USA Hemp Market Outlook to 2030

Region:North America

Author(s):Shubham Kashyap

Product Code:KROD1970

November 2024

94

About the Report

USA Hemp Market Overview

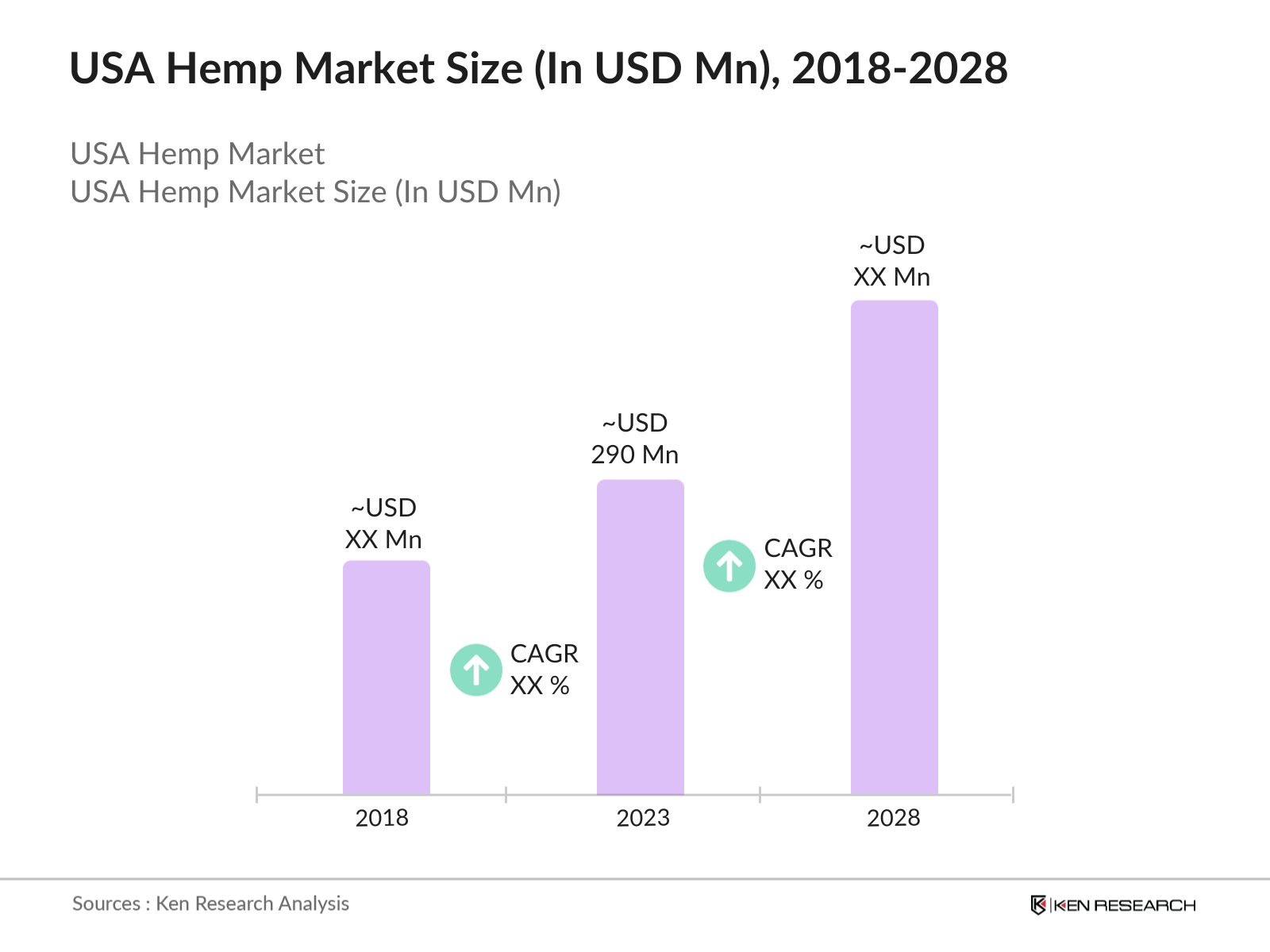

- The USA Hemp Market was valued at USD 290 million in 2023, driven by increasing demand for hemp-derived products such as CBD oils, textiles, and bioplastics. The rising consumer awareness regarding the therapeutic benefits of CBD, coupled with the growth in sustainable and eco-friendly products, has propelled the market growth.

- Major players in the USA Hemp Market include Charlotte's Web Holdings, Inc., CV Sciences, Inc., Hemp, Inc., Manitoba Harvest, and Elixinol Global Limited. These companies dominate the market through extensive product portfolios, strong distribution networks, and strategic partnerships. They focus on expanding their product lines and enhancing their quality to meet the evolving consumer demands for natural and organic products.

- Regions such as California, Colorado, Kentucky, and Oregon lead the market due to favorable climatic conditions for hemp cultivation, supportive state-level regulations, and a high concentration of processing facilities. These states also exhibit higher demand for premium hemp products, driven by their progressive consumer base and supportive business environment.

- In June 2024, Charlotte's Web Holdings, Inc. launched a new CBD topical collection at Walmart, featuring a balm stick, cream, and cooling gel, each containing 1,000 mg of CBD isolate. This expansion aims to enhance accessibility and affordability for consumers across 827 Walmart locations in five states, reinforcing the company's commitment to quality CBD wellness products.

USA Hemp Market Segmentation

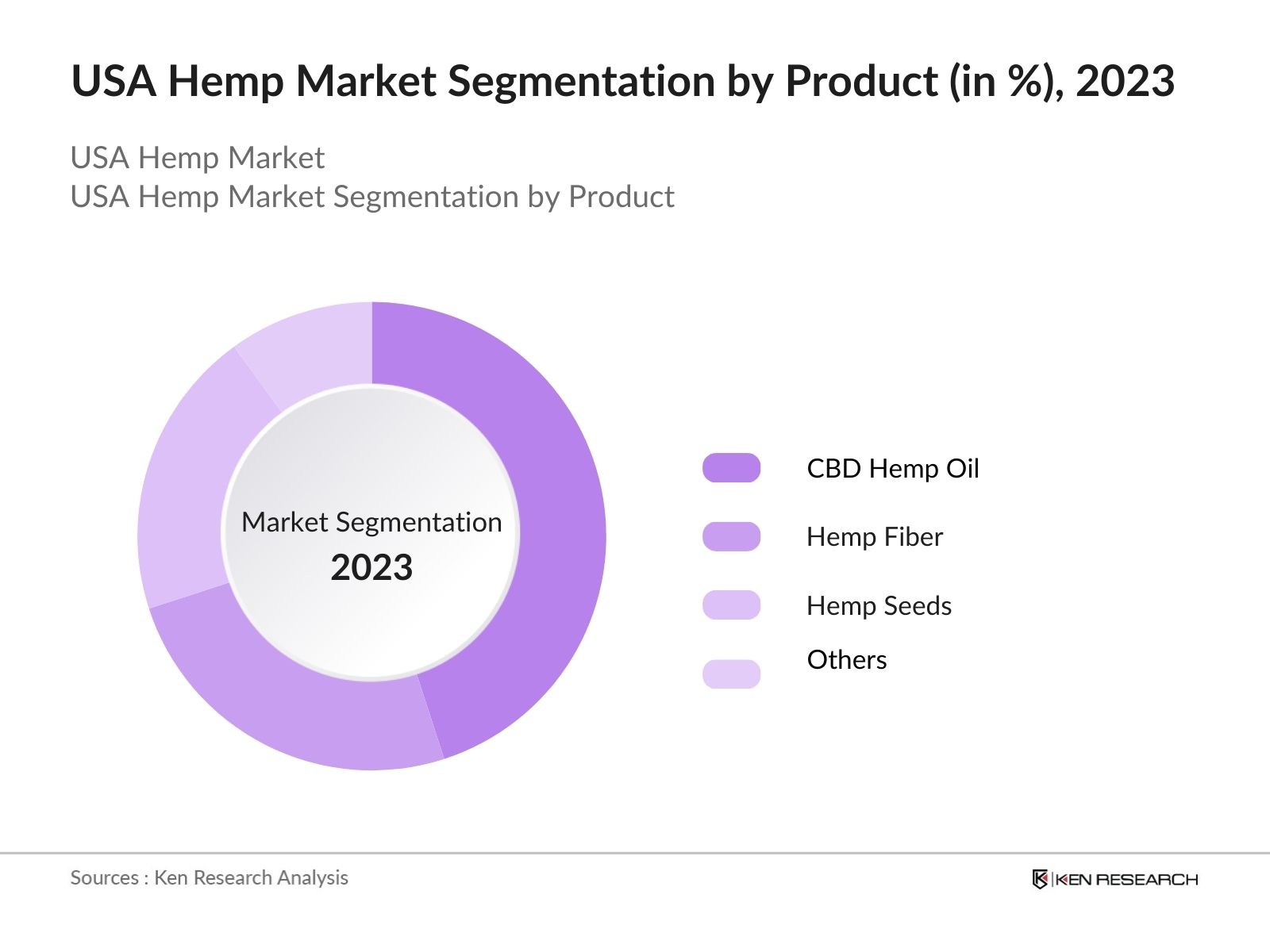

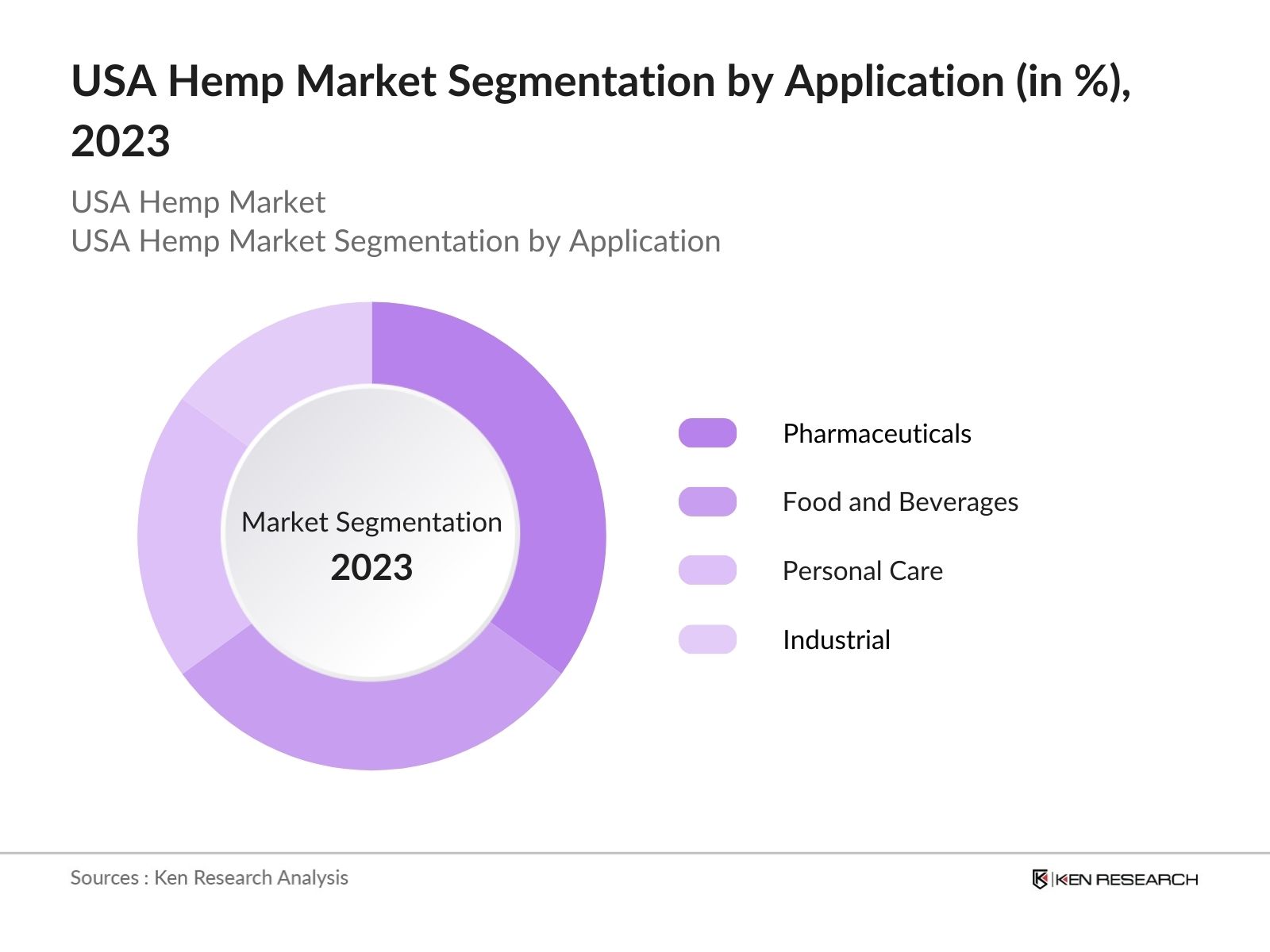

The USA Hemp Market is segmented by product, application, and region.

- By Product: The market is segmented into CBD Hemp Oil, Hemp Fiber, Hemp Seeds, and Others. In 2023, CBD Hemp Oil held the dominant market share, driven by increasing consumer demand for therapeutic and wellness products. Companies like Charlotte's Web and CV Sciences are key players in this segment, offering a wide range of CBD oil products tailored to various health and wellness needs.

- By Application: The market is segmented by application into Pharmaceuticals, Food and Beverages, Personal Care, and Industrial. The Pharmaceuticals segment led the market in 2023, due to the growing use of CBD for pain management, anxiety relief, and other health benefits. The expanding research on hemp-derived compounds' therapeutic properties has further boosted demand in this segment.

- By Region: The market is segmented by region into north, east, west & south. The West region, particularly California and Colorado, dominates the market in 2023 due to favorable regulatory frameworks, extensive hemp farming operations, and high consumer awareness regarding hemp-derived products. These states' economic strength and progressive policies further contribute to market growth.

USA Hemp Market Competitive Landscape

|

Company |

Establishment Year |

Headquarters |

|

Charlotte's Web Holdings, Inc. |

2013 |

Boulder, Colorado |

|

CV Sciences, Inc. |

2010 |

San Diego, California |

|

Hemp, Inc. |

2008 |

Las Vegas, Nevada |

|

Manitoba Harvest |

1998 |

Winnipeg, Canada |

|

Elixinol Global Limited |

2014 |

Sydney, Australia |

- Manitoba Harvest.: In February 2024, Manitoba Harvest launched Bioactive Fiber, a new product developed in partnership with Brightseed, exclusively available at Whole Foods Market. This innovative fiber solution provides 6g of both soluble and insoluble fiber per serving, derived from upcycled hemp hulls. It aims to support gut health and addresses the fiber gap in American diets, promoting overall wellness.

- CV Sciences, Inc.: In March 2024, CV Sciences launched its +PlusCBD Pet product line, introducing Pet Hip and Joint Health Chews and Pet Calming Care Chews. These CBD-infused chews are designed to enhance the physical and emotional well-being of dogs, leveraging natural ingredients and therapeutic properties of CBD derived from organic hemp. The products are available nationwide at select retailers and online.

USA Hemp Market Analysis

Growth Drivers

- Increased Adoption of Hemp-Derived CBD Products in Health and Wellness: The market has seen remarkable growth due to the rising demand for CBD products, driven by increasing consumer awareness and acceptance of CBD's therapeutic benefits. In 2023, the CBD oil industry is anticipated to account for a substantial portion of the total hemp market revenue, with projections indicating that CBD oil sales could represent over 40% of the total hemp-derived product sales, driven by its popularity for health-related uses, highlighting the product's popularity among health-conscious consumers seeking natural remedies for pain, anxiety, and sleep disorders.

- Expansion of Sustainable and Eco-Friendly Products: The shift towards sustainable and eco-friendly products has driven demand for hemp-based products such as hemp paper, textiles, and bioplastics. Hemp is recognized for its versatility and environmental benefits. It can grow in diverse climates, requires minimal water and pesticides, and improves soil health by removing contaminants. Hemp cultivation can produce twice as much fabric per acre compared to cotton while using four times less water. Hemp's versatility and environmental benefits, such as its ability to grow in diverse climates and improve soil health.

- Expansion of Hemp Use in Industrial Applications: Hemps application in various industrial sectors such as construction, automotive, and textiles is rapidly expanding due to its environmental benefits and versatility. The National Hemp Association reported a substantial increase in the use of hemp fibers in construction materials like hempcrete between 2022 and 2024. Additionally, the automotive industry has begun integrating hemp fibers into composite materials for vehicle interiors, contributing to a lightweight and sustainable alternative to traditional materials.

Challenges

- Regulatory Uncertainty and Compliance Issues: Despite federal legalization, the hemp industry still faces substantial regulatory challenges at the state level. Varying state laws regarding hemp cultivation, processing, and sale create a complex regulatory landscape that companies must navigate. Compliance with these regulations, along with ongoing uncertainty about the future of CBD regulations by the FDA, presents a challenge for market participants.

- Market Competition and Product Differentiation: The market is highly competitive, with numerous players offering similar hemp-derived products. Companies must continuously innovate and differentiate their products to maintain market share. The influx of low-cost products, particularly from international markets, further intensifies competition, affecting pricing strategies and profit margins. This increase in competition has been further compounded by the rise of low-cost hemp products imported from international markets.

Government Initiatives

- State-Level Agricultural Grants and Subsidies: Several states, including Kentucky, Oregon, and Colorado, have introduced agricultural grants and subsidies to support hemp farmers. These initiatives are aimed at boosting local hemp cultivation, encouraging sustainable agricultural practices, and enhancing the overall supply chain infrastructure for hemp processing. The initiative also seeks to promote innovation in hemp-derived products, supporting the market's long-term growth.

- Introduction of Standardized Testing and Quality Control Measures: To address quality concerns, the USDA introduced new standardized testing and quality control measures in 2023. These measures mandate consistent testing for THC levels and contaminants in hemp products, ensuring compliance with federal guidelines. The implementation of these standards aims to enhance product quality, increase consumer confidence, and facilitate smoother interstate commerce by minimizing regulatory discrepancies.

USA Hemp Market Future Outlook

The USA Hemp Market is expected to witness robust growth by 2028, driven by increasing consumer demand for CBD and other hemp-derived products, ongoing regulatory support, and rising investments in sustainable and eco-friendly product development.

Future Market Trends

- Growth in Hemp-Based Food and Beverage Products: By 2028, hemp-based food and beverage products are expected to account for a specific share of the market, driven by rising consumer demand for plant-based and organic foods. Manufacturers are focusing on developing innovative hemp-based products, such as protein powders, snacks, and beverages, to cater to health-conscious consumers.

- Regulatory Harmonization and Expansion of Hemp-Derived Product Categories: As the FDA and USDA work towards a more harmonized regulatory framework for hemp and hemp-derived products, the market is expected to benefit from increased clarity and reduced compliance burdens. By 2028, it is anticipated that a broader range of hemp-derived products, including new nutraceuticals, health supplements, and functional foods

Scope of the Report

|

By Product |

CBD Hemp Oil Hemp Fiber Hemp Seeds Others |

|

By Application |

Pharmaceuticals Food and Beverages Personal Care Industrial |

|

By Region |

North East West South |

Products

Key Target Audience Organizations and Entities Who Can Benefit by Subscribing to This Report

CBD Product Manufacturers

Hemp Cultivators and Processors

Pharmaceutical Companies

Food and Beverage Companies

Textile Manufacturers

Bioplastic Manufacturers

E-commerce Companies

Government and Regulatory Bodies (USDA and FDA)

Investment and Venture Capital Firms

Banks and Financial Institute

Sustainable Product Suppliers

Time Period Captured in the Report

Historical Period: 2018-2023

Base Year: 2023

Forecast Period: 2023-2028

Companies

Players Mentioned in the Report

Charlotte's Web Holdings, Inc.

CV Sciences, Inc.

Hemp, Inc.

Manitoba Harvest

Elixinol Global Limited

Bluebird Botanicals

HempFusion Wellness Inc.

Medical Marijuana, Inc.

Nutiva

Isodiol International Inc.

Aurora Cannabis

Canopy Growth Corporation

Green Roads

PureKana

Joy Organics

Table of Contents

1. USA Hemp Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. USA Hemp Market Size (in USD Mn), 2018-2023

2.1. Historical Market Size

2.2. Year-on-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. USA Hemp Market Analysis

3.1. Growth Drivers

3.1.1. Increased Adoption of Hemp-Derived CBD Products in Health and Wellness

3.1.2. Expansion of Sustainable and Eco-Friendly Products

3.1.3. Expansion of Hemp Use in Industrial Applications

3.2. Restraints

3.2.1. Regulatory Uncertainty and Compliance Issues

3.2.2. Market Competition and Product Differentiation

3.3. Opportunities

3.3.1. Rising Consumer Demand for Organic and Plant-Based Products

3.3.2. Growing Investment in Hemp-Derived Bio-based Materials

3.4. Trends

3.4.1. Growth in Hemp-Based Food and Beverage Products

3.4.2. Increased Use of Hemp in Sustainable Construction Materials

3.5. Government Regulation

3.5.1. State-Level Agricultural Grants and Subsidies

3.5.2. Introduction of Standardized Testing and Quality Control Measures

3.6. SWOT Analysis

3.7. Stake Ecosystem

3.8. Competition Ecosystem

4. USA Hemp Market Segmentation, 2023

4.1. By Product (in Value %)

4.1.1. CBD Hemp Oil

4.1.2. Hemp Fiber

4.1.3. Hemp Seeds

4.1.4. Others

4.2. By Application (in Value %)

4.2.1. Pharmaceuticals

4.2.2. Food and Beverages

4.2.3. Personal Care

4.2.4. Industrial

4.3. By Region (in Value %)

4.3.1. North

4.3.2. East

4.3.3. West

4.3.4. South

5. USA Hemp Market Cross Comparison

5.1. Detailed Profiles of Major Companies

5.1.1. Charlotte's Web Holdings, Inc.

5.1.2. CV Sciences, Inc.

5.1.3. Hemp, Inc.

5.1.4. Manitoba Harvest

5.1.5. Elixinol Global Limited

5.2. Cross Comparison Parameters (No. of Employees, Headquarters, Inception Year, Revenue)

6. USA Hemp Market Competitive Landscape

6.1. Market Share Analysis

6.2. Strategic Initiatives

6.3. Mergers and Acquisitions

6.4. Investment Analysis

6.4.1. Venture Capital Funding

6.4.2. Government Grants

6.4.3. Private Equity Investments

7. USA Hemp Market Regulatory Framework

7.1. Regulatory Policies

7.2. Compliance Requirements

7.3. Certification Processes

8. USA Hemp Market Future Size (in USD Mn), 2023-2028

8.1. Future Market Size Projections

8.2. Key Factors Driving Future Market Growth

9. USA Hemp Market Future Segmentation, 2028

9.1. By Product (in Value %)

9.2. By Application (in Value %)

9.3. By Region (in Value %)

10. USA Hemp Market Analysts Recommendations

10.1. TAM/SAM/SOM Analysis

10.2. Customer Cohort Analysis

10.3. Marketing Initiatives

10.4. White Space Opportunity Analysis

Research Methodology

Step: 1 Identifying Key Variables

Ecosystem creation for all the major entities and referring to multiple secondary and proprietary databases to perform desk research around market to collate industry level information.

Step: 2 Market Building

Collating statistics on US hemp market over the years, penetration of marketplaces and service providers ratio to compute revenue generated for US hemp market. We will also review service quality statistics to understand revenue generated which can ensure accuracy behind the data points shared.

Step: 3 Validating and Finalizing

Building market hypothesis and conducting CATIs with industry experts belonging to different companies to validate statistics and seek operational and financial information from company representatives.

Step: 4 Research Output

Our team will approach multiple essential hemp companies and understand nature of product segments and sales, consumer preference and other parameters, which will support us validate statistics derived through bottom to top approach from hemp companies.

Frequently Asked Questions

1. How big is the USA Hemp Market?

The USA Hemp Market was valued at USD 290 million in 2023, driven by increasing demand for CBD products, sustainable industrial materials, and growing consumer interest in natural and organic products.

2. What are the challenges in the USA Hemp Market?

Challenges in the USA Hemp Market include regulatory inconsistencies across states, supply chain disruptions due to weather and pest issues, and market saturation leading to price volatility. These factors create a complex environment for businesses to navigate.

3. Who are the major players in the USA Hemp Market?

Major players in the USA Hemp Market include Charlotte's Web Holdings, Inc., CV Sciences, Inc., Hemp, Inc., Manitoba Harvest, and Elixinol Global Limited. These companies lead the market through strong product portfolios, extensive distribution networks, and strategic partnerships.

4. What are the growth drivers of the USA Hemp Market?

Growth drivers of the USA Hemp Market include the rising adoption of hemp-derived CBD products for health and wellness, increasing use of hemp in industrial applications such as textiles and bioplastics, and growing consumer preference for organic and sustainable products.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.