USA Household Products Market Outlook to 2030

Region:North America

Author(s):Paribhasha Tiwari

Product Code:KROD10799

November 2024

89

About the Report

USA Household Products Market Overview

- The USA Household Products Market is valued at USD 67.5 billion, driven by shifting consumer preferences toward sustainable, eco-friendly products and the increasing adoption of technology-enhanced cleaning and organization solutions. Demand is further amplified by a rising focus on health and hygiene following recent global health crises, driving substantial sales in cleaning and personal care products. This market growth is largely sustained by robust consumer spending patterns and the advent of online retail.

- Metropolitan areas such as New York, Los Angeles, and Chicago dominate the household products market in the USA due to their dense populations and higher disposable incomes, which foster demand for premium and branded household products. Additionally, these regions have a high adoption rate of technologically advanced and sustainable products, which appeals to their environmentally conscious consumers.

- The U.S. government introduced subsidies for manufacturers prioritizing eco-friendly materials, benefiting over 30,000 companies in 2024. These incentives have encouraged brands to innovate around sustainable products, driving the availability of green options for consumers and supporting the countrys commitment to reducing carbon footprints.

USA Household Products Market Segmentation

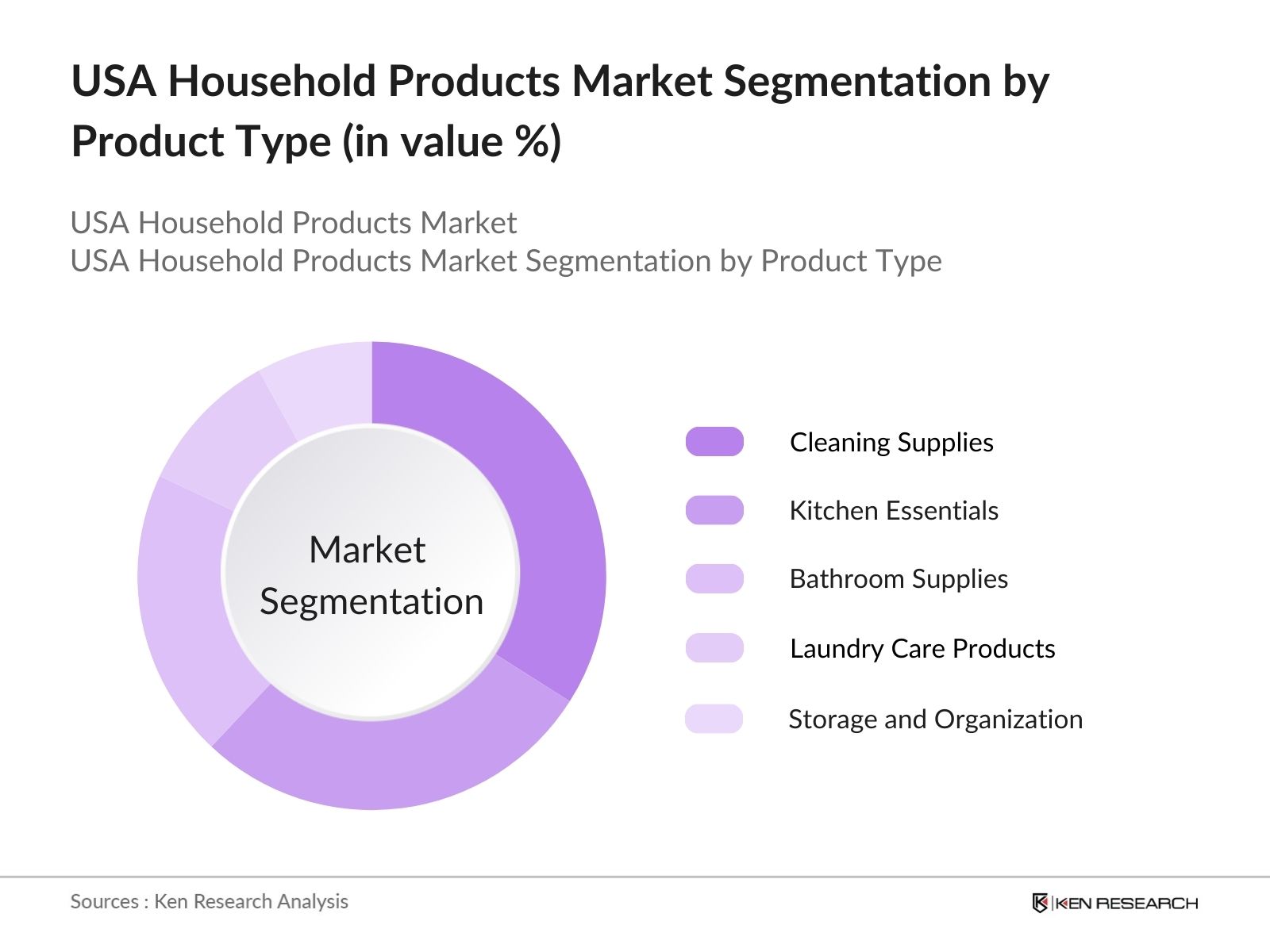

By Product Type: The USA Household Products Market is segmented by product type into cleaning supplies, kitchen essentials, bathroom supplies, laundry care products, and storage and organization. Cleaning supplies hold the largest market share due to heightened awareness of cleanliness and hygiene, which surged particularly in recent years. Consumers prioritize products from well-known brands such as Clorox and Lysol, trusted for their efficacy in disinfecting and cleaning.

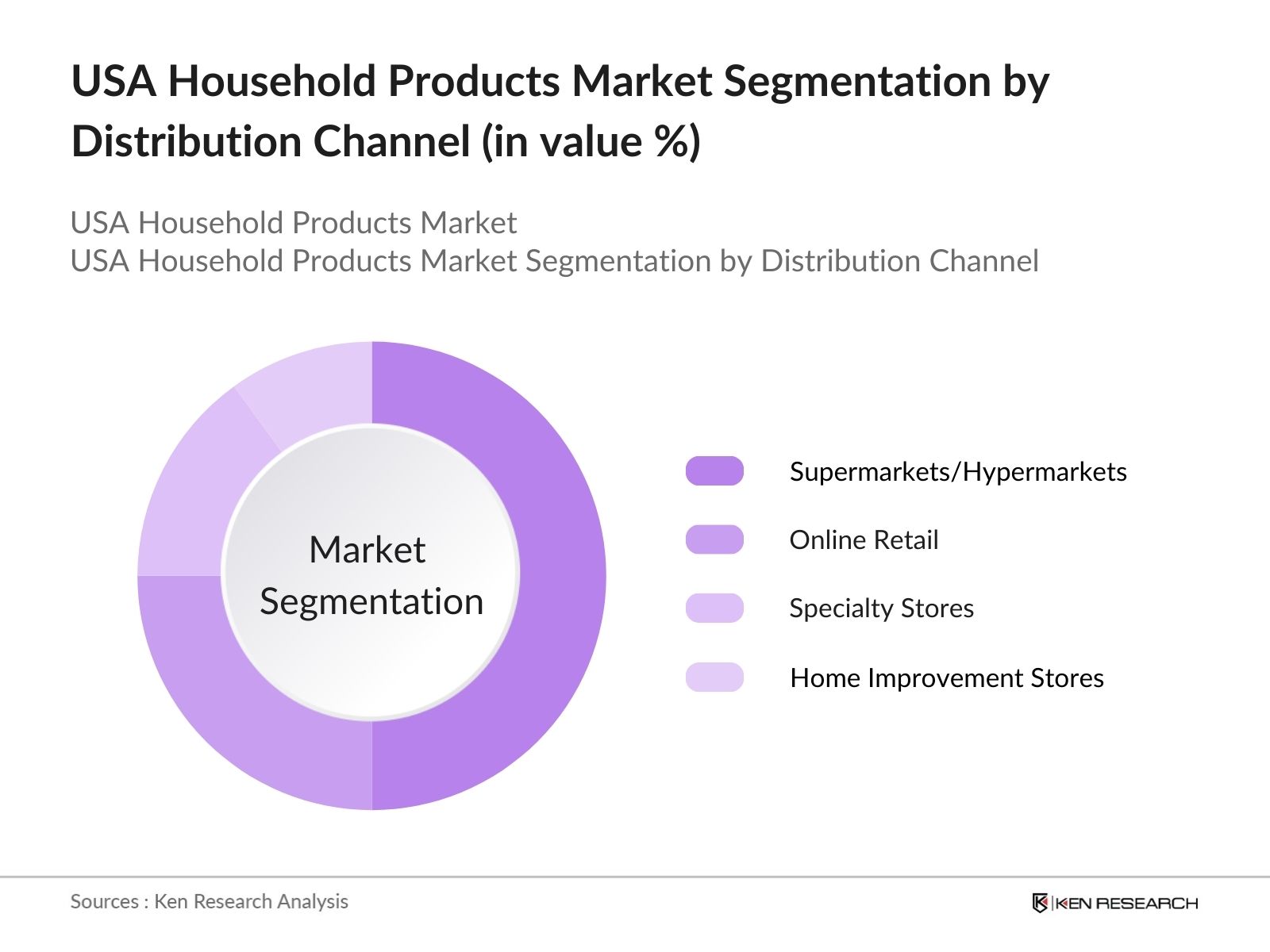

By Distribution Channel: This market is also segmented by distribution channels, including supermarkets/hypermarkets, online retail, specialty stores, and home improvement stores. Supermarkets and hypermarkets lead in market share, as they offer a wide range of household products in one place, allowing consumers to compare brands and products. Chains like Walmart and Target dominate due to their expansive store network and competitive pricing, appealing to a large consumer base.

USA Household Products Market Competitive Landscape

The USA Household Products Market is dominated by a mix of domestic and international players, with some of the largest manufacturers holding a significant share due to brand loyalty, innovation, and extensive distribution networks. The USA household products market features significant competition among major players, including Procter & Gamble, Unilever, and Colgate-Palmolive, which lead due to their strong brand recognition, robust distribution strategies, and innovative product lines focused on sustainability.

USA Household Products Market Analysis

Growth Drivers

- Shift in Consumer Preferences: The growing trend toward personalized household products, especially in cleaning and organization, has seen increased demand. For example, approximately 85 million U.S. households in 2024 are prioritizing convenience-focused products, reflecting a shift in consumer preferences toward ease-of-use and time-saving items. This data aligns with shifts in consumer spending patterns where U.S. household expenditures have increasingly emphasized value-added household items.

- Demand for Eco-Friendly Products: The rise in environmentally conscious consumers has led to a substantial demand for sustainable household goods. Nearly 120 million U.S. households actively purchase eco-friendly products, such as biodegradable or recycled goods, up from 92 million in 2020. This demand is supported by federal initiatives promoting eco-friendly manufacturing and disposal methods, encouraging companies to innovate on sustainable packaging and materials in 2024.

- Impact of E-commerce on Product Accessibility: E-commerce has expanded access to a broader range of household products, with data showing that nearly 105 million households shop online for household essentials. Online retail growth offers diversified and often lower-cost alternatives to consumers, reflecting an increase in household goods sales through digital platforms by over 18 billion units annually, largely due to the accessibility and variety of products available online.

Market Challenges

- Rising Raw Material Costs: The cost of essential materials for household goods, such as plastics and chemicals, has surged, impacting profit margins for manufacturers. Reports indicate that the average price of key raw materials has increased by 8 billion USD, stressing household product companies and leading to higher consumer prices in 2024. This trend has also been influenced by supply chain disruptions and inflationary pressures.

- Stringent Environmental Regulations: Government-imposed environmental regulations on household product manufacturing and waste disposal have intensified, affecting around 75% of industry participants in 2024. Compliance with stricter waste management laws and emission reduction targets has led to added production costs and operational delays for manufacturers, limiting market growth and product affordability for consumers.

USA Household Products Market Future Outlook

Over the next five years, the USA Household Products Market is expected to witness steady growth, bolstered by increased consumer inclination toward eco-friendly products and smart household solutions. This trend is driven by ongoing environmental awareness campaigns and consumer demand for convenience-enhancing products. Additionally, technological integration and brand-driven innovation will play significant roles in shaping market expansion, with brands focusing on minimizing environmental impact while meeting consumer needs.

Market Opportunities

- Growth in Subscription-Based Models: Subscription-based purchasing has become a viable model, with 45 million U.S. households enrolled in home product subscriptions in 2024. These models, particularly popular for cleaning supplies and personal care items, offer convenience and repeat purchases for consumers while enabling manufacturers to build a stable revenue stream, indicating further growth potential for direct-to-consumer brands.

- Technological Innovations (IoT-Enabled Devices): IoT-enabled household products, including smart cleaning robots and automated storage, are gaining traction, with over 16 million U.S. households adopting such technologies in 2024. This surge aligns with advancements in AI-driven home automation, which are forecasted to improve energy efficiency and user convenience, driving substantial consumer interest in tech-integrated household products.

Scope of the Report

|

By Product Type |

Cleaning Supplies Kitchen Essentials Bathroom Supplies Laundry Care Products Storage and Organization |

|

By Distribution Channel |

Supermarkets/Hypermarkets Online Retail Specialty Stores Home Improvement Stores |

|

By Price Range |

Premium Products Mid-Range Products Value Products |

|

By Material Type |

Plastic-Based Products Metal-Based Products Biodegradable and Eco-Friendly Products Mixed Material Products |

|

By Consumer Demographics |

Millennial Households Family Households Single-Occupant Households |

Products

Key Target Audience

Investors and Venture Capitalist Firms

Government and Regulatory Bodies (U.S. Environmental Protection Agency, Federal Trade Commission)

Household Product Manufacturers

Smart Home Product Innovators

Sustainability-Focused Organizations

Retail Chains and Supermarkets

Logistics and Supply Chain Companies

Research and Development Firms

Companies

Players Mentioned in the Report:

Procter & Gamble

Unilever

Colgate-Palmolive

Kimberly-Clark Corporation

Reckitt Benckiser Group plc

SC Johnson

The Clorox Company

Church & Dwight Co., Inc.

Seventh Generation

Ecover

Table of Contents

1. USA Household Products Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. USA Household Products Market Size (In USD Billion)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. USA Household Products Market Analysis

3.1. Growth Drivers

3.1.1. Shift in Consumer Preferences

3.1.2. Demand for Eco-Friendly Products

3.1.3. Impact of E-commerce on Product Accessibility

3.1.4. Urbanization and Space Optimization Trends

3.2. Market Challenges

3.2.1. Rising Raw Material Costs

3.2.2. Stringent Environmental Regulations

3.2.3. Increased Competition from International Brands

3.3. Opportunities

3.3.1. Growth in Subscription-Based Models

3.3.2. Technological Innovations (IoT-Enabled Devices)

3.3.3. Expansion in Emerging Markets

3.4. Trends

3.4.1. Sustainability and Green Labeling

3.4.2. Increasing Popularity of DIY and Customizable Products

3.4.3. Integration with Smart Home Systems

3.5. Regulatory Landscape

3.5.1. EPA Regulations

3.5.2. Safety and Labeling Standards

3.5.3. Import Tariffs and Trade Policies

3.6. SWOT Analysis

3.7. Supply Chain Analysis

3.8. Porters Five Forces Analysis

3.9. Market Ecosystem

4. USA Household Products Market Segmentation

4.1. By Product Type (In Value %)

4.1.1. Cleaning Supplies

4.1.2. Kitchen Essentials

4.1.3. Bathroom Supplies

4.1.4. Laundry Care Products

4.1.5. Storage and Organization

4.2. By Distribution Channel (In Value %)

4.2.1. Supermarkets/Hypermarkets

4.2.2. Online Retail

4.2.3. Specialty Stores

4.2.4. Home Improvement Stores

4.3. By Price Range (In Value %)

4.3.1. Premium Products

4.3.2. Mid-Range Products

4.3.3. Value Products

4.4. By Material Type (In Value %)

4.4.1. Plastic-Based Products

4.4.2. Metal-Based Products

4.4.3. Biodegradable and Eco-Friendly Products

4.4.4. Mixed Material Products

4.5. By Consumer Demographics (In Value %)

4.5.1. Millennial Households

4.5.2. Family Households

4.5.3. Single-Occupant Households

5. USA Household Products Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. Procter & Gamble

5.1.2. Unilever

5.1.3. Colgate-Palmolive

5.1.4. Henkel AG & Co. KGaA

5.1.5. Church & Dwight Co., Inc.

5.1.6. Reckitt Benckiser Group plc

5.1.7. SC Johnson

5.1.8. Kimberly-Clark Corporation

5.1.9. Clorox Company

5.1.10. Newell Brands

5.1.11. Libman Company

5.1.12. Seventh Generation

5.1.13. Armaly Brands

5.1.14. Ecover

5.1.15. Method Products, PBC

5.2. Cross Comparison Parameters (Revenue, Market Presence, Employee Count, Product Portfolio, Sustainability Initiatives, Distribution Network, Brand Equity, Technology Integration)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Private Equity Investments

6. USA Household Products Market Regulatory Framework

6.1. Product Safety Standards

6.2. Labeling and Ingredient Transparency

6.3. Environmental Compliance Requirements

7. USA Household Products Future Market Size (In USD Billion)

7.1. Future Market Size Projections

7.2. Key Factors Influencing Future Growth

8. USA Household Products Future Market Segmentation

8.1. By Product Type (In Value %)

8.2. By Distribution Channel (In Value %)

8.3. By Price Range (In Value %)

8.4. By Material Type (In Value %)

8.5. By Consumer Demographics (In Value %)

9. USA Household Products Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Consumer Cohort Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

This phase includes mapping all significant stakeholders within the USA Household Products Market. We conducted extensive desk research, relying on secondary and proprietary databases, to identify the core variables that influence market growth.

Step 2: Market Analysis and Construction

Historical data from industry sources and proprietary analysis helped in assessing market dynamics, supply-demand factors, and product penetration rates. This approach ensures accurate representation of revenue data and market trends.

Step 3: Hypothesis Validation and Expert Consultation

Key market hypotheses were developed and validated through structured interviews with industry experts from leading companies, who provided insights into operational strategies and market shifts.

Step 4: Research Synthesis and Final Output

The final phase synthesized data from various sources, including direct feedback from market practitioners, resulting in a validated, comprehensive overview of the USA Household Products Market dynamics.

Frequently Asked Questions

1. How big is the USA Household Products Market?

The USA Household Products Market is valued at USD 67.5 billion, driven by consumer demand for hygiene, sustainability, and convenience in household management.

2. What challenges does the USA Household Products Market face?

Major challenges include rising raw material costs, stringent environmental regulations, and intense competition from both established and emerging brands.

3. Who are the major players in the USA Household Products Market?

Leading players include Procter & Gamble, Unilever, Colgate-Palmolive, and Kimberly-Clark Corporation, each recognized for strong brand loyalty and distribution networks.

4. What drives growth in the USA Household Products Market?

Growth is propelled by increased consumer preference for sustainable products, technological advancements in product design, and the expansion of e-commerce.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.