USA In-Car Audio System Market Outlook to 2030

Region:North America

Author(s):Sanjna

Product Code:KROD10265

November 2024

94

About the Report

USA In-Car Audio System Market Overview

- The USA In-Car Audio System Market, valued at USD 2 billion based on a five-year historical analysis, is driven by technological advancements in automotive infotainment and the growing demand for premium audio experiences among consumers. Enhanced connectivity options and rising consumer expectations have fueled the demand for in-car audio systems, with luxury and high-end vehicle segments particularly driving market growth. This trend is reinforced by consumer preferences for custom audio experiences, further pushing manufacturers to innovate and expand their offerings.

- Key urban centers such as Los Angeles, New York, and Chicago dominate the market due to the high demand for luxury vehicles and premium sound systems in these regions. The presence of affluent consumers and a thriving automotive aftermarket industry in these cities contribute to the popularity of advanced audio solutions, making them focal points for market expansion and innovation in the USA.

- U.S. automotive safety standards significantly influence the in-car audio market. The National Highway Traffic Safety Administration mandates guidelines for audio system installations to ensure driver safety. In 2023, nearly 95% of U.S. vehicles complied with these standards, as companies prioritize user safety to avoid penalties. Compliance with safety regulations has spurred innovations that minimize driver distractions, indirectly shaping the in-car audio system landscape.

USA In-Car Audio System Market Segmentation

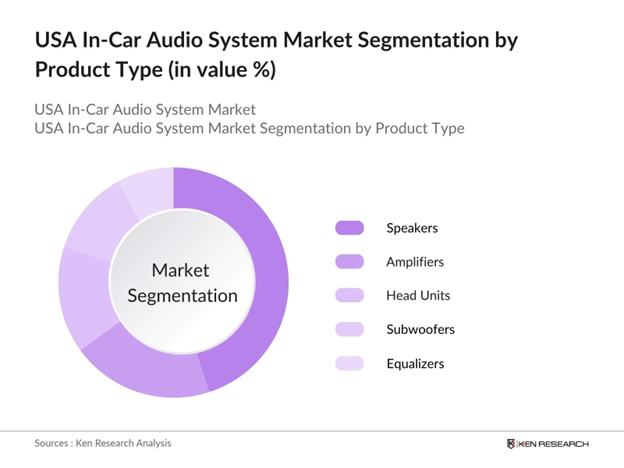

By Product Type: The USA In-Car Audio System market is segmented by product type into speakers, amplifiers, head units, subwoofers, and equalizers. Recently, speakers hold a dominant market share under the product type segmentation due to the essential role they play in audio systems. Manufacturers focus on enhancing speaker quality to improve sound fidelity and user experience, making them a critical component of audio systems. This dominance is attributed to the increasing demand for high-definition sound experiences and the frequent innovations in speaker technologies by major brands.

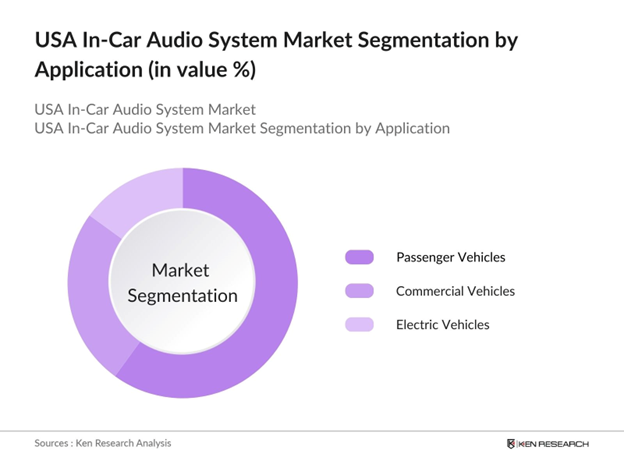

By Application: The market is segmented by application into passenger vehicles, commercial vehicles, and electric vehicles. Passenger vehicles are the leading segment, primarily due to the high adoption of premium audio systems in this category. With consumers increasingly seeking enhanced entertainment options, the demand for high-quality audio systems in passenger vehicles continues to rise. This segment benefits from the growing interest in infotainment solutions that deliver immersive audio experiences during travel, establishing its stronghold in the market.

USA In-Car Audio System Market Competitive Landscape

The USA In-Car Audio System Market is dominated by prominent companies with established expertise in audio technology and automotive systems. This consolidation underscores the influence of a few major players that provide innovative products tailored to consumer preferences for premium sound quality.

USA In-Car Audio System Market Analysis

Growth Drivers

- Rise in Demand for Infotainment Systems: The increasing demand for in-car infotainment systems in the USA is closely tied to changing consumer preferences for integrated and immersive driving experiences. As of 2024, the U.S. automotive industry has recorded 16 million vehicle sales, with approximately 85% of these featuring advanced infotainment options. According to the U.S. Bureau of Economic Analysis, consumer spending on durable goods, particularly electronics, saw an upward trend, indicating a solid demand for technology-integrated systems in vehicles.

- Advancements in Car Connectivity Technologies: Technological advancements in car connectivity are driving the in-car audio systems market in the USA. The U.S. Department of Transportation has emphasized the role of connected vehicles, citing over 70% of new vehicles equipped with Bluetooth or wireless connectivity as of 2024. Additionally, the Federal Communications Commission has facilitated spectrum allocation for vehicle connectivity, boosting the integration of these technologies. The upward trend in automotive IoT implementations, estimated to reach 200 million connections in 2024, underscores this driver, showing a strong foundation for expanding connectivity in audio systems.

- Growing Automotive Industry and Vehicle Sales: The growth of the U.S. automotive industry is a critical driver for in-car audio systems, as evidenced by steady vehicle production and sales figures. According to the National Highway Traffic Safety Administration, the U.S. recorded 15.6 million new vehicle registrations in 2023, showing consistent demand. The automotive sectors contribution to GDP also shows resilience, with the industry accounting for 3% of the national GDP in 2023, reinforcing the growth potential for in-car audio solutions as manufacturers enhance vehicle features to attract consumers.

Challenges

- High Initial Costs of Premium Audio Systems: The high initial costs of premium audio systems present a challenge in the U.S. market. According to the Department of Commerce, the average cost of in-car audio upgrades, specifically premium systems, can range from $2,000 to $5,000, impacting affordability for a broad consumer base. This cost factor limits access for middle-income families, who constitute around 60% of the U.S. population, affecting the market's expansion. The U.S. consumer price index for electronics also saw a 2% increase in 2023, further contributing to the cost burden on consumers.

- Lack of Standardization Across Audio Interfaces: In-car audio systems in the U.S. suffer from a lack of standardization across different audio interfaces. The Federal Communications Commission highlights that around 50% of automotive manufacturers use proprietary connectivity solutions, creating compatibility issues. This inconsistency complicates user experience and integration with third-party devices, limiting the accessibility and adaptability of in-car audio systems.

USA In-Car Audio System Market Future Outlook

Over the next five years, the USA In-Car Audio System Market is anticipated to experience notable growth driven by rising consumer interest in connected audio experiences, advancements in audio technology, and the expansion of electric vehicles. Growing demands for AI-enhanced audio interfaces and integration with digital voice assistants will likely encourage manufacturers to invest in R&D, creating opportunities for enhanced market penetration and product innovation.

Market Opportunities

- Integration of AI and Voice-Activated Assistants: Integrating AI and voice-activated assistants in in-car audio systems provides a substantial opportunity in the U.S. market. The U.S. Census Bureau reports that over 60% of households use voice assistants in 2023, with growing interest in automotive applications. Enhanced AI-driven features enable hands-free control, aligning with federal safety regulations. This integration is also expected to boost adoption rates, as AI-backed systems enhance user engagement and satisfaction, contributing to market expansion.

- Customization and Modular Systems: Customization and modular audio systems are emerging as valuable opportunities in the U.S. market. The U.S. Department of Commerce highlights a 10% increase in consumer spending on customized car interiors and audio upgrades in 2023, indicating a demand for modular solutions. These systems enable consumers to tailor audio setups, enhancing personalization. Such customization appeals to a tech-savvy audience, fostering growth in the segment by aligning with evolving consumer expectations.

Scope of the Report

|

By Product Type |

Speakers |

|

Amplifiers |

|

|

Head Units |

|

|

Subwoofers |

|

|

Equalizers |

|

|

By Application |

Passenger Vehicles |

|

Commercial Vehicles |

|

|

Electric Vehicles |

|

|

By Technology |

Wireless Audio Systems |

|

Wired Audio Systems |

|

|

Smart Audio Systems |

|

|

Customizable Audio Systems |

|

|

By Sound System Type |

Basic Sound Systems |

|

Premium Sound Systems |

|

|

Advanced Surround Systems |

|

|

By Region |

Northeast |

|

Midwest |

|

|

South |

|

|

West |

Products

Key Target Audience

Automotive Manufacturers

Component Suppliers

Audio Equipment Manufacturers

Automotive Dealerships

Technology Integration Firms

Electric Vehicle Manufacturers

Investors and Venture Capitalist Firms

Government and Regulatory Bodies (e.g., National Highway Traffic Safety Administration)

Companies

Players Mentioned in the Report

Alpine Electronics Inc.

Bose Corporation

Harman International

Pioneer Corporation

Sony Corporation

Panasonic Corporation

Denso Corporation

Clarion Co., Ltd.

Blaupunkt GmbH

JVC Kenwood Corporation

Table of Contents

1. USA In-Car Audio System Market Overview

1.1 Definition and Scope

1.2 Market Taxonomy

1.3 Market Growth Rate (Unit Sales Growth Rate, Revenue Growth Rate)

1.4 Market Segmentation Overview

2. USA In-Car Audio System Market Size (In USD Million)

2.1 Historical Market Size

2.2 Year-On-Year Growth Analysis

2.3 Key Market Developments and Milestones (Technological Advancements, Market Entry of Key Players)

3. USA In-Car Audio System Market Analysis

3.1 Growth Drivers

3.1.1 Rise in Demand for Infotainment Systems

3.1.2 Advancements in Car Connectivity Technologies

3.1.3 Growing Automotive Industry and Vehicle Sales

3.1.4 Consumer Preference for Enhanced Audio Experience

3.2 Market Challenges

3.2.1 High Initial Costs of Premium Audio Systems

3.2.2 Lack of Standardization Across Audio Interfaces

3.2.3 Market Competition from Low-Cost Alternatives

3.3 Opportunities

3.3.1 Integration of AI and Voice-Activated Assistants

3.3.2 Customization and Modular Systems

3.3.3 Expansion in Electric and Autonomous Vehicles Market

3.4 Trends

3.4.1 Adoption of Wireless Connectivity Options (Bluetooth, Wi-Fi)

3.4.2 Demand for Compact and Efficient Audio Solutions

3.4.3 Increased Focus on Sustainability in Product Design

3.5 Government Regulations

3.5.1 Automotive Safety Standards for Audio Systems

3.5.2 Environmental Regulations Impacting Manufacturing

3.6 SWOT Analysis

3.7 Stakeholder Ecosystem (Component Manufacturers, OEMs, Dealers, Consumers)

3.8 Porters Five Forces

3.9 Competition Ecosystem

4. USA In-Car Audio System Market Segmentation

4.1 By Product Type (In Value %)

4.1.1 Speakers

4.1.2 Amplifiers

4.1.3 Head Units

4.1.4 Subwoofers

4.1.5 Equalizers

4.2 By Application (In Value %)

4.2.1 Passenger Vehicles

4.2.2 Commercial Vehicles

4.2.3 Electric Vehicles

4.3 By Technology (In Value %)

4.3.1 Wireless Audio Systems

4.3.2 Wired Audio Systems

4.3.3 Smart Audio Systems

4.3.4 Customizable Audio Systems

4.4 By Sound System Type (In Value %)

4.4.1 Basic Sound Systems

4.4.2 Premium Sound Systems

4.4.3 Advanced Surround Systems

4.5 By Region (In Value %)

4.5.1 Northeast USA

4.5.2 Midwest USA

4.5.3 South USA

4.5.4 West USA

5. USA In-Car Audio System Market Competitive Analysis

5.1 Detailed Profiles of Major Companies

5.1.1 Alpine Electronics Inc.

5.1.2 Bose Corporation

5.1.3 Harman International Industries

5.1.4 Pioneer Corporation

5.1.5 Sony Corporation

5.1.6 Panasonic Corporation

5.1.7 Denso Corporation

5.1.8 Clarion Co., Ltd.

5.1.9 Blaupunkt GmbH

5.1.10 JVC Kenwood Corporation

5.2 Cross Comparison Parameters

Number of Employees

Revenue

Market Share

R&D Investment

Manufacturing Capacity

Product Portfolio

Warranty Offered

Customer Support

5.3 Market Share Analysis

5.4 Strategic Initiatives

Collaborations

Partnerships

Innovations

5.5 Mergers and Acquisitions

5.6 Investment Analysis

Capital Investments in R&D

Manufacturing

5.7 Venture Capital Funding

5.8 Government Grants

5.9 Private Equity Investments

6. USA In-Car Audio System Market Regulatory Framework

6.1 Automotive Industry Safety Standards

6.2 Compliance Requirements for Audio System Manufacturing

6.3 Certification Processes for Sound Quality and Emissions

7. USA In-Car Audio System Future Market Size (In USD Million)

7.1 Future Market Size Projections

7.2 Key Factors Driving Future Market Growth

8. USA In-Car Audio System Future Market Segmentation

8.1 By Product Type (In Value %)

8.2 By Application (In Value %)

8.3 By Technology (In Value %)

8.4 By Sound System Type (In Value %)

8.5 By Region (In Value %)

9. USA In-Car Audio System Market Analysts Recommendations

9.1 TAM/SAM/SOM Analysis

9.2 Customer Cohort Analysis

9.3 Marketing Initiatives

9.4 White Space Opportunity Analysis

10. Disclaimer

11. Contact Us

Research Methodology

Step 1: Identification of Key Variables

The first stage involves creating an ecosystem map that includes all major stakeholders in the USA In-Car Audio System Market. Extensive desk research, utilizing both secondary and proprietary databases, was conducted to capture a detailed view of industry-level data. This step was essential for pinpointing the critical variables affecting market behavior.

Step 2: Market Analysis and Construction

Historical data were gathered and analyzed to assess the market penetration, comparing the prevalence of various product types across automotive categories. This phase included evaluating market performance indicators, providing reliable data for constructing an accurate market landscape.

Step 3: Hypothesis Validation and Expert Consultation

Initial hypotheses were formed and subsequently tested through consultations with industry experts across major companies via computer-assisted telephone interviews (CATIs). These insights offered valuable operational knowledge, enabling accurate refinement of the market data and estimates.

Step 4: Research Synthesis and Final Output

In the final phase, engagements with in-car audio system manufacturers were carried out to obtain specific insights into product sales, customer preferences, and competitive dynamics. This approach was used to validate statistics from a bottom-up analysis, ensuring a thorough and precise market assessment.

Frequently Asked Questions

01. How big is the USA In-Car Audio System Market?

The USA In-Car Audio System Market was valued at USD 2 billion, driven by advancements in automotive infotainment and increasing consumer demand for high-quality audio experiences.

02. What are the challenges in the USA In-Car Audio System Market?

Challenges in USA In-Car Audio System Market include high initial costs for premium audio systems, a lack of standardization in interfaces, and strong competition from lower-cost audio alternatives, all of which impact consumer choices.

03. Who are the major players in the USA In-Car Audio System Market?

Key players in USA In-Car Audio System Market include Alpine Electronics, Bose Corporation, Harman International, Pioneer Corporation, and Sony Corporation, each of which influences the market with innovative product offerings and strong brand presence.

04. What are the growth drivers of the USA In-Car Audio System Market?

USA In-Car Audio System Market is driven by consumer demand for infotainment, technological advancements in sound quality, and growing interest in premium audio experiences, especially in luxury vehicle segments.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.