USA Hearing Aids Market Outlook to 2030

Region:North America

Author(s):Sanjna

Product Code:KROD6628

December 2024

82

About the Report

USA Hearing Aids Market Overview

- The USA hearing aids market is valued at USD 4 billion, based on a five-year historical analysis. This market is driven by the increasing prevalence of hearing loss, especially among the aging population, and advancements in hearing aid technology. The adoption of digital and AI-powered hearing aids has significantly influenced the market's growth, with continued demand for smaller, more discreet devices.

- The dominant regions in the USA hearing aids market are metropolitan cities such as New York, Los Angeles, and Chicago. These cities lead due to their high population density, aging demographics, and advanced healthcare infrastructure. Additionally, higher disposable income in these urban areas contributes to the adoption of premium hearing aids and related services.

- In 2022, the FDA approved new regulations for over-the-counter (OTC) hearing aids, making it easier for consumers to purchase these devices without a prescription. This policy aims to reduce the financial and logistical barriers to accessing hearing aids. The U.S. Department of Health and Human Services (HHS) projects that by the end of 2024, nearly 10 million Americans will have purchased OTC hearing aids, reflecting the significant impact of this regulatory change.

USA Hearing Aids Market Segmentation

By Product Type: The USA hearing aids market is segmented by product type into Behind-the-Ear (BTE) Hearing Aids, In-the-Ear (ITE) Hearing Aids, Receiver-in-Canal (RIC) Hearing Aids, and Completely-in-the-Canal (CIC) Hearing Aids. BTE hearing aids dominate the market due to their reliability and versatility, making them suitable for various degrees of hearing loss. BTE devices are popular among elderly patients because they are easier to handle and fit with larger batteries, providing better power for high-performance use.

By Distribution Channel: The USA hearing aids market is segmented by distribution channel into Audiology Clinics, Retail Pharmacies, E-commerce Platforms, and Hospitals. Audiology clinics hold a dominant share in this segment because of the personalized services and expert advice they offer to customers. These clinics are preferred by patients for the comprehensive testing and consultation services they provide before purchasing a hearing aid. Additionally, audiologists can recommend devices that are precisely tuned to a patients specific hearing requirements, which further strengthens the preference for this distribution channel.

USA Hearing Aids Market Competitive Landscape

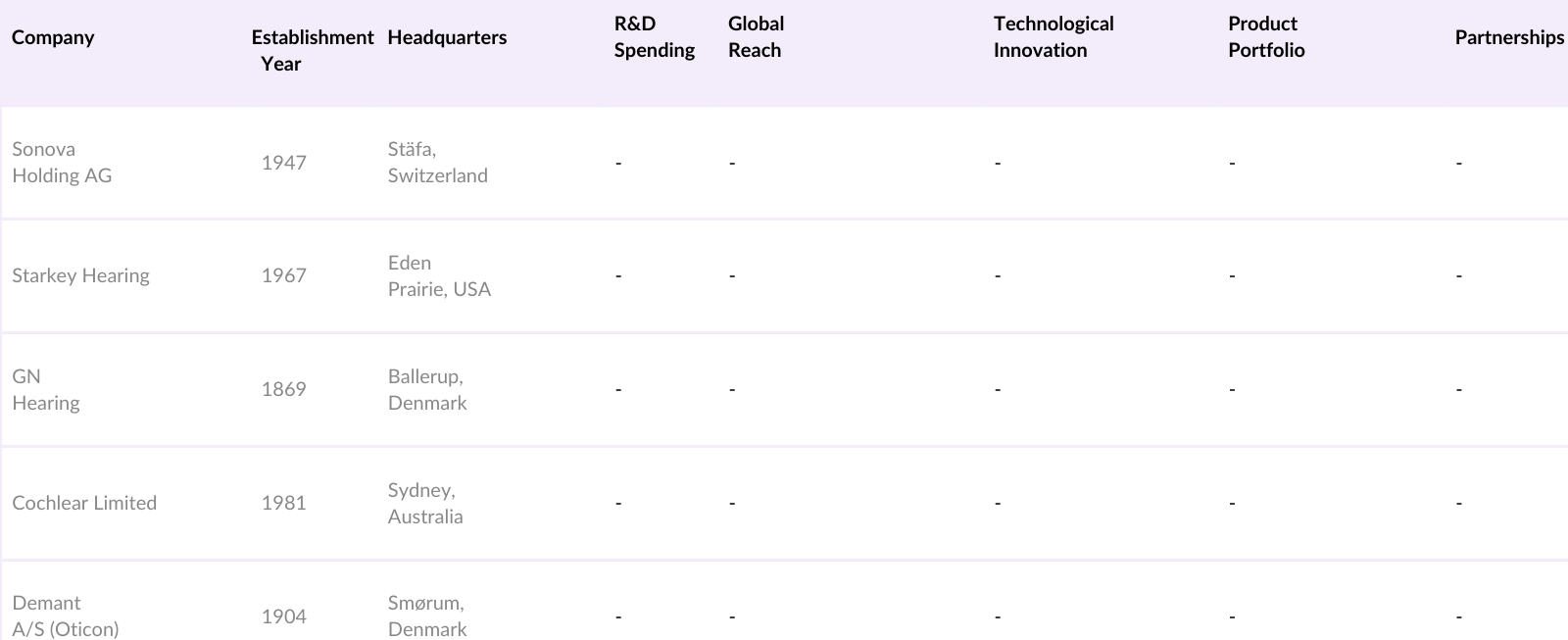

The USA hearing aids market is dominated by several key players, with a mix of domestic and global manufacturers. This competition highlights the significant influence of advanced technology, innovative solutions, and strong distribution networks in the market.

USA Hearing Aids Market Analysis

Growth Drivers

- Technological Advancements in Digital Hearing Aids: With the integration of AI and machine learning, modern hearing aids can automatically adjust to the environment and filter background noise, improving speech recognition by 25%. These devices also come with Bluetooth connectivity, allowing users to stream calls and music directly to their hearing aids. The FDA reports a significant increase in the number of registered digital hearing aid patents in the USA, with over 200 new technologies approved between 2022 and 2024, indicating rapid innovation in the field.

- Rising Prevalence of Hearing Loss: According to the National Institute on Deafness and Other Communication Disorders (NIDCD), approximately 48 million people in the USA experience some degree of hearing loss. The increasing prevalence is attributed to various factors, including noise pollution and an aging population. Hearing loss rates have grown steadily, with the CDC reporting a 7% increase in the number of adults over the age of 65 experiencing hearing impairments between 2020 and 2024.

- Aging Demographics in the USA: The aging population is a key driver for the hearing aids market in the USA. As of 2024, 16.9% of the US population is aged 65 and older, according to the U.S. Census Bureau. This demographic shift significantly impacts the demand for hearing aids, as nearly 33% of individuals over 65 experience hearing loss, based on data from the Centers for Disease Control and Prevention (CDC). With an estimated 71 million Americans expected to be 65 or older by 2030, the market for hearing aids is likely to expand.

Challenges

- High Cost of Hearing Aids: Despite technological advancements, the high cost of hearing aids remains a significant barrier. A typical pair of hearing aids can cost between $3,000 and $6,000 in the USA, according to data from the Hearing Loss Association of America (HLAA). This financial burden limits accessibility, especially for low-income individuals. Furthermore, the National Institutes of Health (NIH) estimates that nearly 28 million Americans who could benefit from hearing aids do not use them, primarily due to affordability issues.

- Limited Insurance Reimbursement: Insurance coverage for hearing aids is limited in the USA, with Medicare offering no direct reimbursement for the cost of hearing aids. According to the Kaiser Family Foundation (KFF), only about 20% of Americans have some form of insurance that partially covers hearing aids. This lack of coverage poses a significant challenge, especially for older adults, as hearing aids are often classified as elective devices rather than essential medical equipment.

USA Hearing Aids Market Future Outlook

USA hearing aids market is expected to show significant growth driven by continuous advancements in hearing aid technology, integration of artificial intelligence in hearing solutions, and a growing aging population. The expansion of online retail and telehealth solutions is likely to make hearing aids more accessible to a broader range of consumers, further propelling the market. The transition towards smaller, more powerful devices, coupled with the growing awareness around early detection of hearing loss, will also serve as catalysts for the future market expansion.

Market Opportunities

- Integration of AI and IoT in Hearing Aids: The integration of Artificial Intelligence (AI) and the Internet of Things (IoT) is revolutionizing hearing aids by offering real-time sound adjustments and health monitoring features. According to data from the U.S. Patent and Trademark Office, there has been a surge in AI-powered hearing aid patents, with over 120 patents filed between 2022 and 2024. These innovations offer features such as self-learning algorithms and connectivity with other smart devices, enhancing user experience and driving market growth.

- Growing Adoption of Telehealth Services: Telehealth is rapidly transforming the hearing aids market, particularly for follow-up consultations and device adjustments. This shift not only provides patients with more accessible care but also reduces the need for in-person visits, making hearing aid services more convenient and cost-effective. As telehealth continues to expand, the hearing aid industry will benefit from enhanced service delivery.

Scope of the Report

|

Segment |

Sub-Segments |

|

Product Type |

Behind-the-Ear (BTE) Hearing Aids |

|

In-the-Ear (ITE) Hearing Aids |

|

|

Receiver-in-Canal (RIC) Hearing Aids |

|

|

In-the-Canal (ITC) Hearing Aids |

|

|

Completely-in-the-Canal (CIC) Hearing Aids |

|

|

Distribution Channel |

Audiology Clinics |

|

Retail Pharmacies |

|

|

E-commerce Platforms |

|

|

Hospitals |

|

|

Technology |

Digital Hearing Aids |

|

Analog Hearing Aids |

|

|

AI-Enabled Hearing Aids |

|

|

End-User |

Adults |

|

Pediatrics |

|

|

Region |

Northeast |

|

Midwest |

|

|

South |

|

|

West |

Products

Key Target Audience

Audiologists and Hearing Clinics

Hearing Aid Manufacturers

Retail Pharmacies

E-commerce Platforms for Medical Devices

Hospitals and ENT Clinics

Investors and Venture Capitalist Firms

Government and Regulatory Bodies (FDA, Centers for Medicare & Medicaid Services)

Companies

Players Mentioned in the Report:

Sonova Holding AG

Starkey Hearing Technologies

GN Hearing

Cochlear Limited

Demant A/S (Oticon)

Amplifon

WS Audiology

MED-EL

Sivantos Pte. Ltd. (Signia)

RION Co. Ltd.

Table of Contents

1. USA Hearing Aids Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. USA Hearing Aids Market Size (In USD Bn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. USA Hearing Aids Market Analysis

3.1. Growth Drivers (Technological Advancements, Increasing Prevalence of Hearing Loss, Aging Population, Regulatory Support)

3.1.1. Technological Advancements in Digital Hearing Aids

3.1.2. Rising Prevalence of Hearing Loss

3.1.3. Aging Demographics in the USA

3.1.4. Regulatory Support for Hearing Devices

3.2. Market Challenges (Affordability, Insurance Coverage, Public Awareness)

3.2.1. High Cost of Hearing Aids

3.2.2. Limited Insurance Reimbursement

3.2.3. Low Public Awareness about Advanced Hearing Solutions

3.3. Opportunities (Innovation in AI-Powered Devices, Telehealth Integration, Emerging Distribution Channels)

3.3.1. Integration of AI and IoT in Hearing Aids

3.3.2. Growing Adoption of Telehealth Services

3.3.3. Expansion of Online Retail and Direct-to-Consumer Models

3.4. Trends (Customization, Miniaturization, User-Friendly Designs)

3.4.1. Demand for Customizable Hearing Solutions

3.4.2. Trends Toward Miniaturization and Invisibility

3.4.3. Focus on User-Friendly and Smart Features

3.5. Government Regulation (FDA Standards, OTC Hearing Aid Act, Medicare Policy Revisions)

3.5.1. FDA Approval for OTC Hearing Aids

3.5.2. Implementation of OTC Hearing Aid Act

3.5.3. Medicare Revisions and Potential Reimbursement Policies

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem (Hearing Clinics, Audiologists, Retailers, Manufacturers)

3.8. Porters Five Forces (Supplier Power, Buyer Power, Competitive Rivalry, Threat of Substitutes, Threat of New Entrants)

3.9. Competition Ecosystem

4. USA Hearing Aids Market Segmentation

4.1. By Product Type (In Value %)

4.1.1. Behind-the-Ear (BTE) Hearing Aids

4.1.2. In-the-Ear (ITE) Hearing Aids

4.1.3. Receiver-in-Canal (RIC) Hearing Aids

4.1.4. In-the-Canal (ITC) Hearing Aids

4.1.5. Completely-in-the-Canal (CIC) Hearing Aids

4.2. By Distribution Channel (In Value %)

4.2.1. Audiology Clinics

4.2.2. Retail Pharmacies

4.2.3. E-commerce Platforms

4.2.4. Hospitals

4.3. By Technology (In Value %)

4.3.1. Digital Hearing Aids

4.3.2. Analog Hearing Aids

4.3.3. AI-Enabled Hearing Aids

4.4. By End-User (In Value %)

4.4.1. Adults

4.4.2. Pediatrics

4.5. By Region (In Value %)

4.5.1. Northeast

4.5.2. Midwest

4.5.3. South

4.5.4. West

5. USA Hearing Aids Market Competitive Analysis

5.1 Detailed Profiles of Major Companies

5.1.1. Sonova Holding AG

5.1.2. Starkey Hearing Technologies

5.1.3. GN Hearing

5.1.4. Cochlear Limited

5.1.5. Sivantos Pte. Ltd. (Signia)

5.1.6. Amplifon

5.1.7. Demant A/S (Oticon)

5.1.8. MED-EL

5.1.9. WS Audiology

5.1.10. RION Co. Ltd.

5.2 Cross Comparison Parameters (R&D Spending, Technological Innovation, Global Reach, Product Portfolio, Distribution Network, Manufacturing Footprint, Market Penetration, Partnerships)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Venture Capital Funding

5.8. Government Grants

5.9. Private Equity Investments

6. USA Hearing Aids Market Regulatory Framework

6.1. FDA Regulations

6.2. OTC Hearing Aid Act

6.3. Medicare and Insurance Reforms

7. USA Hearing Aids Future Market Size (In USD Bn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. USA Hearing Aids Future Market Segmentation

8.1. By Product Type (In Value %)

8.2. By Distribution Channel (In Value %)

8.3. By Technology (In Value %)

8.4. By End-User (In Value %)

8.5. By Region (In Value %)

9. USA Hearing Aids Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

The initial phase involves constructing an ecosystem map encompassing all major stakeholders within the USA hearing aids market. This step is supported by extensive desk research, utilizing secondary and proprietary databases to gather industry-level information. The primary goal is to identify and define the critical variables that influence market dynamics, including distribution channels, product innovations, and customer preferences.

Step 2: Market Analysis and Construction

In this phase, historical data on the USA hearing aids market is compiled and analyzed. The assessment includes market penetration, distribution channel performance, and revenue generation. Service quality statistics are also evaluated to ensure the reliability and accuracy of revenue estimates.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses are developed and validated through consultations with industry experts, including audiologists, manufacturers, and distributors. These consultations provide valuable insights that directly contribute to refining the market analysis and ensuring the accuracy of the collected data.

Step 4: Research Synthesis and Final Output

The final phase involves direct engagement with hearing aid manufacturers and distributors to obtain detailed insights into sales performance, consumer preferences, and emerging trends. This interaction ensures the synthesis of a comprehensive and validated analysis of the USA hearing aids market.

Frequently Asked Questions

01. How big is the USA Hearing Aids Market?

The USA hearing aids market is valued at USD 6.2 billion and continues to grow, driven by technological advancements, an aging population, and increased awareness of hearing health.

02. What are the challenges in the USA Hearing Aids Market?

Challenges of USA hearing aids market include the high cost of hearing aids, limited insurance coverage, and public misconceptions about hearing loss. Additionally, there is a need for greater access to affordable devices, especially in rural areas.

03. Who are the major players in the USA Hearing Aids Market?

Key players in USA hearing aids market include Sonova Holding AG, Starkey Hearing Technologies, GN Hearing, Cochlear Limited, and Demant A/S. These companies have strong brand presence and are driving innovation in the industry.

04. What are the growth drivers of the USA Hearing Aids Market?

Growth drivers in USA hearing aids market include the increasing prevalence of hearing loss, especially among the elderly, technological advancements such as AI-powered hearing aids, and expanding access to hearing care through telehealth platforms.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.