USA Honey Production Market Outlook to 2030

Region:North America

Author(s):Abhinav kumar

Product Code:KROD7046

December 2024

90

About the Report

USA Honey Production Market Overview

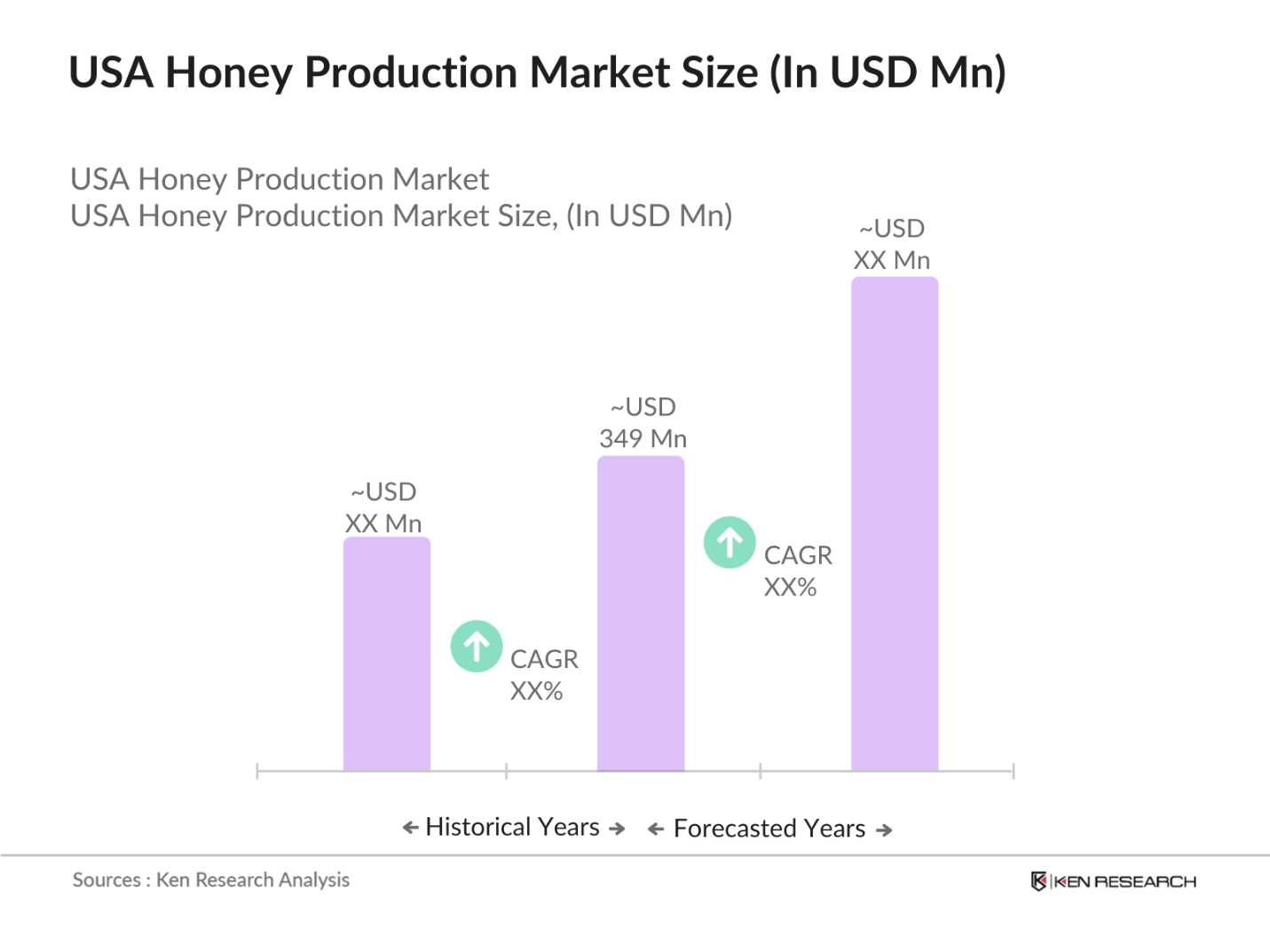

- The USA Honey Production market is valued at USD 349 million in 2023, supported by factors such as increasing consumer demand for organic and raw honey due to rising health consciousness. Honey has gained recognition as a healthier alternative to refined sugars, and its medicinal properties are also driving demand. Government support for the beekeeping industry, including subsidies and grants for bee colony preservation, has further bolstered production, contributing to market growth. Data from the USDA confirms steady expansion, with a rising interest in sustainable agriculture practices.

- The USA honey market is primarily dominated by states like North Dakota, California, and South Dakota, due to their favorable climates and large-scale apiary operations. North Dakota leads the nation in honey production, thanks to vast areas of forage for bees, including sunflowers and canola. Additionally, Californias almond orchards heavily rely on bee pollination, driving demand for commercial beekeeping services in the state. These regions natural resources, combined with well-established commercial honey operations, make them leading contributors to the industry.

- The USDA has strict standards for organic honey certification, ensuring that honey is produced in an environment free from synthetic pesticides and GMOs. In 2024, the USDA revised its certification process, requiring beekeepers to maintain a buffer zone between their hives and non-organic crops, ensuring honey purity. Over 400 U.S. honey producers are currently certified organic under these guidelines, contributing to the growth of the organic honey market. The USDAs oversight ensures that U.S. organic honey meets the highest quality standards, providing a competitive edge in both domestic and international markets.

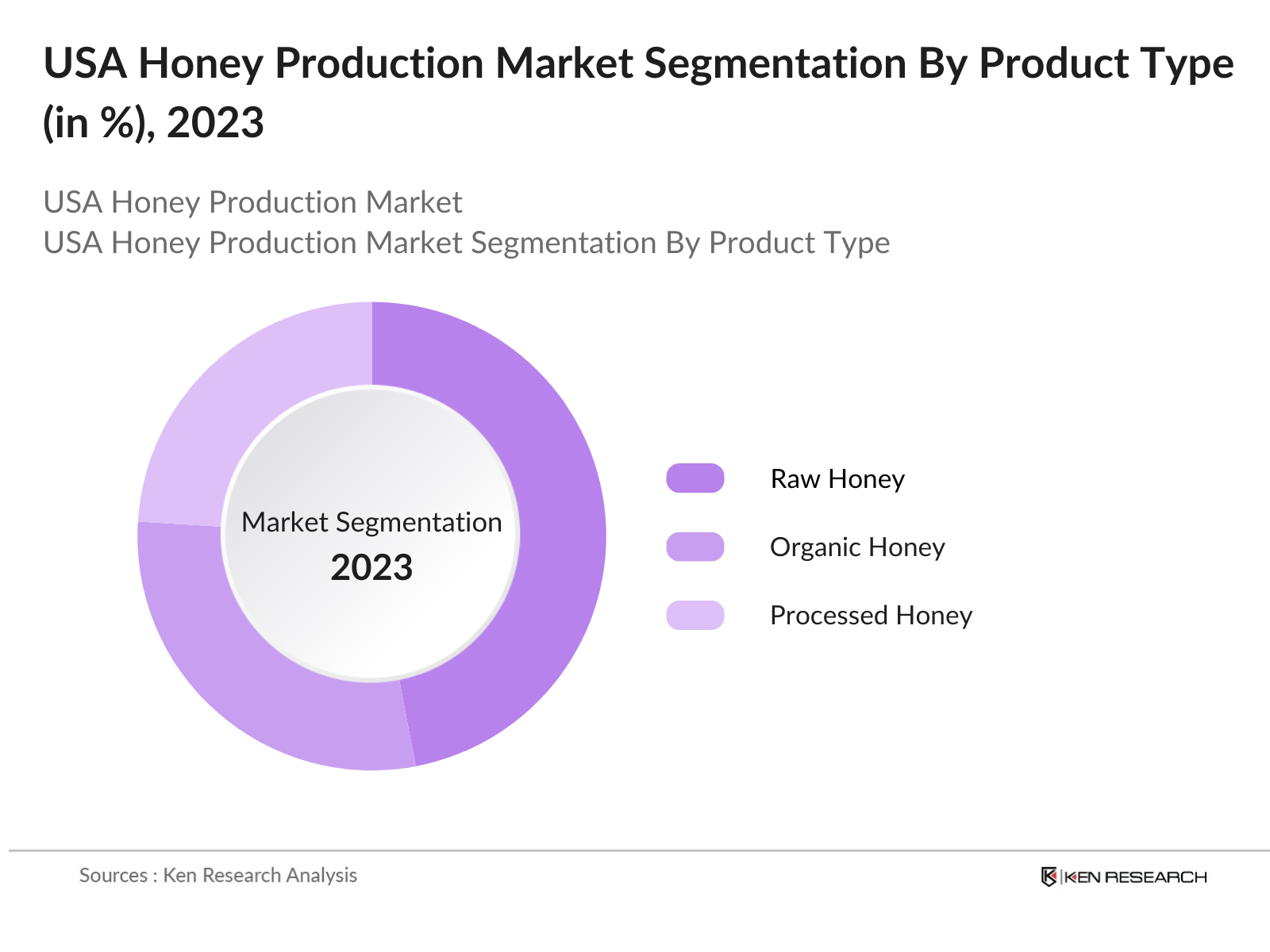

USA Honey Production Market Segmentation

By Product Type: The USA honey market is segmented by product type into raw honey, organic honey, and processed honey. Raw honey holds the dominant market share within the product type segmentation. This is largely due to increasing consumer demand for unprocessed, unpasteurized honey, which is perceived as healthier and more beneficial for immunity and digestive health. Consumers are actively seeking minimally processed food products, contributing to the prominence of raw honey in retail shelves and health food stores across the country.

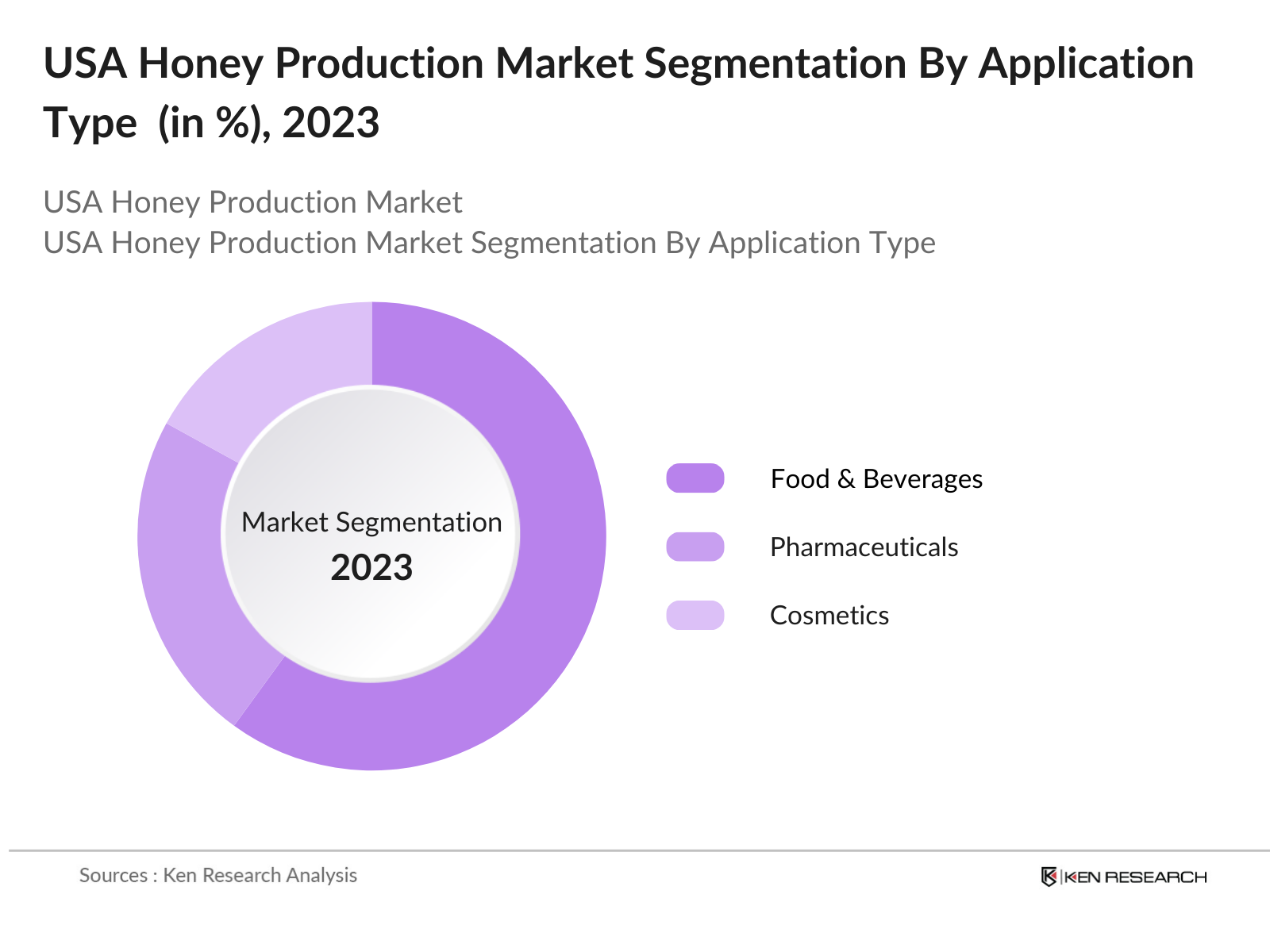

By Application: The USA honey market is segmented by application into food & beverages, pharmaceuticals, and cosmetics. The food & beverages segment commands the largest market share. Honey is widely used as a natural sweetener in a variety of products ranging from baked goods to teas and beverages. Its versatility and growing use in plant-based and functional food products also contribute to its widespread application. As health-conscious consumers continue to avoid artificial sweeteners, honey remains a popular choice for food manufacturers.

USA Honey Production Market Competitive Landscape

The USA Honey Production market is dominated by several key players, each bringing different strengths to the industry. While large-scale producers focus on high production volumes and distribution networks, artisanal honey producers have carved out niches by emphasizing organic and raw honey products. The competitive landscape is characterized by strategic initiatives like product diversification, export expansion, and partnerships with retailers to boost visibility and consumer reach. Localized operations in key honey-producing states also give these companies an edge in optimizing production.

|

Company Name |

Established Year |

Headquarters |

Production Volume (Metric Tons) |

Product Offerings |

Organic Certification |

Sustainability Initiatives |

Distribution Network |

|

Bee Natural Honey |

1990 |

California |

_ |

_ |

_ |

_ |

_ |

|

Dutch Gold Honey |

1946 |

Pennsylvania |

_ |

_ |

_ |

_ |

_ |

|

Nature Nates Honey Co. |

1972 |

Texas |

_ |

_ |

_ |

_ |

_ |

|

Sue Bee Honey |

1921 |

Iowa |

_ |

_ |

_ |

_ |

_ |

|

Savannah Bee Company |

2002 |

Georgia |

_ |

_ |

_ |

_ |

_ |

USA Honey Production Industry Analysis

Growth Drivers

- Increasing Consumer Demand for Organic Honey: The demand for organic honey in the USA has surged due to consumer preferences for natural and organic products. According to data from the USDA, organic farming in the United States saw a significant rise, with over 16,585 certified organic farms operating in 2024. The demand for organic honey correlates with a shift in consumer behavior, where over 35% of U.S. households now prioritize organic food consumption, including honey, as part of their regular diet. This shift is supported by macroeconomic factors such as higher disposable income and awareness of health benefits.

- Government Support for Beekeeping: The U.S. government continues to support the beekeeping industry through various initiatives. In 2024, the USDAs Beekeeping Assistance Program allocated $10 million in grants and subsidies to support sustainable beekeeping practices. These funds are part of a larger initiative to enhance pollinator health and boost honey production. Additionally, state-level programs, such as Californias Bee Informed Partnership, have provided localized support, helping small-scale beekeepers with up to $2 million in financial aid to sustain operations during challenging environmental conditions.

- Rise of Health-Conscious Consumers: The growing health consciousness among U.S. consumers is a major driver for the honey market. According to a survey conducted by the U.S. Department of Health in 2024, over 60 million Americans report prioritizing natural sweeteners, such as honey, over processed sugars in their diet. This rise is linked to the increased awareness of the nutritional benefits of honey, which contains antioxidants and anti-inflammatory properties. The U.S. honey production industry benefits from this health trend, as consumers increasingly opt for honey in food products, teas, and health supplements.

Market Challenges

- Environmental Challenges Impacting Beekeeping: Environmental challenges such as climate change pose a significant threat to U.S. honey production. Data from the National Climate Assessment in 2024 shows that extreme weather events, including prolonged droughts in California and hurricanes in the Southeast, have led to a reduction in bee populations, impacting honey yields. With California producing over 27% of U.S. honey, any environmental disruptions in this region have substantial implications for the market. Bee-friendly crop programs are vital, but the industry continues to face unpredictable environmental hurdles.

- Decline in Bee Populations: Colony Collapse Disorder (CCD) remains a critical issue for U.S. beekeepers. The USDA's 2023 Honey Bee Health Survey reported a 45% decline in managed bee colonies due to factors like pesticides, habitat loss, and diseases. This dramatic reduction has had a direct impact on honey production, with many beekeepers facing declining honey yields as they struggle to maintain healthy colonies. Federal initiatives to combat CCD are ongoing, but the issue continues to pose a significant challenge to the long-term sustainability of honey production in the U.S.

USA Honey Production Market Future Outlook

Over the next five years, the USA Honey Production market is poised for steady growth, driven by increasing consumer preference for organic, raw honey products, and heightened awareness of the role of pollinators in sustaining agriculture. Sustainable beekeeping practices will continue to gain prominence, with technology innovations like hive monitoring systems enhancing production efficiency. Expansion in export markets, particularly in Europe and Asia, will further contribute to revenue growth for American honey producers. Moreover, collaborations with food and beverage manufacturers for innovative honey-infused products will open new avenues for the market.

Opportunities

- Growth in Organic Honey Production: The U.S. organic honey sector has shown resilience and growth potential. In 2023, the USDA reported a 15% increase in certified organic honey farms, with an additional 250 beekeepers transitioning to organic practices. This growth is supported by consumer demand for sustainably sourced and chemical-free honey, with over 500 tons of organic honey produced in the country. With the growing emphasis on organic agriculture, the U.S. honey market is expected to continue benefiting from this shift, especially as consumers seek out premium, organic products.

- Expanding Export Market: The U.S. honey industry is increasingly tapping into international markets, with exports rising by 10,000 tons in 2023, according to the U.S. Census Bureaus trade data. Key markets include the European Union and Japan, where the demand for organic and high-quality honey is growing. In particular, American honey is seen as a premium product in these regions due to the stringent production and purity standards enforced by the USDA. With the expansion of free trade agreements, the export potential for U.S. honey producers is expected to grow further in the coming years.

Scope of the Report

|

By Product Type |

Raw Honey Organic Honey Processed Honey |

|

By Application |

Food & Beverages Pharmaceuticals Cosmetics |

|

By Processing Technique |

Pasteurized Unpasteurized Strained Honey |

|

By Distribution Channel |

Supermarkets/Hypermarkets Specialty Stores Online Retail |

|

By Region |

Midwest Northeast West South |

Products

Key Target Audience Organizations and Entities Who Can Benefit by Subscribing to This Report:

Commercial Beekeepers

Honey Distribution companies

Food & Beverage Manufacturers

Pharmaceutical Companies

Cosmetics Manufacturers

Investments and Venture Capitalist Firms

Government and Regulatory Bodies (USDA, FDA)

Sustainability Advocacy Groups

Companies

Players Mentioned in the Report:

Bee Natural Honey

Dutch Gold Honey

Nature Nates Honey Co.

Sue Bee Honey

Savannah Bee Company

Beeyond the Hive

Golden Blossom Honey

The Honey Jar

Millers Honey Company

Cloister Honey

Honey Pacifica

Really Raw Honey

Waxing Kara

Wedderspoon

Mohawk Valley Trading Company

Table of Contents

1. USA Honey Production Market Overview

1.1 Definition and Scope

1.2 Market Taxonomy

1.3 Market Growth Rate (Metric Tons, USD Value, % Growth)

1.4 Market Segmentation Overview (Product Type, Application, Processing Technique, Distribution Channel, Region)

2. USA Honey Production Market Size (In USD Mn & Metric Tons)

2.1 Historical Market Size

2.2 Year-On-Year Growth Analysis

2.3 Key Market Developments and Milestones

3. USA Honey Production Market Analysis

3.1 Growth Drivers

3.1.1 Increasing Consumer Demand for Organic Honey

3.1.2 Government Support for Beekeeping (Grants, Subsidies)

3.1.3 Rise of Health-Conscious Consumers

3.1.4 Sustainability Initiatives in Agriculture

3.2 Market Challenges

3.2.1 Environmental Challenges Impacting Beekeeping

3.2.2 Decline in Bee Populations (Colony Collapse Disorder)

3.2.3 Competition from Imported Honey

3.3 Opportunities

3.3.1 Growth in Organic Honey Production

3.3.2 Expanding Export Market

3.3.3 Technological Innovations in Beekeeping

3.4 Trends

3.4.1 Increased Preference for Raw and Unprocessed Honey

3.4.2 Adoption of Sustainable Beekeeping Practices

3.4.3 Rise of Honey as an Ingredient in Cosmetic and Pharmaceutical Products

3.5 Government Regulations

3.5.1 USDA Standards for Organic Honey Certification

3.5.2 FDA Guidelines on Honey Labeling and Purity

3.5.3 Local State-Level Regulations on Honey Production and Sales

3.6 SWOT Analysis

3.7 Stake Ecosystem

3.8 Porters Five Forces

3.9 Competition Ecosystem

4. USA Honey Production Market Segmentation

4.1 By Product Type (In Value %)

4.1.1 Raw Honey

4.1.2 Organic Honey

4.1.3 Processed Honey

4.2 By Application (In Value %)

4.2.1 Food & Beverages

4.2.2 Pharmaceuticals

4.2.3 Cosmetics

4.3 By Processing Technique (In Value %)

4.3.1 Pasteurized

4.3.2 Unpasteurized

4.3.3 Strained Honey

4.4 By Distribution Channel (In Value %)

4.4.1 Supermarkets/Hypermarkets

4.4.2 Specialty Stores

4.4.3 Online Retail

4.5 By Region (In Value %)

4.5.1 Midwest

4.5.2 Northeast

4.5.3 West

4.5.4 South

5. USA Honey Production Market Competitive Analysis

5.1 Detailed Profiles of Major Companies

5.1.1 Bee Natural Honey

5.1.2 Dutch Gold Honey

5.1.3 Beeyond the Hive

5.1.4 Nature Nates Honey Co.

5.1.5 Sue Bee Honey

5.1.6 Golden Blossom Honey

5.1.7 Millers Honey Company

5.1.8 Wedderspoon

5.1.9 The Honey Jar

5.1.10 Waxing Kara

5.1.11 Really Raw Honey

5.1.12 Savannah Bee Company

5.1.13 Honey Pacifica

5.1.14 Cloister Honey

5.1.15 Mohawk Valley Trading Company

5.2 Cross Comparison Parameters (Production Capacity, Headquarters, Inception Year, Honey Varieties, Revenue, Market Reach, Sustainability Certifications, Sourcing Practices)

5.3 Market Share Analysis

5.4 Strategic Initiatives

5.5 Mergers and Acquisitions

5.6 Investment Analysis

5.7 Government Grants and Subsidies

5.8 Private Equity and Venture Capital Funding

6. USA Honey Production Market Regulatory Framework

6.1 USDA Organic Certification Standards

6.2 FDA Honey Labeling Regulations

6.3 Environmental Compliance Requirements

6.4 Beekeeping Permits and Zoning Laws

7. USA Honey Production Future Market Size (In USD Mn & Metric Tons)

7.1 Future Market Size Projections

7.2 Key Factors Driving Future Market Growth

8. USA Honey Production Future Market Segmentation

8.1 By Product Type (In Value %)

8.2 By Application (In Value %)

8.3 By Processing Technique (In Value %)

8.4 By Distribution Channel (In Value %)

8.5 By Region (In Value %)

9. USA Honey Production Market Analysts Recommendations

9.1 TAM/SAM/SOM Analysis

9.2 Customer Cohort Analysis

9.3 Marketing Initiatives

9.4 White Space Opportunity Analysis

Research Methodology

Step 1: Identification of Key Variables

The initial step involved identifying critical variables impacting the USA Honey Production Market, including honey production volumes, consumer preferences, and regulatory factors. Primary data was gathered through a comprehensive review of government databases such as the USDA and market studies.

Step 2: Market Analysis and Construction

In this phase, data from industry reports, government statistics, and interviews with key stakeholders were compiled to understand the markets growth trajectory. Detailed analysis of honey production trends and supply chain efficiency was conducted to estimate future growth.

Step 3: Hypothesis Validation and Expert Consultation

Hypotheses on market drivers, such as sustainability initiatives and consumer health trends, were validated through consultations with industry experts, including commercial beekeepers and distributors. These insights refined the market model and confirmed growth assumptions.

Step 4: Research Synthesis and Final Output

The final stage involved synthesizing data into a comprehensive market report. Engagement with honey producers provided first-hand information on production costs, challenges in scaling operations, and strategies for market expansion.

Frequently Asked Questions

01. How big is the USA Honey Production Market?

The USA Honey Production market is valued at USD 349 million, driven by the increasing demand for organic and raw honey, along with government support for sustainable beekeeping practices.

02. What are the challenges in the USA Honey Production Market?

Challenges include environmental threats like Colony Collapse Disorder, which impacts bee populations, and competition from cheaper imported honey, which can undercut local producers.

03. Who are the major players in the USA Honey Production Market?

Key players include Bee Natural Honey, Dutch Gold Honey, Nature Nates Honey Co., Sue Bee Honey, and Savannah Bee Company. These companies dominate due to their strong production capabilities and distribution networks.

04. What are the growth drivers of the USA Honey Production Market?

Growth drivers include rising health consciousness among consumers, increasing demand for natural sweeteners, and technological advancements in beekeeping, which improve production efficiency.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.