USA Industrial Coating Market Outlook to 2030

Region:North America

Author(s):Shreya

Product Code:KROD3209

October 2024

87

About the Report

USA Industrial Coating Market Overview

- The USA Industrial Coating market is valued at USD 16.6 billion based on historical analysis, primarily driven by the countrys booming infrastructure and manufacturing industries. The rapid growth of sectors such as automotive, aerospace, and general industrial is fueling the demand for high-performance coatings. The need for corrosion resistance, durability, and aesthetic appeal in industrial applications further contributes to the markets expansion. Moreover, advancements in coating technologies and increasing environmental regulations are driving the transition to more sustainable and high-performance solutions.

- The dominance of cities like Chicago, Detroit, and Houston in the industrial coating market is mainly due to the presence of major automotive and manufacturing hubs in these regions. Chicago and Detroit are key manufacturing centers, home to many automotive and aerospace companies that heavily utilize industrial coatings. Houston, being a major player in the oil and gas industry, also demands extensive coatings to protect equipment and infrastructure from corrosion and wear in harsh environments. The strategic location of these cities fosters their dominance in the market.

- OSHA sets stringent safety guidelines for handling hazardous materials in the industrial coatings sector. In 2023, OSHA reported over 2,000 inspections in the coatings industry, with violations primarily related to improper handling of chemicals. OSHA mandates that all coating facilities provide workers with protective equipment and training for handling hazardous substances, with penalties for non-compliance reaching up to $156,259 per violation. These regulations ensure worker safety but also add operational costs for manufacturers, as they must invest in safety equipment and training programs to meet OSHA standards.

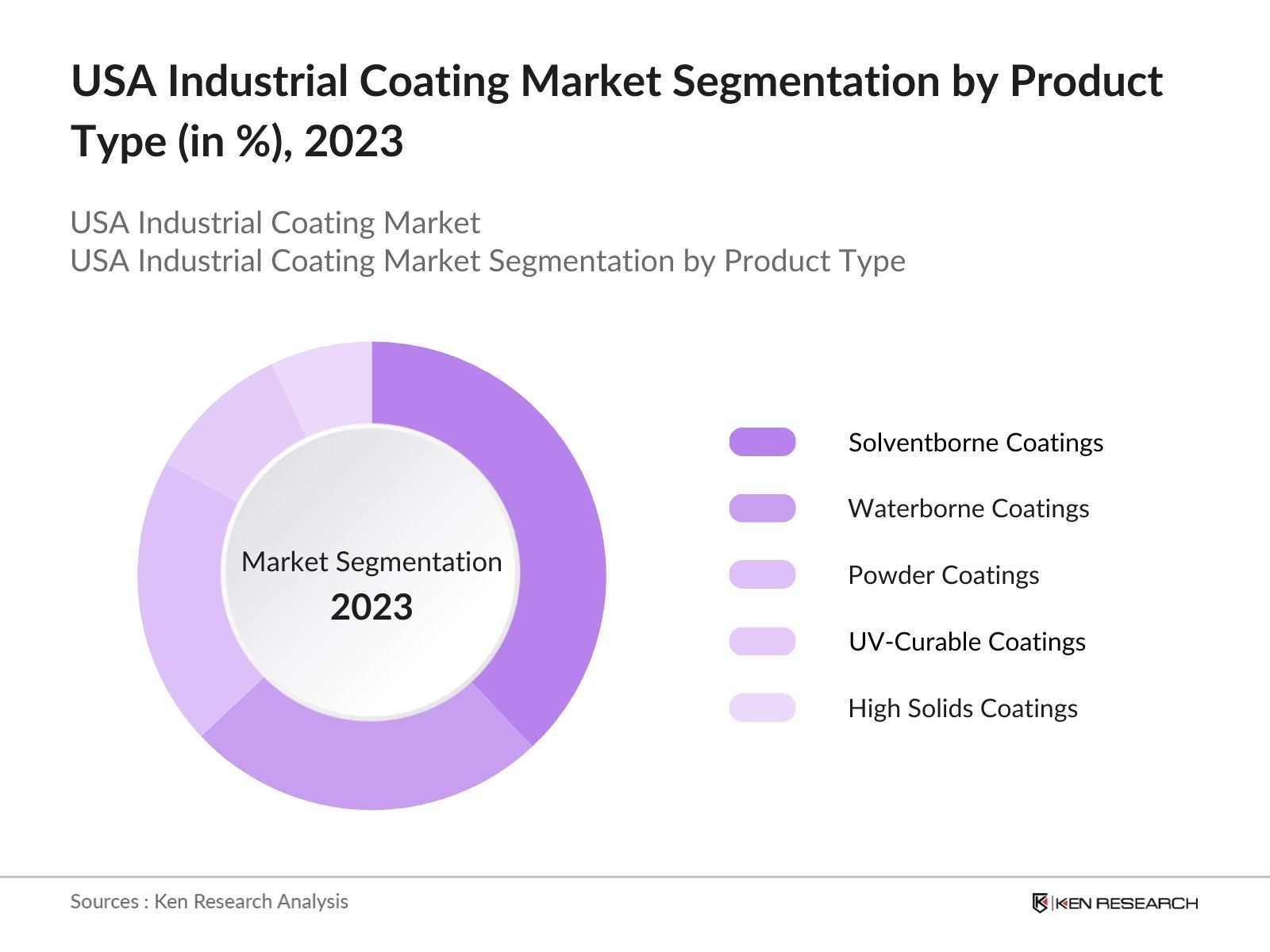

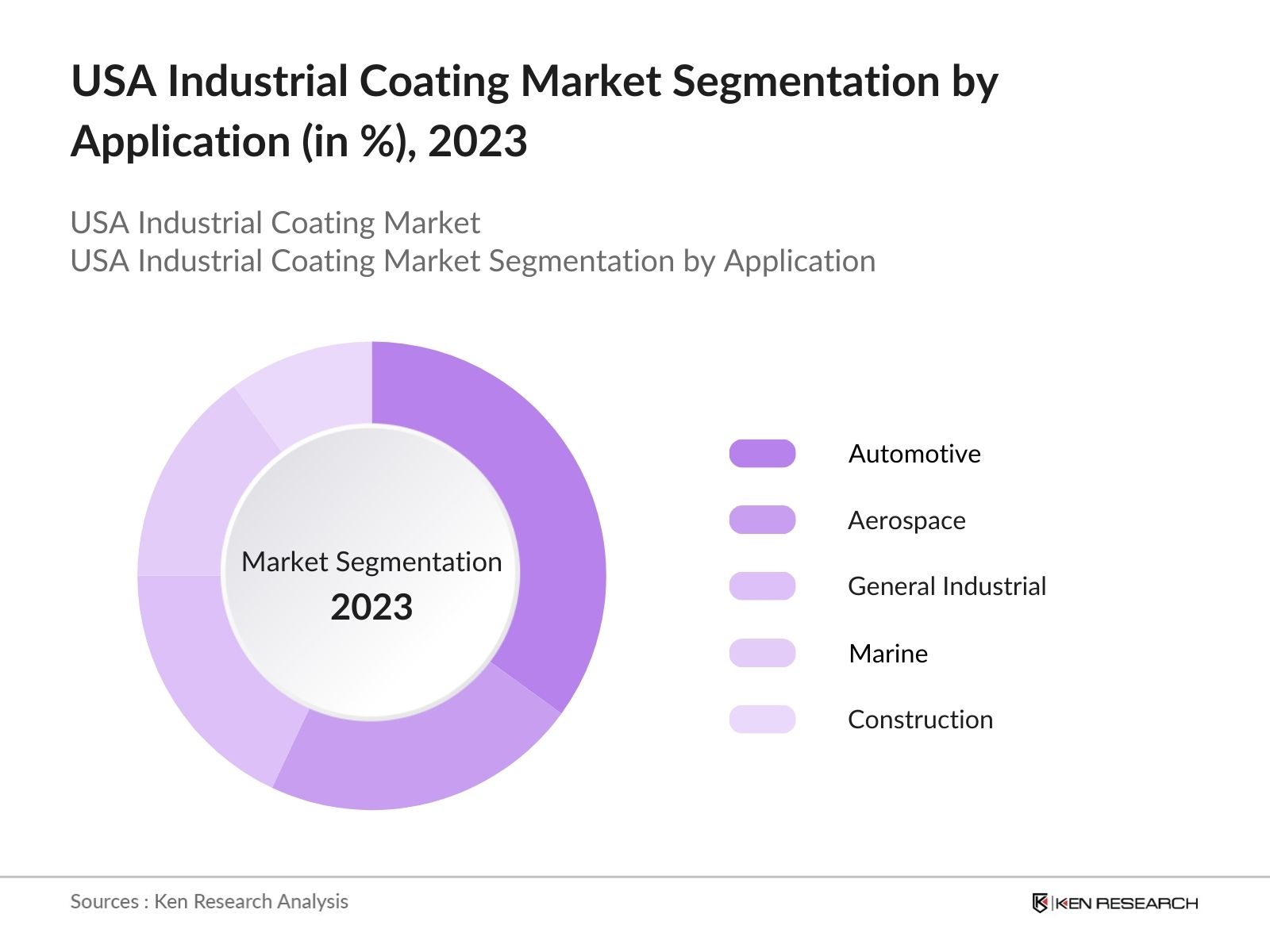

USA Industrial Coating Market Segmentation

- By Product Type: The market is segmented by product type into solventborne coatings, waterborne coatings, powder coatings, UV-curable coatings, and high solids coatings. Recently, solventborne coatings have dominated the market under this segmentation. Despite environmental concerns, solventborne coatings continue to maintain a strong market share due to their superior performance in harsh industrial environments, especially in automotive and heavy machinery applications. These coatings offer excellent adhesion, durability, and resistance to chemicals, making them indispensable in industries where environmental conditions pose a challenge.

- By Application: The USA Industrial Coating market is segmented by application into automotive, aerospace, general industrial, marine, and construction. Automotive applications dominate the market under this segmentation due to the industry's size and demand for high-performance coatings. Industrial coatings are crucial for protecting vehicles from environmental damage and ensuring durability, while enhancing aesthetic appeal. The automotive industry's emphasis on innovation, combined with the use of advanced materials and coatings for electric vehicles, continues to drive growth in this segment.

USA Industrial Coating Market Competitive Landscape

The USA Industrial Coating market is dominated by key players who maintain a strong presence due to their innovation, wide product portfolios, and geographic reach. The competition is fierce, with companies investing heavily in research and development to stay ahead of environmental regulations and meet customer demands. The major players include PPG Industries, Sherwin-Williams, AkzoNobel, and Axalta Coating Systems, which collectively dominate the market. Their extensive distribution networks and ongoing efforts to introduce sustainable products play a key role in maintaining their market leadership.

|

Company |

Establishment Year |

Headquarters |

Revenue (USD bn) |

No. of Employees |

Product Portfolio |

Environmental Compliance |

Key Markets |

Major Acquisitions |

Market Innovation |

|---|---|---|---|---|---|---|---|---|---|

|

PPG Industries |

1883 |

Pittsburgh, PA |

|||||||

|

Sherwin-Williams |

1866 |

Cleveland, OH |

|||||||

|

AkzoNobel |

1792 |

Amsterdam, NL |

|||||||

|

Axalta Coating Systems |

1866 |

Philadelphia, PA |

|||||||

|

BASF Coatings |

1865 |

Ludwigshafen, DE |

USA Industrial Coating Industry Analysis

Growth Drivers

- Stringent Environmental Regulations: The U.S. Environmental Protection Agency (EPA) has enforced stricter regulations to limit volatile organic compounds (VOCs) in industrial coatings. For instance, the EPAs VOC Emission Standards for coatings dictate that companies reduce VOC emissions to 1.7 pounds per gallon. This regulation has pushed the industry towards adopting low-VOC or VOC-free coatings like waterborne and powder coatings, which are expected to dominate the market. These changes in regulation are encouraging manufacturers to innovate eco-friendly coatings while ensuring compliance with the Clean Air Act. This push aligns with the Biden Administrations broader $1.2 trillion Bipartisan Infrastructure Law, emphasizing sustainability.

- Advancements in Coating Technologies: Advancements in industrial coatings, such as nano-coatings, high-performance corrosion inhibitors, and UV-curable coatings, have gained traction in the USA. According to the National Institute of Standards and Technology (NIST), nanotechnology is projected to impact 25% of the industrial sector by 2025, particularly in enhancing the durability of coatings. In 2024, the U.S. manufacturing sector saw a rise in the adoption of nano-coatings in aerospace and automotive industries, driven by their ability to provide superior corrosion resistance, self-healing capabilities, and extended lifecycle. These advancements help industries reduce maintenance costs and meet stricter regulatory compliance.

- Growing Demand for Corrosion-Resistant Coatings: Corrosion-resistant coatings are essential for maintaining the longevity of metal structures in industries like oil & gas, marine, and power generation. According to the National Association of Corrosion Engineers (NACE), the USA spends around $278 billion annually on corrosion-related repairs and maintenance. The ongoing investments in critical infrastructure projects and renewable energy plants have increased demand for such coatings. By 2024, significant expansions in oil pipelines and renewable energy installations are projected to boost this market segment. Moreover, the Department of Energy (DOE) has allocated $7.5 billion for offshore wind projects, further driving the need for corrosion-resistant coatings.

Market Challenges

- Fluctuating Raw Material Prices: Raw materials like titanium dioxide, epoxy resins, and other petroleum-based inputs are crucial in industrial coatings. The U.S. Bureau of Labor Statistics reported a 14.9% increase in raw material prices from 2021 to 2023, heavily affecting the coatings industry. In addition, geopolitical tensions and trade restrictions have contributed to the volatility of raw material supply chains. For example, the U.S. imported 36.2% of its titanium dioxide from overseas, with significant supply disruptions in 2022. This price fluctuation increases costs for manufacturers, affecting the overall profitability of the industrial coatings market.

- High Manufacturing Costs: The cost of production for industrial coatings remains high due to stringent regulatory standards and the need for high-performance formulations. The U.S. Energy Information Administration (EIA) highlighted that the energy costs for manufacturing increased by 12% in 2023, adding to the overall manufacturing cost of coatings. Moreover, the use of advanced materials like fluoropolymers and epoxy-based coatings has further increased costs. This is particularly challenging for small and mid-sized coating manufacturers that struggle to balance high production costs with competitive pricing.

USA Industrial Coating Market Future Outlook

Over the next five years, the USA Industrial Coating market is expected to experience robust growth driven by increasing investments in infrastructure, the expansion of the automotive sector, and a shift towards sustainable and environmentally friendly coatings. As regulations tighten around VOC emissions, companies will continue to innovate and adapt by introducing waterborne and high-solids coatings. The rise of electric vehicles (EVs) and increased focus on corrosion-resistant solutions in critical industries like marine and aerospace will be key drivers of future growth.

Future Market Opportunities

- Adoption of Smart Coatings: The adoption of smart coatings in the USA is gaining momentum due to their self-healing and anti-corrosion properties. According to the National Renewable Energy Laboratory (NREL), smart coatings can extend the life of wind turbine blades by 20 years, reducing maintenance costs. In 2023, the automotive and aerospace industries saw increased investment in these technologies, with major manufacturers integrating smart coatings into their products to improve durability. The U.S. Department of Energy's Advanced Manufacturing Office has allocated $5.2 million towards research in smart materials, highlighting a growing opportunity for smart coatings across multiple sectors.

- Expanding Applications in Automotive and Aerospace: The industrial coatings market is experiencing expanding applications in automotive and aerospace, especially for corrosion resistance and heat management. As reported by the U.S. Bureau of Transportation Statistics, the number of registered vehicles increased to 285 million in 2023, with demand for high-performance coatings growing alongside. In the aerospace sector, the Federal Aviation Administration (FAA) estimates an increase of 3,500 commercial aircraft in service by 2025, further driving the need for advanced coatings. These coatings are crucial for enhancing fuel efficiency, reducing weight, and increasing the lifespan of vehicles and aircraft components.

Scope of the Report

|

Segment |

Sub-Segments |

|---|---|

|

Product Type |

- Solventborne Coatings |

|

Application |

- Automotive |

|

Resin Type |

- Acrylic |

|

Technology |

- Liquid Coatings |

|

Region |

- East |

Products

Key Target Audience

Automotive Manufacturers

Aerospace Companies

General Industrial Equipment Manufacturers

Marine Industry Stakeholders

Construction Companies

Government and Regulatory Bodies (EPA, OSHA)

Banks and Financial Institutes

Investments and Venture Capitalist Firms

Oil and Gas Industry Players

Companies

Major Players in the Market

PPG Industries

Sherwin-Williams

AkzoNobel

Axalta Coating Systems

BASF Coatings

Jotun

Hempel

Nippon Paint Holdings

Kansai Paint Co., Ltd.

RPM International

Masco Corporation

Benjamin Moore & Co.

Behr Process Corporation

Tikkurila

Valspar Corporation

Table of Contents

1. USA Industrial Coating Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. USA Industrial Coating Market Size (In USD Bn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. USA Industrial Coating Market Analysis

3.1. Growth Drivers

3.1.1. Increasing Infrastructure Development

3.1.2. Stringent Environmental Regulations

3.1.3. Advancements in Coating Technologies

3.1.4. Growing Demand for Corrosion-Resistant Coatings

3.2. Market Challenges

3.2.1. Fluctuating Raw Material Prices

3.2.2. High Manufacturing Costs

3.2.3. Regulatory Compliance Burden

3.3. Opportunities

3.3.1. Adoption of Smart Coatings (Anti-corrosion, Self-healing)

3.3.2. Expanding Applications in Automotive and Aerospace

3.3.3. Growth in Green Coatings and Sustainability Solutions

3.4. Trends

3.4.1. Shift towards Waterborne Coatings

3.4.2. Increasing Use of Powder Coatings

3.4.3. Rising Demand for UV-Curable Coatings

3.5. Government Regulation

3.5.1. Environmental Protection Agency (EPA) Regulations on VOC Emissions

3.5.2. Occupational Safety and Health Administration (OSHA) Guidelines

3.5.3. Green Building Standards and LEED Certification

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem

3.8. Porters Five Forces

3.9. Competition Ecosystem

4. USA Industrial Coating Market Segmentation

4.1. By Product Type (In Value %)

4.1.1. Solventborne Coatings

4.1.2. Waterborne Coatings

4.1.3. Powder Coatings

4.1.4. UV-Curable Coatings

4.1.5. High Solids Coatings

4.2. By Application (In Value %)

4.2.1. Automotive

4.2.2. Aerospace

4.2.3. General Industrial

4.2.4. Marine

4.2.5. Construction

4.3. By Resin Type (In Value %)

4.3.1. Acrylic

4.3.2. Epoxy

4.3.3. Polyurethane

4.3.4. Alkyd

4.3.5. Fluoropolymer

4.4. By Technology (In Value %)

4.4.1. Liquid Coatings

4.4.2. Powder Coatings

4.4.3. Radiation-Cured Coatings

4.5. By Region (In Value %)

4.5.1. North

4.5.2. East

4.5.3. South

4.5.4. West

5. USA Industrial Coating Market Competitive Analysis

5.1 Detailed Profiles of Major Companies

5.1.1. PPG Industries

5.1.2. Sherwin-Williams

5.1.3. AkzoNobel

5.1.4. Axalta Coating Systems

5.1.5. RPM International

5.1.6. BASF Coatings

5.1.7. Jotun

5.1.8. Hempel

5.1.9. Nippon Paint Holdings

5.1.10. Kansai Paint Co., Ltd.

5.1.11. Valspar Corporation

5.1.12. Tikkurila

5.1.13. Masco Corporation

5.1.14. Benjamin Moore & Co.

5.1.15. Behr Process Corporation

5.2 Cross Comparison Parameters (Revenue, Inception Year, Product Portfolio, Geographical Presence, Employee Strength, Market Share, Product Innovation, Strategic Partnerships)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Venture Capital Funding

5.8. Government Grants

5.9. Private Equity Investments

6. USA Industrial Coating Market Regulatory Framework

6.1. Environmental Standards

6.2. Compliance Requirements

6.3. Certification Processes

7. USA Industrial Coating Future Market Size (In USD Bn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. USA Industrial Coating Future Market Segmentation

8.1. By Product Type (In Value %)

8.2. By Application (In Value %)

8.3. By Resin Type (In Value %)

8.4. By Technology (In Value %)

8.5. By Region (In Value %)

9. USA Industrial Coating Market Analyst Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

Disclaimer

Contact Us

Research Methodology

Step 1: Identification of Key Variables

In this phase, we created a detailed map of all stakeholders within the USA Industrial Coating market. Using a combination of desk research and proprietary databases, we identified key variables influencing market growth, such as raw material prices, technological advancements, and regulatory frameworks.

Step 2: Market Analysis and Construction

This step involved compiling and analyzing historical data on the USA Industrial Coating market. We examined the penetration rate of various product types and applications and analyzed revenue generation across different market segments, including automotive, aerospace, and marine industries.

Step 3: Hypothesis Validation and Expert Consultation

We validated our market hypotheses through extensive interviews with industry experts and stakeholders from major companies. This allowed us to refine our understanding of market trends and gain insights into future growth drivers and challenges.

Step 4: Research Synthesis and Final Output

The final stage involved synthesizing all data to provide a detailed and accurate representation of the market. By engaging with key industry players, we ensured the reliability of our market projections and the relevance of our analysis.

Frequently Asked Questions

1. How big is the USA Industrial Coating Market?

The USA Industrial Coating market is valued at USD 16.6 billion, primarily driven by the growing demand from sectors such as automotive, aerospace, and general industrial applications.

2. What are the challenges in the USA Industrial Coating Market?

Challenges in the USA Industrial Coating market include fluctuating raw material prices, high production costs, and regulatory compliance with environmental standards such as VOC emission restrictions.

3. Who are the major players in the USA Industrial Coating Market?

Key players in the USA Industrial Coating market include PPG Industries, Sherwin-Williams, AkzoNobel, and Axalta Coating Systems, known for their extensive product portfolios and adherence to environmental standards.

4. What are the growth drivers of the USA Industrial Coating Market?

The USA Industrial Coating market is driven by the demand for durable, corrosion-resistant coatings in automotive and aerospace sectors, along with advancements in coating technologies that meet stringent environmental regulations.

5. Which cities dominate the USA Industrial Coating Market?

Cities like Chicago, Detroit, and Houston dominate the USA Industrial Coating market due to their strong presence in automotive, manufacturing, and oil & gas industries, respectively.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.