USA Industrial Distribution Market Outlook to 2030

Region:North America

Author(s):Shreya Garg

Product Code:KROD10338

December 2024

84

About the Report

USA Industrial Distribution Market Overview

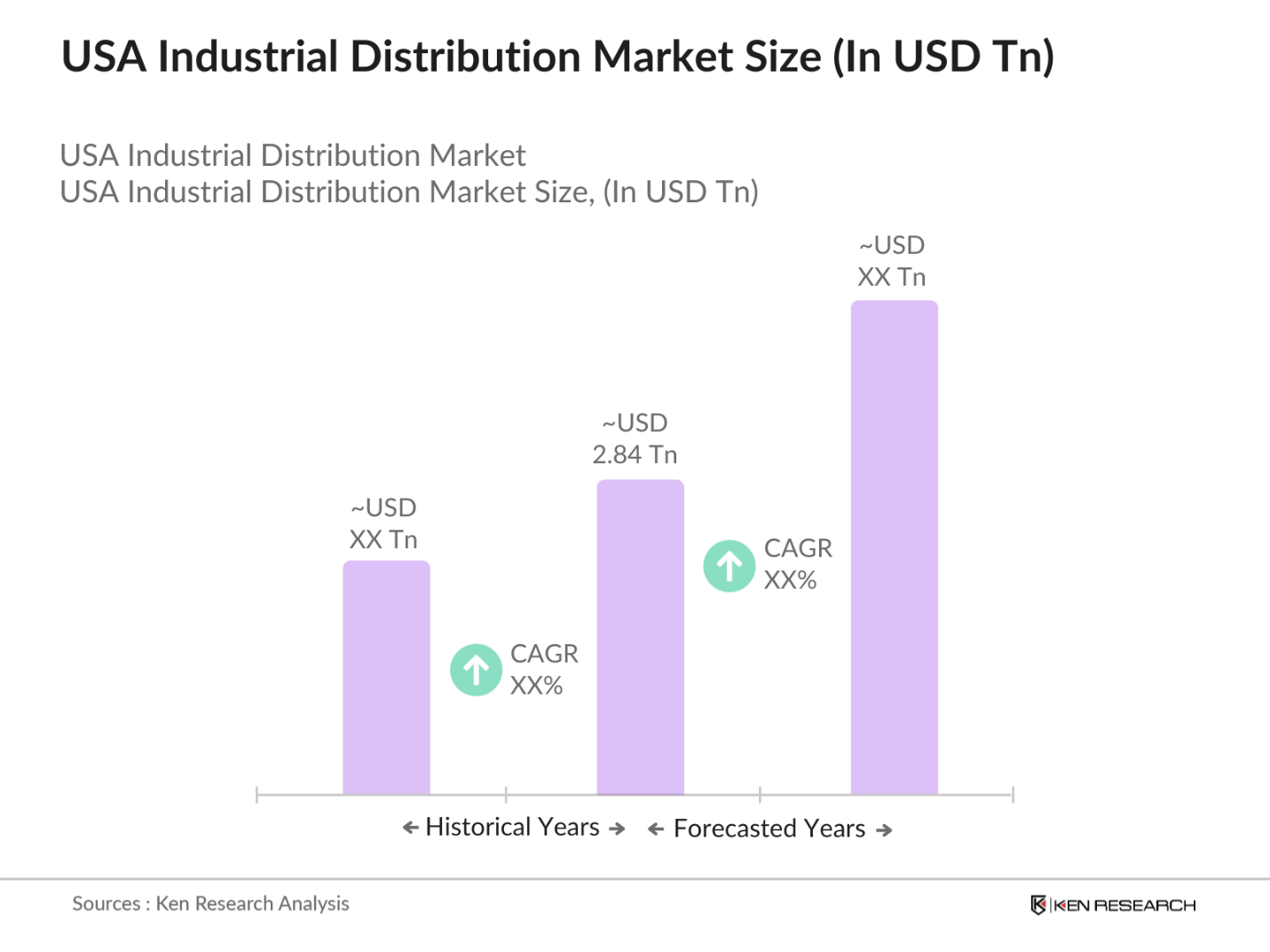

- The USA Industrial Distribution Market is valued at USD 2.84 trillion, driven by a combination of technological advancements and the need for resilient supply chains. The demand is primarily fueled by industries such as manufacturing, construction, and automotive, which require consistent supplies of machinery, equipment, and tools. The integration of digital solutions like IoT and AI in supply chain management has further bolstered market growth, enhanced operational efficiency and reducing costs.

- Prominent regions such as California, Texas, and Illinois dominate the market due to their large industrial bases, well-established infrastructure, and strategic positioning for logistics. These states benefit from a robust network of manufacturers and distributors, making them pivotal hubs for industrial distribution.

- Compliance with OSHA guidelines is crucial for maintaining safety standards in distribution facilities. The U.S. Department of Labor reported that in 2023, there were 2.6 million nonfatal workplace injuries, underscoring the need for rigorous adherence to safety regulations. Distribution centers are required to implement comprehensive safety protocols to reduce injury rates and comply with inspections, ensuring safe working conditions for employees.

USA Industrial Distribution Market Segmentation

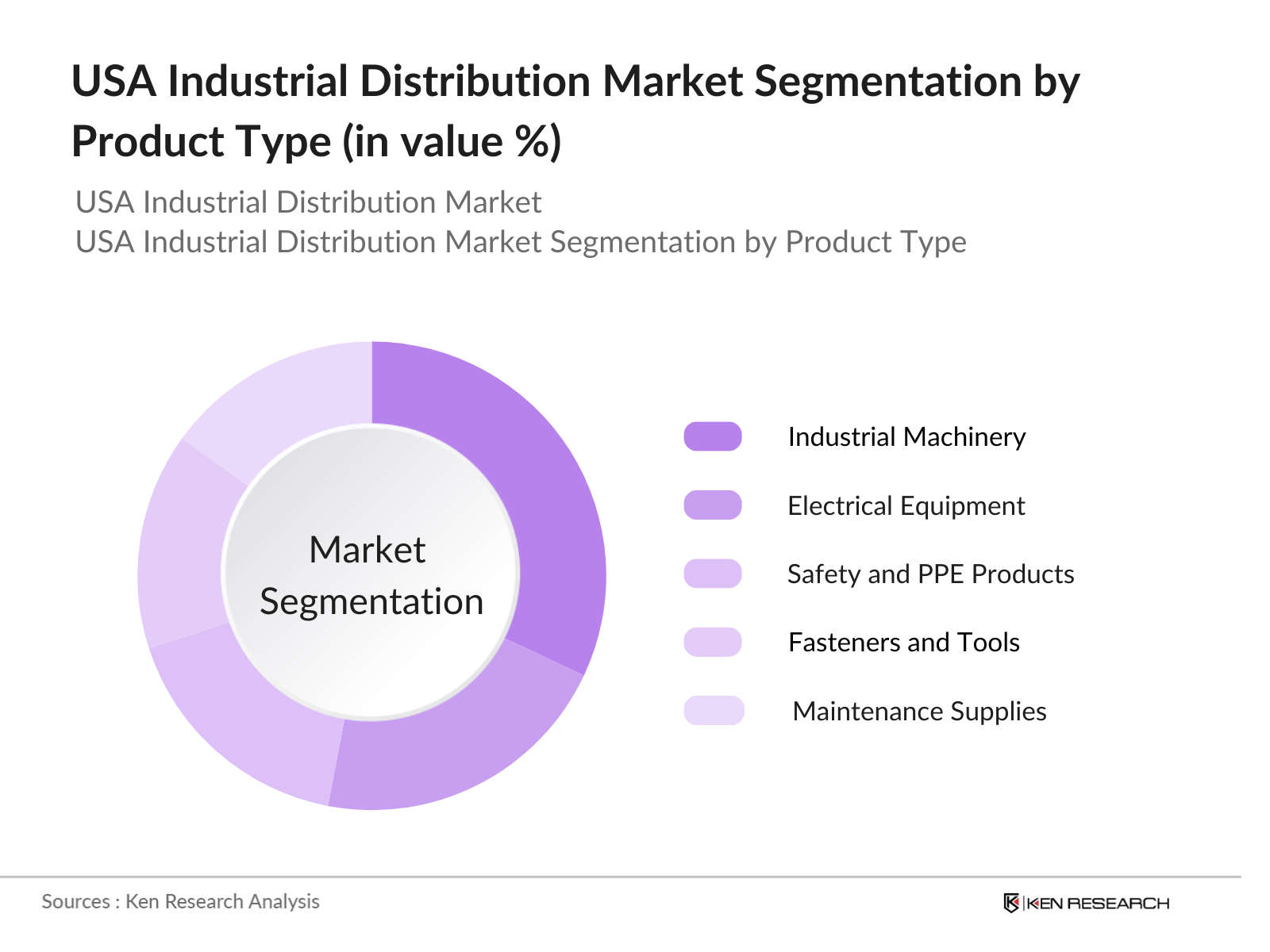

By Product Type: The USA Industrial Distribution market is segmented by product type into industrial machinery, electrical equipment, safety and PPE products, fasteners and tools, and maintenance supplies. Industrial machinery holds a dominant market share due to its critical role in operations across sectors such as manufacturing and construction. The consistent need for machinery replacement and upgrades ensures steady demand in this sub-segment, which is further supported by technological innovations that improve productivity and efficiency.

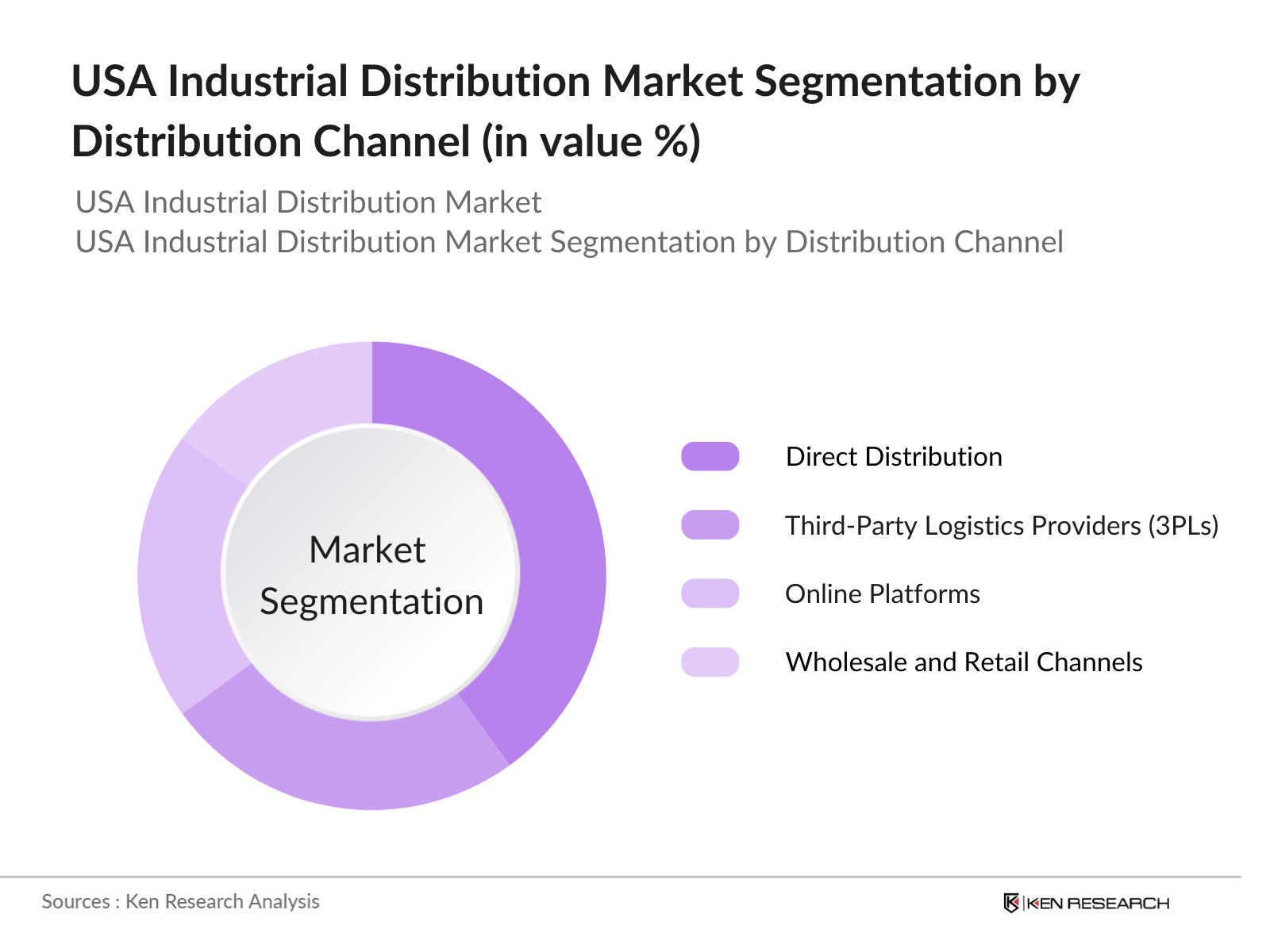

By Distribution Channel: The market is segmented by distribution channel into direct distribution, third-party logistics providers (3PLs), online platforms, and wholesale and retail channels. Direct distribution dominates the segment due to the preference of large enterprises to manage their supply chains in-house for better control and reduced costs. This model is particularly favored by companies with significant operational scale that can maintain dedicated distribution networks.

USA Industrial Distribution Market Competitive Landscape

The USA Industrial Distribution market is dominated by established players that have a strong foothold in the industry. The competitive landscape highlights major players known for their extensive distribution networks and technological integration in supply chain solutions.

USA Industrial Distribution Industry Analysis

Growth Drivers

- Technological Integration: Technological integration is propelling the industrial distribution market in the USA, driven by advancements in IoT, AI, and automation. As of 2024, 20 million IoT-connected devices are in use across industrial sectors, enabling improved logistics, real-time inventory tracking, and predictive maintenance. The deployment of AI-based systems for demand forecasting and process optimization has seen significant uptake, with sectors such as manufacturing, transportation, and warehousing adopting these tools. The U.S. Bureau of Economic Analysis noted that automation technology investments reached over $110 billion in 2023, bolstering operational efficiency and productivity.

- Increased Demand for Supply Chain Resilience: The demand for enhanced supply chain resilience has intensified due to the lingering effects of the COVID-19 pandemic and geopolitical tensions. In 2023, the National Association of Manufacturers reported that over 75% of U.S. manufacturers indicated disruptions from global events impacted their operations, underscoring the importance of robust supply chains. In response, companies are investing heavily in diversified supplier bases and resilient logistics frameworks. U.S. import data shows that supply chain fortification efforts have contributed to a 12% increase in domestic manufacturing activities to reduce reliance on foreign sources.

- Government Infrastructure Initiatives: Government-backed infrastructure initiatives have significantly impacted industrial distribution. The Infrastructure Investment and Jobs Act, passed in 2021, continues to drive developments through 2024, with allocations surpassing $550 billion for public infrastructure projects. This surge in federal spending has fueled demand for construction materials and logistics services, benefiting the distribution sector. The Department of Transportation reports that over 45,000 miles of highways and major infrastructure projects have been initiated since the Act's inception, creating robust opportunities for distribution networks that support these construction efforts.

Market Challenges

- High Operational Costs: High operational costs present significant challenges to the U.S. industrial distribution market. The U.S. Bureau of Labor Statistics (BLS) reported in 2023 that the cost of warehousing, transportation, and labor collectively surpassed $1.5 trillion, driven by rising fuel prices and labor shortages. Trucking and logistics firms noted that fuel expenses alone accounted for an average of 38% of operational budgets. The combination of increased fuel costs and competitive wages required to attract and retain skilled labor exacerbates the financial strain on distribution companies.

- Supply Chain Disruptions: Supply chain disruptions remain a challenge, exacerbated by events such as pandemics and geopolitical tensions. Data from the Council of Supply Chain Management Professionals indicated that in 2022, disruptions led to shipment delays for over 40% of companies surveyed. The U.S. International Trade Commission reported that trade policy shifts and global conflicts have impacted the timely availability of critical materials and components. This instability compels businesses to reassess supply chain strategies to mitigate risks and maintain consistent product flow.

USA Industrial Distribution Market Future Outlook

Over the next few years, the USA Industrial Distribution market is expected to grow due to continuous technological advancements, increased investment in supply chain optimization, and the rise of e-commerce platforms facilitating B2B transactions. The focus on sustainable practices and green logistics will also play a crucial role in shaping the market landscape, driving the adoption of eco-friendly distribution solutions.

Future Market Opportunities

- Adoption of Advanced Robotics and Automation: The adoption of robotics and automation presents a key growth opportunity for industrial distribution. According to the Association for Advancing Automation, over 40,000 industrial robots were deployed across U.S. warehouses in 2023, a 10% increase from the previous year. These robots enhance operational efficiency by handling repetitive tasks, reducing human error, and improving throughput. The integration of automated guided vehicles (AGVs) and robotic picking systems is transforming how distribution centers operate, fostering growth and competitiveness in the sector.

- Strategic Partnerships and Collaborations: Strategic partnerships and collaborations are reshaping the industrial distribution landscape. A 2023 report from the U.S. Department of Commerce indicated that over 60% of logistics firms engaged in strategic partnerships to expand their service offerings and geographic reach. Collaborations between technology providers and distributors have accelerated innovation, including the deployment of AI-driven inventory management systems and blockchain for secure supply chain tracking. These partnerships enable companies to leverage each others strengths, driving efficiency and customer satisfaction.

Scope of the Report

|

Product Type |

Industrial Machinery Electrical Equipment Safety and PPE Products Fasteners and Tools Maintenance Supplies |

|

Application |

Manufacturing Industry Construction Sector Oil & Gas Industry Automotive Sector Aerospace and Defense |

|

Distribution Channel |

Direct Distribution Third-Party Logistics Providers (3PLs) Online Platforms Wholesale and Retail Channels |

|

End User |

SMEs (Small and Medium Enterprises) Large Enterprises, Government Bodies |

|

Region |

Northeast Midwest Southern Western |

Products

Key Target Audience

Industrial Manufacturers

Supply Chain and Logistics Firms

Investors and Venture Capitalist Firms

Government and Regulatory Bodies (e.g., Department of Commerce, OSHA)

Large Enterprises with In-house Distribution Needs

Technology and Software Providers

Transportation and Logistics Companies

Industrial Equipment Distributors

Companies

Major Players

W.W. Grainger, Inc.

Fastenal Company

MSC Industrial Direct Co., Inc.

HD Supply Holdings, Inc.

Ferguson Enterprises, Inc.

Airgas, Inc.

Applied Industrial Technologies, Inc.

Motion Industries, Inc.

Genuine Parts Company (GPC)

MRC Global Inc.

Winsupply Inc.

Sonepar USA

Rexel USA

Graybar Electric Company, Inc.

Industrial Distribution Group, Inc.

Table of Contents

USA Industrial Distribution Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

USA Industrial Distribution Market Size (In USD Bn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

USA Industrial Distribution Market Analysis

3.1. Growth Drivers

3.1.1. Technological Integration (e.g., IoT, AI, Automation)

3.1.2. Increased Demand for Supply Chain Resilience

3.1.3. Government Infrastructure Initiatives

3.1.4. Expanding E-commerce Penetration

3.2. Market Challenges

3.2.1. High Operational Costs

3.2.2. Supply Chain Disruptions (e.g., pandemics, geopolitical tensions)

3.2.3. Shortage of Skilled Workforce

3.3. Opportunities

3.3.1. Adoption of Advanced Robotics and Automation

3.3.2. Strategic Partnerships and Collaborations

3.3.3. Expansion in Secondary and Tertiary Markets

3.4. Trends

3.4.1. Integration of Digital Platforms (ERP, CRM)

3.4.2. Shift Towards Sustainable and Green Practices

3.4.3. Omnichannel Distribution Strategies

3.5. Regulatory Compliance

3.5.1. OSHA Guidelines

3.5.2. Trade and Tariff Regulations

3.5.3. Environmental Standards (EPA Regulations)

3.5.4. Logistics and Transportation Safety Regulations

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem

3.8. Porters Five Forces Analysis

3.9. Competitive Landscape Overview

USA Industrial Distribution Market Segmentation

4.1. By Product Type (In Value %)

4.1.1. Industrial Machinery

4.1.2. Electrical Equipment

4.1.3. Safety and PPE Products

4.1.4. Fasteners and Tools

4.1.5. Maintenance Supplies

4.2. By Application (In Value %)

4.2.1. Manufacturing Industry

4.2.2. Construction Sector

4.2.3. Oil & Gas Industry

4.2.4. Automotive Sector

4.2.5. Aerospace and Defense

4.3. By Distribution Channel (In Value %)

4.3.1. Direct Distribution

4.3.2. Third-Party Logistics Providers (3PLs)

4.3.3. Online Platforms

4.3.4. Wholesale and Retail Channels

4.4. By End User (In Value %)

4.4.1. SMEs (Small and Medium Enterprises)

4.4.2. Large Enterprises

4.4.3. Government Bodies

4.5. By Region (In Value %)

4.5.1. Northeast

4.5.2. Midwest

4.5.3. Southern

4.5.4. Western

USA Industrial Distribution Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. W.W. Grainger, Inc.

5.1.2. Fastenal Company

5.1.3. MSC Industrial Direct Co., Inc.

5.1.4. HD Supply Holdings, Inc.

5.1.5. Ferguson Enterprises, Inc.

5.1.6. Airgas, Inc.

5.1.7. Applied Industrial Technologies, Inc.

5.1.8. Motion Industries, Inc.

5.1.9. Genuine Parts Company (GPC)

5.1.10. MRC Global Inc.

5.1.11. Winsupply Inc.

5.1.12. Sonepar USA

5.1.13. Rexel USA

5.1.14. Graybar Electric Company, Inc.

5.1.15. Industrial Distribution Group, Inc.

5.2. Cross Comparison Parameters (Revenue, Product Portfolio, Market Presence, Employee Strength, R&D Investment, Logistics Network, Customer Base, Key Partnerships)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Venture Capital Funding

5.8. Government Grants and Subsidies

5.9. Private Equity Investments

USA Industrial Distribution Market Regulatory Framework

6.1. Trade Compliance Regulations

6.2. Environmental and Safety Standards

6.3. Industry Certification Requirements

USA Industrial Distribution Future Market Size (In USD Bn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

USA Industrial Distribution Future Market Segmentation

8.1. By Product Type (In Value %)

8.2. By Application (In Value %)

8.3. By Distribution Channel (In Value %)

8.4. By End User (In Value %)

8.5. By Region (In Value %)

USA Industrial Distribution Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Segmentation Analysis

9.3. Marketing Initiatives and Campaigns

9.4. White Space Opportunity Analysis

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

This phase involves mapping out all the key stakeholders and determining the market variables influencing the USA Industrial Distribution Market. Extensive desk research and the use of proprietary databases support this analysis, providing insight into industry trends and key growth factors.

Step 2: Market Analysis and Construction

Historical data analysis is performed to construct a detailed view of the markets performance over the past five years. This includes market size analysis, revenue generation, and a review of distribution channels penetration, ensuring the assessment is comprehensive and accurate.

Step 3: Hypothesis Validation and Expert Consultation

Interviews with industry experts and stakeholders validate market hypotheses and data. Consultations cover a range of operational, logistical, and financial perspectives, refining the data and enhancing its reliability.

Step 4: Research Synthesis and Final Output

A synthesis of primary and secondary research is conducted to ensure robust findings. Engagements with industry participants and real-time data acquisition allow for the most accurate depiction of the market.

Frequently Asked Questions

01 How big is the USA Industrial Distribution Market?

The USA Industrial Distribution market is valued at USD 2.84 Trillion, driven by a strong manufacturing and logistics base.

02 What are the challenges in the USA Industrial Distribution Market?

Challenges in the USA Industrial Distribution market include high operational costs, supply chain disruptions, and a shortage of skilled workforce impacting overall market growth.

03 Who are the major players in the USA Industrial Distribution Market?

Key players in the USA Industrial Distribution market include W.W. Grainger, Inc., Fastenal Company, MSC Industrial Direct Co., Inc., HD Supply Holdings, Inc., and Ferguson Enterprises, Inc.

04 What are the growth drivers of the USA Industrial Distribution Market?

Growth in the USA Industrial Distribution market is driven by technological integration, the rise of e-commerce, and an increased focus on supply chain resilience and efficiency.

05 Which product type dominates the USA Industrial Distribution Market?

Industrial machinery holds the dominant share in the USA Industrial Distribution market due to its essential role in operational efficiency and consistent demand across various sectors.

06 Why is direct distribution a preferred channel in the USA Industrial Distribution Market?

Direct distribution is favored for its ability to provide greater control and cost savings for large enterprises managing extensive supply chains in the USA Industrial Distribution market.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.