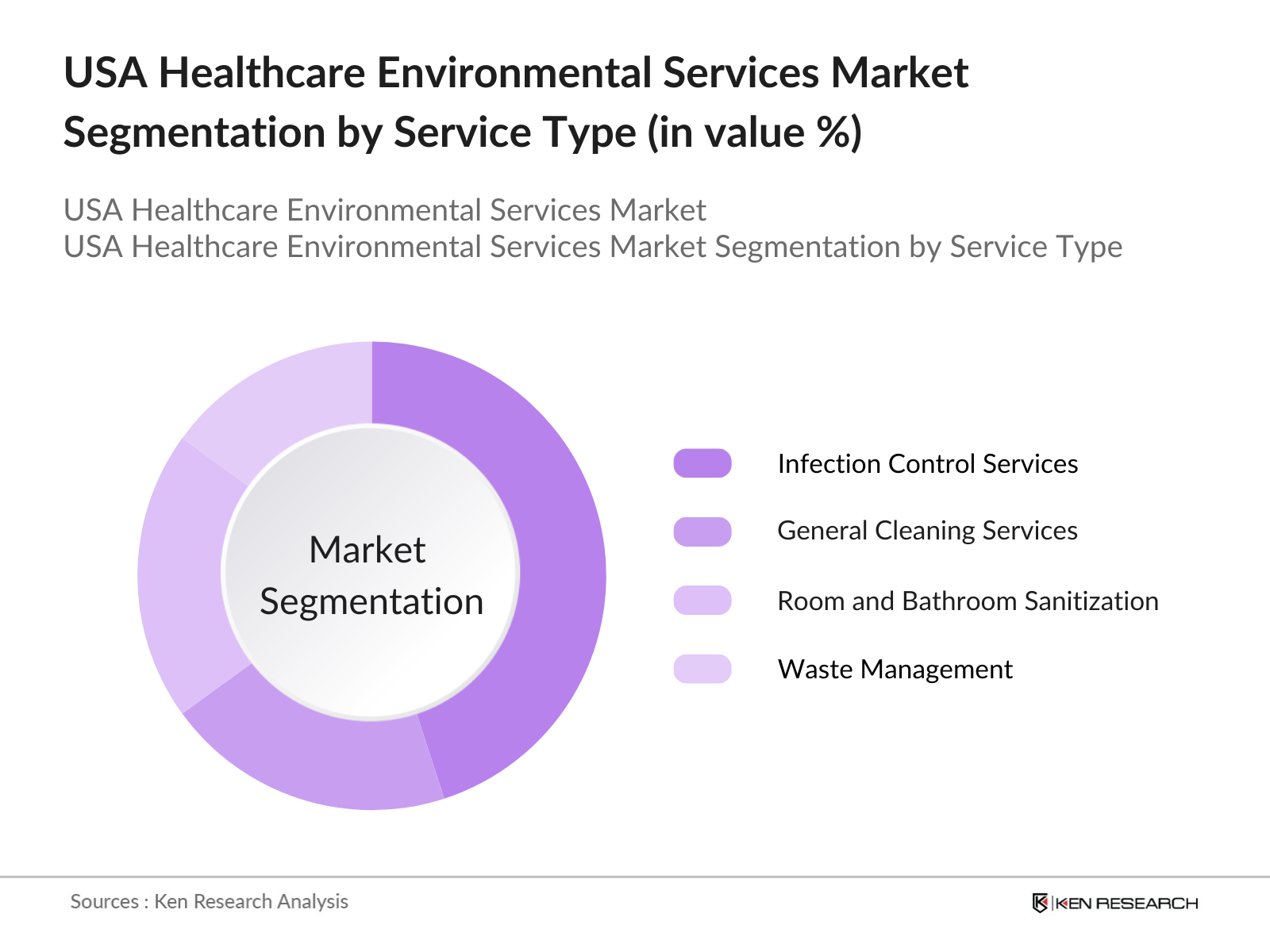

- By Service Type: The USA Healthcare Environmental Services market is segmented by service type into general cleaning services, infection control services, waste management, floor care and maintenance, and room and bathroom sanitization. Infection control services dominate due to the high demand for effective infection management in healthcare facilities. The rise in hospital-acquired infections has driven hospitals to prioritize infection control services, leveraging specialized cleaning protocols and technologies to reduce contamination risks.

- By Facility Type: This market is further segmented by facility type into hospitals, outpatient clinics, long-term care facilities, laboratories, and ambulatory surgical centers. Hospitals command a dominant market share due to their high patient footfall and extensive infection control needs. Their requirement for comprehensive cleaning and sanitation services is a significant contributor to the demand for healthcare environmental services, especially in light of the strict guidelines for hygiene and infection control within hospital environments.

USA Healthcare Environmental Services Market Competitive Landscape

The USA Healthcare Environmental Services market is dominated by both national and international players who contribute to high levels of service quality and technology integration in environmental solutions. This competitive environment underscores the markets consolidation, as a few key players dominate due to their widespread operational presence and adherence to high regulatory standards.

USA Healthcare Environmental Services Industry Analysis

Growth Drivers

- Rise in Hospital-Acquired Infections (HAIs): The increasing prevalence of hospital-acquired infections (HAIs) has escalated the demand for healthcare environmental services in the U.S. In 2024, the Centers for Disease Control and Prevention (CDC) estimated over 1.7 million HAIs across healthcare facilities, leading to more than 98,000 deaths annually. This pressing health concern necessitates rigorous hygiene standards and sanitation practices, underscoring the essential role of environmental services in hospitals. Additionally, the economic impact of HAIs is substantial, with direct costs estimated at $28-45 billion. Enhanced infection control measures aim to reduce these infections, boosting demand for specialized cleaning protocols.

- Increased Government Health & Safety Regulations: Strict health and safety regulations have intensified environmental service requirements across U.S. healthcare facilities. The Occupational Safety and Health Administration (OSHA) mandates compliance with regulations like the Bloodborne Pathogens Standard, affecting over 17 million healthcare workers and necessitating rigorous hygiene standards. Furthermore, 2024 federal funding for health and safety enforcement increased by 12%, reflecting heightened governmental scrutiny. Facilities are investing in services that align with these mandates to avoid penalties, improve patient safety, and ensure compliance, creating sustained growth in the healthcare environmental services sector.

- Expansion of Healthcare Facilities: With the expansion of healthcare facilities nationwide, the need for environmental services is rising. The U.S. added approximately 1,000 new hospitals and outpatient centers between 2022-2024, driven by increasing healthcare demand from an aging population. The American Hospital Association (AHA) reported that over $2 billion was spent in 2023 on new facility construction. As more healthcare facilities emerge, the requirement for comprehensive sanitation and maintenance services grows, bolstering the healthcare environmental services market significantly.

Market Restraints

- High Operational Costs: Healthcare environmental services face high operational costs due to labor, equipment, and compliance with stringent regulations. In 2023, U.S. hospitals spent an average of $1.6 million annually on sanitation services. Costs have risen due to inflation affecting wages and supplies, with the Bureau of Labor Statistics (BLS) noting a 4.3% increase in wage costs for healthcare staff. These expenses make it challenging for facilities to maintain profitability while upholding essential sanitation standards.

- Workforce Shortages: The U.S. healthcare sector grapples with severe workforce shortages, directly impacting environmental services. According to the BLS, there were 200,000 vacant positions in 2023 for janitorial and sanitation roles within healthcare, driven by a lack of skilled personnel and high turnover rates. This shortage leads to increased labor costs and stretches existing staff, making it difficult to maintain consistent cleaning standards and risking operational efficiency in healthcare facilities.

USA Healthcare Environmental Services Market Future Outlook

Over the next five years, the USA Healthcare Environmental Services market is anticipated to grow steadily, driven by increasing investments in infection control measures, technological advancements in cleaning methods, and continued regulatory support. The ongoing demand for healthcare facility expansion and stringent hygiene standards will play a pivotal role in shaping the markets growth trajectory.

Market Opportunities

- Adoption of Green Cleaning Solutions: The adoption of eco-friendly cleaning solutions is gaining momentum in the healthcare sector, addressing environmental and health concerns. The Environmental Protection Agency (EPA) indicates that nearly 40% of U.S. hospitals now prioritize green cleaning solutions to reduce hazardous chemical use. This shift supports sustainable practices and aligns with public expectations for eco-conscious operations, presenting growth opportunities for companies providing green solutions in environmental services.

- Technological Innovations in Cleaning Equipment: Technological advancements, such as automated disinfection systems and robotic cleaners, are reshaping healthcare environmental services. The U.S. Food and Drug Administration (FDA) reports that 2023 saw a 15% increase in the deployment of UV and electrostatic cleaning devices in hospitals. These technologies enhance cleaning efficiency and help facilities meet regulatory requirements, creating opportunities for growth in high-tech cleaning equipment and solutions.

Scope of the Report

|

Service Type |

General Cleaning Services |

|

Infection Control Services |

|

|

Waste Management |

|

|

Floor Care and Maintenance |

|

|

Room and Bathroom Sanitization |

|

|

Facility Type |

Hospitals |

|

Outpatient Clinics |

|

|

Long-Term Care Facilities |

|

|

Laboratories |

|

|

Ambulatory Surgical Centers |

|

|

Cleaning Method |

Manual Cleaning |

|

Mechanical Cleaning |

|

|

Chemical Disinfection |

|

|

UV and Electrostatic Cleaning |

|

|

Region |

Northeast |

|

Midwest |

|

|

South |

|

|

West |

|

|

Pacific |

Products

Key Target Audience

Healthcare Facilities and Hospitals

Healthcare Facility Management Companies

Hospital Infection Control Committees

Investor and Venture Capitalist Firms

Government and Regulatory Bodies (OSHA, CDC)

Private Health Insurance Providers

Cleaning and Sanitation Equipment Manufacturers

Environmental and Public Health NGOs

Companies

Players Mentioned in the Report:

ABM Industries Inc.

Aramark Corporation

ISS Facility Services, Inc.

Sodexo Inc.

Healthcare Services Group

Crothall Healthcare

HHS (Hospital Housekeeping Systems)

Compass Group

Vanguard Cleaning Systems

Medxcel Facilities Management

AVI Food Systems, Inc.

Canon Business Process Services

Guardian Healthcare

SBM Management Services

ServiceMaster Clean

Table of Contents

1. USA Healthcare Environmental Services Market Overview

1.1 Definition and Scope

1.2 Market Taxonomy

1.3 Service Demand Trends

1.4 Market Segmentation Overview

2. USA Healthcare Environmental Services Market Size (USD Mn)

2.1 Historical Market Size

2.2 Year-on-Year Growth Analysis

2.3 Key Market Milestones and Developments

3. USA Healthcare Environmental Services Market Analysis

3.1 Growth Drivers

3.1.1 Rise in Hospital-Acquired Infections (HAIs)

3.1.2 Increased Government Health & Safety Regulations

3.1.3 Expansion of Healthcare Facilities

3.1.4 Growing Awareness of Hygiene Standards

3.2 Market Challenges

3.2.1 High Operational Costs

3.2.2 Workforce Shortages

3.2.3 Training and Certification Requirements

3.3 Opportunities

3.3.1 Adoption of Green Cleaning Solutions

3.3.2 Technological Innovations in Cleaning Equipment

3.3.3 Expansion of Service Contracts

3.4 Trends

3.4.1 Increased Use of UV and Electrostatic Cleaning

3.4.2 Integration of Automation in Cleaning Processes

3.4.3 Outsourcing Healthcare Environmental Services

3.5 Government Regulations

3.5.1 Health & Safety Standards

3.5.2 Infection Control Policies

3.5.3 Waste Management Compliance

3.5.4 Environmental Impact Regulations

3.6 SWOT Analysis

3.7 Stakeholder Ecosystem

3.8 Porters Five Forces Analysis

3.9 Competitive Landscape Overview

4. USA Healthcare Environmental Services Market Segmentation

4.1 By Service Type (in Value %)

4.1.1 General Cleaning Services

4.1.2 Infection Control Services

4.1.3 Waste Management

4.1.4 Floor Care and Maintenance

4.1.5 Room and Bathroom Sanitization

4.2 By Facility Type (in Value %)

4.2.1 Hospitals

4.2.2 Outpatient Clinics

4.2.3 Long-Term Care Facilities

4.2.4 Laboratories

4.2.5 Ambulatory Surgical Centers

4.3 By Cleaning Method (in Value %)

4.3.1 Manual Cleaning

4.3.2 Mechanical Cleaning

4.3.3 Chemical Disinfection

4.3.4 UV and Electrostatic Cleaning

4.4 By Region (in Value %)

4.4.1 Northeast

4.4.2 Midwest

4.4.3 South

4.4.4 West

4.4.5 Pacific

5. USA Healthcare Environmental Services Market Competitive Analysis

5.1 Profiles of Major Competitors

5.1.1 ABM Industries Inc.

5.1.2 Aramark Corporation

5.1.3 Sodexo Inc.

5.1.4 ISS Facility Services, Inc.

5.1.5 Crothall Healthcare

5.1.6 HHS (Hospital Housekeeping Systems)

5.1.7 Compass Group

5.1.8 ServiceMaster Clean

5.1.9 Vanguard Cleaning Systems

5.1.10 Medxcel Facilities Management

5.1.11 Healthcare Services Group, Inc.

5.1.12 AVI Food Systems, Inc.

5.1.13 Canon Business Process Services

5.1.14 Guardian Healthcare

5.1.15 SBM Management Services

5.2 Cross Comparison Parameters (Market Position, Service Range, No. of Employees, Headquarters, Revenue, Years in Operation, Accreditation, Customer Base)

5.3 Market Share Analysis

5.4 Strategic Initiatives and Partnerships

5.5 Mergers and Acquisitions

5.6 Investment Analysis

6. USA Healthcare Environmental Services Regulatory Framework

6.1 Healthcare Environmental Standards

6.2 OSHA Compliance

6.3 Certification and Licensing Requirements

6.4 Environmental Impact and Waste Management Compliance

7. USA Healthcare Environmental Services Future Market Size (USD Mn)

7.1 Market Size Projections

7.2 Factors Influencing Future Market Growth

8. USA Healthcare Environmental Services Market Analysts Recommendations

8.1 TAM/SAM/SOM Analysis

8.2 Client Targeting and Segmentation

8.3 Suggested Marketing Strategies

8.4 Potential Growth Opportunities

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

In this phase, we mapped the stakeholders within the USA Healthcare Environmental Services market through extensive desk research, referencing both public and proprietary databases to identify core variables impacting the market.

Step 2: Market Analysis and Construction

This step involved collecting and analyzing historical data, assessing market penetration and the structure of service providers. Revenue generation was evaluated based on various service types, ensuring accuracy in understanding service quality and cost structures.

Step 3: Hypothesis Validation and Expert Consultation

To validate hypotheses, we conducted interviews with industry experts and practitioners using CATIs. Insights on operational aspects, market shifts, and strategic developments were gathered to refine data accuracy.

Step 4: Research Synthesis and Final Output

The final stage included engaging with major healthcare facilities for comprehensive insights into market dynamics, consumer preferences, and service performance metrics, ensuring a well-rounded market analysis.

Frequently Asked Questions

01. How big is the USA Healthcare Environmental Services Market?

The USA Healthcare Environmental Services market, valued at USD 7 billion, is driven by stringent infection control protocols and the demand for hygiene in healthcare facilities.

02. What challenges does the USA Healthcare Environmental Services Market face?

Challenges include high operational costs, workforce shortages, and the need for constant innovation to comply with evolving health regulations, which increase overheads and training demands.

03. Who are the major players in the USA Healthcare Environmental Services Market?

Key players include ABM Industries Inc., Aramark Corporation, ISS Facility Services, and Sodexo Inc., who dominate due to their extensive service networks and compliance with healthcare regulations.

04. What are the growth drivers in the USA Healthcare Environmental Services Market?

Growth is propelled by factors such as rising infection control needs, advancements in disinfection technology, and the expansion of healthcare facilities, particularly in high-density states.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.