USA Hydrogen Energy Storage Market Outlook to 2030

Region:North America

Author(s):Abhinav kumar

Product Code:KROD2303

December 2024

85

About the Report

USA Hydrogen Energy Storage Market Overview

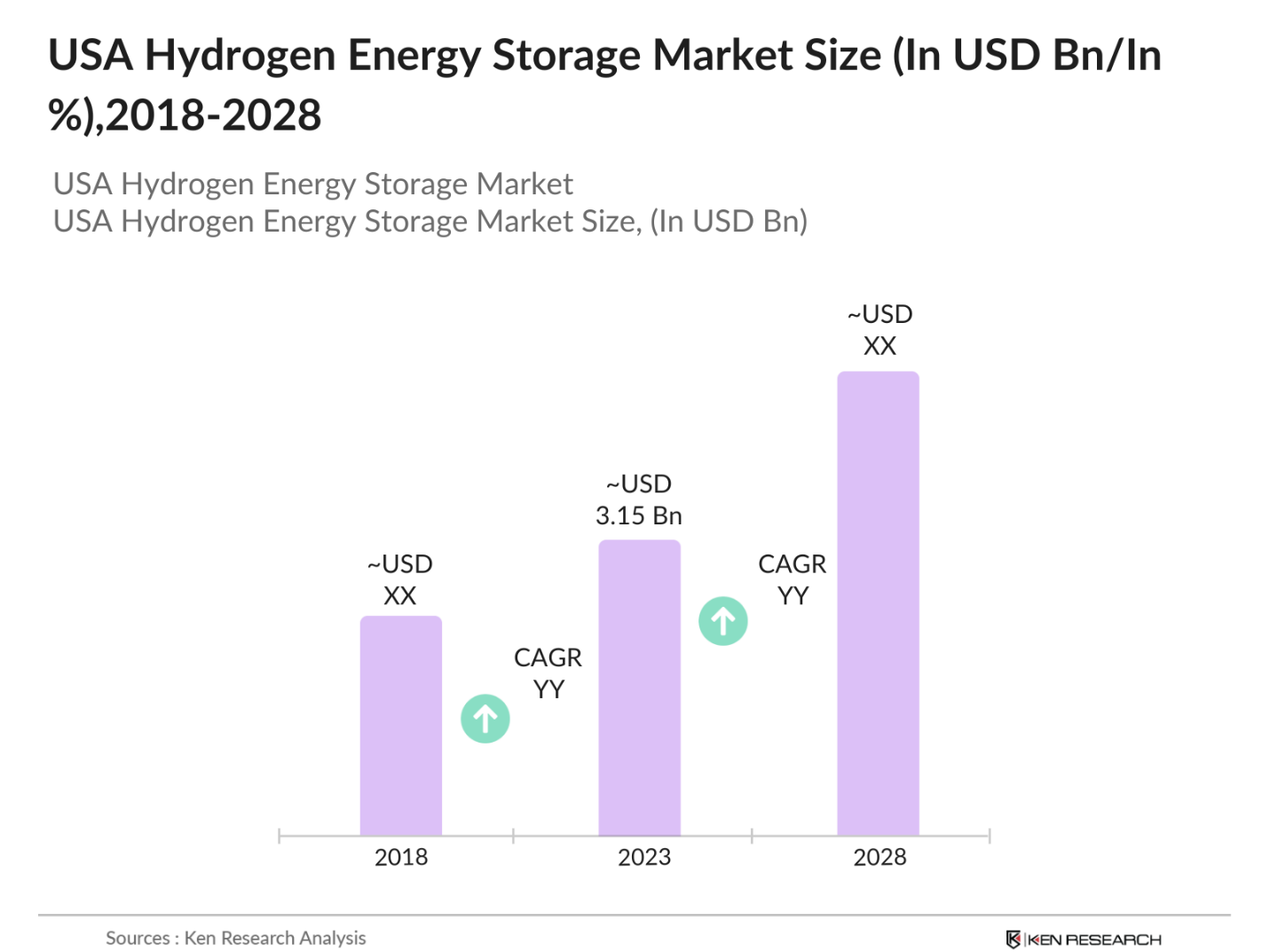

- The USA hydrogen energy storage market, valued at USD 3.15 billion, is driven by increasing demand for renewable energy and the need for reliable, large-scale energy storage solutions. Hydrogen is becoming an essential component in balancing grid power and storing excess renewable energy, especially from wind and solar.

- The dominant regions in the USA hydrogen energy storage market include California and Texas due to their progressive energy policies and high renewable energy penetration. California leads with its established hydrogen infrastructure, while Texas benefits from extensive industrial hydrogen usage. These states also have favorable climates for solar and wind energy generation, which further drives hydrogen energy storage needs.

- As decarbonization efforts gain momentum, hydrogen energy storage plays a pivotal role. The U.S. aims to achieve net-zero carbon emissions by 2050, and hydrogen is viewed as an essential solution for energy storage, enabling the transition from fossil fuels. In 2023, the U.S. emitted 5.2 billion metric tons of CO2, with 30% coming from the power sector. Hydrogen storage can capture excess renewable energy and reduce reliance on fossil fuels during peak demand periods.

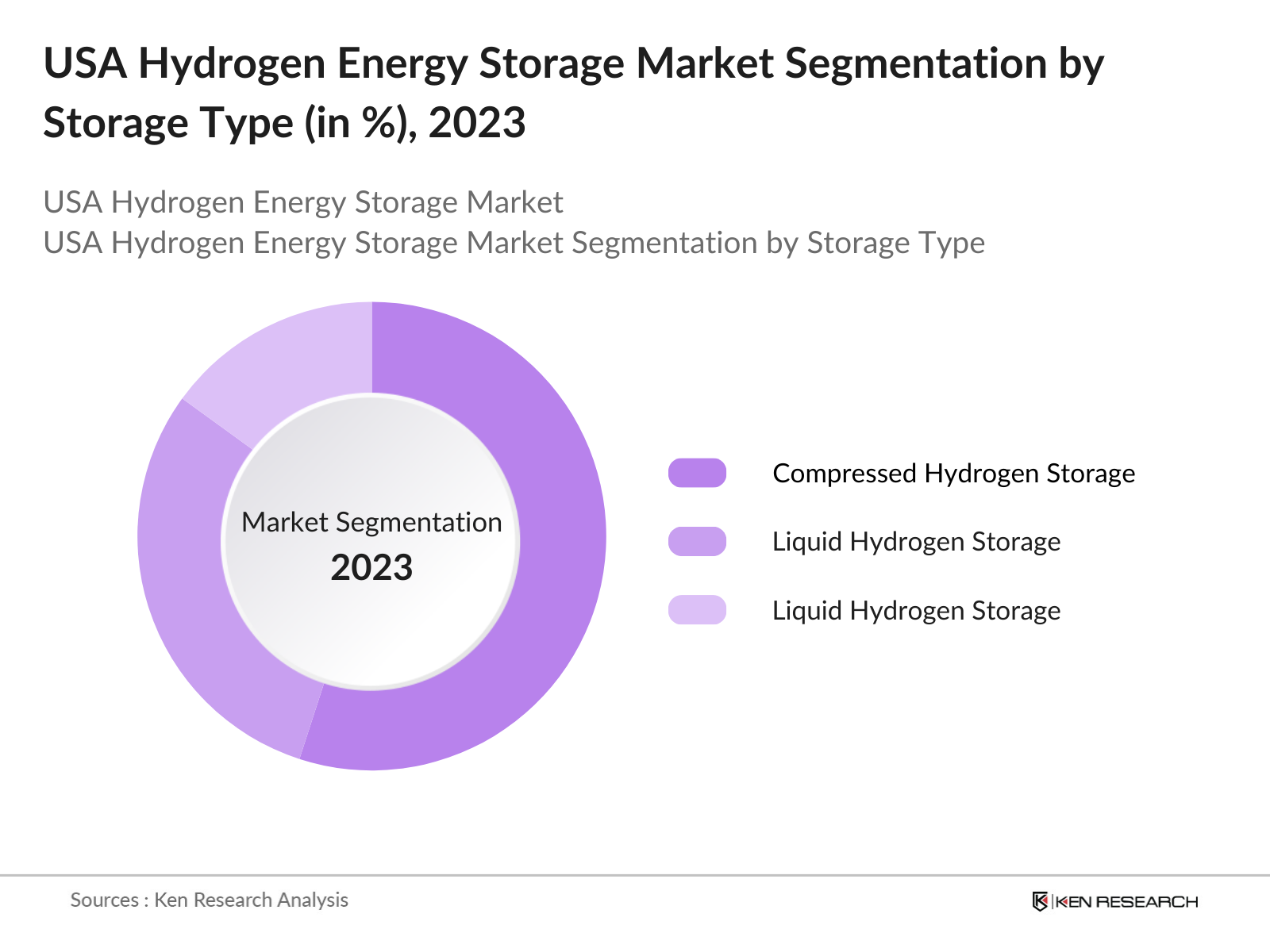

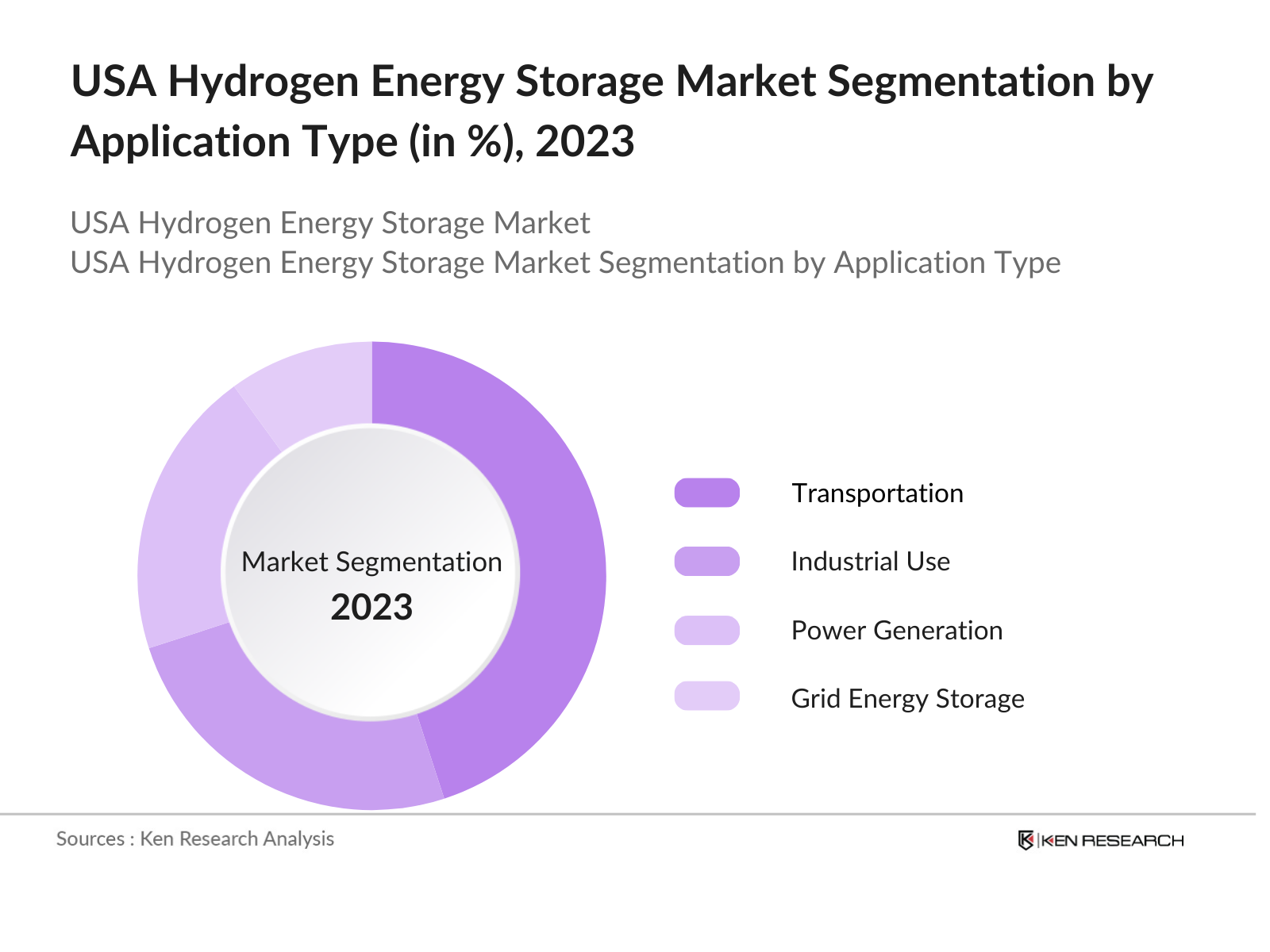

USA Hydrogen Energy Storage Market Segmentation

By Storage Type: The USA hydrogen energy storage market is segmented by storage type into compressed hydrogen storage, liquid hydrogen storage, and solid-state hydrogen storage. Compressed hydrogen storage has a dominant market share in the USA under the segmentation by storage type. This is due to its widespread use in various applications, including industrial and transportation sectors.

By Application: The USA hydrogen energy storage market is segmented by application into transportation, industrial use, power generation, and grid energy storage. Transportation is the leading application for hydrogen energy storage, driven by the increasing adoption of fuel cell vehicles, particularly in California. Hydrogen-powered vehicles offer longer ranges and faster refueling compared to battery-electric vehicles, making them appealing for commercial fleets and heavy-duty transportation.

USA Hydrogen Energy Storage Market Competitive Landscape

The USA hydrogen energy storage market is dominated by a few major players that have established their presence through advanced technology development, strategic partnerships, and government collaborations. These players are investing in large-scale hydrogen storage projects to meet the growing demand for energy storage solutions and to enhance their hydrogen infrastructure.

|

Company Name |

Establishment Year |

Headquarters |

|

Air Liquide |

1902 |

Paris, France |

|

Plug Power Inc. |

1997 |

Latham, New York |

|

Bloom Energy |

2001 |

San Jose, California |

|

Linde PLC |

1879 |

Guildford, UK |

|

Siemens Energy |

2020 |

Munich, Germany |

USA Hydrogen Energy Storage Industry Analysis

USA Hydrogen Energy Storage Market Growth Driver

- Rising Demand for Renewable Energy: The increasing demand for renewable energy in the U.S. is a key driver for hydrogen energy storage. In 2024, the U.S. Department of Energy reported that the share of renewable energy in electricity generation reached 22.5% by mid-year, driven by the countrys commitment to carbon-neutrality targets. Hydrogen energy storage helps manage the intermittent nature of renewables like solar and wind, storing excess energy and releasing it when needed.

- Government Policies Supporting Hydrogen Economy: Government support for hydrogen is substantial in the U.S., with the 2022 Bipartisan Infrastructure Law allocating $9.5 billion for hydrogen-related projects, including storage. In 2023, the U.S. Department of Energy launched the Hydrogen Shot initiative, aiming to reduce the cost of clean hydrogen to $1 per kilogram over the next decade. This push has accelerated developments in hydrogen storage infrastructure, as hydrogen is seen as a key pillar for achieving decarbonization in industries such as steelmaking and transportation

- Technological Advancements in Energy Storage: Technological breakthroughs in hydrogen storage are a significant growth driver. Solid oxide fuel cells (SOFCs) and liquid hydrogen storage have seen marked improvements in efficiency. The National Renewable Energy Laboratory (NREL) reported that new materials for hydrogen storage, such as metal-organic frameworks (MOFs), can store up to 150 kg of hydrogen per cubic meter, which is a notable improvement from previous standards.

USA Hydrogen Energy Storage Market Challenges

- High Costs of Hydrogen Storage Technologies: Hydrogen storage technologies remain costly, particularly due to the high price of materials like carbon fiber used in tanks and the energy-intensive processes required for hydrogen liquefaction. In 2023, the U.S. Department of Energy estimated that the cost of hydrogen storage was $10-15 per kg of stored hydrogen. These costs create significant barriers for widespread adoption, especially for smaller energy producers

- Infrastructure Constraints: The current hydrogen storage infrastructure in the U.S. is insufficient to meet growing demands. As of 2024, the U.S. had only about 1,600 miles of hydrogen pipelines, concentrated in industrial regions. Comparatively, natural gas pipelines cover over 3 million miles. This infrastructure gap limits the ability to store and transport hydrogen efficiently. Additionally, storage facilities are clustered in a few areas, posing logistical challenges for wider deployment.

USA Hydrogen Energy Storage Future Outlook

Over the next five years, the USA hydrogen energy storage market is expected to witness significant growth, driven by federal and state-level policy support, technological advancements, and increasing investments in hydrogen storage infrastructure. The expansion of hydrogen in sectors like transportation and industrial power generation will further catalyze market growth.

- Hydrogens Role in Heavy Industry and Transportation: Hydrogen energy storage offers vast opportunities in heavy industry and transportation, particularly in sectors hard to electrify. The U.S. industrial sector consumed 32.2 quadrillion BTUs of energy in 2023, with hydrogen poised to play a critical role in reducing emissions from industries like steel and cement production. The Department of Energys Hydrogen Program also targets the transportation sector, where hydrogen fuel cells could power trucks and buses, which accounted for 60% of U.S. transportation emissions in 2023. Over 1,000 hydrogen-powered buses were operational in the U.S. by 2024.

- Partnerships with Utilities and Grid Operators: Utilities and grid operators are increasingly collaborating on hydrogen energy storage projects to enhance grid resilience and integrate more renewable energy. In 2024, the Federal Energy Regulatory Commission (FERC) approved three large-scale hydrogen storage projects that will support grid stabilization efforts, particularly in regions prone to power fluctuations. These partnerships focus on long-duration storage, with hydrogen being stored during periods of low electricity demand and released during peak times. The U.S. is expected to integrate 2 GW of hydrogen storage into its grid by the end of 2024.

Scope of the Report

|

Storage Type |

Compressed Hydrogen Storage Liquid Hydrogen Storage Solid-State Hydrogen Storage |

|

Application |

Transportation Industrial Use Power Generation Grid Energy Storage |

|

End-Use Industry |

Automotive Chemicals Energy & Power Aerospace & Defense Others (e.g., Metal Processing) |

|

Storage Capacity |

Small-Scale Storage (Up to 100kg) Medium-Scale Storage (100kg to 1 ton) Large-Scale Storage (Above 1 ton) |

|

Region |

North-East USA South-West USA Midwest USA West Coast USA |

Products

Target Audience Organizations and Entities Who Can Benefit by Subscribing to This Report:

Hydrogen Production Companies

Energy Storage Technology Industries

Automotive Companies

Industrial Gas Companies

Power Generation Companies

Government and Regulatory Bodies (U.S. Department of Energy, Environmental Protection Agency)

Investments and Venture Capitalist Firms

Transportation Sector Companies

Companies

Players Mentioned in the Report:

Air Liquide

Plug Power Inc.

Bloom Energy

Linde PLC

Siemens Energy

Hydrogenics Corporation

Nel ASA

Ballard Power Systems

ITM Power

Hexagon Composites

Nikola Corporation

Chart Industries

Cummins Inc.

Toshiba Energy Systems

FirstElement Fuel

Table of Contents

1. USA Hydrogen Energy Storage Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. USA Hydrogen Energy Storage Market Size (In USD Bn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. USA Hydrogen Energy Storage Market Analysis

3.1. Growth Drivers

3.1.1. Rising Demand for Renewable Energy

3.1.2. Government Policies Supporting Hydrogen Economy

3.1.3. Technological Advancements in Energy Storage

3.1.4. Growing Focus on Decarbonization

3.2. Market Challenges

3.2.1. High Costs of Hydrogen Storage Technologies

3.2.2. Infrastructure Constraints

3.2.3. Safety Concerns Related to Hydrogen Storage

3.3. Opportunities

3.3.1. Hydrogens Role in Heavy Industry and Transportation

3.3.2. Partnerships with Utilities and Grid Operators

3.3.3. Expansion into Remote and Off-Grid Areas

3.4. Trends

3.4.1. Adoption of Green Hydrogen Solutions

3.4.2. Growth in Hydrogen-Powered Fuel Cells

3.4.3. Development of Large-Scale Hydrogen Storage Facilities

3.5. Government Regulation

3.5.1. U.S. Hydrogen Energy Roadmap

3.5.2. Clean Energy Tax Incentives and Subsidies

3.5.3. Safety Standards for Hydrogen Storage

3.5.4. Public-Private Partnerships for Hydrogen Projects

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem

3.7.1. Producers (Hydrogen Production Companies)

3.7.2. Storage Providers

3.7.3. Grid and Utility Operators

3.8. Porters Five Forces

3.8.1. Bargaining Power of Suppliers

3.8.2. Bargaining Power of Buyers

3.8.3. Threat of New Entrants

3.8.4. Threat of Substitutes

3.8.5. Industry Rivalry

3.9. Competition Ecosystem

4. USA Hydrogen Energy Storage Market Segmentation

4.1. By Storage Type (In Value %)

4.1.1. Compressed Hydrogen Storage

4.1.2. Liquid Hydrogen Storage

4.1.3. Solid-State Hydrogen Storage

4.2. By Application (In Value %)

4.2.1. Transportation

4.2.2. Industrial Use

4.2.3. Power Generation

4.2.4. Grid Energy Storage

4.3. By End-Use Industry (In Value %)

4.3.1. Automotive

4.3.2. Chemicals

4.3.3. Energy & Power

4.3.4. Aerospace & Defense

4.3.5. Others (e.g., Metal Processing)

4.4. By Storage Capacity (In Value %)

4.4.1. Small-Scale Storage (Up to 100kg)

4.4.2. Medium-Scale Storage (100kg to 1 ton)

4.4.3. Large-Scale Storage (Above 1 ton)

4.5. By Region (In Value %)

4.5.1. North-East USA

4.5.2. South-West USA

4.5.3. Midwest USA

4.5.4. West Coast USA

5. USA Hydrogen Energy Storage Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. Air Liquide

5.1.2. Plug Power Inc.

5.1.3. Bloom Energy

5.1.4. Linde PLC

5.1.5. Hydrogenics Corporation

5.1.6. Nel ASA

5.1.7. Ballard Power Systems

5.1.8. ITM Power

5.1.9. Hexagon Composites

5.1.10. Siemens Energy

5.1.11. Nikola Corporation

5.1.12. Chart Industries

5.1.13. Cummins Inc.

5.1.14. Toshiba Energy Systems

5.1.15. FirstElement Fuel

5.2. Cross Comparison Parameters (No. of Employees, Headquarters, Storage Technology, Revenue, Hydrogen Production Capacity, Energy Storage Capacity, Collaboration Networks, Key Clients)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Venture Capital Funding

5.8. Government Grants

5.9. Private Equity Investments

6. USA Hydrogen Energy Storage Market Regulatory Framework

6.1. Environmental Standards

6.2. Compliance Requirements

6.3. Certification Processes

7. USA Hydrogen Energy Storage Future Market Size (In USD Bn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. USA Hydrogen Energy Storage Future Market Segmentation

8.1. By Storage Type (In Value %)

8.2. By Application (In Value %)

8.3. By End-Use Industry (In Value %)

8.4. By Storage Capacity (In Value %)

8.5. By Region (In Value %)

9. USA Hydrogen Energy Storage Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

Research Methodology

Step 1: Identification of Key Variables

This initial step involves mapping the ecosystem of the USA Hydrogen Energy Storage Market. It includes gathering data on the main stakeholders, such as hydrogen producers, storage providers, and utility operators. Desk research and proprietary databases are leveraged to identify critical variables like storage capacity, technological advancements, and regulatory factors.

Step 2: Market Analysis and Construction

The market is analyzed using historical data to assess growth trends in hydrogen energy storage. This phase involves evaluating market penetration, grid storage demand, and the increasing use of hydrogen in transportation. A thorough assessment of storage technologies will also be conducted to determine their effectiveness and adoption rates.

Step 3: Hypothesis Validation and Expert Consultation

Industry hypotheses are validated through interviews with experts from key companies and industry leaders. This step ensures that data on storage technologies, hydrogen capacity, and market dynamics is accurate and reflective of the current industry landscape.

Step 4: Research Synthesis and Final Output

The final step includes synthesizing the data collected from interviews and secondary research, followed by the generation of comprehensive market insights. This synthesis ensures that all aspects of the market, including storage technology developments and future opportunities, are well-documented and accurate.

Frequently Asked Questions

01. How big is the USA Hydrogen Energy Storage Market?

The USA hydrogen energy storage market is valued at USD 3.15 billion, driven by increasing demand for renewable energy and large-scale energy storage solutions.

02. What are the challenges in the USA Hydrogen Energy Storage Market?

Challenges include high costs of storage technologies, infrastructure limitations, and safety concerns associated with hydrogen storage. Developing a widespread hydrogen infrastructure remains a significant hurdle.

03. Who are the major players in the USA Hydrogen Energy Storage Market?

Key players include Air Liquide, Plug Power Inc., Bloom Energy, Linde PLC, and Siemens Energy. These companies dominate due to their extensive hydrogen production capacity, technological expertise, and strategic partnerships.

04. What are the growth drivers of the USA Hydrogen Energy Storage Market?

The market is propelled by federal and state policies supporting hydrogen, advancements in storage technology, and the increasing use of hydrogen for decarbonization in industries and transportation.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.