USA Home Fitness Equipment Market Outlook to 2030

Region:North America

Author(s):Yogita Sahu

Product Code:KROD11049

November 2024

95

About the Report

USA Home Fitness Equipment Market Overview

- The U.S. home fitness equipment market is valued at USD 5 billion, reflecting a solid growth trajectory driven by increased health consciousness and convenience-oriented lifestyles. The market's expansion is supported by a five-year historical trend where consumers increasingly invest in fitness solutions that can be accessed at home, fueled by advancements in digital connectivity, integration with virtual classes, and equipment innovations catering to home use.

- The market is largely concentrated in metropolitan areas like New York, Los Angeles, and Chicago, which dominate due to high disposable income, urban density, and greater awareness of fitness trends. These cities also benefit from a robust infrastructure for e-commerce and distribution, making it easier for manufacturers to supply home fitness equipment to a concentrated consumer base.

- The U.S. government has invested over $1 billion in 2024 to promote national health and fitness programs, aiming to reduce lifestyle-related diseases through physical activity. This funding has spurred public awareness campaigns encouraging fitness, which indirectly boosts home fitness equipment sales as individuals seek convenient ways to exercise.

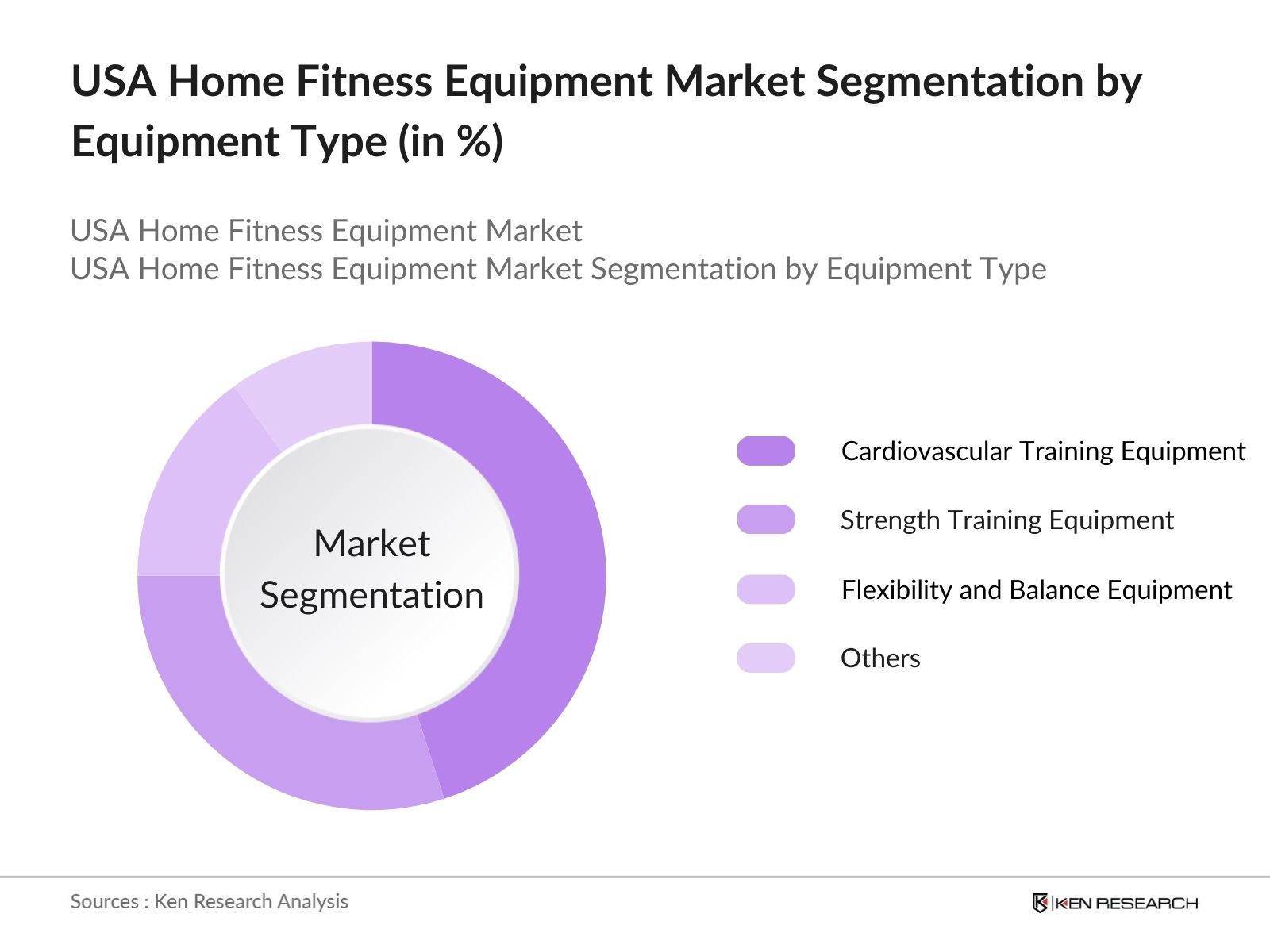

USA Home Fitness Equipment Market Segmentation

By Equipment Type: The market is segmented by equipment type into cardiovascular training equipment, strength training equipment, flexibility and balance equipment, and others. Recently, cardiovascular training equipment has maintained a dominant market share due to its effectiveness in facilitating high-calorie burn workouts at home. Products like treadmills and stationary bikes are increasingly popular among consumers aiming to maintain cardiovascular health, with brands such as Peloton leading in innovation and market presence.

By Distribution Channel: Distribution channels in the market include online retail, offline retail, and direct sales. Online retail channels have seen the highest market share, as consumers prefer the convenience of browsing and purchasing products online. Leading e-commerce platforms provide a range of products, competitive pricing, and direct-to-door shipping options, making this channel the most dominant. Brands are also investing in D2C (Direct-to-Consumer) sales, ensuring better margins and customer engagement.

USA Home Fitness Equipment Market Competitive Landscape

The market is marked by a mix of domestic and international brands competing for market share. Companies such as Peloton, Nautilus, and Life Fitness dominate with strong brand loyalty and product innovation.

USA Home Fitness Equipment Market Analysis

Market Growth Drivers

- Rising Health Awareness Among Americans: In 2024, health concerns among the U.S. population continue to grow, with over 100 million Americans actively engaging in fitness and wellness activities. This trend is driven by rising obesity levels, which impacted over 93 million adults as per recent health data. The increased emphasis on physical health is expected to boost demand for home fitness equipment, as individuals aim to incorporate fitness routines into their daily lives.

- Increasing Shift to Hybrid Work Models: As of 2024, around 25 million workers operate on a hybrid work schedule, allowing them more time at home to engage in fitness activities. The shift toward remote work, which remains stable among various industries, provides flexibility for employees to manage their fitness regimes at home. This trend has significantly influenced home fitness equipment purchases, with equipment sales reaching over 10 million units annually due to the convenience of exercising at home during work breaks or after hours.

- Surge in Online Fitness Platforms Integration: Online fitness platforms have gained momentum, with over 35 million Americans subscribed to digital fitness classes that can be accessed through home equipment. Integration of interactive platforms with fitness machines, like treadmills with screen monitors for live streaming classes, has driven growth in this sector. Companies report high sales of equipment compatible with these platforms, reflecting consumers' demand for tech-integrated home fitness solutions that offer a gym-like experience at home.

Market Challenges

- High Cost of Premium Home Fitness Equipment: As of 2024, the average cost for premium home fitness equipment such as high-end treadmills or elliptical machines ranges from $2,000 to $5,000. This high price point can deter middle-income households, especially as inflation rates have affected consumer spending in recent years. Financial surveys highlight that around 20 million households find such expenditures prohibitive, affecting the market's growth potential.

- Space Constraints in Urban Households: The average apartment size in major U.S. cities is approximately 900 square feet, often insufficient for larger fitness machines. According to a recent housing survey, 40% of urban households cite space as a limitation in purchasing home fitness equipment. This constraint is particularly evident in densely populated areas like New York City and San Francisco, where compact living spaces pose a challenge to market expansion.

USA Home Fitness Equipment Market Future Outlook

Over the coming years, the U.S. home fitness equipment industry is projected to grow steadily, driven by advancements in smart technology, product customization, and increasing consumer preference for home-based fitness solutions.

Future Market Opportunities

- Expansion of AI-Powered Personalized Training Programs: Over the next five years, the use of AI in home fitness equipment is projected to grow, with the industry expected to deploy over 1 million AI-enhanced fitness machines by 2029. These devices will offer customized training regimens, enabling users to benefit from virtual personal trainers and data-driven workout optimization.

- Increased Adoption of Subscription-Based Equipment Leasing Models: By 2029, the subscription model for high-end home fitness equipment is forecasted to attract over 5 million users. This shift will allow consumers to rent premium equipment for short-term use, offering a flexible solution for those seeking high-quality fitness experiences without long-term commitments.

Scope of the Report

|

Equipment Type |

Cardiovascular Training Equipment |

|

Distribution Channel |

Online Retail |

|

End-User |

Residential |

|

Price Range |

Low-End |

|

Region |

Northeast |

Products

Key Target Audience Organizations and Entities Who Can Benefit by Subscribing This Report:

Fitness Equipment Retailers

Smart Fitness Technology Providers

Health and Wellness Startups

Investor and Venture Capitalist Firms

Government and Regulatory Bodies (e.g., FDA, U.S. Consumer Product Safety Commission)

Fitness Equipment Manufacturers

Fitness Influencers and Online Trainers

E-commerce Platforms

Companies

Players Mentioned in the Report:

Peloton Interactive, Inc.

Nautilus, Inc.

Technogym S.p.A.

Johnson Health Tech Co., Ltd.

ICON Health & Fitness, Inc.

Life Fitness, Inc.

Bowflex

ProForm

NordicTrack

Horizon Fitness

Table of Contents

1. USA Home Fitness Equipment Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. USA Home Fitness Equipment Market Size (In USD Billion)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. USA Home Fitness Equipment Market Analysis

3.1. Growth Drivers

3.1.1. Rising Health Consciousness

3.1.2. Technological Advancements in Equipment

3.1.3. Increase in Home-Based Workouts

3.1.4. Availability of Financing Options

3.2. Market Challenges

3.2.1. High Initial Investment Costs

3.2.2. Space Constraints in Urban Areas

3.2.3. Competition from Commercial Gyms

3.3. Opportunities

3.3.1. Integration with Virtual Fitness Platforms

3.3.2. Development of Compact and Multifunctional Equipment

3.3.3. Expansion into Untapped Demographics

3.4. Trends

3.4.1. Adoption of Smart Fitness Equipment

3.4.2. Subscription-Based Models for Equipment Access

3.4.3. Eco-Friendly and Sustainable Equipment Design

3.5. Government Regulations

3.5.1. Safety Standards for Fitness Equipment

3.5.2. Import Tariffs and Trade Policies

3.5.3. Tax Incentives for Health and Wellness Products

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem

3.8. Porters Five Forces Analysis

3.9. Competitive Landscape

4. USA Home Fitness Equipment Market Segmentation

4.1. By Equipment Type (In Value %)

4.1.1. Cardiovascular Training Equipment

4.1.2. Strength Training Equipment

4.1.3. Flexibility and Balance Equipment

4.1.4. Others

4.2. By Distribution Channel (In Value %)

4.2.1. Online Retail

4.2.2. Offline Retail

4.2.3. Direct Sales

4.3. By End-User (In Value %)

4.3.1. Residential

4.3.2. Commercial

4.3.3. Government Institutions

4.4. By Price Range (In Value %)

4.4.1. Low-End

4.4.2. Mid-Range

4.4.3. High-End

4.5. By Region (In Value %)

4.5.1. Northeast

4.5.2. Midwest

4.5.3. South

4.5.4. West

5. USA Home Fitness Equipment Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. Peloton Interactive, Inc.

5.1.2. Nautilus, Inc.

5.1.3. Technogym S.p.A.

5.1.4. Johnson Health Tech Co., Ltd.

5.1.5. ICON Health & Fitness, Inc.

5.1.6. Precor Incorporated

5.1.7. Life Fitness, Inc.

5.1.8. Bowflex

5.1.9. ProForm

5.1.10. NordicTrack

5.1.11. Horizon Fitness

5.1.12. TRUE Fitness Technology, Inc.

5.1.13. Cybex International, Inc.

5.1.14. Octane Fitness

5.1.15. Torque Fitness

5.2. Cross Comparison Parameters (Revenue, Market Share, Product Portfolio, Distribution Network, Technological Innovations, Customer Base, Geographic Presence, Strategic Initiatives)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Venture Capital Funding

5.8. Government Grants

5.9. Private Equity Investments

6. USA Home Fitness Equipment Market Regulatory Framework

6.1. Safety and Quality Standards

6.2. Compliance Requirements

6.3. Certification Processes

7. USA Home Fitness Equipment Future Market Size (In USD Billion)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. USA Home Fitness Equipment Future Market Segmentation

8.1. By Equipment Type (In Value %)

8.2. By Distribution Channel (In Value %)

8.3. By End-User (In Value %)

8.4. By Price Range (In Value %)

8.5. By Region (In Value %)

9. USA Home Fitness Equipment Market Analysts Recommendations

9.1. Total Addressable Market (TAM), Serviceable Available Market (SAM), and Serviceable Obtainable Market (SOM) Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

Disclaimer

Contact Us

Research Methodology

Step 1: Identification of Key Variables

The research began by constructing a comprehensive map of the home fitness equipment markets ecosystem, identifying all key players and trends. A combination of proprietary databases and secondary data sources provided a broad overview of the market structure.

Step 2: Market Analysis and Data Compilation

Historical data on market penetration and revenue was compiled, focusing on consumer trends and preferences. This data was validated through quantitative analysis, identifying the top-performing segments and assessing sales across distribution channels.

Step 3: Hypothesis Validation through Expert Interviews

Industry experts from fitness equipment manufacturing and e-commerce sectors were interviewed to gain insights into competitive dynamics, consumer preferences, and technological advancements. This qualitative data enriched the quantitative findings and provided context for emerging trends.

Step 4: Synthesis and Final Reporting

The final phase involved synthesizing data points from quantitative and qualitative sources. Direct engagement with fitness equipment providers enabled a final verification step, ensuring accuracy and completeness in the market analysis.

Frequently Asked Questions

1. How big is the U.S. Home Fitness Equipment Market?

The U.S. home fitness equipment market is valued at USD 5 billion, supported by a growing trend in home-based workouts and digital fitness solutions.

2. What are the key growth drivers for the U.S. Home Fitness Equipment Market?

Growth in the U.S. home fitness equipment market is driven by health-conscious consumer behavior, advancements in digital fitness solutions, and increased demand for home-based workout options.

3. Which are the leading cities for the U.S. Home Fitness Equipment Market?

Metropolitan areas like New York, Los Angeles, and Chicago lead due to higher disposable incomes, urban density, and greater awareness of fitness trends.

4. Who are the major players in the U.S. Home Fitness Equipment Market?

Key players in the U.S. home fitness equipment market include Peloton Interactive, ICON Health & Fitness, Nautilus, Johnson Health Tech, and Life Fitness, each known for their innovation and strong brand presence.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.