USA In Vitro Diagnostics Market Outlook to 2030

Region:North America

Author(s):Shubham Kashyap

Product Code:KROD3587

November 2024

86

About the Report

U.S. IVD Market Overview

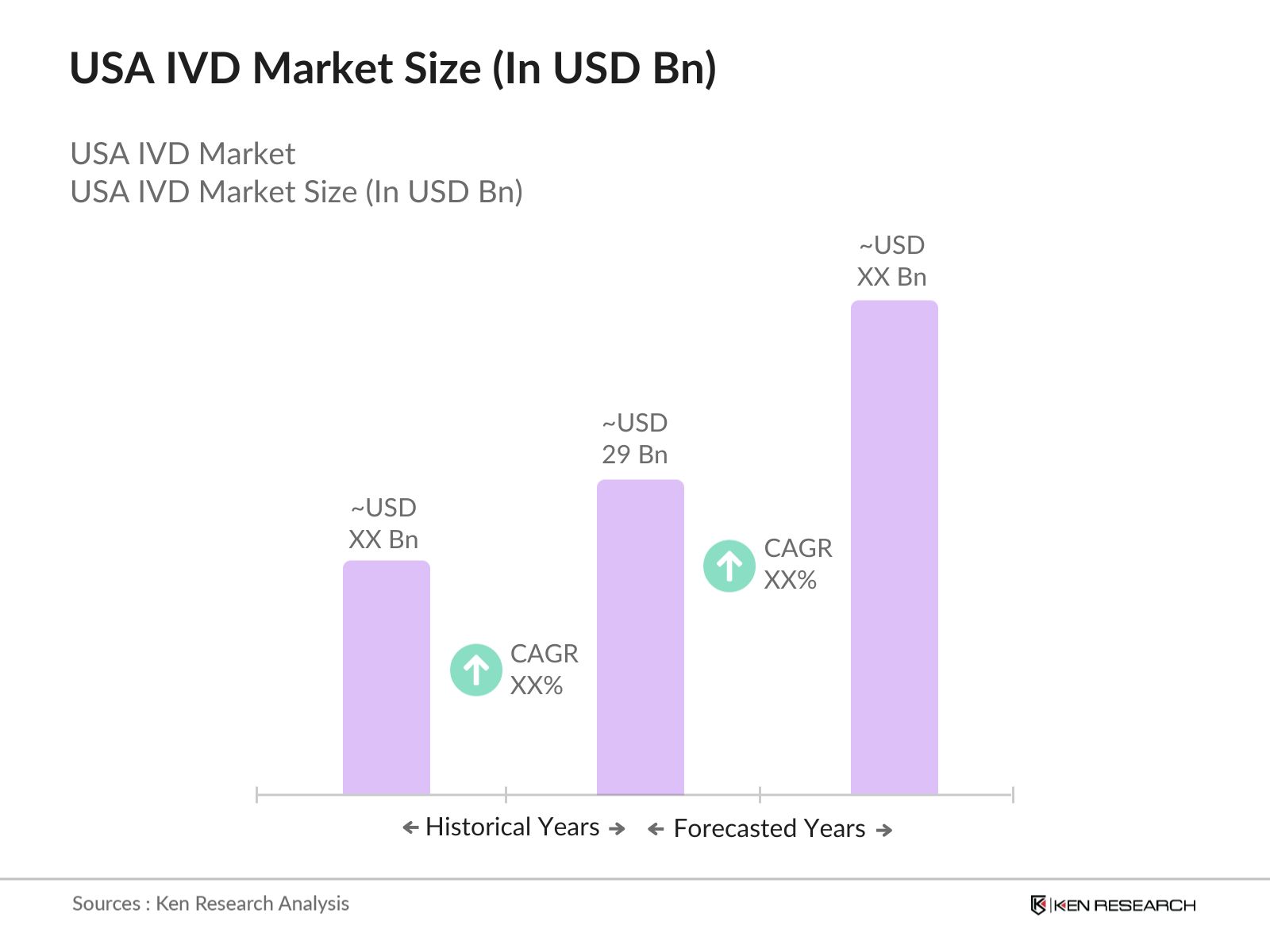

- The U.S. In Vitro Diagnostics (IVD) Market is valued at USD 29 billion, driven by the rising prevalence of chronic diseases, growing demand for personalized medicine, and increasing use of advanced diagnostic tools. The market has experienced significant growth due to advancements in molecular diagnostics, point-of-care testing, and the widespread adoption of automation in diagnostic laboratories.

- Major metropolitan areas such as New York, Los Angeles, and Chicago are key hubs for the IVD market, benefiting from the high concentration of leading healthcare providers, research institutions, and diagnostic companies. In rural areas, the demand for IVD testing is steadily increasing as healthcare infrastructure expands, supported by government initiatives that improve access to diagnostic services.

- The U.S. Food and Drug Administration (FDA) plays a crucial role in regulating the IVD market, ensuring that diagnostic tests are safe, effective, and reliable. Regulatory frameworks like the Clinical Laboratory Improvement Amendments (CLIA) further govern the quality standards for laboratories performing diagnostic testing across the U.S.

U.S. IVD Market Segmentation

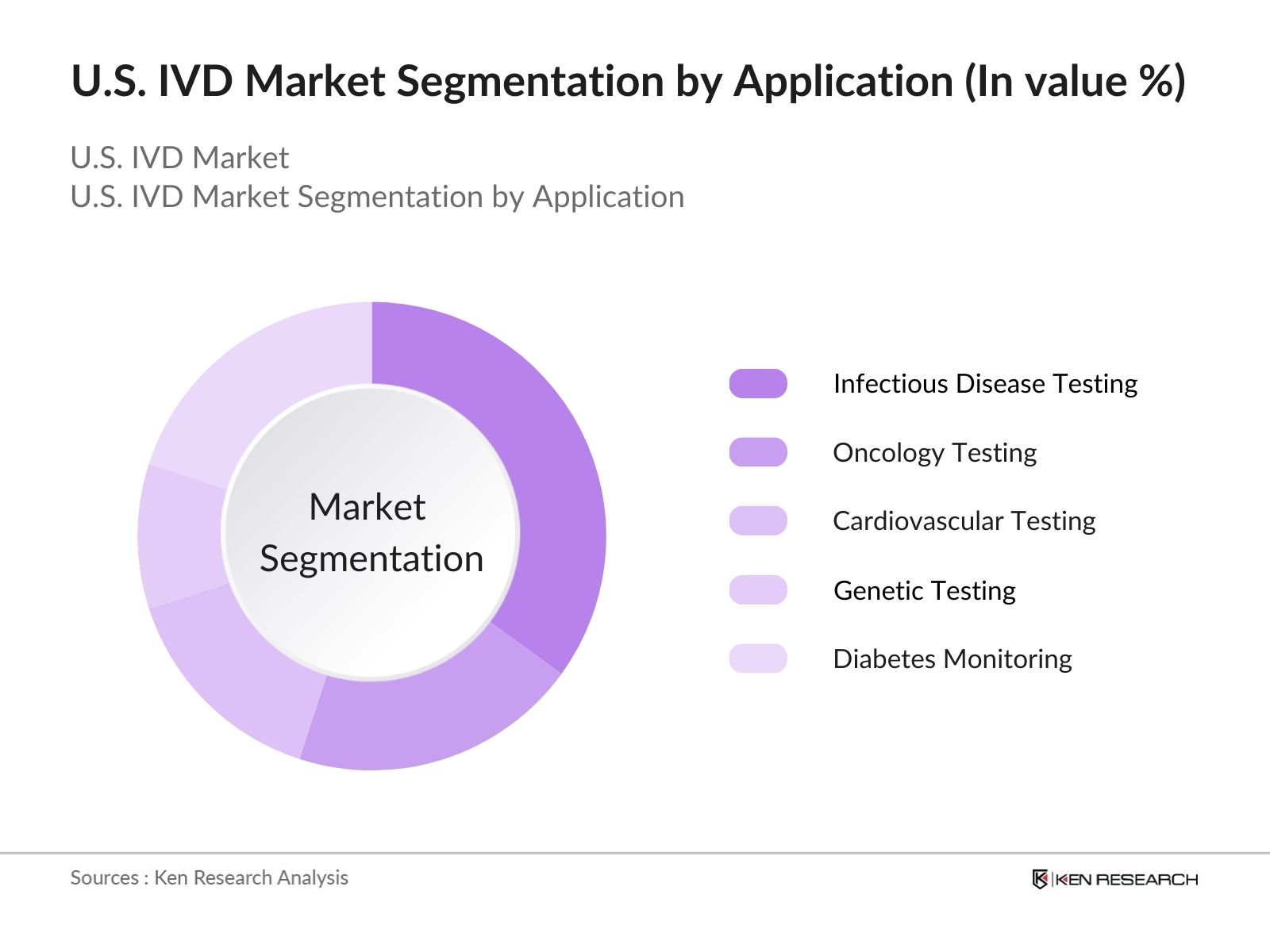

- By Application: The market is segmented into infectious disease testing, oncology testing, and cardiovascular testing. Infectious disease testing holds the largest share due to the ongoing need for COVID-19 diagnostics and the rising incidence of other viral and bacterial infections. Oncology testing is growing rapidly, driven by advancements in molecular diagnostics that enable early detection of cancers. Cardiovascular testing also plays a significant role, as heart disease remains the leading cause of death in the U.S., prompting the need for accurate and timely diagnostics.

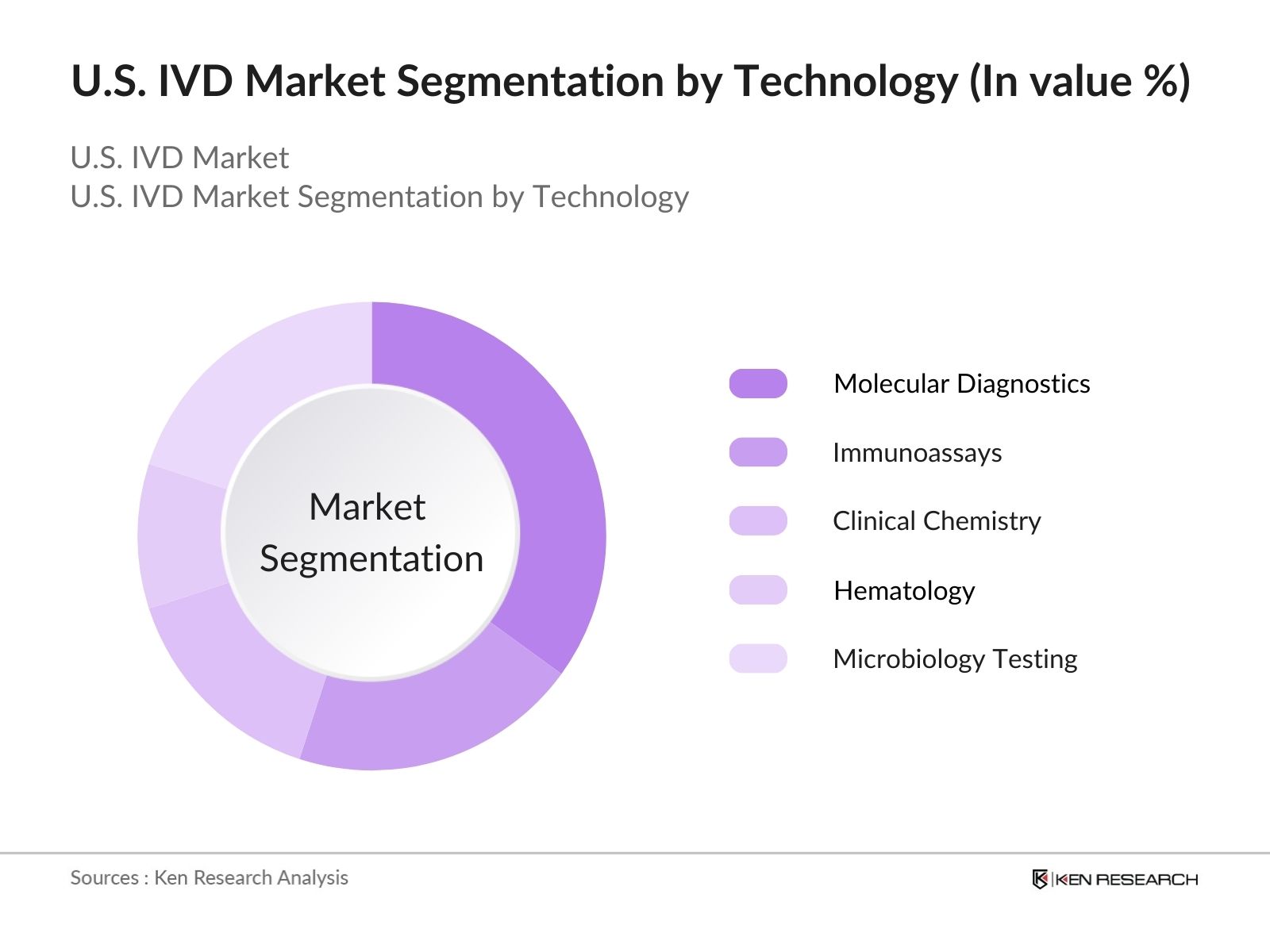

- By Technology: The market is segmented into molecular diagnostics, immunoassays, and clinical chemistry. Molecular diagnostics dominates the market, propelled by the increasing adoption of next-generation sequencing (NGS) and polymerase chain reaction (PCR) technologies for accurate and precise testing. Immunoassays remain critical for diagnosing a wide range of conditions, while clinical chemistry tests continue to be used extensively in routine diagnostic procedures.

U.S. IVD Market Competitive Landscape

The U.S. IVD market is highly competitive, with several key players continuously investing in research and development to enhance their product portfolios. Major players include Abbott Laboratories, Thermo Fisher Scientific, Roche Diagnostics, Danaher Corporation, and Siemens Healthineers. These companies are leveraging advanced technologies such as digital pathology, molecular diagnostics, and artificial intelligence to maintain a competitive edge in the rapidly evolving diagnostic landscape.

|

Company Name |

Establishment Year |

Headquarters |

No. of Employees |

Revenue (USD) |

Key Products |

Sustainability Initiatives |

Geographical Reach |

Technology Adoption |

Partnerships |

|

Abbott Laboratories |

1888 |

Abbott Park, IL |

|||||||

|

Thermo Fisher Scientific |

1956 |

Waltham, MA |

|||||||

|

Roche Diagnostics |

1896 |

Basel, Switzerland |

|||||||

|

Danaher Corporation |

1984 |

Washington, D.C. |

|||||||

|

Siemens Healthineers |

1847 |

Erlangen, Germany |

U.S. IVD Market Analysis

Growth Drivers

- Rising Prevalence of Chronic Diseases: The rising prevalence of chronic diseases in the U.S. is significantly contributing to the growth of the IVD market. The Centers for Disease Control and Prevention (CDC) reports that 6 in 10 adults in the U.S. have a chronic disease, with 4 in 10 suffering from two or more conditions such as diabetes, cancer, and heart disease. In 2024, the burden of chronic diseases is expected to remain high, driving the need for more frequent and advanced diagnostic testing to manage and monitor these conditions.

- Growing Adoption of Personalized Medicine: Personalized medicine is becoming a crucial aspect of healthcare in the U.S., with its integration into diagnostics driving growth in the IVD market. As of 2023, personalized medicine tests, including genetic and biomarker-based diagnostics, made up nearly 35% of all IVD procedures. The demand for tailored treatment plans is increasing, particularly for chronic diseases like cancer and cardiovascular diseases. According to the American Cancer Society, approximately 1.96 million new cancer cases were projected for 2023 alone, with around 609,820 cancer deaths expected, highlighting the need for more personalized diagnostic solutions.

- Technological Advancements in Diagnostics: The U.S. IVD market is experiencing rapid advancements in diagnostic technologies, particularly with innovations in molecular diagnostics and genomics. In 2023, the molecular diagnostics segment in the U.S. accounted for over 40% of the total IVD tests, driven by the increasing adoption of Polymerase Chain Reaction (PCR) and Next-Generation Sequencing (NGS) technologies. These innovations have enhanced the accuracy of diagnostic procedures, allowing earlier detection of diseases like cancer. The National Institutes of Health (NIH) reported an investment of substantial amount into precision medicine research in 2022, further propelling the development of advanced diagnostic tools.

Market Challenges

- Regulatory Hurdles and Compliance: The U.S. IVD market faces strict regulatory oversight from the FDA and CLIA, ensuring that diagnostic tests meet rigorous standards for accuracy and reliability. Compliance with these regulations can be time-consuming and costly for companies, particularly those developing novel diagnostic technologies. The 2023 FDA updates to IVD regulations added further complexities, particularly for companies involved in molecular testing.

- Ethical Concerns in Genetic Testing: The ethical implications of genetic testing remain a challenge for the IVD market, particularly in the realm of molecular diagnostics. Concerns over privacy, data security, and the potential misuse of genetic information persist despite the Genetic Information Nondiscrimination Act (GINA). A 2022 Pew Research Center survey revealed that over 70% of Americans are concerned about the security of their genetic data, underscoring the need for stronger safeguards in genetic testing.

U.S. IVD Market Future Outlook

The U.S. In Vitro Diagnostics (IVD) Market is projected to grow steadily over the next five years, driven by increasing healthcare expenditure, the growing adoption of personalized medicine, and technological advancements in diagnostics. The expansion of telemedicine and home testing kits will also play a crucial role in the future of IVD, enabling wider access to diagnostic services.

Future Market Opportunities

- Expansion of Home-Based Testing: Home-based diagnostic testing represents a significant growth opportunity in the U.S. IVD market. The COVID-19 pandemic accelerated the adoption of home testing kits, and this trend is expected to continue for various conditions, including infectious diseases, chronic disease management, and genetic testing. According to a 2023 report by the U.S. Census Bureau, millions of households used home-based diagnostic tests during the pandemic, highlighting the potential for sustained growth in this segment.

- Integration with Digital Health Platforms: The integration of IVD testing with digital health platforms offers a promising avenue for growth, particularly in enhancing the efficiency and accessibility of diagnostics. Telemedicine platforms are increasingly incorporating diagnostic testing into their services, allowing for seamless virtual consultations and at-home sample collection. This integration not only reduces the need for in-person visits but also expands diagnostic reach to underserved populations, particularly in rural areas where access to healthcare is limited.

Scope of the Report

|

By Application |

Infectious Disease Testing Oncology Testing Cardiovascular Testing Genetic Testing Diabetes Monitoring |

|

By Technology |

Molecular Diagnostics Immunoassays Clinical Chemistry Hematology Microbiology Testing |

|

By Distribution Channel |

Hospitals and Clinics Diagnostic Laboratories Research Institutes Homecare Settings Academic Institutions |

|

By Mode of Delivery |

Laboratory-Based Testing Point-of-Care Testing Home-Based Testing |

|

By Region |

Northeast Midwest South West |

Products

Key Target Audience

Healthcare Providers (Hospitals, Clinics)

Diagnostic Laboratories

Research Institutes

Pharmaceutical Companies

Investors and Venture Capitalist Firms

Government and Regulatory Bodies (FDA, CLIA)

Medical Device Manufacturers

Telemedicine Providers

Banks and Financial Institutions

Companies

Major Players Mentioned in the Report

Abbott Laboratories

Roche Diagnostics

Thermo Fisher Scientific

Danaher Corporation

Siemens Healthineers

Becton, Dickinson and Company (BD)

Hologic, Inc.

Bio-Rad Laboratories

Qiagen N.V.

Illumina, Inc.

Sysmex Corporation

Agilent Technologies

Ortho Clinical Diagnostics

PerkinElmer Inc.

Beckman Coulter

Table of Contents

1. U.S. IVD Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. U.S. IVD Market Size (In USD Bn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. U.S. IVD Market Analysis

3.1. Growth Drivers (Market-specific drivers)

3.1.1. Technological Advancements in Diagnostics

3.1.2. Growing Adoption of Personalized Medicine

3.1.3. Increase in Chronic Disease Prevalence

3.1.4. Rise of Point-of-Care Testing

3.2. Market Challenges (Market-specific challenges)

3.2.1. Regulatory Hurdles in IVD Approvals

3.2.2. Ethical and Privacy Concerns in Genetic Testing

3.2.3. High Cost of Advanced Diagnostic Equipment

3.2.4. Complex Reimbursement Landscape

3.3. Opportunities (Market-specific opportunities)

3.3.1. Expansion of Home-Based Testing Kits

3.3.2. Integration with Digital Health Platforms

3.3.3. Growing Demand for Companion Diagnostics

3.3.4. Development of AI-Powered Diagnostic Solutions

3.4. Trends (Market-specific trends)

3.4.1. Emergence of Telemedicine-Based Diagnostics

3.4.2. Adoption of Next-Generation Sequencing (NGS)

3.4.3. Increasing Use of Liquid Biopsies

3.4.4. Automation in Diagnostic Laboratories

3.5. Government Regulation (Regulatory bodies and laws)

3.5.1. FDA Approval Process for IVD Devices

3.5.2. CLIA Regulations for Diagnostic Laboratories

3.5.3. Genetic Information Nondiscrimination Act (GINA)

3.5.4. Compliance with HIPAA Regulations

3.6. SWOT Analysis

3.7. Stake Ecosystem (Market-specific stakeholders)

3.8. Porters Five Forces

3.9. Competition Ecosystem

4. U.S. IVD Market Segmentation

4.1. By Application (In Value %)

4.1.1. Infectious Disease Testing

4.1.2. Oncology Testing

4.1.3. Cardiovascular Testing

4.1.4. Genetic Testing

4.1.5. Diabetes Monitoring

4.2. By Technology (In Value %)

4.2.1. Molecular Diagnostics

4.2.2. Immunoassays

4.2.3. Clinical Chemistry

4.2.4. Hematology

4.2.5. Microbiology Testing

4.3. By End User (In Value %)

4.3.1. Hospitals and Clinics

4.3.2. Diagnostic Laboratories

4.3.3. Research Institutes

4.3.4. Homecare Settings

4.3.5. Academic Institutions

4.4. By Mode of Delivery (In Value %)

4.4.1. Laboratory-Based Testing

4.4.2. Point-of-Care Testing

4.4.3. Home-Based Testing

4.5. By Region (In Value %)

4.5.1. Northeast

4.5.2. Midwest

4.5.3. South

4.5.4. West

5. U.S. IVD Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. Abbott Laboratories

5.1.2. Thermo Fisher Scientific

5.1.3. Roche Diagnostics

5.1.4. Danaher Corporation

5.1.5. Siemens Healthineers

5.1.6. Becton, Dickinson and Company (BD)

5.1.7. Hologic, Inc.

5.1.8. Bio-Rad Laboratories

5.1.9. Qiagen N.V.

5.1.10. Illumina, Inc.

5.1.11. Sysmex Corporation

5.1.12. Agilent Technologies

5.1.13. Ortho Clinical Diagnostics

5.1.14. PerkinElmer Inc.

5.1.15. Beckman Coulter

5.2. Cross Comparison Parameters (Headquarters, Employees, Revenue, Technology Adoption, Product Portfolio, Key Strategic Partnerships, Market Presence, Recent Innovations)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Venture Capital Funding

5.8. Government Grants

5.9. Private Equity Investments

6. U.S. IVD Market Regulatory Framework

6.1. FDA Guidelines for IVD Device Approval

6.2. CLIA Certification Requirements

6.3. HIPAA Compliance for Diagnostic Data

6.4. GINA Regulations on Genetic Testing

7. U.S. IVD Future Market Size (In USD Bn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. U.S. IVD Future Market Segmentation

8.1. By Application (In Value %)

8.2. By Technology (In Value %)

8.3. By End User (In Value %)

8.4. By Mode of Delivery (In Value %)

8.5. By Region (In Value %)

9. U.S. IVD Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

Research Methodology

Step 1: Identification of Key Variables

In this phase, a comprehensive ecosystem map of the U.S. IVD market was constructed. This involved detailed desk research using proprietary databases and secondary sources to define the key variables affecting market dynamics. Critical factors influencing market growth, technological adoption, and stakeholder engagement were identified to provide a solid foundation for the research.

Step 2: Market Analysis and Construction

Historical data was compiled and analyzed, covering key market trends, technological adoption, and market penetration across different regions. The analysis also included a deep dive into the contribution of different market segments such as infectious disease testing and molecular diagnostics to the overall revenue generation.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses were developed based on the collected data and then validated through consultations with industry experts from leading diagnostic companies. These interviews provided valuable operational and financial insights, helping refine market data and projections. Industry leaders' insights added depth and accuracy to the findings.

Step 4: Research Synthesis and Final Output

The final step involved synthesizing the data gathered from various sources, including direct engagement with IVD manufacturers and healthcare providers. This comprehensive approach ensured that the analysis covered all market nuances and provided an accurate portrayal of the U.S. IVD market. The research outputs were validated using both top-down and bottom-up approaches.

Frequently Asked Questions

01 How big is the U.S. In Vitro Diagnostics (IVD) Market?

The U.S. In Vitro Diagnostics (IVD) market is valued at USD 29 billion, driven by advancements in diagnostic technologies and increasing demand for chronic disease management.

02 What are the challenges in the U.S. IVD Market?

Challenges in the U.S. IVD market include strict regulatory requirements, high costs associated with advanced diagnostic equipment, and concerns over the ethical use of genetic testing data.

03 Who are the major players in the U.S. IVD Market?

Key players in the U.S. In Vitro Diagnostics (IVD) market include Abbott Laboratories, Roche Diagnostics, Thermo Fisher Scientific, Danaher Corporation, and Siemens Healthineers. These companies are dominant due to their innovation and extensive product portfolios.

04 What are the growth drivers of the U.S. IVD Market?

The U.S. In Vitro Diagnostics (IVD) market is driven by the growing prevalence of chronic diseases, increasing adoption of molecular diagnostics, and technological advancements in point-of-care testing and automation.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.