USA Hearing Amplifiers Market Outlook to 2030

Region:North America

Author(s):Naman Rohilla

Product Code:KROD6253

December 2024

94

About the Report

USA Hearing Amplifiers Market Overview

- The USA Hearing Amplifiers market is valued at USD 31.5 billion, based on a five-year historical analysis. This market's growth is driven by an aging population with increasing rates of hearing impairment, advancements in affordable amplification technologies, and the rising awareness of hearing health solutions. The demand for hearing amplifiers, especially in over-the-counter formats, aligns with broader health trends and regulatory support, creating opportunities for consumer-oriented products.

- Dominant states such as California, Texas, and Florida lead this market due to their high elderly population and increasing adoption of health technology innovations. These regions are also major hubs for healthcare and technology companies, fostering early adoption and availability of advanced hearing amplifiers.

- The OTC Hearing Aids Act, passed in recent years, directly impacts the availability and regulation of hearing amplifiers. This legislation allows specific types of hearing devices to be sold without a prescription, which has led to an increase in market access for lower-cost hearing solutions. The act also facilitates a broader consumer base by reducing the need for audiologist consultations for initial purchases, enhancing affordability and accessibility in the market.

USA Hearing Amplifiers Market Segmentation

- By Product Type: The market is segmented by product type into In-the-Ear (ITE) Amplifiers, Behind-the-Ear (BTE) Amplifiers, Canal Amplifiers, and Invisible-in-Canal (IIC) Amplifiers. Recently, Behind-the-Ear (BTE) Amplifiers have taken a dominant market share under the product type segment. This dominance is due to BTE amplifiers' versatility, ease of use for elderly users, and enhanced battery life. BTE devices also offer robust amplification for users with varying degrees of hearing impairment, contributing to their popularity among consumers.

- By Technology: The USA Hearing Amplifiers market is also segmented by technology into Analog and Digital. Digital technology dominates this segmentation due to its ability to provide clearer sound quality, customization options, and compatibility with smartphone applications, which allows users to control settings and monitor hearing health. The adaptability of digital amplifiers to different listening environments also adds to their appeal among consumers.

USA Hearing Amplifiers Market Competitive Landscape

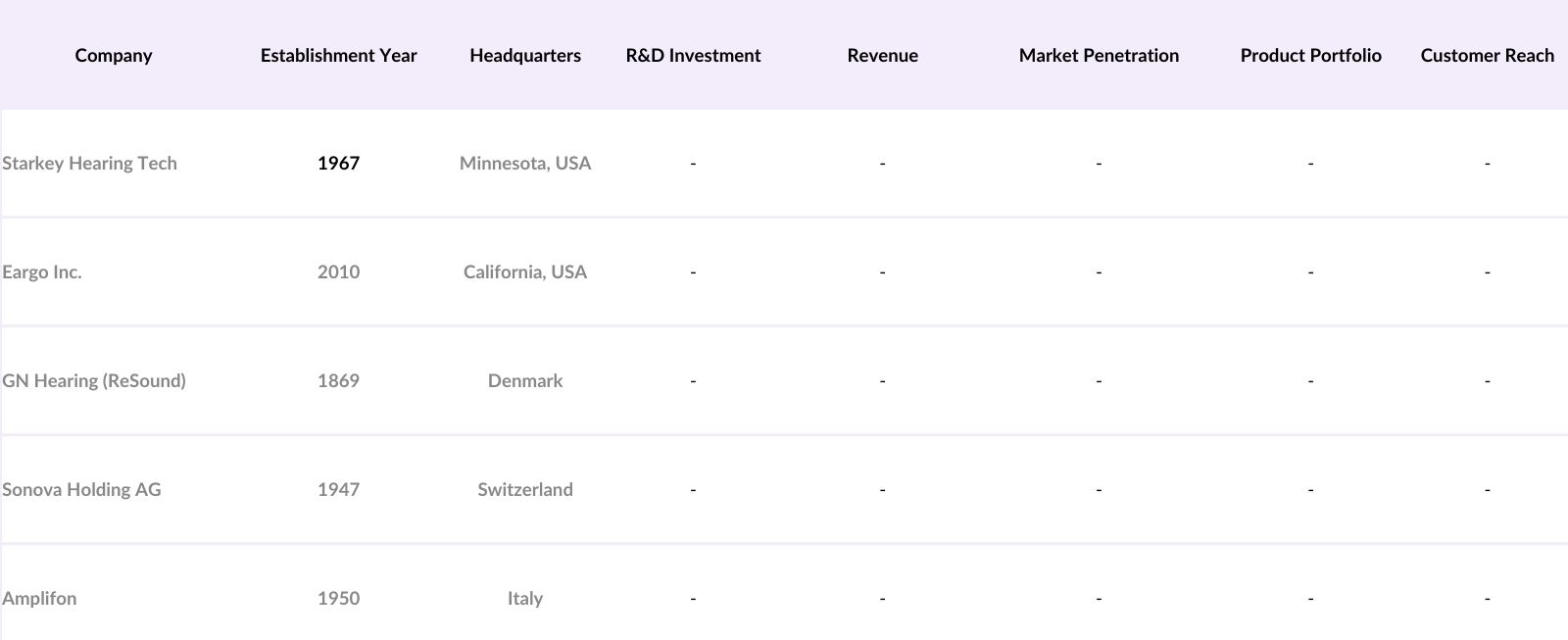

The USA Hearing Amplifiers market is dominated by a few major players, including Starkey Hearing Technologies, Eargo Inc., and GN Hearing (ReSound). This consolidation highlights the influence of these key companies, which leverage their advanced technologies, extensive distribution channels, and customer-centric services to maintain a strong presence in the market.

USA Hearing Amplifiers Market Analysis

Market Growth Drivers

- Aging Population: The USAs aging population has led to a heightened demand for hearing amplifiers, with approximately 54 million individuals aged 65 and older in 2024, according to the U.S. Census Bureau. This demographic is projected to account for a notable share of the hearing-impaired population, increasing the demand for hearing devices as older adults are more prone to age-related hearing loss. The Social Security Administration further reports that hearing impairment is a common disability among seniors, impacting social engagement and quality of life, thereby intensifying the need for accessible auditory support solutions.

- Rising Demand for Affordable Hearing Solutions: With the cost of traditional hearing aids often inaccessible for many, hearing amplifiers provide a lower-cost alternative. Over 70% of adults with untreated hearing loss are below the poverty threshold, as per the U.S. Department of Health and Human Services. Hearing amplifiers fulfill a crucial demand for budget-friendly hearing support, especially for individuals without comprehensive insurance. The Consumer Expenditure Survey in 2024 shows that out-of-pocket healthcare expenses continue to grow, further emphasizing the demand for cost-effective health solutions, including hearing aids and amplifiers.

- Increased Awareness of Hearing Health: Awareness regarding hearing health has increased due to public health initiatives and media campaigns. According to the Centers for Disease Control and Prevention (CDC), about 15% of American adults report some hearing difficulty, with nearly one in three cases avoidable or manageable with early intervention. Awareness campaigns by entities like the American Speech-Language-Hearing Association highlight the impact of untreated hearing loss on mental health and overall well-being, fostering a rise in consumer demand for affordable solutions like hearing amplifiers.

Market Challenges

- Stigma Associated with Hearing Devices: Social stigma continues to impact the adoption of hearing devices, as many users associate such devices with aging or disability. A study from the National Institute on Deafness and Other Communication Disorders reveals that nearly 25% of Americans avoid hearing devices due to social stigma. This cultural hesitation creates a substantial barrier in the market, where overcoming stigma is essential to achieving wider adoption and market penetration for hearing amplifiers among various age groups.

- Limited Product Differentiation: Hearing amplifiers often face challenges of differentiation due to the lack of distinct features across brands. The U.S. Patent and Trademark Office reports that patent filings for unique technologies in hearing devices have grown by only 3% annually since 2020, signifying limited innovation in this space. This limited differentiation creates a competitive landscape where brands struggle to establish unique value propositions, potentially impacting the user experience and reducing brand loyalty.

USA Hearing Amplifiers Market Future Outlook

Over the next few years, the USA Hearing Amplifiers market is expected to experience growth, driven by the continued rise in the aging population, increasing consumer awareness regarding hearing health, and the development of direct-to-consumer distribution channels. Advances in technology, including Bluetooth-enabled devices and smartphone integration, will further support market expansion as consumers seek enhanced usability and personalized solutions in hearing devices.

Market Opportunities

- Entry of Direct-to-Consumer Models: The direct-to-consumer (DTC) sales model has gained traction in the hearing amplifier market, simplifying access to devices and reducing consumer costs. According to a U.S. Department of Commerce report, DTC e-commerce sales for health-related products have grown by approximately 20% annually, reflecting an openness to online purchases of health devices. The DTC model enables manufacturers to bypass traditional retail channels, allowing more affordable pricing structures and increased convenience for users seeking accessible auditory solutions.

- Rising Popularity of Wearable Health Tech: Wearable health technology, which includes hearing amplifiers, has become highly popular in recent years, with a growth in adoption of over 15 million units for wearable health monitoring devices in 2023 alone, according to data from the CDC. This increase reflects a consumer shift toward integrated health solutions, positioning hearing amplifiers as a complementary device in the expanding category of health-focused wearables. The trend enhances market visibility and aligns hearing amplifiers with consumers overall health management goals.

Scope of the Report

|

Segment |

Sub-Segment |

|

Product Type |

In-the-Ear (ITE) Amplifiers |

|

Behind-the-Ear (BTE) Amplifiers |

|

|

Canal Amplifiers |

|

|

Invisible-in-Canal (IIC) Amplifiers |

|

|

Technology |

Analog |

|

Digital |

|

|

End User |

Elderly Population |

|

Adults |

|

|

Teenagers |

|

|

Sales Channel |

Online Retail |

|

Offline Retail |

|

|

Region |

Northeast USA |

|

Midwest USA |

|

|

Southern USA |

|

|

Western USA |

Products

Key Target Audience

Hearing Aid Manufacturers

Retail and E-commerce Distributors

Audiologists and Hearing Care Providers

Medical Device Investors and Venture Capitalist Firms

Healthcare Clinics and Hospitals

Insurance Providers

Government and Regulatory Bodies (e.g., FDA, U.S. Department of Health & Human Services)

Technology Integration Service Providers

Companies

Players Mentioned in the Report

Starkey Hearing Technologies

Eargo Inc.

ReSound (GN Hearing)

Sonova Holding AG

Amplifon

Bose Corporation

Phonak

Oticon

Widex

MDHearingAid

Table of Contents

1. USA Hearing Amplifiers Market Overview

1.1 Definition and Scope

1.2 Market Taxonomy

1.3 Market Growth Rate

1.4 Market Segmentation Overview

2. USA Hearing Amplifiers Market Size (In USD Bn)

2.1 Historical Market Size

2.2 Year-On-Year Growth Analysis

2.3 Key Market Developments and Milestones

3. USA Hearing Amplifiers Market Analysis

3.1 Growth Drivers

3.1.1 Aging Population (Demographics)

3.1.2 Rising Demand for Affordable Hearing Solutions (Consumer Preferences)

3.1.3 Technological Advancements in Miniaturization (Innovation)

3.1.4 Increased Awareness of Hearing Health (Public Awareness)

3.2 Market Challenges

3.2.1 Stigma Associated with Hearing Devices (Social Perception)

3.2.2 Limited Product Differentiation (Product Competition)

3.2.3 Regulatory Barriers (Compliance Requirements)

3.3 Opportunities

3.3.1 Entry of Direct-to-Consumer Models (Sales Channels)

3.3.2 Rising Popularity of Wearable Health Tech (Industry Trends)

3.3.3 Strategic Partnerships with Audiologists (Alliances)

3.4 Trends

3.4.1 Bluetooth and Wireless Connectivity (Device Features)

3.4.2 Integration with Smartphone Apps (Tech Integration)

3.4.3 Growth in E-commerce Sales (Sales Channels)

3.5 Government Regulations

3.5.1 Over-the-Counter (OTC) Hearing Aids Act (Legislation)

3.5.2 FDA Device Classification (Regulatory Standards)

3.6 SWOT Analysis

3.7 Stake Ecosystem

3.8 Porters Five Forces

3.9 Competition Ecosystem

4. USA Hearing Amplifiers Market Segmentation

4.1 By Product Type (In Value %)

4.1.1 In-the-Ear (ITE) Amplifiers

4.1.2 Behind-the-Ear (BTE) Amplifiers

4.1.3 Canal Amplifiers

4.1.4 Invisible-in-Canal (IIC) Amplifiers

4.2 By Technology (In Value %)

4.2.1 Analog

4.2.2 Digital

4.3 By End User (In Value %)

4.3.1 Elderly Population

4.3.2 Adults

4.3.3 Teenagers

4.4 By Sales Channel (In Value %)

4.4.1 Online Retail

4.4.2 Offline Retail

4.5 By Region (In Value %)

4.5.1 Northeast USA

4.5.2 Midwest USA

4.5.3 Southern USA

4.5.4 Western USA

5. USA Hearing Amplifiers Market Competitive Analysis

5.1 Detailed Profiles of Major Companies

5.1.1 Starkey Hearing Technologies

5.1.2 Eargo Inc.

5.1.3 ReSound (GN Hearing)

5.1.4 Sonova Holding AG

5.1.5 Amplifon

5.1.6 Bose Corporation

5.1.7 Phonak

5.1.8 Oticon

5.1.9 Widex

5.1.10 MDHearingAid

5.1.11 Audicus

5.1.12 Siemens Hearing Instruments

5.1.13 Miracle-Ear

5.1.14 Nuheara

5.1.15 Tweak Hearing

5.2 Cross Comparison Parameters (Revenue, Market Presence, Product Portfolio, R&D Investment, Customer Reach, Innovation Capabilities, Brand Reputation, Sales Network)

5.3 Market Share Analysis

5.4 Strategic Initiatives

5.5 Mergers and Acquisitions

5.6 Investment Analysis

5.7 Government Grants

5.8 Private Equity Investments

6. USA Hearing Amplifiers Market Regulatory Framework

6.1 FDA Guidelines on Hearing Devices

6.2 OTC Hearing Aid Compliance

6.3 Certification Processes

7. USA Hearing Amplifiers Future Market Size (In USD Bn)

7.1 Future Market Size Projections

7.2 Key Factors Driving Future Market Growth

8. USA Hearing Amplifiers Future Market Segmentation

8.1 By Product Type (In Value %)

8.2 By Technology (In Value %)

8.3 By End User (In Value %)

8.4 By Sales Channel (In Value %)

8.5 By Region (In Value %)

9. USA Hearing Amplifiers Market Analysts Recommendations

9.1 TAM/SAM/SOM Analysis

9.2 Customer Cohort Analysis

9.3 Marketing Initiatives

9.4 White Space Opportunity Analysis

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

The initial phase involved mapping key stakeholders in the USA Hearing Amplifiers Market through desk research and secondary data sources. Primary focus was on demographic trends, consumer preferences, and technological advancements in the market.

Step 2: Market Analysis and Construction

Historical data on market penetration, revenue generation, and product adoption were compiled and analyzed to understand the market's structure. Specific attention was given to the adoption rates of analog vs. digital hearing amplifiers.

Step 3: Hypothesis Validation and Expert Consultation

Market assumptions were validated through consultations with industry experts and key players, conducted via telephone interviews. This provided firsthand insights into market trends and competitive dynamics.

Step 4: Research Synthesis and Final Output

This phase involved synthesizing data from manufacturers, audiologists, and distributors to verify and refine the analysis. A bottom-up approach was used to calculate the market size, ensuring comprehensive and reliable market insights.

Frequently Asked Questions

01. How big is the USA Hearing Amplifiers Market?

The USA Hearing Amplifiers market is valued at USD 31.5 billion, driven by an aging population and advancements in affordable hearing technologies.

02. What are the challenges in the USA Hearing Amplifiers Market?

Key challenges include the social stigma associated with hearing devices and regulatory complexities in distribution channels.

03. Who are the major players in the USA Hearing Amplifiers Market?

The market includes key players like Starkey Hearing Technologies, Eargo Inc., ReSound (GN Hearing), and Sonova Holding AG, each with strong distribution networks and customer-centric products.

04. What are the growth drivers of the USA Hearing Amplifiers Market?

Growth is fueled by rising hearing health awareness, technological innovations, and the aging population seeking accessible and affordable hearing solutions.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.