USA Home Healthcare Services Market Outlook to 2030

Region:North America

Author(s):Meenakshi Bisht

Product Code:KROD7210

December 2024

90

About the Report

USA Home Healthcare Services Market Overview

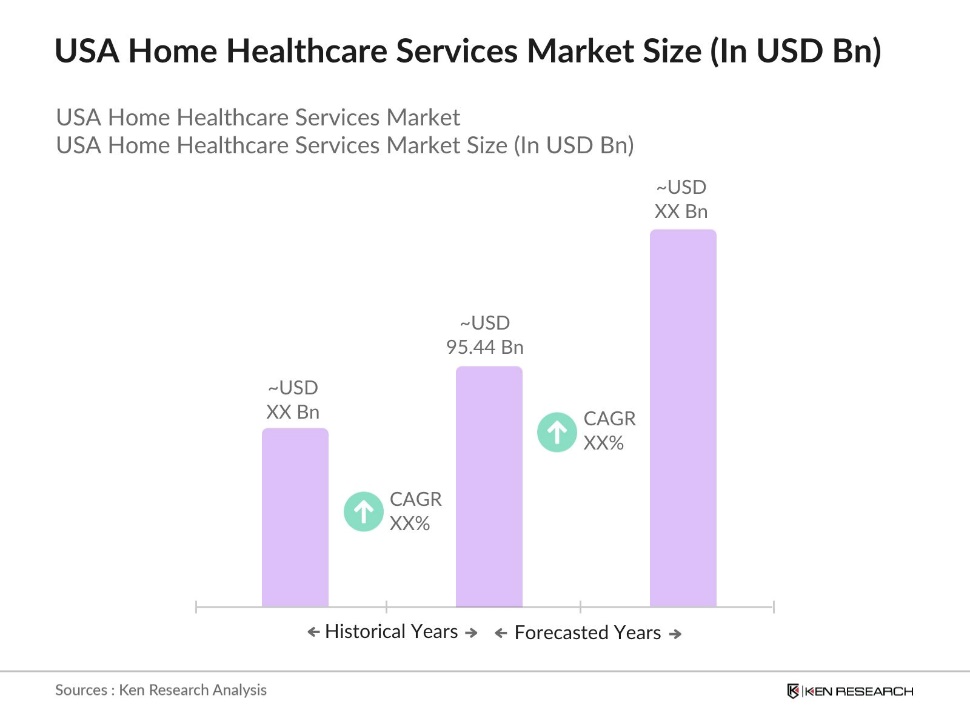

- The USA home healthcare services market has experienced a growth, reaching a valuation of USD 95.44 billion. This expansion is primarily driven by the increasing aging population, the prevalence of chronic diseases, and a shift towards cost-effective healthcare solutions. The demand for in-home medical services has surged as patients and healthcare providers recognize the benefits of receiving care in familiar surroundings, which often leads to better patient outcomes and reduced hospital readmissions.

- Major metropolitan areas such as New York City, Los Angeles, and Chicago dominate the U.S. home healthcare services market. These cities have a higher concentration of elderly populations and individuals with chronic conditions, leading to increased demand for home-based care. Additionally, urban centers often have more developed healthcare infrastructures and a greater availability of home healthcare providers, facilitating the delivery of comprehensive in-home services.

- The HHQRP requires agencies to report quality metrics, influencing Medicare reimbursement eligibility. The Medicare-certified agencies participate in this program, which emphasizes patient outcomes and safety standards. Compliance with HHQRP requirements is essential for retaining certification and Medicare reimbursements, and in 2024, reporting obligations have become more rigorous, focusing on infection rates and readmissions.

USA Home Healthcare Services Market Segmentation

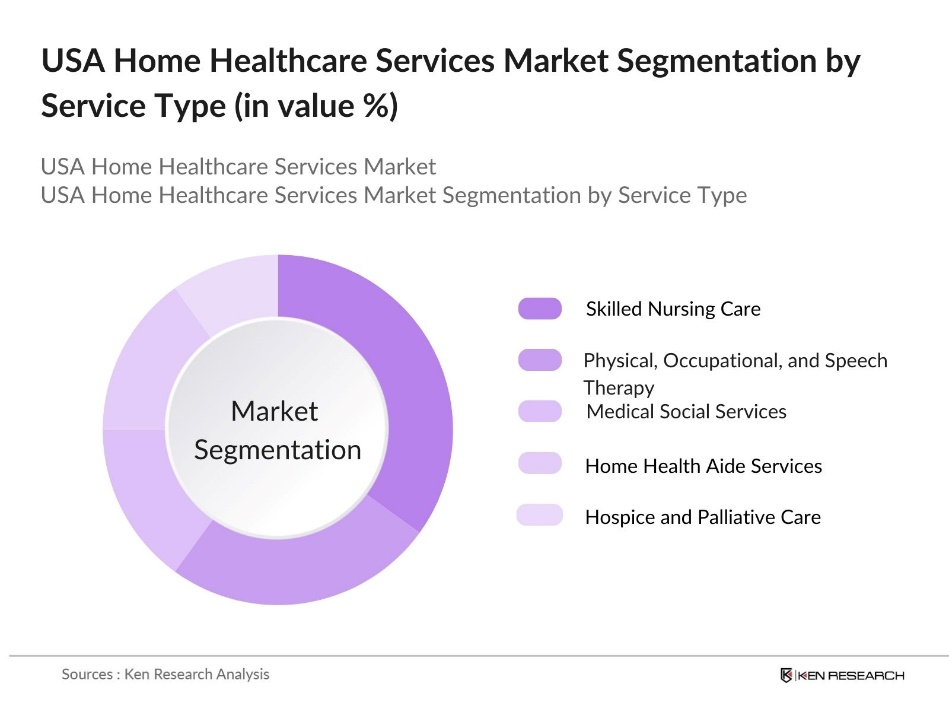

By Service Type: The market is segmented by service type into skilled nursing care, physical, occupational, and speech therapy, medical social services, home health aide services, and hospice and palliative care. Skilled nursing care holds a dominant market share within this segmentation. This dominance is attributed to the increasing number of patients requiring medical supervision for chronic illnesses, post-operative care, and medication management. The expertise of skilled nurses in providing specialized care at home reduces the need for prolonged hospital stays, aligning with patient preferences for home-based recovery.

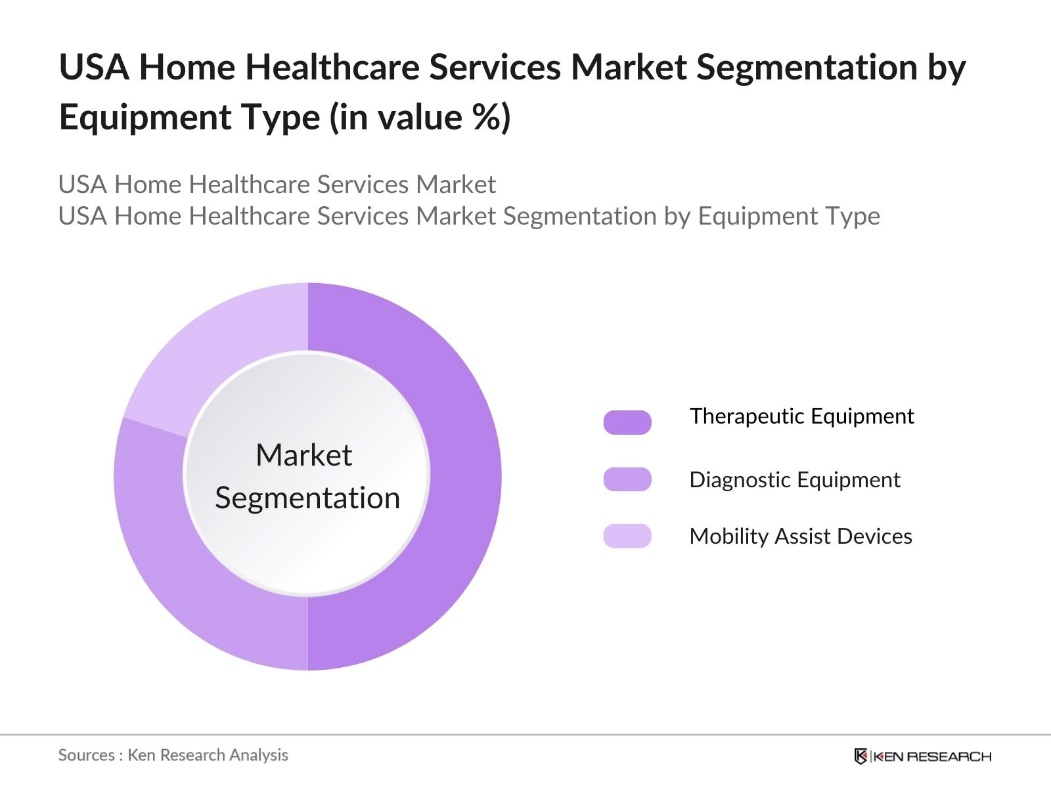

By Equipment Type: The market is segmented by equipment type into therapeutic equipment, diagnostic equipment, and mobility assist devices. Therapeutic equipment, including items such as home dialysis machines and respiratory therapy devices, leads this segment. The rising incidence of chronic diseases like diabetes and respiratory disorders necessitates the use of therapeutic equipment for ongoing treatment at home. Advancements in medical technology have made these devices more accessible and user-friendly, encouraging their adoption in home healthcare settings.

USA Home Healthcare Services Market Competitive Landscape

The U.S. home healthcare services market is characterized by the presence of several key players who offer a range of services and products to meet the diverse needs of patients. These companies have established strong market positions through extensive service portfolios, strategic acquisitions, and technological innovations.

USA Home Healthcare Services Industry Analysis

Growth Drivers

- Aging Population: The aging population in the United States is a primary driver for home healthcare services. According to the U.S. Census Bureau, by 2024, approximately 57 million Americans will be over 65, representing nearly 17% of the population. This demographic shift is accelerating the demand for home-based healthcare services, as older adults require more frequent medical attention and long-term care.

- Prevalence of Chronic Diseases: Chronic illnesses, such as diabetes and cardiovascular conditions, have become increasingly prevalent in the U.S. According to the CDC, approximately 28.7 million people in the U.S. have diabetes and 8.6 million are undiagnosed. These figures reflect the need for continuous monitoring and management, making home healthcare a viable solution. The cost of hospital admissions due to chronic diseases is also rising, intensifying the shift towards more affordable and accessible home care services.

- Technological Advancements: Technological advancements are revolutionizing home healthcare by enabling remote monitoring, real-time data tracking, and personalized care through mobile health (mHealth) applications. The adoption of wearable health devices supports chronic condition management, while telemedicine integration allows providers to deliver accessible, efficient care remotely. These innovations enhance patient engagement and expand healthcare accessibility, making home healthcare a viable, convenient alternative to traditional in-person care settings.

Market Challenges

- Regulatory Compliance: Home healthcare providers must navigate strict regulatory standards from federal and state agencies, including rigorous reporting and adherence to patient safety and quality guidelines. Programs like the Home Health Quality Reporting Program (HHQRP) establish compliance measures that Medicare-certified agencies must follow. Non-compliance can lead to penalties and reduced reimbursements, adding financial strain. Recent regulatory changes related to staffing and quality assessments have further increased the operational demands on providers.

- Workforce Shortages: The home healthcare industry faces significant workforce shortages, with demand for home health aides outpacing the available workforce. Challenges such as wage competition from other sectors and demanding work conditions have worsened this shortage, making it difficult for agencies to maintain adequate staffing. This shortage impacts the availability and quality of home healthcare services, with gaps in patient care and increased wait times.

USA Home Healthcare Services Market Future Outlook

Over the next five years, the U.S. home healthcare services market is expected to experience substantial growth. This expansion will be driven by continuous advancements in medical technology, increasing consumer demand for personalized and convenient care, and supportive government policies promoting home-based healthcare solutions. The integration of telehealth services and remote patient monitoring is anticipated to enhance the efficiency and reach of home healthcare providers, catering to a broader patient base.

Market Opportunities

- Telehealth Integration: The integration of telehealth presents a significant opportunity for home healthcare, enabling continuous patient monitoring and reducing the need for in-person visits. Telehealth allows providers to remotely address patients needs, offer consultations, and manage chronic conditions. With improved broadband access, telehealth has expanded across more households, allowing seamless remote care and enhancing the accessibility and convenience of healthcare services directly in the home setting.

- Expansion into Rural Areas: Expanding home healthcare into rural areas holds substantial potential, addressing the limited healthcare access many rural residents face. Home healthcare can bridge this gap, offering essential medical services and improving health outcomes in underserved regions. Government initiatives and incentives are supporting this expansion, funding programs aimed at extending home healthcare services to rural communities that traditionally lack nearby medical facilities.

Scope of the Report

|

Service Type |

Skilled Nursing Care |

|

Equipment Type |

Therapeutic Equipment |

|

Indication |

Cardiovascular Disorders |

|

Payer |

Public Insurance |

|

Region |

Northeast |

Products

Key Target Audience

Medical Equipment Manufacturers

Health Insurance Companies

Healthcare IT Industry

Government and Regulatory Bodies (e.g., Centers for Medicare & Medicaid Services)

Investors and venture capital Firms

Banks and Financial Institutions

Companies

Players Mentioned in the Report

Amedisys, Inc.

LHC Group, Inc.

Encompass Health Corporation

Brookdale Senior Living Inc.

Kindred Healthcare, LLC

AccentCare, Inc.

Interim HealthCare Inc.

Visiting Nurse Service of New York

Bayada Home Health Care

Addus HomeCare Corporation

Table of Contents

1. USA Home Healthcare Services Market Overview

1.1 Definition and Scope

1.2 Market Taxonomy

1.3 Market Growth Rate

1.4 Market Segmentation Overview

2. USA Home Healthcare Services Market Size (USD Mn)

2.1 Historical Market Size

2.2 Year-On-Year Growth Analysis

2.3 Key Market Developments and Milestones

3. USA Home Healthcare Services Market Analysis

3.1 Growth Drivers

3.1.1 Aging Population

3.1.2 Prevalence of Chronic Diseases

3.1.3 Technological Advancements

3.1.4 Cost-Effectiveness

3.2 Market Challenges

3.2.1 Regulatory Compliance

3.2.2 Workforce Shortages

3.2.3 Reimbursement Issues

3.3 Opportunities

3.3.1 Telehealth Integration

3.3.2 Expansion into Rural Areas

3.3.3 Personalized Care Models

3.4 Trends

3.4.1 Adoption of Remote Patient Monitoring

3.4.2 Value-Based Care Models

3.4.3 Increased Use of AI and Data Analytics

3.5 Government Regulations

3.5.1 Medicare and Medicaid Policies

3.5.2 Home Health Quality Reporting Program

3.5.3 State-Specific Licensing Requirements

3.6 SWOT Analysis

3.7 Stakeholder Ecosystem

3.8 Porters Five Forces Analysis

3.9 Competitive Landscape

4. USA Home Healthcare Services Market Segmentation

4.1 By Service Type (Value %)

4.1.1 Skilled Nursing Care

4.1.2 Physical, Occupational, and Speech Therapy

4.1.3 Medical Social Services

4.1.4 Home Health Aide Services

4.1.5 Hospice and Palliative Care

4.2 By Equipment Type (Value %)

4.2.1 Therapeutic Equipment

4.2.2 Diagnostic Equipment

4.2.3 Mobility Assist Devices

4.3 By Indication (Value %)

4.3.1 Cardiovascular Disorders

4.3.2 Diabetes

4.3.3 Respiratory Diseases

4.3.4 Cancer

4.3.5 Neurological Disorders

4.4 By Payer (Value %)

4.4.1 Public Insurance

4.4.2 Private Insurance

4.4.3 Out-of-Pocket

4.5 By Region (Value %)

4.5.1 Northeast

4.5.2 Midwest

4.5.3 South

4.5.4 West

5. USA Home Healthcare Services Market Competitive Analysis

5.1 Detailed Profiles of Major Companies

5.1.1 Amedisys, Inc.

5.1.2 LHC Group, Inc.

5.1.3 Encompass Health Corporation

5.1.4 Brookdale Senior Living Inc.

5.1.5 Kindred Healthcare, LLC

5.1.6 AccentCare, Inc.

5.1.7 Interim HealthCare Inc.

5.1.8 Visiting Nurse Service of New York

5.1.9 Bayada Home Health Care

5.1.10 Addus HomeCare Corporation

5.1.11 Elara Caring

5.1.12 BrightStar Care

5.1.13 Home Instead, Inc.

5.1.14 VITAS Healthcare

5.1.15 Medline Industries, LP

5.2 Cross Comparison Parameters (Number of Employees, Headquarters, Inception Year, Revenue, Service Portfolio, Geographic Presence, Accreditation Status, Technological Adoption)

5.3 Market Share Analysis

5.4 Strategic Initiatives

5.5 Mergers and Acquisitions

5.6 Investment Analysis

5.6.1 Venture Capital Funding

5.6.2 Government Grants

5.6.3 Private Equity Investments

6. USA Home Healthcare Services Market Regulatory Framework

6.1 Federal Regulations

6.2 State Regulations

6.3 Accreditation Standards

6.4 Compliance Requirements

7. USA Home Healthcare Services Future Market Size (USD Mn)

7.1 Future Market Size Projections

7.2 Key Factors Driving Future Market Growth

8. USA Home Healthcare Services Future Market Segmentation

8.1 By Service Type (Value %)

8.2 By Equipment Type (Value %)

8.3 By Indication (Value %)

8.4 By Payer (Value %)

8.5 By Region (Value %)

9. USA Home Healthcare Services Market Analysts Recommendations

9.1 Total Addressable Market (TAM), Serviceable Available Market (SAM), Serviceable Obtainable Market (SOM) Analysis

9.2 Customer Cohort Analysis

9.3 Marketing Initiatives

9.4 White Space Opportunity Analysis

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

The initial phase involves constructing an ecosystem map encompassing all major stakeholders within the U.S. Home Healthcare Services Market. This step is underpinned by extensive desk research, utilizing a combination of secondary and proprietary databases to gather comprehensive industry-level information. The primary objective is to identify and define the critical variables that influence market dynamics.

Step 2: Market Analysis and Construction

In this phase, we compile and analyze historical data pertaining to the U.S. Home Healthcare Services Market. This includes assessing market penetration, the ratio of service providers to patients, and the resultant revenue generation. Furthermore, an evaluation of service quality statistics is conducted to ensure the reliability and accuracy of the revenue estimates, taking into account the impact of emerging technologies and regulatory changes in the market.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses are developed and subsequently validated through in-depth interviews with industry experts, leveraging computer-assisted telephone interviews (CATIs) and surveys. These consultations provide valuable insights from professionals across home healthcare service providers, equipment manufacturers, and healthcare consultants, refining and corroborating market data.

Step 4: Research Synthesis and Final Output

The final phase involves synthesizing research findings from primary and secondary sources, ensuring a balanced and comprehensive view of the U.S. Home Healthcare Services Market. The insights gathered from direct industry engagement are cross-verified with quantitative data to produce a robust, validated analysis that supports strategic decision-making.

Frequently Asked Questions

01 How big is the U.S. Home Healthcare Services Market?

The U.S. Home Healthcare Services Market is valued at USD 95.44 billion, driven by the rising demand for in-home care solutions, particularly among elderly and chronically ill populations.

02 What challenges does the U.S. Home Healthcare Services Market face?

Challenges in U.S. Home Healthcare Services Market include regulatory compliance complexities, workforce shortages, and reimbursement hurdles, which affect the sustainability and scalability of home healthcare services.

03 Who are the major players in the U.S. Home Healthcare Services Market?

Key players in U.S. Home Healthcare Services Market include Amedisys, Inc., LHC Group, Inc., Encompass Health Corporation, Brookdale Senior Living Inc., and Kindred Healthcare, LLC, each with a significant market presence and service breadth.

04 What drives growth in the U.S. Home Healthcare Services Market?

The U.S. Home Healthcare Services Market growth is driven by an aging population, a high prevalence of chronic conditions, and a preference for cost-effective, convenient home-based care solutions.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.