USA HVAC Market Outlook to 2030

Region:North America

Author(s):Shubham Kashyap

Product Code:KROD3457

October 2024

85

About the Report

USA HVAC Market Overview

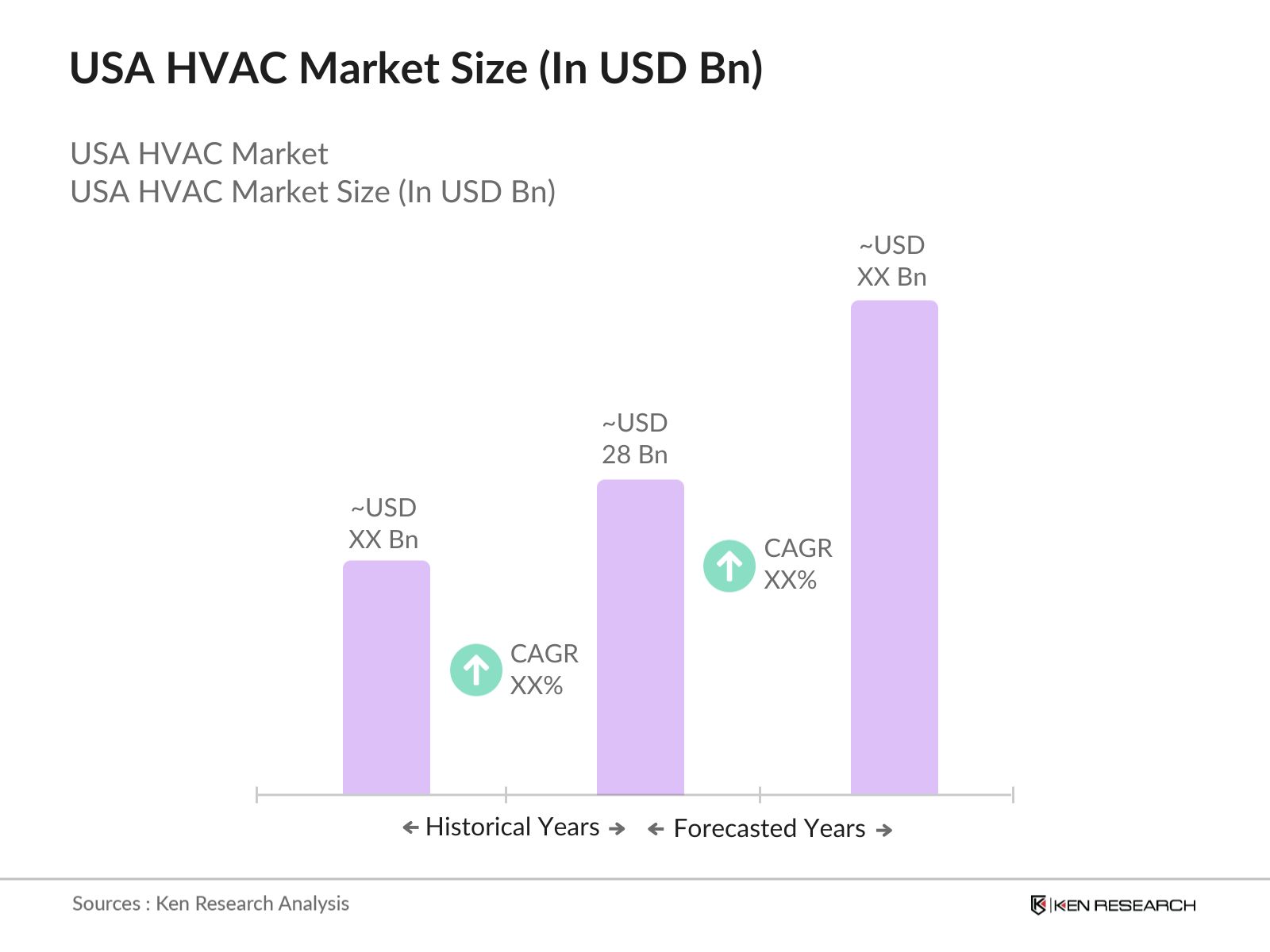

- The USA HVAC (Heating, Ventilation, and Air Conditioning) market is a vital component of the country’s building infrastructure valued at USD 28 billion, driven by the need for energy-efficient systems in both residential and commercial spaces. , the market's growth is fueled by the increasing demand for improved indoor air quality, energy-efficient systems, and advanced technologies in smart buildings. The implementation of stringent environmental regulations, as well as the growing need for HVAC systems that can support energy-efficient heating and cooling solutions, has further bolstered the sector's expansion.

- Key regions such as California, Texas, and New York lead in HVAC consumption, largely due to their climate variability and the high concentration of commercial buildings and urban developments. In these states, the drive for energy efficiency and sustainability is prompting building owners to invest in modern HVAC systems. With extreme weather events becoming more frequent, the demand for heating systems in colder areas and air conditioning in warmer climates is growing, pushing the HVAC market to expand at a rate.

- Governmental organizations such as the U.S. Department of Energy (DOE) and the Environmental Protection Agency (EPA) play a critical role in regulating HVAC systems by establishing energy efficiency standards and promoting sustainability. These agencies have set ambitious goals for reducing the carbon footprint of buildings by encouraging the use of energy-efficient HVAC technologies, which has spurred innovation in the industry.

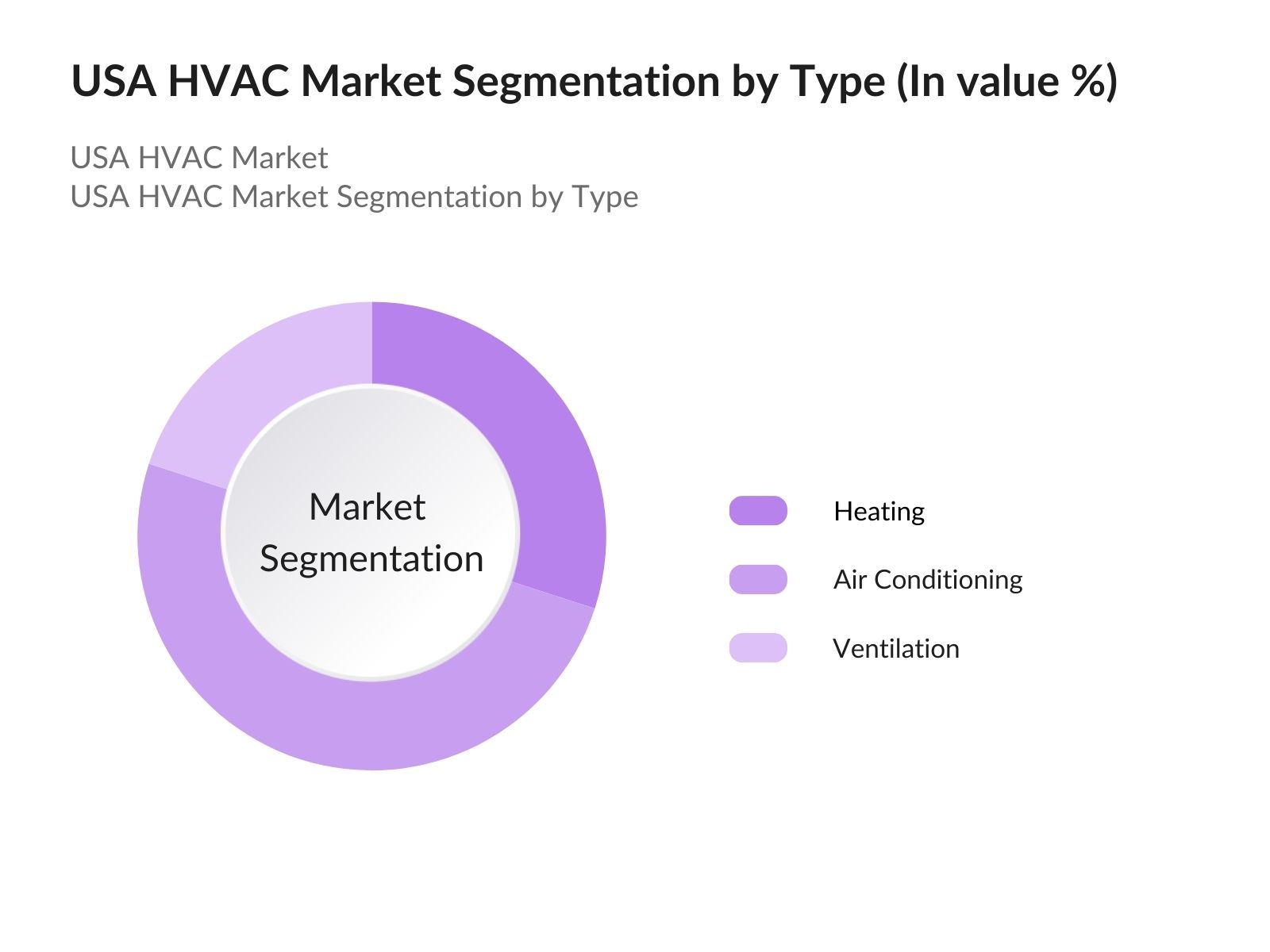

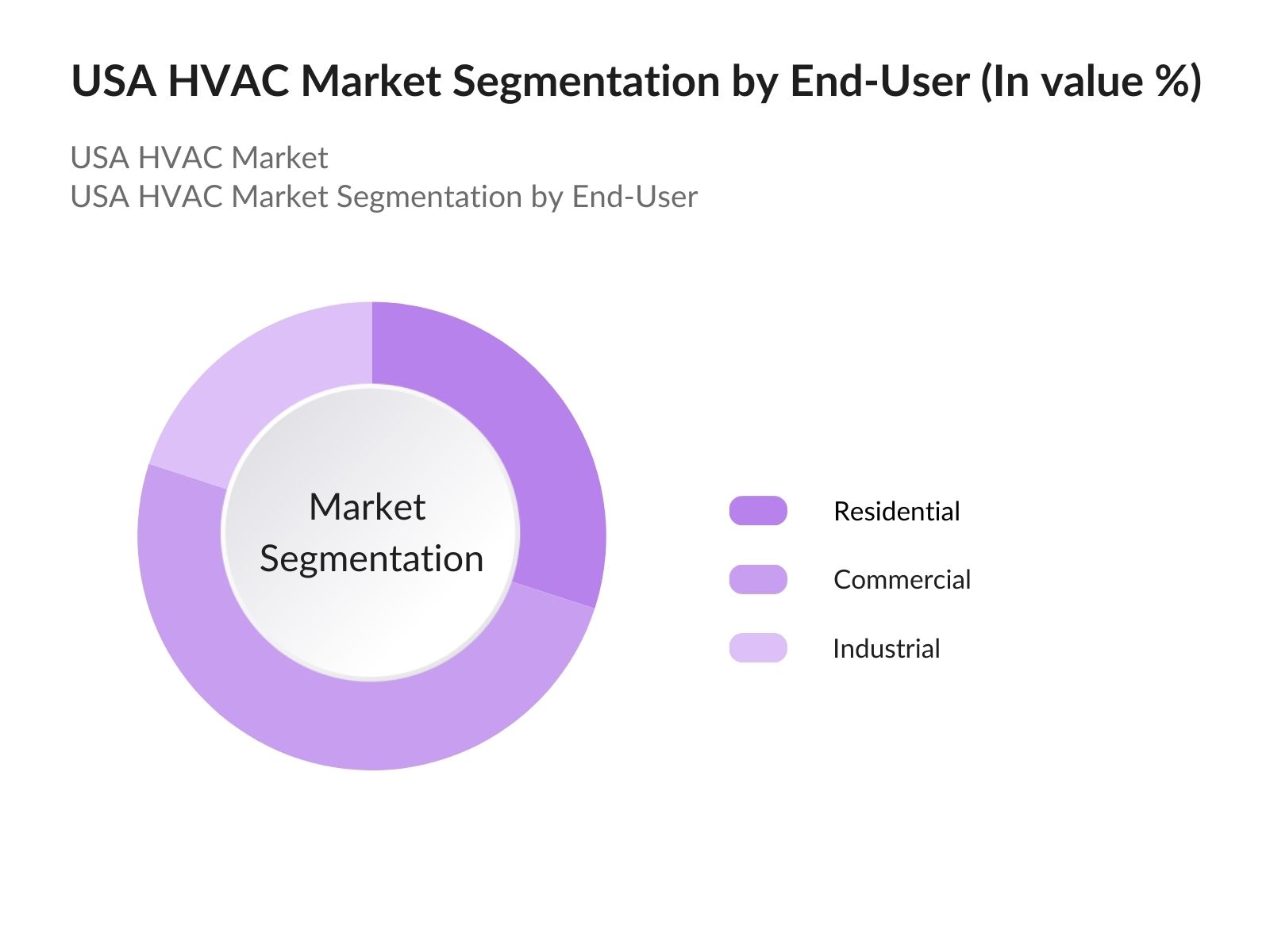

USA HVAC Market Segmentation

- By Type of HVAC System: The market is segmented into heating, ventilation, and air conditioning systems. Among these, air conditioning holds a dominant market share, driven by the increasing demand for energy-efficient cooling solutions, especially in states with warmer climates like Texas and Florida. With technological advancements such as variable refrigerant flow (VRF) systems and smart HVAC controls, air conditioning systems are becoming more efficient and cost-effective. The heating segment, which includes furnaces and boilers, remains a part of the market, particularly in colder regions like the Midwest and Northeast.

- By End-Use Industry: The market is further segmented by industry, including residential, commercial, and industrial sectors. The residential sector is the largest consumer of HVAC systems, driven by the need for temperature control in both newly constructed and renovated homes. Energy efficiency incentives and building regulations are encouraging homeowners to replace outdated systems with more efficient alternatives. The commercial sector, particularly offices, shopping malls, and hospitals, also represents a portion of the market, as businesses aim to reduce energy costs and meet environmental sustainability standards.

USA HVAC Market Competitive Landscape

The USA HVAC market is highly competitive, with a strong presence of both domestic and international players. Key companies such as Carrier, Trane Technologies, Lennox International, and Johnson Controls dominate the market, focusing on innovation, sustainability initiatives, and energy efficiency to meet the growing demand for advanced HVAC systems.

|

Company Name |

Establishment Year |

Headquarters |

No. of Employees |

Revenue (USD Billion) |

Key Products |

Sustainability Initiatives |

Technology Investments |

|

Carrier |

1915 |

Palm Beach Gardens, FL |

- |

- |

- |

- |

- |

|

Trane Technologies |

1885 |

Davidson, NC |

- |

- |

- |

- |

- |

|

Lennox International |

1895 |

Richardson, TX |

- |

- |

- |

- |

- |

|

Johnson Controls |

1885 |

Cork, Ireland |

- |

- |

- |

- |

- |

USA HVAC Industry Analysis

Growth Drivers

- Increasing Demand for Energy Efficiency: The rising focus on reducing energy consumption is a key driver of the USA HVAC market. Government regulations such as the Energy Policy Act of 2024 mandate energy-efficient upgrades to HVAC systems in both residential and commercial buildings. HVAC manufacturers are increasingly focusing on developing systems that minimize energy use while maintaining comfort levels. Variable refrigerant flow (VRF) technology and smart thermostats are widely adopted in commercial buildings to optimize energy usage. In 2023, millions of homes in the U.S. replaced their outdated HVAC systems with energy-efficient alternatives, contributing to market growth.

- Rising Urbanization and Commercial Construction: Urbanization is leading to a rise in construction activities, particularly for commercial and residential buildings, which directly influences the demand for HVAC systems. By 2024, urban areas are expected to account for 82% of the U.S. population, driving an increase in commercial construction projects that require efficient HVAC systems. In cities like New York, Los Angeles, and Chicago, commercial buildings consume over 30% of total energy use, necessitating the need for high-efficiency HVAC systems to meet growing demand.

- Adoption of Smart HVAC Systems: The adoption of smart HVAC systems is growing due to increasing demand for energy-saving solutions. Smart thermostats, sensors, and advanced monitoring systems allow users to control temperature and energy usage remotely. As of 2023, the U.S. smart home penetration has increased substantially with HVAC systems being a primary driver. Smart HVAC systems can reduce energy consumption by up to 20%, contributing to the U.S. efforts in energy savings. For example, Nest thermostats can save up to 15% of energy costs annually, reflecting the widespread adoption of smart HVAC solutions.

Market Challenges

- High Initial Cost of Energy-Efficient Systems: Despite the long-term savings offered by energy-efficient HVAC systems, their high initial cost remains a challenge for both residential and commercial consumers. Advanced HVAC technologies, such as geothermal heating systems and VRF air conditioning, are priced higher than traditional systems, which can be a deterrent for potential buyers. As a result, mid-range HVAC systems remain a more popular option, particularly in regions where energy efficiency mandates are less stringent.

- Shortage of Skilled HVAC Technicians: The HVAC industry is facing a shortage of skilled technicians, which poses a challenge for both installation and maintenance services. According to the U.S. Bureau of Labor Statistics, the demand for HVAC technicians is expected to grow substantially over the next five years. However, the number of qualified technicians entering the field is insufficient to meet this demand, leading to longer installation times and higher labor costs.

USA HVAC Market Future Outlook

The USA HVAC market is expected to witness continued growth, driven by rising demand for energy-efficient systems, technological advancements, and increasing commercial construction activities. As the government pushes for greener infrastructure and energy-efficient building practices, the HVAC industry will likely see increased investment in R&D for smart, IoT-enabled HVAC systems that optimize energy consumption. The adoption of smart thermostats, air quality monitoring systems, and advanced air filtration technologies is expected to accelerate, providing a boost to the market.

Future Market Opportunities

- Opportunities in Green Building Certifications: Green building certifications such as LEED (Leadership in Energy and Environmental Design) are driving demand for energy-efficient HVAC systems. In 2024, over 46,000 buildings in the U.S. are LEED-certified, with the certification requiring advanced HVAC systems to reduce energy consumption. These certifications provide opportunities for HVAC manufacturers to tap into the green building sector, as they promote sustainable construction practices. By installing HVAC systems that comply with LEED requirements, builders and developers can achieve higher building valuations and attract eco-conscious tenants.

- Growth in HVAC Retrofitting for Older Buildings: The retrofitting of HVAC systems in older buildings presents an opportunity in the U.S. market. 50% of commercial buildings in the U.S. are over 20 years old, and these structures often rely on outdated HVAC systems. Retrofitting such buildings with energy-efficient systems helps reduce operational costs by 15-30%. Retrofitting projects have gained momentum with government rebates and incentives, leading to a 9% increase in HVAC retrofits in 2023. The push for energy-efficient upgrades will continue to drive this market segment in 2024.

Scope of the Report

|

By HVAC System |

Heating (Furnaces, Boilers) Ventilation (Air Handlers, Exhaust) Air Conditioning (Split Systems, etc.) |

|

By End-User |

Residential Commercial (Offices, Hospitals, etc.) Industrial (Manufacturing, Warehouses) |

|

By Technology |

Smart HVAC Systems VRF Systems Geothermal Heat Pumps |

|

By Component |

Compressors Condensers Evaporators Controls and Sensors |

|

By Region |

North East South West |

Products

Key Target Audience

- HVAC Manufacturers

- HVAC Distributors and Retailers

- Commercial Real Estate Developers

- Residential Builders and Contractors

- Investors and Venture Capitalist Firms

- Government and Regulatory Bodies (e.g., U.S. Department of Energy, EPA)

- Facility Management Companies

- Data Center Operators

- Banks and Financial Institutions

Companies

Players Mentioned in the Report

- Carrier

- Trane Technologies

- Lennox International

- Johnson Controls

- Rheem Manufacturing

- Daikin Industries

- Mitsubishi Electric

- Bosch Thermotechnology

- Honeywell International

- LG Electronics

- Goodman Manufacturing

- Nortek Global HVAC

- Fujitsu General

- Emerson Electric

- Samsung HVAC

Table of Contents

1. USA HVAC Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Segmentation Overview

1.4. Market Growth Rate

2. USA HVAC Market Size (In USD Billion)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. USA HVAC Market Analysis

3.1. Growth Drivers (Energy Efficiency Mandates, Smart HVAC Adoption, Urbanization Trends)

3.1.1. Rising Energy Efficiency Standards

3.1.2. Adoption of Smart HVAC Systems

3.1.3. Growing Urban Population and Commercial Buildings

3.1.4. Government Energy Initiatives and Rebates

3.2. Market Challenges (High Initial Costs, Skilled Labor Shortage)

3.2.1. High Costs of Energy-Efficient HVAC Systems

3.2.2. Shortage of Skilled HVAC Technicians

3.2.3. Compliance with Environmental Regulations

3.2.4. Volatile Raw Material Prices

3.3. Opportunities (Green Building Certifications, Retrofitting Projects)

3.3.1. Opportunities in Green Building Certifications

3.3.2. Growth in HVAC Retrofitting for Older Buildings

3.3.3. Expansion of HVAC Applications in Smart Cities

3.3.4. Increasing Demand for HVAC Systems in Data Centers

3.4. Trends (IoT Integration, Smart Thermostats)

3.4.1. Integration of IoT in HVAC Systems

3.4.2. Increased Use of Smart Thermostats

3.4.3. Demand for Indoor Air Quality Monitoring Systems

3.4.4. Rising Interest in Renewable Energy-Powered HVAC Systems

3.5. Government Regulation (Energy Star, LEED Certifications)

3.5.1. U.S. Department of Energy Efficiency Standards

3.5.2. EPA HVAC Guidelines

3.5.3. HVAC System Recycling Regulations

3.5.4. Incentives for Green HVAC Technologies

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem

3.8. Porter’s Five Forces

3.9. Competition Ecosystem

4. USA HVAC Market Segmentation

4.1. By Type of HVAC System (In Value %)

4.1.1. Heating (Furnaces, Boilers)

4.1.2. Ventilation (Air Handlers, Exhaust Systems)

4.1.3. Air Conditioning (Split Systems, Packaged Units)

4.2. By End-Use Industry (In Value %)

4.2.1. Residential

4.2.2. Commercial (Offices, Shopping Malls, Hospitals)

4.2.3. Industrial (Manufacturing Plants, Warehouses)

4.3. By Technology (In Value %)

4.3.1. Smart HVAC Systems

4.3.2. Variable Refrigerant Flow (VRF) Systems

4.3.3. Geothermal Heat Pumps

4.3.4. Traditional HVAC Systems

4.4. By Region (In Value %)

4.4.1. North

4.4.2. West

4.4.3. South

4.4.4. East

4.5. By Component Type (In Value %)

4.5.1. Compressors

4.5.2. Condensers

4.5.3. Evaporators

4.5.4. Controls and Sensors

5. USA HVAC Market Competitive Analysis

5.1. Detailed Profiles of Major Companies (In Value, Revenue, Employees, Sustainability Initiatives)

5.1.1. Carrier

5.1.2. Trane Technologies

5.1.3. Lennox International

5.1.4. Johnson Controls

5.1.5. Rheem Manufacturing

5.1.6. Daikin Industries

5.1.7. Mitsubishi Electric

5.1.8. Bosch Thermotechnology

5.1.9. Honeywell International

5.1.10. LG Electronics

5.1.11. Goodman Manufacturing

5.1.12. Nortek Global HVAC

5.1.13. Fujitsu General

5.1.14. Emerson Electric

5.1.15. Samsung HVAC

5.2. Cross Comparison Parameters (No. of Employees, Headquarters, Revenue, Technology Adoption, Green Initiatives, Market Share, Product Portfolio, R&D Spending)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Venture Capital Funding

5.8. Private Equity Investments

6. USA HVAC Market Regulatory Framework

6.1. Energy Efficiency Certification Standards

6.2. Compliance with Environmental Regulations

6.3. HVAC System Installation and Safety Certifications

7. USA HVAC Future Market Size (In USD Billion)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. USA HVAC Market Analysts’ Recommendations

8.1. TAM/SAM/SOM Analysis

8.2. Customer Cohort Analysis

8.3. White Space Opportunity Analysis

8.4. Market Penetration Strategies

Disclaimer

Contact Us

Research Methodology

Step 1: Identification of Key Variables

The research process begins with identifying the key variables influencing the USA HVAC market. This is achieved through comprehensive desk research, including data from proprietary databases and secondary sources. The primary aim is to identify market drivers, challenges, and trends.

Step 2: Market Analysis and Construction

In this step, historical data is gathered to analyze market penetration, revenue generation, and the overall performance of the HVAC market. This includes an assessment of product types, end-use industries, and regional demand to create a reliable market overview.

Step 3: Hypothesis Validation and Expert Consultation

Industry hypotheses are developed and validated through in-depth consultations with HVAC industry experts. These interviews provide direct insights into market dynamics, operational performance, and financial considerations, further enhancing the accuracy of the market estimates.

Step 4: Research Synthesis and Final Output

The final phase involves synthesizing all research inputs, including primary data from industry experts and secondary data from reputable sources. This ensures a comprehensive and validated analysis of the HVAC market, providing an accurate portrayal of the current landscape and outlook.

Frequently Asked Questions

01. How big is the USA HVAC Market?

The USA HVAC market is valued at USD 28 billion, driven by increasing demand for energy-efficient systems and smart HVAC technologies across residential, commercial, and industrial sectors.

02. What are the challenges in the USA HVAC Market?

Challenges in the USA HVAC market include the high initial cost of energy-efficient HVAC systems, a shortage of skilled technicians, and fluctuating raw material prices. Compliance with environmental regulations also adds to the complexity of the market.

03. Who are the major players in the USA HVAC Market?

Key players in the USA HVAC market include Carrier, Trane Technologies, Lennox International, Johnson Controls, and Rheem Manufacturing. These companies dominate the market due to their extensive product offerings, focus on innovation, and commitment to sustainability.

04. What are the growth drivers of the USA HVAC Market?

The USA HVAC market is driven by the rising demand for energy-efficient systems, advancements in IoT-enabled HVAC solutions, and increasing investments in commercial and residential construction projects.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.